Entra en Wall Street con StreetInsider Premium. Reclama tu prueba gratuita de 1 semana aquí.

UNIDO

Estados

VALORES

Y COMISIÓN DE INTERCAMBIO

WASHINGTON,

D.C.20549

FORMAR

20-F

☐ REGISTRO

DECLARACIÓN DE ACUERDO CON LA SECCIÓN 12 (b) O (g) DE LA LEY DE CAMBIO DE VALORES DE 1934

O

☒ ANUAL

INFORME DE CONFORMIDAD CON LA SECCIÓN 13 O 15 (d) DE LA LEY DE INTERCAMBIO DE VALORES DE 1934

por

el ejercicio fiscal finalizó el 30 de junio de 2019

O

☐ TRANSICIÓN

INFORME DE CONFORMIDAD CON LA SECCIÓN 13 O 15 (d) DE LA LEY DE INTERCAMBIO DE VALORES DE 1934

por

El período de transición de _________ a _____________.

O

☐ CÁSCARA

INFORME DE LA COMPAÑÍA DE CONFORMIDAD CON LA SECCIÓN 13 O 15 (d) DE LA LEY DE INTERCAMBIO DE VALORES DE 1934

Fecha

de evento que requiere este informe de empresa fantasma:

Comisión

número de expediente: 333-226308

Huitao

Tecnología Co., Ltd.

(Exacto

nombre del Registrante como se especifica en su Carta)

Caimán

Islas

(Jurisdicción

de incorporación u organización)

9 9

Cuarta carretera de circunvalación del noroeste

Yingu

Mansion Suite 1708, Distrito de Haidian

Beijing,

República Popular de China 100190

(Habla a

de las principales oficinas ejecutivas)

Yang

(Sean) Liu

Jefe

Oficial ejecutivo

Tel:

+86 10 82525361

9 9

Cuarta carretera de circunvalación del noroeste

Yingu

Mansion Suite 1708, Distrito de Haidian

Beijing,

República Popular de China 100190

(Nombre,

Número de teléfono, correo electrónico y / o fax y dirección de la persona de contacto de la empresa)

Valores

registrado o que se registrará de conformidad con la Sección 12 (b) de la Ley:

| Título de cada clase | Símbolo (s) de comercio | Nombre de cada intercambio en que se registró |

||

| Acciones ordinarias, valor nominal $ 0.001 | HHT | Mercado de capitales Nasdaq |

Valores

registrado o registrado de conformidad con la Sección 12 (g) de la Ley:

Ninguna

(Título

de clase)

Valores

para lo cual existe una obligación de informar de conformidad con la Sección 15 (d) de la Ley:

Ninguna

(Título

de clase)

los

El número de acciones en circulación de cada una de las clases de capital o acciones ordinarias del emisor al 30 de junio de 2019 era:

7.174.626 acciones ordinarias, valor nominal $ 0.001 por acción.

Indicar

mediante una marca de verificación si el solicitante de registro es un emisor experimentado bien conocido, tal como se define en la Regla 405 de la Ley de Valores. si ☐ No ☒

Si

este informe es un informe anual o de transición, indique con una marca de verificación si el solicitante no está obligado a presentar informes de conformidad

a la Sección 13 o 15 (d) de la Ley de Bolsa de Valores de 1934. Sí ☐ No ☒

Indicar

mediante una marca de verificación si el solicitante de registro (1) ha presentado todos los informes que debe presentar la Sección 13 o 15 (d) de la Bolsa de Valores

Ley de 1934 durante los 12 meses anteriores (o por un período tan corto que se requirió que el solicitante de registro presente dichos informes),

y (2) ha estado sujeto a dichos requisitos de presentación durante los últimos 90 días. Sí ☒ No ☐

Indicar

mediante una marca de verificación si el solicitante de registro ha enviado electrónicamente todos los archivos de datos interactivos que se deben presentar de conformidad

a la Regla 405 del Reglamento S-T (§ 232.405 de este capítulo) durante los 12 meses anteriores (o por un período más corto que

el solicitante de registro debía presentar dichos archivos). si ☒ No ☐

Indicar

mediante una marca de verificación si el solicitante de registro es un archivador acelerado grande, un archivador acelerado, un archivador no acelerado o un emergente

empresa en crecimiento. Consulte la definición de "gran archivador acelerado", "archivador acelerado" y "crecimiento emergente

empresa "en la Regla 12b-2 de la Ley de Intercambio.

Grande

archivador acelerado ☐ Archivador acelerado ☐ Archivador no acelerado ☒ Emergente

empresa de crecimiento ☐

Si

una compañía de crecimiento emergente que prepara sus estados financieros de acuerdo con los US GAAP, indique con una marca de verificación si

El solicitante de registro ha optado por no utilizar el período de transición extendido para cumplir con las normas de contabilidad financiera nuevas o revisadas †

provisto de conformidad con la Sección 13 (a) de la Ley de Intercambio. ☐

Indicar

mediante una marca de verificación qué base de contabilidad ha utilizado el registratario para preparar los estados financieros incluidos en esta presentación:

☒ NOSOTROS.

GAAP ☐ Normas Internacionales de Información Financiera emitidas por la Contabilidad Internacional

Junta de normas ☐ Otro ☐

Si

Se ha marcado "Otro" en respuesta a la pregunta anterior, indique con una marca de verificación qué elemento del estado financiero

el solicitante de registro ha elegido seguir: Artículo 17 ☐ Artículo 18 ☐

Si

Este es un informe anual, indique mediante una marca de verificación si el solicitante de registro es una compañía fantasma (como se define en la Regla 12b-2 del Intercambio

Actuar). si ☐ No ☒

Huitao

TECNOLOGÍA CO., LTD.

FORMAR

INFORME ANUAL 20-F

MESA

De contenidos

CIERTO

INFORMACIÓN

En

este informe anual en el Formulario 20-F, a menos que se indique lo contrario, "nosotros", "nos", "nuestro", la "Compañía"

y "Huitao Technology" se refieren a Huitao Technology Co., Ltd., una compañía organizada en las Islas Caimán, su predecesora

entidades y sus filiales.

A no ser que

el contexto indica lo contrario, todas las referencias a "China" y "China" se refieren a la República Popular

de China, todas las referencias a "Renminbi" o "RMB" son a la moneda legal de la República Popular

de China, todas las referencias a "EE. UU. dólares "," dólares "y" $ "corresponden a la moneda legal de

los Estados Unidos. Este informe anual contiene traducciones de montos de Renminbi a dólares estadounidenses a tasas específicas únicamente para

La conveniencia del lector. No hacemos ninguna representación de que las cantidades de Renminbi o dólares estadounidenses a las que se hace referencia en este informe puedan

han sido o podrían convertirse a dólares estadounidenses o renminbi, según sea el caso, a una tasa particular o en absoluto. En octubre

31, 2019, la tasa de compra en efectivo anunciada por el Banco Popular de China fue de RMB7.0395 a $ 1.00.

A no ser que

indicado lo contrario, referencias a

| ● | "China," "Chino" y "RPC" son referencias a la República Popular de China; |

|

| ● | "BVI" se refiere a las Islas Vírgenes Británicas; |

|

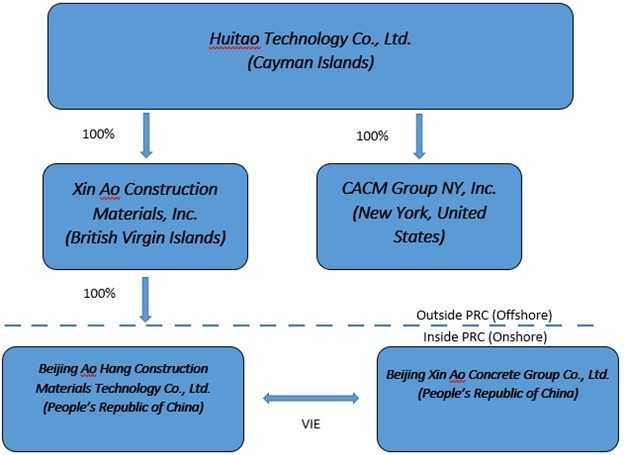

| ● | "Tecnología Huitao", "Huitao", "la Compañía", "nosotros", "nosotros" o "nuestro" son referencias al negocio combinado de Huitao Technology Co., Ltd. y sus subsidiarias de propiedad absoluta, BVI-ACM, CACM y China-ACMH, así como su entidad VIE Xin Ao; |

|

| ● | "BVI-ACM" se refiere a Xin Ao Construction Materials, Inc; |

|

| ● | "CACM" se refiere a CACM Group NY, Inc. | |

| ● | "China-ACMH" se refiere a Beijing Ao Hang Construction Materials Technology Co., Ltd .; |

|

| ● | "Xin Ao" se refiere a Beijing Xin Ao Concrete Group Co., Ltd .; |

MIRANDO HACIA ADELANTE

Declaraciones

Esta

el informe contiene "declaraciones prospectivas" a los efectos de las disposiciones de seguridad de los valores privados

Ley de Reforma de Litigios de 1995 que representa nuestras creencias, proyecciones y predicciones sobre eventos futuros. Todas las declaraciones otras

que las declaraciones de hechos históricos son "declaraciones a futuro", incluidas las proyecciones de ganancias, ingresos

u otros elementos financieros, cualquier declaración de los planes, estrategias y objetivos de gestión para operaciones futuras, cualquier declaración

con respecto a nuevos proyectos propuestos u otros desarrollos, cualquier declaración con respecto a condiciones o desempeño económico futuro, cualquier

declaraciones de creencias, metas, estrategias, intenciones y objetivos de la administración, y cualquier declaración de suposiciones subyacentes

cualquiera de los anteriores Palabras como "may", "will", "should", "could", "would",

"Predice", "potencial", "continuar", "espera", "anticipa", "futuro",

"Intenciones", "planes", "cree", "estimaciones" y expresiones similares, así como

declaraciones en tiempo futuro, identifique declaraciones prospectivas.

Estas

Las declaraciones son necesariamente subjetivas e implican riesgos conocidos y desconocidos, incertidumbres y otros factores importantes que podrían

causar que nuestros resultados reales, desempeño o logros, o resultados de la industria, difieran materialmente de cualquier resultado futuro, desempeño

o logros descritos o implícitos en tales declaraciones. Los resultados reales pueden diferir materialmente de los resultados esperados descritos

en nuestras declaraciones prospectivas, incluso con respecto a la medición correcta e identificación de factores que afectan nuestro negocio

o el alcance de su impacto probable, y la precisión e integridad de la información disponible públicamente con respecto a

los factores en los que se basa nuestra estrategia comercial o el éxito de nuestro negocio. Dadas estas incertidumbres, no debe

deposite una confianza indebida en estas declaraciones prospectivas. Estas declaraciones prospectivas incluyen, entre otras cosas, declaraciones

relativa a:

| ● | nuestra expectativas con respecto al mercado de nuestros productos y servicios concretos; |

|

| ● | nuestra expectativas con respecto al continuo crecimiento de la industria del concreto; |

|

| ● | nuestra creencias sobre la competitividad de nuestros productos; |

|

| ● | nuestra expectativas con respecto a la expansión de nuestra capacidad de fabricación; |

|

| ● | nuestra expectativas con respecto al aumento en el crecimiento de los ingresos y nuestra capacidad de mantener la rentabilidad como resultado de los aumentos en nuestros volúmenes de producción; |

|

| ● | nuestra desarrollo comercial futuro, resultados de operaciones y condición financiera; |

|

| ● | competencia de otros fabricantes de productos de hormigón; |

|

| ● | el pérdida de cualquier miembro de nuestro equipo de gestión; |

|

| ● | nuestras expectativas con respecto a litigios pendientes y reclamos de garantía; | |

| ● | nuestra expectativas con respecto al financiamiento de nuestro negocio; |

|

| ● | nuestra capacidad de integrar filiales y operaciones adquiridas en operaciones existentes; |

|

| ● | mercado condiciones que afectan nuestro capital social; |

|

| ● | nuestra capacidad de implementar con éxito nuestra estrategia de adquisición selectiva; |

|

| ● | cambios en condiciones económicas generales; |

|

| ● | cambios en las normas contables o en la aplicación de tales normas; |

|

| ● | alguna incumplimiento de la presentación periódica y otros requisitos de The Nasdaq Stock Market, o Nasdaq, para continuar cotizando; |

|

| ● | alguna no identificar y remediar las debilidades materiales u otras deficiencias en nuestro control interno y control de divulgación sobre informes financieros; |

| ● | el inicio de cualquier litigio civil, procedimientos regulatorios, acciones gubernamentales de cumplimiento u otros efectos adversos como resultado de las reformulaciones de nuestro Informe Anual en el formulario 10-K para el año fiscal que finalizó el 30 de junio de 2017 e informes trimestrales en el Formulario 10-Q para los períodos que terminaron el 31 de marzo de 2018, el 31 de diciembre de 2017 y el 30 de septiembre de 2017 (en lo sucesivo denominado "Reexpresado Informes "o" Reexpresión "). |

Mirando hacia adelante

las declaraciones no deben leerse como una garantía de rendimiento o resultados futuros, y no serán necesariamente indicaciones precisas

de si, o los tiempos en que, nuestro rendimiento o resultados pueden lograrse. Las declaraciones prospectivas se basan en información

disponible en el momento en que se hacen esas declaraciones y la creencia de la gerencia a partir de ese momento con respecto a eventos futuros, y

están sujetos a riesgos e incertidumbres que podrían causar que el desempeño real o los resultados difieran materialmente de los expresados

en o sugerido por las declaraciones prospectivas. Los factores importantes que podrían causar tales diferencias incluyen, pero no están limitados

a, aquellos factores discutidos bajo los encabezados "Factores de riesgo", "Revisión operativa y financiera y perspectivas"

y en otra parte de este informe.

| ARTICULO 1) |

IDENTIDAD DE DIRECTORES, DIRECCIÓN SUPERIOR Y ASESORES |

No

Aplicable.

| ARTICULO 2) |

OFERTA ESTADÍSTICA Y CALENDARIO ESPERADO |

No

Aplicable.

3.A.

Datos financieros seleccionados

los

La siguiente tabla presenta la información financiera consolidada seleccionada de nuestra empresa. Los estados consolidados seleccionados

de datos integrales de ingresos para los años terminados el 30 de junio de 2019, 2018 y 2017 y los datos del balance general consolidado seleccionados

al 30 de junio de 2019 y 2018 se han derivado de nuestros estados financieros consolidados auditados, que se incluyen en este

informe anual que comienza en la página F-1. Nuestros estados financieros consolidados auditados se preparan y presentan de acuerdo con

principios de contabilidad generalmente aceptados en los Estados Unidos, o US GAAP. Nuestros resultados históricos no necesariamente indican

resultados esperados para cualquier período futuro. Debe leer los siguientes datos financieros seleccionados junto con el consolidado

estados financieros y notas relacionadas y "Punto 5. Revisión operativa y financiera y perspectivas" incluidos en otra parte

en este informe

los

La siguiente tabla presenta nuestro resumen de los estados consolidados de resultados e información integral de resultados:

| Por los años terminados | ||||||||||||

| 2019 | 2018 | 2017 | ||||||||||

| Ingresos | PS | 43,651,923 | PS | 45,734,647 | PS | 45,048,413 | ||||||

| Costo de ingresos | 39,093,782 | 39,022,360 | 43,953,477 | |||||||||

| Beneficio bruto | 4,558,141 | 6.712.287 | 1,094,936 | |||||||||

| Provisión para cuentas incobrables | (2,559,785 | ) | (2,184,221 | ) | (3,352,063 | ) | ||||||

| Gastos de venta, generales y administrativos. | (5,996,609 | ) | (5,301,168 | ) | (5.380.702 | ) | ||||||

| Gastos de investigación y desarrollo. | (223,668 | ) | (1,182,133 | ) | (846,438 | ) | ||||||

| Gastos de compensación de acciones | (4,592,200 | ) | (1,388,501 | ) | (289,000 | ) | ||||||

| Pérdida de operaciones | (8.814.121 | ) | (3,343,736 | ) | (8,773,267 | ) | ||||||

| Otros gastos, neto | (5,574,409 | ) | (4,056,229 | ) | (2,264,853 | ) | ||||||

| Pérdida antes de la provisión para impuestos sobre la renta | (14.388.530 | ) | (7.399.965 | ) | (11,038,120 | ) | ||||||

| Provisión para impuestos sobre la renta | – | – | – | |||||||||

| Pérdida neta | PS | (14.388.530 | ) | PS | (7.399.965 | ) | PS | (11,038,120 | ) | |||

los

La siguiente tabla presenta los datos resumidos de nuestro balance general:

| Al 30 de junio de | ||||||||

| 2019 | 2018 | |||||||

| Efectivo y equivalentes de efectivo | PS | 347,486 | PS | 1,098,691 | ||||

| Cuentas y documentos por cobrar, neto (incluida la parte relacionada) | 37,010,458 | 43.322.463 | ||||||

| Otros activos circulantes | 15,147,569 | 6.230.520 | ||||||

| Planta y equipo, neto | 1,659,520 | 2,748,409 | ||||||

| Los activos totales | 54,165,033 | 53,400,083 | ||||||

| Responsabilidad total | (53,644,235 | ) | (43,697,875 | ) | ||||

| Equidad total de los accionistas | PS | 520,798 | PS | 9,702,208 | ||||

3.B.

Capitalización y endeudamiento

No

Aplicable.

3.C.

Razones para la oferta y uso de los ingresos

No

Aplicable.

3.D.

Factores de riesgo

Un

La inversión en nuestras acciones ordinarias implica un alto grado de riesgo. Debe considerar cuidadosamente los riesgos e incertidumbres descritos

a continuación junto con toda la otra información contenida en este informe anual, incluidos los asuntos discutidos bajo los títulos

“Declaraciones prospectivas” y “Revisión y perspectivas operativas y financieras” antes de que decida invertir

en nuestro acciones ordinarias. Somos una compañía holding con operaciones sustanciales en China y estamos sujetos a un

entorno regulatorio que en muchos aspectos difiere de los Estados Unidos. Si alguno de los siguientes riesgos, o cualquier otro riesgo

e incertidumbres que actualmente no son previsibles para nosotros, realmente ocurren, nuestro negocio, condición financiera, resultados de operaciones,

La liquidez y nuestras perspectivas de crecimiento futuro podrían verse afectadas de manera adversa y material.

Riesgos

Relacionado con nuestro negocio

Consideraciones de liquidez y preocupación actual

Al evaluar la liquidez de la Compañía,

La Compañía monitorea y analiza su efectivo disponible y sus compromisos operativos y de gastos de capital. La liquidez de la empresa

las necesidades son cumplir con sus requisitos de capital de trabajo, gastos operativos y obligaciones de gastos de capital.

La empresa se dedica a la producción de productos avanzados.

Materiales de construcción para infraestructura a gran escala, desarrollos comerciales y residenciales. El negocio de la Compañía es

capital intensivo y la Compañía está altamente apalancada. Financiamiento de la deuda en forma de préstamos bancarios a corto plazo, préstamos relacionados

las partes y las notas de aceptación bancaria se han utilizado para financiar los requisitos de capital de trabajo y los gastos de capital de

la compañia. El déficit de trabajo de la Compañía era de aproximadamente $ 1.1 millones al 30 de junio de 2019. Al 30 de junio de 2019, la Compañía

tenía efectivo disponible de aproximadamente $ 0.3 millones, y los activos corrientes restantes se componen principalmente de cuentas por cobrar y pagos anticipados

y avances.

Aunque la Compañía cree que puede darse cuenta

sus activos actuales en el curso normal de los negocios, la capacidad de la Compañía de pagar sus obligaciones actuales dependerá de

La realización futura de sus activos corrientes. La gerencia ha considerado su experiencia histórica, el entorno económico, las tendencias.

en la industria de la construcción en la RPC, la cobranza esperada de sus cuentas por cobrar y otras cuentas por cobrar y la realización

de los pagos anticipados en inventario, y proporcionó una reserva para cuentas incobrables al 30 de junio de 2019. La Compañía espera darse cuenta

el saldo de sus activos corrientes, neto de la reserva para cuentas de cobro dudoso dentro del ciclo operativo normal de doce meses.

Sin embargo, la Compañía está involucrada en varios

demandas, reclamos y disputas relacionadas con sus operaciones y las garantías personales de sus funcionarios a las entidades afiliadas de su propiedad

por ellos. La Compañía defiende activamente estas acciones e intenta mitigar la exposición de la Compañía a cualquier responsabilidad.

en exceso de la provisión actual de aproximadamente $ 6.6 millones, (véase la Nota 14 en las notas adjuntas a la información financiera consolidada

declaraciones). El resultado final de estas acciones pendientes no se puede determinar actualmente, pero actualmente la gerencia opina

que cualquier posible responsabilidad adicional no tendría un impacto material en la posición financiera consolidada de la Compañía.

Sin embargo, debido a las incertidumbres con los litigios, el sistema legal de la RPC, las reclamaciones y las disputas, es al menos razonablemente posible

La opinión de la gerencia sobre el resultado podría cambiar en el corto plazo.

Además, al 30 de junio de 2019, la Compañía

VIE, Xin Ao, estuvo sujeto a varios juicios civiles con juicios potenciales por un monto aproximado de $ 26.7 millones (ver Nota

14 en las notas adjuntas a los estados financieros consolidados) y la probabilidad del resultado de estas demandas no puede

Actualmente se determinará. Estas demandas involucran a la Compañía principalmente debido a las garantías personales del Sr. Xianfu Han y el Sr.

Weili He, los accionistas y ex funcionarios de la Compañía. Porque el Sr. Han y el Sr. He eran los accionistas controladores de

Xin Ao, los demandantes incluyeron a Xin Ao en sus quejas conjuntas. Xin Ao no estuvo involucrado en la mayoría de las demandas, pero fue nombrado como

un acusado conjunto en las demandas. Como resultado, Xin Ao podría estar expuesto a cualquier juicio en el futuro según las leyes de la RPC. señor.

Han y el Sr.He acordaron indemnizar a la Compañía por cualquier monto que Xin Ao deba pagar. En caso de que el resultado de estas demandas

exigir a Xin Ao que pague porque los otros coacusados de las demandas y el Sr. Han y el Sr.He no pudieron liquidar sus gastos personales.

activos o su interés de propiedad en sus compañías privadas a tiempo para pagar los juicios, el trabajo de la Compañía

el déficit al 30 de junio de 2019 podría incrementarse de aproximadamente $ 1.1 millones a un déficit operativo neto de aproximadamente $ 27.8

millón.

Además, la Compañía está en pago y

incumplimiento técnico bajo su acuerdo de préstamo bancario para el cual el banco ha presentado ante los tribunales de la RPC que ha emitido un aviso de demanda

en mayo de 2019 para el reembolso inmediato de los préstamos pendientes. No se han realizado reembolsos y el saldo al 30 de junio de 2019

es de aproximadamente $ 24.7 millones.

La gerencia de la Compañía ha considerado

si hay un problema de empresa en funcionamiento debido a las pérdidas recurrentes de la Compañía por las operaciones, el incumplimiento de la Compañía

préstamos bancarios, los cargos por reclamos estimados y la posible exposición adicional por acciones pendientes contra la Compañía que actualmente se encuentra

desconocido. La gerencia ha determinado que hay dudas sustanciales sobre nuestra capacidad de continuar como empresa en funcionamiento. Si la empresa

no puede generar ingresos significativos, asegurar la paciencia continua de su banco y / o financiamiento adicional o resolver

cualquier cargo de reclamo estimado pendiente, se le puede solicitar a la Compañía que suspenda o reduzca sus operaciones. La empresa financiera

Las declaraciones no incluyen ajustes que podrían resultar del resultado de esta incertidumbre.

La gerencia está tratando de aliviar la marcha

preocupan el riesgo a través del financiamiento de capital, obteniendo apoyo financiero adicional y compromisos de garantía de crédito y reestructuración de deuda

para la mayoría de los pasivos por litigios.

Nuestra

El negocio está sujeto al riesgo de concentración de proveedores.

Nuestra

los cinco principales proveedores proporcionan aproximadamente el 34.9% del abastecimiento de las materias primas para nuestro negocio de producción de concreto para

año terminado el 30 de junio de 2019. Como resultado de esta concentración en nuestra cadena de suministro, nuestros negocios y operaciones serían negativamente

afectado si alguno de nuestros proveedores clave experimentara una interrupción significativa que afecte el precio, la calidad, la disponibilidad o el tiempo

entrega de sus productos. La pérdida parcial o completa de uno de estos proveedores, o un cambio adverso significativo en nuestra relación

con cualquiera de estos proveedores, podría resultar en la pérdida de ingresos, costos adicionales y demoras en la distribución que podrían dañar nuestro negocio y

relaciones del cliente. Además, la concentración en nuestra cadena de suministro puede exacerbar nuestra exposición a los riesgos asociados con el

terminación por parte de proveedores clave de nuestros acuerdos de distribución o cualquier cambio adverso en los términos de dichos acuerdos, que podría

tener un impacto adverso en nuestros ingresos y rentabilidad.

Nosotros

puede experimentar accidentes graves en el curso de nuestras operaciones, lo que puede causar daños materiales importantes y lesiones personales.

Significativo

Los accidentes y desastres naturales relacionados con la industria pueden causar interrupciones en varias partes de nuestras operaciones, o pueden resultar en

daños a la propiedad o al medio ambiente, aumento de los gastos operativos o pérdida de ingresos. La ocurrencia de tales accidentes y la

las consecuencias resultantes pueden no estar cubiertas adecuadamente, o en absoluto, por las pólizas de seguro que tenemos. De acuerdo con la costumbre

En China, no contamos con ningún seguro de interrupción comercial o seguro de responsabilidad civil por daños personales

o daños ambientales derivados de accidentes en nuestra propiedad o relacionados con nuestras operaciones que no sean nuestros automóviles. Pérdidas

o los pagos incurridos pueden tener un efecto adverso importante en nuestro desempeño operativo si tales pérdidas o pagos no son totalmente

asegurado.

Nuestra

La expansión planificada y los proyectos de mejora técnica podrían retrasarse o verse afectados negativamente, entre otras cosas, por fallas en

recibir aprobaciones regulatorias, dificultades para obtener financiamiento suficiente, dificultades técnicas o recursos humanos u otros

restricciones

Nosotros

pretenden expandir nuevas instalaciones de producción durante los próximos años. Los costos proyectados para nuestra expansión planificada y técnica

Los proyectos de mejora y expansión pueden exceder los contemplados originalmente. Ahorro de costos y otros beneficios económicos esperados

de estos proyectos no puede materializarse como resultado de dichos retrasos, sobrecostos o cambios en las circunstancias del mercado.

A

Para realizar mejoras en nuestra planta actual, no es necesario que solicitemos la aprobación reglamentaria. Sin embargo, para construir

una nueva planta de concreto, necesitaremos (i) solicitar una licencia comercial de la Administración local de Industria y Comercio,

(ii) solicite un Certificado de Calificación de la Industria del Comité de Construcción Municipal local y (iii) reciba

aprobación de la Oficina de Protección Ambiental local en el área del distrito correspondiente. No hay garantía de que podamos

para obtener estas aprobaciones regulatorias de manera oportuna o en absoluto.

Nosotros

No podemos asegurarle que nuestra estrategia de crecimiento tendrá éxito.

Uno

Una de nuestras estrategias es crecer aumentando la distribución y las ventas de nuestros productos penetrando en los mercados existentes en

China y entrando en nuevos mercados geográficos en China. Sin embargo, existen muchos obstáculos para ingresar a estos nuevos mercados, incluidos, pero

no se limita a la competencia de compañías establecidas en tales mercados existentes en China. Por lo tanto, no podemos asegurarle que

podremos superar con éxito tales obstáculos y establecer nuestros productos en cualquier mercado adicional. Nuestra incapacidad para

implementar esta estrategia de crecimiento con éxito puede tener un impacto negativo en nuestro crecimiento, condición financiera futura, resultados de operaciones

o flujos de efectivo.

Si

fallamos en administrar efectivamente nuestro crecimiento y expandimos nuestras operaciones, nuestro negocio, condición financiera, resultados de operaciones y

Las perspectivas podrían verse negativamente afectadas.

Nuestra

El éxito futuro depende de nuestra capacidad de expandir nuestro negocio para abordar el crecimiento de la demanda de nuestros productos y servicios. En orden

Para maximizar el crecimiento potencial en nuestros mercados actuales y potenciales, creemos que debemos expandir nuestra fabricación y comercialización

operaciones Nuestra capacidad para lograr estos objetivos está sujeta a riesgos e incertidumbres importantes, que incluyen:

| ● | el Necesidad de fondos adicionales para construir instalaciones de fabricación adicionales, que es posible que no podamos obtener de manera razonable términos o en absoluto; |

| ● | retrasos y sobrecostos como resultado de una serie de factores, muchos de los cuales pueden estar fuera de nuestro control, como problemas con el equipo proveedores y servicios de fabricación proporcionados por terceros fabricantes o subcontratistas; |

| ● | nuestra recibo de las aprobaciones o permisos gubernamentales necesarios que puedan requerirse para expandir nuestras operaciones de manera oportuna o en absoluto; |

| ● | desviación de atención gerencial significativa y otros recursos; y |

| ● | fracaso para ejecutar nuestro plan de expansión de manera efectiva. |

A

Para dar cabida a nuestro crecimiento, necesitaremos implementar una variedad de sistemas operativos y financieros nuevos y mejorados, procedimientos,

y controles, incluidas las mejoras en nuestros sistemas de contabilidad y otros sistemas de gestión interna, al dedicar recursos adicionales

a nuestra función de informes y contabilidad, y mejoras a nuestro sistema de mantenimiento de registros y seguimiento de contratos. También necesitaremos

para reclutar más personal y capacitar y administrar nuestra creciente base de empleados. Además, nuestra gerencia deberá mantener

y expandir nuestras relaciones con nuestros clientes existentes y encontrar nuevos clientes para nuestros servicios. No hay garantía de que nuestro

la gerencia puede tener éxito en mantener y expandir estas relaciones.

Si

nos encontramos con cualquiera de los riesgos descritos anteriormente, o si de otra manera no podemos establecer u operar con éxito capacidad adicional

o aumentar nuestra producción, es posible que no podamos hacer crecer nuestro negocio e ingresos, reducir nuestros costos operativos, mantener nuestra competitividad

o mejorar nuestra rentabilidad y, en consecuencia, nuestro negocio, condición financiera, resultados de operaciones y perspectivas serán

afectado negativamente.

Si

no podemos estimar con precisión los riesgos o costos generales asociados con un proyecto en el que estamos haciendo una oferta, podemos lograr

una ganancia menor a la anticipada o incluso incurrir en una pérdida en el contrato.

Sustancialmente

Todos nuestros ingresos y cartera de contratos se derivan típicamente de contratos de precio unitario fijo. Los contratos de precio unitario fijo requieren

nosotros para realizar el contrato por un precio unitario fijo independientemente de nuestros costos reales. Como resultado, obtenemos una ganancia en estos

solo se contrae si estimamos con éxito nuestros costos y luego controlamos con éxito los costos reales y evitamos sobrecostos. Si nuestro

los estimados de costos para un contrato son inexactos, o si no ejecutamos el contrato dentro de nuestros estimados de costos, entonces los sobrecostos

puede hacer que el contrato no sea tan rentable como esperábamos, o puede causarnos pérdidas. Esto, a su vez, podría negativamente

afectar nuestro flujo de efectivo, ganancias y posición financiera.

los

los costos incurridos y las ganancias brutas realizadas en esos contratos pueden variar, a veces sustancialmente, de las proyecciones originales debidas

a una variedad de factores, que incluyen, entre otros:

| ● | en el sitio condiciones que difieren de las asumidas en la oferta original; |

|

| ● | retrasos causado por las condiciones climáticas; |

|

| ● | más tarde fechas de inicio del contrato de lo esperado cuando ofertamos por el contrato; |

|

| ● | contrato modificaciones que crean costos no anticipados no cubiertos por las órdenes de cambio; |

|

| ● | cambios en disponibilidad, proximidad y costos de materiales, incluidos acero, concreto, agregados y otros materiales de construcción (tales como piedra, grava y arena), así como combustible y lubricantes para nuestros equipos; |

|

| ● | disponibilidad y nivel de habilidad de los trabajadores en la ubicación geográfica de un proyecto; |

|

| ● | nuestra incumplimiento de los proveedores o subcontratistas; |

|

| ● | fraude o robo cometido por nuestros empleados; |

|

| ● | mecánico problemas con nuestra maquinaria o equipo; |

|

| ● | citas emitido por autoridades gubernamentales |

|

| ● | dificultades en la obtención de los permisos o aprobaciones gubernamentales requeridos; |

|

| ● | cambios en las leyes y reglamentos aplicables; y |

|

| ● | reclamaciones o demandas de terceros que aleguen daños derivados de nuestro trabajo o del proyecto del que forma parte nuestro trabajo. |

Económico

Las bajas o reducciones en el financiamiento gubernamental de proyectos de infraestructura podrían reducir significativamente nuestros ingresos.

Nuestra

el negocio depende en gran medida de la cantidad de trabajo de infraestructura financiado por varias entidades gubernamentales, que, a su vez, depende

sobre la condición general de la economía, la necesidad de infraestructura nueva o de reemplazo, las prioridades asignadas a varios proyectos

financiado por entidades gubernamentales y niveles de gasto del gobierno nacional o local. Disminución de la financiación gubernamental de la infraestructura.

los proyectos podrían disminuir el número de contratos de construcción civil disponibles y limitar nuestra capacidad de obtener nuevos contratos, que

podría reducir nuestros ingresos y ganancias.

Nuestra

la planta de producción de concreto en Beijing puede estar sujeta a un plan general de rezonificación de la ciudad que, si se implementa en el futuro, puede requerir

nosotros para reubicar o posiblemente cerrar permanentemente parte de esta planta.

Nuestra

la planta de producción de concreto en Beijing puede estar sujeta a un plan general de rezonificación de la ciudad que ha sido preparado por el municipio de Beijing

gobierno. Según el plan de rezonificación, se pretende que las propiedades donde se ubica esta planta se rezonifiquen de la industria

para uso comercial. Si y cuando se implementa con respecto a esas propiedades, el plan de rezonificación puede requerir que desocupemos estas propiedades

y reubicar la planta. En caso de que tengamos que desalojar la planta, implementaríamos ciertas estrategias para minimizar

pérdida de capacidad de producción durante la reubicación. No puede garantizarse que nuestras estrategias para hacer frente a la reubicación del

las instalaciones pueden implementarse, o que tales estrategias pueden implementarse antes de que se nos requiera desocupar la planta debido a la

plan general propuesto de rezonificación de la ciudad. Si se nos exige reubicar la planta, nuestros resultados de operación y condición financiera

puede verse afectada material y negativamente.

Nuestra

La exposición a clientes o proveedores con problemas financieros podría dañar nuestro negocio, nuestra situación financiera y nuestros resultados operativos.

Nosotros

Produzca, venda y entregue concreto premezclado, y confíe en proveedores, que en el pasado y en el futuro puedan tener experiencia financiera

dificultades, particularmente a la luz de las condiciones recientes en los mercados de crédito y la economía general que afectaron el acceso a

capital y liquidez. Como resultado, dedicamos recursos significativos para monitorear las cuentas por cobrar y los saldos de inventario con ciertas

de nuestros clientes Si nuestros clientes experimentan dificultades financieras, podríamos tener dificultades para recuperar las cantidades que nos deben

estos clientes, o la demanda de nuestros servicios por parte de estos clientes podría disminuir. Además, el gobierno endureció monetaria

política para regular la inflación, lo que a su vez llevó a retrasos en el pago de nuestros proyectos de construcción de viviendas. Por preocupación

sobre la inflación, el gobierno chino comenzó a endurecer su política monetaria a partir de octubre de 2010, lo que afectó a los bienes raíces.

y las industrias de construcción negativamente. Como resultado, nuestras cuentas por cobrar aumentaron y la provisión para cuentas incobrables

También aumentó. Algunos de nuestros clientes parecían sufrir una disminución de los negocios y la escasez de efectivo. El subsidio para dudosos

las cuentas aumentaron a aproximadamente $ 21.2 millones al 30 de junio de 2019, en comparación con aproximadamente $ 19.3 millones al 30 de junio,

2018. De hecho, nuestra provisión para cuentas incobrables, como un porcentaje de nuestras cuentas por cobrar totales, ha aumentado de aproximadamente

31% al 30 de junio de 2018, a aproximadamente 36.5% al 30 de junio de 2019. La imposibilidad de cobrar nuestras cuentas por cobrar pendientes

could adversely affect our operating cash flows and reduce our working capital. As a result, we may suffer material write-offs

on our accounts receivable. The inability of our suppliers to supply us with needed raw materials could adversely affect our production

process and therefore, we may not be able to fulfill our contract arrangements with customers.

We

rely on internal models to manage risk, to provide accounting estimates and to make other business decisions. Our results could

be adversely affected if those models do not provide reliable estimates or predictions of future activity.

We

rely heavily on internal models in making a variety of decisions crucial to the successful operation of our business, including

the allowance for doubtful accounts and other accounting estimates. It is therefore important that our models are accurate, and

any failure in this regard could have a material adverse effect on our results. Models are inherently imperfect predictors of

actual results because they are based on historical data available to us and our assumptions about factors such as credit demand,

payment rates, default rates, delinquency rates and other factors that may overstate or understate future experience. Our models

could produce unreliable results for a number of reasons, including the limitations of historical data to predict results due

to unprecedented events or circumstances, invalid or incorrect assumptions underlying the models, the need for manual adjustments

in response to rapid changes in economic conditions, incorrect coding of the models, incorrect data being used by the models or

inappropriate application of a model to products or events outside of the model’s intended use. In particular, models are

less dependable when the economic environment is outside of historical experience, as has been the case recently. Due to the factors

described above and in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”,

we may, among other things, experience actual write-offs that exceed our estimates and which are possibly greater than our allowance

for doubtful accounts, or which require material adjustments to the allowance. Unanticipated and excessive default and write-off

experience can adversely affect our profitability and financial condition and adversely affect our ability to finance our business.

Our

business will be damaged if project contracts with the Chinese government, for which we may act as a subcontractor are cancelled.

We

do not enter into any contracts directly with the Chinese government. For contracts that are funded by the Chinese government,

we place bids and enter into subcontracts with the private entity prime contractor. A sudden cancellation of a prime contract,

and in turn our subcontract, could cause our equipment and work crews to remain idle for a significant period of time until other

comparable work becomes available. This idle time could have a material adverse effect on our business and results of operations.

Our

industry is highly competitive, with numerous larger companies with greater resources competing with us, and our failure to compete

effectively could reduce the number of new contracts awarded to us or adversely affect our margins on contracts awarded.

Our

competition includes a number of state-owned and large private PRC-based manufacturers and distributors that produce and sell

products similar to ours. We compete primarily on the basis of quality, technological innovation and price. Essentially all of

the contracts on which we bid are awarded through a competitive bid process, with awards generally being made to the lowest bidder,

though other factors such as shorter schedules or prior experience with the customer are often just as important. Within our markets,

we compete with many national, regional and local state-owned and private construction firms. Some of these competitors have achieved

greater market penetration or have greater financial and other resources than us. In addition, there are a number of larger national

companies in our industry that could potentially establish a presence in our markets and compete with us for contracts. As a result,

we may need to accept lower contract margins in order to compete against these competitors. If we are unable to compete successfully

in our markets, our relative market share and profits could be reduced.

We

could face increased competition in our principal market.

Our

principal market, Beijing, has enjoyed stronger economic growth and a higher demand for construction than other regions of China.

As a result, we believe that competitors will try to expand their sales and build up their distribution networks in our principal

market. We anticipate that this trend will continue and likely accelerate. Increased competition may have a material adverse effect

on our financial condition and results of operations.

Our

dependence on subcontractors and suppliers of materials could increase our costs and impair our ability to compete on contracts

on a timely basis or at all, which would adversely affect our profits and cash flow.

We

rely on third-party subcontractors to perform some of the work on many of our contracts. We do not bid on contracts unless we

have the necessary subcontractors committed for the anticipated scope of the contract and at prices that we have included in our

bid. Therefore, to the extent that we cannot obtain third-party subcontractors, our profits and cash flow will suffer.

We

may have inadvertently violated Section 13(k) of the Exchange Act and may be subject to sanctions as a result.

Section

13(k) of the Securities Exchange Act of 1934 (Section 402 of the Sarbanes-Oxley Act of 2002, (“Sarbanes-Oxley”) provides

that it is unlawful for a company that has a class of securities registered under Section 12 of the Exchange Act to, directly

or indirectly, including through any subsidiary, extend or maintain credit in the form of a personal loan to or for any director

or executive officer of the company. We overlooked this prohibition and Xin Ao, our VIE, inadvertently made certain advances and

provided a guarantee to Beijing Lianlv Technology Group Co. Ltd., an entity controlled by Mr. Han and Mr. He our former chief

executive and former chief financial officers. Such advance and guarantee may have violated Section 13(k). Issuers who are found

to have violated Section 13(k) may be subject to civil sanctions, including injunctive remedies and monetary penalties, as well

as criminal sanctions. The imposition of any of such sanctions on the Company could have a material adverse effect on our business,

financial position, results of operations or cash flows.

We

have identified material weaknesses in our internal control over financial reporting, and we cannot provide assurances that these

weaknesses will be effectively remediated or that additional material weaknesses will not occur in the future. If our internal

control over financial reporting or our disclosure controls and procedures are not effective, we may not be able to accurately

report our financial results, prevent fraud or file our periodic reports in a timely manner, which may cause investors to lose

confidence in our reported financial information and which may lead to a decline in our stock price.

En

October 6, 2018, the Audit Committee of the Board of Directors, after consultation with the Company’s then independent registered

public accounting firm, Friedman LLP (“Friedman”) concluded, that the Company’s audited financial statements

at and for the year ended June 30, 2017 contained in the Company’s Annual Report on Form 10-K originally filed with the

SEC on as well the unaudited financial statements at and for the periods ended March 31, 2018, December 31, 2017 and September

30, 2017 contained in the Company’s Quarterly Reports on Form 10-Q originally filed on November 15, 2017, February 13, 2018

and May 15, 2018, respectively, should no longer be relied upon. The Company’s review of the above-mentioned filings revealed

that the financial statements in such filings contained errors primarily as a result of omission of certain contingencies. Como

a result of such review, the Company has decided to make certain corrections to include certain contingencies disclosure in the

aforementioned consolidated financial statements and notes thereto. The Company also evaluated whether any of the contingencies’

losses should be recorded in the aforementioned consolidated financial statements and recorded $1.2 million of contingent liabilities

for the year ended June 30, 2018. As a result of the errors described above, management has concluded that the Company’s

internal control over financial reporting and its disclosure controls and procedures were not effective as of the ends of each

of the applicable restatement periods.

Furthermore, as discussed in “Part II, Item 15. Controls and Procedures,” our management has

identified material weaknesses in our internal control over financial reporting, which were not remediated as of June 30, 2019.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there

is a reasonable possibility that a material misstatement of the registrant’s annual or interim financial statements will

not be prevented or detected on a timely basis.

We

did not maintain an effective control environment as there was an insufficient complement of personnel with appropriate accounting

knowledge, experience and competence, resulting in incorrect application of accounting principles generally accepted in the United

States of America (“U.S. GAAP”). This material weakness contributed to the following material weaknesses. We did not

maintain effective controls over our financial close process. Also, we did not design and maintain effective controls over the

review of supporting information to determine the completeness and accuracy of the accounting for complex transactions, specifically

related to the business combination that occurred on September 9, 2016, which resulted in an incorrect application of U.S. GAAP

that resulted in material misstatements and a restatement of our unaudited condensed consolidated financial statements for the

three and nine months ended September 30, 2016.

Como

of the date of this Annual Report, we are re-assessing the design of our controls and modifying processes related to the identification

and reporting for contingencies. However, there can be no assurance that we will be able to fully remediate our existing material

weaknesses or that our internal control over financial reporting will not suffer in the future from other material weaknesses,

thus making us unable to prevent or detect on a timely basis material misstatements in our periodic reports with the SEC. If we

fail to remediate these material weaknesses or otherwise maintain effective internal control over financial reporting in the future,

the existence of one or more internal control deficiencies could result in errors in our financial statements, and substantial

costs and resources may be required to rectify internal control deficiencies. If we cannot produce reliable financial

reports, we may have difficulty in filing timely periodic reports with the SEC, investors could lose confidence in our reported

financial information, the market price of our stock could decline significantly, we may be unable to obtain additional financing

to operate and expand our business, and our business and financial condition could be materially harmed. In addition, any failure

to remediate the existing material weaknesses or a failure to maintain effective internal control over financial reporting could

negatively impact our results of operations, cash flows and financial condition, subject us to potential litigation and regulatory

inquiry and cause us to incur additional costs in future periods relating to the implementation of remedial measures.

Matters

relating to or arising from the restatements, Audit Committee investigation and the associated material weaknesses identified

in our internal control over financial reporting, including adverse publicity, have caused us to incur significant legal, accounting

and other professional fees and other costs, have exposed us to greater risks associated with other civil litigation, regulatory

proceedings and government enforcement actions, have diverted resources and attention that would otherwise be directed toward

our operations and implementation of our business strategy and may impact our ability to attract and retain customers, employees

and vendors, any of which could have a material adverse effect on our business, financial condition and results of operations.

We

may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the Foreign Corrupt

Practices Act or Chinese anti-corruption law could have a material adverse effect on our business.

We

are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments

to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the

purpose of obtaining or retaining business. Chinese anti-corruption law also strictly prohibits bribery of government officials.

We have operations, agreements with third parties and make sales in China, where corruption may occur. Our activities in China

create the risk of unauthorized payments or offers of payments by one of the employees, consultants, sales agents or distributors

of our Company, even though these parties are not always subject to our control. It is our policy to implement safeguards to prevent

these practices by our employees. However, our existing safeguards and any future improvements may prove to be less than effective,

and the employees, consultants, sales agents or distributors of our Company may engage in conduct for which we might be held responsible.

Violations

of the FCPA or other anti-corruption laws may result in severe criminal or civil sanctions, and we may be subject to other liabilities,

which could negatively affect our business, operating results and financial condition. In addition, the United States government

may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that

we acquire.

los

relative lack of public company experience of our management team may put us at a competitive disadvantage.

Our

management team lacks U.S. public company experience, which could impair our ability to comply with legal and regulatory requirements

such as those imposed by the Sarbanes-Oxley Act. Our senior management does not have experience managing a U.S. publicly traded

company and lacks knowledge about the Sarbanes-Oxley Act. Such responsibilities include complying with federal securities laws

and making required disclosures on a timely basis. Our senior management are unable to implement programs and policies in an effective

and timely manner or that adequately respond to the increased legal, regulatory and reporting requirements associated with being

a U.S. publicly traded company. Our failure to comply with all applicable requirements could lead to the imposition of fines and

penalties, distract our management from attending to the management and growth of our business, result in a loss of investor confidence

in our financial reports and have an adverse effect on our business and stock price.

We

depend heavily on key personnel, and turnover of key employees and senior management could harm our business.

Our

future business and results of operations depend in significant part upon the continued contributions of our key technical and

senior management personnel, including Yang (Sean) Liu, our Chairman and Chief Executive Officer and Lili Jiang, our director

and Chief Financial Officer. They also depend in significant part upon our ability to attract and retain additional qualified

management, technical, operational and support personnel for our operations. If we lose a key employee, if a key employee fails

to perform in his or her current position, or if we are not able to attract and retain skilled employees as needed, our business

could suffer. Significant turnover in our senior management could significantly deplete the institutional knowledge held by our

existing senior management team. We depend on the skills and abilities of these key employees in managing the reclamation, technical,

and marketing aspects of our business, any part of which could be harmed by turnover in the future.

Certain

of our existing stockholders have substantial influence over our company, and their interests may not be aligned with the interests

of our other stockholders.

Our Chief Executive Officer, Yang (Sean)

Liu, owns approximately 1.6% of our outstanding voting securities and our Chief Financial Officer, Lili Jiang, owns approximately

1.6% of our outstanding voting securities as of the date of this annual report, in a fully-diluted share base. As a result,

each have significant influence over our business, including decisions regarding mergers, consolidations, liquidations and the

sale of all or substantially all of our assets, election of directors and other significant corporate actions. This concentration

of ownership may also have the effect of discouraging, delaying or preventing a future change of control, which could deprive

our stockholders of an opportunity to receive a premium for their shares as part of a sale of our company and might reduce the

price of our shares.

We will require additional capital and

we may not be able to obtain it on acceptable terms or at all.

We will require additional cash resources due

to current and any changed business conditions or other future developments, including any investments or acquisitions we may decide

to pursue. If our resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities

or obtain additional credit facilities. The sale of additional equity securities could result in dilution to our stockholders.

The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and

financing covenants that would restrict our operations. Our ability to obtain additional capital on acceptable terms is subject

to a variety of uncertainties, including:

| ● | our current financial position and the continuing going concern and litigation issues; | |

| ● | investors’ perception of, and demand for, securities of Chinese-based companies involved in construction supply or concrete industries; |

|

| ● | conditions of the U.S. and other capital markets in which we may seek to raise funds; |

|

| ● | our future results of operations, financial condition and cash flows; y |

|

| ● | economic, political and other conditions in China. |

Financing

may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms

favorable to us, or at all, could have a material adverse effect on our business, financial condition and results of operations.

We

may be exposed to potential risks relating to our internal controls over financial reporting.

Como

directed by Section 404 of the Sarbanes-Oxley Act of 2002 or SOX 404, the SEC adopted rules requiring public companies to include

a report of management on the company’s internal controls over financial reporting in their annual reports. Under current

law, the auditor attestation will not be required as long as our filing status remains as a smaller reporting company, but we

may cease to be a smaller reporting company in future years, in which case we will be subject to the auditor attestation requirement.

We were subject to management report for the fiscal year ended June 30, 2019, and a report of our management for the 2019 fiscal

year is included under Item 15 of this annual report concluding that, as of June 30, 2019, our internal controls over financial

reporting were not effective. If we cannot remediate the material weakness identified in a timely manner or, if and when we are

subject to the auditor attestation report requirement, we are unable to receive a positive attestation from our independent auditors

with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements,

which could adversely affect the price of our ordinary shares.

We

have limited insurance coverage for our operations in China.

los

insurance industry in China is still at an early stage of development. Insurance companies in China offer limited insurance products.

We have determined that the risks of disruption or liability from our business, the loss or damage to our property, including

our facilities, equipment and office furniture, the cost of insuring for these risks, and the difficulties associated with acquiring

such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we do not have

any business liability, disruption, litigation or property insurance coverage for our operations in China except for insurance

on some company owned vehicles. Any uninsured occurrence of loss or damage to property, or litigation or business disruption may

result in the incurrence of substantial costs and the diversion of resources, which could have an adverse effect on our operating

results.

We

may not be current in our payment of social insurance and housing accumulation fund for our employees and such shortfall may expose

us to relevant administrative penalties.

los

PRC laws and regulations require all employers in China to fully contribute their own portion of the social insurance premium

and housing accumulation fund for their employees within a certain period of time. Failure to do so may expose the employers to

make rectification for the accrued premium and fund by the relevant labor authority. Also, an administrative fine may be imposed

on the employers as well as the key management members. As of June 30, 2019, Xin Ao has fully contributed the social insurance

premium and housing accumulation fund according to PRC laws and regulations.

Our

operations may incur substantial liabilities to comply with environmental laws and regulations.

Our

concrete manufacturing operations are subject to laws and regulations relating to the release or disposal of materials into the

environment or otherwise relating to environmental protection. Applicable law required that we obtain an environmental impact

report and environmental approval from the environmental protection administration prior to obtaining the business license and

construction enterprise qualification certificate for Xin Ao. However, the local administration of industry and commerce and the

Beijing Municipal Construction Commission did not require Xin Ao to provide the environmental impact report and environmental

approval, and Xin Ao has not received any notice of non-compliance nor has any fine or other penalty been assessed. However, the

environmental protection administration may in the future require that Xin Ao provide the applicable report and apply for the

required environment approval. Our failure to have complied with the applicable laws regarding delivery of the report may result

in the assessment of administrative, civil and criminal penalties, the incurrence of investigatory or remedial obligations and

the imposition of injunctive relief. Resolution of these matters may require considerable management time and expense. In addition,

changes in environmental laws and regulations occur frequently and any changes that result in more stringent or costly manufacturing,

storage, transport, disposal or cleanup requirements could require us to make significant expenditures to reach and maintain compliance

and may otherwise have a material adverse effect on our industry in general and on our own results of operations, competitive

position or financial condition.

If

we are unable to realize the current assets within the normal operating cycle, the Company may not have sufficient funds to meet

our working capital requirements and debt obligations as they become due.

Our

business is capital intensive and highly leveraged. Debt financing in the form of short term bank loans, loans from related parties

and bank acceptance notes, have been utilized to finance the working capital requirements and the capital expenditures of the

Company. We are currently in default of our bank loan agreement and the bank has demanded repayment in accordance with a court

order. There are a number of factors, such as the demand for the Company’s products, economic conditions, the competitive

pricing in the concrete-mix industry, the Company’s operating results not continuing to deteriorate and the Company’s

bank and shareholders being able to provide continued support, might result in insufficient funds to meet our working capital

requirements, operating expenses and capital expenditure obligations. Due to recurring losses, the Company’s working deficit

was approximately $1.1 million as of June 30, 2019 as compared to a working capital of $7.0 million as of June 30, 2018. As of

June 30, 2019, cash on-hand balance of approximately $0.3 million with the remaining current assets are mainly composed of accounts

receivables and prepayments and advances. If we fail to realize the current assets within the normal operating cycle, or if we

are otherwise unable to establish other available funds, we may not have sufficient funds to meet our working capital requirements

and debt obligations, grow our business and revenues, reduce our operating costs and, consequently, our business, financial condition,

results of operations, and prospects will be adversely affected.

Risks

Related to Doing Business in China

En

order to comply with PRC regulatory requirements, we operate our businesses through companies with which we have contractual relationships

but in which we do not have controlling ownership. If the PRC government determines that our agreements with these companies are

not in compliance with applicable regulations, our business in the PRC could be materially adversely affected.

We

do not have direct or indirect equity ownership of our variable interest entity, or VIE, Xin Ao, which operates all our businesses

in China. At the same time, however, we have entered into contractual arrangements with Xin Ao and its individual owners pursuant

to which we received an economic interest in, and exert a controlling influence over Xin Ao, in a manner substantially similar

to a controlling equity interest.

A pesar de que

we believe that our current business operations are in compliance with the current laws in China, we cannot be sure that the PRC

government would view our operating arrangements to be in compliance with PRC regulations that may be adopted in the future. There

have been recent reports of potential PRC government efforts to regulate or perhaps limit the use of VIE structures for new foreign

investment, particularly in the internet and other telecommunications industries. We are monitoring developments in this area

and do not believe any adverse impact on our operations is likely.

If

we are determined not to be in compliance with future PRC regulations, the PRC government could levy fines, revoke our business

and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, require

us to restructure our business, corporate structure or operations, impose additional conditions or requirements with which we

may not be able to comply, impose restrictions on our business operations or on our customers, or take other regulatory or enforcement

actions against us that could be harmful to our business. As a result, our business in the PRC could be materially adversely affected.

A

slowdown or other adverse developments in the PRC economy may materially and adversely affect our customers, demand for our services

and our business.

We

are a holding company. All of our operations are conducted in the PRC and all of our revenues are generated from sales in the

PRC.

According

to several articles published by the Wall Street Journal, The New York Times, and BBC News in September and October 2019, China’s

economic slowdown worsened in the July-to-September period as the trade war with the United States and a host of other problems

leave China struggling to meet its goals. Value-added industrial output in China rose 4.4% in August 2019 compared to August 2018,

which was far below economists’ expectation of 5.2% growth and also slower than the 4.8% increase in July, according to

the National Bureau of Statistics. Fixed-asset investment outside Chinese rural households climbed 5.5% in the January-August

period in 2019 compared to the same period in 2018, which was also slightly below expectations. Retail sales in China rose 7.5%

in August 2019 from a year earlier, which was lower than the 7.6% gain in July 2019 and below expectations for a 7.9% rise. If

China’s economy continues to slow down, it may negatively affect our business operation and financial results.

We

rely on contractual arrangements with our VIEs for our operations, which may not be as effective in providing control over these

entities as direct ownership.

Our

operations and financial results are dependent on our VIEs, Xin Ao and its subsidiaries, in which we have no equity ownership

interest and must rely on contractual arrangements to control and operate the businesses of our VIEs. These contractual arrangements

are not as effective in providing control over the VIEs as direct ownership. For example, the VIEs may be unwilling or unable

to perform its contractual obligations under our commercial agreements. Consequently, we would not be able to conduct our operations

in the manner currently planned. In addition, the VIEs may seek to renew their agreements on terms that are disadvantageous to

us. Although we have entered into a series of agreements that provide us with substantial ability to control the VIEs, we may

not succeed in enforcing our rights under them insofar as our contractual rights and legal remedies under PRC law are inadequate.

In addition, if we are unable to renew these agreements on favorable terms when these agreements expire or enter into similar

agreements with other parties, our business may not be able to operate or expand, and our operating expenses may significantly

increase.

En

addition, the VIE structure is subject to uncertainty amid the PRC’s changing legislative practice. In January 2015, China’s

Ministry of Commerce unveiled a draft legislation that could change how the government is regulating corporate structures, especially

for VIEs controlled by foreign investments. Instead of looking at “ownership”, the draft law focused on the entities

or individuals hold control of a VIE. If a VIE is deemed to be controlled by foreign investors, it may be barred from operating

in restricted sectors or the prohibited sectors listed on a “negative list”, where only companies controlled by Chinese

nationals could operate, even if structured as VIEs.

En

the event that the draft law is implemented in any form, and that the Company’s business is characterized as one of the

“restricted” or “prohibited” sectors, Xin Ao and its subsidiaries may be barred from operation which will

materially adversely affect our business.

If

we become directly subject to the recent scrutiny, criticism and negative publicity involving certain U.S.-listed Chinese companies,

we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, stock

price and reputation and could result in a loss of your investment in our stock, especially if such matter cannot be addressed

and resolved quickly.

Recently,

U.S. public companies that have substantially all of their operations in China, particularly companies like us which have completed

so-called reverse merger transactions, have been the subject of intense scrutiny, criticism and negative publicity by investors,

short sellers, financial commentators and regulatory agencies, such as the United States Securities and Exchange Commission. Much

of the scrutiny, criticism and negative publicity has centered around financial and accounting irregularities and mistakes, a

lack of effective internal controls over financial accounting, inadequate corporate governance policies or a lack of adherence

thereto and, in many cases, allegations of fraud. As a result of the scrutiny, criticism and negative publicity, the publicly

traded stock of many U.S. listed Chinese companies has sharply decreased in value and, in some cases, has become virtually worthless.

Many of these companies are now subject to shareholder lawsuits, SEC enforcement actions and are conducting internal and external

investigations into the allegations. It is not clear what affect this sector-wide scrutiny, criticism and negative publicity will

have on our company, our business and our stock price. If we become the subject of any unfavorable allegations, whether such allegations

are proven to be true or untrue, we will have to expend significant resources to investigate such allegations and/or defend our

company. This situation could be costly and time consuming and distract our management from growing our company. If such allegations

are not proven to be groundless, our company and business operations will be severely impacted and your investment in our stock

could be rendered worthless.

Adverse

changes in political and economic policies of the PRC government could impede the overall economic growth of China, which could

reduce the demand for our products and damage our business.

We

conduct all of our operations and generate all of our revenue in China. Accordingly, our business, financial condition, results

of operations and prospects are affected significantly by economic, political and legal developments in China. The PRC economy

differs from the economies of most developed countries in many respects, including:

| ● | el higher level of government involvement; |

|

| ● | el early stage of development of the market-oriented sector of the economy; |

|

| ● | el rapid growth rate; |

|

| ● | el higher level of control over foreign exchange; y |

|

| ● | el allocation of resources. |

Como

the PRC economy has been transitioning from a planned economy to a more market-oriented economy, the PRC government has implemented

various measures to encourage economic growth and guide the allocation of resources. While these measures may benefit the overall

PRC economy, they may also have a negative effect on us.

A pesar de que

the PRC government has in recent years implemented measures emphasizing the utilization of market forces for economic reform,

the PRC government continues to exercise significant control over economic growth in China through the allocation of resources,

controlling payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular

industries or companies in different ways.

Alguna

adverse change in the economic conditions or government policies in China could have a material adverse effect on the overall

economic growth and the level of new construction investments and expenditures in China, which in turn could lead to a reduction

in demand for our services and consequently have a material adverse effect on our business and prospects.

Uncertainties

with respect to the PRC legal system could limit the legal protections available to you and us.

We

conduct substantially all of our business through our operating subsidiary in the PRC. Our operating subsidiaries are generally

subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested

enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have

limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded

to various forms of foreign investments in China. However, since the PRC legal system continues to rapidly evolve, the interpretations

of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties,

which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in

substantial costs and diversion of resources and management attention. In addition, all of our executive officers and almost all

of our directors are residents of China and not of the United States, and substantially all the assets of these persons are located

outside the United States. As a result, it could be difficult for investors to affect service of process in the United States

or to enforce a judgment obtained in the United States against our Chinese operations and subsidiaries.

los

PRC government exerts substantial influence over the manner in which we must conduct our business activities.

los

PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy

through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations,

including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other

matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements.

However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations

of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such

regulations or interpretations.

Accordingly,

government actions in the future, including any decision not to continue to support recent economic reforms and to return to a

more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant

effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest

we then hold in Chinese properties or joint ventures.

Restrictions

on currency exchange may limit our ability to receive and use our sales revenue effectively.

Most

of our sales revenue and expenses are denominated in RMB. Under PRC law, the RMB is currently convertible under the “current