Archivado de conformidad con la Regla 424 (b) (2)

Declaración de registro No. 333-231751

Suplemento de precios del 30 de septiembre de 2019 a

Prospecto del producto Suplemento MLN-ES-ETF-1 del 19 de junio de 2019 y

Folleto Fechado el 18 de junio de 2019

|

El banco Toronto-Dominion $ 231,000 iShares® MSCI EAFE ETF-Linked Capped Leverageged Buffered Notes con vencimiento el 4 de octubre de 2021 |

El Toronto-Dominion Bank ("TD" o "nosotros") ha ofrecido las Notas amortiguadas apalancadas limitadas (las "Notas") vinculadas al rendimiento de las acciones de los iShares®

MSCI EAFE ETF (el "Activo de referencia"), que se describe a continuación.

Las Notas proporcionan una participación apalancada en el rendimiento positivo del Activo de referencia si el nivel del Activo de referencia aumenta del Nivel inicial al Nivel final,

sujeto a la cantidad máxima de reembolso. Los inversores recibirán su Monto principal al vencimiento si el Nivel final está por debajo del Nivel inicial hasta el Porcentaje de amortiguación. Si el nivel final está por debajo del nivel inicial en más de la memoria intermedia

Porcentaje, los inversores perderán el 1% del monto principal de los Bonos por cada disminución del 1% desde el Nivel inicial hasta el Nivel final de más del Porcentaje de amortiguación, y pueden perder parte o casi toda su inversión en los Bonos. Alguna

Los pagos de los Bonos están sujetos a nuestro riesgo de crédito.

Los Bonos no están garantizados y no son cuentas de ahorro ni depósitos asegurados de un banco. Los Bonos no están asegurados ni garantizados por Canada Deposit Insurance Corporation, EE. UU.

Federal Deposit Insurance Corporation o cualquier otra agencia gubernamental o entidad de Canadá o Estados Unidos. Las Notas no se enumerarán ni se mostrarán en ninguna bolsa de valores o red de comunicaciones electrónicas.

|

El pago al vencimiento será mayor que el monto principal solo si el cambio de porcentaje es mayor que cero. Las Notas no garantizan la |

Las Notas tienen características complejas e invertir en las Notas implica una serie de riesgos. Consulte "Factores de riesgo adicionales" a partir de la página P-6 de este precio.

suplemento, “Factores de riesgo adicionales específicos de las Notas” que comienzan en la página PS-6 del suplemento del prospecto del producto MLN-ES-ETF-1 con fecha 19 de junio de 2019 (el “suplemento del prospecto del producto”) y “Factores de riesgo” en la página 1 del prospecto de junio

18 de 2019 (el "prospecto").

Ni la Comisión de Bolsa y Valores (la "SEC") ni ninguna comisión estatal de valores ha aprobado o desaprobado estas Notas o determinado que esto

suplemento de precios, el suplemento del prospecto del producto o el prospecto es veraz o completo. Cualquier representación en contrario es un delito penal.

El 3 de octubre de 2019, entregaremos los Bonos en forma de registro a través de las instalaciones de The Depository Trust Company contra el pago en fondos disponibles de inmediato.

Este suplemento de precios se relaciona con las Notas.

|

Activo de referencia |

Bloomberg Corazón |

Inicial Nivel |

Factor de apalancamiento |

Buffer Porcentaje |

Nivel de búfer |

Nivel de Cap / Cantidad máxima de canje |

CUSIP / ISIN |

|

iShares® MSCI EAFE ETF |

EPT |

$ 65.21 |

200% |

10% |

$ 58.6890, que es el 90% del nivel inicial |

$ 72.5135, que es el 111.20% del nivel inicial / $ 1,224.00 |

89114Q6W3 / US89114Q6W30 |

|

Precio de oferta pública1 |

Descuento de suscripción2 |

Ingresos a TD |

|||

|

Total |

Por nota |

Total |

Por nota |

Total |

Por nota |

|

$ 231,000.00 |

$ 1,000.00 |

PS1,155.00 |

$ 5.00 |

PS229,845.00 |

$ 995.00 |

El valor estimado de los Bonos en el momento en que los términos de sus Bonos se establecieron en la Fecha de fijación de precios, según nuestros modelos de precios internos, era de $ 986.70, como se discutió

más adelante en "Factores de riesgo adicionales: valor estimado" que comienza en la página P-7 e "Información adicional sobre el valor estimado de las notas" en la página P-25 de este suplemento de precios. El valor estimado es menor que la oferta pública.

precio de los Bonos.

El precio de oferta pública, el descuento de suscripción y los ingresos de TD enumerados anteriormente se relacionan con las Notas que emitimos inicialmente. Podemos decidir vender Notas adicionales después de la fecha de

este suplemento de precios, a precios de oferta pública y con descuentos de suscripción y ganancias a TD que difieren de los montos establecidos anteriormente. El rendimiento (ya sea positivo o negativo) de su inversión en los Bonos dependerá en parte del

precio de oferta pública que paga por tales Notas.

|

1 |

Ciertos distribuidores que compran los Bonos para la venta a ciertas cuentas de asesoramiento basadas en tarifas pueden renunciar a algunas o todas sus concesiones de venta, tarifas o comisiones. El precio de oferta pública para |

|

2 |

TD Securities (USA) LLC (“TDS”) recibirá una comisión de $ 5.00 (0.50%) por $ 1,000.00 del monto principal de los Bonos y utilizará toda esa comisión para permitir la venta de concesiones a |

|

Notas amortiguadas apalancadas limitadas Debido 4 de octubre de 2021 |

|

Resumen

La información en esta sección "Resumen" está calificada por la información más detallada establecida en este suplemento de precios, el suplemento del prospecto del producto y el prospecto.

|

Editor: |

TD |

|

Problema: |

Valores de deuda senior, Serie E |

|

Tipo de nota: |

Notas amortiguadas apalancadas limitadas |

|

Término: |

Aproximadamente 2 años |

|

Activo de referencia: |

Acciones de los iShares® MSCI EAFE ETF |

|

CUSIP / ISIN: |

89114Q6W3 / US89114Q6W30 |

|

Índice objetivo: |

El MSCI® Índice EAFESM |

|

Agente: |

TDS |

|

Moneda: |

Dólares estadounidenses |

|

Inversión mínima: |

$ 1,000 y denominaciones mínimas de $ 1,000 en exceso |

|

Cantidad principal: |

$ 1,000 por nota |

|

Fecha de precios: |

30 de septiembre de 2019 |

|

Fecha de asunto: |

3 de octubre de 2019, que son tres días hábiles posteriores a la fecha de fijación de precios. Bajo la Regla 15c6-1 de la Ley de Bolsa de Valores de 1934, según enmendada (la "Ley de Bolsa"), las transacciones en el mercado secundario generalmente |

|

Fecha de la valoración: |

30 de septiembre de 2021, sujeto a aplazamiento si dicho día no es un Día de Negociación o por interrupciones del mercado y de otro tipo, como se describe en “Términos Generales de las Notas – Eventos de Interrupción del Mercado” en el producto |

|

Fecha de vencimiento: |

4 de octubre de 2021, sujeto a aplazamiento si dicho día no es un Día Hábil o si se pospone la Fecha de Valoración, como se describe en “Términos Generales de las Notas – Eventos de Interrupción del Mercado” en el producto |

|

Pago al vencimiento: |

Si, en la Fecha de valoración, el cambio de porcentaje es positivo, entonces el inversionista recibirá un monto por cada $ 1,000 Monto principal de las Notas (yo) Cantidad principal + (Cantidad principal x Porcentaje (ii) La cantidad máxima de canje Si, en la Fecha de valoración, el cambio de porcentaje es menor o igual a 0%, pero no mayor que el porcentaje de búfer (es decir, el porcentaje Si, en la Fecha de valoración, el cambio de porcentaje es negativo por más de el porcentaje de búfer (es decir, el cambio de porcentaje está entre -10% y Cantidad principal + (Cantidad principal x (Cambio de porcentaje + Porcentaje de búfer)) Si el nivel final es menor que el nivel de amortiguación, el inversor recibirá menos del monto principal de las notas al vencimiento y puede perder una parte sustancial de Todos los montos utilizados o resultantes de cualquier cálculo relacionado con el Pago al vencimiento se redondearán hacia arriba o hacia abajo, según corresponda, al centavo más cercano. |

|

Cambio porcentual: |

El cambio porcentual es el cociente, expresado como un porcentaje, de la siguiente fórmula: Nivel final – Nivel inicial Nivel inicial |

|

Nivel inicial, factor de apalancamiento, Porcentaje de buffer y buffer Nivel: |

Inicial Nivel(1) (2) |

Buffer Porcentaje |

Nivel de búfer(2) |

Influencia Factor |

|

|

$ 65.21 |

10% |

$ 58.6890, que es el 90% del nivel inicial |

200% |

|

(1) El nivel inicial es el nivel de cierre del activo de referencia en la fecha de fijación de precios. (2) El nivel inicial y el nivel de la memoria intermedia están sujetos a ajustes, como se describe en “Términos generales de las notas: ajustes antidilución” en el prospecto del producto. |

|

|

Nivel final: |

El nivel de cierre del activo de referencia en la fecha de valoración. |

|

Nivel de cierre de la referencia Activo: |

El nivel de cierre será el precio de venta de cierre o el último precio de venta informado (o, en el caso de NASDAQ, el precio de cierre oficial) para el activo de referencia en una acción por acción |

|

Período de seguimiento: |

Monitoreo de Fecha de Valoración |

|

Precio máximo y máximo Cantidad de canje: |

Nivel de tapa(1) |

Cantidad máxima de canje (por seguridad) |

|

|

$ 72.5135, que es el 111.20% del nivel inicial |

$ 1,224.00 |

|

(1) El nivel de límite está sujeto a ajustes como se describe |

|

|

Día laboral: |

Cualquier día que sea lunes, martes, miércoles, jueves o viernes que no sea feriado legal ni día en que las instituciones bancarias estén autorizadas o obligatorias por ley a cerrar en la ciudad de Nueva York o Toronto. |

|

Tratamiento fiscal de EE. UU .: |

Al comprar una Nota, cada titular acuerda, en ausencia de un cambio estatutario o reglamentario o una determinación administrativa o resolución judicial en contrario, caracterizar las Notas, para el gobierno federal de EE. UU. |

|

Tratamiento fiscal canadiense: |

Consulte la discusión en el suplemento del prospecto del producto en "Suplementario Discusión de las consecuencias fiscales canadienses ", que se aplica a las Notas. |

|

Agente de cálculo: |

TD |

|

Listado: |

Las Notas no se enumerarán ni se mostrarán en ninguna bolsa de valores o red de comunicaciones electrónicas. |

|

Liquidación y liquidación: |

DTC global (incluso a través de sus participantes indirectos Euroclear y Clearstream, Luxemburgo) como se describe en "Descripción de los valores de deuda – Formas de los valores de deuda" y |

|

Rescate canadiense: |

Los Bonos no son valores de deuda rescatables (como se define en el prospecto) bajo la Ley de Corporación de Seguro de Depósitos de Canadá. |

Términos adicionales de sus notas

Debe leer este suplemento de precios junto con el prospecto, tal como lo complementa el suplemento del prospecto del producto, cada uno relacionado con nuestros Valores de deuda senior, Serie E, de los cuales el

Las notas son una parte. Los términos en mayúscula utilizados pero no definidos en este suplemento de precios tendrán los significados que se les dan en el suplemento del prospecto del producto. En caso de conflicto, regirá la siguiente jerarquía: primero, este precio

suplemento; segundo, el suplemento del prospecto del producto; y por último, el prospecto Las Notas varían de los términos descritos en el suplemento del prospecto del producto de varias maneras importantes. Debieras

lea este suplemento de precios cuidadosamente.

Este suplemento de precios, junto con los documentos enumerados a continuación, contiene los términos de las Notas y reemplaza todas las declaraciones orales anteriores o contemporáneas, así como cualquier otra escrita

materiales que incluyen términos de precios preliminares o indicativos, correspondencia, ideas comerciales, estructuras para implementación, estructuras de muestra, folletos u otros materiales educativos nuestros. Debe considerar cuidadosamente, entre otras cosas, el

asuntos establecidos en "Factores de riesgo adicionales" en el presente, "Factores de riesgo adicionales específicos de las Notas" en el suplemento del prospecto del producto y "Factores de riesgo" en el prospecto, ya que las Notas involucran riesgos no asociados con la deuda convencional

valores. Le instamos a consultar a sus asesores de inversiones, legales, fiscales, contables y de otro tipo antes de invertir en los Bonos. Puede acceder a estos documentos en el sitio web de la SEC en www.sec.gov de la siguiente manera (o si esa dirección ha cambiado, revisando

nuestras presentaciones para la fecha relevante en el sitio web de la SEC):

Nuestra clave de índice central, o CIK, en el sitio web de la SEC es 0000947263. Como se usa en este suplemento de precios, el "Banco", "nosotros", "nosotros" o "nuestro" se refiere al Banco Toronto-Dominion y sus subsidiarias.

Nos reservamos el derecho de cambiar los términos o rechazar cualquier oferta de compra de las Notas antes de su emisión. En caso de cambios en los términos de las Notas, se lo notificaremos y se le pedirá que lo haga.

acepta dichos cambios en relación con su compra. También puede optar por rechazar dichos cambios, en cuyo caso podemos rechazar su oferta de compra.

Factores de riesgo adicionales

Las Notas implican riesgos no asociados con una inversión en notas de tasa fija ordinaria. Esta sección describe los riesgos más significativos relacionados con los términos de las Notas, a menos que se indique lo contrario.

especificado. Para obtener información adicional sobre estos riesgos, consulte "Factores de riesgo adicionales específicos de las Notas" en el suplemento del prospecto del producto y "Factores de riesgo" en el prospecto.

Debe considerar cuidadosamente si las Notas se adaptan a sus circunstancias particulares antes de decidir comprarlas. En consecuencia, los posibles inversores deben consultar su inversión,

asesores legales, fiscales, contables y de otro tipo en cuanto a los riesgos que conlleva una inversión en los Bonos y la idoneidad de los Bonos a la luz de sus circunstancias particulares.

Principal en riesgo.

Los inversores en los Bonos podrían perder parte o casi todo su Monto principal si hay una disminución en el nivel del Activo de referencia. Específicamente, perderá el 1% de la cantidad principal de

sus Notas por cada 1% de que el Nivel Final sea menor que el Nivel Inicial en más del Porcentaje del Búfer y podría perder casi toda su inversión.

Las Notas no pagan intereses y su rendimiento puede ser inferior al rendimiento de una deuda convencional de vencimiento comparable.

No habrá pagos periódicos de intereses sobre los Bonos, ya que habría una garantía de deuda convencional a tasa fija o variable con un vencimiento comparable. El regreso que harás

recibir en los Bonos, que podría ser negativo, puede ser inferior al rendimiento que podría obtener de otras inversiones. Incluso si su rendimiento es positivo, su rendimiento puede ser menor que el rendimiento que ganaría si comprara un convencional, deuda senior con intereses seguridad de TD de madurez comparable.

Su rendimiento estará limitado por el monto máximo de reembolso y puede ser menor que el rendimiento de una inversión hipotética directa en el activo de referencia.

La oportunidad de participar en los posibles aumentos en el nivel del Activo de referencia a través de una inversión en los Bonos será limitada porque el Pago al vencimiento no excederá el

Cantidad máxima de canje. Además, el efecto del Factor de apalancamiento no se tendrá en cuenta para ningún Nivel final del Activo de referencia que exceda el Nivel de límite, independientemente de cuánto se aprecie el Activo de referencia. En consecuencia, su

el rendimiento de los Bonos puede ser menor que el rendimiento de una inversión en una nota directamente vinculada al rendimiento del Activo de referencia o en una inversión hipotética en el Activo de referencia o en las acciones que comprenden el Activo de referencia (el

"Componentes de los activos de referencia").

Los inversores están sujetos al riesgo crediticio de TD, y las calificaciones crediticias y los spreads de crédito de TD pueden afectar negativamente el valor de mercado de los pagarés.

Aunque el rendimiento de los Bonos se basará en el rendimiento del Activo de referencia, el pago de cualquier monto adeudado en los Bonos está sujeto al riesgo de crédito de TD. Las notas son senior de TD

obligaciones de deuda no garantizadas. Los inversores dependen de la capacidad de TD para pagar todos los montos adeudados en las Notas en la Fecha de Vencimiento y, por lo tanto, están sujetos al riesgo de crédito de TD y a los cambios en la visión del mercado de TD

solvencia Es probable que cualquier disminución en las calificaciones crediticias de TD o aumento en los diferenciales de crédito cobrados por el mercado por asumir el riesgo crediticio de TD afecte negativamente el valor de mercado de los Bonos. Si TD no puede cumplir con su financiera

obligaciones a medida que vencen, los inversores no pueden recibir ninguna cantidad adeudada según los términos de los Bonos.

El descuento del agente, si corresponde, los gastos de la oferta y ciertos costos de cobertura pueden afectar negativamente los precios secundarios del mercado.

Suponiendo que no haya cambios en las condiciones del mercado ni en ningún otro factor relevante, el precio, si lo hubiera, al cual podrá vender los Bonos probablemente será menor que el precio de oferta pública. El público

el precio de oferta incluye, y cualquier precio cotizado a usted es probable que excluya, cualquier descuento de suscripción pagado en relación con la distribución inicial, los gastos de oferta y el costo de cubrir nuestras obligaciones bajo las Notas. Adicionalmente,

es probable que dicho precio refleje los descuentos, márgenes y otros costos de transacción del concesionario, como un descuento para contabilizar los costos asociados con el establecimiento o la cancelación de cualquier transacción de cobertura relacionada.

Puede que no haya un mercado activo de negociación para las notas: las ventas en el mercado secundario pueden dar lugar a pérdidas significativas.

Puede haber poco o ningún mercado secundario para los Bonos. Las Notas no se enumerarán ni se mostrarán en ninguna bolsa de valores o red de comunicaciones electrónicas. El agente u otro de nuestros

los afiliados pueden hacer un mercado para los Bonos; sin embargo, no están obligados a hacerlo y pueden detener cualquier actividad de creación de mercado en cualquier momento. Incluso si se desarrolla un mercado secundario para los Bonos, es posible que no proporcione liquidez significativa o se negocie en

Precios ventajosos para usted. Esperamos que los costos de transacción en cualquier mercado secundario sean altos. Como resultado, la diferencia entre los precios de oferta y demanda de sus Notas en cualquier mercado secundario podría ser sustancial.

Si vende sus Bonos antes de la Fecha de Vencimiento, es posible que tenga que hacerlo con un descuento sustancial del Monto Principal, independientemente del nivel del Activo de Referencia, y como resultado, usted

puede sufrir pérdidas sustanciales.

Si el nivel del activo de referencia cambia, el valor de mercado de sus notas puede no cambiar de la misma manera.

Sus Notas pueden negociarse de manera muy diferente al rendimiento del Activo de referencia. Los cambios en el nivel del activo de referencia pueden no resultar en un cambio comparable en el valor de mercado de sus Notas. Incluso si los

El nivel del activo de referencia aumenta por encima del nivel inicial durante la vida de los Bonos, el valor de mercado de sus Bonos puede no aumentar en la misma cantidad y podría disminuir.

El pago al vencimiento no está vinculado al nivel de cierre del activo de referencia en ningún momento que no sea la fecha de valoración.

El Nivel Final se basará en el nivel de cierre del Activo de Referencia en la Fecha de Valoración, según se pueda ajustar como se describe en el suplemento del prospecto del producto. Por lo tanto, si el cierre

El nivel del activo de referencia se redujo precipitadamente en la fecha de valoración, el pago al vencimiento de sus notas puede ser significativamente menor de lo que hubiera sido si el pago al vencimiento se hubiera vinculado al nivel de cierre del activo de referencia

antes de tal caída. Aunque el nivel de cierre real del Activo de referencia en la Fecha de vencimiento o en otros momentos durante la vida de sus Bonos puede ser mayor que su nivel de cierre en la Fecha de valoración, no se beneficiará del cierre

nivel del activo de referencia en cualquier momento que no sea la fecha de valoración.

Podemos vender un monto principal agregado adicional de las notas a un precio de oferta pública diferente.

A nuestra exclusiva opción, podemos decidir vender un monto de capital agregado adicional de los Bonos posterior a la fecha de este suplemento de precios. El precio de oferta pública de los Bonos en el

la venta posterior puede diferir sustancialmente (mayor o menor) del precio de oferta pública original que pagó según lo dispuesto en la portada de este suplemento de precios.

Si compra sus notas con una prima sobre el monto principal, el retorno de su inversión será menor que el retorno de los pagarés comprados al monto principal y el impacto de

Ciertos términos clave de las notas se verán afectados negativamente.

El Pago al vencimiento no se ajustará en función del precio de oferta pública que pague por los Bonos. Si compra Notas a un precio que difiere del Monto Principal de las Notas, entonces

El rendimiento de su inversión en dichos Bonos mantenidos hasta la Fecha de Vencimiento será diferente y puede ser sustancialmente menor que el rendimiento de los Bonos comprados al monto principal. Si compra sus Bonos con una prima sobre el Monto Principal y los retiene

hasta la Fecha de Vencimiento, el rendimiento de su inversión en los Bonos será menor de lo que hubiera sido si hubiera comprado los Bonos al Monto Principal o un descuento al Monto Principal. Además, el impacto del nivel de búfer y el nivel de límite

El rendimiento de su inversión dependerá del precio que pague por sus Notas en relación con el Monto del capital. Por ejemplo, si compra sus Notas con una prima sobre el Monto principal, el Nivel de límite solo permitirá un rendimiento positivo más bajo en

su inversión en las Notas de lo que hubiera sido el caso para las Notas compradas al Monto del Principal o un descuento al Monto del Principal. Del mismo modo, el nivel de búfer, si bien proporciona cierta protección para el retorno de las notas, permitirá un

mayor disminución porcentual en su inversión en los Bonos de lo que hubiera sido el caso para los Bonos comprados al Monto Principal o un descuento al Monto Principal.

Existen riesgos de mercado asociados con el activo de referencia.

El nivel del activo de referencia puede aumentar o disminuir bruscamente debido a factores específicos, los componentes del activo de referencia y sus emisores (los "emisores del constituyente del activo de referencia"), como

volatilidad del precio de las acciones, ganancias, condiciones financieras, desarrollos corporativos, industriales y regulatorios, cambios y decisiones de gestión y otros eventos, así como factores generales del mercado, como la volatilidad general del mercado de acciones y materias primas y

niveles, tasas de interés y condiciones económicas y políticas. Usted, como inversor en las Notas, debe realizar su propia investigación sobre el Activo de referencia. Para obtener información adicional, consulte "Información sobre el activo de referencia" en este documento.

Valor estimado

El valor estimado de sus notas es inferior al precio de oferta pública de sus notas.

El valor estimado de sus Notas es menor que el precio de oferta pública de sus Notas. La diferencia entre el precio de oferta pública de sus Bonos y el valor estimado de

los Bonos reflejan los costos y las ganancias esperadas asociadas con la venta y estructuración de los Bonos, así como la cobertura de nuestras obligaciones bajo los Bonos. Porque cubrir nuestras obligaciones conlleva riesgos y puede verse influenciado por fuerzas del mercado más allá de nuestro

control, esta cobertura puede generar una ganancia mayor o menor a la esperada, o una pérdida.

El valor estimado de sus notas se basa en nuestra tasa de financiación interna.

El valor estimado de sus Notas se determina por referencia a nuestra tasa de financiación interna. La tasa de financiación interna utilizada en la determinación del valor estimado de la

Notes generalmente representa un descuento de los diferenciales de crédito para nuestros títulos de deuda convencionales de tasa fija y la tasa de endeudamiento que pagaríamos por nuestros títulos de deuda convencionales de tasa fija. Este descuento se basa, entre otras cosas, en nuestro

vista del valor de financiación de los Bonos, así como los mayores costos de emisión, operacionales y de gestión de pasivos en curso de los Bonos en comparación con los costos de nuestra deuda convencional a tasa fija, así como los costos de financiamiento estimados de cualquier

posiciones de cobertura, teniendo en cuenta los requisitos regulatorios e internos. Si la tasa de interés implícita en los diferenciales de crédito para nuestros títulos de deuda convencionales de tasa fija, o la tasa de endeudamiento, pagaríamos nuestra deuda convencional de tasa fija

Si se usaran valores, esperaríamos que los términos económicos de los Bonos sean más favorables para usted. Además, suponiendo que todos los demás términos económicos se mantengan constantes, se espera que el uso de una tasa de financiación interna para los Bonos aumente

El valor estimado de las Notas en cualquier momento.

El valor estimado de las notas se basa en nuestros modelos de precios internos, que pueden resultar inexactos y pueden ser diferentes de los modelos de precios de

Otras instituciones financieras.

El valor estimado de sus Notas se basa en nuestros modelos de precios internos. Nuestros modelos de precios tienen en cuenta una serie de variables, como nuestra tasa de financiación interna en la Fecha de fijación de precios,

y se basan en una serie de supuestos subjetivos, que no se evalúan ni verifican de forma independiente y pueden o no materializarse. Además, nuestros modelos de precios pueden ser diferentes de los modelos de precios de otras instituciones financieras y

Las metodologías utilizadas por nosotros para estimar el valor de los Bonos pueden no ser consistentes con las de otras instituciones financieras que pueden ser compradores o vendedores de Bonos en el mercado secundario. Como resultado, el precio de mercado secundario de sus Notas

puede ser materialmente menor que el valor estimado de las Notas determinado por referencia a nuestros modelos de precios internos. Además, las condiciones del mercado y otros factores relevantes en el futuro pueden cambiar, y cualquier suposición puede resultar incorrecta.

El valor estimado de sus pagarés no es una predicción de los precios a los que puede vender sus pagarés en el mercado secundario, en caso de que existan, y dichos títulos secundarios.

Los precios de mercado, si los hay, probablemente serán inferiores al precio de oferta pública de sus pagarés y pueden ser inferiores al valor estimado de sus pagarés.

El valor estimado de los Bonos no es una predicción de los precios a los cuales el Agente, otros afiliados nuestros o terceros pueden estar dispuestos a comprarle los Bonos en

transacciones del mercado secundario (si están dispuestos a comprar, lo que no están obligados a hacer). El precio al que puede vender sus Notas en el mercado secundario en cualquier momento, si lo hay, estará influenciado por muchos factores que no pueden

predecirse, como las condiciones del mercado, y cualquier diferencial de oferta y demanda para operaciones de tamaño similar, y puede ser sustancialmente menor que el valor estimado de los Bonos. Además, como los precios del mercado secundario de sus Notas tienen en cuenta los niveles en

que nuestros títulos de deuda se negocian en el mercado secundario, y no tienen en cuenta nuestros diversos costos y beneficios esperados asociados con la venta y estructuración de los Bonos, así como la cobertura de nuestras obligaciones en virtud del Bonos, mercado secundario

los precios de sus Notas probablemente sean inferiores al precio de oferta pública de sus Notas. Como resultado, el precio al que el Agente, otras filiales nuestras o de terceros pueden estar dispuestos a comprarle las Notas en el mercado secundario

las transacciones, de haberlas, probablemente serán inferiores al precio que pagó por sus Notas, y cualquier venta anterior a la Fecha de vencimiento podría ocasionarle una pérdida sustancial.

El precio temporal al que el agente puede comprar inicialmente las notas en el mercado secundario puede no ser indicativo de los precios futuros de sus notas.

Suponiendo que todos los factores relevantes permanecen constantes después de la Fecha de fijación de precios, el precio al que el Agente puede comprar o vender inicialmente los Bonos en el mercado secundario (si el Agente

hacer un mercado en los Bonos, que no está obligado a hacer) puede exceder el valor estimado de los Bonos, así como el valor secundario de mercado de los Bonos, por un período temporal después de la Fecha de Emisión de los Bonos, como se discute más adelante debajo

"Información adicional sobre el valor estimado de los Bonos". El precio al que el Agente puede comprar o vender inicialmente los Bonos en el mercado secundario puede no ser indicativo de los precios futuros de sus Bonos.

El valor de mercado de sus notas puede estar influenciado por muchos factores impredecibles.

Cuando nos referimos al valor de mercado de sus Bonos, nos referimos al valor que podría recibir por sus Bonos si elige venderlos en el mercado abierto antes de la Fecha de Vencimiento. Una serie de factores,

muchos de los cuales están fuera de nuestro control, influirán en el valor de mercado de sus Notas, incluyendo:

| ● |

el nivel del activo de referencia; |

| ● |

la volatilidad, es decir, la frecuencia y la magnitud de los cambios, en el nivel del activo de referencia; |

| ● |

las tasas de dividendos, si corresponde, de los componentes del activo de referencia; |

| ● |

eventos económicos, financieros, regulatorios y políticos, militares u otros que puedan afectar los precios de cualquiera de los componentes del activo de referencia y, por lo tanto, el nivel del activo de referencia; |

| ● |

la correlación entre los componentes del activo de referencia; |

| ● |

tasa de interés y tasas de rendimiento en el mercado; |

| ● |

el tiempo restante hasta la madurez; |

| ● |

cualquier fluctuación en el tipo de cambio entre monedas en las que se cotizan y negocian los componentes del activo de referencia y el dólar estadounidense; y |

| ● |

nuestra solvencia crediticia, ya sea real o percibida, e incluye mejoras o rebajas reales o anticipadas en nuestras calificaciones crediticias o cambios en otras medidas crediticias. |

Estos factores influirán en el precio que recibirá si vende sus Notas antes del vencimiento, incluido el precio que puede recibir por sus Notas en cualquier transacción de creación de mercado. Si vendes

sus Notas antes del vencimiento, puede recibir menos que el Monto principal de sus Notas.

Los niveles futuros del activo de referencia no se pueden predecir. The actual change in the level of the Reference Asset over the life of the Notes, as well as the Payment at Maturity, may bear little

or no relation to the hypothetical historical closing levels of the Reference Asset or to the hypothetical examples shown elsewhere in this pricing supplement.

We Have No Affiliation with the Investment Adviser or the Target Index Sponsor and Will Not Be Responsible for Any Actions taken by Such Entity.

Neither the Investment Adviser nor the Target Index Sponsor is an affiliate of ours and neither will be involved in the Notes offering in any way. Consequently, we have no control over the actions of such entities,

including any actions of the type that would require the Calculation Agent to adjust any amounts payable on the Notes. Neither the Investment Adviser nor the Target Index Sponsor has any obligation of any sort with respect to the Notes, and thus

neither has any obligation to take your interests into consideration for any reason, including in taking any actions that might affect the value of the Notes. None of our proceeds from the issuance of the Notes will be delivered to the Investment

Adviser or the Target Index Sponsor.

Market Disruption Events and Postponements.

The Valuation Date, and therefore the Maturity Date, are subject to postponement as described in the product prospectus supplement due to the occurrence of one or more market disruption events.

For a description of what constitutes a market disruption event as well as the consequences of that market disruption event, see “General Terms of the Notes—Market Disruption Events” in the product prospectus supplement.

There Are Potential Conflicts of Interest Between You and the Calculation Agent.

The Calculation Agent will, among other things, determine the amounts payable on the Notes. We will serve as the Calculation Agent and may appoint a different Calculation Agent after the Issue

Date without notice to you. The Calculation Agent will exercise its judgment when performing its functions. For example, the Calculation Agent may have to determine whether a market disruption event affecting the Reference Asset has occurred, which

may, in turn, depend on the Calculation Agent’s judgment as to whether the event has materially interfered with our ability or the ability of one of our affiliates to unwind our hedge positions. Because this determination by the Calculation Agent

may affect the amounts payable on the Notes, the Calculation Agent may have a conflict of interest if it needs to make a determination of this kind. For additional information on the Calculation Agent’s role, see “General Terms of the Notes — Role

of Calculation Agent” in the product prospectus supplement.

Trading and Business Activities by the Bank or its Affiliates May Adversely Affect the Market Value of, and the Amount Payable on, the Notes.

We, the Agent and our respective affiliates may hedge our obligations under the Notes by purchasing securities, futures, options or other derivative instruments with returns

linked or related to changes in the level of the Reference Asset or one or more Reference Asset Constituents, and we may adjust these hedges by, among other things, purchasing or selling securities, futures, options or other derivative instruments

at any time. It is possible that we or one or more of our affiliates could receive substantial returns from these hedging activities while the market value of the Notes declines. We and/or one or more of our affiliates may also issue or underwrite

other securities or financial or derivative instruments with returns linked or related to changes in the performance of the Reference Asset or one or more Reference Asset Constituents.

These trading activities may present a conflict between the holders’ interest in the Notes and the interests we and/or our affiliates will have in our or their proprietary

accounts, in facilitating transactions, including options and other derivatives transactions, for our or their customers’ accounts and in accounts under our or their management. These trading activities could be adverse to the interests of the

holders of the Notes.

We, the Agent and our respective affiliates may, at present or in the future, engage in business with one or Reference Asset Constituent Issuers, including

making loans to or providing advisory services to those companies. These services could include investment banking and merger and acquisition advisory services. These business activities may present a conflict between our, the Agent’s and our

affiliates’ obligations, and your interests as a holder of the Notes. Moreover, we, the Agent or our affiliates may have published, and in the future expect to publish, research reports with respect to the Reference Asset, one or more Reference

Asset Constituents or one or more Reference Asset Constituent Issuers. This research is modified from time to time without notice and may express opinions or provide recommendations that are inconsistent with purchasing or holding the Notes. Alguna

of these activities by us or one or more of our affiliates or the Agents or their affiliates may affect the level of the Reference Asset or one or more Reference Asset Constituents and, therefore, the

market value of the Notes and the Payment at Maturity.

Significant Aspects of the Tax Treatment of the Notes Are Uncertain.

Significant aspects of the U.S. tax treatment of the Notes are uncertain. You should read carefully the section entitled “Material U.S. Federal Income Tax Consequences” herein and in the product

prospectus supplement under “Material U.S. Federal Income Tax Consequences”. You should consult your tax advisor as to the tax consequences of your investment in the Notes.

For a discussion of the Canadian federal income tax consequences of investing in the Notes, please see the discussion in the product prospectus supplement under “Supplemental Discussion of Canadian Tax Consequences”.

If you are not a Non-resident Holder (as that term is defined in the prospectus) for Canadian federal income tax purposes or if you acquire the Notes in the secondary market, you should consult your tax advisors as to

the consequences of acquiring, holding and disposing of the Notes and receiving the payments that might be due under the Notes.

There Are Liquidity, Management and Custody Risks Associated with an ETF.

Although shares of the Reference Asset are listed for trading on a securities exchange and a number of similar products have been traded on various exchanges for varying periods of time, there is

no assurance that an active trading market will continue for such shares or that there will be liquidity in that trading market.

An ETF is subject to management risk, which is the risk that the investment adviser’s investment strategy, the implementation of which is subject to a number of constraints, may not produce the

intended results. The Reference Asset is also not actively managed and may be affected by a general decline in market segments relating to the Target Index. The Investment Adviser invests in securities included in, or representative of, the Target

Index regardless of their investment merits. The Investment Adviser does not attempt to take defensive positions in declining markets.

In addition, the Reference Asset is subject to custody risk, which refers to the risks in the process of clearing and settling trades and to the holding of securities by local banks, agents and depositories. Low trading volumes and volatile

prices in less developed markets make trades harder to complete and settle, and governments or trade groups may compel local agents to hold securities in designated depositories that are not subject to independent evaluation. The less developed a

country’s securities market is, the greater the likelihood of custody problems.

Changes that Affect the Target Index Will Affect the Market Value of the Notes and the Amount You Will Receive at Maturity.

The Reference Asset seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Target Index, as specified herein under

“Information Regarding the Reference Asset”. The policies of the sponsor of the Target Index (the “Target Index Sponsor”) concerning the calculation of the Target Index, additions, deletions or substitutions of the components of the Target Index

and the manner in which changes affecting those components, such as stock dividends, reorganizations or mergers, may be reflected in the Target Index and, therefore, could affect the amount payable on the Notes at maturity and the market value of

the Notes prior to maturity. The amounts payable on the Notes and their market value could also be affected if the Target Index Sponsor changes these policies, for example, by changing the manner in which it calculates the Target Index. Some of the

risks that relate to a target index of an ETF include those discussed in the product prospectus supplement, which you should review.

The Reference Asset and the Target Index Are Different and the Performance of the Reference Asset May Not Correlate With That of the Target Index.

The performance of the Reference Asset may not exactly replicate the performance of the Target Index because the Reference Asset will reflect transaction costs and fees that are not included in

the calculation of the Target Index. It is also possible that the Reference Asset may not fully replicate or may in certain circumstances diverge significantly from the performance of the Target Index due to the temporary unavailability of certain

securities in the secondary market, the performance of any derivative instruments contained in the Reference Asset, differences in trading hours between the Reference Asset and the Target Index or due to other circumstances.

The Level of the Reference Asset May Not Completely Track its Net Asset Value.

The net asset value (the “NAV”) of the Reference Asset may fluctuate with changes in the market value of the Reference Asset Constituents. The market prices of the Reference Asset may fluctuate in

accordance with changes in NAV and supply and demand on the applicable stock exchanges. Furthermore, the Reference Asset Constituents may be unavailable in the secondary market during periods of market volatility, which may make it difficult for

market participants to accurately calculate the intraday NAV per share of the Reference Asset and may adversely affect the liquidity and prices of the Reference Asset, perhaps significantly. For any of these reasons, the market price of the

Reference Asset may differ from its NAV per share and may trade at, above or below its NAV per share.

An Investment in the Notes Is Subject to Risks Associated with Non-U.S. Securities Markets.

Because non-U.S. companies or non-U.S. equity securities held by the Reference Asset are publicly traded in the applicable non-U.S. countries and trade in currencies other than U.S. dollars,

investments in the Notes involve particular risks. For example, the non-U.S. securities markets may be more volatile and have less liquidity than the U.S. securities markets, and market developments may affect these markets differently from the

U.S. or other securities markets. Direct or indirect government intervention to stabilize the securities markets outside the U.S., as well as cross-shareholdings in certain companies, may affect trading prices and trading volumes in those markets.

Also, the public availability of information concerning the non-U.S. issuers may vary depending on their home jurisdiction and the reporting requirements imposed by their respective regulators. In addition, the non-U.S. issuers may be subject to

accounting, auditing and financial reporting standards and requirements that differ from those applicable to U.S. reporting companies.

Securities prices outside the U.S. are subject to political, economic, financial, military and social factors that apply in foreign countries. These factors, which could negatively affect non-U.S.

securities markets, include the possibility of changes in a non-U.S. government’s economic and fiscal policies, the possible imposition of, or changes in, currency exchange laws or other laws or restrictions applicable to foreign companies or

investments in foreign equity securities, the possibility of fluctuations in the rate of exchange between currencies and the possibility of outbreaks of hostility or political instability or adverse public health developments. Moreover, non-U.S.

economies may differ favorably or unfavorably from the U.S. economy in important respects such as growth of gross national product, rate of inflation, trade surpluses, capital reinvestment, resources and self-sufficiency.

An Investment in the Notes Is Subject to Exchange Rate Risk.

The level of the Reference Asset will fluctuate based in large part upon their respective net asset values, which will in turn depend in part upon changes in the value of the currencies in which

the Reference Asset Constituents are traded. Accordingly, investors in the Notes will be exposed to currency exchange rate risk with respect to each of the currencies in which the Reference Asset Constituents are traded. An investor’s net exposure

will depend on the extent to which these currencies strengthen or weaken against the U.S. dollar. If the dollar strengthens against these currencies, the net asset value and the level of the Reference Asset and the market value of, and amount

payable on, the Notes will be adversely affected.

Time Zone Differences Between the Cities Where the Reference Asset and the Reference

Asset Constituents Trade May Create Discrepancies in Trading Levels.

As a result of the time zone difference, if applicable, between the cities where the Reference Asset Constituents and where the shares of the Reference Asset trade, there may be discrepancies

between the level of the Reference Asset and the Reference Asset Constituents. In addition, there may be periods when the non-U.S. securities markets are closed for trading (for example, during holidays in a country other than the United States)

that may result in the values of the Reference Asset remaining unchanged for multiple trading days in the city where the shares of the Reference Asset trade. Conversely, there may be periods in which the applicable foreign securities markets are

open, but the securities market on which the Reference Asset trade are closed.

You Will Have Limited Anti-Dilution Protection with respect to the Reference Asset.

The Calculation Agent will adjust the Initial Level, Cap Level and Buffer Level for stock splits, reverse stock splits, stock dividends, extraordinary dividends and other events that affect the Reference Asset, but only in the situations we

describe in “General Terms of the Notes—Anti-Dilution Adjustments” in the product prospectus supplement. The Calculation Agent will not be required to make an adjustment for every event that may affect the Reference Asset. Those events or other

actions by an Investment Adviser or a third party may nevertheless adversely affect the level of the Reference Asset, and adversely affect the value of, and amount payable on, your Notes.

You Will Have No Rights to Receive Any Shares of the Reference Asset or any of the Reference Asset Constituents held by the Reference Asset, and You Will Not Be Entitled to

Dividends or Other Distributions by the Reference Asset or any Reference Asset Constituent.

The Notes are our debt securities. They are not equity instruments, shares of stock, or securities of any other issuer. Investing in the Notes will not make you a holder of shares of the Reference Asset or any

Reference Asset Constituent. Unlike a holder of the share, you will only participate in the appreciation of the Reference Asset up to the Cap Level and the maximum return on your investment is limited. Furthermore, you will not have any voting

rights, any rights to receive dividends or other distributions, any rights against the Investment Adviser or any Reference Asset Constituent Issuer, or any other rights with respect to the Reference Asset or any Reference Asset Constituent. Como un

result, the return on your Notes may not reflect the return you would realize if you actually owned shares of the Reference Asset or Reference Asset Constituents and received the dividends paid or other distributions made in connection with them.

Your Notes will be paid in cash and you have no right to receive delivery of shares of the Reference Asset or any Reference Asset Constituent.

The U.K.’s referendum to leave the European Union may adversely affect the performance of the Reference Assets.

The Target Index of the Reference Asset consists of stocks that have been issued by U.K. and/or European Union member companies. The U.K.’s referendum on June 23, 2016 to leave the European Union,

which we refer to as “Brexit,” has and may continue to cause disruptions to capital and currency markets worldwide and to the markets tracked by the Reference Asset in particular. The full impact of the Brexit decision, however, remains uncertain.

A process of negotiation, which is likely to take a number of years, will determine the future terms of the U.K.’s relationship with the European Union. The performance of the Reference Asset and, therefore the market value of, and amount payable

on, the Notes may be negatively affected by interest rate, exchange rate and other market and economic volatility, as well as regulatory and political uncertainty.

Hypothetical Returns

The examples and graph set out below are included for illustration purposes only and are hypothetical examples only: amounts below may have been rounded for ease of analysis. los hipotético Percentage Changes of the Reference Asset used to illustrate the calculation of the Payment at Maturity (rounded to two decimal places) are not estimates or forecasts of the Final Level or the level

of the Reference Asset on any trading day prior to the Maturity Date. All examples reflect the Buffer Percentage of 10% (the Buffer Level is 90% of the Initial Level), the Leverage Factor of 200%, the Cap Level equal to 111.20% of the Initial

Level, the Maximum Redemption Amount of $1,224.00, that a holder purchased Notes with an aggregate Principal Amount of $1,000 and that no market disruption event occurs on the Valuation Date. The actual terms of the Notes are indicated on the cover

hereof.

|

Example 1— |

Calculation of the Payment at Maturity where the Percentage Change is positive. |

|

|

Percentage Change: |

2.00% |

|

|

Payment at Maturity: |

The lesser of (i) $1,000.00 + ($1,000.00 x 2.00% x 200.00%) or (ii) Maximum Redemption Amount = the lesser of (i) $1,000.00 + ($1,000.00 x 2.00% x 200.00%) = $1,000.00 + $40.00 = $1,040.00 or (ii) $1,224.00. = $1,040.00 |

|

|

On a $1,000.00 investment, a 2.00% Percentage Change results in a Payment at Maturity of $1,040.00, a 4.00% return on the Notes. |

||

|

Example 2— |

Calculation of the Payment at Maturity where the Percentage Change is positive (and the Payment at Maturity is subject to the Maximum Redemption Amount). |

|

|

Percentage Change: |

20.00% |

|

|

Payment at Maturity: |

The lesser of (i) $1,000.00 + ($1,000.00 x 20.00% x 200.00%) or (ii) Maximum Redemption Amount = the lesser of (i) $1,000.00 + ($1,000.00 x 20.00% x 200.00) = $1,000.00 + $400.00 = $1,400.00 or (ii) $1,224.00. = $1,224.00 |

|

|

On a $1,000.00 investment, a 20.00% Percentage Change results in a Payment at Maturity equal to the Maximum Redemption Amount of $1,224.00, a 22.40% return on the Notes. |

||

|

Example 3— |

Calculation of the Payment at Maturity where the Percentage Change is negative (but not by more than the Buffer Percentage). |

|

|

Percentage Change: |

-8.00% |

|

|

Payment at Maturity: |

At maturity, if the Percentage Change is negative BUT not by more than the Buffer Percentage, then the Payment at Maturity will equal the Principal Amount. |

|

|

On a $1,000.00 investment, a -8.00% Percentage Change results in a Payment at Maturity of $1,000.00, a 0.00% return on the Notes. |

||

|

Example 4— |

Calculation of the Payment at Maturity where the Percentage Change is negative (by more than the Buffer Percentage). |

|

|

Percentage Change: |

-35.00% |

|

|

Payment at Maturity: |

$1,000.00 + ($1,000.00 x (-35.00% + 10.00%)) = $1,000.00 – $250.00 = $750.00 |

|

|

On a $1,000.00 investment, a -35.00% Percentage Change results in a Payment at Maturity of $750.00, a -25.00% return on the Notes. |

||

The following table shows the return profile for the Notes at the Maturity Date, assuming that the investor purchased the Notes on the Issue Date at the public offering price and held the Notes until the Maturity

Date. The returns and losses illustrated in the following table are not estimates or forecasts of the Percentage Change or the return or loss on the Notes. Neither TD nor the Agent is predicting or guaranteeing any gain or particular return on the

Notes.

|

Hypothetical Percentage Change |

Hypothetical Payment at Maturity ($) |

Hypothetical Return on Notes (%) |

|

50.00% |

$1,224.00 |

22.40% |

|

40.00% |

$1,224.00 |

22.40% |

|

30.00% |

$1,224.00 |

22.40% |

|

20.00% |

$1,224.00 |

22.40% |

|

15.00% |

$1,224.00 |

22.40% |

|

11.20% |

$1,224.00 |

22.40% |

|

10.00% |

$1,200.00 |

20.00% |

|

5.00% |

$1,100.00 |

10.00% |

|

3.00% |

$1,060.00 |

6.00% |

|

2.00% |

$1,040.00 |

4.00% |

|

1.00% |

$1,020.00 |

2.00% |

|

0.00% |

$1,000.00 |

0.00% |

|

-2.00% |

$1,000.00 |

0.00% |

|

-5.00% |

$1,000.00 |

0.00% |

|

-7.00% |

$1,000.00 |

0.00% |

|

-10.00% |

$1,000.00 |

0.00% |

|

-20.00% |

$900.00 |

-10.00% |

|

-30.00% |

$800.00 |

-20.00% |

|

-40.00% |

$700.00 |

-30.00% |

|

-50.00% |

$600.00 |

-40.00% |

|

-75.00% |

$350.00 |

-65.00% |

|

-100.00% |

$100.00 |

-90.00% |

Information Regarding the Reference Asset

All disclosures contained in this document regarding the Reference Asset, including, without limitation, its make-up, methods of calculation, and changes in any Reference Asset components, have been derived from

publicly available sources. The information reflects the policies of, and is subject to change by, the Investment Adviser. The Investment Adviser, which owns the copyright and all other rights to the Reference Asset, has no obligation to continue

to publish, and may discontinue publication of, the Reference Asset. None of the websites referenced in the Reference Asset description below, or any materials included in those websites, are incorporated by reference into this document.

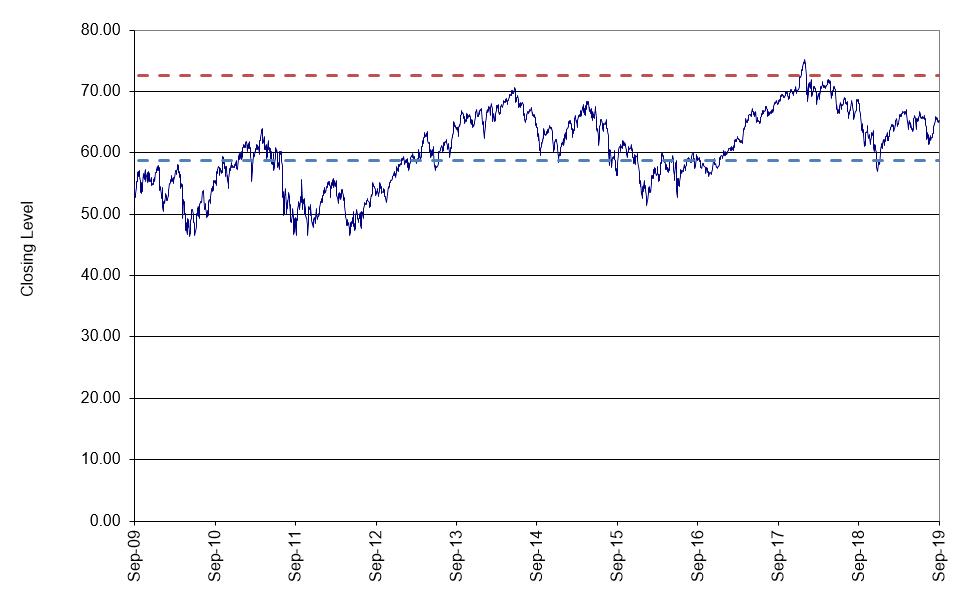

The graph below shows the daily historical Closing Levels of the Reference Asset for the periods specified. We obtained the information regarding the historical performance of the Reference Asset in the graph below

from Bloomberg Professional® service (“Bloomberg”).

We have not independently verified the accuracy or completeness of the information obtained from Bloomberg. The historical performance of the Reference Asset should not be taken as an indication of its future

performance, and no assurance can be given as to the Final Level of the Reference Asset. We cannot give you any assurance that the performance of the Reference Asset will result in any positive return on your initial investment.

The Reference Asset is registered under the Securities Act of 1933, the Securities Exchange Act of 1934 and/or the Investment Company Act of 1940, each as amended. Companies with securities

registered under the SEC are required to file periodically certain financial and other information specified by the SEC. Information provided to or filed with the SEC can be inspected and copied at the public reference facilities maintained by the

SEC or through the SEC’s website at www.sec.gov. In addition, information regarding the Reference Asset may be obtained from other sources including, but not limited to, press releases, newspaper articles and other publicly disseminated documents.

We obtained the information regarding the Investment Adviser from publicly available information, including, without limitation, its filings with the SEC, but we have not independently verified

the accuracy or completeness of any such information or conduced any independent review or due diligence. You are urged to conduct your own investigation into the Reference Asset and Investment Adviser.

The Reference Asset and Target Index

The Index Sponsor of the Target Index is MSCI Inc. (“MSCI”). MSCI calculates, publishes and disseminates levels of the Target Index daily by MSCI through numerous data vendors, on the MSCI website

and in real time on Bloomberg and Reuters Limited. The Target Index is an MSCI Global Investable Market Index, which is a family of within the MSCI International Equity Indices discussed below under “The MSCI International Equity Indices.”

The return on your Notes is linked to the performance of the Reference Asset, and not to the performance of the Target Index.

We have derived all information contained in this pricing supplement regarding the Target Index, including, without limitation, its make-up, method of calculation and changes in its components,

from publicly available information, including Bloomberg. The information reflects the policies of, and is subject to change by the MSCI. MSCI has no obligation to continue to publish, and may discontinue publication of, the Target Index.

Construction of the Target Index

MSCI undertakes an index construction process, which involves: (i) defining the equity universe; (ii) determining the market investable equity universe for each market; (iii) determining market

capitalization size segments for each market; (iv) applying index continuity rules for the standard index; (v) creating style segments within each size segment within each market; and (vi) classifying securities under the Global Industry

Classification Standard. The Target Index construction methodology differs in some cases depending on whether the relevant market is considered a developed market or an emerging market. All of the MSCI Indices are standard indices, meaning that

only securities that would qualify for inclusion in a large cap index or a mid-cap index will be included as described below.

Defining the Equity Universe

Identifying Eligible Equity Securities: The equity universe initially looks at securities listed in any of the countries in the MSCI Global Index series,

which will be classified as either “developed markets” or “emerging markets”. All listed equity securities, including real estate investment trusts and certain income trusts in Canada are eligible for inclusion in the equity universe. Limited

partnerships, limited liability companies and business trusts, which are listed in the U.S. and are not structured to be taxed as limited partnerships, are likewise eligible for inclusion in the equity universe. Conversely,

mutual funds, exchange-traded funds, equity derivatives and most investment trusts are not eligible for inclusion in the equity universe. Preferred shares that exhibit characteristics of equity securities are eligible.

Country Classification of Eligible Securities: Each company and its securities (i.e., share classes) are classified in one and only one country, which

allows for a distinctive sorting of each company by its respective country.

Determining the Market Investable Equity Universes

A market investable equity universe for a market is derived by (i) identifying eligible listings for each security in the equity universe; and (ii) applying investability screens to individual

companies and securities in the equity universe that are classified in that market. A market is generally equivalent to a single country. The global investable equity universe is the aggregation of all market investable equity universes.

| (i) |

Identifying Eligible Listings: A security may have a listing in the country where it is classified (a “local listing”) and/or in a different country (a “foreign listing”). A security may be represented by either a local listing or a |

In order for a country to meet the foreign listing materiality requirement, the following is determined: all securities represented by a foreign listing that would be included in

the country’s MSCI Country Investable Market Index if foreign listings were eligible from that country. The aggregate free-float adjusted market capitalization for all such securities should represent at least (i) 5% of the free float-adjusted

market capitalization of the relevant MSCI Country Investable Market Index and (ii) 0.05% of the free-float adjusted market capitalization of the MSCI ACWI Investable Market Index. If a country does not meet the foreign listing materiality

requirement, then securities in that country may not be represented by a foreign listing in the global investable equity universe.

| (ii) |

Applying Investability Screens: The investability screens used to determine the investable equity universe in each market are: |

Equity Universe Minimum Size Requirement: This investability screen is applied at the company level. In order to be included in a market

investable equity universe, a company must have the required minimum full market capitalization. The equity universe minimum size requirement applies to companies in all markets and is derived as follows:

| ● |

First, the companies in the developed market equity universe are sorted in descending order of full market capitalization and the cumulative coverage of the free float-adjusted market capitalization of the developed market equity |

| ● |

Second, when the cumulative free float-adjusted market capitalization coverage of 99% of the sorted equity universe is achieved, by adding each company’s free float-adjusted market capitalization in descending order, the full market |

| ● |

The rank of this company by descending order of full market capitalization within the developed market equity universe is noted, and will be used in determining the equity universe minimum size requirement at the next rebalance. |

As of November 2018, the equity universe minimum size requirement was set at U.S. $276 million. Companies with a full market capitalization below this level are not included in

any market investable equity universe. The equity universe minimum size requirement is reviewed and, if necessary, revised at each semi-annual index review, as described below.

Equity Universe Minimum Free Float-Adjusted Market Capitalization Requirement: This investability screen is applied at the individual security level. To be

eligible for inclusion in a market investable equity universe, a security must have a free float-adjusted market capitalization equal to or higher than 50% of the equity universe minimum size requirement.

Minimum Liquidity Requirement: This investability screen is applied at the individual security level. To be eligible for inclusion in a market investable

equity universe, a security must have at least one eligible listing that has adequate liquidity as measured by its 12-month and 3-month annualized traded value ratio (“ATVR”) and 3-month frequency of trading. The ATVR attempts to mitigate the

impact of extreme daily trading volumes and takes into account the free float-adjusted market capitalization of securities. A minimum liquidity level of 20% of the 3-month ATVR and 90% of 3-month frequency of trading over the last 4 consecutive

quarters, as well as 20% of the 12-month ATVR, are required for inclusion of a security in a market investable equity universe of a developed market. A minimum liquidity level of 15% of the 3-month ATVR and 80% of 3-month frequency of trading over

the last 4 consecutive quarters, as well as 15% of the 12-month ATVR, are required for inclusion of a security in a market investable equity universe of an emerging market.

Only one listing per security may be included in the market investable equity universe. In instances where a security has two or more eligible listings that meet the above liquidity requirements,

then the following priority rules are used to determine which listing will be used for potential inclusion of the security in the market investable equity universe:

| (1) |

Local listing (if the security has two or more local listings, then the listing with the highest 3-month ATVR will be used) |

| (2) |

Foreign listing in the same geographical region (MSCI classifies markets into three main geographical regions: EMEA, Asia Pacific and Americas. If the security has two or more listings in the same geographical region, then the |

| (3) |

Foreign listing in a different geographical region (if the security has two or more listings in a different geographical region, then the listing with the highest 3-month ATVR will be used). |

Due to liquidity concerns relating to securities trading at very high stock prices, a security that is currently not a constituent of a MSCI Global Investable Markets Index that is trading at a

stock price above U.S. $10,000 will fail the liquidity screening and will not be included in any market investable equity universe.

Global Minimum Foreign Inclusion Factor Requirement: This investability screen is applied at the individual security level. To determine the free float of

a security, MSCI considers the proportion of shares of such security available for purchase in the public equity markets by international investors. In practice, limitations on the investment opportunities for international investors include:

strategic stakes in a company held by private or public shareholders whose investment objective indicates that the shares held are not likely to be available in the market; limits on the proportion of a security’s share capital authorized for

purchase by non-domestic investors; or other foreign investment restrictions which materially limit the ability of foreign investors to freely invest in a particular equity market, sector or security.

MSCI will then derive a “foreign inclusion factor” for the company that reflects the proportion of shares outstanding that is available for purchase in the public equity markets by international

investors. MSCI will then “float-adjust” the weight of each constituent company in an index by the company’s foreign inclusion factor.

Once the free float factor has been determined for a security, the security’s total market capitalization is then adjusted by such free float factor, resulting in the free float-adjusted market

capitalization figure for the security.

Minimum Length of Trading Requirement: This investability screen is applied at the individual security level. For an initial public offering to be eligible for inclusion in a

market investable equity universe, the new issue must have started trading at least three months before the implementation of a semi-annual index review. This requirement is applicable to small new issues in all markets. Large initial public

offerings are not subject to the minimum length of trading requirement and may be included in a market investable equity universe and a standard index, such as the Target Index, outside of a

quarterly or semi-annual index review.

Minimum Foreign Room Requirement: This investability screen is applied at the individual security level. For a security that is subject to a foreign

ownership limit to be eligible for inclusion in a market investable equity universe, the proportion of shares still available to foreign investors relative to the maximum allowed (referred to as “foreign room”) must be at least 15%.

Defining Market Capitalization Size Segments for Each Market

Once a market investable equity universe is defined, it is segmented into the following size-based indices:

| ● |

Investable Market Index (Large Cap + Mid Cap + Small Cap) |

| ● |

Standard Index (Large Cap + Mid Cap) |

Creating the size segment indices in each market involves the following steps: (i) defining the market coverage target range for each size segment; (ii) determining the global minimum size range

for each size segment; (iii) determining the market size−segment cutoffs and associated segment number of companies; (iv) assigning companies to the size segments; and (v) applying final size-segment investability requirements. For emerging market

indices, the market coverage for a standard index is 42.5%. As of March 2018, the global minimum size range for an emerging market standard index is a full market capitalization of USD 3.19 billion to USD 7.33 billion.

Index Continuity Rules for Standard Indices

In order to achieve index continuity, as well as provide some basic level of diversification within a market index, notwithstanding the effect of other index construction rules, a minimum number

of five constituents will be maintained for a developed market standard index and a minimum number of three constituents will be maintained for an emerging market standard index, and involves the following steps:

| ● |

If after the application of the index construction methodology, a developed market standard index contains fewer than five securities or an emerging market standard index contains fewer than three securities, then the largest |

| ● |

At subsequent Target Index reviews, if the minimum number of securities described above is not met, then after the market investable equity universe is identified, the securities are ranked by free float-adjusted market |

Creating Style Indices within Each Size Segment

All securities in the investable equity universe are classified into value or growth segments. The classification of a security into the value or growth segment is used by MSCI to construct

additional indices.

Classifying Securities under the Global Industry Classification Standard

All securities in the global investable equity universe are assigned to the industry that best describes their business activities. The GICS classification of each security is used by MSCI to

construct additional indices.

As of the close of business on September 21, 2018, MSCI and S&P Dow Jones Indices LLC updated the Global Industry Classification Sector structure. Among other things, the update broadened the

Telecommunications Services sector and renamed it the Communication Services sector. The renamed sector includes the previously existing Telecommunication Services Industry group, as well as the Media Industry group, which was moved from the

Consumer Discretionary sector and renamed the Media & Entertainment Industry group. The Media & Entertainment Industry group contains three industries: Media, Entertainment and Interactive Media & Services. The Media industry continues

to consist of the Advertising, Broadcasting, Cable & Satellite and Publishing sub-industries. The Entertainment industry contains the Movies & Entertainment sub-industry (which includes online entertainment streaming companies in addition

to companies previously classified in such industry prior to September 21, 2018) and the Interactive Home Entertainment sub-industry (which includes companies previously classified in the Home Entertainment Software sub-industry prior to September

21, 2018 (when the Home Entertainment Software sub-industry was a sub-industry in the Information Technology sector)), as well as producers of interactive gaming products, including mobile gaming applications). The Interactive Media & Services

industry and sub-industry includes companies engaged in content and information creation or distribution through proprietary platforms, where revenues are derived primarily through pay-per-click advertisements, and includes search engines, social

media and networking platforms, online classifieds and online review companies. The Global Industry Classification Sector structure changes are effective for the MSCI Emerging Markets Index in connection with the November 2018 semi-annual index

review.

Calculation Methodology for the Target Index

The Target Index is a net daily total return index. A daily total return index measures the market performance, including price performance and income from regular cash distributions, while a net daily total return

index measures the price performance and income from dividends, net of certain withholding taxes. MSCI calculates withholding taxes using the highest applicable withholding tax rate applicable to institutional investors. This net income is

reinvested in the Target Index and thus makes up part of the total index performance. MSCI’s net daily total return methodology reinvests net cash dividends in indices the day the security is quoted ex-dividend, or on the ex-date (converted to U.S.

dollars, as applicable). Certain dividends, including special/extraordinary dividends and commemorative dividends, are reinvested in the indices if, a day prior to the ex-date, the dividend impact on price is less than 5%. If the impact is 5% or

more, the dividend will be reflected in the indices through a price adjustment. A specific price adjustment is always applied for stock dividends that are issued at no cost to the shareholders, an extraordinary capital repayment or a dividend paid

in the shares of another company. Cash payments related to corporate events, such as mergers and acquisitions, are considered on a case-by-case basis.

Notwithstanding the Reference Asset’s investment objective, the return on your Notes will not reflect any dividends paid on the Reference Asset shares, on the Reference Asset Constituents or on

the securities that comprise the Target Index.

Maintenance of the Target Index

In order to maintain the representativeness of the Target Index, structural changes may be made by adding or deleting component securities. Currently, such changes in the Target Index may

generally only be made on four dates throughout the year: after the close of the last business day of each February, May, August and November.

Each country index is maintained with the objective of reflecting, on a timely basis, the evolution of the underlying equity markets. In maintaining each component country index, emphasis is also

placed on its continuity, continuous investability of constituents and replicability of the index and on index stability and minimizing turnover.

MSCI classifies index maintenance in three broad categories. The first consists of ongoing event related changes, such as mergers and acquisitions, which are generally implemented in the country

indices in which they occur. The second category consists of quarterly index reviews, aimed at promptly reflecting other significant market events. The third category consists of semi-annual index reviews that systematically re-assess the various

dimensions of the equity universe.

Ongoing event-related changes to the Target Index are the result of mergers, acquisitions, spin-offs, bankruptcies, reorganizations and other similar corporate events. They can also result from

capital reorganizations in the form of rights issues, stock bonus issues, public placements and other similar corporate actions that take place on a continuing basis. MSCI will remove from the Target Index as soon as practicable securities of

companies that file for bankruptcy or other protection from their creditors, that are suspended and for which a return to normal business activity and trading is unlikely in the near future; or that fail stock exchange listing requirements with a

delisting announcement. Securities may also be considered for early deletion in other significant cases, such as decreases in free float and foreign ownership limits, or when a constituent company acquires or merges with a non-constituent company

or spins-off another company. In practice, when a constituent company is involved in a corporate event which results in a significant decrease in the company’s free float adjusted market capitalization or the company decreases its foreign inclusion

factor to below 0.15, the securities of that constituent company are considered for early deletion from the indices simultaneously with the event unless, in either case, it is a standard index constituent with a minimum free float-adjusted market

capitalization is not at least two-thirds of one-half of the standard index interim size segment cut-off. Share conversions may also give rise to an early deletion. All changes resulting from corporate events are announced prior to their

implementation, provided all necessary information on the event is available.

MSCI’s quarterly index review process is designed to ensure that the country indices continue to be an accurate reflection of evolving equity markets. This goal is achieved by timely reflecting

significant market driven changes that were not captured in each index at the time of their actual occurrence and that should not wait until the semi-annual index review due to their importance. These quarterly index reviews may result in additions