Archivado de conformidad con la Regla 424 (b) (2)

Declaración de registro No. 333-231751

|

El banco Toronto-Dominion $ 4,778,000 Billetes vinculados a canasta con apalancamiento con vencimiento el 17 de noviembre de 2021 |

|

Las notas no tienen interés. El monto que se le pagará en sus notas en la fecha de vencimiento (17 de noviembre de 2021) se basa en el

rendimiento de una cesta de cinco índices con ponderación desigual: el EURO STOXX 50® Índice (36% de ponderación), TOPIX (27% de ponderación), el FTSE® 100 Index (19% de ponderación), el Swiss Market Index (10% de ponderación) y el S & P / ASX 200

Índice (ponderación del 8%), medido desde la fecha de fijación de precios (18 de marzo de 2020) hasta la fecha de valoración (15 de noviembre de 2021).

Si el nivel final de la canasta en la fecha de valoración es mayor que el nivel inicial de la canasta, el rendimiento de sus notas será positivo e igual a la tasa de participación del 300%

multiplicado por el cambio porcentual de la canasta, sujeto al monto máximo de pago de $ 1,553.20 por cada monto de capital de $ 1,000 de sus notas. Si el nivel de canasta final es igual al nivel de canasta inicial, recibirá la cantidad principal de

Tus notas. Si el nivel final de la canasta es menor que el nivel inicial de la canasta, el rendimiento de sus billetes será negativo y perderá el 1% del monto principal de sus billetes por cada 1% que la canasta final

nivel ha disminuido por debajo del nivel inicial de la cesta. Puede perder el monto total de su capital.

El nivel de cesta inicial se estableció en 100 en la fecha de fijación de precios y el nivel de cesta final será igual a (i) 100 veces (ii) el suma de 1 más, calculado para cada componente de la cesta, (a) el cambio porcentual de cada componente de la cesta desde la fecha de fijación de precios hasta la fecha de valoración multiplicado por (b) su peso en la cesta. El nivel de índice inicial de cada componente de la cesta es: 2,385.82 con respecto al EURO STOXX 50® Índice, 1,270.84 con respecto a TOPIX, 5,080.58 con

respeto al FTSE® Índice 100, 8.338,74 con respecto al índice del mercado suizo y 4.953,202 con respecto al índice S & P / ASX 200.

Para determinar su pago al vencimiento, calcularemos el cambio porcentual de la cesta, que es el porcentaje de aumento o disminución en el nivel final de la cesta desde

nivel inicial de la canasta. Al vencimiento, por cada monto principal de $ 1,000 de sus notas, recibirá un monto en efectivo igual a:

| ● |

Si el cambio porcentual es positivo (el nivel de canasta final es mayor que el nivel de canasta inicial), el suma de (i) $ 1,000 más |

| ● |

si el cambio porcentual es cero (el nivel de canasta final es igual al nivel de canasta inicial), $ 1,000; o |

| ● |

Si el cambio porcentual es negativo (el nivel final de la cesta es menor que el nivel inicial de la cesta), el suma de (i) $ 1,000 más |

Las disminuciones en los niveles de los componentes de la cesta pueden compensar los aumentos en los niveles de otros componentes de la cesta. El rendimiento de los componentes de la cesta con

Las ponderaciones más altas tendrán un mayor impacto en el rendimiento de las notas. Las notas no garantizan la devolución del capital al vencimiento.

Las notas no están garantizadas y no son cuentas de ahorro ni depósitos asegurados de un banco. Las notas no están aseguradas ni garantizadas por la Corporación de Seguros de Depósitos de Canadá, EE. UU.

Federal Deposit Insurance Corporation o cualquier otra agencia o instrumentalidad gubernamental. Cualquier pago en las notas está sujeto a nuestro riesgo de crédito. Las notas no se enumerarán ni se mostrarán en ningún intercambio de valores o comunicaciones electrónicas

red.

Debe leer la divulgación en este documento para comprender mejor los términos y riesgos de su inversión. Consulte "Factores de riesgo adicionales" que comienzan en la página P-8 de este

suplemento de precios.

Ni la Comisión de Bolsa y Valores de EE. UU. Ni ninguna comisión estatal de valores ha aprobado o desaprobado estos valores o determinado que esto

suplemento de precios, el suplemento del prospecto del producto o el prospecto es veraz o completo. Cualquier representación en contrario es un delito penal.

El valor estimado inicial de las notas en el momento en que se establecieron los términos de sus notas en la fecha de fijación de precios era de $ 983.40 por cada $ 1,000 principal

cantidad, que es inferior al precio de oferta pública que se detalla a continuación. Consulte “Información adicional sobre el valor estimado de las notas” en la página siguiente y “Factores de riesgo adicionales” que comienzan en la página P-8 de este documento para

Información Adicional. El valor real de sus notas en cualquier momento reflejará muchos factores y no puede predecirse con precisión.

|

Precio de oferta pública1 |

Descuento de suscripción1 |

Ingresos a TD |

||

|

Por nota |

$ 1,000.00 |

$ 0.00 |

$ 1,000.00 |

|

|

Total |

$ 4,778,000.00 |

$ 0.00 |

$ 4,778,000.00 |

TD Securities (USA) LLC

Suplemento de precios con fecha 18 de marzo de 2020

1 Consulte el "Plan de distribución suplementario (conflictos de intereses)" en este documento.

El precio de oferta pública, el descuento de suscripción y los ingresos de TD enumerados anteriormente se relacionan con las notas que emitimos inicialmente. Podemos decidir vender notas adicionales

después de la fecha de este suplemento de precios, a precios de oferta pública y con descuentos de suscripción y ganancias a TD que difieren de los montos establecidos anteriormente. El rendimiento (ya sea positivo o negativo) de su inversión en las notas será

dependerá en parte del precio de oferta pública que pague por dichas notas.

Nosotros, TD Securities (USA) LLC ("TDS"), o cualquiera de nuestros afiliados, podemos usar este suplemento de precios en la venta inicial de los pagarés. Además, nosotros, TDS o cualquiera de

nuestros afiliados pueden usar este suplemento de precios en una transacción de creación de mercado en una nota después de su venta inicial. A menos que nosotros, TDS o cualquiera de nuestros afiliados informemos al comprador de otra manera en la confirmación de la venta,

Este suplemento de precios se utilizará en una transacción de creación de mercado.

Información adicional sobre el valor estimado de las notas

Los términos finales para los Bonos se determinaron en la Fecha de fijación de precios, en función de las condiciones de mercado vigentes y se establecen en este suplemento de fijación de precios. Los términos económicos de la

Las notas se basan en la tasa de financiación interna de TD (que es la tasa de endeudamiento interna de TD basada en variables como los puntos de referencia del mercado y el apetito de TD por los préstamos) y varios factores, incluidas las comisiones de ventas que se espera pagar a TDS, cualquier

venta de concesiones, descuentos, comisiones o tarifas que se espera que se permitan o paguen a intermediarios no afiliados, el beneficio estimado que TD o cualquiera de los afiliados de TD esperan obtener en relación con la estructuración de los Bonos, el costo estimado

TD puede incurrir en la cobertura de sus obligaciones en virtud de los Bonos y el desarrollo estimado y otros costos en los que TD puede incurrir en relación con los Bonos. Debido a que la tasa de financiación interna de TD generalmente representa un descuento de los niveles en los que TD

el comercio de valores de deuda de referencia en el mercado secundario, el uso de una tasa de financiación interna para los Bonos en lugar de los niveles en los que se espera que el comercio de valores de deuda de referencia de TD en el mercado secundario haya tenido un efecto adverso en el

términos económicos de las Notas. En la portada de este suplemento de precios, TD ha proporcionado el valor estimado inicial para las Notas. El valor estimado inicial se determinó por referencia a los modelos de precios internos de TD que tienen en cuenta un

número de variables y se basan en una serie de supuestos, que pueden materializarse o no, por lo general, incluyendo volatilidad, tasas de interés (tasas pronosticadas, actuales e históricas), análisis de sensibilidad de precios, tiempo hasta el vencimiento de los Bonos,

y la tasa de financiación interna de TD. Para obtener más información sobre el valor estimado inicial, consulte "Factores de riesgo adicionales" en este documento. Debido a que la tasa de financiación interna de TD generalmente representa un descuento de los niveles en los que los valores de deuda de referencia de TD

comercio en el mercado secundario, el uso de una tasa de financiación interna para los Bonos en lugar de los niveles en los que se espera el comercio de valores de deuda de referencia de TD en el mercado secundario, suponiendo que todos los demás términos económicos se mantengan constantes, para

aumentar el valor estimado de las Notas. Para obtener más información, consulte la discusión en "Factores de riesgo adicionales: el valor estimado de las notas de TD y TDS se determina por referencia a las tasas de financiamiento interno de TD y no se determina por

Referencia a diferenciales de crédito o la tasa de interés TD pagaría por sus valores de deuda de tasa fija convencionales ”.

El valor estimado de TD en la Fecha de fijación de precios no es una predicción del precio al que los Bonos pueden negociarse en el mercado secundario, ni será el precio al que TDS puede comprar o

vender los Bonos en el mercado secundario. Sujeto a las condiciones normales de mercado y financiamiento, TDS u otra filial de TD tiene la intención de ofrecer comprar los Bonos en el mercado secundario, pero no está obligado a hacerlo.

Suponiendo que todos los factores relevantes permanecen constantes después de la Fecha de fijación de precios, el precio al que TDS puede comprar o vender inicialmente los Bonos en el mercado secundario, si alguno, puede exceder

El valor estimado de TD en la Fecha de fijación de precios para un período temporal que se espera sea aproximadamente 3 meses después de la Fecha de fijación de precios porque, a su discreción, TD puede optar por reembolsar efectivamente a los inversores una parte del costo estimado de cobertura

sus obligaciones bajo los Bonos y otros costos en relación con los Bonos en los que TD ya no esperará incurrir durante el plazo de los Bonos. TD hizo dicha elección discrecional y determinó este período de reembolso temporal sobre la base de

una serie de factores, incluido el plazo de vigencia de los Bonos y cualquier acuerdo que TD pueda tener con los distribuidores de los Bonos. El monto de los costos estimados de TD que efectivamente se reembolsa a los inversionistas de esta manera no se puede asignar de manera proporcional

durante todo el período de reembolso, y TD puede suspender dicho reembolso en cualquier momento o revisar la duración del período de reembolso después de la Fecha de fijación de precios de las Notas en función de los cambios en las condiciones del mercado y otros factores que no pueden

predicho.

Si una parte que no sea TDS o sus afiliados está comprando o vendiendo sus Bonos en el mercado secundario con base en su propio valor estimado de sus Bonos, que fue calculado por

referencia a los diferenciales de crédito de TD o la tasa de endeudamiento que TD pagaría por sus títulos de deuda convencionales de tasa fija (a diferencia de la tasa de financiación interna de TD), el precio al que dicha parte compraría o vendería sus Notas podría ser significativamente menor.

Le instamos a leer los "Factores de riesgo adicionales" en este documento.

Resumen

La información en esta sección "Resumen" está calificada por la información más detallada establecida en este suplemento de precios, el suplemento del prospecto del producto y el

folleto.

|

Editor: |

El Toronto-Dominion Bank ("TD") |

|

Problema: |

Valores de deuda senior, Serie E |

|

Tipo de nota: |

Notas vinculadas a la cesta con límite apalancado (las "Notas") |

|

Término: |

Aproximadamente 20 meses |

|

Cesta: |

Una cesta con ponderación desigual que consta de los siguientes índices (cada uno, un "Componente de la cesta"): |

|

Componente de cesta |

Bloomberg Ticker |

Ponderación de componentes |

Nivel de índice inicial * |

|||||

|

EURO STOXX 50® Índice |

SX5E |

36% |

2.385,82 |

|||||

|

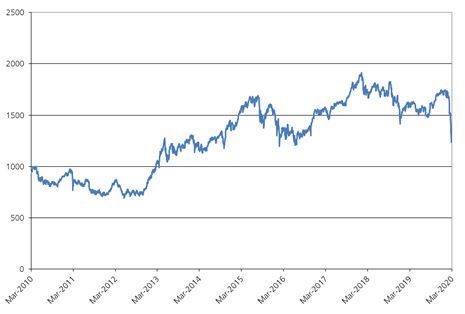

TOPIX |

TPX |

27% |

1.270,84 |

|||||

|

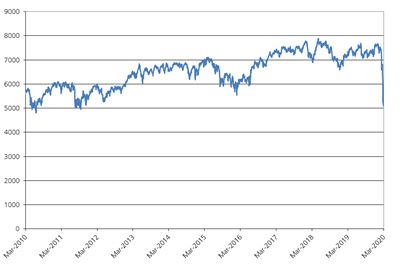

FTSE® 100 Índice |

UKX |

19% |

5.080,58 |

|||||

|

Índice del mercado suizo |

SMI |

10% |

8.338,74 |

|||||

|

Índice S & P / ASX 200 |

AS51 |

8% |

4,953.202 |

|

* Con respecto a cada componente de la cesta, su nivel de cierre en la fecha de fijación de precios. |

|

|

CUSIP / ISIN: |

89114RFA9 / US89114RFA95 |

|

Agente: |

TD Securities (USA) LLC ("TDS") |

|

Moneda: |

Dólares estadounidenses |

|

Inversión mínima: |

$ 1,000 y denominaciones mínimas de $ 1,000 en exceso |

|

Cantidad principal: |

$ 1,000 por nota; $ 4,778,000 en total para todas las Notas ofrecidas; El monto principal agregado de los Bonos ofrecidos puede incrementarse si el Emisor, a su exclusivo criterio, decide vender |

|

Fecha de precios: |

18 de marzo de 2020 |

|

Fecha de asunto: |

25 de marzo de 2020 |

|

Fecha de la valoración: |

15 de noviembre de 2021, sujeto a aplazamiento por eventos de interrupción del mercado y otras interrupciones, como se describe en "- Nivel de índice final" a continuación. |

|

Fecha de vencimiento: |

17 de noviembre de 2021, sujeto a aplazamiento por eventos de interrupción del mercado y otras interrupciones, como se describe en "Términos generales de las notas – Fecha de vencimiento" que comienza en la página PS-19 en el |

|

Pago al vencimiento: |

Por cada Monto principal de $ 1,000 de los Bonos, le pagaremos en la Fecha de vencimiento un monto en efectivo igual a: ● Si el ● si la final ● si la final ● Si el nivel final de la canasta es menos que el nivel de cesta inicial, el suma de (i) $ 1,000 más (ii) el producto de (a) $ 1,000 veces (b) el cambio de porcentaje. Si el Nivel de canasta final es menor que el Nivel de canasta inicial, el inversionista recibirá menos del Monto principal de los Bonos al vencimiento y Todos los montos utilizados o resultantes de cualquier cálculo relacionado con el Pago al vencimiento se redondearán hacia arriba o hacia abajo, según corresponda, al centavo más cercano. |

|

Factor de apalancamiento: |

300,00% |

|

Nivel de tapa: |

118.44% del nivel de cesta inicial |

|

Pago máximo Cantidad: |

$ 1,553.20 por $ 1,000 Monto principal de los Bonos (155.32% del Monto principal de los Bonos). Como resultado del Monto de pago máximo, el rendimiento máximo al vencimiento de los Bonos es |

|

Cambio porcentual: |

los cociente de (1) el nivel de cesta final menos el nivel de cesta inicial dividido por (2) el Nivel de cesta inicial, expresado como un porcentaje. |

|

Nivel de cesta inicial: |

100 |

|

Nivel de canasta final: |

100 × (1 + (el suma de los productos del Componente de la cesta Devolución para cada Componente de la cesta multiplicado por |

|

Componente de cesta Regreso: |

Con respecto a cada componente de la cesta: Nivel de índice final – Nivel de índice inicial Nivel de índice inicial |

|

Nivel de índice inicial: |

Con respecto a cada componente de la cesta, su nivel de cierre en la fecha de fijación de precios, como se muestra en la tabla anterior. |

|

Nivel de índice final: |

Con respecto a cada Componente de la Cesta, su Nivel de Cierre en la Fecha de Valoración, sujeto a ajustes según lo dispuesto en “Términos Generales de las Notas – No disponibilidad de Si la Fecha de valoración programada originalmente no es un Día de negociación con respecto a un Componente de la cesta o un evento de interrupción del mercado con respecto a un Componente de la cesta se produce o continúa |

|

Nivel de cierre: |

Con respecto a cada Componente de la cesta, su Nivel de cierre será el nivel de cierre oficial de ese Componente de la cesta o cualquier índice sucesor (como se define en el suplemento del prospecto del producto) |

|

Día laboral: |

Cualquier día que sea lunes, martes, miércoles, jueves o viernes que no sea feriado legal ni día en que las instituciones bancarias estén autorizadas o obligatorias por ley a cerrar en Nueva York |

|

Día de negociación: |

Un día de negociación con respecto a un componente de cesta significa un día en el que: (UN) el Eurex (en cuanto al EURO STOXX 50® (SI) ese componente de la cesta o su |

|

Tratamiento fiscal de EE. UU .: |

Al comprar una Nota, cada titular acuerda, en ausencia de un cambio estatutario o reglamentario o una determinación administrativa o resolución judicial en contrario, caracterizar las Notas, |

|

Impuesto canadiense Tratamiento: |

Consulte la discusión en el suplemento del prospecto del producto en "Discusión complementaria de las consecuencias fiscales canadienses", que se aplica a las Notas. |

|

Agente de cálculo: |

TD |

|

Listado: |

Las Notas no se enumerarán ni se mostrarán en ninguna bolsa de valores o red de comunicaciones electrónicas. |

|

Liquidación y Asentamiento: |

DTC global (incluso a través de sus participantes indirectos Euroclear y Clearstream, Luxemburgo) como se describe en "Descripción de los valores de deuda – Formas de los valores de deuda" y |

|

Rescate canadiense: |

Los Bonos no son valores de deuda rescatables (como se define en el prospecto) bajo la Ley de Corporación de Seguros de Depósitos de Canadá. |

Términos adicionales de sus notas

Debe leer este suplemento de precios junto con el prospecto, tal como lo complementa el suplemento del prospecto del producto, en relación con nuestros Valores de deuda senior, Serie E, de

de los cuales estas Notas son parte. Los términos en mayúscula utilizados pero no definidos en este suplemento de precios tendrán los significados que se les dan en el suplemento del prospecto del producto. En caso de conflicto, regirá la siguiente jerarquía: primero, esto

suplemento de precios; segundo, el suplemento del prospecto del producto; y por último, el prospecto. Las Notas varían de los términos descritos en el suplemento del prospecto del producto de varias maneras importantes.

Debe leer este suplemento de precios cuidadosamente.

Este suplemento de precios, junto con los documentos enumerados a continuación, contiene los términos de las Notas y reemplaza todas las declaraciones orales anteriores o contemporáneas, así como cualquier

otros materiales escritos que incluyen términos de precios preliminares o indicativos, correspondencia, ideas comerciales, estructuras para implementación, estructuras de muestra, folletos u otros materiales educativos nuestros. Debe considerar cuidadosamente, entre otros

cosas, los asuntos establecidos en "Factores de riesgo adicionales" en este documento, "Factores de riesgo adicionales específicos de las Notas" en el suplemento del prospecto del producto y "Factores de riesgo" en el prospecto, ya que las Notas implican riesgos no asociados con

títulos de deuda convencionales. Le instamos a consultar a sus asesores de inversiones, legales, fiscales, contables y de otro tipo con respecto a una inversión en las Notas. Puede acceder a estos documentos en el sitio web de la Comisión de Bolsa y Valores de EE. UU. (La "SEC")

en www.sec.gov de la siguiente manera (o si esa dirección ha cambiado, revisando nuestras presentaciones para la fecha relevante en el sitio web de la SEC):

| ◾ |

Folleto de fecha 18 de junio de 2019: |

| ◾ |

Prospecto del producto Suplemento MLN-EI-1 del 19 de junio de 2019: |

Nuestra clave de índice central, o CIK, en el sitio web de la SEC es 0000947263. Como se usa en este suplemento de precios, el "Banco", "nosotros", "nosotros" o "nuestro" se refiere al Toronto-Dominion Bank y sus subsidiarias.

Factores de riesgo adicionales

Las Notas implican riesgos no asociados con una inversión en valores de deuda convencionales. Esta sección describe los riesgos más significativos relacionados con los términos de las Notas.

Para obtener información adicional sobre estos riesgos, consulte "Factores de riesgo adicionales específicos de las Notas" en el suplemento del prospecto del producto y "Factores de riesgo" en el prospecto.

Debe considerar cuidadosamente si las Notas son adecuadas para sus circunstancias particulares. En consecuencia, debe consultar su inversión, legal, fiscal, contable y otros

asesores sobre los riesgos que conlleva una inversión en los Bonos y la idoneidad de los Bonos a la luz de sus circunstancias particulares.

Principal en riesgo.

Los inversores en los Bonos podrían perder su Monto Principal completo si hay una disminución en el nivel de la Cesta. Si el nivel de canasta final es menor que el nivel de canasta inicial,

perderá una parte de cada monto de capital de $ 1,000 en una cantidad igual a (i) el cambio de porcentaje negativo multiplicado por (ii) $ 1,000. Específicamente, perderá el 1% del monto principal de cada uno de

sus Notas por cada 1% de que el Nivel de canasta final sea menor que el Nivel de canasta inicial y puede perder su Monto principal principal.

Los Bonos no pagan intereses y su rendimiento sobre los Bonos puede ser inferior al rendimiento de los valores de deuda convencionales de vencimiento comparable.

No habrá pagos periódicos de intereses sobre los Bonos, ya que habría una garantía de deuda convencional a tasa fija o variable que tenga el mismo término. El retorno que tu

que recibirá en los Bonos, lo que podría ser negativo, puede ser inferior al rendimiento que podría obtener de otras inversiones. Incluso si su rendimiento es positivo, su rendimiento puede ser menor que el rendimiento que ganaría si comprara un senior convencional

Seguridad de deuda con intereses de TD.

Su rendimiento potencial sobre las notas está limitado por el monto máximo de pago y puede ser inferior al rendimiento de una inversión directa en los componentes de la cesta.

La oportunidad de participar en los posibles aumentos en el nivel de la Cesta a través de una inversión en los Bonos será limitada porque el Pago al vencimiento no

exceder el monto máximo de pago. Además, el efecto del Factor de apalancamiento no se tendrá en cuenta para ningún Nivel de canasta final que exceda el Nivel de límite, sin importar cuánto pueda subir el nivel de la Canasta por encima del Nivel de límite.

En consecuencia, su rendimiento en las Notas puede ser menor que su rendimiento si realizara una inversión en un valor directamente relacionado con el rendimiento de los Componentes de la Cesta.

Los cambios en el nivel del componente de una cesta pueden verse compensados por los cambios en el nivel de los otros componentes de la cesta.

Un cambio en el nivel de un Componente de la cesta puede no correlacionarse con cambios en los niveles de los otros Componentes de la cesta. El nivel de uno o más componentes de la cesta puede aumentar

mientras que el nivel de uno o más componentes de la cesta puede no aumentar tanto o incluso disminuir. Por lo tanto, al determinar el nivel de la canasta en cualquier momento, los aumentos en el nivel de un componente de la canasta pueden ser moderados o totalmente

compensación, en menores aumentos o disminuciones en el nivel de uno o más componentes de la cesta. Debido a que las ponderaciones de los componentes de la cesta no son iguales, el rendimiento del EURO STOXX 50® Index, TOPIX y el FTSE® 100

El índice tendrá un impacto significativamente mayor en el rendimiento de los Bonos que el rendimiento del Índice del mercado suizo o el Índice S & P / ASX 200.

Los inversores están sujetos al riesgo de crédito de TD, y las calificaciones crediticias y los spreads de crédito de TD pueden afectar negativamente el valor de mercado de los pagarés.

Aunque el rendimiento de los Bonos se basará en el rendimiento de la Cesta, el pago de cualquier monto adeudado en los Bonos está sujeto al riesgo de crédito de TD. Las Notas son la deuda no garantizada de TD

obligaciones Los inversores dependen de la capacidad de TD para pagar todas las cantidades adeudadas en los Bonos en la Fecha de Vencimiento y, por lo tanto, están sujetos al riesgo de crédito de TD y a los cambios en la visión del mercado de la calidad crediticia de TD. Cualquier disminución

en las calificaciones crediticias de TD o el aumento en los diferenciales de crédito cobrados por el mercado por asumir el riesgo crediticio de TD es probable que afecte negativamente el valor de mercado de los Bonos. Si TD no puede cumplir con su financiera

obligaciones a medida que vencen, es posible que no reciba ningún monto adeudado según los términos de las Notas.

Existen riesgos de mercado asociados con los componentes de la cesta.

El nivel de la cesta puede aumentar o disminuir bruscamente debido a factores específicos de los componentes de la cesta, los valores incluidos en los componentes de la cesta (el "componente de la cesta

Componentes ") y sus emisores (los" Emisores de componentes de la cesta "), como la volatilidad del precio de las acciones, ganancias, condiciones financieras, desarrollos corporativos, industriales y regulatorios, cambios y decisiones de gestión y otros eventos, así como

factores generales del mercado, como la volatilidad y los niveles generales del mercado, las tasas de interés y las condiciones económicas y políticas. Usted, como inversor en las Notas, debe realizar su propia investigación sobre los Componentes de la cesta, el Componente de la cesta

Constituyentes y los Emisores Constituyentes del Componente Canasta. Para obtener información adicional, consulte "Información sobre los componentes de la cesta" en este documento. Recientemente, la infección por coronavirus ha causado volatilidad en el

mercados financieros globales y amenazaron con una desaceleración en la economía global. El coronavirus o cualquier otra enfermedad o infección contagiosa puede afectar negativamente a los Emisores del Componente Basket y, por lo tanto, a los Componentes Basket. Ciertos mercados no estadounidenses

puede ser particularmente sensible a los efectos del coronavirus u otras enfermedades o infecciones transmisibles.

El descuento del agente, si corresponde, los gastos de oferta y ciertos costos de cobertura pueden afectar negativamente los precios secundarios del mercado.

Suponiendo que no haya cambios en las condiciones del mercado ni en ningún otro factor relevante, el precio, si lo hubiera, al cual podrá vender los Bonos probablemente será menor que la oferta pública.

precio. El precio de oferta pública incluye, y es probable que excluya cualquier precio que se le cotice, los gastos de oferta, así como el costo de cubrir nuestras obligaciones bajo los Bonos. Además, es probable que dicho precio refleje a cualquier distribuidor

descuentos, recargos y otros costos de transacción, como un descuento para contabilizar los costos asociados con el establecimiento o cancelación de cualquier transacción de cobertura relacionada. Además, si el distribuidor al que compra las Notas, o uno de sus afiliados, es

para llevar a cabo actividades de cobertura para nosotros en relación con las Notas, ese distribuidor o una de sus filiales puede obtener ganancias en relación con dichas actividades de cobertura y dicha ganancia, si la hubiera, será adicional a la compensación que el distribuidor

recibe por la venta de las Notas a usted. Debe tener en cuenta que la posibilidad de que ese distribuidor o uno de sus afiliados gane honorarios en relación con las actividades de cobertura puede crear un incentivo adicional para que ese distribuidor le venda las Notas en

Además de cualquier compensación que recibirían por la venta de los Bonos.

Puede que no haya un mercado activo de negociación para las notas: las ventas en el mercado secundario pueden dar lugar a pérdidas significativas.

Puede haber poco o ningún mercado secundario para los Bonos. Las Notas no se enumerarán ni se mostrarán en ninguna bolsa de valores o red de comunicaciones electrónicas. TDS y nuestro

los afiliados pueden hacer un mercado para los Bonos; sin embargo, no están obligados a hacerlo. TDS y nuestros afiliados pueden detener cualquier actividad de creación de mercado en cualquier momento. Incluso si se desarrolla un mercado secundario para los Bonos, es posible que no proporcione

liquidez o comercio a precios ventajosos para usted. Esperamos que los costos de transacción en cualquier mercado secundario sean altos. Como resultado, la diferencia entre los precios de oferta y demanda de sus Notas en cualquier mercado secundario podría ser sustancial.

Si vende sus Notas antes de la Fecha de Vencimiento, es posible que tenga que hacerlo con un descuento sustancial del precio de oferta pública, independientemente de los niveles de los Componentes de la Cesta

y, como resultado, puede sufrir pérdidas sustanciales.

Si el nivel de los componentes de la cesta cambia, el valor de mercado de sus notas puede no cambiar de la misma manera.

Sus Notas pueden negociarse de manera muy diferente del rendimiento de los Componentes de la Cesta. Los cambios en los niveles de los componentes de la cesta pueden no dar lugar a un cambio comparable en el

Valor de mercado de sus Notas. Incluso si los niveles de los Componentes de la cesta aumentan por encima de los Niveles de índice iniciales durante la vida de los Bonos, el valor de mercado de sus Bonos puede no aumentar en la misma cantidad y podría disminuir.

El pago al vencimiento no está vinculado a los niveles de los componentes de la cesta en ningún momento que no sea la fecha de valoración.

The Final Basket Level will be based on the Closing Levels of the Basket Components on the Valuation Date (subject to adjustment as described elsewhere in this pricing supplement). Therefore, if the

Closing Levels of the Basket Components dropped precipitously on the Valuation Date, the Payment at Maturity for your Notes may be significantly less than it would have been had the Payment at Maturity been linked to the Closing Levels of the

Basket Components prior to such drop in the levels of the Basket Components. Although the actual levels of the Basket Components on the Maturity Date or at other times during the life of your Notes may be higher than their levels on the Valuation

Date, you will only benefit from the Closing Levels of the Basket Components on the Valuation Date.

We May Sell an Additional Aggregate Principal Amount of the Notes at a Different Public Offering Price.

At our sole option, we may decide to sell an additional aggregate Principal Amount of the Notes subsequent to the date of this pricing supplement. The public offering price of the

Notes in the subsequent sale may differ substantially (higher or lower) from the original public offering price you paid as provided on the cover of this pricing supplement.

If You Purchase Your Notes at a Premium to Principal Amount, the Return on Your Investment Will Be Less Than the Return on Notes Purchased at Principal Amount

and the Impact of Certain Key Terms of the Notes Will be Negatively Affected.

The Payment at Maturity will not be adjusted based on the public offering price you pay for the Notes. If you purchase Notes at a price that differs from the Principal Amount of

the Notes, then the return on your investment in such Notes held to the Maturity Date will differ from, and may be substantially less than, the return on Notes purchased at Principal Amount. If you purchase your Notes at a premium to Principal

Amount and hold them to the Maturity Date, the return on your investment in the Notes will be less than it would have been had you purchased the Notes at Principal Amount or a discount to Principal Amount. In addition, the impact of the Cap Level

on the return on your investment will depend upon the price you pay for your Notes relative to Principal Amount. For example, if you purchase your Notes at a premium to Principal Amount, the Cap Level will only permit a lower positive return on

your investment in the Notes than would have been the case for Notes purchased at Principal Amount or a discount to Principal Amount.

You Will Not Have Any Rights to the Securities Included in Any Basket Component.

As a holder of the Notes, you will not have voting rights or rights to receive cash dividends or other distributions or other rights that holders of securities included in a

Basket Component (the “Basket Component Constituents”) would have. The Final Basket Level will not reflect any dividends paid on any Basket Component Constituents.

We Have No Affiliation with Any Index Sponsor and Will Not Be Responsible for Any Actions Taken by Any Index Sponsor.

No Index Sponsor is an affiliate of ours or will be involved in any offerings of the Notes in any way. Consequently, we have no control of any actions of an Index Sponsor,

including any actions of the type that would require the Calculation Agent to adjust the Payment at Maturity. No Index Sponsor has any obligation of any sort with respect to the Notes. Thus, no Index Sponsor has any obligation to take your

interests into consideration for any reason, including in taking any actions that might affect the value of the Notes. None of our proceeds from any issuance of the Notes will be paid to any Index Sponsor, except to the extent that we are required

to pay an Index Sponsor licensing fees with respect to the relevant Basket Component.

TD’s Initial Estimated Value of the Notes at the Time of Pricing (When the Terms of Your Notes Were Set on the Pricing Date) is Less Than the Public Offering

Price of the Notes.

TD’s initial estimated value of the Notes is only an estimate. TD’s initial estimated value of the Notes is less than the public offering price of the Notes. The difference

between the public offering price of the Notes and TD’s initial estimated value reflects costs and expected profits associated with selling and structuring the Notes, as well as hedging its obligations under the Notes with a third party. Porque

hedging our obligations entails risks and may be influenced by market forces beyond our control, this hedging may result in a profit that is more or less than expected, or a loss.

TD’s and TDS’s Estimated Value of the Notes are Determined By Reference to TD’s Internal Funding Rates and are Not Determined By Reference to Credit Spreads or

the Borrowing Rate TD Would Pay for its Conventional Fixed-Rate Debt Securities.

TD’s initial estimated value of the Notes and TDS’s estimated value of the Notes at any time are determined by reference to TD’s internal funding rate. The internal funding rate used in the

determination of the estimated value of the Notes generally represents a discount from the credit spreads for TD’s conventional fixed-rate debt securities and the borrowing rate TD would pay for its conventional fixed-rate debt securities. Esta

discount is based on, among other things, TD’s view of the funding value of the Notes as well as the higher issuance, operational and ongoing liability management costs of the Notes in comparison to those costs for TD’s conventional fixed-rate

debt, as well as estimated financing costs of any hedge positions, taking into account regulatory and internal requirements. If the interest rate implied by the credit spreads for TD’s conventional fixed-rate debt securities, or the borrowing rate

TD would pay for its conventional fixed-rate debt securities were to be used, TD would expect the economic terms of the Notes to be more favorable to you. Additionally, assuming all other economic terms are held constant, the use of an internal

funding rate for the Notes is expected to increase the estimated value of the Notes at any time.

TD’s Initial Estimated Value of the Notes Does Not Represent Future Values of the Notes and May Differ From Others’ (Including TDS’s) Estimates.

TD’s initial estimated value of the Notes was determined by reference to its internal pricing models when the terms of the Notes were set. These pricing models take into account a

number of variables, such as TD’s internal funding rate on the Pricing Date, and are based on a number of assumptions as discussed further under “Additional Information Regarding the Estimated Value of the Notes” herein. Different pricing models

and assumptions (including the pricing models and assumptions used by TDS) could provide valuations for the Notes that are different from, and perhaps materially less than, TD’s initial estimated value. Therefore, the price at which TDS would buy

or sell your Notes (if TDS makes a market, which it is not obligated to do) may be materially less than TD’s initial estimated value. In addition, market conditions and other relevant factors in the future may change, and any assumptions may prove

to be incorrect.

The Estimated Value of the Notes Is Not a Prediction of the Prices at Which You May Sell Your Notes in the Secondary Market, If Any, and Such Secondary Market

Prices, If Any, Will Likely be Less Than the Public Offering Price of Your Notes and May Be Less Than the Estimated Value of Your Notes.

The estimated value of the Notes is not a prediction of the prices at which TDS, other affiliates of ours or third parties may be willing to purchase the Notes from you in

secondary market transactions (if they are willing to purchase, which they are not obligated to do). The price at which you may be able to sell your Notes in the secondary market at any time, if any, will be influenced by many factors that cannot

be predicted, such as market conditions, and any bid and ask spread for similar sized trades, and may be substantially less than the estimated value of the Notes. Further, as secondary market prices of your Notes take into account the levels at

which our debt securities trade in the secondary market, and do not take into account our various costs and expected profits associated with selling and structuring the Notes, as well as hedging our obligations under the Notes, secondary market

prices of your Notes will likely be less than the public offering price of your Notes. As a result, the price at which TDS, other affiliates of ours or third parties may be willing to purchase the Notes from you in secondary market transactions, if

any, will likely be less than the price you paid for your Notes, and any sale prior to the Maturity Date could result in a substantial loss to you.

The Temporary Price at Which TDS May Initially Buy the Notes in the Secondary Market May Not Be Indicative of Future Prices of Your Notes.

Assuming that all relevant factors remain constant after the Pricing Date, the price at which TDS may initially buy or sell the Notes in the secondary market (if TDS makes a

market in the Notes, which it is not obligated to do) may exceed the estimated value of the Notes on the Pricing Date, as well as the secondary market value of the Notes, for a temporary period after the Pricing Date of the Notes, as discussed

further under “Additional Information Regarding the Estimated Value of the Notes.” The price at which TDS may initially buy or sell the Notes in the secondary market may not be indicative of future prices of your Notes.

The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors.

When we refer to the market value of your Notes, we mean the value that you could receive for your Notes if you chose to sell them in the open market before the Maturity Date. UN

number of factors, many of which are beyond our control, will influence the market value of your Notes, including:

| • |

the levels of the Basket Components; |

| • |

the volatility – i.e., the frequency and magnitude of changes – in the level of the Basket; |

| • |

the dividend rates, if applicable, of the Basket Component Constituents; |

| • |

economic, financial, regulatory and political, military or other events (including domestic or global health concerns) that may affect the prices of any of the Basket Component Constituents and thus the level |

| • |

the correlation among the Basket Components; |

| • |

interest rate and yield rates in the market; |

| • |

the time remaining until your Notes mature; |

| • |

any fluctuations in the exchange rate between currencies in which the Basket Component Constituents are quoted and traded and the U.S. dollar, as applicable; y |

| • |

our creditworthiness, whether actual or perceived, and including actual or anticipated upgrades or downgrades in our credit ratings or changes in other credit measures. |

These factors will influence the price you will receive if you sell your Notes before maturity, including the price you may receive for your Notes in any market-making transaction. If you sell your

Notes prior to maturity, you may receive less than the Principal Amount of your Notes.

The future levels of the Basket cannot be predicted. The actual change in the level of the Basket over the life of the Notes, as well as the Payment at Maturity, may bear little

or no relation to the hypothetical historical closing levels of the Basket or to the hypothetical examples shown elsewhere in this pricing supplement.

Investment in the Offered Notes Is Subject to Risks Associated with Non-U.S. Securities Markets.

The value of your Notes is linked to Basket Components which include Basket Component Constituents traded in one or more non-U.S. securities markets. Investments linked to the

value of non-U.S. equity securities involve particular risks. Any non-U.S. securities market may be less liquid, more volatile and affected by global or domestic market developments in a different way than are the U.S. securities market or other

non-U.S. securities markets. Both government intervention in a non-U.S. securities market, either directly or indirectly, and cross-shareholdings in non-U.S. companies, may affect trading prices and volumes in that market. Also, there is generally

less publicly available information about non-U.S. companies than about those U.S. companies that are subject to the reporting requirements of the SEC. Further, non-U.S. companies are likely subject to accounting, auditing and financial reporting

standards and requirements that differ from those applicable to U.S. reporting companies.

The prices of securities in a non-U.S. country are subject to political, economic, financial and social factors that are unique to such non-U.S. country's geographical region.

These factors include: recent changes, or the possibility of future changes, in the applicable non-U.S. government's economic and fiscal policies; the possible implementation of, or changes in, currency exchange laws or other laws or restrictions

applicable to non-U.S. companies or investments in non-U.S. equity securities; fluctuations, or the possibility of fluctuations, in currency exchange rates; and the possibility of outbreaks of hostility, political instability, natural disaster or

adverse public health developments. The United Kingdom ceased to be a member of the European Union on January 31, 2020 (an event commonly referred to as "Brexit"). The effect of Brexit is uncertain, and, among other things, Brexit has contributed,

and may continue to contribute, to volatility in the prices of securities of companies located in Europe (or elsewhere) and currency exchange rates, including the valuation of the euro and British pound in particular. Any one of these factors, or

the combination of more than one of these or other factors, could negatively affect such non-U.S. securities market and the prices of securities therein. Further, geographical regions may react to global factors in different ways, which may cause

the prices of securities in a non-U.S. securities market to fluctuate in a way that differs from those of securities in the U.S. securities market or other non-U.S. securities markets. No estadounidenses economies may also differ from the U.S. economy in

important respects, including growth of gross national product, rate of inflation, capital reinvestment, resources and self-sufficiency, which may have a negative effect on non-U.S. securities prices.

Your Notes Are Linked to Basket Components that are comprised of Basket Component Constituents that Are Traded in Non-U.S. Currencies But Are Not Adjusted to Reflect Their U.S.

Dollar Value, Therefore, the Return on Your Notes Will Not Be Adjusted for Changes in Exchange Rates.

Because your Notes are linked to Basket Components with Basket Component Constituents that are traded in non-U.S. currencies but are not adjusted to reflect their U.S. dollar

value, the Payment at Maturity will not be adjusted for changes in the applicable non-U.S. currency/U.S. dollar exchange rates. The Payment at Maturity will be based solely upon the overall change in the levels of the Basket Components over the

life of your Notes. Changes in exchange rates, however, may reflect changes in the economy of the countries in which the Basket Component Constituents are listed that, in turn, may affect the level of the relevant Basket Component, and therefore

the Basket.

As of the Date of this Pricing Supplement, There is No Actual History for the Closing Levels of the Basket.

The Payment at Maturity, if any, for each of your Notes is linked to the Percentage Change in the Basket, which began being calculated on the Pricing Date. Since there will be no

actual history for the closing levels of the Basket, no actual historical information about the Closing Levels of the Basket will be available for you to consider in making an independent investigation of the performance of the Basket, which may

make it difficult for you to make an informed decision with respect to an investment in your Notes.

Hypothetical Past Basket Performance is No Guide to Future Performance.

The actual performance of the Basket over the life of the Notes, as well as the Payment at Maturity, may bear little relation to the hypothetical historical closing levels of the Basket (when available) or to the

hypothetical return examples set forth elsewhere in this pricing supplement. The future performance of the Basket cannot be predicted.

There Are Potential Conflicts of Interest Between You and the Calculation Agent.

The Calculation Agent will, among other things, determine the amount of your payment on the Notes. We will serve as the Calculation Agent and may appoint a different Calculation

Agent after the Issue Date without notice to you. The Calculation Agent will exercise its judgment when performing its functions and may take into consideration our ability to unwind any related hedges. Because this discretion by the Calculation

Agent may affect payments on the Notes, the Calculation Agent may have a conflict of interest if it needs to make any such decision. For example, the Calculation Agent may have to determine whether a market disruption event affecting a Basket

Component has occurred. This determination may, in turn, depend on the Calculation Agent’s judgment whether the event has materially interfered with our ability or the ability of one of our affiliates to unwind our hedge positions. Because this

determination by the Calculation Agent will affect the payment on the Notes, the Calculation Agent may have a conflict of interest if it needs to make a determination of this kind. For additional information as to the Calculation Agent’s role, see

“General Terms of the Notes — Role of Calculation Agent” in the product prospectus supplement.

Market Disruption Events and Postponements.

The Valuation Date, and therefore the Maturity Date, are subject to postponement as described in the product prospectus supplement due to the occurrence of one or more market

disruption events. For a description of what constitutes a market disruption event as well as the consequences of that market disruption event, see “General Terms of the Notes—Market Disruption Events” in the product prospectus supplement and

“Summary—Final Index Level” herein.

Trading and Business Activities by TD and Our Affiliates May Adversely Affect the Market Value of, and Any Amount Payable on, the Notes.

TD and our affiliates may hedge our obligations under the Notes by purchasing securities, futures, options or other derivative instruments with returns linked or related to

changes in the levels of the Basket Components or the prices of one or more Basket Component Constituents, and we or they may adjust these hedges by, among other things, purchasing or selling securities, futures, options or other derivative

instruments at any time. It is possible that we or one or more of our affiliates could receive substantial returns from these hedging activities while the market value of the Notes declines. We or one or more of our affiliates may also issue or

underwrite other securities or financial or derivative instruments with returns linked or related to changes in the performance of the applicable Basket Components or one or more Basket Component Constituents.

These trading activities may present a conflict between the holders’ interest in the Notes and the interests we and our affiliates will have in our or their proprietary accounts,

in facilitating transactions, including options and other derivatives transactions, for our or their customers’ accounts and in accounts under our or their management. These trading activities could be adverse to the interests of the holders of the

Notes.

We and our affiliates may, at present or in the future, engage in business with one or more issuers of a Basket Component Constituent (a “Basket Component Constituent Issuer”),

including making loans to or providing advisory services to those companies. These services could include investment banking and merger and acquisition advisory services. These business activities may present a conflict between us and our

affiliates obligations, and your interests as a holder of the Notes. Moreover, we, and our affiliates may have published, and in the future expect to publish, research reports with respect to one or more Basket Components or Basket Component

Constituent Issuers. This research is modified from time to time without notice and may express opinions or provide recommendations that are inconsistent with purchasing or holding the Notes. Any of these business activities by us or one or more of

our affiliates may affect the level of one or more Basket Components or one or more Basket Component Constituents and, therefore, the market value of, and any amount payable on, the Notes.

Significant Aspects of the Tax Treatment of the Notes Are Uncertain.

Significant aspects of the U.S. tax treatment of the Notes are uncertain. You should consult your tax advisor about your tax situation and should read carefully the section

entitled “Material U.S. Federal Income Tax Consequences” below and the section entitled “Material U.S. Federal Income Tax Consequences” in the product prospectus supplement.

For a discussion of the Canadian federal income tax consequences of investing in the Notes, please see the discussion in the product prospectus supplement under “Supplemental

Discussion of Canadian Tax Consequences”.

If you are not a Non-resident Holder (as that term is defined in the prospectus) for Canadian federal income tax purposes or if you acquire the Notes in the secondary market, you should consult your

tax advisors as to the consequences of acquiring, holding and disposing of the Notes and receiving the payments that might be due under the Notes.

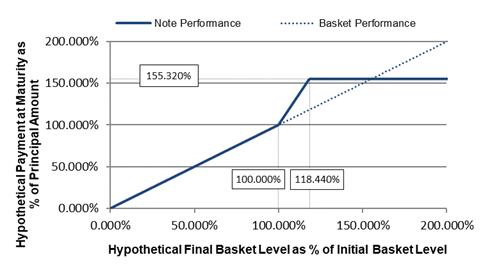

Hypothetical Returns

The examples and graph set out below are included for illustration purposes only. They should not be taken as an indication or prediction of future investment results and merely are

intended to illustrate the impact that the various hypothetical Basket levels on the Valuation Date could have on the Payment at Maturity assuming all other variables remain constant.

The examples below are based on a range of Final Basket Levels and Final Index Levels that are entirely hypothetical; the Basket level on any day throughout the life of the Notes,

including the Final Basket Level on the Valuation Date, cannot be predicted. The Basket Components have been highly volatile in the past — meaning that the levels of the Basket Components have changed considerably in relatively short periods — and

the performance of the Basket cannot be predicted for any future period.

The information in the following examples reflects hypothetical rates of return on the offered Notes assuming that they are purchased on the Issue Date at the

Principal Amount and held to the Maturity Date. If you sell your Notes in a secondary market prior to the Maturity Date, your return will depend upon the market value of your Notes at the time of sale, which may be affected by a number of factors

that are not reflected in the examples below, such as interest rates, the volatility of the Basket Components and our creditworthiness. In addition, the estimated value of your Notes at the time the terms of your Notes were set on the Pricing Date

is less than the original public offering price of your Notes. For more information on the estimated value of your Notes, see “Additional Risk Factors — TD’s Initial Estimated Value of the Notes at the Time of Pricing (When the Terms of Your Notes

Were Set on the Pricing Date) is Less Than the Public Offering Price of the Notes” herein. The information in the examples also reflect the key terms and assumptions in the box below.

|

Key Terms and Assumptions |

|

|

Principal Amount |

$1,000 |

|

Initial Basket Level |

100 |

|

Leverage Factor |

300.00% |

|

Cap Level |

118.44% of the Initial Basket Level |

|

Maximum Payment Amount |

$1,553.20 |

|

Neither a market disruption event nor a non-Trading Day occurs with respect to any Basket Component on the originally scheduled Valuation Date |

|

|

No change in or affecting any of the Basket Components or the method by which an Index Sponsor calculates the relevant Basket Component |

|

|

Notes purchased on the Issue Date at the Principal Amount and held to the Maturity Date |

|

The actual performance of the Basket over the life of your Notes, as well as the Payment at Maturity, if any, may bear little relation to the hypothetical examples shown below or to

the hypothetical levels of the Basket or the historical levels of the Basket Components shown elsewhere in this pricing supplement. For information about the historical levels of the Basket Components and the hypothetical levels of the Basket

during recent periods, see “Information Regarding the Basket Components — Historical Information of the Basket Components” and “Information Regarding the Basket Components — Hypothetical Information of the Basket” below.

Also, the hypothetical examples shown below do not take into account the effects of applicable taxes. Because of the U.S. tax treatment applicable to your Notes, tax liabilities

could affect the after-tax rate of return on your Notes to a comparatively greater extent than the after-tax return on the Basket Components.

The levels in the left column of the table below represent hypothetical Final Basket Levels and are expressed as percentages of the Initial Basket Level. los

amounts in the right column represent the hypothetical Payment at Maturity, based on the corresponding hypothetical Final Basket Level, and are expressed as percentages of the Principal Amount of a Note (rounded to the nearest one-thousandth of a

percent). Thus, a hypothetical Payment at Maturity of 100.000% means that the value of the cash payment that we would pay for each $1,000 of the outstanding Principal Amount of the offered Notes on the Maturity Date would equal 100.000% of the

Principal Amount of a Note, based on the corresponding hypothetical Final Basket Level and the assumptions noted above.

|

Hypothetical Final Basket Level (as Percentage of Initial Basket Level) |

Hypothetical Payment at Maturity (as Percentage of Principal Amount) |

|

200.000% |

155.320% |

|

175.000% |

155.320% |

|

150.000% |

155.320% |

|

130.000% |

155.320% |

|

120.000% |

155.320% |

|

118.440% |

155.320% |

|

115.000% |

145.000% |

|

110.000% |

130.000% |

|

105.000% |

115.000% |

|

100.000% |

100.000% |

|

95.000% |

95.000% |

|

90.000% |

90.000% |

|

80.000% |

80.000% |

|

75.000% |

75.000% |

|

50.000% |

50.000% |

|

25.000% |

25.000% |

|

0.000% |

0.000% |

If, for example, the Final Basket Level were determined to be 25.000% of the Initial Basket Level, the Payment at Maturity that we would pay on your Notes at

maturity would be 25.000% of the Principal Amount of your Notes, as shown in the table above. As a result, if you purchased your Notes on the Issue Date at the Principal Amount and held them to the Maturity Date, you would lose 75.000% of your

investment (if you purchased your Notes at a premium to Principal Amount you would lose a correspondingly higher percentage of your investment). If the Final Basket Level were determined to be 0.000% of the Initial Basket Level, you would lose

100.000% of your investment in the Notes. In addition, if the Final Basket Level were determined to be 200.000% of the Initial Basket Level, the Payment at Maturity that we would pay on your Notes at maturity would be capped at the Maximum Payment

Amount, or 155.320% of each $1,000 Principal Amount of your Notes, as shown in the table above. As a result, if you held your Notes to the Maturity Date, you would not benefit from any increase in the Final Basket Level of greater than 118.440% of

the Initial Basket Level.

The following examples illustrate the hypothetical Payment at Maturity for each Note based on hypothetical Final Basket Levels and

hypothetical Final Index Levels of the Basket Components, calculated based on the key terms and assumptions above.

The levels in Column A represent hypothetical Initial Index Levels for each Basket Component, and the levels in Column B represent hypothetical Final Index Levels

for each Basket Component. The percentages in Column C represent hypothetical Basket Component Returns for each Basket Component. The amounts in Column D represent the applicable weightings of each Basket Component, and the amounts in Column E

represent the productos of the percentages in Column C times the corresponding amounts in Column D. The Final Basket Level for each example is shown beneath each

example, and will equal 100 multiplied by the sum of one plus the suma of the amounts shown in Column E, and the Percentage Change for each example will equal the quotient of (i) the Final Basket Level for such example minus the Initial Basket Level divided by (ii) the Initial Basket

Level, expressed as a percentage. The values below have been rounded for ease of analysis.

The hypothetical Initial Index Level for each Basket Component of 100.00 has been chosen for illustrative purposes only and does not represent a likely Initial Index Level for

any Basket Component. Because each hypothetical Initial Index Level has been set to 100.00, these examples do not accurately reflect the differences in the levels of the Basket Components. For historical data regarding the actual historical levels

of the Basket Components, please see the historical information set forth below under “Information Regarding the Basket Components — Historical Information of the Basket Components”.

Example 1: The Final Basket Level is greater than the Cap Level. The Payment at Maturity equals the Maximum Payment Amount.

|

Column A |

Column B |

Column C |

Column D |

Column E |

||||||

|

Hypothetical Initial Index |

Hypothetical Final Index Level |

|||||||||

|

EURO STOXX 50® Index |

100.00 |

170.00 |

70.00% |

36.00% |

0.2520 |

|||||

|

TOPIX |

100.00 |

170.00 |

70.00% |

27.00% |

0.1890 |

|||||

|

FTSE® 100 Index |

100.00 |

170.00 |

70.00% |

19.00% |

0.1330 |

|||||

|

Swiss Market Index |

100.00 |

170.00 |

70.00% |

10.00% |

0.0700 |

|||||

|

S&P/ASX 200 Index |

100.00 |

170.00 |

70.00% |

8.00% |

0.0560 |

|||||

Final Basket Level = 100 x (1 + (0.2520+ 0.1890 + 0.1330 + 0.0700 + 0.0560)) = 170.00

In this example, all of the hypothetical Final Index Levels for the Basket Components are greater than the applicable hypothetical Initial Index Levels, which results in the

hypothetical Final Basket Level being greater than the Initial Basket Level of 100.00. Because the hypothetical Final Basket Level of 170.00 is greater than the Cap Level, the hypothetical Payment at Maturity that we would pay on your Notes would

be capped at the Maximum Payment Amount of $1,553.20 for each $1,000 Principal Amount of your Notes (i.e. 155.320% of each $1,000 Principal Amount of your Notes).

Example 2: The Final Basket Level is greater than the Initial Basket Level but less than the Cap Level.

|

Column A |

Column B |

Column C |

Column D |

Column E |

||||||

|

Hypothetical Initial Index Level |

Hypothetical Final Index Level |

|||||||||

|

EURO STOXX 50® Index |

100.00 |

101.00 |

1.00% |

36.00% |

0.0036 |

|||||

|

TOPIX |

100.00 |

102.00 |

2.00% |

27.00% |

0.0054 |

|||||

|

FTSE® 100 Index |

100.00 |

103.00 |

3.00% |

19.00% |

0.0057 |

|||||

|

Swiss Market Index |

100.00 |

120.00 |

20.00% |

10.00% |

0.0200 |

|||||

|

S&P/ASX 200 Index |

100.00 |

135.00 |

35.00% |

8.00% |

0.0280 |

Final Basket Level = 100 x (1 + (0.0036 + 0.0054 + 0.0057 + 0.0200 + 0.0280)) = 106.27

Percentage Change = (106.27 – 100.00) / 100.00 = 6.27%

In this example, all of the hypothetical Final Index Levels for the Basket Components are greater than the applicable hypothetical Initial Index Levels, which results in the

hypothetical Final Basket Level being greater than the Initial Basket Level of 100.00. Because the hypothetical Final Basket Level of 106.27 is greater than the Initial Basket Level but less than the Cap Level, the hypothetical Payment at Maturity

for each $1,000 Principal Amount of your Notes will equal:

Payment at Maturity = $1,000 + ($1,000 × 300.00% × 6.27%) = $1,188.10

Example 3: The Final Basket Level is equal to the Initial Basket Level. The Payment at Maturity equals the $1,000 Principal Amount.

|

Column A |

Column B |

Column C |

Column D |

Column E |

||||||

|

Hypothetical Initial Index Level |

Hypothetical Final Index Level |

|||||||||

|

EURO STOXX 50® Index |

100.00 |

95.00 |

-5.00% |

36.00% |

-0.0180 |

|||||

|

TOPIX |

100.00 |

105.00 |

5.00% |

27.00% |

0.0135 |

|||||

|

FTSE® 100 Index |

100.00 |

95.00 |

-5.00% |

19.00% |

-0.0095 |

|||||

|

Swiss Market Index |

100.00 |

105.00 |

5.00% |

10.00% |

0.0050 |

|||||

|

S&P/ASX 200 Index |

100.00 |

111.25 |

11.25% |

8.00% |

0.0090 |

Final Basket Level = 100 x (1 + (-0.0180 + 0.0135 + -0.0095 + 0.0050 + 0.0090)) = 100.00

In this example, the hypothetical Final Index Levels of the EURO STOXX 50® Index and the FTSE® 100 Index are less than their applicable hypothetical Initial Index Levels, while

the hypothetical Final Index Levels of the TOPIX, the Swiss Market Index and the S&P/ASX 200 Index are greater than their applicable Initial Index Levels. Because the hypothetical Final Basket Level of 100.00 is equal to the Initial Basket

Level, the hypothetical Payment at Maturity for each $1,000 Principal Amount of your Notes will equal the Principal Amount of the Note, or $1,000.

Example 4: The Final Basket Level is less than the Initial Basket Level. The Payment at Maturity is less than the $1,000 Principal Amount.

|

Column A |

Column B |

Column C |

Column D |

Column E |

||||||

|

Hypothetical Initial Index Level |

Hypothetical Final Index Level |

|||||||||

|

EURO STOXX 50® Index |

100.00 |

35.00 |

-65.00% |

36.00% |

-0.2340 |

|||||

|

TOPIX |

100.00 |

90.00 |

-10.00% |

27.00% |

-0.0270 |

|||||

|

FTSE® 100 Index |

100.00 |

100.00 |

0.00% |

19.00% |

0.0000 |

|||||

|

Swiss Market Index |

100.00 |

135.00 |

35.00% |

10.00% |

0.0350 |

|||||

|

S&P/ASX 200 Index |

100.00 |

135.00 |

35.00% |

8.00% |

0.0280 |

Final Basket Level = 100 x (1 + (-0.2340 + -0.0270 + 0.0000 + 0.0350 + 0.0280)) = 80.20

Percentage Change = (80.20 – 100.00) / 100.00 = -19.80%

In this example, the hypothetical Final Index Levels of the EURO STOXX 50® Index and the TOPIX are less than their applicable hypothetical Initial Index Levels, while the hypothetical

Final Index Level of the FTSE® 100 Index is equal to its hypothetical Initial Index Level and the hypothetical Final Index Levels of the Swiss Market Index and the S&P/ASX 200 Index are greater than their applicable Initial Index

Levels.

Because the Basket is unequally weighted, increases in the lower weighted Basket Components will be offset by decreases in the more heavily weighted Basket Components. In this example, the large

decline in the EURO STOXX 50® Index and the TOPIX results in the hypothetical Final Basket Level being less than the Initial Basket Level, even though the FTSE® 100 Index remained flat and the Swiss Market Index and the

S&P/ASX 200 Index increased.

Because the hypothetical Final Basket Level of 80.20 is less than the Initial Basket Level, the hypothetical Payment at Maturity for each $1,000 Principal Amount of your Notes

will equal:

Payment at Maturity = $1,000 + ($1,000 × -19.80%) = $802.00

Example 5: The Final Basket Level is less than the Initial Basket Level. The Payment at Maturity is less than the $1,000 Principal Amount.

|

Column A |

Column B |

Column C |

Column D |

Column E |

||||||

|

Hypothetical Initial Index Level |

Hypothetical Final Index Level |

|||||||||

|

EURO STOXX 50® Index |

100.00 |

50.00 |

-50.00% |

36.00% |

-0.1800 |

|||||

|

TOPIX |

100.00 |

60.00 |

-40.00% |

27.00% |

-0.1080 |

|||||

|

FTSE® 100 Index |

100.00 |

60.00 |

-40.00% |

19.00% |

-0.0760 |

|||||

|

Swiss Market Index |

100.00 |

65.00 |

-35.00% |

10.00% |

-0.0350 |

|||||

|

S&P/ASX 200 Index |

100.00 |

55.00 |

-45.00% |

8.00% |

-0.0360 |

Final Basket Level = 100 x (1 + (-0.1800 + -0.1080 + -0.0760 + -0.0350 + -0.0360)) = 56.50

Percentage Change = (56.50 – 100.00) / 100.00 = -43.50%

In this example, the hypothetical Final Index Levels for all of the Basket Components are less than the applicable hypothetical Initial Index Levels, which results in the

hypothetical Final Basket Level being less than the Initial Basket Level of 100.00. Because the hypothetical Final Basket Level of 56.50 is less than the Initial Basket Level, the hypothetical Payment at Maturity for each $1,000 Principal Amount of

your Notes will equal:

Payment at Maturity = $1,000 + ($1,000 × -43.50%) = $565.00

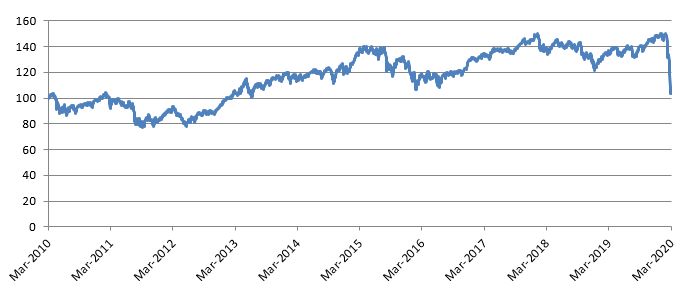

The following chart shows a graphical illustration of the hypothetical Payment at Maturity that we would pay on your Notes on the Maturity Date, if the Final Basket Level were

any of the hypothetical levels shown on the horizontal axis. The hypothetical Payments at Maturity in the chart are expressed as percentages of the Principal Amount of your Notes and the hypothetical Final Basket Levels are expressed as percentages

of the Initial Basket Level. The chart shows that any hypothetical Final Basket Level of less than 100.000% (the section left of the 100.000% marker on the horizontal axis) would result in a hypothetical Payment at Maturity of less than 100.000% of

the Principal Amount of your Notes (the section below the 100.000% marker on the vertical axis) and, accordingly, in a loss of principal to the holder of the Notes. The chart also shows that any hypothetical Final Basket Level of greater than or

equal to 118.440% (the section right of the 118.440% marker on the horizontal axis) would result in a capped return on your investment.

los Payments at Maturity shown above are entirely hypothetical; they are based on levels of the Basket that may not be achieved on the

Valuation Date and on assumptions that may prove to be erroneous. The actual market value of your Notes on the Maturity Date or at any other time, including any time you may wish to sell your Notes, may bear little relation to the hypothetical

Payment at Maturity shown above, and these amounts should not be viewed as an indication of the financial return on an investment in the offered Notes. The hypothetical Payment at Maturity on the Notes in the examples above assume you purchased

your Notes at their Principal Amount and have not been adjusted to reflect the actual public offering price you pay for your Notes. The return on your investment (whether positive or negative) in your Notes will be affected by the amount you pay

for your Notes. If you purchase your Notes for a price other than the Principal Amount, the return on your investment will differ from, and may be significantly less than, the hypothetical returns suggested by the above examples. Please read

“Additional Risk Factors Specific to the Notes — The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” beginning on page PS-7 of the product prospectus supplement.

Payments on the Notes are economically equivalent to the amounts that would be paid on a combination of other instruments. For example, payments on the Notes are economically

equivalent to a combination of a non-interest-bearing bond bought by the holder and one or more options entered into between the holder and us (with one or more implicit option premiums paid over time). The discussion in this paragraph does not

modify or affect the terms of the Notes or the U.S. federal income tax treatment of the Notes, as described elsewhere in this pricing supplement.

|

We cannot predict the actual Final Basket Level or what the market value of your Notes will be on any particular Trading |

Information Regarding The Basket Components

All disclosures contained in this pricing supplement regarding the Basket Components, including, without limitation, their make-up, methods of calculation, and changes in their

components, have been derived from publicly available sources. The information reflects the policies of, and is subject to change by, the Index Sponsors. Each Index Sponsor, which owns the copyright and all other rights to the relevant Basket

Component, has no obligation to continue to publish, and may discontinue publication of, the relevant Basket Component. The consequences of an Index Sponsor discontinuing publication of the relevant Basket Component are discussed in the section of

the product prospectus supplement entitled “General Terms of the Notes — Unavailability of the Level of the Reference Asset.” Neither we nor TDS accepts any responsibility for the calculation, maintenance or publication of any Basket Component or

any successor index. None of the websites referenced in the Basket Component descriptions below, or any materials included in those websites, are incorporated by reference into this pricing supplement or any document incorporated herein by

reference.

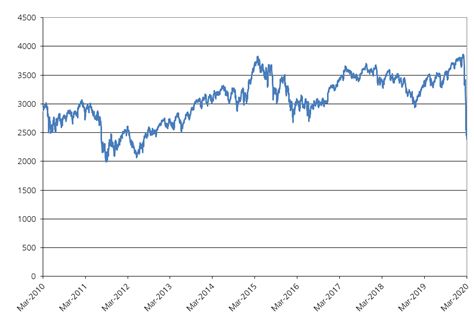

EURO STOXX 50® Index (“SX5E”)

The SX5E is a free-float market capitalization-weighted index of 50 European blue-chip stocks. The 50 stocks included in the SX5E trade in euros, and are allocated based on their

country of incorporation, primary listing and largest trading volume, to one of the following countries: Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain, which we refer to collectively as

the Eurozone. Companies allocated to a Eurozone country but not traded in Euros are not eligible for inclusion in the SX5E. The SX5E was created by and is sponsored and maintained by STOXX Limited. Publication of the SX5E began on February 26,

1998, based on an initial index value of 1,000 at December 31, 1991. The level of the SX5E is disseminated on the STOXX Limited website. STOXX Limited is under no obligation to continue to publish the SX5E and may discontinue publication of it at

any time. Additional information regarding the SX5E may be obtained from the STOXX Limited website: stoxx.com.

The top ten Basket Component Constituents of the SX5E as of January 31, 2020, by weight, are: SAP SE (4.91%), Total S.A. (4.51%), ASML Holding N.V. (4.15%), LVMH Moët Hennessy Louis

Vuitton SE (4.05%), Linde plc (3.89%), Sanofi (3.78%), Allianz SE (3.45%), Siemens AG (3.42%), Unilever N.V. (2.94%) and Airbus SE (2.93%).

As of January 31, 2020, the top ten industry sectors which comprise the SX5E represent the following weights in the SX5E: Industrial Goods & Services (11.5%), Personal &

Household Goods (11.3%), Technology (11.0%), Health Care (10.1%), Banks (9.4%), Chemicals (8.4%), Insurance (6.8%), Oil & Gas (5.7%), Utilities (5.6%) and Food & Beverage (4.0%). Percentages may not sum to 100% due to rounding. Sector

designations are determined by STOXX using criteria it has selected or developed. Index sponsors may use very different standards for determining sector designations. In addition, many companies operate in a number of sectors, but are listed in

only one sector and the basis on which that sector is selected may also differ. As a result, sector comparisons between indices with different index sponsors may reflect differences in methodology as well as actual differences in the sector

composition of the indices.

As of January 31, 2020, the eight countries which comprise the SX5E represent the following weights in the SX5E: France (38.9%), Germany (32.0%), Netherlands (10.9%), Spain (9.2%),

Italy (5.0%), Belgium (2.2%), Ireland (1.0%) and Finland (0.8%); Constituent, Sector and Country weightings may be found at stoxx.com/download/indices/factsheets/SX5GT.pdf and are updated periodically.

The above information was derived from information prepared by STOXX Limited, however, the percentages we have listed above are approximate and may not match the information

available on STOXX Limited's website due to subsequent corporation actions or other activity relating to a particular stock.

SX5E Composition.

The SX5E is composed of 50 Basket Component Constituents chosen by STOXX Limited from the 19 EURO STOXX Supersector indices, which represent the Eurozone portion of the STOXX Europe

600 Supersector indices. The 19 supersectors from which stocks are selected for the SX5E are Automobiles & Parts, Banks, Basic Resources, Chemicals, Construction & Materials, Financial Services, Food & Beverages, Health Care, Industrial

Goods & Services, Insurance, Media, Oil & Gas, Personal & Household Goods, Real Estate, Retail, Technology, Telecommunications, Travel & Leisure and Utilities, although stocks from each of these supersectors are not necessarily

included at a given time.

Component Selection

The composition of the SX5E is reviewed by STOXX Limited annually in September. Within each of the 10 EURO STOXX Supersector indices, the respective Basket Component Constituents are

ranked by free-float market capitalization. The largest stocks are added to the selection list until the coverage is close to, but still less than, 60% of the free-float market capitalization of the corresponding EURO STOXX Total Market Index

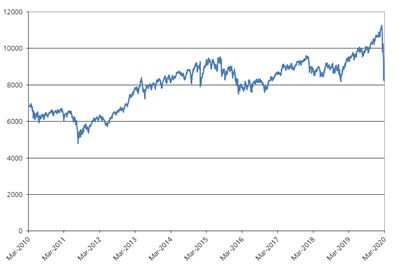

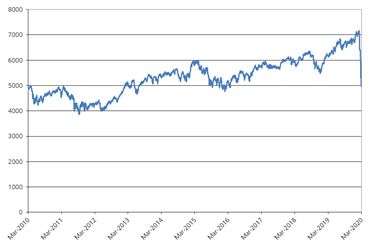

Supersector Index. If the next highest-ranked stock brings the coverage closer to 60% in absolute terms, then it is also added to the selection list. All remaining stocks that are current SX5E components are then added to the selection list. los