Noticias e investigaciones antes de escuchar sobre esto en CNBC y otros. Solicite su prueba gratuita de 2 semanas para StreetInsider Premium aquí.

Fondo de bonos de corta duración líder

| Acciones Institucionales: | LCCIX |

| Acciones del inversor: | LCCMX |

| Acciones de clase A: | LCAMX |

| Acciones de clase C: | LCMCX |

Fondo de retorno total líder

| Acciones Institucionales: | LCTIX |

| Acciones del inversor: | LCTRX |

| Acciones de clase A: | LCATX |

| Acciones de clase C: | LCCTX |

Fondo de tasa flotante líder

| Acciones Institucionales: | LFIFX |

| Acciones del inversor: | LFVFX |

FOLLETO

1 de octubre de 2019

| Asesorado por: | ||||||

| Leader Capital Corp. | ||||||

| 315 W. Mill Plain Blvd. | ||||||

| Suite 204 | ||||||

| Vancouver, WA 98660 | ||||||

| 1-800-711-9164 | www.leadercapital.com |

Este Folleto proporciona información importante.

sobre los fondos que debe conocer antes de invertir. Léalo detenidamente y guárdelo para futuras referencias.

Estos valores no han sido aprobados o desaprobados

por la Comisión de Bolsa y Valores de EE. UU. ni la Comisión de Bolsa y Valores de EE. UU. ha aprobado la precisión o

adecuación de este Folleto. Cualquier representación en contrario es un delito penal.

NOTA IMPORTANTE: a partir del 1 de enero de 2021,

según lo permitido por las regulaciones adoptadas por la Comisión de Bolsa y Valores de EE. UU., copias en papel del accionista de los fondos

los informes ya no se enviarán por correo, a menos que solicite específicamente copias en papel de los informes del fondo o de su

intermediario financiero, como un corredor de bolsa o banco. En cambio, los informes estarán disponibles en un sitio web, y usted

recibir una notificación por correo cada vez que se publique un informe y se le proporcione un enlace al sitio web para acceder al informe.

Si ya eligió recibir accionista

informa electrónicamente, no se verá afectado por este cambio y no necesita tomar ninguna medida. Puede elegir recibir accionista

informes y otras comunicaciones del fondo o de su intermediario financiero electrónicamente llamando o enviando una solicitud por correo electrónico.

Puede elegir recibir todos los informes futuros

en papel sin cargo. Puede informar al fondo o a su intermediario financiero que desea continuar recibiendo copias en papel

de sus informes de accionistas llamando o enviando una solicitud por correo electrónico. Su elección para recibir informes en papel se aplicará a todos

Fondos mantenidos con el complejo del Fondo / su intermediario financiero.

mesa

de contenidos

| RESUMEN DEL FONDO DE BONOS DE CORTA DURACIÓN LÍDER | 1 |

| RESUMEN DEL FONDO TOTAL DE DEVOLUCIONES DEL LÍDER | 8 |

| RESUMEN DEL FONDO DE TASA FLOTANTE LÍDER | 14 |

| INFORMACIÓN ADICIONAL SOBRE LAS PRINCIPALES ESTRATEGIAS DE INVERSIÓN Y RIESGOS RELACIONADOS | 19 |

| ADMINISTRACIÓN | 31 |

| CÓMO SE VALORAN LAS ACCIONES | 32 |

| CÓMO COMPRAR ACCIONES | 33 |

| CÓMO CANJEAR ACCIONES | 36 |

| COMPRAS Y CANCELACIONES FRECUENTES DE ACCIONES DE FONDO | 38 |

| ESTADO FISCAL, DIVIDENDOS Y DISTRIBUCIONES | 39 |

| DISTRIBUCIÓN DE ACCIONES | 40 |

| ASPECTOS FINANCIEROS MÁS DESTACADOS | 41 |

| AVISO DE PRIVACIDAD | 51 |

RESUMEN DEL FONDO DE BONOS DE CORTA DURACIÓN LÍDER

Objetivos de inversión: La inversión primaria

El objetivo del Leader Short Duration Bond Fund (el “Fondo”) es entregar un alto nivel de ingresos actuales, con un

objetivo secundario de apreciación del capital.

Honorarios y gastos del fondo: los

La siguiente tabla describe los honorarios y gastos que puede pagar si compra y mantiene acciones del Fondo. Puede calificar para ventas

cobrar descuentos en compras de acciones de Clase A si usted y su familia invierten, o acuerdan invertir en el futuro, al menos $ 50,000

en el fondo. Puede obtener más información sobre estos descuentos en los cargos de ventas y otros descuentos de su profesional financiero

y en la seccion Cómo comprar acciones del Folleto del Fondo y en la sección

Compra, reembolso y fijación de precios de acciones de la Declaración de fondos del Fondo

Información.

|

Honorarios de accionistas (honorarios pagados directamente de su inversión) |

Institucional Comparte |

Inversor Comparte |

Clase A Comparte |

Clase C Comparte |

|

Cargo máximo de venta (carga) impuesto a las compras (como% del precio de oferta) |

Ninguna | Ninguna | 1,50% | Ninguna |

| Cargo máximo por ventas diferidas (carga) (como% del precio de compra más bajo o la redención procede)(1) |

Ninguna | Ninguna | Ninguna | 1,00% |

| Cargo máximo de venta (carga) impuesto sobre Dividendos reinvertidos y otras distribuciones |

Ninguna | Ninguna | Ninguna | Ninguna |

|

Tarifa de canje (como porcentaje de la cantidad canjeada) |

Ninguna | Ninguna | Ninguna | Ninguna |

|

Gastos operativos anuales del fondo (gastos que paga cada año como |

||||

| Los gastos de gestión | 0,75% | 0,75% | 0,75% | 0,75% |

| Distribución y / o servicio (12b-1) Tarifas | Ninguna | 0,50% | 0,50% | 1,00% |

| Otros gastos | 0,55% | 0,56% | 0,56% | 0,56% |

| Intereses y dividendos sobre valores vendidos en corto | 0,13% | 0,13% | 0,13% | 0,13% |

| Resto de otros gastos | 0,42% | 0,43% | 0,43% | 0,43% |

| Honorarios y gastos del fondo adquirido(3) | 0.02% | 0.02% | 0.02% | 0.02% |

| Gastos operativos totales del fondo anual | 1,32% | 1,83% | 1,83% | 2,33% |

| (1) | Un cargo por ventas diferidas contingentes de 1.00% se aplica a ciertos canjes realizados dentro de los 12 meses posteriores a la fecha de compra. |

| (2) | El Fondo es el sucesor del Líder. Fondo de Bonos de Duración Corta (el "Fondo de Duración Corta Predecesor"), una serie de Northern Lights Fund Trust, que fue reorganizado en el Fondo el 15 de julio de 2019. |

| (3) | Los honorarios y gastos del fondo adquirido son los costos indirectos de invertir en otras compañías de inversión. Los gastos operativos en esta tabla de tarifas no se correlacionan con los gastos. ratio en los aspectos financieros destacados del Fondo porque los aspectos financieros destacados incluyen solo los gastos operativos directos incurridos por el Fondo. |

Ejemplo: Este ejemplo está destinado

para ayudarlo a comparar el costo de invertir en el Fondo con el costo de invertir en otros fondos mutuos.

El ejemplo supone que invierte $ 10,000

en el Fondo por los períodos de tiempo indicados y luego canjear todas sus acciones al final de esos períodos. El ejemplo también supone

que su inversión tiene un rendimiento del 5% cada año y que los gastos operativos del Fondo siguen siendo los mismos. Aunque tu real

los costos pueden ser mayores o menores, según estos supuestos, sus costos serían:

| Clase | 1 año | 3 años | 5 años | 10 años |

| Acciones Institucionales | $ 134 | $ 418 | $ 723 | $ 1,590 |

| Acciones de inversionistas | $ 186 | $ 576 | $ 990 | $ 2,148 |

| Acciones de clase A | $ 333 | $ 717 | $ 1,125 | $ 2,266 |

| Acciones de clase C | $ 336 | $ 727 | $ 1,245 | $ 2,666 |

Volumen de negocios de la cartera: El Fondo paga la transacción

costos, como las comisiones, cuando compra y vende valores (o "entrega" su cartera). Una mayor rotación de cartera

puede indicar costos de transacción más altos y puede generar impuestos más altos cuando las acciones del Fondo se mantienen en una cuenta sujeta a impuestos. Estos costos,

que no se reflejan en los gastos operativos anuales del fondo o en el Ejemplo, afectan el rendimiento del Fondo. Durante la mayoría

reciente año fiscal, la tasa de rotación de la cartera del Fondo de corta duración del predecesor fue del 496,37% del valor promedio de su

portafolio.

Principales estrategias de inversión: los

El Fondo espera alcanzar sus objetivos invirtiendo en una cartera de títulos de deuda con grado de inversión y sin grado de inversión

(también conocidos como "bonos basura") títulos de deuda, tanto nacionales como extranjeros, incluidos los mercados emergentes. El fondo define

emisores de mercados emergentes como los que se encuentran fuera de Norteamérica, Europa, Japón, Australia y Nueva Zelanda. Valores de renta fija

en los cuales el Fondo puede invertir incluyen bonos extranjeros y nacionales, pagarés, deuda corporativa, valores de deuda convertibles, preferentes

valores, valores del gobierno estadounidense y extranjero, valores municipales nacionales, valores respaldados por activos (préstamos y créditos respaldados

valores, incluidas las obligaciones de préstamos garantizados ("CLO"), valores solo de interés y STRIPS (operaciones separadas)

de interés registrado y principal de valores, un tipo de instrumento de deuda de cupón cero). El promedio efectivo del Fondo

La duración de las inversiones de su cartera será normalmente de tres años o menos. El Fondo también puede mantener efectivo o equivalentes de efectivo, y

Puede celebrar acuerdos de recompra. Leader Capital Corp. (el "Asesor") utiliza un análisis fundamental de arriba hacia abajo,

lo que significa que el Asesor analiza la economía, los ciclos de tasas de interés, la oferta y la demanda de crédito y las características individuales

valores al hacer selecciones de inversión.

Normalmente, el Fondo invertirá al menos el 80%

de sus activos netos (incluidos los préstamos para fines de inversión) en valores de renta fija. El fondo puede invertir hasta el 40%

de sus activos en bonos de baja calidad y alto rendimiento con calificación B o superior por Moody’s Investors Service, Standard & Poor’s

Ratings Group, Fitch Ratings, Inc. u otra Organización Nacional de Calificación Estadística Reconocida (“NRSRO”) o, si no está calificado

por dichas NRSRO, determinadas por el Asesor como de calidad comparable. El Fondo puede invertir hasta el 20% de sus activos, determinado

en el momento de la inversión, en valores de renta fija extranjera denominados en moneda extranjera. Valores de renta fija extranjera

puede ser de grado de inversión, inferior al grado de inversión o no calificado. El Fondo puede invertir en valores del Gobierno del Tesoro de EE. UU. Con

sin límite. El Fondo puede usar opciones y swaps de incumplimiento crediticio para gestionar el riesgo de inversión.

El Fondo también puede vender acciones de capital en corto

al 20% de los activos del Fondo. El Asesor considerará reducir el stock de emisores en los que el Fondo posee una posición en

los valores de deuda convertibles del mismo emisor. Al seguir su estrategia corta, el Asesor busca aprovechar tácticamente

de la relación de precios entre las acciones de un emisor y sus valores convertibles.

El Fondo puede invertir hasta el 20% de sus activos.

en valores de tasa variable y variable, efectivo, equivalentes de efectivo y valores de renta fija distintos a los descritos anteriormente. los

El fondo también puede invertir en otros fondos mutuos que inviertan principalmente en valores de tasa variable, incluidos los fondos que también se recomiendan

por el asesor. Al conservar algo de efectivo o equivalentes de efectivo, el Fondo puede evitar obtener ganancias y pérdidas por la venta de inversiones

cuando hay canjes de accionistas. Sin embargo, el Fondo puede tener dificultades para cumplir sus objetivos de inversión cuando mantiene un

Posición de efectivo significativa.

El asesor considerará una tasa variable o variable

seguridad para tener un vencimiento igual a su vencimiento establecido (o fecha de redención si se ha solicitado redención), excepto que

puede considerar: (1) valores de tasa variable que tengan un vencimiento igual al período restante hasta el próximo reajuste en el

tasa de interés, a menos que esté sujeto a una función de demanda; (2) valores de tasa variable sujetos a una función de demanda para tener un

vencimiento restante igual al mayor de (a) el siguiente reajuste en la tasa de interés o (b) el período restante hasta el

el principal puede recuperarse a través de la demanda; y (3) valores de tasa variable sujetos a una característica de demanda para tener un vencimiento

igual al período restante hasta que el principal pueda recuperarse a través de la demanda.

El Asesor puede vender un valor si su valor

se vuelve poco atractivo, como cuando sus fundamentos se deterioran o cuando existen otras oportunidades de inversión que pueden tener más

rendimientos atractivos. El Asesor puede participar en la compra y venta frecuente de valores para lograr el objetivo de inversión del Fondo.

Principales riesgos de inversión: Como con todo

fondos mutuos, existe el riesgo de que pueda perder dinero a través de su inversión en el Fondo.

| · | Riesgo de fondo afiliado. Inversiones en otras compañías de inversión, incluido un fondo afiliado, están sujetas a tarifas de asesoramiento de inversión y otros gastos, que será pagado indirectamente por el Fondo. Como resultado, el costo de invertir en el Fondo será mayor que el costo de invertir directamente en un fondo afiliado y puede ser más alto que otros fondos mutuos que invierten directamente en acciones y bonos. El asesor puede recibir gestión u otros honorarios de un fondo afiliado en el que el Fondo puede invertir. Es posible que un conflicto de intereses entre el Fondo y un fondo afiliado podrían afectar la forma en que el Asesor cumple con sus deberes fiduciarios para el Fondo y un fondo afiliado. |

| · | Riesgo respaldado por activos. La tasa predeterminada los préstamos de activos subyacentes pueden ser más altos de lo previsto, lo que podría reducir los pagos al Fondo. Las tasas predeterminadas son sensibles a condiciones económicas generales como el desempleo, los niveles salariales y las tasas de crecimiento económico. |

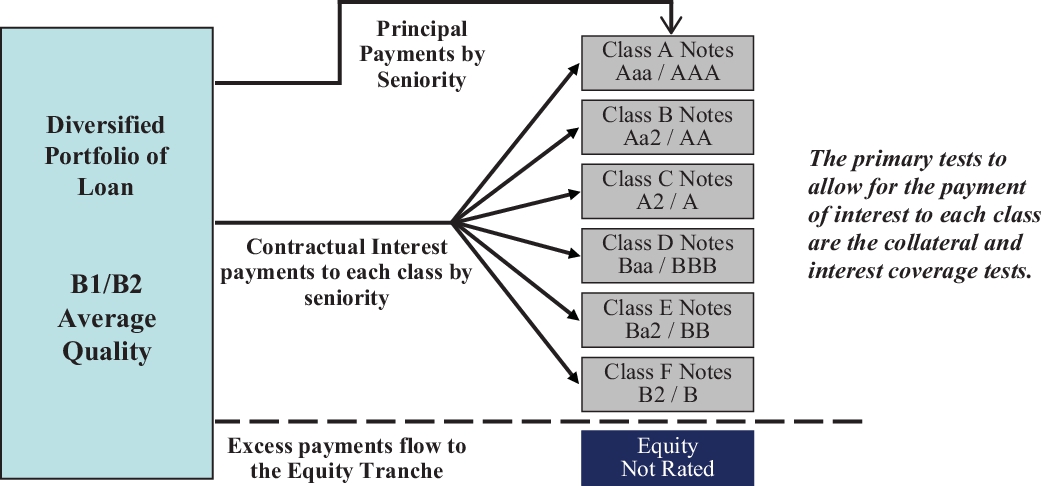

| · | Riesgo de obligación de préstamo colateralizado. Los CLO son valores respaldados por una cartera subyacente de obligaciones de deuda y préstamo, respectivamente. Las CLO emiten clases o "tramos" que varían en riesgo y rendimiento y pueden experimentar pérdidas sustanciales debido a incumplimientos reales, disminución del valor de mercado debido a garantías incumplimientos y eliminación de tramos subordinados, anticipación del mercado de incumplimientos y aversión de los inversores a los valores de CLO como clase. Los riesgos de invertir en CLO dependen en gran medida del tramo invertido y del tipo de deudas y préstamos subyacentes en el tramo del CLO, respectivamente, en el que invierte el Fondo. Las CLO también conllevan riesgos que incluyen, entre otros, la tasa de interés riesgo y riesgo crediticio. |

| · | Riesgo de valores de deuda convertible. Convertible Los títulos de deuda someten al Fondo a los riesgos asociados tanto con los títulos de renta fija como con los títulos de renta variable. Si un convertible El valor de la inversión en seguridad de la deuda es mayor que su valor de conversión, su precio probablemente aumentará cuando las tasas de interés caen y disminuyen cuando suben las tasas de interés. Si el valor de conversión excede el valor de inversión, el precio del convertible La seguridad de la deuda tenderá a fluctuar directamente con el precio de la seguridad de capital subyacente. |

| · | Riesgo de swap de incumplimiento crediticio. Los CDS son típicamente contratos financieros de dos partes que transfieren la exposición crediticia entre las dos partes. Bajo un CDS típico, una de las partes (el "Vendedor") recibe pagos periódicos predeterminados de la otra parte (el "comprador"). El vendedor acepta para hacer pagos compensatorios específicos al comprador si ocurre un evento de crédito negativo, como la bancarrota o el incumplimiento por parte del emisor del instrumento de deuda subyacente. El uso de CDS implica técnicas de inversión y riesgos diferentes a los asociados. con transacciones de seguridad de cartera ordinarias, como riesgos de contraparte, concentración y exposición potencialmente elevados. |

| · | Riesgo crediticio. El emisor de un fijo es posible que la seguridad de ingresos no pueda hacer pagos de intereses o capital cuando vencen. En general, cuanto menor es la calificación crediticia de un valor, cuanto mayor es el riesgo de que el emisor incumpla su obligación. Riesgos de crédito asociados con valores de tasa de subasta ("ARS") reflejar las de otras emisiones de bonos en términos de riesgo de incumplimiento asociado con los emisores. Debido a que el ARS no tiene una función de venta permitiendo que el tenedor de bonos requiera la compra de los bonos por parte del emisor o un tercero, son muy sensibles a los cambios en calificaciones crediticias y normalmente requieren las calificaciones más altas (por ejemplo, AAA / Aaa) para que sean comercializables. |

| · | Riesgo de cambio. Comercio de divisas Los riesgos incluyen riesgo de mercado, riesgo de crédito y riesgo país. El riesgo de mercado resulta de cambios adversos en los tipos de cambio en las monedas. en el que el Fondo es largo o corto. El riesgo de crédito se produce porque una contraparte de comercio de divisas puede incumplir. Surge el riesgo país porque un gobierno puede interferir con las transacciones en su moneda. |

| · | Riesgo de derivados. Al escribir opciones de compra y venta, el Fondo está expuesto a disminuciones en el valor del activo subyacente contra el cual se suscribió la opción. En la medida requerida, el Fondo cubrirá la exposición financiera creada escribiendo opciones de venta y compra comprando o vendiendo opciones de compensación o futuros o designando activos líquidos para cubrir dicha exposición financiera. Al comprar opciones, el Fondo está expuesto al potencial pérdida del precio de compra de la opción. Los derivados pueden ser ilíquidos y el mercado de derivados no está regulado en gran medida. El uso de Los derivados pueden no ser siempre una estrategia exitosa y su uso podría reducir el rendimiento del Fondo. |

| · | Riesgo de mercados emergentes. El Fondo puede invertir en países. con mercados de valores recién organizados o menos desarrollados. En general, las estructuras económicas en estos países son menos diversas y maduros que los de los países desarrollados y sus sistemas políticos tienden a ser menos estables. Las economías de mercado emergentes pueden estar basadas en solo unas pocas industrias, por lo tanto, los emisores de seguridad, incluidos los gobiernos, pueden ser más susceptibles a la debilidad económica y más probable de incumplimiento. Los países de mercados emergentes también pueden tener gobiernos relativamente inestables, economías más débiles y países menos desarrollados. sistemas legales con menos derechos de titular de seguridad. |

| · | Riesgo extranjero. Las inversiones extranjeras implican adicional Riesgos que generalmente no están asociados con la inversión en valores del gobierno de los EE. UU. y / o valores de compañías nacionales, incluyendo fluctuaciones del tipo de cambio, inestabilidad política y económica, diferencias en los estándares de información financiera y una regulación menos estricta de los mercados de valores. La retirada del Reino Unido de la Unión Europea (el llamado Brexit) puede crear una mayor economía incertidumbre para los emisores de deuda europeos e impacta negativamente en su calidad crediticia. Los valores sujetos a estos riesgos pueden ser menores líquido que los que no están sujetos a estos riesgos. |

| · | Riesgo de valores gubernamentales. Es posible que el El gobierno de los EE. UU. No proporcionaría apoyo financiero a sus agencias o instrumentos si la ley no lo requiere. Si una agencia o instrumento del gobierno de los EE. UU. En el que el Fondo invierte incumplimientos y el gobierno de los EE. UU. No respalda la obligación, el precio de la acción o el rendimiento del Fondo podría caer. Valores de entidades patrocinadas por el gobierno de EE. UU., Como Freddie Mac o Fannie Mae, no son emitidos ni garantizados por el gobierno de los EE. UU. La garantía del gobierno de EE. UU. el pago del principal y el pago oportuno de los intereses de los valores del Gobierno de los EE. UU. que son propiedad del Fondo no implica que el Las acciones del Fondo están garantizadas por la Corporación Federal de Seguro de Depósitos o cualquier otra agencia gubernamental, o que el precio de las acciones del Fondo no fluctuará. |

| · | Riesgo de bonos de alto rendimiento. Bonos de baja calidad, conocidos como bonos de alto rendimiento o "bonos basura", presentan un riesgo significativo de pérdida de capital e intereses. Estos bonos ofrecen el potencial de un mayor rendimiento, pero también implica un mayor riesgo que los bonos de mayor calidad, incluida una mayor posibilidad que el emisor, el deudor o el garante del bono no pueden realizar sus pagos de intereses y capital (calidad crediticia riesgo). Si eso sucede, el valor del bono puede disminuir, y el precio de las acciones del Fondo puede disminuir y su distribución de ingresos puede ser reducido Una recesión económica o un período de aumento de las tasas de interés (riesgo de tasa de interés) podría afectar negativamente al mercado para estos bonos y reducir la capacidad del Fondo para vender sus bonos (riesgo de liquidez). La falta de un mercado líquido para estos bonos. podría disminuir el precio de las acciones del Fondo. La capacidad de los gobiernos para pagar sus obligaciones se ve afectada negativamente por incumplimiento, insolvencia, quiebra o inestabilidad política, incluida la participación autoritaria y / o militar en la toma de decisiones gubernamentales, conflicto armado, guerra civil, inestabilidad social y el impacto de estos eventos y circunstancias en la economía de un país y los ingresos de su gobierno. Por lo tanto, los bonos del gobierno pueden presentar un riesgo significativo. Los gobiernos también pueden repudiar sus deudas a pesar de su capacidad de pago. La capacidad del Fondo para recuperarse de un gobierno en incumplimiento es limitada porque eso el mismo gobierno puede bloquear el acceso a los recursos legales exigidos por el tribunal u otros medios de recuperación. |

| · | Riesgo de valores solo de interés. Ciertos valores, denominados "valores de interés solamente" implican una mayor incertidumbre con respecto al retorno de la inversión. Solo un interés la seguridad no tiene derecho a ningún pago principal. Si los activos de la hipoteca en un grupo prepago o impago a tasas rápidas, puede reducir la cantidad de interés disponible para pagar un valor relacionado solo de interés y puede causar que un inversionista en ese interés solo garantice no recuperar la inversión inicial del inversor. |

| · | Riesgo de tipo de interés. El valor del Fondo puede fluctuar. basado en cambios en las tasas de interés y las condiciones del mercado. A medida que aumentan las tasas de interés, el valor de los instrumentos que generan ingresos puede disminución. Este riesgo aumenta a medida que aumenta el plazo de la nota. Los ingresos obtenidos de valores de tasa variable o variable variarán a medida que las tasas de interés disminuyen o aumentan. Sin embargo, las tasas de interés en valores de tasa variable, así como ciertas tasas de interés variable los valores cuyas tasas de interés se restablecen solo periódicamente, pueden fluctuar en valor como resultado de cambios en las tasas de interés cuando hay es una correlación imperfecta entre las tasas de interés de los valores y las tasas de interés del mercado prevalecientes. |

| · | Riesgo específico del emisor. El valor de una seguridad específica. puede ser más volátil que el mercado en su conjunto y puede funcionar de manera diferente al valor del mercado en su conjunto. |

| · | Riesgo de cambio legislativo. Los valores municipales son sujeto al riesgo de que los cambios legislativos y los desarrollos locales y comerciales puedan afectar negativamente el rendimiento o el valor del Las inversiones del fondo en dichos valores. |

| · | Riesgo de liquidez. Algunos valores pueden tener pocos creadores de mercado y bajo volumen de negociación, que tiende a aumentar los costos de transacción y puede dificultar que el Fondo disponga de una garantía en absoluto o a un precio que represente el valor de mercado actual o justo. |

| · | Riesgo de gestión. La estrategia utilizada por el asesor puede no producir los resultados previstos. La capacidad del Fondo para cumplir sus objetivos de inversión está directamente relacionada con la Estrategias de inversión del asesor para el Fondo. Su inversión en el Fondo varía con la efectividad del Asesor investigación, análisis y asignación de activos entre valores de cartera. Si las estrategias de inversión del Asesor no producen Los resultados esperados, su inversión podría verse disminuida o incluso perdida. |

| · | Riesgo de mercado. Los riesgos generales del mercado de renta fija pueden afectar el valor de los valores individuales en los que invierte el Fondo. Factores como los niveles de tasa de interés global, el crecimiento económico, Las condiciones del mercado y los acontecimientos políticos afectan los mercados de valores de renta fija. Cuando el valor de las inversiones del Fondo disminuye, su inversión en el Fondo disminuye en valor y podría perder dinero. |

| · | Riesgo de valores municipales. El valor de municipal los bonos que dependen de una fuente de ingresos específica o de una fuente de ingresos general para financiar sus obligaciones de pago pueden fluctuar como resultado de cambios en los flujos de efectivo generados por la (s) fuente (s) de ingresos o cambios en la prioridad de la obligación municipal de recibir Los flujos de efectivo generados por las fuentes de ingresos. Además, los cambios en las leyes fiscales federales o la actividad de un emisor pueden afectar negativamente afectar el estado exento de impuestos de los bonos municipales. Las inversiones en valores de tasa flotante inversa generalmente implican un mayor riesgo que las inversiones en bonos municipales de vencimiento comparable y calidad crediticia y sus valores son más volátiles que los municipales bonos debido al apalancamiento que conllevan. |

| · | portafolio Riesgo de rotación. La frecuencia de las transacciones del Fondo variará de año en año. El aumento de la rotación de la cartera puede dar lugar a mayores comisiones de corretaje, márgenes de beneficio del distribuidor y otros costos de transacción y puede generar ganancias de capital imponibles. Mayor los costos asociados con una mayor rotación de la cartera pueden compensar las ganancias en el rendimiento del Fondo. Rotación aumentó a medida que el Fondo realizó cambios estratégicos en la asignación de cartera para aprovechar el panorama cambiante de las tasas de interés y para abordar un aumento en la actividad de participación de capital. los Se espera que la rotación de la cartera del Fondo sea superior al 100% anual, ya que el Fondo se negocia activamente. |

| · | Riesgo de seguridad preferido. El valor de los valores preferidos fluctuará con los cambios en las tasas de interés. Por lo general, un aumento en las tasas de interés provoca una disminución en El valor de las acciones preferentes. Los valores preferentes también están sujetos al riesgo de crédito, que es la posibilidad de que un emisor de las acciones preferentes no realizarán sus pagos de dividendos. |

| · | Riesgo del acuerdo de recompra. El fondo puede celebrar acuerdos de recompra en los que compra un valor (conocido como "valor subyacente") de un valor concesionario o banco. En caso de quiebra u otro incumplimiento por parte del vendedor de un acuerdo de recompra, el Fondo podría experimentar retrasos en la liquidación del valor subyacente y pérdidas en caso de una disminución en el valor del valor subyacente mientras el Fondo busca hacer valer sus derechos en virtud del acuerdo de recompra. |

| · | Riesgo de venta corta. Si se vendió un valor incrementos en el precio a corto u otro instrumento, el Fondo puede tener que cubrir su posición corta a un precio más alto que la venta en corto precio, lo que resulta en una pérdida. Es posible que el Fondo no pueda implementar con éxito su estrategia de venta corta debido a la disponibilidad limitada de valores deseados o por otras razones. |

| · | TIRAS Riesgo. Las TIRAS son un tipo de Bono de cupón cero. Los bonos de cupón cero no hacen pagos periódicos de intereses. En cambio, se venden con un descuento de su cara valor y pueden canjearse a su valor nominal cuando maduren. El valor de mercado de un bono de cupón cero es generalmente más volátil que El valor de mercado de otros valores de renta fija con vencimientos similares que hacen pagos periódicos de intereses. Bonos de cupón cero También puede responder a los cambios en las tasas de interés en mayor medida que otros valores de renta fija con vencimientos similares y Calidad crediticia. |

| · | Valores de tasa variable y variable Riesgo. Los valores de tasa variable y variable pueden disminuir en valor si las tasas de interés de mercado o las tasas de interés pagadas por ellos lo hacen No moverse como se esperaba. Por el contrario, los valores de tasa variable y variable generalmente no aumentarán de valor si las tasas de interés del mercado disminución. Los valores de tasa variable y variable pueden estar sujetos a un mayor riesgo de liquidez que otros valores de deuda, lo que significa que puede haber limitaciones en la capacidad del Fondo para vender los valores en un momento dado. Cierta tasa variable y variable los valores tienen una característica de piso de tasa de interés, que evita que la tasa de interés pagadera por el valor caiga por debajo de nivel especificado en comparación con una tasa de interés de referencia (la "tasa de referencia"), como LIBOR. Tal piso protege el Fondo por pérdidas resultantes de una disminución en la tasa de referencia por debajo del nivel especificado. Sin embargo, si la tasa de referencia está debajo del piso, habrá un desfase entre un aumento en la tasa de referencia y un aumento en la tasa de interés pagadera por el valor, y el Fondo puede no beneficiarse del aumento de las tasas de interés durante un período de tiempo significativo. |

Actuación: El Fondo adquirió los activos.

y pasivos del Fondo de corta duración del predecesor el 15 de julio de 2019. Como resultado de la reorganización, el Fondo es la contabilidad

Sucesor del Fondo de corta duración del predecesor. Los resultados de rendimiento que se muestran en el gráfico de barras y la tabla de rendimiento a continuación reflejan

el rendimiento de la clase de acciones del inversor del Fondo de corta duración del predecesor. El gráfico de barras y la tabla a continuación proporcionan

alguna indicación de los riesgos de invertir en el Fondo y el Fondo de corta duración del predecesor. El gráfico de barras muestra los rendimientos anuales.

de la Clase de Inversionista del Fondo Predecesor de Duración Corta de acciones para cada año calendario desde el Predecesor Corto

Duración del inicio del Fondo. Los rendimientos de las otras Clases de acciones del Fondo de corta duración del predecesor serían sustancialmente

similar porque las acciones se invierten en la misma cartera de valores y los rendimientos anuales diferirían solo en la medida

que las Clases no tienen los mismos gastos. La tabla de rendimiento compara el rendimiento del precursor de corta duración

Las acciones del Fondo a lo largo del tiempo para el desempeño del BofA Merrill Lynch 1-3 Year Government / Corporate Index. El predecesor

El rendimiento pasado del Fondo de corta duración, antes y después de impuestos, no es necesariamente una indicación de cómo funcionará el Fondo

en el futuro. La información de rendimiento actualizada está disponible sin costo visitando www.leadercapital.com o llamando al (800) 711-9164.

Clase de inversionista

Devoluciones del año calendario a partir de diciembre

31

| Mejor barrio: | 30/06/2009 | 11,12% |

| Peor trimestre | 30/09/2011 | (4,86)% |

Las acciones de la clase de inversores del Fondo tenían un

rendimiento total de 2.04% durante el período del 1 de enero de 2019 al 30 de junio de 2019.

Rendimientos totales anuales promedio

(Para los períodos terminados el 31 de diciembre,

2018)

| Un año | Cinco años | Diez años | Desde el inicio* | |

| Clase de inversionista antes de impuestos | 2,34% | 0,16% | 2,21% | 2,34% * |

| Retorno de clase de inversor después de impuestos sobre distribuciones | 1,15% | (0,89%) | 1,15% | 1,12% * |

| Retorno de clase de inversor después de impuestos sobre distribuciones y venta de acciones del fondo |

1,38% | (0,34%) | 1,27% | 1,32% * |

| Declaración de clase institucional antes de impuestos | 2,86% | 0,73% | 3,45% | 3.71% ** |

| Devolución de clase A antes de impuestos | 0,64% | (0,66%) | N / A | 0,85% *** |

| Declaración de clase C antes de impuestos | 1,95% | (0.27%) | N / A | 0,91% **** |

| BofA Merrill Lynch 1-3 años Índice gubernamental / corporativo + |

1,64% | 1,04% | 1,56% | 2,39% * |

| * * | La fecha de inicio de la clase de inversores fue el 14 de julio de 2005. |

| ** ** | La fecha de inicio de la Clase Institucional fue el 31 de octubre de 2008. |

| *** | La fecha de inicio de la Clase A fue el 21 de marzo de 2012. |

| **** | La fecha de inicio de la Clase C fue el 8 de agosto de 2012. |

Después de que las declaraciones de impuestos se calculan utilizando el historial

tasas impositivas federales de ingreso marginal más altas individuales y no reflejan el efecto de los impuestos estatales y locales. Declaraciones reales después de impuestos

dependen de la situación fiscal de un inversor y pueden diferir de las mostradas, y las declaraciones después de impuestos que se muestran no son relevantes para los inversores

que poseen acciones del Fondo a través de acuerdos con impuestos diferidos, como planes 401 (k) o cuentas de jubilación individuales ("IRA").

Las declaraciones después de impuestos se muestran solo para las acciones de la clase Investor, y las declaraciones después de impuestos para otras clases variarán.

+ BofA Merrill Lynch 1-3 años Gobierno / Corporativo

Index es un índice que rastrea valores corporativos y del gobierno de EE. UU. A corto plazo con vencimientos entre 1 y 2,99 años. El índice

es producido por BofA Merrill Lynch. El índice no refleja la deducción de tarifas, gastos o impuestos que los inversores de fondos mutuos

oso. A diferencia de un fondo mutuo, un índice no refleja ningún costo de negociación o comisión de gestión. Los inversores no pueden invertir directamente en

un índice.

Asesor de inversiones: Leader Capital Corp.

es el asesor de inversiones del Fondo.

Asesor de inversiones Gerente de cartera: John

E. Lekas, fundador de Leader Capital Corp., ha sido gerente de cartera del Fondo y predecesor del Fondo de corta duración

desde que comenzó a operar en julio de 2005.

Compra y venta de acciones del fondo: por

Acciones de Clase Institucional, el monto mínimo de inversión inicial para una cuenta es de $ 2,000,000. No hay mínimo para posteriores

inversiones. Para las acciones de Clase Inversionista, Clase A y Clase C, el monto mínimo de inversión inicial para todas las cuentas (incluyendo

IRA) es de $ 2,500 y la inversión posterior mínima es de $ 100. Puede comprar y canjear acciones del Fondo cualquier día que el

La Bolsa de Nueva York está abierta. Las solicitudes de reembolso pueden hacerse por escrito, por teléfono o a través de un intermediario financiero.

y será pagado por ACH, cheque o transferencia bancaria.

Información sobre los impuestos:

Dividendos y distribuciones de ganancias de capital que recibe del Fondo, ya sea que reinvierta sus distribuciones en un Fondo adicional

las acciones o las recibe en efectivo, están sujetas a impuestos a las tasas impositivas ordinarias de ingresos o ganancias de capital a menos que esté invirtiendo

a través de un plan con impuestos diferidos, como un plan IRA o 401 (k).

Pagos a agentes de bolsa y otros servicios financieros

Intermediaries: If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank),

the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may

create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the

Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

LEADER TOTAL RETURN FUND SUMMARY

Investment Objective: The investment

objective of the Leader Total Return Fund (the “Fund”) is to seek income and capital appreciation to produce a high

total return.

Fees and Expenses of the Fund: los

following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales

charge discounts on purchases of Class A shares if you and your family invest, or agree to invest in the future, at least $50,000

in the Fund. More information about these sales charge discounts and other discounts is available from your financial professional

and in the section How to Purchase Shares of the Fund’s Prospectus and in the section

Purchase, Redemption and Pricing of Shares of the Fund’s Statement of Additional

Information.

|

Shareholder Fees (fees paid directly from your investment) |

Institutional Shares |

Investor Shares |

Class A Shares |

Class C Shares |

|

Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) |

None | None | 1.50% | None |

| Maximum Deferred Sales Charge (Load) (as a % of the lower of original purchase price or redemption proceeds)(1) |

None | None | None | 1.00% |

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends and other Distributions |

None | None | None | None |

|

Redemption Fee (as a % of amount redeemed, on shares held less |

None | None | None | None |

|

Annual Fund Operating Expenses (expenses that you pay each year as a |

||||

| Management Fees | 0.75% | 0.75% | 0.75% | 0.75% |

| Distribution and/or Service (12b-1) Fees | None | 0.50% | 0.50% | 1.00% |

| Other Expenses | 1.13% | 1.17% | 1.04% | 1.21% |

| Acquired Fund Fees and Expenses(3) | 0.03% | 0.03% | 0.03% | 0.03% |

| Total Annual Fund Operating Expenses | 1.91% | 2.45% | 2.32% | 2.99% |

| (1) | A contingent deferred sales charge of 1.00% applies on certain redemptions made within 12 months of their purchase date. |

| (2) | The Fund is the successor to the Leader Total Return Fund (the “Predecessor Total Return Fund”), a series of Northern Lights Fund Trust, which was reorganized into the Fund on July 15, 2019. |

| (3) | Acquired Fund Fees and Expenses are the indirect costs of investing in other investment companies. The operating expenses in this fee table do not correlate to the expense ratio in the Fund’s financial highlights because the financial statements include only the direct operating expenses incurred by the Fund. |

Ejemplo: This Example is intended

to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000

in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes

that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual

costs may be higher or lower, based upon these assumptions your costs would be:

| Clase | 1 Year | 3 Years | 5 Years | 10 Years |

| Institutional Shares | $194 | $600 | $1,032 | $2,233 |

| Investor Shares | $248 | $764 | $1,306 | $2,786 |

| Class A Shares | $382 | $864 | $1,372 | $2,766 |

| Class C Shares | $402 | $924 | $1,572 | $3,308 |

Portfolio Turnover: The Fund pays transaction

costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover

may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs,

which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most

recent fiscal year, the portfolio turnover rate of the Predecessor Total Return Fund was 397.79% of the average value of its portfolio.

Principal Investment Strategies: los

Fund seeks to achieve its investment objective by investing primarily in domestic and foreign fixed income securities of various

maturities and credit qualities that are denominated in U.S. dollars or foreign currencies. Fixed income security types include

bonds, convertible debt securities, interest-only securities, preferred securities, notes and debentures issued by corporations,

governments and their agencies or instrumentalities as well as mortgage-backed securities (agency, adjustable rate and collateralized

mortgage-backed securities) and asset-backed securities (loan and credit-backed securities including collateralized loan obligations

(“CLOs”). The Fund’s investments in foreign issuers may include issuers from emerging markets. The Fund defines

emerging market issuers as those found outside of North America, Europe, Japan, Australia and New Zealand.

Individual securities are purchased without

restriction as to maturity or duration; however, the average portfolio duration normally varies within 75% to 125% of the three-year

average duration of the Morningstar Core Bond Index, which as of May 31, 2019 was 5.59 years. The Fund will normally have an average

portfolio duration in between 3.50 to 6.00 years.

The Fund invests primarily in investment-grade

securities, but may invest up to 40% of its total assets in high yield securities (commonly referred to as “junk bonds”).

The Fund defines junk bonds as those rated lower than Baa3 by Moody’s Investors Service (“Moody’s”) or

lower than BBB- by Standard and Poor’s Rating Group (“S&P”), or, if unrated, determined by the Advisor to

be of similar credit quality. However, the Fund restricts its junk bond purchases to those rated B3 or higher by Moody’s

or B- or higher by S&P, or, if unrated, determined by the Advisor to be of comparable quality. The Fund may invest in U.S.

treasury government securities with no limit. Foreign issues denominated in U.S. dollars will be excluded from the 40% allocation

limit.

The Advisor allocates Fund assets among various

fixed income sectors, maturities and specific issues using an opportunistic approach by assessing risk and reward.

| · | Sector selection focuses on identifying portions of the fixed income market that the Advisor believes offer the highest yield or expected capital appreciation from interest rate declines or currency exchange rate gains. |

| · | Maturity or yield curve management focuses on selecting securities with maturities that the Advisor believes have the highest yield and/or highest potential capital appreciation, when compared to securities with shorter or longer maturities. |

| · | Security selection focuses on identifying specific securities that offer the highest yield or expected capital appreciation when compared to a peer group of securities with similar credit quality and maturity. |

The Advisor buys securities for either or both

their interest income and their potential for capital appreciation, generally resulting from decreases in interest rates, foreign

currency appreciation, or improving credit fundamentals for a particular sector or security. The Advisor may sell a security if

its value becomes unattractive, such as when its fundamentals deteriorate or when other investment opportunities exist that may

have more attractive yields.

The Fund may short equity stocks up to 20% of

its total assets. The Advisor will consider shorting the stock of issuers in which the Fund owns a position in the same issuer’s

convertible debt securities. In pursuing its short strategy, the Advisor seeks to tactically take advantage of the price relationship

between an issuer’s stock and its convertible securities.

The Advisor may engage in frequent buying and

selling of securities to achieve the Fund’s investment objective.

Principal Investment Risks: As with all

mutual funds, there is the risk that you could lose money through your investment in the Fund.

| · | Collateralized Loan Obligation Risk. CLOs are securities backed by an underlying portfolio of debt and loan obligations, respectively. CLOs issue classes or “tranches” that vary in risk and yield and may experience substantial losses due to actual defaults, decrease of market value due to collateral defaults and removal of subordinate tranches, market anticipation of defaults and investor aversion to CLO securities as a class. The risks of investing in CLOs depend largely on the tranche invested in and the type of the underlying debts and loans in the tranche of the CLO, respectively, in which the Fund invests. CLOs also carry risks including, but not limited to, interest rate risk and credit risk. |

| · | Convertible Debt Securities Risk. Convertible debt securities subject the Fund to the risks associated with both fixed-income securities and equity securities. Si a convertible debt security’s investment value is greater than its conversion value, its price will likely increase when interest rates fall and decrease when interest rates rise. If the conversion value exceeds the investment value, the price of the convertible security will tend to fluctuate directly with the price of the underlying equity security. |

| · | Credit Risk. Issuers may not make interest and principal payments on securities held by the Fund, resulting in losses to the Fund. In addition, the credit quality of securities held by the Fund may be lowered if an issuer’s financial condition changes. Lower credit quality may lead to greater volatility in the price of a security and lower liquidity making it difficult for the Fund to sell the security. |

| · | Currency Risk. Currency trading risks include market risk, credit risk and country risk. Market risk results from adverse changes in exchange rates in the currencies the Fund is long or short. Credit risk results because a currency-trade counterparty may default. Country risk arises because a government may interfere with transactions in its currency. |

| · | Emerging Markets Risk. The Fund may invest in countries with newly organized or less developed securities markets. Generally, economic structures in these countries are less diverse and mature than those in developed countries and their political systems tend to be less stable. Emerging market economies may be based on only a few industries, therefore security issuers, including governments, may be more susceptible to economic weakness and more likely to default. Emerging market countries also may have relatively unstable governments, weaker economies, and less-developed legal systems with fewer security holder rights. |

| · | Foreign Risk. Foreign investments involve additional risks not typically associated with investing in U.S. Government securities and/or securities of domestic companies, including currency rate fluctuations, political and economic instability, differences in financial reporting standards and less strict regulation of securities markets. The withdrawal of the United Kingdom from the European Union (so-called Brexit) may create greater economic uncertainty for European debt issuers and negatively impact their credit quality. Securities subject to these risks may be less liquid than those that are not subject to these risks. |

| · | Government Securities Risk. It is possible that the U.S. Government would not provide financial support to its agencies or instrumentalities if it is not required to do so by law. If a U.S. Government agency or instrumentality in which the Fund invests defaults and the U.S. Government does not stand behind the obligation, the Fund’s share price or yield could fall. Securities of U.S. Government sponsored entities, such as Freddie Mac or Fannie Mae, are neither issued nor guaranteed by the U.S. Government. The U.S. Government’s guarantee of ultimate payment of principal and timely payment of interest of the U.S. Government securities owned by the Fund does not imply that the Fund’s shares are guaranteed by the Federal Deposit Insurance Corporation or any other government agency, or that the price of the Fund’s shares will not fluctuate. |

| · | High-Yield Bond Risk. Lower-quality bonds, known as high-yield bonds or “junk bonds,” present a significant risk for loss of principal and interest. These bonds offer the potential for higher return, but also involve greater risk than bonds of higher quality, including an increased possibility that the bond’s issuer, obligor or guarantor may not be able to make its payments of interest and principal (credit quality risk). If that happens, the value of the bond may decrease, and the Fund’s share price may decrease and its income distribution may be reduced. An economic downturn or period of rising interest rates (interest rate risk) could adversely affect the market for these bonds and reduce the Fund’s ability to sell its bonds (liquidity risk). The lack of a liquid market for these bonds could decrease the Fund’s share price. The ability of governments to repay their obligations is adversely impacted by default, insolvency, bankruptcy or by political instability, including authoritarian and/or military involvement in governmental decision-making, armed conflict, civil war, social instability and the impact of these events and circumstances on a country’s economy and its government’s revenues. Therefore, government bonds can present a significant risk. Governments may also repudiate their debts in spite of their ability to pay. The Fund’s ability to recover from a defaulting government is limited because that same government may block access to court-mandated legal remedies or other means of recovery. |

| · | Interest Only Securities Risk. Certain securities, called “interest only securities” involve greater uncertainty regarding the return on investment. An interest only security is not entitled to any principal payments. If the mortgage assets in a pool prepay or default at rapid rates, it may reduce the amount of interest available to pay a related interest only security and may cause an investor in that interest only security to fail to recover the investor’s initial investment. |

| · | Interest Rate Risk. The value of the Fund may fluctuate based on changes in interest rates and market conditions. As interest rates rise, the value of income producing instruments may decrease. This risk increases as the term of the note increases. Income earned on floating- or variable-rate securities will vary as interest rates decrease or increase. However, the interest rates on variable-rate securities, as well as certain floating-rate securities whose interest rates are reset only periodically, can fluctuate in value as a result of interest rate changes when there is an imperfect correlation between the interest rates on the securities and prevailing market interest rates. |

| · | Issuer-Specific Risk. The value of a specific security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole. |

| · | Liquidity Risk. Some securities may have few market-makers and low trading volume, which tends to increase transaction costs and may make it difficult for the Fund to dispose of a security at all or at a price which represents current or fair market value. |

| · | Management Risk. The Advisor’s judgments about the attractiveness, value and potential appreciation of particular security in which the Fund invests may prove to be incorrect and may not produce the desired results. |

| · | Market Risk. Overall fixed income market risks may affect the value of individual securities in which the Fund invests. Factors such as global interest rate levels, economic growth, market conditions and political events affect the fixed income securities markets. When the value of the Fund’s investments goes down, your investment in the Fund decreases in value and you could lose money. |

| · | Mortgage-Backed and Asset-Backed Securities Risk. los default rate on underlying mortgage loans or asset loans may be higher than anticipated, potentially reducing payments to the Fund. Default rates are sensitive to overall economic conditions such as unemployment, wage levels and economic growth rates. Mortgage-backed securities are susceptible maturity risk because issuers of securities held by the Fund are able to prepay principal due on these securities, particularly during periods of declining interest rates. |

| · | Portfolio Turnover Risk. The frequency of the Fund’s transactions will vary from year to year. Increased portfolio turnover may result in higher brokerage commissions, dealer mark-ups and other transaction costs and may result in taxable capital gains. Turnover increased as the Fund made strategic changes to portfolio allocation to take advantage of the changing interest rate landscape and to address an increase in capital share activity. los Fund’s portfolio turnover is expected to be over 100% annually, as the Fund is actively traded. |

| · | Preferred Security Risk. The value of preferred securities will fluctuate with changes in interest rates. Typically, a rise in interest rates causes a decline in the value of preferred stock. Preferred securities are also subject to credit risk, which is the possibility that an issuer of preferred stock will fail to make its dividend payments. |

| · | Short Sale Risk. If a security sold short or other instrument increases in price, the Fund may have to cover its short position at a higher price than the short sale price, resulting in a loss. The Fund may not be able to successfully implement its short sale strategy due to limited availability of desired securities or for other reasons. |

Performance: The Fund acquired the assets

and liabilities of the Predecessor Total Return Fund on July 15, 2019. As a result of the reorganization, the Fund is the accounting

successor of the Predecessor Total Return Fund. Performance results shown in the bar chart and the performance table below reflect

the performance of the Predecessor Total Return Fund’s Investor Class of shares. The bar chart and table below provide some

indication of the risks of investing in the Fund and the Predecessor Total Return Fund. The bar chart shows the annual returns

of the Predecessor Total Return Fund’s Investor Class shares performance for each calendar year since the Predecessor Total

Return Fund’s inception. Returns for the Predecessor Total Return Fund’s other Classes of shares would be substantially

similar because the shares are invested in the same portfolio of securities and the annual returns would differ only to the extent

that the Classes do not have the same expenses. The performance table compares the performance of the Predecessor Total Return

Fund’s shares over time to the performance of the Bloomberg Barclays U.S. Aggregate Bond Index. The Predecessor Total Return

Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

Updated performance information is available at no cost by visiting www.leadercapital.com or by calling (800) 711-9164.

Investor Class

Calendar Year Returns as of December

31

| Best Quarter: | 03/31/2012 | 5.93% |

| Worst Quarter: | 9/30/2011 | (6.72)% |

The Fund’s Investor Class shares had a

total return of 2.98% during the period January 1, 2019 to June 30, 2019.

Average Annual Total Returns

(For the periods ended December 31,

2018)

| One Year | Five Years | Since Inception | |

| Investor Class Return Before Taxes | 6.00% | 1.52% | 3.70%* |

| Investor Class Return After Taxes on Distributions | 4.55% | 0.06% | 2.17%* |

| Investor Class Return After Taxes on Distributions and Sale of Fund Shares |

3.52% | 0.50% | 2.21%* |

| Institutional Class Return Before Taxes | 6.62% | 2.26% | 4.32%* |

| Class A Return Before Taxes | 4.39% | 0.80% | 2.94%** |

| Class C Return Before Taxes | 5.46% | 1.06% | 3.16%*** |

| Bloomberg Barclays US Intermediate Aggregate Index+ |

0.92% | 2.09% | 2.27%* |

| * * | Inception date for Investor Class and Institutional Class was July 30, 2010. |

| ** ** | Inception date for Class A was March 21, 2012. |

| *** | Inception date for Class C is August 8, 2012. |

After tax returns are calculated using the historical

highest individual federal marginal income tax rates and do not reflect the effect of state and local taxes. Actual after-tax returns

depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors

who hold shares of the Fund through tax-deferred arrangements, such as 401(k) plans or IRAs. After-tax returns are shown for only

Investor Class shares, and after-tax returns for other classes will vary.

+ Bloomberg Barclays US Intermediate Aggregate

Index measures the performance of the U.S. investment grade bond market. The index invests in a wide spectrum of public, investment-grade,

taxable, fixed income securities in the United States – including government, corporate, and international dollar-denominated bonds,

as well as mortgage-backed and asset-backed securities, all with maturities of more than 1 year. Investors may not invest directly

in an index. Unlike the Fund’s returns, the Index does not reflect any fees or expenses.

Investment Advisor: Leader Capital Corp.

is the Fund’s investment advisor.

Investment Advisor Portfolio Managers: John

E. Lekas, founder of Leader Capital Corp., has been the Fund’s and Predecessor Total Return Fund’s portfolio manager

since it commenced operations in July 2010.

Purchase and Sale of Fund Shares: por

Institutional Class shares, the minimum initial investment amount for all accounts (including IRAs) is $2,000,000. No hay

minimum for subsequent investments. For Investor Class, Class A and Class C shares, the minimum initial investment amount for all

accounts (including IRAs) is $2,500 and the minimum subsequent investment is $100. You may purchase and redeem shares of the Fund

on any day that the New York Stock Exchange is open. Redemption requests may be made in writing, by telephone, or through a financial

intermediary and will be paid by ACH, check or wire transfer.

Tax Information:

Dividends and capital gain distributions you receive from the Fund, whether you reinvest your distributions in additional Fund

shares or receive them in cash, are taxable to you at either ordinary income or capital gains tax rates unless you are investing

through a tax-deferred plan such as an IRA or 401(k) plan.

Payments to Broker-Dealers and Other Financial

Intermediaries: If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank),

the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may

create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the

Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

LEADER FLOATING RATE FUND SUMMARY

Investment Objectives: The primary investment

objective of the Leader Floating Rate Fund (the “Fund”) is to deliver a high level of current income, with a secondary

objective of capital appreciation.

Fees and Expenses of the Fund: los

following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. More information about

these sales charge discounts and other discounts is available from your financial professional and in the How to Purchase

Shares of the Fund’s Prospectus and in the section Purchase, Redemption and Pricing

of Shares of the Fund’s Statement of Additional Information.

|

Shareholder Fees (fees paid directly from your investment) |

Institutional Shares |

Investor Shares |

|

Maximum Sales Charge (Load) Imposed on Purchases (as a % of offering price) |

None | None |

|

Maximum Deferred Sales Charge (Load) (as a % of the lower of original purchase price |

None | None |

|

Maximum Sales Charge (Load) Imposed on Reinvested Dividends and other Distributions |

None | None |

| Redemption Fee (as a percentage of amount redeemed) | None | None |

|

Annual Fund Operating Expenses (expenses that you pay each year as a |

||

| Management Fees | 0.65% | 0.65% |

| Distribution and/or Service (12b-1) Fees(2) | None | 0.38% |

| Other Expenses | 0.30% | 0.31% |

| Acquired Fund Fees & Expenses(3) | 0.01% | 0.01% |

| Total Annual Fund Operating Expenses | 0.96% | 1.35% |

| (1) | The Fund is the successor to the Leader Floating Rate Fund (the “Predecessor Floating Rate Fund”), a series of Northern Lights Fund Trust, which was reorganized into the Fund on July 15, 2019. |

| (2) | The Fund has limited 12b-1 fees for Investor Class shares to 0.38% for the current fiscal year. |

| (3) | Acquired Fund Fees and Expenses are the indirect costs of investing in other investment companies. The operating expenses in this fee table do not correlate to the expense ratio in the Fund’s financial highlights because the financial statements include only the direct operating expenses incurred by the Fund. |

Ejemplo: This Example is intended

to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that

you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. los

Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same

and the contractual agreement to reduce management fees and pay other Fund expenses remains in effect only until September 30,

2020. Although your actual costs may be higher or lower, based upon these assumptions your costs would be:

| Clase | 1 Year | 3 Years | 5 Years | 10 Years |

| Institutional Shares | $98 | $306 | $531 | $1,178 |

| Investor Shares | $137 | $428 | $739 | $1,624 |

Portfolio Turnover: The Fund pays transaction

costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover

may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs,

which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the most

recent fiscal year, the Predecessor Floating Rate Fund’s portfolio turnover rate was 248.18% of the average value of its

portfolio.

Principal Investment Strategies: Under

normal circumstances, the Fund invests at least 80% of its net assets, plus any amount of borrowings for investment purposes, in

floating rate debt securities. For the purposes of the Fund’s 80% investment policy, the Fund defines the following US dollar

denominated domestic and foreign floating rate securities as floating rate debt securities:

| · | bonds and corporate debt |

| · | bank loans and bank loan participations |

| · | agency and non-agency commercial mortgage-backed securities (“CMBS”) and residential mortgage-backed securities (“RMBS”) |

| · | interest-only securities |

| · | collateralized loan obligations (“CLOs”) that are backed by domestic and foreign floating rate debt obligations |

| · | collateralized debt obligations (“CDOs”) that are backed by domestic and foreign floating rate debt obligations |

| · | US government securities |

The Fund invests in floating rate debt securities

with an interest rate that resets quarterly based on the London Interbank Offered Rate (“LIBOR”). The Fund allocates

assets across floating rate debt security types without restriction, subject to its 80% floating rate debt policy. The Fund’s

investments in foreign issuers may include issuers from emerging markets. The Fund defines emerging market issuers as those found

outside of North America, Europe, Japan, Australia and New Zealand.

While the Fund invests without restriction as

to the maturity of any single debt security, the Fund’s portfolio average effective duration (a measure of interest rate

risk similar to maturity) will be one year or less. When the Fund invests in debt securities, each security must be rated no lower

than the A category by Standard & Poor’s Ratings Group, Moody’s Investors Service or Fitch Ratings, Inc. If a debt

security is downgraded to below an A rating, the Fund will sell such security within 30 days.

CMBS, RMBS, CLOs, and CDOs are single-purpose

investment vehicles that hold baskets of loans and issue securities that are paid from the cash flows of the underlying loans.

Investors purchase a particular class of securities called a tranche (a French word for slice). The tranches receive payments from

the principal and interest payments made by underlying borrowers in accordance to the rank of the tranche. Normally, CMBS, RMBS,

CLOs, and CDOs have multiple tranches with investors in the bottom tranches having last priority to receive payment. By investing

in A rated or better debt tranches, the Fund will not be less than third in priority for payment. Loans and loan participations

may be unsecured which means that they are not collateralized by any specific assets of the borrower. The Fund allocates assets

across security types without restriction, subject to its 80% floating rate debt policy. The Fund does not purchase floating rate

securities with subordinate underlying loans or debt obligations.

The Advisor utilizes a fundamental top-down

analysis, meaning the Advisor analyzes the economy, interest rate cycles, the supply and demand for credit and the characteristics

of individual securities in making investment selections for the Fund. The Advisor may sell a security if its value becomes unattractive,

such as when its fundamentals deteriorate, its credit rating is downgraded (including, as described above, sales required when

a security is downgraded to below an A rating) or when other investment opportunities exist that may have more attractive yields.

As a result of its trading strategy, the Fund

expects to engage in frequent portfolio transactions that will likely result in higher portfolio turnover and commissions than

many investment companies.

The Fund uses effective duration to measure

interest rate risk. While the Fund invests without restriction as to the maturity of any single debt security, the Fund’s

portfolio average effective duration (a measure of interest rate risk similar to maturity) will be one year or less. The Fund defines

the effective duration of a floating rate security as the time remaining to its next interest rate reset.

Principal Investment Risks: As with all

mutual funds, there is the risk that you could lose money through your investment in the Fund.

- CLO and CDO Risk. CLOs and CDOs are securities backed

by an underlying portfolio of loan and debt obligations, respectively. CLOs and CDOs issue classes or “tranches” that

vary in risk and yield and may experience substantial losses due to actual defaults, decrease of market value due to collateral

defaults and removal of subordinate tranches, market anticipation of defaults and investor aversion to CLO and CDO securities as

a class. Investments in CLO and CDO securities may be riskier and less transparent than direct investments in the underlying loans

and debt obligations.

The risks of investing in CLOs and

CDOs depend largely on the tranche invested in and the type of the underlying debts and loans in the tranche of the CLO or CDO,

respectively, in which the Fund invests. The tranches in a CLO or CDO vary substantially in their risk profile. The senior tranches

are relatively safer because they have first priority on the collateral in the event of default. As a result, the senior tranches

of a CLO or CDO generally have a higher credit rating and offer lower coupon rates than the junior tranches, which offer higher

coupon rates to compensate for their higher default risk. The CLOs and CDOs in which the Fund may invest may incur, or may have

already incurred, debt that is senior to the Fund’s investment. CLOs and CDOs also carry risks including, but not limited

to, interest rate risk and credit risk.

Investments in CLOs and CDOs may

be subject to certain tax provisions that could result in the Fund incurring tax or recognizing income prior to receiving cash

distributions related to such income. CLOs and CDOs that fail to comply with certain U.S. tax disclosure requirements may be subject

to withholding requirements that could adversely affect cash flows and investment results. Any unrealized losses the Fund experiences

with respect to its CLO and CDO investments may be an indication of future realized losses.

The senior tranches of certain

CLOs and CDOs in which the Fund invests may be concentrated in a limited number of industries or borrowers, which may subject those

CLOs and CDOs, and in turn the Fund, to the risk of significant loss if there is a downturn in a particular industry in which the

CLO or CDO is concentrated.

The application of risk retention

rules to CLOs and CDOs may affect the overall CLO and CDO market, resulting in fewer investment opportunities for the Fund.

| · | Credit Risk. The issuer of a fixed income security may not be able to make interest or principal payments when due. Generally, the lower the credit rating of a security, the greater the risk is that the issuer will default on its obligation. |

| · | Distribution Risk. There is a risk that shareholders may not receive distributions from the Fund or that such distributions may not grow or may be reduced over time, including on a per share basis. The Fund may have difficulty paying out distributions if income from its investments is recognized before or without receiving cash representing such income. |

| · | Emerging Markets Risk. The Fund may invest in countries with newly organized or less developed securities markets. Generally, economic structures in these countries are less diverse and mature than those in developed countries and their political systems tend to be less stable. Emerging market economies may be based on only a few industries, therefore security issuers, including governments, may be more susceptible to economic weakness and more likely to default. Emerging market countries also may have relatively unstable governments, weaker economies, and less-developed legal systems with fewer security holder rights. |

| · | Foreign Risk. Foreign investments involve additional risks not typically associated with investing in U.S. Government securities and/or securities of domestic companies, including currency rate fluctuations, political and economic instability, differences in financial reporting standards and less strict regulation of securities markets. The withdrawal of the United Kingdom from the European Union (so-called Brexit) may create greater economic uncertainty for European debt issuers and negatively impact their credit quality. Securities subject to these risks described above may be less liquid than those that are not subject to these risks. |

| · | Government Securities Risk. It is possible that the U.S. Government would not provide financial support to its agencies or instrumentalities if it is not required to do so by law. If a U.S. Government agency or instrumentality in which the Fund invests defaults and the U.S. Government does not stand behind the obligation, the Fund’s share price or yield could fall. Securities of U.S. Government sponsored entities, such as Freddie Mac or Fannie Mae, are neither issued nor guaranteed by the U.S. Government. The U.S. Government’s guarantee of ultimate payment of principal and timely payment of interest of the U.S. Government securities owned by the Fund does not imply that the Fund’s shares are guaranteed by the Federal Deposit Insurance Corporation or any other government agency, or that the price of the Fund’s shares will not fluctuate. |

| · | Interest Only Securities Risk. Certain securities, called “interest only securities” involve greater uncertainty regarding the return on investment. An interest only security is not entitled to any principal payments. If the mortgage assets in a pool prepay or default at rapid rates, it may reduce the amount of interest available to pay a related interest only security and may cause an investor in that interest only security to fail to recover the investor’s initial investment. |

| · | Interest Rate Risk. The value of the Fund may fluctuate based on changes in interest rates and market conditions. As interest rates rise, the value of income producing instruments may decrease. This risk increases as the term of the note increases. Income earned on floating-rate securities will vary as interest rates decrease or increase. However, the interest rates on certain floating-rate securities whose interest rates are reset only periodically, can fluctuate in value as a result of interest rate changes when there is an imperfect correlation between the interest rates on the securities and prevailing market interest rates. |

| · | Liquidity Risk. Some securities may have few market-makers and low trading volume, which tends to increase transaction costs and may make it difficult for the Fund to dispose of a security at all or at a price which represents current or fair market value. |

| · | Loan and Loan Participation Risk. The secondary market for loans and loan participations is a private, unregulated inter-dealer or inter-bank resale market. Purchases and sales of loans and loan participations are generally subject to contractual restrictions that must be satisfied before a loan or loan participations can be bought or sold. These restrictions may impede the Fund’s ability to buy or sell loans and loan participations and may negatively impact the transaction price. It may take longer than seven days for transactions in loans and loan participations to settle. The Fund may hold cash, sell investments or temporarily borrow from banks or other lenders to meet short-term liquidity needs due to the extended loan settlement process, such as to satisfy redemption requests from Fund shareholders. Loan participations are indirectly subject to default risk of the bank granting the participation. Such a default will likely delay the Fund’s access to the cash flows from underlying loan. Loans and loan participations may be unsecured which means that they are not collateralized by any specific assets of the borrower. |

| U.S. federal securities laws afford certain protections against fraud and misrepresentation in connection with the offering or sale of a security, as well as against manipulation of trading markets for securities. The typical practice of a lender in relying exclusively or primarily on reports from the borrower may involve the risk of fraud, misrepresentation, or market manipulation by the borrower. It is unclear whether U.S. federal securities law protections are available to an investment in a loan. In certain circumstances, loans may not be deemed to be securities, and in the event of fraud or misrepresentation by a borrower, lenders may not have the protection of the anti-fraud provisions of the federal securities laws. |

| · | Management Risk. The strategy used by the Advisor may fail to produce the intended results. The ability of the Fund to meet its investment objectives is directly related to the Advisor’s investment strategies for the Fund. Your investment in the Fund varies with the effectiveness of the Advisor’s research, analysis and asset allocation among portfolio securities. The Advisor’s judgments about the attractiveness, value and potential appreciation of particular security in which the Fund invests may prove to be incorrect and may not produce the desired resultados. If the Advisor’s investment strategies do not produce the expected results, your investment could be diminished or even lost. The Fund’s board of trustees may change Fund operating policies and strategies without prior notice or shareholder approval, the effects of which may be adverse. |

| · | Market Risk. Overall fixed income market risks may affect the value of individual securities in which the Fund invests. Factors such as global interest rate levels, economic growth, market conditions and political events affect the fixed income securities markets. Uncertainty relating to the LIBOR calculation process may adversely affect the value of the Fund’s investments in floating rate debt securities that are indexed to LIBOR. When the value of the Fund’s investments goes down, your investment in the Fund decreases in value and you could lose money. |