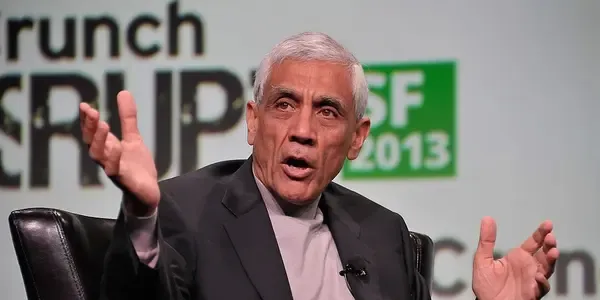

Vinod Khosla Net Worth is a topic of considerable interest, given his immense influence in the tech industry. As an Indian-American entrepreneur and venture capitalist, Vinod Khosla has amassed a net worth of approximately $9 billion. Known as one of Silicon Valley’s most impactful venture capitalists, Khosla’s journey took a significant turn in 1982 when he co-founded Sun Microsystems with Andy Bechtolsheim and Scott McNealy. Serving as the first CEO, Khosla played a pivotal role in transforming Sun Microsystems into a leading computer hardware and software powerhouse.

By 1986, Khosla had joined Kleiner Perkins as a general partner, marking the beginning of a new chapter in his career. His knack for identifying and nurturing early-stage technology companies became evident as he championed various clean technology initiatives. This vision culminated in the establishment of Khosla Ventures in 2004, a firm dedicated to investing in traditional and clean technology startups. The firm’s portfolio spans diverse sectors, including technology, healthcare, and sustainable energy, underscoring Khosla’s commitment to innovation.

What is Vinod Khosla net worth?

| Name | Vinod Khosla |

|---|---|

| Category: | Richest Business › Richest Billionaires |

| Net Worth: | $9 Billion |

| Birthdate: | Jan 28, 1955 (70 years old) |

| Birthplace: | Delhi |

| Gender: | Male |

| Profession: | Venture capitalist, Entrepreneur, Businessperson |

| Nationality: | United States of America |

Khosla’s audacity in backing groundbreaking clean technologies has been a hallmark of his career. From biofuels to solar technologies, his investments have reshaped the landscape of Silicon Valley and beyond. His commitment to sustainability is not just about financial returns but also about fostering a better future for the planet.

Martin’s Beach Dispute

One episode in Khosla’s story involves the controversial ‘Martin’s Beach’ dispute. This legal saga centered on a piece of land near Half Moon Bay, which Khosla purchased for $32.5 million in 2008. Historically, this land had provided public access to Martin’s Beach, a tradition Khosla disrupted in 2010 by locking the access gate. The ensuing legal battles, initiated by the Surfrider Foundation, highlighted the tensions between private property rights and public coastal access. By October 2019, a settlement restored public access to the beach, reinforcing California’s robust coastal access laws.

Early Life

Born on January 28, 1955, in New Delhi, India, Vinod Khosla’s early life was steeped in ambition. Influenced by his father’s military career, Khosla initially considered following in those footsteps. However, a pivotal moment came when he read about Intel, igniting his passion for technology. His academic journey saw him earn a bachelor’s degree in electrical engineering from IIT Delhi and later, a master’s in biomedical engineering from Carnegie Mellon University. This trajectory led him to Stanford, where he eventually obtained an MBA in 1980, overcoming initial rejections with perseverance.

Sun Microsystems

After completing his MBA, Khosla initially joined Daisy Systems as CFO but soon recognized a greater opportunity. In 1982, he founded Sun Microsystems alongside Scott McNealy and Andy Bechtolsheim, leveraging the ‘Stanford University Network’ technology. Under his leadership, Sun Microsystems became profitable in its first year, setting the stage for its IPO in 1986. Despite the dotcom bust, the company rebounded, ultimately being acquired by Oracle in 2010 for $7.4 billion.

Venture Capital Career

Khosla’s venture capital career took off at Kleiner Perkins, where he invested in transformative technologies and initiatives like SKS Microfinance. In 2004, he founded Khosla Ventures, with a mission to support entrepreneurs in breakthrough technologies. The firm, managing over $15 billion, has nurtured companies such as QuantumScape and Impossible Foods. With a vision to ‘reinvent societal infrastructure,’ Khosla Ventures continues to push the boundaries of innovation across multiple industries.

49ers Purchase

In a move reflecting Silicon Valley’s growing interest in sports, Vinod Khosla acquired a minority stake in the San Francisco 49ers in 2025. This investment, valued at $8.5 billion for the team, marks Khosla’s entry into professional sports ownership and aligns with a broader trend of tech billionaires investing in NFL franchises.

Personal Life

Vinod Khosla’s personal life reflects his deep-rooted values and commitment to social causes. Married to his childhood sweetheart, Neeru, since 1980, they have four children together. Neeru co-founded the CK-12 Foundation, promoting STEM education. Khosla is actively involved in various philanthropic endeavors, including significant donations to the Wikimedia Foundation and initiatives to support hospitals in India during the COVID-19 pandemic. His political affiliations have seen him support Democratic causes, hosting fundraising events for notable figures such as Barack Obama and endorsing Hillary Clinton in 2016.

In conclusion, Vinod Khosla Net Worth not only reflects his financial achievements but also his indelible impact on technology, sustainability, and philanthropy. His career, marked by bold decisions and innovative investments, continues to inspire future generations in Silicon Valley and beyond.

What is Vinod Khosla’s estimated net worth?

Vinod Khosla, a renowned Indian-American entrepreneur and venture capitalist, has an estimated net worth of $2.8 billion. He co-founded Sun Microsystems and later founded Khosla Ventures, a leading Silicon Valley venture capital firm. His investments in technology and renewable energy have contributed to his impressive wealth

How did Vinod Khosla make his fortune?

Vinod Khosla made his fortune as a venture capitalist and co-founder of Sun Microsystems. He then went on to found Khosla Ventures, a leading Silicon Valley venture capital firm that has invested in successful companies like Google and Square. Khosla’s strategic investments and entrepreneurial mindset have played a key role in his success

What companies has Vinod Khosla invested in?

Vinod Khosla, a renowned venture capitalist and co-founder of Sun Microsystems, has invested in numerous companies including Square, DoorDash, and Impossible Foods. He is known for his focus on disruptive technologies and has also invested in healthcare and energy startups. His investments have helped these companies grow and become successful in their respective industries

How does Vinod Khosla spend his money?

Vinod Khosla, a successful venture capitalist and co-founder of Sun Microsystems, invests his money in various industries such as technology, healthcare, and renewable energy. He also donates to philanthropic causes and supports startups through his venture capital firm, Khosla Ventures. Additionally, he has invested in real estate and owns multiple properties around the world. Khosla is known for his strategic and diverse investment approach, which has led to his significant wealth and success

What philanthropic efforts has Vinod Khosla been involved in?

Vinod Khosla, a renowned venture capitalist and co-founder of Sun Microsystems, has been actively involved in philanthropic efforts through his Khosla Ventures Impact Fund. He focuses on investing in companies that have a positive impact on society and the environment, such as renewable energy, sustainable agriculture, and healthcare technology. Additionally, he has donated millions of dollars to various charitable organizations, including the Khosla Family Foundation which supports education and healthcare initiatives in developing countries

You may also like:

What is Alexis Ohanian Net Worth?

What is Morgan and Morgan net worth?

Descargo de responsabilidad

Toda la información contenida en este sitio web se publica solo con fines de información general y no como un consejo de inversión. Cualquier acción que el lector realice sobre la información que se encuentra en nuestro sitio web es estrictamente bajo su propio riesgo. Nuestra prioridad es brindar información de alta calidad. Nos tomamos nuestro tiempo para identificar, investigar y crear contenido educativo que sea útil para nuestros lectores. Para mantener este estándar y continuar creando contenido de buena calidad. Pero nuestros lectores pueden basarse en su propia investigación.