Entra en Wall Street con StreetInsider Premium. Reclama tu prueba gratuita de 1 semana aquí.

|

La información en este preliminar SUJETO A TERMINACIÓN, FECHA ENERO |

| Citigroup Global Markets Holdings Inc. |

Enero 2020 Senior a medio plazo Suplemento de precios Archivado de acuerdo con Declaración de registro |

Cupón contingente autocallable vinculado a la equidad

Valores vinculados al peor desempeño de Anheuser-Busch InBev SA / NV y Constellation Brands, Inc. con vencimiento el 2 de febrero de 2021

| ▪ | Los valores ofrecidos por este suplemento de precios son títulos de deuda no garantizados emitidos por Citigroup Global Markets Holdings Inc. y garantizados por Citigroup Inc. La oferta de valores la posibilidad de pagos periódicos de cupones contingentes a una tasa anualizada que, si se pagan todos, produciría un rendimiento que generalmente es más alto que el rendimiento de nuestros títulos de deuda convencionales del mismo vencimiento. A cambio de este mayor potencial rendimiento, debe estar dispuesto a aceptar los riesgos de que (i) su rendimiento real sea inferior al rendimiento de nuestra deuda convencional valores del mismo vencimiento porque no puede recibir uno o más pagos de cupones contingentes, o ninguno, (ii) el valor de lo que recibe al vencimiento puede ser significativamente menor que el monto principal declarado de sus valores, y puede ser cero, y (iii) los valores pueden ser llamados automáticamente para su redención antes de su vencimiento a partir de la primera fecha potencial de llamada automática especificado a continuación. Cada uno de estos riesgos dependerá únicamente del desempeño del peor desempeño de los subyacentes especificados abajo. |

| ▪ | Estará sujeto a los riesgos asociados con cada de los subyacentes y se verán afectados negativamente por movimientos adversos en cualquiera de los subyacentes. Aunque tú tendrá una exposición negativa al subyacente de peor desempeño, no recibirá dividendos con respecto a ningún subyacente o participar en cualquier apreciación de cualquier subyacente. |

| ▪ | Los inversores en los valores deben estar dispuestos a aceptar (i) una inversión que puede tener una liquidez limitada o nula y (ii) el riesgo de no recibir ningún pago adeudado por los valores si nosotros y Citigroup Inc. no cumplimos con nuestras obligaciones. Todos los pagos de los valores están sujetos al riesgo de crédito de Citigroup Global Markets Holdings Inc. y Citigroup Inc. |

| TÉRMINOS CLAVE | |

| Editor: | Citigroup Global Markets Holdings Inc., una subsidiaria de propiedad total de Citigroup Inc. |

| Garantizar: | Todos los pagos adeudados de los valores están garantizados total e incondicionalmente por Citigroup Inc. |

| Subyacentes | Subyacente | Valor subyacente inicial* * | Valor de barrera del cupón** ** | Valor final de barrera** ** | Ratio de equidad*** |

| Anheuser-Busch InBev SA / NV | PS | PS | PS | ||

| Constellation Brands, Inc. | PS | PS | PS |

|

* *Para cada subyacente, su valor de cierre en el precio ** **Para cada subyacente, 77.00% de su inicial ***Para cada subyacente, el monto principal indicado |

|||

| Importe principal declarado: | $ 1,000 por seguridad | ||

| Fecha de fijación de precios: | 28 de enero de 2020 | ||

| Fecha de asunto: | 31 de enero de 2020 | ||

| Fechas de valoración: | 28 de abril de 2020, 28 de julio de 2020, 28 de octubre de 2020 y 28 de enero de 2021 (la "fecha de valoración final"), cada uno sujeto a aplazamiento si dicha fecha no es un día de negociación programado o ocurren ciertos eventos de interrupción del mercado | ||

| Fecha de vencimiento: | A menos que sea redimido anteriormente, 2 de febrero de 2021 | ||

| Fechas de pago de cupones contingentes: | El quinto día hábil después de cada fecha de valoración, excepto que la fecha de pago del cupón contingente posterior a la fecha de valoración final será la fecha de vencimiento | ||

| Cupón contingente: | En cada fecha de pago de cupón contingente, a menos que se canjee previamente, los valores pagarán un cupón contingente igual a 2.25% a 2.375% del monto principal declarado de los valores (equivalente a una tasa de cupón contingente de 9.00% a 9.50% por año) ( se determinará en la fecha de fijación de precios) si y solo si el valor de cierre del subyacente de peor desempeño en la fecha de valuación inmediatamente anterior es mayor o igual a su valor de barrera de cupón. Si el valor de cierre del subyacente de peor desempeño en cualquier fecha de valoración es menor que su valor de barrera de cupón, no recibirá ningún pago de cupón contingente en la fecha de pago de cupón contingente inmediatamente siguiente. Si el valor de cierre del subyacente de peor desempeño en una o más fechas de valuación es menor que su valor de barrera de cupón y, en una fecha de valuación posterior, el valor de cierre del subyacente de peor desempeño en esa fecha de valuación posterior es mayor o igual a su valor de la barrera del cupón, su pago de cupón contingente para esa fecha de valoración posterior incluirá todos los pagos de cupones contingentes no pagados previamente (sin intereses sobre montos no pagados anteriormente). Sin embargo, si el valor de cierre del subyacente de peor desempeño en una fecha de valuación es menor que el valor de la barrera del cupón y el valor de cierre del subyacente de peor desempeño en cada fecha de valuación subsecuente hasta la fecha de valuación final, incluida esta, es menor que la barrera del cupón valor, no recibirá los pagos de cupones contingentes impagos con respecto a esas fechas de valoración. | ||

| Pago al vencimiento: |

Si los valores no se rescatan automáticamente antes del vencimiento, § Si § Si un número fijo de acciones subyacentes de peor desempeño Si los valores no se rescatan automáticamente antes del vencimiento |

||

| Listado: | Los valores no se incluirán en ninguna bolsa de valores. | ||

| Asegurador: | Citigroup Global Markets Inc. ("CGMI"), una filial del emisor, que actúa como principal | ||

| Tarifa de suscripción y precio de emisión: | Precio de emisión(1) | Tarifa de suscripción(2) | Ingresos al emisor |

| Por seguridad: | $ 1,000.00 | $ 10.00 | $ 990.00 |

| Total: | PS | PS | PS |

(Los términos clave continúan en la página siguiente)

(1) Citigroup Global Markets Holdings Inc. actualmente espera que

el valor estimado de los valores en la fecha de fijación de precios será de al menos $ 926.50 por valor, que será menor que la emisión

precio. El valor estimado de los valores se basa en los modelos de precios patentados de CGMI y nuestra tasa de financiación interna.

No es una indicación de ganancias reales para CGMI u otros de nuestros afiliados, ni es una indicación del precio, si lo hay, al cual

CGMI o cualquier otra persona pueden estar dispuestos a comprarle los valores en cualquier momento después de la emisión. Ver "Valoración de la

Valores "en este suplemento de precios.

(2) Para obtener más información sobre la distribución de los valores,

consulte "Plan de distribución suplementario" en este suplemento de precios. Además de la tarifa de suscripción, CGMI y

sus afiliados pueden beneficiarse de la actividad de cobertura esperada relacionada con esta oferta, incluso si el valor de los valores disminuye.

Consulte "Uso de los ingresos y la cobertura" en el folleto adjunto.

Invertir en los valores

implica riesgos no asociados con una inversión en valores de deuda convencionales. Ver "Resumen de factores de riesgo" al comienzo

en la página PS-5.

Ni la Comisión de Bolsa y Valores

ni ninguna comisión estatal de valores ha aprobado o desaprobado los valores o determinado que este suplemento de precios y

El suplemento del producto adjunto, el prospecto y el prospecto son veraces o completos. Cualquier representación a la

lo contrario es un delito penal.

Deberías leer este suplemento de precios

junto con el suplemento del producto que lo acompaña, el prospecto y el prospecto, a los que se puede acceder a través de los hipervínculos

abajo:

Producto

Suplemento No. EA-04-08 del 15 de febrero de 2019 Folleto

Suplemento y Folleto cada uno con fecha 14 de mayo de 2018

Los valores no son depósitos bancarios y

no están asegurados ni garantizados por la Federal Deposit Insurance Corporation ni por ninguna otra agencia gubernamental, ni son obligaciones

de, o garantizado por, un banco.

| Citigroup Global Markets Holdings Inc. |

| TÉRMINOS CLAVE (continuación) | |

| Canje anticipado automático: | Si, en cualquier fecha potencial de llamada automática, el valor de cierre del subyacente de peor desempeño en esa fecha potencial de llamada automática es mayor o igual a su valor subyacente inicial, cada valor que posea se invocará automáticamente en esa fecha potencial de llamada automática para el canje en el inmediatamente después de la fecha de pago del cupón contingente por un monto en efectivo igual a $ 1,000.00 más el pago de cupón contingente relacionado. La función de canje anticipado automático puede limitar significativamente su rendimiento potencial de los valores. Si el subyacente de peor desempeño se desempeña de una manera que de otro modo sería favorable, es probable que los valores se soliciten automáticamente para su reembolso antes del vencimiento, lo que acorta su oportunidad de recibir pagos de cupones contingentes. Los valores pueden solicitarse automáticamente para su redención tan pronto como la primera fecha potencial de llamada automática especificada a continuación. |

| Posibles fechas de llamada automática: | Las fechas de valoración programadas para el 28 de abril de 2020, el 28 de julio de 2020 y el 28 de octubre de 2020 |

| Valor subyacente final: | Para cada subyacente, su valor de cierre en la fecha de valoración final |

| Peor desempeño subyacente: | Para cualquier fecha de valoración, el subyacente con el rendimiento subyacente más bajo determinado a partir de esa fecha de valoración |

| Retorno subyacente: | Para cada subyacente en cualquier fecha de valoración, (i) su valor de cierre en esa fecha de valoración menos su valor subyacente inicial, dividido por (ii) su valor subyacente inicial |

| CUSIP / ISIN: | 17324XVL1 / US17324XVL18 |

Información Adicional

General. Los términos de los valores se establecen en

el suplemento del producto que lo acompaña, el prospecto y el prospecto, complementados por este suplemento de precios. El acompañante

el suplemento del producto, el prospecto y el prospecto contienen divulgaciones importantes que no se repiten en este suplemento de precios.

Por ejemplo, el suplemento del producto que lo acompaña contiene información importante sobre cómo el valor de cierre de cada subyacente

será determinado y sobre los ajustes que se pueden hacer a los términos de los valores en caso de interrupción del mercado

eventos y otros eventos especificados con respecto a cada subyacente. Es importante que lea el suplemento del producto que lo acompaña,

suplemento de prospecto y prospecto junto con este suplemento de precios para decidir si invertir en los valores. Cierto

los términos utilizados pero no definidos en este suplemento de precios se definen en el suplemento del producto adjunto.

Valor de cierre. El "valor de cierre" de cada

subyacente en cualquier fecha es el precio de cierre de sus acciones subyacentes en dicha fecha, según lo dispuesto en el suplemento del producto adjunto.

Las "acciones subyacentes" de los subyacentes corresponden a Constellation Brands, Inc., sus acciones de Clase A comunes.

acciones y con respecto a Anheuser-Busch InBev SA / NV American Depositary Shares ("ADS") que representan sus acciones ordinarias.

Consulte el suplemento del producto adjunto para obtener más información.

| Citigroup Global Markets Holdings Inc. |

Ejemplos hipotéticos

Los ejemplos en la primera sección a continuación ilustran cómo determinar

si se pagará un cupón contingente (y si se pagará cualquier pago de cupón contingente no pagado previamente) y si

los valores se solicitarán automáticamente para su redención después de una fecha de valoración que también es una posible fecha de llamada automática. los

Los ejemplos en la segunda sección a continuación ilustran cómo determinar el pago al vencimiento de los valores, asumiendo los valores

no se canjean automáticamente antes del vencimiento. Los ejemplos son únicamente para fines ilustrativos, no muestran todos los resultados posibles

y no son una predicción de ningún pago que se pueda hacer por los valores.

Los siguientes ejemplos se basan en los siguientes valores hipotéticos.

y no reflejan los valores subyacentes iniciales reales, los valores de barrera del cupón, los valores de barrera finales o las proporciones de capital de los subyacentes.

Para conocer el valor subyacente inicial real, el valor de barrera del cupón, el valor de barrera final y la relación de capital de cada subyacente, consulte el

portada de este suplemento de precios. Hemos utilizado estos valores hipotéticos, en lugar de los valores reales, para simplificar los cálculos.

y ayuda a comprender cómo funcionan los valores. Sin embargo, debe comprender que los pagos reales de los valores

se calculará en función del valor subyacente inicial real, el valor de barrera del cupón, el valor de barrera final y la relación de capital de cada

subyacente, y no los valores hipotéticos indicados a continuación. Para facilitar el análisis, las cifras a continuación se han redondeado. Los ejemplos

a continuación, suponga que la tasa de cupón contingente se establece en el valor más bajo indicado en la portada de este suplemento de precios.

La tasa de cupón contingente real se determinará en la fecha de fijación de precios.

| Subyacente | Valor subyacente hipotético inicial | Valor de barrera de cupón hipotético | Valor hipotético de barrera final | Ratio de equidad hipotética |

| Anheuser-Busch InBev SA / NV | $ 100.00 | $ 77.00 (77.00% de su hipotético valor subyacente inicial) | $ 77.00 (77.00% de su hipotético valor subyacente inicial) | 10.00000 |

| Constellation Brands, Inc. | $ 100.00 | $ 77.00 (77.00% de su hipotético valor subyacente inicial) | $ 77.00 (77.00% de su hipotético valor subyacente inicial) | 10.00000 |

Ejemplos hipotéticos de cupones contingentes

Pagos y cualquier pago al canje anticipado automático después de una fecha de valoración que también es una posible fecha de llamada automática

Los tres ejemplos hipotéticos a continuación ilustran cómo determinar

si se pagará un cupón contingente y si los valores se canjearán automáticamente después de una valoración hipotética

fecha que también es una posible fecha de llamada automática, suponiendo que los valores de cierre de los subyacentes en la valoración hipotética

La fecha es como se indica a continuación.

| Valor de cierre hipotético de Anheuser-Busch InBev SA / NV en la fecha de valoración hipotética | Valor de cierre hipotético de Constellation Brands, Inc. en la fecha de valoración hipotética | Pago hipotético por valor de $ 1,000.00 en la fecha de pago del cupón contingente relacionado | |

| Ejemplo 1 Fecha de valoración hipotética n. ° 1 |

$ 120 (retorno subyacente = ($ 120 – $ 100) / $ 100 = 20%) |

$ 85 (retorno subyacente = ($ 85 – $ 100) / $ 100 = -15%) |

$ 22.50 (se paga el cupón contingente; los valores no se canjean) |

| Ejemplo 2 Fecha de valoración hipotética # 2 |

$ 45 (retorno subyacente = ($ 45 – $ 100) / $ 100 = -55%) |

$ 120 (retorno subyacente = ($ 120 – $ 100) / $ 100 = 20%) |

$ 0.00 (sin cupón contingente; valores no redimidos) |

| Ejemplo 3 Fecha de valoración hipotética # 3 |

$ 110 (retorno subyacente = ($ 110 – $ 100) / $ 100 = 10%) |

$ 115 (retorno subyacente = ($ 115 – $ 100) / $ 100 = 15%) |

$ 1,045.00 (cupón contingente más se paga el cupón contingente no pagado anteriormente; valores rescatados) |

Ejemplo 1: En hipotética

fecha de valoración # 1, Constellation Brands, Inc. tiene el rendimiento subyacente más bajo y, por lo tanto, es el subyacente de peor desempeño

en la fecha de valoración hipotética. En este escenario, el valor de cierre del peor desempeño subyacente en lo hipotético

La fecha de valoración es mayor que su valor de barrera de cupón pero menor que su valor subyacente inicial. Como resultado, los inversores en el

los valores recibirían el pago del cupón contingente en la fecha de pago del cupón contingente relacionado y los valores no

ser redimido automáticamente.

Ejemplo 2 En hipotética

fecha de valoración # 2, Anheuser-Busch InBev SA / NV tiene el rendimiento subyacente más bajo y, por lo tanto, es el subyacente de peor desempeño

en la fecha de valoración hipotética. En este escenario, el valor de cierre del peor desempeño subyacente en lo hipotético

La fecha de valoración es inferior a su valor de barrera de cupón. Como resultado, los inversores no recibirían ningún pago sobre el contingente relacionado

fecha de pago del cupón y los valores no se canjearán automáticamente.

Los inversores en los valores no recibirán un contingente

cupón en la fecha de pago de cupón contingente después de una fecha de valoración si el valor de cierre del subyacente de peor desempeño

en esa fecha de valoración es menor que su valor de barrera de cupón. Si un cupón contingente se paga después de una fecha de valoración depende

únicamente en el valor de cierre del subyacente de peor desempeño en esa fecha de valuación.

Ejemplo 3 En hipotética

fecha de valoración # 3, Anheuser-Busch InBev SA / NV tiene el rendimiento subyacente más bajo y, por lo tanto, es el subyacente de peor desempeño

en la fecha de valoración hipotética. En este escenario, el valor de cierre del peor desempeño subyacente en lo hipotético

La fecha de valoración es mayor que su valor de barrera de cupón y su valor subyacente inicial. Como resultado, los valores serían

se canjeará automáticamente en la fecha de pago del cupón contingente relacionado por un monto en efectivo igual a $ 1,000.00 más el

pago de cupón contingente relacionado más cualquier pago de cupón contingente no pagado previamente. Porque no hay pago de cupón contingente

se recibió en relación con la fecha de valoración hipotética n. ° 2, los inversores en los valores también recibirían los impagos anteriores

pago de cupón contingente en la fecha de pago de cupón contingente relacionado.

Si la fecha de valoración hipotética no fuera también un potencial

fecha de llamada automática, los valores no se canjearán automáticamente en la fecha de pago del cupón contingente relacionado.

| Citigroup Global Markets Holdings Inc. |

Ejemplos hipotéticos del pago en

Vencimiento de los valores

Los siguientes tres ejemplos hipotéticos ilustran el cálculo.

del pago al vencimiento de los valores, suponiendo que los valores no se hayan redimido automáticamente antes y que

Los valores subyacentes finales de los subyacentes son los que se indican a continuación.

| Valor subyacente hipotético final de Anheuser-Busch InBev SA / NV | Valor subyacente hipotético final de Constellation Brands, Inc. | Pago hipotético al vencimiento por seguridad de $ 1,000.00 | |

| Ejemplo 4 | $ 110 (retorno subyacente = ($ 110 – $ 100) / $ 100 = 10%) |

$ 120 (retorno subyacente = ($ 120 – $ 100) / $ 100 = 20%) |

$ 1,022.50 más cualquier pago de cupón contingente no pagado previamente |

| Ejemplo 5 | $ 110 (retorno subyacente = ($ 110 – $ 100) / $ 100 = 10%) |

$ 30 (retorno subyacente = ($ 30 – $ 100) / $ 100 = -70%) |

Una cantidad de acciones subyacentes del peor desempeño subyacente en la fecha de valoración final (o, a nuestro exclusivo criterio, efectivo) por un valor de $ 300.00 basado en su valor subyacente final |

| Ejemplo 6 | $ 0 (retorno subyacente = ($ 0 – $ 100) / $ 100 = -100%) |

$ 45 (retorno subyacente = ($ 45 – $ 100) / $ 100 = -55%) |

Un número de acciones subyacentes del peor desempeño subyacente en la fecha de valoración final (o, a nuestro exclusivo criterio, efectivo) por un valor de $ 0.00 basado en su valor subyacente final |

Ejemplo 4 Sobre el

fecha de valoración final, Anheuser-Busch InBev SA / NV tiene el rendimiento subyacente más bajo y, por lo tanto, es el subyacente de peor desempeño

en la fecha de valoración final. En este escenario, el valor subyacente final del peor desempeño subyacente en la valoración final

La fecha es mayor que su valor de barrera final. En consecuencia, al vencimiento, recibiría el monto principal declarado de los valores

más el pago del cupón contingente adeudado al vencimiento (suponiendo que no haya pagos de cupones contingentes no pagados anteriormente), pero usted lo haría

No participar en la apreciación de ninguno de los subyacentes.

Ejemplo 5: Sobre el

fecha de valoración final, Constellation Brands, Inc. tiene el rendimiento subyacente más bajo y, por lo tanto, es el subyacente de peor desempeño

en la fecha de valoración final. En este escenario, el valor subyacente final del peor desempeño subyacente en la valoración final

la fecha es menor que su valor de barrera final. En consecuencia, al vencimiento, recibiría por cada valor que luego tenga un valor fijo

cantidad de acciones subyacentes del peor desempeño subyacente en la fecha de valoración final igual a su índice de capital (o, en nuestro

opción, el valor en efectivo de los mismos).

En este escenario, el valor de varias acciones subyacentes

del subyacente de peor desempeño en la fecha de valoración final igual a su índice de capital, basado en su valor subyacente final,

Sería $ 300.00. Por lo tanto, el valor de las acciones subyacentes del peor desempeño subyacente en la fecha de valoración final

(o, a nuestro criterio, efectivo) que reciba al vencimiento sería significativamente menor que el monto principal declarado de sus valores.

Usted incurriría en una pérdida basada en el desempeño del subyacente de peor desempeño en la fecha de valoración final. Además, porque

el valor subyacente final del subyacente de peor desempeño en la fecha de valoración final está por debajo de su valor de barrera de cupón, usted

no recibiría ningún pago de cupón contingente (incluidos los pagos de cupón contingente no pagados anteriormente) al vencimiento.

Si el valor subyacente final del subyacente de peor desempeño

en la fecha de valoración final es menor que su valor de barrera final, tendremos la opción de entregarlo en la fecha de vencimiento

ya sea una cantidad de acciones subyacentes del peor desempeño subyacente en la fecha de valoración final igual a su índice de capital o

el valor en efectivo de esas acciones subyacentes en función de su valor subyacente final. El valor de esas acciones subyacentes al vencimiento

La fecha puede ser diferente a su valor subyacente final.

Ejemplo 6 Sobre el

fecha de valoración final, Anheuser-Busch InBev SA / NV tiene el rendimiento subyacente más bajo y, por lo tanto, es el subyacente de peor desempeño

en la fecha de valoración final. En este escenario, las acciones subyacentes del peor desempeño subyacente en la valoración final

la fecha no tiene valor y usted perdería toda su inversión en los valores al vencimiento. Además, porque el subyacente final

el valor del subyacente de peor desempeño en la fecha de valoración final está por debajo de su valor de barrera de cupón, no recibirá ningún

pago de cupón contingente al vencimiento.

Es posible que el valor de cierre del peor desempeño

subyacente será menor que su valor de barrera de cupón en cada fecha de valoración y menor que su valor de barrera final en la fecha final

fecha de valoración, de modo que no recibirá ningún pago de cupón contingente durante el plazo de los valores (incluidos los anteriores

pagos de cupones contingentes impagos) y recibirán una cantidad significativamente menor que el monto principal establecido de sus valores, y

posiblemente nada, en la madurez.

| Citigroup Global Markets Holdings Inc. |

Factores de riesgo resumidos

Una inversión en valores es significativamente más riesgosa que

Una inversión en títulos de deuda convencionales. Los valores están sujetos a todos los riesgos asociados con una inversión en

nuestros títulos de deuda convencionales (garantizados por Citigroup Inc.), incluido el riesgo de que nosotros y Citigroup Inc. podamos incumplir nuestro

obligaciones bajo los valores, y también están sujetos a riesgos asociados con cada subyacente. En consecuencia, los valores son

adecuado solo para inversores que sean capaces de comprender las complejidades y los riesgos de los valores. Debes consultar a tu

Asesores financieros, fiscales y legales propios sobre los riesgos de una inversión en los valores y la idoneidad de los valores.

a la luz de tus circunstancias particulares.

El siguiente es un resumen de ciertos factores de riesgo clave para los inversores.

en los valores. Debe leer este resumen junto con la descripción más detallada de los riesgos relacionados con una inversión.

en los valores contenidos en la sección "Factores de riesgo relacionados con los valores" que comienzan en la página EA-7 en el

suplemento de producto acompañante. También debe leer detenidamente los factores de riesgo incluidos en el suplemento del folleto adjunto.

y en los documentos incorporados por referencia en el folleto adjunto, incluido el Informe anual más reciente de Citigroup Inc.

Informe en el Formulario 10-K y cualquier Informe trimestral posterior en el Formulario 10-Q, que describe los riesgos relacionados con el negocio de Citigroup

Inc. más generalmente.

Citigroup Inc. publicará ganancias trimestrales el 14 de enero de

2020, que es durante el período de comercialización y antes de la fecha de fijación de precios de estos valores.

| § | Puede perder una parte importante o toda su inversión. A diferencia de los títulos de deuda convencionales, los títulos hacen no prever el reembolso del monto principal declarado al vencimiento en todas las circunstancias. Si los valores no son automáticamente canjeado antes del vencimiento, su pago al vencimiento dependerá del valor subyacente final del subyacente de peor desempeño en la fecha de valoración final. Si el valor subyacente final del subyacente de peor desempeño en la fecha de valoración final es menor que su valor de barrera final, no recibirá el monto principal declarado de sus valores al vencimiento y, en su lugar, recibirá recibir acciones subyacentes del peor rendimiento subyacente en la fecha de valoración final (o, a nuestro exclusivo criterio, en efectivo en su valor subyacente final) que se espera que tenga un valor significativamente menor que el monto principal declarado y posiblemente nada. Allí no existe un pago mínimo al vencimiento de los valores, y puede perder toda su inversión. |

Podemos elegir, a nuestro exclusivo criterio, pagarle en efectivo

al vencimiento en lugar de entregar cualquier acción subyacente. Si optamos por pagarle en efectivo al vencimiento en lugar de entregar cualquier subyacente

acciones, la cantidad de ese efectivo puede ser menor que el valor de mercado de las acciones subyacentes en la fecha de vencimiento porque el mercado

Es probable que el valor fluctúe entre la fecha de valoración final y la fecha de vencimiento. Por el contrario, si no ejercitamos nuestro efectivo

derecho de elección y, en su lugar, entregarle acciones subyacentes en la fecha de vencimiento, el valor de mercado de dichas acciones subyacentes puede

ser menor que el monto en efectivo que hubiera recibido si hubiéramos ejercido nuestro derecho de elección de efectivo. No tendremos ninguna obligación de

tenga en cuenta sus intereses al decidir si ejercer nuestro derecho de elección de efectivo.

| § | No recibirá ningún cupón contingente en la fecha de pago del cupón contingente posterior a la fecha de valoración en la que El valor de cierre del peor desempeño subyacente en esa fecha de valoración es menor que su valor de barrera de cupón. Un contingente el pago del cupón se realizará en una fecha de pago de cupón contingente si y solo si el valor de cierre del subyacente de peor desempeño en la fecha de valoración inmediatamente anterior es mayor o igual a su valor de barrera de cupón. Si el valor de cierre de lo peor el rendimiento subyacente en cualquier fecha de valoración es inferior a su valor de barrera de cupón, no recibirá ningún pago de cupón contingente en la fecha de pago del cupón contingente inmediatamente siguiente. Solo recibirá un pago de cupón contingente que no ha sido pagado en una fecha de pago de cupón contingente subsiguiente si y solo si el valor de cierre del subyacente de peor desempeño en el la fecha de valuación relacionada es mayor o igual a su valor de barrera de cupón. Si el valor de cierre del subyacente de peor desempeño en cada fecha de valoración está por debajo de su valor de barrera de cupón, no recibirá ningún pago de cupón contingente durante el plazo de los valores |

| § | Mayores tasas de cupones contingentes están asociadas con un mayor riesgo. Los valores ofrecen pagos de cupones contingentes en una tasa anualizada que, si todos se pagan, produciría un rendimiento que generalmente es más alto que el rendimiento de nuestra deuda convencional valores del mismo vencimiento. Este mayor rendimiento potencial se asocia con mayores niveles de riesgo esperado a partir de la fijación de precios. fecha para los valores, incluido el riesgo de que no pueda recibir un pago de cupón contingente en uno o más, o en ninguno, contingente fechas de pago de cupones y el riesgo de que el valor de lo que recibe al vencimiento pueda ser significativamente menor que el principal declarado cantidad de sus valores y puede ser cero. La volatilidad y la correlación entre los valores de cierre de los subyacentes son Factores importantes que afectan estos riesgos. Mayor volatilidad esperada de, y menor correlación esperada entre los valores de cierre de los subyacentes a la fecha de fijación de precios puede resultar en una tasa de cupón contingente más alta, pero también representaría una mayor expectativa Probabilidad a la fecha de fijación de precios de que el valor de cierre del subyacente de peor desempeño en una o más fechas de valoración ser inferior a su valor de barrera de cupón, de modo que no recibirá uno o más pagos de cupón contingentes o ninguno durante el plazo de los valores y que el valor subyacente final del subyacente de peor desempeño en la fecha de valoración final sea menor que su valor de barrera final, de modo que no se le reembolse el monto principal declarado de sus valores al vencimiento. |

| § | Los valores están sujetos a un mayor riesgo porque tienen múltiples subyacentes. Los valores son más riesgosos. que inversiones similares que pueden estar disponibles con solo un subyacente. Con múltiples subyacentes, hay una mayor posibilidad de que cualquiera de los subyacentes funcionará mal, afectando negativamente su rendimiento de los valores. |

| § | Los valores están sujetos a los riesgos de cada uno de los subyacentes y se verán afectados negativamente si alguno subyace funciona mal. Usted está sujeto a los riesgos asociados con cada uno de los subyacentes. Si alguno de los subyacentes funciona mal, usted será afectado negativamente Los valores no están vinculados a una cesta compuesta por los subyacentes, donde el rendimiento combinado de los subyacentes sería mejor que el desempeño del subyacente de peor desempeño solo. En cambio, estás sujeto a la riesgos completos de cualquiera de los subyacentes es el subyacente de peor desempeño. |

| Citigroup Global Markets Holdings Inc. |

| § | No se beneficiará de ninguna manera del rendimiento de un subyacente de mejor rendimiento. El rendimiento de los valores. depende únicamente del rendimiento del subyacente de peor rendimiento, y no se beneficiará de ninguna manera del rendimiento de cualquier mejor desempeño subyacente. |

| § | Estará sujeto a riesgos relacionados con la relación entre los subyacentes. Es preferible desde tu perspectiva para que los subyacentes se correlacionen entre sí, en el sentido de que sus valores de cierre tienden a aumentar o disminuir a valores similares tiempos y por magnitudes similares. Al invertir en los valores, usted asume el riesgo de que los subyacentes no exhiban esto. relación. Cuanto menos correlacionados los subyacentes, más probable es que cualquiera de los subyacentes funcione mal the term of the securities. All that is necessary for the securities to perform poorly is for one of the underlyings to perform poorly. It is impossible to predict what the relationship between the underlyings will be over the term of the securities. los underlyings differ in significant ways and, therefore, may not be correlated with each other. |

| § | You may not be adequately compensated for assuming the downside risk of the worst performing underlying. The potential contingent coupon payments on the securities are the compensation you receive for assuming the downside risk of the worst performing underlying, as well as all the other risks of the securities. That compensation is effectively “at risk” and may, therefore, be less than you currently anticipate. First, the actual yield you realize on the securities could be lower than you anticipate because the coupon is “contingent” and you may not receive a contingent coupon payment on one or more, or any, of the contingent coupon payment dates. Second, the contingent coupon payments are the compensation you receive not only for the downside risk of the worst performing underlying, but also for all of the other risks of the securities, including the risk that the securities may be automatically redeemed prior to maturity, interest rate risk and our and Citigroup Inc.’s credit risk. If those other risks increase or are otherwise greater than you currently anticipate, the contingent coupon payments may turn out to be inadequate to compensate you for all the risks of the securities, including the downside risk of the worst performing underlying. |

| § | The securities may be automatically redeemed prior to maturity, limiting your opportunity to receive contingent coupon payments. On any potential autocall date, the securities will be automatically called for redemption if the closing value of the worst performing underlying on that potential autocall date is greater than or equal to its initial underlying value. As a result, if the worst performing underlying performs in a way that would otherwise be favorable, the securities are likely to be automatically redeemed, cutting short your opportunity to receive contingent coupon payments. If the securities are automatically redeemed prior to maturity, you may not be able to reinvest your funds in another investment that provides a similar yield with a similar level of risk. |

| § | The securities offer downside exposure to the worst performing underlying, but no upside exposure to any underlying. You will not participate in any appreciation in the value of any underlying over the term of the securities. Consequently, your return on the securities will be limited to the contingent coupon payments you receive, if any, and may be significantly less than the return on any underlying over the term of the securities. In addition, as an investor in the securities, you will not receive any dividends or other distributions or have any other rights with respect to any of the underlyings. |

| § | The performance of the securities will depend on the closing values of the underlyings solely on the valuation dates, which makes the securities particularly sensitive to volatility in the closing values of the underlyings on or near the valuation dates. Whether the contingent coupon will be paid on any given contingent coupon payment date (and whether any previously unpaid contingent coupon payments will be paid) and whether the securities will be automatically redeemed prior to maturity will depend on the closing values of the underlyings solely on the applicable valuation dates, regardless of the closing values of the underlyings on other days during the term of the securities. If the securities are not automatically redeemed prior to maturity, what you receive at maturity will depend solely on the closing value of the worst performing underlying on the final valuation date, and not on any other day during the term of the securities. Because the performance of the securities depends on the closing values of the underlyings on a limited number of dates, the securities will be particularly sensitive to volatility in the closing values of the underlyings on or near the valuation dates. You should understand that the closing value of each underlying has historically been highly volatile. |

| § | The securities are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. If we default on our obligations under the securities and Citigroup Inc. defaults on its guarantee obligations, you may not receive anything owed to you under the securities. |

| § | The securities will not be listed on any securities exchange and you may not be able to sell them prior to maturity. The securities will not be listed on any securities exchange. Therefore, there may be little or no secondary market for the securities. CGMI currently intends to make a secondary market in relation to the securities and to provide an indicative bid price for the securities on a daily basis. Any indicative bid price for the securities provided by CGMI will be determined in CGMI’s sole discretion, taking into account prevailing market conditions and other relevant factors, and will not be a representation by CGMI that the securities can be sold at that price, or at all. CGMI may suspend or terminate making a market and providing indicative bid prices without notice, at any time and for any reason. If CGMI suspends or terminates making a market, there may be no secondary market at all for the securities because it is likely that CGMI will be the only broker-dealer that is willing to buy your securities prior to maturity. Accordingly, an investor must be prepared to hold the securities until maturity. |

| § | The estimated value of the securities on the pricing date, based on CGMI’s proprietary pricing models and our internal funding rate, is less than the issue price. The difference is attributable to certain costs associated with selling, structuring and hedging the securities that are included in the issue price. These costs include (i) any selling concessions or other fees paid in connection with the offering of the securities, (ii) hedging and other costs incurred by us and our affiliates in connection with the offering of the securities and (iii) the expected profit (which may be more or less than actual profit) to CGMI or other of our affiliates in connection with hedging our obligations under the securities. These costs adversely affect the economic terms of the securities because, if they were lower, the economic terms of the securities would be more favorable to you. The economic terms of the securities are also likely to be adversely affected by the use of our internal funding rate, rather than our secondary market rate, to price |

| Citigroup Global Markets Holdings Inc. |

the securities. See “The

estimated value of the securities would be lower if it were calculated based on our secondary market rate” below.

| § | The estimated value of the securities was determined for us by our affiliate using proprietary pricing models. CGMI derived the estimated value disclosed on the cover page of this pricing supplement from its proprietary pricing models. In doing so, it may have made discretionary judgments about the inputs to its models, such as the volatility of, and correlation between, the closing values of the underlyings, dividend yields on the underlyings and interest rates. CGMI’s views on these inputs may differ from your or others’ views, and as an underwriter in this offering, CGMI’s interests may conflict with yours. Both the models and the inputs to the models may prove to be wrong and therefore not an accurate reflection of the value of the securities. Moreover, the estimated value of the securities set forth on the cover page of this pricing supplement may differ from the value that we or our affiliates may determine for the securities for other purposes, including for accounting purposes. Tú should not invest in the securities because of the estimated value of the securities. Instead, you should be willing to hold the securities to maturity irrespective of the initial estimated value. |

| § | The estimated value of the securities would be lower if it were calculated based on our secondary market rate. The estimated value of the securities included in this pricing supplement is calculated based on our internal funding rate, which is the rate at which we are willing to borrow funds through the issuance of the securities. Our internal funding rate is generally lower than our secondary market rate, which is the rate that CGMI will use in determining the value of the securities for purposes of any purchases of the securities from you in the secondary market. If the estimated value included in this pricing supplement were based on our secondary market rate, rather than our internal funding rate, it would likely be lower. We determine our internal funding rate based on factors such as the costs associated with the securities, which are generally higher than the costs associated with conventional debt securities, and our liquidity needs and preferences. Our internal funding rate is not an interest rate that is payable on the securities. |

Because there is not an active market for traded instruments

referencing our outstanding debt obligations, CGMI determines our secondary market rate based on the market price of traded instruments

referencing the debt obligations of Citigroup Inc., our parent company and the guarantor of all payments due on the securities,

but subject to adjustments that CGMI makes in its sole discretion. As a result, our secondary market rate is not a market-determined

measure of our creditworthiness, but rather reflects the market’s perception of our parent company’s creditworthiness

as adjusted for discretionary factors such as CGMI’s preferences with respect to purchasing the securities prior to maturity.

| § | The estimated value of the securities is not an indication of the price, if any, at which CGMI or any other person may be willing to buy the securities from you in the secondary market. Any such secondary market price will fluctuate over the term of the securities based on the market and other factors described in the next risk factor. Moreover, unlike the estimated value included in this pricing supplement, any value of the securities determined for purposes of a secondary market transaction will be based on our secondary market rate, which will likely result in a lower value for the securities than if our internal funding rate were used. In addition, any secondary market price for the securities will be reduced by a bid-ask spread, which may vary depending on the aggregate stated principal amount of the securities to be purchased in the secondary market transaction, and the expected cost of unwinding related hedging transactions. As a result, it is likely that any secondary market price for the securities will be less than the issue price. |

| § | The value of the securities prior to maturity will fluctuate based on many unpredictable factors. The value of your securities prior to maturity will fluctuate based on the closing values of the underlyings, the volatility of, and correlation between, the closing values of the underlyings, dividend yields on the underlyings, interest rates generally, the time remaining to maturity and our and Citigroup Inc.’s creditworthiness, as reflected in our secondary market rate, among other factors described under “Risk Factors Relating to the Securities—Risk Factors Relating to All Securities—The value of your securities prior to maturity will fluctuate based on many unpredictable factors” in the accompanying product supplement. Changes in the closing values of the underlyings may not result in a comparable change in the value of your securities. You should understand that the value of your securities at any time prior to maturity may be significantly less than the issue price. |

| § | Immediately following issuance, any secondary market bid price provided by CGMI, and the value that will be indicated on any brokerage account statements prepared by CGMI or its affiliates, will reflect a temporary upward adjustment. The amount of this temporary upward adjustment will steadily decline to zero over the temporary adjustment period. See “Valuation of the Securities” in this pricing supplement. |

| § | The securities are subject to risks associated with non-U.S. markets. Investments linked to the value of non-U.S. stocks involve risks associated with the securities markets in those countries, including risks of volatility in those markets, governmental intervention in those markets and cross-shareholdings in companies in certain countries. Also, there is generally less publicly available information about companies in some of these jurisdictions than about U.S. companies that are subject to the reporting requirements of the SEC. Further, non-U.S. companies are generally subject to accounting, auditing and financial reporting standards and requirements and securities trading rules that are different from those applicable to U.S. reporting companies. The prices of securities in foreign markets may be affected by political, economic, financial and social factors in those countries, or global regions, including changes in government, economic and fiscal policies and currency exchange laws. Moreover, the economies in such countries may differ favorably or unfavorably from the economy of the United States in such respects as growth of gross national product, rate of inflation, capital reinvestment, resources and self-sufficiency. |

| § | Fluctuations in exchange rates will affect the closing value of Anheuser-Busch InBev SA/NV. Because Anheuser-Busch InBev SA/NV includes stocks that trade outside the United States and the closing value of Anheuser-Busch InBev SA/NV is based on the U.S. dollar value of those stocks, Anheuser-Busch InBev SA/NV is subject to currency exchange rate risk with respect to each of the currencies in which such stocks trade. Exchange rate movements may be volatile and may be driven by numerous factors specific to the relevant countries, including the supply of, and the demand for, the applicable currencies, as well as government policy and intervention and macroeconomic factors. Exchange rate movements may also be influenced significantly by speculative trading. In |

| Citigroup Global Markets Holdings Inc. |

general, if the U.S. dollar strengthens

against the currencies in which the stocks included in Anheuser-Busch InBev SA/NV trade, the closing value of Anheuser-Busch InBev

SA/NV will be adversely affected for that reason alone.

| § | Our offering of the securities is not a recommendation of any underlying. The fact that we are offering the securities does not mean that we believe that investing in an instrument linked to the underlyings is likely to achieve favorable returns. In fact, as we are part of a global financial institution, our affiliates may have positions (including short positions) in the underlyings or in instruments related to the underlyings, and may publish research or express opinions, that in each case are inconsistent with an investment linked to the underlyings. These and other activities of our affiliates may affect the closing values of the underlyings in a way that negatively affects the value of and your return on the securities. |

| § | The closing value of an underlying may be adversely affected by our or our affiliates’ hedging and other trading activities. We expect to hedge our obligations under the securities through CGMI or other of our affiliates, who may take positions in the underlyings or in financial instruments related to the underlyings and may adjust such positions during the term of the securities. Our affiliates also take positions in the underlyings or in financial instruments related to the underlyings on a regular basis (taking long or short positions or both), for their accounts, for other accounts under their management or to facilitate transactions on behalf of customers. These activities could affect the closing values of the underlyings in a way that negatively affects the value of and your return on the securities. They could also result in substantial returns for us or our affiliates while the value of the securities declines. |

| § | We and our affiliates may have economic interests that are adverse to yours as a result of our affiliates’ business activities. Our affiliates engage in business activities with a wide range of companies. These activities include extending loans, making and facilitating investments, underwriting securities offerings and providing advisory services. These activities could involve or affect the underlyings in a way that negatively affects the value of and your return on the securities. They could also result in substantial returns for us or our affiliates while the value of the securities declines. In addition, in the course of this business, we or our affiliates may acquire non-public information, which will not be disclosed to you. |

| § | The calculation agent, which is an affiliate of ours, will make important determinations with respect to the securities. If certain events occur during the term of the securities, such as market disruption events and other events with respect to an underlying, CGMI, as calculation agent, will be required to make discretionary judgments that could significantly affect your return on the securities. In making these judgments, the calculation agent’s interests as an affiliate of ours could be adverse to your interests as a holder of the securities. See “Risk Factors Relating to the Securities—Risk Factors Relating to All Securities—The calculation agent, which is an affiliate of ours, will make important determinations with respect to the securities” in the accompanying product supplement. |

| § | Even if an underlying pays a dividend that it identifies as special or extraordinary, no adjustment will be required under the securities for that dividend unless it meets the criteria specified in the accompanying product supplement. In general, an adjustment will not be made under the terms of the securities for any cash dividend paid by an underlying unless the amount of the dividend per share, together with any other dividends paid in the same quarter, exceeds the dividend paid per share in the most recent quarter by an amount equal to at least 10% of the closing value of that underlying on the date of declaration of the dividend. Any dividend will reduce the closing value of the underlying by the amount of the dividend per share. If an underlying pays any dividend for which an adjustment is not made under the terms of the securities, holders of the securities will be adversely affected. See “Description of the Securities—Certain Additional Terms for Securities Linked to an Underlying Company or an Underlying ETF—Dilution and Reorganization Adjustments—Certain Extraordinary Cash Dividends” in the accompanying product supplement. |

| § | The securities will not be adjusted for all events that may have a dilutive effect on or otherwise adversely affect the closing value of an underlying. For example, we will not make any adjustment for ordinary dividends or extraordinary dividends that do not meet the criteria described above, partial tender offers or additional underlying share issuances. Moreover, the adjustments we do make may not fully offset the dilutive or adverse effect of the particular event. Investors in the securities may be adversely affected by such an event in a circumstance in which a direct holder of the underlying shares of an underlying would not. |

| § | The securities may become linked to an underlying other than an original underlying upon the occurrence of a reorganization event or upon the delisting of the underlying shares of that original underlying. For example, if an underlying enters into a merger agreement that provides for holders of its underlying shares to receive shares of another entity and such shares are marketable securities, the closing value of that underlying following consummation of the merger will be based on the value of such other shares. Additionally, if the underlying shares of an underlying are delisted, the calculation agent may select a successor underlying. See “Description of the Securities—Certain Additional Terms for Securities Linked to an Underlying Company or an Underlying ETF” in the accompanying product supplement. |

| § | The securities are subject to risks associated with non-U.S. companies. An underlying is a non-U.S. company. The value of an underlying, therefore, may be affected by political, economic, financial and social factors in the country where an underlying is located, including changes in that country’s governmental, economic and fiscal policies, currency exchange laws or other laws or restrictions. |

| § | The securities are linked to ADSs and therefore are subject to currency exchange rate risk. There are significant risks associated with an investment linked to ADSs that are quoted and traded in U.S. dollars and represent an equity security issued by a foreign company. If the equity security represented by the ADSs is traded in a foreign currency on a foreign exchange, the price of the ADSs will be affected by fluctuations in the currency exchange rate between the U.S. dollar and the relevant foreign currency. In addition, if a significant portion of the underlying’s revenues or assets is denominated in one or more foreign currencies, changes in the exchange rate between the U.S. dollar and those foreign currencies may affect the underlying’s financial performance and, in turn, the price of the ADSs. In recent years, the rate of exchange between the U.S. dollar and some other currencies has been highly volatile and this volatility may continue in the future. These risks generally depend on economic and political events that cannot be predicted. |

| § | There are important differences between the rights of holders of ADSs and the rights of holders of the equity securities represented by the ADSs. Because the securities are linked to the performance of ADSs representing an equity security issued by a |

| Citigroup Global Markets Holdings Inc. |

foreign company (the “underlying

equity”), you should be aware that important differences exist between the rights of holders of ADSs and an underlying equity.

The ADSs are issued by a financial institution (the “ADS depositary”) under a deposit agreement, which sets forth the

rights and responsibilities of the ADS depositary, an underlying and holders of the ADSs. The rights of holders of ADSs under that

deposit agreement may be different from the rights of holders of the underlying equity. For example, the underlying may make distributions

in respect of its underlying equity that are not passed on to the holders of its ADSs. Any such differences between the rights

of holders of the ADSs and holders of the underlying equity may be significant and may materially and adversely affect the value

of the securities.

| § | If the underlying shares of an underlying are delisted, we may call the securities prior to maturity for an amount that may be less than the stated principal amount. If we exercise this call right, you will receive the amount described under “Description of the Securities—Certain Additional Terms for Securities Linked to an Underlying Company or an Underlying ETF—Delisting of an Underlying Company” in the accompanying product supplement. This amount may be less, and possibly significantly less, than the stated principal amount of the securities. |

| § | The U.S. federal tax consequences of an investment in the securities are unclear. There is no direct legal authority regarding the proper U.S. federal tax treatment of the securities, and we do not plan to request a ruling from the Internal Revenue Service (the “IRS”). Consequently, significant aspects of the tax treatment of the securities are uncertain, and the IRS or a court might not agree with the treatment of the securities as described in “United States Federal Tax Considerations” abajo. If the IRS were successful in asserting an alternative treatment of the securities, the tax consequences of the ownership and disposition of the securities might be materially and adversely affected. Moreover, future legislation, Treasury regulations or IRS guidance could adversely affect the U.S. federal tax treatment of the securities, possibly retroactively. |

Non-U.S.

investors should note that persons having withholding responsibility in respect of the securities may withhold on any coupon payment

paid to a non-U.S. investor, generally at a rate of 30%. To the extent that we have withholding responsibility in respect of the

securities, we intend to so withhold.

Tú

should read carefully the discussion under “United States Federal Tax Considerations” and “Risk Factors Relating

to the Securities” in the accompanying product supplement and “United States Federal Tax Considerations” in this

pricing supplement. You should also consult your tax adviser regarding the U.S. federal tax consequences of an investment in the

securities, as well as tax consequences arising under the laws of any state, local or non-U.S. taxing jurisdiction.

| Citigroup Global Markets Holdings Inc. |

Information About Anheuser-Busch InBev SA/NV

Anheuser-Busch InBev SA/NV manufactures alcoholic beverages.

The company produces and distributes beers. Anheuser-Busch InBev SA/NV serves customers worldwide. The underlying shares of Anheuser-Busch

InBev SA/NV are registered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Información

provided to or filed with the SEC by Anheuser-Busch InBev SA/NV pursuant to the Exchange Act can be located by reference to the

SEC file number 001-37911 through the SEC’s website at http://www.sec.gov. In addition, information regarding Anheuser-Busch

InBev SA/NV may be obtained from other sources including, but not limited to, press releases, newspaper articles and other publicly

disseminated documents. The underlying shares of Anheuser-Busch InBev SA/NV trade on the New York Stock Exchange under the ticker

symbol “BUD.”

We have derived all information regarding Anheuser-Busch InBev

SA/NV from publicly available information and have not independently verified any information regarding Anheuser-Busch InBev SA/NV.

This pricing supplement relates only to the securities and not to Anheuser-Busch InBev SA/NV. We make no representation as to the

performance of Anheuser-Busch InBev SA/NV over the term of the securities.

The securities represent obligations of Citigroup Global Markets

Holdings Inc. (guaranteed by Citigroup Inc.) only. Anheuser-Busch InBev SA/NV is not involved in any way in this offering and has

no obligation relating to the securities or to holders of the securities.

Historical Information

The closing value of Anheuser-Busch InBev SA/NV on January 8,

2020 was $81.98.

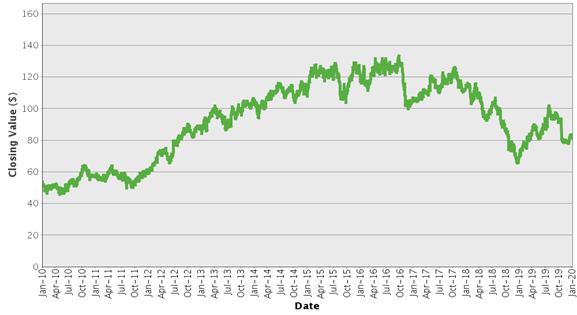

The graph below shows the closing value of Anheuser-Busch InBev

SA/NV for each day such value was available from January 4, 2010 to January 8, 2020. We obtained the closing values from Bloomberg

L.P., without independent verification. If certain corporate transactions occurred during the historical period shown below, including,

but not limited to, spin-offs or mergers, then the closing values shown below for the period prior to the occurrence of any such

transaction have been adjusted by Bloomberg L.P. as if any such transaction had occurred prior to the first day in the period shown

abajo. You should not take historical closing values as an indication of future performance.

| Anheuser-Busch InBev SA/NV – Historical Closing Values January 4, 2010 to January 8, 2020 |

|

| Citigroup Global Markets Holdings Inc. |

Information About Constellation Brands, Inc.

Constellation Brands, Inc. is an international producer and marketer

of beer, wine and spirits. The underlying shares of Constellation Brands, Inc. are registered under the Securities Exchange Act

of 1934, as amended (the “Exchange Act”). Information provided to or filed with the SEC by Constellation Brands, Inc.

pursuant to the Exchange Act can be located by reference to the SEC file number 001-08495 through the SEC’s website at http://www.sec.gov.

In addition, information regarding Constellation Brands, Inc. may be obtained from other sources including, but not limited to,

press releases, newspaper articles and other publicly disseminated documents. The underlying shares of Constellation Brands, Inc.

trade on the New York Stock Exchange under the ticker symbol “STZ.”

We have derived all information regarding Constellation Brands,

Inc. from publicly available information and have not independently verified any information regarding Constellation Brands, Inc.

This pricing supplement relates only to the securities and not to Constellation Brands, Inc. We make no representation as to the

performance of Constellation Brands, Inc. over the term of the securities.

The securities represent obligations of Citigroup Global Markets

Holdings Inc. (guaranteed by Citigroup Inc.) only. Constellation Brands, Inc. is not involved in any way in this offering and has

no obligation relating to the securities or to holders of the securities.

Historical Information

The closing value of Constellation Brands, Inc. on January 8,

2020 was $190.29.

The graph below shows the closing value of Constellation Brands,

Inc. for each day such value was available from January 4, 2010 to January 8, 2020. We obtained the closing values from Bloomberg

L.P., without independent verification. If certain corporate transactions occurred during the historical period shown below, including,

but not limited to, spin-offs or mergers, then the closing values shown below for the period prior to the occurrence of any such

transaction have been adjusted by Bloomberg L.P. as if any such transaction had occurred prior to the first day in the period shown

abajo. You should not take historical closing values as an indication of future performance.

| Constellation Brands, Inc. – Historical Closing Values January 4, 2010 to January 8, 2020 |

|

| Citigroup Global Markets Holdings Inc. |

United States Federal Tax Considerations

You should read carefully the discussion under “United

States Federal Tax Considerations” and “Risk Factors Relating to the Securities” in the accompanying product

supplement and “Summary Risk Factors” in this pricing supplement.

Due to the lack of any controlling legal authority, there is

substantial uncertainty regarding the U.S. federal tax consequences of an investment in the securities. In connection with any

information reporting requirements we may have in respect of the securities under applicable law, we intend (in the absence of

an administrative determination or judicial ruling to the contrary) to treat the securities for U.S. federal income tax purposes

as prepaid forward contracts with associated coupon payments that will be treated as gross income to you at the time received or

accrued in accordance with your regular method of tax accounting. In the opinion of our counsel, Davis Polk & Wardwell LLP,

this treatment of the securities is reasonable under current law; however, our counsel has advised us that it is unable to conclude

affirmatively that this treatment is more likely than not to be upheld, and that alternative treatments are possible. Moreover,

our counsel’s opinion is based on market conditions as of the date of this preliminary pricing supplement and is subject

to confirmation on the pricing date.

Assuming this treatment of the securities is respected and subject

to the discussion in “United States Federal Tax Considerations” in the accompanying product supplement, the following

U.S. federal income tax consequences should result under current law:

| · | Any coupon payments on the securities should be taxable as ordinary income to you at the time received or accrued in accordance with your regular method of accounting for U.S. federal income tax purposes. |

| · | Upon a sale or exchange of a security (including retirement at maturity for cash), you should recognize capital gain or loss equal to the difference between the amount realized and your tax basis in the security. For this purpose, the amount realized does not include any coupon paid on retirement and may not include sale proceeds attributable to an accrued coupon, which may be treated as a coupon payment. Such gain or loss should be long-term capital gain or loss if you held the security for more than one year. If, upon retirement of the securities, you receive underlying shares, you should not recognize gain or loss with respect to the underlying shares received, other than any fractional underlying share for which you receive cash. Your basis in any underlying shares received, including any fractional underlying share deemed received, should be equal to your tax basis in the securities. |

We do not plan to request

a ruling from the IRS regarding the treatment of the securities. An alternative characterization of the securities could materially

and adversely affect the tax consequences of ownership and disposition of the securities, including the timing and character of

income recognized. In addition, the U.S. Treasury Department and the IRS have requested comments on various issues regarding the

U.S. federal income tax treatment of “prepaid forward contracts” and similar financial instruments and have indicated

that such transactions may be the subject of future regulations or other guidance. Furthermore, members of Congress have proposed

legislative changes to the tax treatment of derivative contracts. Any legislation, Treasury regulations or other guidance promulgated

after consideration of these issues could materially and adversely affect the tax consequences of an investment in the securities,

possibly with retroactive effect. You should consult your tax adviser regarding possible alternative tax treatments of the securities

and potential changes in applicable law.

This discussion does not

address the U.S. federal tax consequences of the ownership or disposition of the underlying shares that you may receive at maturity.

You should consult your tax adviser regarding the particular U.S. federal tax consequences of the ownership and disposition of

the underlying shares.

Withholding Tax on Non-U.S. Holders. Because significant

aspects of the tax treatment of the securities are uncertain, persons having withholding responsibility in respect of the securities

may withhold on any coupon payment paid to Non-U.S. Holders (as defined in the accompanying product supplement), generally at a

rate of 30%. To the extent that we have (or an affiliate of ours has) withholding responsibility in respect of the securities,

we intend to so withhold. In order to claim an exemption from, or a reduction in, the 30% withholding, you may need to comply with

certification requirements to establish that you are not a U.S. person and are eligible for such an exemption or reduction under

an applicable tax treaty. You should consult your tax adviser regarding the tax treatment of the securities, including the possibility

of obtaining a refund of any amounts withheld and the certification requirement described above.

As discussed under “United

States Federal Tax Considerations—Tax Consequences to Non-U.S. Holders” in the accompanying product supplement, Section

871(m) of the Code and Treasury regulations promulgated thereunder (“Section 871(m)”) generally impose a 30% withholding

tax on dividend equivalents paid or deemed paid to Non-U.S. Holders with respect to certain financial instruments linked to U.S.

equities (“U.S. Underlying Equities”) or indices that include U.S. Underlying Equities. Section 871(m) generally applies

to instruments that substantially replicate the economic performance of one or more U.S. Underlying Equities, as determined based

on tests set forth in the applicable Treasury regulations. However, the regulations, as modified by an IRS notice, exempt financial

instruments issued prior to January 1, 2023 that do not have a “delta” of one. Based on the terms of the securities

and representations provided by us as of the date of this preliminary pricing supplement, our counsel is of the opinion that the

securities should not be treated as transactions that have a “delta” of one within the meaning of the regulations with

respect to any U.S. Underlying Equity and, therefore, should not be subject to withholding tax under Section 871(m). However, the

final determination regarding the treatment of the securities under Section 871(m) will be made as of the pricing date for the

securities, and it is possible that the securities will be subject to withholding tax under Section 871(m) based on the circumstances

as of that date.

A determination that the

securities are not subject to Section 871(m) is not binding on the IRS, and the IRS may disagree with this treatment. Moreover,

Section 871(m) is complex and its application may depend on your particular circumstances, including your other transactions. Tú

should consult your tax adviser regarding the potential application of Section 871(m) to the securities.

We will not be required to pay any additional amounts with respect

to amounts withheld.

| Citigroup Global Markets Holdings Inc. |

You should read the section entitled “United States

Federal Tax Considerations” in the accompanying product supplement. The preceding discussion, when read in combination with

that section, constitutes the full opinion of Davis Polk & Wardwell LLP regarding the material U.S. federal tax consequences

of owning and disposing of the securities.

You should also consult your tax adviser regarding all aspects

of the U.S. federal income and estate tax consequences of an investment in the securities and any tax consequences arising under

the laws of any state, local or non-U.S. taxing jurisdiction.

Supplemental Plan of Distribution

CGMI, an affiliate of Citigroup Global Markets Holdings Inc.

and the underwriter of the sale of the securities, is acting as principal and will receive an underwriting fee of $10.00 for each

security sold in this offering. Broker-dealers affiliated with CGMI, including Citi International Financial Services, Citigroup

Global Markets Singapore Pte. Ltd. and Citigroup Global Markets Asia Limited, and financial advisors employed by such affiliated

broker-dealers will collectively receive a fixed selling concession of $10.00 for each security they sell. For the avoidance of

doubt, the fees and selling concessions described in this pricing supplement will not be rebated if the securities are automatically

redeemed prior to maturity.

See “Plan of Distribution; Conflicts of Interest”

in the accompanying product supplement and “Plan of Distribution” in each of the accompanying prospectus supplement

and prospectus for additional information.

Valuation of the Securities

CGMI calculated the estimated value of the securities set forth

on the cover page of this pricing supplement based on proprietary pricing models. CGMI’s proprietary pricing models generated

an estimated value for the securities by estimating the value of a hypothetical package of financial instruments that would replicate

the payout on the securities, which consists of a fixed-income bond (the “bond component”) and one or more derivative

instruments underlying the economic terms of the securities (the “derivative component”). CGMI calculated the estimated

value of the bond component using a discount rate based on our internal funding rate. CGMI calculated the estimated value of the

derivative component based on a proprietary derivative-pricing model, which generated a theoretical price for the instruments that

constitute the derivative component based on various inputs, including the factors described under “Summary Risk Factors—The

value of the securities prior to maturity will fluctuate based on many unpredictable factors” in this pricing supplement,

but not including our or Citigroup Inc.’s creditworthiness. These inputs may be market-observable or may be based on assumptions

made by CGMI in its discretionary judgment.

The estimated value of the securities is a function of the terms

of the securities and the inputs to CGMI’s proprietary pricing models. As of the date of this preliminary pricing supplement,

it is uncertain what the estimated value of the securities will be on the pricing date because certain terms of the securities

have not yet been fixed and because it is uncertain what the values of the inputs to CGMI’s proprietary pricing models will

be on the pricing date.

For a period of approximately three months following issuance

of the securities, the price, if any, at which CGMI would be willing to buy the securities from investors, and the value that will

be indicated for the securities on any brokerage account statements prepared by CGMI or its affiliates (which value CGMI may also

publish through one or more financial information vendors), will reflect a temporary upward adjustment from the price or value

that would otherwise be determined. This temporary upward adjustment represents a portion of the hedging profit expected to be

realized by CGMI or its affiliates over the term of the securities. The amount of this temporary upward adjustment will decline

to zero on a straight-line basis over the three-month temporary adjustment period. However, CGMI is not obligated to buy the securities

from investors at any time. See “Summary Risk Factors—The securities will not be listed on any securities exchange

and you may not be able to sell them prior to maturity.”

Certain Selling Restrictions

Hong Kong Special Administrative Region

The contents of this pricing supplement and the accompanying

product supplement, prospectus supplement and prospectus have not been reviewed by any regulatory authority in the Hong Kong Special

Administrative Region of the People’s Republic of China (“Hong Kong”). Investors are advised to exercise caution

in relation to the offer. If investors are in any doubt about any of the contents of this pricing supplement and the accompanying

product supplement, prospectus supplement and prospectus, they should obtain independent professional advice.

The securities have not been offered or sold and will not be

offered or sold in Hong Kong by means of any document, other than

| (i) | to persons whose ordinary business is to buy or sell shares or debentures (whether as principal or agent); o |

| (ii) | to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong (the “Securities and Futures Ordinance”) and any rules made under that Ordinance; o |

| (iii) | in other circumstances which do not result in the document being a “prospectus” as defined in the Companies Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of that Ordinance; y |

There is no advertisement, invitation or document relating to

the securities which is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except

if permitted to do so under the securities laws of Hong Kong) other than with respect to securities which are or are intended to

be disposed of only to persons outside Hong Kong or only to “professional investors” as defined in the Securities and

Futures Ordinance and any rules made under that Ordinance.

| Citigroup Global Markets Holdings Inc. |

Non-insured Product: These securities are not insured by any

governmental agency. These securities are not bank deposits and are not covered by the Hong Kong Deposit Protection Scheme.

Singapur

This pricing supplement and the accompanying product supplement,

prospectus supplement and prospectus have not been registered as a prospectus with the Monetary Authority of Singapore, and the

securities will be offered pursuant to exemptions under the Securities and Futures Act, Chapter 289 of Singapore (the “Securities

and Futures Act”). Accordingly, the securities may not be offered or sold or made the subject of an invitation for subscription

or purchase nor may this pricing supplement or any other document or material in connection with the offer or sale or invitation

for subscription or purchase of any securities be circulated or distributed, whether directly or indirectly, to any person in Singapore

other than (a) to an institutional investor pursuant to Section 274 of the Securities and Futures Act, (b) to a relevant person

under Section 275(1) of the Securities and Futures Act or to any person pursuant to Section 275(1A) of the Securities and Futures

Act and in accordance with the conditions specified in Section 275 of the Securities and Futures Act, or (c) otherwise pursuant