Archivado de conformidad con la Regla 424 (b) (2)

Declaración de registro No. 333-227001

|

Royal Bank of Canada $ 1,442,000 Apalancamiento apalancado MSCI EAFE® Notas indexadas, con vencimiento el 23 de mayo de 2022 |

Las notas no tendrán interés. El monto que se le pagará en sus pagarés en la fecha de vencimiento establecida (23 de mayo de 2022,

sujeto a ajustes) se basa en el rendimiento de MSCI EAFE® Índice (al que nos referimos como "subyacente") medido desde la fecha de negociación (19 de diciembre de 2019) hasta la fecha de determinación (19 de mayo de 2022, inclusive)

ajustamiento). Si el nivel de subyacente final en la fecha de determinación es mayor que el nivel de subyacente inicial (2023.57, que era el nivel de cierre del subyacente en la fecha de negociación), el rendimiento de sus notas será positivo, sujeto a la

monto máximo de liquidación ($ 1,326.40 por cada monto de capital de $ 1,000 de las notas). Si el nivel de subyacente final es menor que el nivel de subyacente inicial pero mayor o igual que el nivel de búfer del 85.00% del nivel de subyacente inicial, usted

recibirá el monto principal de sus notas. Si el nivel subyacente final es menor que el nivel del búfer, el rendimiento de sus notas será negativo. Podría perder toda su inversión en las notas.

Para determinar su pago al vencimiento, calcularemos el rendimiento subyacente, que es el porcentaje de aumento o disminución en el nivel subyacente final a partir del

nivel inicial subyacente. En la fecha de vencimiento establecida, por cada monto de capital de $ 1,000 de sus notas, recibirá un monto en efectivo igual a:

| • |

si el retorno subyacente es positivo (el nivel subyacente final es mas grande que el nivel subyacente inicial), el suma |

| • |

si el retorno subyacente es cero o negativo pero no debajo -15% (el nivel final subyacente es igual o menor que el nivel subyacente inicial pero no más del 15%), $ 1,000; o |

| • |

si el retorno subyacente es negativo y es abajo -15% (el nivel final subyacente es menos que la inicial |

Nuestro valor estimado de las notas a la fecha de este suplemento de precios es de $ 994.78 por cada $ 1,000 en monto de capital, que es menor que el precio de emisión original.

El valor real de las notas en cualquier momento reflejará muchos factores, no se puede predecir con precisión y puede ser inferior a esta cantidad. Describimos nuestra determinación del valor estimado inicial con más detalle a continuación.

Su inversión en las notas implica ciertos riesgos, que incluyen, entre otras cosas, nuestro riesgo de crédito. Consulte la sección "Factores de riesgo adicionales

Específico para sus notas "que comienza en la página PS-7 de este suplemento de precios.

Lo anterior es solo un breve resumen de los términos de sus notas. Debe leer la divulgación adicional provista en este suplemento de precios para poder

Comprenda mejor los términos y riesgos de su inversión.

|

Fecha de emisión original: |

27 de diciembre de 2019 |

Precio de emisión original: |

100.00% del monto principal |

|

Descuento de suscripción: |

0.00% del monto principal |

Ingresos netos al emisor: |

100.00% del monto principal |

Consulte “Plan de distribución suplementario (conflictos de intereses)” en la página PS-20 de este suplemento de precios.

El precio de emisión, el descuento de suscripción y los ingresos netos mencionados anteriormente se relacionan con las notas que vendemos inicialmente. Podemos decidir vender notas adicionales después de la fecha de este precio

suplemento, a precios de emisión y con descuentos de suscripción y ganancias netas que difieren de los montos establecidos anteriormente. El rendimiento (ya sea positivo o negativo) de su inversión en los pagarés dependerá en parte del precio de emisión que pague

tales notas

Ni la Comisión de Bolsa y Valores ni ningún otro organismo regulador ha aprobado o desaprobado las notas ni ha pasado la exactitud o adecuación de

este suplemento de precios, el suplemento del prospecto del producto que lo acompaña, el suplemento del prospecto que lo acompaña o el prospecto que lo acompaña. Cualquier representación en contrario es un delito penal. Las notas no constituirán depósitos que sean

asegurado por la Corporación de Seguros de Depósitos de Canadá, la Corporación Federal de Seguros de Depósitos de EE. UU. o cualquier otra agencia o entidad gubernamental canadiense o estadounidense. Las notas no están sujetas a conversión en nuestras acciones ordinarias en la subsección

39.2 (2.3) de la Ley de la Corporación de Seguros de Depósitos de Canadá.

RBC Capital Markets, LLC

Suplemento de precios con fecha 19 de diciembre de 2019.

RESUMEN INFORMACIÓN

|

Nos referimos a las notas que ofrecemos con este suplemento de precios como las "notas ofrecidas" o las "notas". Cada una de las notas ofrecidas, incluidas sus notas, tiene los términos que se describen a continuación. Por favor Esta sección pretende ser un resumen y debe leerse junto con la sección titulada “Términos generales de las notas” que comienza en la página PS-4 del prospecto del producto adjunto |

Términos clave

Editor: Royal Bank of Canada

Subrayado: el MSCI EAFE® Índice (símbolo de Bloomberg, "Índice MXEA"), según lo publicado por MSCI Inc. ("MSCI", o el

"Patrocinador subyacente")

Moneda especificada: Dólares estadounidenses ("$")

Denominaciones: $ 1,000 y múltiplos integrales de $ 1,000 en exceso de $ 1,000. Las notas solo pueden transferirse en cantidades

de $ 1,000 e incrementos de $ 1,000 a partir de entonces

Cantidad principal: cada nota tendrá un monto principal de $ 1,000; $ 1,442,000 en total para todos los ofrecidos

notas el monto principal agregado de los pagarés ofrecidos puede incrementarse si el emisor, a su exclusivo criterio, decide vender un monto adicional de los pagarés ofrecidos en una fecha posterior a la fecha de este suplemento de precios

Compra a un monto diferente al principal: la cantidad que le pagaremos en la fecha de vencimiento establecida para sus notas

no se ajustará en función del precio de emisión que pague por sus pagarés, por lo que si adquiere billetes con una prima (o descuento) sobre el monto del principal y los mantiene hasta la fecha de vencimiento establecida, podría afectar su inversión de varias maneras. los

El rendimiento de su inversión en dichos bonos será menor (o mayor) de lo que hubiera sido si hubiera comprado los billetes a un precio igual al monto del capital. Además, el nivel de búfer no ofrecería la misma medida de protección a su

inversión como sería el caso si hubiera comprado los pagarés al monto principal. Además, el nivel máximo se activaría con un rendimiento porcentual menor (o mayor) que el indicado a continuación, en relación con su inversión inicial. Ver "Si el

El precio de emisión original de sus notas representa una prima sobre el monto principal, el rendimiento de sus notas será menor que el rendimiento de las notas para las cuales el precio de emisión original es igual al monto principal o representa un descuento para el

Cantidad principal "en la página PS-12 de este suplemento de precios

Importe de liquidación en efectivo (en la fecha de vencimiento establecida): por cada monto de capital de $ 1,000 de sus notas, le pagaremos

la fecha de vencimiento establecida una cantidad en efectivo igual a:

| • |

si el nivel subyacente final es mas grande que o igual a el nivel máximo, el monto máximo de liquidación; |

| • |

si el nivel subyacente final es mas grande que el nivel subyacente inicial pero menos que el nivel de la tapa, el suma |

| • |

si el nivel subyacente final es igual a o menos que el nivel subyacente inicial pero mas grande que o igual a el nivel de amortiguación, $ 1,000; o |

| • |

si el nivel subyacente final es menos que el nivel de amortiguación, el suma de (1) $ 1,000 más (2) el producto de (i) la tasa de amortiguación veces (ii) el la suma de el retorno subyacente más |

Nivel inicial subyacente: 2023.57, que era el nivel de cierre del subyacente en la fecha de negociación

Nivel final subyacente: el nivel de cierre del subyacente en la fecha de determinación, excepto en circunstancias limitadas

descrito en “Términos generales de las notas – Fechas de determinación y fechas promedio” en la página PS-5 del prospecto del producto adjunto suplemento PB-1 y sujeto a ajustes según lo dispuesto en “Términos generales de las notas – No disponibilidad de

el Nivel del Subrayador "en la página PS-6 del suplemento del prospecto del producto adjunto PB-1.

Retorno subyacente: el cociente de (1) el nivel subyacente final menos el nivel subyacente inicial dividido por (2) el nivel subyacente inicial, expresado como un porcentaje

Tasa de participación al alza: 170%

Nivel de tapa: 119.20% del nivel inicial subyacente

Monto máximo de liquidación: $ 1,326.40 por cada monto de capital de $ 1,000 de las notas

Nivel de buffer: 85% del nivel subyacente inicial (igual a un retorno subyacente de -15%)

Cantidad de buffer: 15%

Tasa de amortiguación: el cociente del nivel subyacente inicial dividido por el nivel de amortiguación, que equivale aproximadamente a 117.65%

Fecha de comercio: 19 de diciembre de 2019

Fecha de emisión original (fecha de liquidación): 27 de diciembre de 2019

Fecha de determinación: 19 de mayo de 2022, sujeto a ajustes como se describe en “Términos generales de las notas – Determinación

Fechas y fechas promedio "en la página PS-5 del suplemento del prospecto del producto adjunto PB-1

Fecha de vencimiento declarada: 23 de mayo de 2022, sujeto a ajustes según se describe en “Términos generales de las notas – Declarado

Fecha de vencimiento "en la página PS-5 del prospecto del producto adjunto suplemento PB-1

No hay interés: las notas ofrecidas no serán de interés

Sin listado: las notas ofrecidas no se incluirán en ningún intercambio de valores o sistema de cotización de intermediario

Sin redención: las notas no están sujetas a canje antes del vencimiento

Nivel de cierre: cuando nos referimos al nivel de cierre del subyacente en cualquier día de negociación, nos referimos al nivel de cierre del

subyacente o cualquier sucesor subyacente informado por Bloomberg Financial Services, o cualquier servicio de informes sucesores que podamos seleccionar, en dicho día de negociación. Actualmente, Bloomberg Financial Services informa el nivel de cierre del subyacente a menos

lugares decimales que el patrocinador subyacente. Como resultado, el nivel de cierre del subyacente informado por Bloomberg Financial Services puede ser menor o mayor que su nivel de cierre oficial publicado por el patrocinador del subyacente

Día laboral: como se describe en “Términos generales de las notas – Disposiciones especiales de cálculo – Día hábil” en la página

PS-11 del prospecto del producto acompañante suplemento PB-1

Día de negociación: como se describe en "Términos generales de las notas – Disposiciones especiales de cálculo – Día de negociación – Índices"

en la página PS-11 del suplemento del prospecto del producto adjunto PB-1

Uso de ingresos y cobertura: como se describe en "Uso de los ingresos y la cobertura" en la página PS-13 del producto que lo acompaña

prospecto suplemento PB-1

ERISA: como se describe en la "Ley de seguridad de los ingresos de jubilación de los empleados" en la página PS-20 del producto adjunto

prospecto suplemento PB-1

Agente de cálculo: RBC Capital Markets, LLC ("RBCCM")

Comerciante: RBCCM

Tratamiento fiscal de EE. UU .: Al comprar una nota, cada titular acuerda (en ausencia de un cambio en la ley, un

determinación o resolución judicial en sentido contrario) para tratar la nota como un contrato derivado liquidado en efectivo prepago para fines del impuesto federal sobre los ingresos de los EE. UU. Sin embargo, las consecuencias del impuesto sobre la renta federal de los Estados Unidos de su inversión en las notas son

incierto y el Servicio de Impuestos Internos podría afirmar que las notas deben pagar impuestos de una manera diferente a la descrita en la oración anterior. Consulte la discusión en el prospecto adjunto bajo "Impuestos

Consecuencias ", la discusión en el suplemento del prospecto adjunto en" Ciertas consecuencias del impuesto sobre la renta ", y la discusión (incluida la opinión de nuestro abogado Morrison & Foerster LLP) en el prospecto del producto adjunto

complemente PB-1 en "Discusión complementaria de las consecuencias del impuesto sobre la renta federal de EE. UU." y la discusión a continuación en "Discusión complementaria de las consecuencias del impuesto sobre la renta federal de EE. UU.", que se aplican a las notas.

Tratamiento fiscal canadiense: para una discusión sobre ciertas consecuencias del impuesto sobre la renta federal canadiense de invertir en las notas,

consulte la sección titulada "Consecuencias fiscales: impuestos canadienses" en el folleto adjunto

CUSIP no .: 78015KHM9

ISIN no .: US78015KHM99

FDIC: las notas no constituirán depósitos asegurados por la Corporación Federal de Seguro de Depósitos, Canadá

Deposit Insurance Corporation o cualquier otra agencia gubernamental canadiense o estadounidense

Escritura: los pagarés se emitirán bajo nuestro contrato de deuda senior, modificado y complementado hasta el 7 de septiembre,

2018, que se describe en el prospecto adjunto. Consulte la sección "Descripción de los valores de deuda" que comienza en la página 4 del prospecto para obtener una descripción del contrato de deuda senior, incluidas las circunstancias limitadas que

constituiría un evento de incumplimiento bajo las notas que estamos ofreciendo

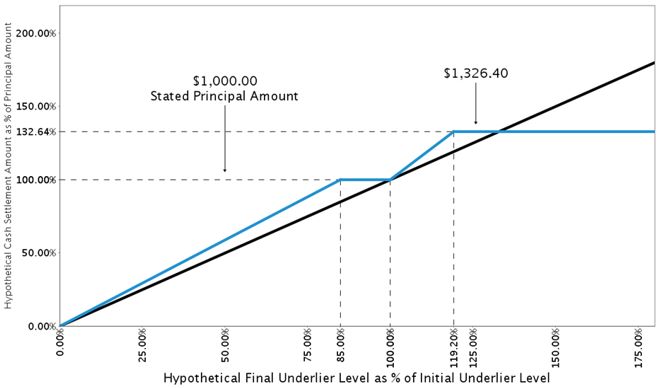

EJEMPLOS HIPOTETETICOS

La siguiente tabla y tabla se proporcionan solo con fines ilustrativos. No deben tomarse como una indicación o predicción de los resultados de inversión futuros y están destinados

simplemente para ilustrar el impacto que varios niveles hipotéticos subyacentes finales en la fecha de determinación podrían tener sobre el monto de liquidación en efectivo al vencimiento, suponiendo que todas las demás variables permanezcan constantes.

Los ejemplos a continuación se basan en un rango de niveles subyacentes finales que son completamente hipotéticos. Nadie puede predecir cuál será el nivel subyacente en ningún día durante el período de

sus notas, y nadie puede predecir cuál será el nivel final subyacente. El subyacente ha sido muy volátil en el pasado, lo que significa que el nivel subyacente ha cambiado considerablemente en períodos relativamente cortos, y su rendimiento no puede ser

previsto para cualquier período futuro.

La información en los siguientes ejemplos refleja tasas de rendimiento hipotéticas en las notas, suponiendo que se compren en la fecha de emisión original con un capital de $ 1,000

importe y se mantienen hasta su vencimiento. Si vende sus notas en cualquier mercado secundario antes de su vencimiento, su rendimiento dependerá del valor de mercado de sus notas en el momento de la venta, que puede verse afectado por una serie de factores que no se reflejan en

la tabla a continuación, como las tasas de interés y la volatilidad del subyacente. Además, suponiendo que no haya cambios en las condiciones del mercado o nuestra solvencia crediticia y otros factores relevantes, el valor de sus notas en la fecha de negociación (según lo determinado por

la referencia a los modelos de precios utilizados por RBCCM y teniendo en cuenta nuestros diferenciales de crédito) es, y el precio que puede recibir por sus notas puede ser, significativamente menor que el monto del principal. Para obtener más información sobre el valor de sus notas en el

en el mercado secundario, consulte "Factores de riesgo adicionales específicos de sus pagarés: el precio, si corresponde, en el que puede vender sus pagarés antes del vencimiento puede ser inferior al precio de emisión original y nuestro valor estimado inicial" a continuación. La información

en la tabla también refleja los términos y supuestos clave en el cuadro a continuación.

|

Términos clave y supuestos |

|||

|

Cantidad principal |

$ 1,000 |

||

|

Tasa de participación al revés |

170% |

||

|

Nivel de tapa |

119.20% del nivel inicial subyacente |

||

|

Monto máximo de liquidación |

$ 1,326.40 |

||

|

Nivel de amortiguación |

85.00% del nivel subyacente inicial |

||

|

Tasa de amortiguación |

, lo que equivale aproximadamente a 117.65% , lo que equivale aproximadamente a 117.65% |

||

|

Cantidad de amortiguación |

15,00% |

||

|

Ni un evento de interrupción del mercado ni un día sin negociación ocurre en la fecha de determinación programada originalmente Ningún cambio afecta el método por el cual el patrocinador subyacente calcula el subyacente Notas compradas en la fecha de emisión original a un precio igual al monto del principal y mantenidas hasta la fecha de vencimiento establecida |

|||

El rendimiento real del subyacente durante el plazo de sus notas, así como el monto pagadero al vencimiento, si corresponde, pueden tener poca relación con los ejemplos hipotéticos que se muestran a continuación.

o a los niveles subyacentes históricos que se muestran en otra parte de este suplemento de precios. Para obtener información sobre los niveles históricos del subyacente durante los períodos recientes, consulte "El subyacente: rendimiento histórico del subyacente" a continuación. Antes de invertir

en las notas, debe consultar información disponible públicamente para determinar los niveles del subyacente entre la fecha de este suplemento de precios y la fecha de compra de las notas.

Además, los ejemplos hipotéticos que se muestran a continuación no tienen en cuenta los efectos de los impuestos aplicables. Debido al tratamiento fiscal de los EE. UU. Aplicable a sus pagarés, obligaciones fiscales

podría afectar la tasa de rendimiento después de impuestos en sus pagarés en un grado comparativamente mayor que el rendimiento después de impuestos sobre las acciones incluidas en el subyacente (las "acciones subyacentes").

Los niveles en la columna izquierda de la tabla a continuación representan hipotéticos niveles finales subyacentes y se expresan como porcentajes del nivel inicial subyacente. Las cantidades en la columna derecha representan

los montos hipotéticos de liquidación de efectivo, basados en el nivel hipotético final subyacente correspondiente (expresado como un porcentaje del nivel subyacente inicial), y se expresan como porcentajes del monto principal de una nota (redondeado al

la milésima parte de un por ciento más cercano). Por lo tanto, un monto hipotético de liquidación en efectivo de 100.000% significa que el valor del pago en efectivo que entregaríamos por cada monto de capital de $ 1,000 de las notas al vencimiento sería igual al monto de capital de

una nota, basada en el correspondiente nivel de subyacente hipotético final (expresado como un porcentaje del nivel de subyacente inicial) y los supuestos mencionados anteriormente.

|

Nivel hipotético final subyacente (como porcentaje de el nivel subyacente inicial) |

Monto hipotético de liquidación de efectivo (como porcentaje de la cantidad principal) |

|

160,000% |

132,640% |

|

150.000% |

132,640% |

|

140.000% |

132,640% |

|

130.000% |

132,640% |

|

120.000% |

132,640% |

|

119.000% |

132,300% |

|

110.000% |

117.000% |

|

107.000% |

111,900% |

|

105.000% |

108.500% |

|

95.000% |

100.000% |

|

90.000% |

100.000% |

|

80.000% |

94,118% |

|

75.000% |

88,235% |

|

50.000% |

58.824% |

|

25.000% |

29,412% |

Si, por ejemplo, se determina que el nivel de subyacente final es el 25,000% del nivel de subyacente inicial, el monto de liquidación en efectivo que entregaríamos en sus pagarés al vencimiento

sea aproximadamente el 29.412% del monto principal de sus pagarés, como se muestra en la columna del monto hipotético de liquidación en efectivo de la tabla anterior. Como resultado, si compró sus pagarés al monto principal en la fecha de liquidación y los retuvo en

vencimiento, perdería aproximadamente el 70.588% de su inversión.

Si se determinara que el nivel de subyacente final es 160,000% del nivel de subyacente inicial, el monto de liquidación en efectivo que entregaríamos en sus pagarés al vencimiento se limitaría al máximo

monto de liquidación (expresado como un porcentaje del monto principal), o 132.640% del monto principal de sus pagarés, como se muestra en la columna de monto hipotético de liquidación en efectivo de la tabla anterior. Como resultado, si compró sus notas en el

monto principal en la fecha de liquidación y los mantuvo hasta su vencimiento, no se beneficiaría de ningún aumento en el nivel de subyacente final por encima del 119.200% del nivel de subyacente inicial.

El siguiente cuadro también ilustra los montos hipotéticos de liquidación de efectivo (expresados como un porcentaje del monto principal de sus pagarés) que pagaríamos en sus pagarés en el

fecha de vencimiento establecida, si el nivel subyacente final (expresado como un porcentaje del nivel subyacente inicial) fuera cualquiera de los niveles hipotéticos mostrados en el eje horizontal. El gráfico muestra que cualquier hipotético nivel final subyacente (expresado como

un porcentaje del nivel subyacente inicial) menor que el nivel de amortiguación resultaría en un monto hipotético de liquidación de efectivo de menos del 100.00% del monto principal de sus notas (la sección debajo del marcador 100.00% en el eje vertical)

y, en consecuencia, en una pérdida de capital para el titular de los pagarés. Por otro lado, cualquier nivel hipotético final subyacente que sea mayor que el nivel inicial subyacente (la sección derecha del marcador 100.00% en el eje horizontal)

resultará en un monto hipotético de liquidación en efectivo que es mayor al 100.00% del monto principal de sus pagarés en forma apalancada (la sección sobre el marcador de 100.00% en el eje vertical), sujeto al monto máximo de liquidación.

|

|

■ La nota de rendimiento |

■ El rendimiento subyacente |

Nadie puede predecir el nivel subyacente final. El monto real que recibirá un tenedor de los bonos al vencimiento y el retorno real de su inversión en el

las notas, si las hay, dependerán del nivel real subyacente final, que será determinado por el agente de cálculo como se describe a continuación. Además, el rendimiento real de sus notas dependerá aún más del precio de emisión original. Además, el

Los supuestos en los que se basan la tabla y el gráfico hipotéticos pueden resultar inexactos. En consecuencia, el rendimiento de su inversión en los pagarés, si corresponde, y el monto real de liquidación en efectivo a pagar con respecto a los pagarés al vencimiento pueden

ser muy diferente de la información reflejada en la tabla y el cuadro de arriba.

FACTORES DE RIESGO ADICIONALES ESPECÍFICOS PARA SUS NOTAS

|

Una inversión en sus pagarés está sujeta a los riesgos que se describen a continuación, así como a los riesgos que se describen en "Factores de riesgo" que comienzan en la página S-1 del suplemento del folleto adjunto y |

Puede perder toda su inversión en las notas

El monto principal de su inversión no está protegido y puede perder una cantidad significativa, o incluso toda su inversión en las notas. La liquidación en efectivo

el monto, si corresponde, dependerá del desempeño del subyacente y el cambio en el nivel del subyacente desde la fecha de negociación hasta la fecha de determinación, y usted puede recibir una cantidad significativamente menor que el monto principal de los pagarés. Sujeto a nuestro

riesgo de crédito, recibirá al menos el monto principal de los pagarés al vencimiento solo si el nivel subyacente final es mayor o igual que el nivel de amortiguación. Si el nivel subyacente final es menor que el nivel del búfer, perderá, por

cada $ 1,000 en la cantidad principal de las notas, una cantidad igual al producto de (i) la tasa de amortiguación veces (ii) la suma de retorno subyacente más la cantidad de amortiguación veces (iii) $ 1,000. Podría perder parte o la totalidad del monto principal. Por lo tanto, dependiendo del nivel final subyacente, podría perder una parte sustancial y

quizás la totalidad de su inversión en los pagarés, que incluiría cualquier prima sobre el monto del capital que haya pagado cuando compró los pagarés.

Además, si las notas no se retienen hasta el vencimiento, suponiendo que no haya cambios en las condiciones del mercado o en nuestra solvencia y otros factores relevantes, el precio

puede recibir por las notas puede ser significativamente menor que el precio que pagó por ellas.

Nuestro valor estimado inicial de las notas es menor que el precio de emisión original

Nuestro valor estimado inicial que se establece en la portada de este documento es menor que el precio de emisión original de las notas. No representa un mínimo

precio al que nosotros, RBCCM o cualquiera de nuestros otros afiliados estaríamos dispuestos a comprar los pagarés en cualquier mercado secundario (si existe alguno) en cualquier momento. Esto se debe, entre otras cosas, al hecho de que el precio de emisión original de las notas refleja el

tasa de endeudamiento que pagamos para emitir valores de este tipo (una tasa de financiación interna que es inferior a la tasa a la que prestamos fondos mediante la emisión de deuda a tasa fija convencional) y la inclusión en el precio de emisión original de los costos relacionados con nuestro

cobertura de las notas.

El precio, en su caso, al que puede vender sus notas antes del vencimiento puede ser inferior al precio de emisión original y nuestro valor estimado inicial

Suponiendo que no haya cambios en las condiciones del mercado ni en ningún otro factor relevante, el precio, si lo hay, al cual puede vender sus notas antes del vencimiento puede ser menor

que el precio de emisión original y nuestro valor estimado inicial. Esto se debe a que no se espera que dicho precio de venta incluya nuestra ganancia estimada y los costos relacionados con nuestra cobertura de los pagarés. Además, cualquier precio al que pueda vender

Es probable que las notas reflejen los diferenciales habituales de oferta y demanda para operaciones similares y el costo de deshacer cualquier transacción de cobertura relacionada. Además, se espera que el valor de las notas determinado para cualquier precio del mercado secundario se base en parte en

el rendimiento que se refleja en la tasa de interés de nuestros títulos de deuda convencionales de vencimiento similar que se negocian en el mercado secundario, en lugar de la tasa de financiación interna que usamos para fijar el precio de los pagarés y determinar el valor inicial

valor estimado. Como resultado, el precio del mercado secundario de los bonos será menor que si se utilizara la tasa de financiación interna. Estos factores, junto con varios factores crediticios, de mercado y económicos durante el plazo de las notas y, potencialmente,

Se espera que los cambios en el nivel del subyacente reduzcan el precio al que puede vender los pagarés en cualquier mercado secundario y afectarán el valor de los pagarés de formas complejas e impredecibles.

Como se establece a continuación en la sección "Plan de distribución suplementario (conflictos de intereses)", por un período de tiempo limitado después de la fecha de negociación, su corredor puede

recompra las notas a un precio que sea mayor que el valor estimado de las notas en ese momento. Sin embargo, suponiendo que no haya cambios en ningún otro factor relevante, se espera que el precio que reciba si vende sus notas disminuya gradualmente durante

ese periodo.

Las notas no están diseñadas para ser instrumentos comerciales a corto plazo. En consecuencia, debe ser capaz y estar dispuesto a mantener sus notas hasta la madurez.

El valor estimado inicial de las notas es solo una estimación, calculada en el momento en que se establecieron los términos de las notas

Nuestro valor estimado inicial de los pagarés se basa en el valor de nuestra obligación de realizar los pagos en los pagarés, junto con el valor medio de mercado de los bonos.

derivado incrustado en los términos de las notas. Consulte "Estructuración de las notas" a continuación. Nuestra estimación se basa en una variedad de supuestos, incluida nuestra tasa de financiación interna (que representa un descuento de nuestros diferenciales de crédito), expectativas en cuanto a

dividendos de las acciones subyacentes, tasas de interés y volatilidad, y el plazo esperado de las notas. Estas suposiciones se basan en ciertos pronósticos sobre eventos futuros, que pueden resultar incorrectos. Otras entidades pueden valorar las notas o similares

valores a un precio significativamente diferente al nuestro.

El valor de las notas en cualquier momento después de la fecha de negociación variará en función de muchos factores, incluidos los cambios en las condiciones del mercado, y no se puede predecir con precisión. Como resultado,

se debe esperar que el valor real que recibiría si vendiera los pagarés en cualquier mercado secundario, si lo hubiera, difiere materialmente de nuestro valor estimado inicial de sus pagarés.

Sus notas no generarán interés

No recibirá ningún pago de intereses en las notas. Incluso si el monto pagadero en los pagarés al vencimiento excede el monto principal de los pagarés, el total

el rendimiento que gana en los pagarés puede ser menor de lo que hubiera ganado invirtiendo en una garantía de deuda no indexada de vencimiento comparable que devengue intereses a una tasa de mercado prevaleciente. Su inversión puede no reflejar la oportunidad completa

le cuesta cuando tiene en cuenta los factores que afectan el valor temporal del dinero.

El potencial para que el valor de sus notas aumente será limitado

Su capacidad para participar en cualquier cambio en el nivel del subyacente durante el término de sus notas será limitada debido al nivel de límite. El nivel de límite será

limite la cantidad en efectivo que puede recibir por cada una de sus notas al vencimiento, sin importar cuánto pueda aumentar el nivel del subyacente más allá del nivel de límite durante el plazo de sus notas. En consecuencia, el monto pagadero por cada una de sus notas puede ser

significativamente menos que su rendimiento si hubiera invertido directamente en las acciones subyacentes.

El pago del monto a pagar en sus pagarés está sujeto a nuestro riesgo de crédito, y las percepciones del mercado sobre nuestra solvencia pueden afectar negativamente el valor de mercado

de sus notas

Las notas son nuestras obligaciones de deuda no garantizadas. Los inversores están sujetos a nuestro riesgo crediticio y las percepciones del mercado sobre nuestra solvencia pueden afectar negativamente

Valor de mercado de las notas. Es probable que cualquier disminución en la visión del mercado o la confianza en nuestra calidad crediticia afecte negativamente el valor de mercado de los pagarés.

El monto a pagar en sus notas no está vinculado al nivel del subyacente en ningún momento que no sea la fecha de determinación

El monto a pagar en sus notas se basará en el nivel de subyacente final. Por lo tanto, por ejemplo, si el nivel de cierre del subyacente disminuye precipitadamente en

En la fecha de determinación, el monto a pagar al vencimiento puede ser significativamente menor de lo que hubiera sido si se hubiera vinculado el monto a pagar al nivel de cierre del subyacente antes de esa disminución. Aunque el nivel real de la

El subyacente al vencimiento o en otros momentos durante el plazo de las notas puede ser superior al nivel final subyacente, no se beneficiará del nivel de cierre del subyacente en ningún momento que no sea la fecha de determinación.

Las notas pueden no tener un mercado de negociación activo

Las notas no se incluirán en ningún intercambio de valores. El concesionario tiene la intención de ofrecer comprar las notas en el mercado secundario, pero no está obligado a hacerlo. los

dealer or any of its affiliates may stop any market-making activities at any time. Even if there is a secondary market, it may not provide enough liquidity to allow you to easily trade or sell the notes. Because other dealers are not likely to make a

secondary market for the notes, the price at which you may be able to trade the notes is likely to depend on the price, if any, at which the dealer is willing to buy the notes. We expect that transaction costs in any secondary market would be high.

As a result, the difference between bid and asked prices for your notes in any secondary market could be substantial.

If you sell your notes before maturity, you may have to do so at a substantial discount from the price that you paid for them, and as a result, you may suffer

substantial losses.

The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors

The following factors, among others, many of which are beyond our control, may influence the market value of your notes:

| • |

the level of the underlier; |

| • |

the volatility—i.e., the frequency and magnitude of changes—of the level of the underlier; |

| • |

the dividend rates of the underlier stocks; |

| • |

economic, financial, regulatory, political, military and other events that affect stock markets generally and the underlier stocks; |

| • |

interest and yield rates in the market; |

| • |

the time remaining until the notes mature; y |

| • |

our creditworthiness, whether actual or perceived, and including actual or anticipated upgrades or downgrades in our credit ratings or changes in other credit measures. |

These factors may influence the market value of your notes if you sell your notes before maturity, including the price you may receive for your notes in any market

making transaction. If you sell your notes prior to maturity, you may receive less than the principal amount of your notes.

An Investment in the Notes Is Subject to Risks Associated with Foreign Securities Markets

The underlier tracks the value of certain foreign equity securities. The underlier consists of twenty-one developed equity market country indices, which are in turn comprised of the

stocks traded in the equity markets of such countries. You should be aware that investments in securities linked to the value of foreign equity securities involve particular risks. The foreign securities markets comprising the underlier may have less

liquidity and may be more volatile than U.S. or other securities markets and market developments may affect foreign markets differently from U.S. or other securities markets. Direct or indirect government intervention to stabilize these foreign

securities markets, as well as cross-shareholdings in foreign companies, may affect trading prices and volumes in these markets. Also, there is generally less publicly available information about foreign companies than about those U.S. companies that

are subject to the reporting requirements of the U.S. Securities and Exchange Commission, and foreign companies are subject to accounting, auditing and financial reporting standards and requirements that differ from those applicable to U.S. reporting

companies.

Prices of securities in foreign countries are subject to political, economic, financial and social factors that apply in those geographical regions. These factors,

which could negatively affect those securities markets, include the possibility of recent or future changes in a foreign government’s economic and fiscal policies, the possible imposition of, or changes in, currency exchange laws or other laws or

restrictions applicable to foreign companies or investments in foreign equity securities and the possibility of fluctuations in the rate of exchange between currencies, the possibility of outbreaks of hostility and political instability and the

possibility of natural disaster or adverse public health development in the region. Moreover, foreign economies may differ favorably or unfavorably from the U.S. economy in important respects such as growth of gross national product, rate of

inflation, capital reinvestment, resources and self-sufficiency.

The Notes Are Linked to the Index, and Are Therefore Subject to Foreign Currency Exchange Rate Risk

The payment amount on the notes will be calculated based on the underlier, and the prices of the underlier stocks are converted into U.S. dollars for purposes of

calculating the level of the underlier. As a result, investors in the notes will be exposed to currency exchange rate risk with respect to each of the currencies represented by the underlier. An investor’s net exposure will depend on the extent to

which the currencies represented by the underlier strengthen or weaken against the U.S. dollar and the relative weight of each relevant currency represented by the underlier. If, taking into account such weight, the dollar strengthens against such

currencies, the level of the underlier will be adversely affected and the amount payable, if any, at maturity of the notes may be reduced.

Foreign currency exchange rates vary over time, and may vary considerably during the life of the notes. Changes in a particular exchange rate result from the

interaction of many factors directly or indirectly affecting economic and political conditions.

Of particular importance are:

| • |

existing and expected rates of inflation; |

| • |

existing and expected interest rate levels; |

| • |

the balance of payments; |

| • |

the extent of governmental surpluses or deficits in the relevant countries; y |

| • |

other financial, economic, military and political factors. |

All of these factors are, in turn, sensitive to the monetary, fiscal and trade policies pursued by the governments of the various component countries and the United

States and other countries important to international trade and finance.

It has been reported that the U.K. Financial Conduct Authority and regulators from other countries are in the process of investigating the potential manipulation of

published currency exchange rates. If such manipulation has occurred or is continuing, certain published exchange rates may have been, or may be in the future, artificially lower (or higher) than they would otherwise have been. Any such manipulation

could have an adverse impact on any payments on, and the value of, your notes and the trading market for your notes. In addition, we cannot predict whether any changes or reforms affecting the determination or publication of exchange rates or the

supervision of currency trading will be implemented in connection with these investigations. Any such changes or reforms could also adversely impact your notes.

If the Level or Price of the Underlier or the Underlier Stocks Changes, the Market Value of the Notes May Not Change in the Same Manner

The notes may trade quite differently from the performance of the underlier or the underlier stocks. Changes in the level or price, as applicable, of the underlier

or the underlier stocks may not result in a comparable change in the market value of the notes. Some of the reasons for this disparity are discussed under “— The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” above.

The Return on the Notes Will Not Reflect Any Dividends Paid on the Underlier Stocks

The underlier sponsor calculates the levels of the underlier by reference to the prices of the underlier stocks without taking account of the value of dividends paid

on those underlier stocks. Therefore, the return on the notes will not reflect the return you would realize if you actually owned the underlier stocks and received the dividends paid on those underlier stocks.

You Have No Shareholder Rights or Rights to Receive Any Underlier Stock

Investing in your notes will not make you a holder of any of the underlier stocks. Neither you nor any other holder or owner of your notes will have any voting

rights, any right to receive dividends or other distributions, any rights to make a claim against the underlier stock issuers or any other rights with respect to the underlier stocks. Your notes will be paid in cash to the extent any amount is

payable at maturity, and you will have no right to receive delivery of any of the underlier stocks.

We Will Not Hold Any of the Underlier Stocks for Your Benefit, if We Hold Them at All

The indenture and the terms governing your notes do not contain any restriction on our ability or the ability of any of our affiliates to sell, pledge or otherwise

convey all or any portion of the underlier stocks that we or they may acquire. Neither we nor our affiliates will pledge or otherwise hold any assets for your benefit, including any of these securities. Consequently, in the event of our bankruptcy,

insolvency or liquidation, any of those securities that we own will be subject to the claims of our creditors generally and will not be available for your benefit specifically.

Our Hedging Activities and/or Those of Our Distributors May Negatively Impact Investors in the Notes and Cause Our Interests and Those of Our Clients and

Counterparties to Be Contrary to Those of Investors in the Notes

The dealer or one or more of our other affiliates and/or distributors has hedged or expects to hedge its obligations under the hedging transaction that it may enter into with us by

purchasing futures and/or other instruments linked to the underlier or the underlier stocks. The dealer or one or more of our other affiliates and/or distributors also expects to adjust the hedge by,

among other things, purchasing or selling any of the foregoing, and perhaps other instruments linked to the underlier or one or more of the underlier stocks, at any

time and from time to time, and to unwind the hedge by selling any of the foregoing on or before the determination date.

We, the dealer, or one or more of our other affiliates and/or distributors may also enter into, adjust and unwind hedging transactions relating to other basket- or

index-linked notes whose returns are linked to changes in the level or price of the underlier or the underlier stocks. Any of these hedging activities may adversely affect the level of the underlier —directly or indirectly by affecting the price of

the underlier stocks—and therefore the market value of the notes and the amount you will receive, if any, on the notes. In addition, you should expect that these transactions will cause us, the dealer or our other affiliates and/or distributors, or

our clients or counterparties, to have economic interests and incentives that do not align with, and that may be directly contrary to, those of an investor in the notes. We, the dealer and our other affiliates and/or distributors will have no

obligation to take, refrain from taking or cease taking any action with respect to these transactions based on the potential effect on an investor in the notes, and may receive substantial returns with respect to these hedging activities while the

value of the notes may decline. Additionally, if the distributor from which you purchase notes is to conduct hedging activities for us in connection with the notes, that distributor may profit in connection with such hedging activities and such

profit, if any, will be in addition to the compensation that the distributor receives for the sale of the notes to you. You should be aware that the potential to earn fees in connection with hedging activities may create a further incentive for the

distributor to sell the notes to you in addition to the compensation they would receive for the sale of the notes.

Market Activities by Us and by the Dealer for Our Own Account or for Our Clients Could Negatively Impact Investors in the Notes

We, the dealer and our other affiliates provide a wide range of financial services to a substantial and diversified client base. As such, we each may act as an

investor, investment banker, research provider, investment manager, investment advisor, market maker, trader, prime broker or lender. In those and other capacities, we, the dealer and/or our other affiliates purchase, sell or hold a broad array of

investments, actively trade securities (including the notes or other securities that we have issued), the underlier stocks, derivatives, loans, credit default swaps, indices, baskets and other financial instruments and products for our own accounts

or for the accounts of our customers, and we will have other direct or indirect interests, in those securities and in other markets that may be not be consistent with your interests and may adversely affect the level of the underlier and/or the value

of the notes. Any of these financial market activities may, individually or in the aggregate, have an adverse effect on the level of the underlier and the market value of your notes, and you should expect that our interests and those of the dealer

and/or our other affiliates, or our clients or counterparties, will at times be adverse to those of investors in the notes.

In addition to entering into these transactions itself, we, the dealer and our other affiliates may structure these transactions for our clients or counterparties,

or otherwise advise or assist clients or counterparties in entering into these transactions. These activities may be undertaken to achieve a variety of objectives, including: permitting other purchasers of the notes or other securities to hedge their

investment in whole or in part; facilitating transactions for other clients or counterparties that may have business objectives or investment strategies that are inconsistent with or contrary to those of investors in the notes; hedging the exposure

of us, the dealer or our other affiliates in connection with the notes, through their market-making activities, as a swap counterparty or otherwise; enabling us, the dealer or our other affiliates to comply with internal risk limits or otherwise

manage firmwide, business unit or product risk; and/or enabling us, the dealer or our other affiliates to take directional views as to relevant markets on behalf of itself or our clients or counterparties that are inconsistent with or contrary to the

views and objectives of investors in the notes.

We, the dealer and our other affiliates regularly offer a wide array of securities, financial instruments and other products into the marketplace, including existing

or new products that are similar to the notes or other securities that we may issue, the underlier stocks or other securities or instruments similar to or linked to the foregoing. Investors in the notes should expect that we, the dealer and our other

affiliates will offer securities, financial instruments, and other products that may compete with the notes for liquidity or otherwise.

We, the Dealer and Our Other Affiliates Regularly Provide Services to, or Otherwise Have Business Relationships with, a Broad Client Base, Which Has Included and

May Include Us and the Issuers of the Underlier Stocks

We, the dealer and our other affiliates regularly provide financial advisory, investment advisory and transactional services to a substantial and diversified client

base. You should assume that we or they will, at present or in the future, provide such services or otherwise engage in transactions with, among others, us and the issuers of the underlier stocks, or transact in securities or instruments or with

parties that are directly or indirectly related to these entities. These services could include making loans to or equity investments in those companies, providing financial advisory or other investment banking services, or issuing research reports.

You should expect that we, the dealer and our other affiliates, in providing these services, engaging in such transactions, or acting for our own accounts, may take actions that have direct or indirect effects on the notes or other securities that we

may issue, the underlier stocks or other securities or instruments similar to or linked to the foregoing, and that such actions could be adverse to the interests of investors in the notes. In addition, in connection with these activities, certain

personnel within us, the dealer or our other affiliates may have access to confidential material non-public information about these parties that would not be disclosed to investors of the notes.

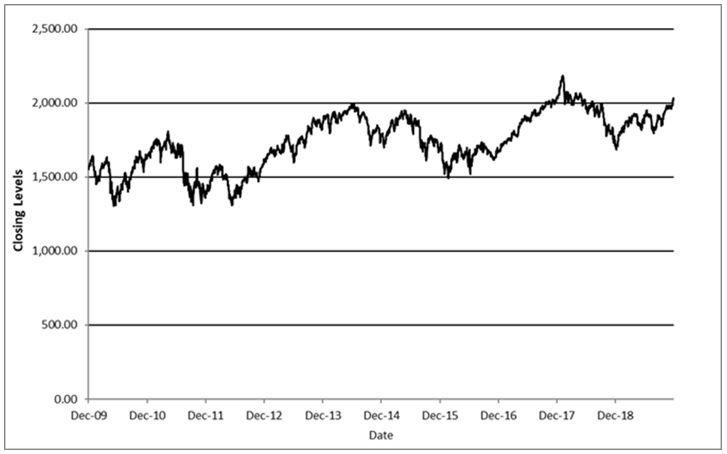

Past Underlier Performance Is No Guide to Future Performance

The actual performance of the underlier over the term of the notes may bear little relation to the historical levels of the underlier. Likewise, the amount payable at maturity may

bear little relationship to the hypothetical return table or chart set forth elsewhere in this pricing supplement. We cannot predict the future performance of the underlier. Trading activities undertaken by market participants, including certain

investors in the notes or their affiliates, including in short positions and derivative positions, may adversely affect the level of the underlier.

As the Calculation Agent, RBCCM Will Have the Authority to Make Determinations that Could Affect the Amount You Receive, if Any, at Maturity

As the calculation agent for the notes, RBCCM will have discretion in making various determinations that affect the notes, including determining the final underlier

level, which will be used to determine the cash settlement amount at maturity, and determining whether to postpone the determination date because of a market disruption event or because that day is not a trading day. The calculation agent also has

discretion in making certain adjustments relating to a discontinuation or modification of the underlier, as described under “General Terms of the Notes—Unavailability of the Level of the Underlier” on page PS-6 of the accompanying product prospectus

supplement PB-1. The exercise of this discretion by RBCCM, which is our wholly owned subsidiary, could adversely affect the value of the notes and may create a conflict of interest between you and RBCCM. For a description of market disruption events

as well as the consequences of the market disruption events, see the section entitled “General Terms of the Notes—Market Disruption Events” beginning on page PS-7 of the accompanying product prospectus supplement PB-1. We may change the calculation

agent at any time without notice, and RBCCM may resign as calculation agent at any time.

The Policies of the Underlier Sponsor and Changes that Affect the Underlier or the Underlier Stocks Could Affect the Amount Payable on the Notes, if Any, and Their

Market Value

The policies of the underlier sponsor concerning the calculation of the levels of the underlier, additions, deletions or substitutions of the underlier stocks and

the manner in which changes affecting such underlier stocks or their issuers, such as stock dividends, reorganizations or mergers, are reflected in the level of the underlier, could affect the levels of the underlier and, therefore, the amount

payable on the notes, if any, at maturity and the market value of the notes prior to maturity. The amount payable on the notes, if any, and their market value could also be affected if the underlier sponsor changes these policies, for example, by

changing the manner in which it calculates the level of the underlier, or if the underlier sponsor discontinues or suspends calculation or publication of the level of the underlier, in which case it may become difficult to determine the market value

of the notes. If events such as these occur, the calculation agent will determine the amount payable, if any, at maturity as described herein.

The Calculation Agent Can Postpone the Determination of the Final Underlier Level if a Market Disruption Event Occurs or Is Continuing

The determination of the final underlier level may be postponed if the calculation agent determines that a market disruption event has occurred or is continuing on

the determination date with respect to the underlier. If such a postponement occurs, the calculation agent will use the closing level of the underlier on the first subsequent trading day on which no market disruption event occurs or is continuing,

subject to the limitations set forth in the accompanying product prospectus supplement PB-1. If a market disruption event occurs or is continuing on a determination date, the stated maturity date for the notes could also be postponed.

If the determination of the level of the underlier for any determination date is postponed to the last possible day, but a market disruption event occurs or is

continuing on that day, that day will nevertheless be the date on which the level of the underlier will be determined by the calculation agent. In such an event, the calculation agent will make a good faith estimate in its sole discretion of the

level that would have prevailed in the absence of the market disruption event. See “General Terms of the Notes—Market Disruption Events” in the accompanying product prospectus supplement PB-1.

There Is No Affiliation Between Any Underlier Stock Issuers or the Underlier Sponsor and Us or the Dealer, and Neither We Nor the Dealer Is Responsible for Any

Disclosure by Any of the Underlier Stock Issuers or the Underlier Sponsor

We are not affiliated with the issuers of the underlier stocks or with the underlier sponsor. As discussed herein, however, we, the dealer, and our other affiliates

may currently, or from time to time in the future, engage in business with the issuers of the underlier stocks. Nevertheless, none of us, the dealer, or our respective affiliates assumes any responsibility for the accuracy or the completeness of any

information about the underlier or any of the underlier stocks. You, as an investor in the notes, should make your own investigation into the underlier and the underlier stocks. See the section below entitled “The Underlier” for additional

information about the underlier.

Neither the underlier sponsor nor any issuers of the underlier stocks are involved in this offering of the notes in any way, and none of them have any obligation of

any sort with respect to the notes. Thus, neither the underlier sponsor nor any of the issuers of the underlier stocks have any obligation to take your interests into consideration for any reason, including in taking any corporate actions that might

affect the value of the notes.

You Must Rely on Your Own Evaluation of the Merits of an Investment Linked to the Underlier

In the ordinary course of business, we, the dealer, our other affiliates and any additional dealers, including in acting as a research provider, investment advisor,

market maker, principal investor or distributor, may express research or investment views on expected movements in the underlier or the underlier stocks, and may do so in the future. These views or reports may be communicated to our clients, clients

of our affiliates and clients of any additional dealers, and may be inconsistent with, or adverse to, the objectives of investors in the notes. However, these views are subject to change from time to time. Moreover, other professionals who transact

business in markets relating to the underlier or the underlier stocks may at any time have significantly different views from those of these entities. For these reasons, you are encouraged to derive information concerning the underlier or the

underlier stocks from multiple sources, and you should not rely solely on views expressed by us, the dealer, our other affiliates, or any additional dealers.

We May Sell an Additional Aggregate Amount of the Notes at a Different Original Issue Price

At our sole option, we may decide to sell an additional aggregate amount of the notes subsequent to the trade date. The price of the notes in the subsequent sale may differ

substantially (higher or lower) from the principal amount.

If the Original Issue Price for Your Notes Represents a Premium to the Principal Amount, the Return on Your Notes Will Be Lower Than the Return on Notes for Which

the Original Issue Price Is Equal to the Principal Amount or Represents a Discount to the Principal Amount

The cash settlement amount will not be adjusted based on the original issue price. If the original issue price for your notes differs from the principal amount, the

return on your notes held to maturity will differ from, and may be substantially less than, the return on notes for which the original issue price is equal to the principal amount. If the original issue price for your notes represents a premium to

the principal amount and you hold them to maturity, the return on your notes will be lower than the return on notes for which the original issue price is equal to the principal amount or represents a discount to the principal amount.

In addition, the impact of the buffer level and the cap level on the return on your investment will depend upon the price you pay for your notes relative to the

principal amount. For example, if you purchase your notes at a premium to the principal amount, the cap level will only permit a lower percentage increase in your investment in the notes than would have been the case for notes purchased at the

principal amount or a discount to the principal amount. Similarly, the buffer level, while still providing some protection for the return on the notes, will allow a greater percentage decrease in your investment in the notes than would have been the

case for notes purchased at the principal amount or a discount to the principal amount.

Significant Aspects of the Income Tax Treatment of an Investment in the Notes Are Uncertain

The tax treatment of an investment in the notes is uncertain. We do not plan to request a ruling from the Internal Revenue Service or the Canada Revenue Agency

regarding the tax treatment of an investment in the notes, and the Internal Revenue Service, the Canada Revenue Agency or a court may not agree with the tax treatment described in this pricing supplement.

The Internal Revenue Service has issued a notice indicating that it and the U.S. Treasury Department are actively considering whether, among other issues, a holder

should be required to accrue interest over the term of an instrument such as the notes even though that holder will not receive any payments with respect to the notes until maturity or earlier sale or exchange and whether all or part of the gain a

holder may recognize upon sale, exchange or maturity of an instrument such as the notes could be treated as ordinary income. The outcome of this process is uncertain and could apply on a retroactive basis.

Please read carefully the section entitled “Supplemental Discussion of U.S. Federal Income Tax Consequences” in the accompanying product prospectus supplement PB-1,

the section entitled “Certain Income Tax Consequences” in the accompanying prospectus supplement and the section entitled “Tax Consequences” in the accompanying prospectus. You should consult your tax advisor about your own tax situation.

Non-U.S. Investors May Be Subject to Certain Additional Risks

The notes will be denominated in U.S. dollars. If you are a non-U.S. investor who purchases the notes with a currency other than U.S. dollars, changes in rates of

exchange may have an adverse effect on the value, price or returns of your investment.

This pricing supplement contains a general description of certain U.S. tax considerations relating to the notes. If you are a non-U.S. investor, you should consult

your tax advisors as to the consequences, under the tax laws of the country where you are resident for tax purposes, of acquiring, holding and disposing of the notes and receiving the payments that might be due under the notes.

For a discussion of certain Canadian federal income tax consequences of investing in the notes, please see the section entitled “Tax Consequences — Canadian

Taxation” in the accompanying prospectus. If you are not a Non-resident Holder (as that term is defined in “Tax Consequences — Canadian Taxation” in the accompanying prospectus) or if you acquire the notes in the secondary market, you should consult

your tax advisor as to the consequences of acquiring, holding and disposing of the notes and receiving the payments that might be due under the notes.

Certain Considerations for Insurance Companies and Employee Benefit Plans

Any insurance company or fiduciary of a pension plan or other employee benefit plan that is subject to the prohibited transaction rules of the Employee Retirement Income Security

Act of 1974, as amended (“ERISA”), or the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), including an IRA or a Keogh plan (or a governmental plan to which similar prohibitions apply), and that is considering purchasing the

notes with the assets of the insurance company or the assets of such a plan, should consult with its counsel regarding whether the purchase or holding of the notes could become a “prohibited transaction” under ERISA, the Internal Revenue Code or any

substantially similar prohibition in light of the representations a purchaser or holder in any of the above categories is deemed to make by purchasing and holding the notes. This is discussed in more detail under “Employee Retirement Income Security

Act” in the accompanying product prospectus supplement PB-1.

THE UNDERLIER

General

The underlier is the MSCI EAFE® Index (Bloomberg ticker “MXEA”). All information contained in this pricing supplement regarding the underlier including, without limitation, its make-up, method

of calculation and changes in its components and its historical closing values, is derived from publicly available information prepared by the underlier sponsor. Such information reflects the policies of, and is subject to change by, the underlier

sponsor. The underlier sponsor owns the copyright and all rights to the underlier. The underlier sponsor is under no obligation to continue to publish, and may discontinue publication of, the underlier. The consequences of the underlier sponsor

discontinuing or modifying the underlier are described in the section entitled “Description of the Notes—Unavailability of the Level of the Underlier” on page PS-6 of the accompanying product prospectus supplement PB-1.

The underlier is calculated and maintained by the underlier sponsor. Neither we nor RBCCM has participated in the preparation of such documents or made any due diligence inquiry with respect to the

underlier or underlier sponsor in connection with the offering of the notes. In connection with the offering of the notes, neither we nor RBCCM makes any representation that such publicly available information regarding the underlier or underlier

sponsor is accurate or complete. Furthermore, we cannot give any assurance that all events occurring prior to the offering of the notes (including events that would affect the accuracy or completeness of the publicly available information described

in this pricing supplement) that would affect the level of the underlier or have been publicly disclosed. Subsequent disclosure of any such events could affect the value received at maturity and therefore the market value of the notes.

We, the dealer or our respective affiliates may presently or from time to time engage in business with one or more of the issuers of the underlier stocks of the underlier without regard to your

interests, including extending loans to or entering into loans with, or making equity investments in, one or more of such issuers or providing advisory services to one or more of such issuers, such as merger and acquisition advisory services. En el

course of business, we, the dealer or our respective affiliates may acquire non-public information about one or more of such issuers and none of us, the dealer or our respective affiliates undertake to disclose any such information to you. En

addition, we, the dealer or our respective affiliates from time to time have published and in the future may publish research reports with respect to such issuers. These research reports may or may not recommend that investors buy or hold the

securities of such issuers. As a prospective purchaser of the notes, you should undertake an independent investigation of the underlier or of the issuers of the underlier stocks to the extent required, in your judgment, to allow you to make an

informed decision with respect to an investment in the notes.

We are not incorporating by reference the website of the underlier sponsor or any material it includes into this pricing supplement. In this pricing supplement, unless the context requires otherwise, references to the

underlier will include any successor underlier to the underlier and references to the underlier sponsor will include any successor thereto.

MSCI EAFE® Index Weighting by Sector as of November 29, 2019*

|

Sector |

Percentage (%) |

|

Financials |

18.35% |

|

Industrials |

15.14% |

|

Health Care |

12.12% |

|

Consumer Discretionary |

11.61% |

|

Consumer Staples |

11.39% |

|

Information Technology |

7.04% |

|

Materiales |

7.02% |

|

Communication Services |

5.27% |

|

Energy |

4.84% |

|

Utilities |

3.66% |

|

Real Estate |

3.55% |

|

Total |

100.00% |

* Percentages may not sum to 100% due to rounding. (Sector designations are determined by the underlier sponsor using criteria it has selected or developed. Index sponsors may use

very different standards for determining sector designations. In addition, many companies operate in a number of sectors, but are listed in only one sector and the basis on which that sector is selected may also differ. As a result, sector

comparisons between indices with different index sponsors may reflect differences in methodology as well as actual differences in the sector composition of the indices.) As of the close of business on September 21, 2018, S&P Dow Jones Indices LLC

and MSCI, Inc. updated the Global Industry Classification Sector structure. Among other things, the update broadened the Telecommunications Services sector and renamed it the Communication Services sector. The renamed sector includes the previously

existing Telecommunication Services Industry group, as well as the Media Industry group, which was moved from the Consumer Discretionary sector and renamed the Media & Entertainment Industry group. The Media & Entertainment Industry group

contains three industries: Media, Entertainment and Interactive Media & Services. The Media industry continues to consist of the Advertising, Broadcasting, Cable & Satellite and Publishing sub-industries. The Entertainment industry contains

the Movies & Entertainment sub-industry (which includes online entertainment streaming companies in addition to companies previously classified in such industry prior to September 21, 2018) and the Interactive Home Entertainment sub-industry

(which includes companies previously classified in the Home Entertainment Software sub-industry prior to September 21, 2018 (when the Home Entertainment Software sub-industry was a sub-industry in the Information Technology sector)), as well as

producers of interactive gaming products, including mobile gaming applications). The Interactive Media & Services industry and sub-industry includes companies engaged in content and information creation or distribution through proprietary

platforms, where revenues are derived primarily through pay-per-click advertisements, and includes search engines, social media and networking platforms, online classifieds and online review companies. The Global Industry Classification Sector

structure changes were implemented in the MSCI EAFE® Index in connection with the November 2018 semi-annual index review.

MSCI EAFE® Index Weighting by Country as of November 29, 2019*

|

País |

Percentage (%) |

|

Japan |

24.82% |

|

United Kingdom |

16.17% |

|

Francia |

11.45% |

|

Suiza |

9.22% |

|

Alemania |

8.78% |

|

Otro |

29.56% |

* Percentages may not sum to 100% due to rounding.

Description of the Underlier

The MSCI EAFE® Index

The underlier is intended to measure equity market performance in developed market countries, excluding the United States and Canada. The underlier is a free float-adjusted market capitalization equity

index with a base date of December 31, 1969 and an initial value of 100. The underlier is calculated daily in U.S. dollars and published in real time every 60 seconds during market trading hours. As of December 12, 2019, the underlier consisted of

companies from the following 21 developed countries: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and

Reino Unido.

The underlier is comprised of companies in both the Large Cap Index and Mid Cap Index, as discussed in the section “—Defining Market Capitalization Size Segments for Each Market” below.

The underlier is part of the MSCI Regional Equity Indices series and is an MSCI Global Investable Market Index, which is a family within the MSCI International Equity Indices.

Constructing the MSCI Global Investable Market Indices. MSCI undertakes an index construction process, which involves:

• defining the equity universe;

• determining the market investable equity universe for each market;

• determining market capitalization size segments for each market;

• applying index continuity rules for the MSCI Standard Index;

• creating style segments within each size segment within each market; y

• classifying securities under the Global Industry Classification Standard (the “GICS”).

Defining the Equity Universe. The equity universe is defined by:

• Identifying Eligible Equity Securities: the equity universe initially looks at securities listed in any of the countries in the MSCI Global

Index Series, which will be classified as either Developed Markets (“DM”) or Emerging Markets (“EM”). All listed equity securities, including Real Estate Investment Trusts and certain income trusts in Canada, are eligible for inclusion in the equity

universo. Conversely, mutual funds, ETFs, equity derivatives, and most investment trusts, are not eligible for inclusion in the equity universe. Preferred shares that exhibit characteristics of equity

securities are eligible in the equity universe. MSCI will analyse preferred shares on a case-by-case basis. The key criterion for preferred shared eligibility is that the share should not have features that make it resemble, and behave like, a fixed

income security.

• Classifying Eligible Securities into the Appropriate Country: each company and its securities (i.e., share classes) are classified in only one

country.

Effective with the November 2015 semi-annual index review, companies traded outside of their country of classification (i.e., “foreign listed companies”) will become eligible for

inclusion in the MSCI Country Investable Market Indexes along with the applicable MSCI Global Index. In order for a MSCI Country Investable Market Index to be eligible to include foreign listed companies, it must meet the Foreign Listing Materiality

Requirement. To meet the Foreign Listing Materiality Requirement, the aggregate market capitalization of all securities represented by foreign listings should represent at least (i) 5% of the free float-adjusted market capitalization of the relevant

MSCI Country Investable Market Index and (ii) 0.05% of the free-float adjusted market capitalization of the MSCI ACWI Investable Market Index.

Determining the Market Investable Equity Universes. A market investable equity universe for a market is derived by identifying eligible listings for each security

in the equity universe, and by applying investability screens to individual companies and securities in the equity universe that are classified in that market. A market is equivalent to a single country, except in DM Europe, where all DM countries in

Europe are aggregated into a single market for index construction purposes. Subsequently, individual DM Europe country indices within the MSCI Europe Index are derived from the constituents of the MSCI Europe Index under the global investable market

indices methodology.

A security may be listed in the country where it is classified (i.e. local listing) and/or in a different country (i.e. “foreign listing”). Securities may be represented by either a

local or foreign listing. A security may be represented by a foreign listing only if:

• The security is classified in a country that meets the Foreign Listing Materiality Requirement, and

• The security’s foreign listing is traded on an eligible stock exchange of: a DM country if the security is classified in a DM country, a DM or an EM country if

the security is classified in an EM country, or a DM or an EM or a FM country if the security is classified in a FM country. Securities in that country may not be represented by a foreign listing in the global investable equity universe if a country

does not meet the requirement.

The investability screens used to determine the investable equity universe in each market are as follows:

• Equity Universe Minimum Size Requirement: this investability screen is applied at the company level. En

order to be included in a market investable equity universe, a company must have the required minimum full market capitalization. The size requirement also applies to companies in all developed and emerging markets.

• Equity Universe Minimum Free Float-Adjusted Market Capitalization Requirement: this investability

screen is applied at the individual security level. To be eligible for inclusion in a market investable equity universe, a security must have a free float-adjusted market capitalization equal to or higher than 50% of the equity universe minimum size

requirement.

• DM and EM Minimum Liquidity Requirement: this investability screen is applied at the individual security level. A

be eligible for inclusion in a market investable equity universe, a security must have adequate liquidity. The twelve-month and three-month Annual Traded Value Ratio (“ATVR”), a measure that screens out extreme daily trading volumes and takes into

account the free float-adjusted market capitalization size of securities, together with the three-month frequency of trading are used to measure liquidity. A minimum liquidity level of 20% of three- and twelve-month ATVR and 90% of three-month

frequency of trading over the last four consecutive quarters are required for inclusion of a security in a market investable equity universe of a DM, and a minimum

liquidity level of 15% of three- and twelve-month ATVR and 80% of three-month frequency of trading over the last four consecutive quarters are required for inclusion of a security in a

market investable equity universe of an EM.

• Global Minimum Foreign Inclusion Factor Requirement: this investability screen is applied at the

individual security level. To be eligible for inclusion in a market investable equity universe, a security’s Foreign Inclusion Factor (“FIF”) must reach a certain threshold. The FIF of a security is defined as the proportion of shares outstanding

that is available for purchase in the public equity markets by international investors. This proportion accounts for the available free float of and/or the foreign ownership limits applicable to a specific security (or company).

In general, a security must have an FIF equal to or larger than 0.15 to be eligible for inclusion in a market investable equity universe.

• Minimum Length of Trading Requirement: this investability screen is applied at the individual security

level. For an initial public offering (“IPO”) to be eligible for inclusion in a market investable equity universe, the new issue must have started trading at least three months before the implementation of a semi-annual index review (as described

below). This requirement is applicable to small new issues in all markets. Large IPOs are not subject to the minimum length of trading requirement and may be included in a market investable equity universe and the Standard Index outside of a

Quarterly or Semi-Annual Index Review.

• Minimum Foreign Room Requirement: this investability screen is applied at the

individual security level. For a security that is subject to a foreign ownership limit to be eligible for inclusion in a market investable equity universe, the proportion of shares still available to foreign investors relative to the maximum allowed

(referred to as “foreign room”) must be at least 15%.

Defining Market Capitalization Size Segments for Each Market. Once a market investable equity universe is defined, it is segmented into the following size-based

indices:

• Investable Market Index (Large + Mid + Small);