Entra en Wall Street con StreetInsider Premium. Reclama tu prueba gratuita de 1 semana aquí.

| Archivo de la Ley de 1933 No. | 33-54445 |

| Acta de 1940 Archivo No. | 811-7193 |

Formulario N-1A

COMISIÓN NACIONAL DEL MERCADO DE VALORES

Washington, DC 20549

| DECLARACIÓN DE REGISTRO BAJO LA LEY DE VALORES DE 1933 | ||||

| Enmienda pre-efectiva No. | ||||

| Enmienda posterior a la vigencia No. | 102 | |||

| y / o | ||||

| DECLARACIÓN DE REGISTRO BAJO LA LEY DE LA COMPAÑÍA DE INVERSIONES DE 1940 | ||||

| Enmienda No. | 103 | |||

CONFIANZA INSTITUCIONAL FEDERADA

(Nombre exacto del registrante como se especifica en la Carta)

Fondos de inversores federados

4000 Ericsson Drive

Warrendale, PA 15086-7561

(Dirección de las oficinas ejecutivas principales)

(412) 288-1900

(Número de teléfono del registratario, incluido

Codigo de AREA)

Peter J. Germain, Esquire

Torre de inversores federados

Pittsburgh, Pennsylvania 15222-3779

(Nombre y dirección del agente de servicio)

| Se propone que esta presentación sea efectiva (marque la casilla correspondiente): | |||

| X | inmediatamente después de la presentación de conformidad con el párrafo (b) | ||

| en conformidad con el párrafo (b) | |||

| 60 días después de la presentación de conformidad con el párrafo (a) (1) | |||

| en | de conformidad con el párrafo (a) (1) | ||

| 75 días después de la presentación de conformidad con el párrafo (a) (2) | |||

| en | de conformidad con el párrafo (a) (2) de la Regla 485 | ||

| Si corresponde, marque la siguiente casilla: | |||

| Esta enmienda posterior a la vigencia designa una nueva fecha de vigencia para una enmienda posterior a la vigencia presentada anteriormente. | |||

Folleto

31 de diciembre de 2019

| Clase de acciones El | Corazón | Institucional El | FIHBX | R6 El | FIHLX |

Institucional Federado

Fondo de bonos de alto rendimiento

Una cartera de federados

Fideicomiso Institucional

Una búsqueda de fondos mutuos

altos ingresos corrientes al invertir principalmente en valores de renta fija corporativos de menor calificación, incluidos valores de deuda emitidos por empresas estadounidenses o extranjeras.

Como con todos los fondos mutuos,

La Comisión de Bolsa y Valores (SEC) no aprobó ni desaprobó estos valores ni aprobó la adecuación de este Folleto. Cualquier representación en contrario es un delito penal.

IMPORTANTE

AVISO A LOS ACCIONISTAS

A partir del 1 de enero,

2021, según lo permitido por las regulaciones adoptadas por la Comisión de Bolsa y Valores, las copias en papel de los informes de accionistas del Fondo ya no se enviarán por correo, a menos que solicite específicamente copias en papel de

informes del Fondo o de su intermediario financiero, como un corredor de bolsa o banco. En cambio, los informes estarán disponibles en un sitio web, y se le notificará por correo cada vez que se publique un informe y

provisto de un enlace al sitio web para acceder al informe.

Si ya elegiste

reciba informes de los accionistas de forma electrónica, no se verá afectado por este cambio y no necesita tomar ninguna medida. Puede optar por recibir informes de accionistas y otras comunicaciones del Fondo o de su

intermediario financiero electrónicamente poniéndose en contacto con su intermediario financiero (como un corredor de bolsa o banco); otros accionistas pueden llamar al Fondo al 1-800-341-7400, Opción 4.

Puedes elegir recibir

Todos los informes futuros en papel sin cargo. Puede informar al Fondo o a su intermediario financiero que desea continuar recibiendo copias en papel de sus informes de accionistas comunicándose con su intermediario financiero

(como un corredor de bolsa o banco); otros accionistas pueden llamar al Fondo al 1-800-341-7400, Opción 4. Su elección de recibir informes en papel se aplicará a todos los fondos mantenidos con el complejo del Fondo o su

intermediario.

No está asegurado por la FDIC ■ Mayo

Perder valor ■ Sin garantía bancaria

Resumen del fondo

Información

Alto rendimiento institucional federado

Fondo de Bonos (el "Fondo")

RESUMEN DE RIESGO / RETORNO: INVERSIÓN

OBJETIVO

los

El objetivo de inversión del fondo es buscar altos ingresos corrientes.

RESUMEN DE RIESGO / RETORNO: HONORARIOS Y

GASTOS

Esta

La tabla describe los honorarios y gastos que puede pagar si compra y mantiene las Acciones Institucionales (IS) y las Acciones de Clase R6 (R6) del Fondo. Si compra las Acciones del Fondo a través de un corredor que actúa como agente en representación

de sus clientes, es posible que deba pagar una comisión a dicho corredor; tales comisiones, si las hay, no se reflejan en el Ejemplo a continuación.

| Honorarios de los accionistas (honorarios pagados directamente de su inversión) | ES | R6 |

|

Cargo máximo de ventas (carga) impuesto a las compras (como porcentaje del precio de oferta) |

Ninguna | Ninguna |

|

Cargo máximo de ventas diferidas (carga) (como un porcentaje del precio de compra original o de los ingresos por canje, según corresponda) |

Ninguna | Ninguna |

|

Cargo máximo de venta (carga) impuesto a los dividendos reinvertidos (y otras distribuciones) (como porcentaje del precio de oferta) |

Ninguna | Ninguna |

|

Tarifa de canje (como porcentaje del monto canjeado, si corresponde) |

Ninguna | Ninguna |

|

Tarifa de cambio |

Ninguna | Ninguna |

| Gastos operativos anuales del fondo (gastos que paga cada año como porcentaje del valor de su inversión) | ||

|

Comisión de gestión |

0,40% | 0,40% |

|

Tarifa de distribución (12b-1) |

Ninguna | Ninguna |

|

Otros gastos |

0,15% | 0,11% |

|

Gastos operativos totales del fondo anual |

0,55% | 0,51% |

|

Exenciones de tarifas y / o reembolsos de gastos1 |

(0.05)% | (0.02)% |

|

Gastos operativos totales del fondo anual después de exenciones de tarifas y / o reembolsos de gastos |

0,50% | 0,49% |

| 1 | El Asesor y algunos de sus afiliados por propia iniciativa han acordado renunciar a ciertos montos de sus respectivas tarifas y / o reembolsar los gastos. Total de gastos operativos anuales del fondo (excluyendo honorarios y gastos adquiridos del fondo, gastos por intereses, gastos extraordinarios y gastos relacionados con poderes pagados por el Fondo, si corresponde) pagados por la clase IS del Fondo y acciones R6 (después de las exenciones voluntarias y / o reembolsos) no excederá del 0,49% y el 0,48% (el "Límite de tarifa"), respectivamente, hasta, pero sin incluir el último de (la "Fecha de terminación"): (a) 1 de enero de 2021; o (b) la fecha de la Próximo Folleto efectivo del Fondo. Si bien el Asesor y sus afiliados actualmente no anticipan la terminación o el aumento de estos acuerdos antes de la Fecha de terminación, estos acuerdos solo pueden terminarse o el Límite de tarifa aumentó antes de la Fecha de finalización con el acuerdo de la Junta de Fideicomisarios del Fondo. |

Ejemplo

Esta

El objetivo de Ejemplo es ayudarlo a comparar el costo de invertir en el Fondo con el costo de invertir en otros fondos mutuos.

los

El ejemplo supone que invierte $ 10,000 por los períodos de tiempo indicados y luego canjea todas sus Acciones al final de esos períodos. El ejemplo también supone que su inversión tiene un retorno del 5% cada año y que

Los gastos operativos son los que se muestran en la tabla anterior y siguen siendo los mismos. Aunque sus costos y retornos reales pueden ser más altos o más bajos, según estos supuestos, sus costos serían:

| Clase de acciones | 1 año | 3 años | 5 años | 10 años |

| ES | $ 56 | $ 176 | $ 307 | $ 689 |

| R6 | $ 52 | $ 164 | $ 285 | $ 640 |

Volumen de negocios de cartera

El Fondo paga los costos de transacción, como las comisiones, cuando compra y vende valores (o "entrega" su cartera). Una tasa de rotación de cartera más alta puede indicar una mayor

costos de transacción y pueden generar impuestos más altos cuando las Acciones del Fondo se mantienen en una cuenta sujeta a impuestos. Estos costos, que no se reflejan en los Gastos operativos anuales del Fondo o en el Ejemplo, afectan el rendimiento del Fondo.

Durante el año fiscal más reciente, la tasa de rotación de la cartera del Fondo fue del 26% del valor promedio de su cartera.

RESUMEN DE RIESGO / RETORNO: INVERSIONES,

RIESGOS Y RENDIMIENTO

¿Cuáles son los principales del fondo?

Estrategias de inversión?

los

El Fondo persigue su objetivo de inversión invirtiendo principalmente en una cartera diversificada de bonos corporativos de alto rendimiento (también conocidos como "bonos basura"), que incluyen títulos de deuda emitidos por EE. UU. O extranjeros

empresas (incluidos los valores de deuda de mercados emergentes). El asesor de inversiones del Fondo (el "Asesor") selecciona valores que considera que tienen características atractivas de riesgo-rendimiento. El consejero

El proceso de selección de valores incluye un análisis de la condición financiera del emisor, la fortaleza del negocio y del producto, la posición competitiva y la experiencia en gestión. El Asesor no limita las inversiones del Fondo a

valores de un rango de vencimiento particular.

los

El Fondo puede invertir en contratos de derivados (por ejemplo, contratos de futuros, contratos de opciones y contratos de intercambio) para implementar sus estrategias de inversión como se describe más detalladamente en el Folleto del Fondo. No puede haber

Garantía de que el uso del Fondo de contratos derivados o instrumentos híbridos funcionará según lo previsto. Las inversiones derivadas realizadas por el Fondo se incluyen dentro de la política del 80% del Fondo (como se describe a continuación) y son

calculado a valor de mercado.

los

El Fondo invertirá sus activos para que al menos el 80% de sus activos netos (más cualquier préstamo para fines de inversión) se invierta en inversiones calificadas por debajo del grado de inversión. El Fondo notificará a los accionistas por adelantado

de cualquier cambio en su política de inversión que permita al Fondo invertir, en circunstancias normales, menos del 80% de sus activos netos en inversiones calificadas por debajo del grado de inversión.

¿Cuáles son los principales riesgos de

¿Invertir en el fondo?

Todos

los fondos mutuos asumen riesgos de inversión. Por lo tanto, es posible perder dinero invirtiendo en el Fondo. Los factores principales que pueden reducir los rendimientos del Fondo incluyen:

| ■ | Riesgo asociado con valores sin grado de inversión. Los valores con calificación inferior al grado de inversión pueden estar sujetos a mayores riesgos de tasa de interés, crédito y liquidez que los valores con grado de inversión. Estos valores se consideran especulativos. con respecto a la capacidad del emisor para pagar intereses y pagar el principal. |

| ■ | Riesgo de crédito del emisor. Es posible que los intereses o el principal de los valores no se paguen a su vencimiento. Los valores sin grado de inversión generalmente tienen un mayor riesgo de incumplimiento que los valores con grado de inversión. Tal la falta de pago o incumplimiento puede reducir el valor de las carteras del Fondo, el precio de sus acciones y su rendimiento. |

| ■ | Riesgo de crédito de contraparte. El riesgo de crédito incluye la posibilidad de que una parte de una transacción que involucre al Fondo no cumpla con sus obligaciones. Esto podría hacer que el Fondo pierda dinero o pierda el beneficio de la transacción o evitar que el Fondo venda o compre otros valores para implementar su estrategia de inversión. |

| ■ | Riesgo relacionado con la economía. El valor de la cartera del Fondo puede disminuir conjuntamente con una caída en el valor general de los mercados en los que invierte el Fondo y / u otros mercados. Económica, política y financiera. las condiciones, o tendencias y desarrollos económicos o de la industria, pueden ocasionalmente y por períodos de tiempo variables, causar que el Fondo experimente volatilidad, falta de liquidez, amortizaciones de accionistas u otros posibles efectos adversos. Entre otras inversiones, los bonos y préstamos de baja calificación pueden ser particularmente sensibles a los cambios en la economía. |

| ■ | Riesgo de liquidez. La liquidez de los bonos corporativos individuales varía considerablemente. Los bonos corporativos de baja calificación tienen menos liquidez que los valores de inversión, lo que significa que puede ser más difícil vender o comprar un valor a un precio o tiempo favorable. |

| ■ | Riesgo de tipo de interés. Los precios de los valores de renta fija generalmente caen cuando las tasas de interés aumentan. Cuanto mayor sea la duración de una garantía de renta fija, más susceptible será al riesgo de tasa de interés. Reciente y Es probable que los posibles cambios futuros en la política monetaria realizados por los bancos centrales y / o sus gobiernos afecten el nivel de las tasas de interés. |

| ■ | Riesgo de inversión extranjera. Debido a que el Fondo invierte en valores emitidos por compañías extranjeras y gobiernos nacionales, el precio de las Acciones del Fondo puede verse más afectado por las condiciones económicas y políticas extranjeras, políticas tributarias y estándares de contabilidad y auditoría que de otro modo podrían ser el caso. |

| ■ | Riesgo de cambio. Los tipos de cambio para las monedas fluctúan diariamente. El valor de las inversiones extranjeras del Fondo y el valor de las acciones pueden verse afectados favorable o desfavorablemente por los cambios de moneda. tipos de cambio relativos al dólar estadounidense. |

| ■ | Riesgo relacionado con la eurozona. Varios países de la Unión Europea (UE) han experimentado y pueden seguir experimentando graves dificultades económicas y financieras. Otros países miembros de la UE también pueden caer sujeto a tales dificultades. Estos eventos podrían afectar negativamente el valor y la liquidez de las inversiones del Fondo en valores denominados en euros y contratos de derivados, valores de emisores ubicados en la UE o con exposición significativa a emisores o países de la UE. |

| ■ | Riesgo de apalancamiento. El riesgo de apalancamiento se crea cuando una inversión expone al Fondo a un nivel de riesgo que excede el monto invertido. |

| ■ | Riesgo de invertir en países de mercados emergentes. Los valores emitidos o negociados en mercados emergentes generalmente conllevan mayores riesgos que los valores emitidos o negociados en mercados desarrollados. |

| ■ | Riesgo de invertir en contratos derivados e instrumentos híbridos. Los contratos derivados y los instrumentos híbridos implican riesgos diferentes o posiblemente mayores que los riesgos asociados con la inversión directa en valores y otros instrumentos tradicionales. inversiones. Los problemas de riesgo específicos relacionados con el uso de tales contratos e instrumentos incluyen problemas de valoración e impuestos, un mayor potencial de pérdidas y / o costos para el Fondo, y una posible reducción en las ganancias para el fondo. Cada uno de estos temas se describe con mayor detalle en este prospecto. |

| ■ | Riesgo de pérdida después de la redención. El Fondo también puede invertir en instrumentos de préstamo de financiación del comercio principalmente invirtiendo en otras compañías de inversión (que no están disponibles para inversión general por parte del público) que poseen instrumentos, es asesorado por un afiliado del Asesor y está estructurado como un fondo de pago extendido. |

| ■ | Riesgo tecnológico. El Asesor utiliza diversas tecnologías en la gestión del Fondo, de acuerdo con su objetivo y estrategia de inversión descritos en este Folleto. Por ejemplo, datos de propiedad y de terceros. y los sistemas se utilizan para apoyar la toma de decisiones para el Fondo. La imprecisión de datos, el mal funcionamiento del software u otra tecnología, las imprecisiones de programación y circunstancias similares pueden afectar el rendimiento de estos sistemas, que pueden afectar negativamente el rendimiento del Fondo. |

los

Las acciones ofrecidas por este Folleto no son depósitos u obligaciones de ningún banco, no están respaldadas ni garantizadas por ningún banco y no están aseguradas ni garantizadas por el gobierno de EE. UU., El Seguro Federal de Depósitos

Corporación, la Junta de la Reserva Federal o cualquier otra agencia gubernamental.

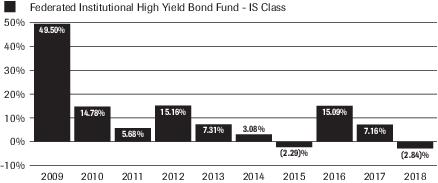

Rendimiento: gráfico de barras y

Mesa

Gráfico de barras de riesgo / retorno

El bar

El cuadro y la tabla de rendimiento a continuación reflejan los datos históricos de rendimiento del Fondo y están destinados a ayudarlo a analizar los riesgos de inversión del Fondo a la luz de sus rendimientos históricos. El gráfico de barras muestra el

variabilidad de los rendimientos totales de la clase IS del Fondo año por año calendario. La tabla de retorno total anual promedio muestra los retornos promediado durante los períodos establecidos, e incluye información comparativa de rendimiento. El rendimiento del Fondo fluctuará, y el rendimiento pasado (antes y después de impuestos) no es necesariamente una indicación de resultados futuros. Información de rendimiento actualizada para el Fondo

está disponible en la sección "Productos" en FederatedInvestors.com o llamando al 1-800-341-7400.

<! – 40 comienzo de la descripción gráfica:

<! – 40 comienzo de la descripción gráfica:| Fondo de bonos de alto rendimiento institucional federado – | Clase IS |

| 2009 | 49,50% |

| 2010 | 14,78% |

| 2011 | 5,68% |

| 2012 | 15,16% |

| 2013 | 7,31% |

| 2014 | 3,08% |

| 2015 | -2,29% |

| 2016 | 15,09% |

| 2017 | 7,16% |

| 2018 | -2,84% |

41 descripción gráfica final ->

El IS del fondo

El rendimiento total de la clase para el período de nueve meses desde el 1 de enero de 2019 hasta el 30 de septiembre de 2019 fue del 11.86%.

Dentro de los períodos mostrados en el

gráfico de barras, el rendimiento trimestral más alto de la clase IS del Fondo fue del 18,11% (trimestre finalizado el 30 de junio de 2009). Su rendimiento trimestral más bajo fue de (4.97)% (trimestre terminado el 30 de septiembre de 2011).

Retorno total anual promedio

Mesa

los

La clase R6 del Fondo comenzó a operar el 29 de junio de 2016. Para los períodos anteriores al comienzo de las operaciones de la clase R6 del Fondo, la información de rendimiento que se muestra a continuación es para la clase IS del Fondo. los

el rendimiento de la clase IS no se ha ajustado para reflejar los gastos aplicables a la clase R6, ya que la clase R6 tiene un índice de gastos más bajo que el índice de gastos de la clase IS. El rendimiento de la clase IS

se ha ajustado para eliminar cualquier exención voluntaria de los gastos del Fondo relacionados con la clase IS que pueda haber ocurrido durante los períodos anteriores al comienzo de las operaciones de la clase R6, lo que habría causado el

Los gastos de la clase IS serán más bajos que los gastos brutos de la clase R6. La clase R6 del Fondo tendría rendimientos anuales sustancialmente similares a los de la clase IS porque las acciones se invierten en la misma cartera

de valores y los rendimientos anuales diferirían solo en la medida en que las clases no tengan los mismos gastos. Además de Devolución antes de impuestos, se muestra Devolución después de impuestos para la clase IS del Fondo

ilustran el efecto de los impuestos federales en los rendimientos del Fondo. Las declaraciones después de impuestos se muestran solo para la clase IS, y las declaraciones después de impuestos para la clase R6 serán diferentes de las que se muestran para la clase IS. Las declaraciones reales después de impuestos dependen de la situación fiscal personal de cada inversor y es probable que difieran de las mostradas. Las declaraciones después de impuestos se calculan utilizando un conjunto estándar de

Suposiciones Los rendimientos declarados suponen el más alto histórico federal tasas impositivas de ingresos y ganancias de capital. Estas declaraciones después de impuestos hacen no reflejar el efecto de cualquier aplicable estado y local impuestos. Las declaraciones después de impuestos no son relevantes para los inversores que poseen Acciones a través de un plan 401 (k), una Cuenta de Retiro Individual u otro plan de inversión con ventajas impositivas.

(Para el

Período finalizado el 31 de diciembre de 2018)

| 1 año | 5 años | 10 años | |

| ES: | |||

| Devolución antes de impuestos | (2,84)% | 3.83% | 10,46% |

| Devolución después de impuestos sobre distribuciones | (5,14)% | 1,24% | 7,41% |

| Devolución después de impuestos sobre distribuciones y venta de acciones de fondos | (1.64)% | 1,76% | 7,08% |

| R6: | |||

| Devolución antes de impuestos | (2,82)% | 3.83% | 10,41% |

| Bloomberg Barclays Índice corporativo de alto rendimiento del 2% del emisor corporativo de EE. UU.1 (no refleja ninguna deducción por honorarios, gastos o impuestos) |

(2,08)% | 3.84% | 11,14% |

| Lipper Promedio de fondos de alto rendimiento2 | (2,99)% | 2,73% | 9.19% |

| 1 | El índice limitado de emisor del 2% del alto rendimiento corporativo Bloomberg Barclays de EE. UU. Es una versión restringida por el emisor del índice de alto rendimiento corporativo Bloomberg Barclays de EE. UU. Que mide el mercado de bonos corporativos imponibles, de tasa fija y sin grado de inversión denominados en USD. El índice sigue las mismas reglas que el índice sin límite, pero limita la exposición de cada emisor al 2% del valor total de mercado y redistribuye cualquier exceso de valor de mercado en todo el índice de forma proporcional. |

| 2 | Las cifras de Lipper representan el promedio de los rendimientos totales informados por todos los fondos mutuos designados por Lipper, Inc., como pertenecientes a la categoría respectiva y no ajustado para reflejar los cargos de venta. |

GESTIÓN DE FONDOS

los

El asesor de inversiones del Fondo es una empresa federada de gestión de inversiones.

Mark E.

Durbiano, CFA, Gerente Senior de Cartera, ha sido el gerente de cartera del Fondo desde su inicio en noviembre de 2002.

Steven

J. Wagner, Senior Portfolio Manager, ha sido el administrador de la cartera del Fondo desde diciembre de 2017.

compra y venta de fondo

Comparte

Puedes

comprar, canjear o intercambiar Acciones del Fondo en cualquier día que la Bolsa de Nueva York esté abierta. Las acciones se pueden comprar a través de una empresa intermediaria financiera que ha suscrito un servicio de venta y / o servicio del Fondo

acuerdo con el Distribuidor o un afiliado ("Intermediario financiero") o directamente del Fondo, por transferencia bancaria o por cheque. Tenga en cuenta que pueden aplicarse ciertas restricciones de compra. Canjear o intercambiar acciones

a través de un intermediario financiero o directamente del Fondo por teléfono al 1-800-341-7400 o por correo.

Clase IS

los

El monto mínimo de inversión inicial para las Acciones Institucionales del Fondo es generalmente de $ 1,000,000 y no existe un monto mínimo de inversión posterior. Ciertos tipos de cuentas son elegibles para inversiones mínimas más bajas.

El monto mínimo de inversión para los Programas de inversión sistemática es de $ 50.

Clase R6

Allí

No se requieren montos mínimos de inversión inicial o posterior. El monto mínimo de inversión para los Programas de inversión sistemática es de $ 50.

Información sobre los impuestos

Clase IS

los

Las distribuciones de los fondos están sujetas a impuestos como ingresos ordinarios o ganancias de capital, excepto cuando su inversión es a través de un plan 401 (k), una cuenta de jubilación individual u otro plan de inversión con ventajas impositivas.

Clase R6

los

Las distribuciones del fondo están sujetas a impuestos como ingresos ordinarios o ganancias de capital, excepto cuando su inversión es a través de un plan de inversión con ventajas impositivas.

Pagos a Broker-Dealers y

Otros intermediarios financieros

Clase IS

Si tu

comprar el Fondo a través de un corredor de bolsa u otro intermediario financiero (como un banco), el Fondo y / o sus compañías relacionadas pueden pagarle al intermediario por la venta de Acciones del Fondo y servicios relacionados. Estas

los pagos pueden crear un conflicto de intereses al influir en el corredor de bolsa u otro intermediario y su vendedor para recomendar el Fondo sobre otra inversión. Pregúntele a su vendedor o visite su financiero

sitio web del intermediario para más información.

Pagos a Broker-Dealers y

Otros intermediarios financieros

Clase R6

Clase

Las Acciones R6 no realizan ningún pago a los intermediarios financieros, ni de los activos del Fondo ni del asesor de inversiones y sus filiales.

¿Cuáles son los fondos?

Estrategias de inversión?

los

El objetivo de inversión del fondo es buscar altos ingresos corrientes. Si bien no hay garantía de que el Fondo logrará su objetivo de inversión, se esfuerza por lograrlo siguiendo las estrategias y políticas descritas en

Este Folleto.

los

El fondo proporciona exposición al mercado de bonos corporativos de alto rendimiento. El asesor de inversiones del Fondo (el "Asesor") gestiona activamente la cartera del Fondo buscando obtener los rendimientos potencialmente más altos de

bonos de alto rendimiento (también conocidos como "bonos basura"), en comparación con los rendimientos de los títulos de alto grado al tratar de minimizar el riesgo de incumplimiento y otros riesgos mediante una cuidadosa selección y diversificación de valores. los

El Fondo invierte principalmente en bonos nacionales de alto rendimiento, pero puede invertir una parte de su cartera en valores de emisores con sede fuera de los Estados Unidos (incluidos los mercados emergentes). Una descripción de los diferentes

Los tipos de valores en los que invierte el Fondo, y sus riesgos, siguen inmediatamente la discusión de la estrategia.

El Asesor selecciona valores que cree que tienen características atractivas de riesgo-rendimiento. Los valores en los que invierte el Fondo tienen altos rendimientos principalmente debido a la mayor rentabilidad del mercado.

incertidumbre sobre la capacidad del emisor para hacer todos los pagos de intereses y capital requeridos, y por lo tanto sobre los rendimientos que de hecho realizará el Fondo.

los

El asesor intenta seleccionar bonos para inversión del Fondo que ofrezcan altos rendimientos potenciales para los riesgos de incumplimiento asumidos. El proceso de selección de valores del Asesor consiste en un crédito intensivo,

Análisis fundamental de la empresa emisora. El análisis del Asesor se enfoca en la condición financiera de la empresa emisora junto con el negocio del emisor y la fortaleza del producto, posición competitiva y administración

pericia. Además, el Asesor considera los factores económicos, financieros y de industria actuales, que pueden afectar al emisor.

los

El asesor intenta minimizar el riesgo de crédito de la cartera del Fondo a través de la diversificación. El Asesor selecciona valores para mantener una amplia diversificación de cartera tanto por empresa como por industria. El asesor no

alcanzar un vencimiento promedio para la cartera del Fondo.

los

El Fondo puede usar contratos derivados y / o instrumentos híbridos para implementar elementos de su estrategia de inversión. Por ejemplo, el Fondo puede usar contratos derivados o instrumentos híbridos para aumentar o disminuir la

exposición de la cartera a las inversiones subyacentes al instrumento derivado o híbrido en un intento de beneficiarse de los cambios en el valor de las inversiones subyacentes. Además, a modo de ejemplo, el Fondo

puede usar contratos derivados en un intento de:

| ■ | aumentar o disminuir la duración efectiva de la cartera del Fondo; |

| ■ | obtener primas de la venta de contratos de derivados; |

| ■ | obtener ganancias de negociar un contrato de derivados; o |

| ■ | cobertura contra posibles pérdidas. |

Allí

no puede garantizarse que el uso del Fondo de contratos derivados o instrumentos híbridos funcionará según lo previsto. Las inversiones derivadas realizadas por el Fondo se incluyen dentro de la política del 80% del Fondo (como se describe a continuación) y

se calculan a valor de mercado.

los

El Fondo invertirá sus activos para que al menos el 80% de sus activos netos (más cualquier préstamo para fines de inversión) se invierta en inversiones calificadas por debajo del grado de inversión. El Fondo notificará a los accionistas por adelantado

de cualquier cambio en su política de inversión que permita al Fondo invertir, en circunstancias normales, menos del 80% de sus activos netos en inversiones calificadas por debajo del grado de inversión.

INVERSIONES TEMPORALES

los

El Fondo puede apartarse temporalmente de sus principales estrategias de inversión invirtiendo sus activos en títulos de deuda a corto plazo y obligaciones similares o manteniendo efectivo. Puede hacer esto en respuesta a inusuales

circunstancias, tales como: condiciones adversas de mercado, económicas u otras (por ejemplo, para ayudar a evitar pérdidas potenciales, o durante los períodos en que hay una escasez de valores apropiados); para mantener la liquidez para cumplir

amortizaciones de accionistas; o para acomodar entradas de efectivo. Es posible que tales inversiones afecten los rendimientos de inversión del Fondo y / o la capacidad de lograr los objetivos de inversión del Fondo.

¿Cuáles son los fondos?

Principales inversiones?

los

A continuación se proporciona información general sobre las principales inversiones del Fondo. La Declaración de información adicional (SAI) del Fondo proporciona información sobre las inversiones no principales del Fondo y puede proporcionar

Información adicional sobre las principales inversiones del Fondo.

Valores de renta fija

Los valores de renta fija pagan intereses, dividendos o distribuciones a una tasa específica. La tasa puede ser un porcentaje fijo del principal o puede ajustarse periódicamente. Además, el emisor de una renta fija

la garantía debe pagar el monto principal de la garantía, normalmente dentro de un tiempo específico. Los valores de renta fija proporcionan ingresos más regulares que los valores de renta variable. Sin embargo, los rendimientos de los valores de renta fija

son limitados y normalmente no aumentan con las ganancias del emisor. Esto limita la apreciación potencial de los valores de renta fija en comparación con los valores de renta variable.

UN

El rendimiento de la seguridad mide el ingreso anual obtenido de una seguridad como un porcentaje de su precio. El rendimiento de un valor aumentará o disminuirá dependiendo de si cuesta menos (un "descuento") o más (un

"Prima") que el monto principal. Si el emisor puede canjear el valor antes de su vencimiento programado, el precio y el rendimiento de un valor de descuento o prima pueden cambiar en función de la probabilidad de un

Redención temprana. Los valores con mayores riesgos generalmente tienen mayores rendimientos.

los

A continuación se describen los valores de renta fija en los que el Fondo invierte principalmente:

Acciones preferidas

Las acciones preferidas tienen derecho a recibir dividendos o distribuciones específicos antes de que el emisor realice pagos sobre sus acciones comunes. Algunas acciones preferentes también participan en dividendos y distribuciones pagados en

acciones comunes Las acciones preferidas también pueden permitir al emisor canjear las acciones. El Fondo también puede tratar dichas acciones preferentes rescatables como una garantía de renta fija.

Valores de deuda corporativa (tipo A

de seguridad de renta fija)

Los títulos de deuda corporativos son títulos de renta fija emitidos por empresas. Las notas, bonos, obligaciones y papel comercial son los tipos más frecuentes de títulos de deuda corporativos. El Fondo también puede comprar

participaciones en préstamos bancarios a empresas. Los riesgos crediticios de los títulos de deuda corporativos varían ampliamente entre los emisores.

En

Además, el riesgo de crédito de la garantía de la deuda del emisor puede variar en función de su prioridad de reembolso. Por ejemplo, los títulos de deuda de mayor rango ("senior") tienen mayor prioridad que los de menor rango

("Subordinados") valores. Esto significa que el emisor podría no realizar pagos en valores subordinados mientras continúa realizando pagos en valores senior. Además, en caso de quiebra,

los tenedores de valores senior pueden recibir montos pagaderos a los tenedores de valores subordinados. Algunos valores subordinados, como los pagarés preferentes y los títulos de capital, también permiten al emisor

diferir los pagos bajo ciertas circunstancias. Por ejemplo, las compañías de seguros emiten valores conocidos como bonos excedentes que permiten a la compañía de seguros diferir cualquier pago que reduzca su capital por debajo de

los requisitos reglamentarios.

Ingreso fijo de menor calificación

Valores

Los valores de renta fija de menor calificación son valores clasificados por debajo del grado de inversión (es decir, BB o inferior) por una organización de calificación estadística (NRSRO) reconocida a nivel nacional. No hay una calificación mínima aceptable para un

valores que el Fondo comprará o mantendrá y el Fondo podrá comprar o mantener valores no calificados y valores cuyos emisores están en incumplimiento.

Valores de cupón cero (un tipo de

Seguridad de Renta Fija)

Los valores de cupón cero no pagan intereses o capital hasta el vencimiento final, a diferencia de los valores de deuda que proporcionan pagos periódicos de intereses (denominado pago de cupón). Los inversores compran valores de cupón cero

a un precio inferior al monto pagadero al vencimiento. La diferencia entre el precio de compra y el monto pagado al vencimiento representa intereses sobre la garantía de cupón cero. Los inversores deben esperar hasta el vencimiento para recibir

interés y capital, lo que aumenta la tasa de interés y los riesgos crediticios de un valor de cupón cero.

Allí

Hay muchas formas de valores de cupón cero. Algunos se emiten con descuento y se denominan bonos de cupón cero o bonos de apreciación de capital. Otros se crean a partir de bonos que generan intereses separando el derecho a

recibir los pagos de cupones del bono del derecho a recibir el principal del bono que vence al vencimiento, un proceso conocido como eliminación de cupones. Además, algunos valores le dan al emisor la opción de entregar más

valores en lugar de pagos de intereses en efectivo, aumentando así la cantidad pagadera al vencimiento. Estos se conocen como pago en especie, valores PIK o valores de alternancia.

Instrumentos de demanda (un tipo de

Seguridad de la deuda corporativa)

Demanda

Los instrumentos son valores de deuda corporativa que requieren que el emisor o un tercero, como un concesionario o banco (el "Proveedor de Demanda"), recompren el valor por su valor nominal a pedido. Alguna demanda

los instrumentos son "condicionales", de modo que la ocurrencia de ciertas condiciones libera al Proveedor de la Demanda de su obligación de recomprar la garantía. Otros instrumentos de demanda son

"Incondicional", de modo que no existan condiciones bajo las cuales la obligación del Proveedor de Demanda de recomprar la garantía pueda terminar. El Fondo trata los instrumentos de demanda como valores a corto plazo, incluso

aunque su vencimiento declarado puede extenderse más allá de un año.

Valores convertibles (A

Seguridad de Renta Fija)

Los valores convertibles son valores de renta fija que el Fondo tiene la opción de cambiar por valores de renta variable a un precio de conversión específico. La opción permite al Fondo obtener rendimientos adicionales si el

El precio de mercado de los valores de renta variable supera el precio de conversión. Por ejemplo, el Fondo puede mantener valores de renta fija que sean convertibles en acciones ordinarias a un precio de conversión de $ 10 por acción. Si

el valor de mercado de las acciones ordinarias alcanzó los $ 12, el Fondo podría obtener $ 2 adicionales por acción mediante la conversión de sus valores de renta fija.

Los valores convertibles tienen rendimientos más bajos que los valores de renta fija comparables. Además, en el momento en que se emite un valor convertible, el precio de conversión excede el valor de mercado del patrimonio subyacente

valores. Thus, convertible securities may provide lower returns than non-convertible, fixed-income securities or equity securities depending upon changes in the price of the underlying equity securities. However,

convertible securities permit the Fund to realize some of the potential appreciation of the underlying equity securities with less risk of losing its initial investment.

To the

extent the Fund invests in convertible securities, it typically invests in securities that can be exchanged for instruments that are publically traded or listed on a centralized market or stock exchange. The Fund may

receive securities not publically traded or listed on a centralized market or stock exchange in connection with bankruptcies, restructurings, or other unusual circumstances.

los

Fund treats convertible securities as fixed-income securities for purposes of its investment policies and limitations, because of their unique characteristics.

FOREIGN SECURITIES

Foreign

securities are securities of issuers based outside the United States. To the extent a Fund invests in securities included in its applicable broad-based securities market index, the Fund may consider an issuer to be

based outside the United States if the applicable index classifies the issuer as based outside the United States. Accordingly, the Fund may consider an issuer to be based outside the United States if the issuer

satisfies at least one, but not necessarily all, of the following:

| ■ | it is organized under the laws of, or has its principal office located in, another country; |

| ■ | the principal trading market for its securities is in another country; |

| ■ | it (directly or through its consolidated subsidiaries) derived in its most current fiscal year at least 50% of its total assets, capitalization, gross revenue or profit from goods produced, services performed or sales made in another country; o |

| ■ | it is classified by an applicable index as based outside the United States. |

While

the Fund typically invests in U.S. dollar denominated foreign securities, the Fund may also invest in foreign securities that are denominated in foreign currencies Along with the risks normally associated with

domestic securities of the same type, foreign securities are subject to currency risks and risks of foreign investing. Trading in certain foreign markets is also subject to liquidity risks.

Foreign Exchange Contracts

En

order to convert U.S. dollars into the currency needed to buy a foreign security, or to convert foreign currency received from the sale of a foreign security into U.S. dollars, or to decrease or eliminate the Fund's

exposure to foreign currencies in which a portfolio security is denominated, the Fund may enter into spot currency trades. In a spot trade, the Fund agrees to exchange one currency for another at the current

exchange rate. The Fund may also enter into derivative contracts in which a foreign currency is an underlying asset. The exchange rate for currency derivative contracts may be higher or lower than the spot exchange

rate. Use of these derivative contracts may increase or decrease the Fund's exposure to currency risks.

Derivative Contracts

Derivative contracts are financial instruments that require payments based upon changes in the values of designated securities, commodities, currencies, indices, or other assets or instruments including other

derivative contracts, (each a “Reference Instrument” and collectively, “Reference Instruments”). Each party to a derivative contract may sometimes be referred to as a counterparty. Algunos

derivative contracts require payments relating to an actual, future trade involving the Reference Instrument. These types of derivatives are frequently referred to as “physically settled” derivatives.

Other derivative contracts require payments relating to the income or returns from, or changes in the market value of, a Reference Instrument. These types of derivatives are known as “cash-settled”

derivatives, since they require cash payments in lieu of delivery of the Reference Instrument.

Many

derivative contracts are traded on securities or commodities exchanges. In this case, the exchange sets all the terms of the contract except for the price. Investors make payments due under their contracts through the

exchange. Most exchanges require investors to maintain margin accounts through their brokers to cover their potential obligations to the exchange. Parties to the contract make (or collect) daily payments to the margin

accounts to reflect losses (or gains) in the value of their contracts. This protects investors against potential defaults by the other party to the contract. Trading contracts on an exchange also allows investors to

close out their contracts by entering into offsetting contracts.

los

Fund may also trade derivative contracts over-the-counter (OTC) in transactions negotiated directly between the Fund and a financial institution. OTC contracts do not necessarily have standard terms, so they may be

less liquid and more difficult to close out than exchange-traded contracts. In addition, OTC contracts with more specialized terms may be more difficult to value than exchange-traded contracts, especially in times of

financial stress.

los

market for swaps and other OTC derivatives was largely unregulated prior to the enactment of federal legislation known as the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank

Act”). Regulations enacted by the Commodity Futures Trading Commission (the CFTC) under the Dodd-Frank Act require the Fund to clear certain swap contracts through a clearing house or central counterparty (a

CCP).

To

clear a swap through the CCP, the Fund will submit the contract to, and post margin with, a futures commission merchant (FCM) that is a clearing house member. The Fund may enter into the swap with a financial

institution other than the FCM and arrange for the contract to be transferred to the FCM for clearing, or enter into the contract with the FCM itself. If the Fund must centrally clear a transaction, the CFTC's

regulations also generally require that the swap be executed on a registered exchange or through a market facility that is known as a swap execution facility or SEF. Central clearing is presently required only for

certain swaps; the CFTC is expected to impose a mandatory central clearing requirement for additional derivative instruments over time.

los

CCP, SEF and FCM are all subject to regulatory oversight by the CFTC. In addition, most derivative market participants are now regulated as swap dealers or major swap participants and are subject to certain minimum

capital and margin requirements and business conduct standards. Similar regulatory requirements are expected to apply to derivative contracts that are subject to the jurisdiction of the SEC, although the SEC has not

yet finalized its regulations. In addition, uncleared OTC swaps will be subject to regulatory collateral requirements that could adversely affect the Fund's ability to enter into swaps in the OTC market. These

developments could cause the Fund to terminate new or existing swap agreements or to realize amounts to be received under such instruments at an inopportune time.

Until

the mandated rulemaking and regulations are implemented completely, it will not be possible to determine the complete impact of the Dodd-Frank Act and related regulations on the Fund.

Depending on how the Fund uses derivative contracts and the relationships between the market value of a derivative contract and the Reference Instrument, derivative contracts may increase or decrease the Fund's

exposure to the risks of the Reference Instrument, and may also expose the Fund to liquidity and leverage risks. OTC contracts also expose the Fund to credit risks in the event that a counterparty defaults on the

contract, although this risk may be mitigated by submitting the contract for clearing through a CCP.

Pago

obligations arising in connection with derivative contracts are frequently required to be secured with margin (which is commonly called “collateral”). To the extent necessary to meet such requirements, the

Fund may purchase U.S. Treasury and/or government agency securities.

los

Fund may invest in a derivative contract if it is permitted to own, invest in, or otherwise have economic exposure to the Reference Instrument. The Fund is not required to own a Reference Instrument in order to buy or

sell a derivative contract relating to that Reference Instrument. The Fund may trade in the following specific types and/or combinations of derivative contracts:

Futures Contracts (A Type of

Derivative)

Futures

contracts provide for the future sale by one party and purchase by another party of a specified amount of a Reference Instrument at a specified price, date and time. Entering into a contract to buy a Reference

Instrument is commonly referred to as buying a contract or holding a long position in the asset. Entering into a contract to sell a Reference Instrument is commonly referred to as selling a contract or holding a short

position in the Reference Instrument. Futures contracts are considered to be commodity contracts. The Adviser has claimed an exclusion from the definition of the term “commodity pool operator” under the

Commodity Exchange Act with respect to the Fund and, therefore, is not subject to registration or regulation with respect to the Fund. Futures contracts traded OTC are frequently referred to as forward contracts. los

Fund can buy or sell financial futures (such as interest rate futures, index futures and security futures), as well as, currency futures and currency forward contracts.

Option Contracts (A Type of

Derivative)

Option

contracts (also called “options”) are rights to buy or sell a Reference Instrument for a specified price (the “exercise price”) during, or at the end of, a specified period. The seller (or

“writer”) of the option receives a payment, or premium, from the buyer, which the writer keeps regardless of whether the buyer uses (or exercises) the option. A call option gives the holder (buyer) the

right to buy the Reference Instrument from the seller (writer) of the option. A put option gives the holder the right to sell the Reference Instrument to the writer of the option. Options may be bought or sold on a

wide variety of Reference Instruments. Options that are written on futures contracts will be subject to margin requirements similar to those applied to futures contracts.

Swap Contracts (A Type of

Derivative)

A swap

contract (also known as a “swap”) is a type of derivative contract in which two parties agree to pay each other (swap) the returns derived from Reference Instruments. Swaps do not always involve the

delivery of the Reference Instruments by either party, and the parties might not own the Reference Instruments underlying the swap. The payments are usually made on a net basis so that, on any given day, the Fund

would receive (or pay) only the amount by which its payment under the contract is less than (or exceeds) the amount of the other party's payment. Swap agreements are sophisticated instruments that can take many

different forms and are known by a variety of names. Common types of swaps in which the Fund may invest include interest rate swaps, caps and floors, total return swaps, credit default swaps and currency swaps.

OTHER INVESTMENTS, TRANSACTIONS,

TECHNIQUES

Hybrid Instruments

Híbrido

instruments combine elements of two different kinds of securities or financial instruments (such as a derivative contract). Frequently, the value of a hybrid instrument is determined by reference to changes in the

value of a Reference Instrument (that is a designated security, commodity, currency, index or other asset or instrument including a derivative contract). The Fund may use hybrid instruments only in connection with

permissible investment activities. Hybrid instruments can take on many forms including, but not limited to, the following forms. First, a common form of a hybrid instrument combines elements of a derivative contract

with those of another security (typically a fixed-income security). In this case all or a portion of the interest or principal payable on a hybrid security is determined by reference to changes in the price of a

Reference Instrument. Second, hybrid instruments may include convertible securities with conversion terms related to a Reference Instrument.

Depending on the type and terms of the hybrid instrument, its risks may reflect a combination of the risks of investing in the Reference Instrument with the risks of investing in other securities, currencies and

derivative contracts. Thus, an investment in a hybrid instrument may entail significant risks in addition to those associated with traditional securities or the Reference Instrument. Hybrid instruments are also

potentially more volatile than traditional securities or the Reference Instrument. Moreover, depending on the structure of the particular hybrid, it may expose the Fund to leverage risks or carry liquidity risks.

Asset Segregation

In order to cover its obligations in connection with derivative contracts or special transactions, the Fund will either own the underlying assets, enter into offsetting transactions or set aside

cash or readily marketable securities in each case, as provided by the SEC or SEC staff guidance. This requirement may cause the Fund to miss favorable trading opportunities, due to a lack of sufficient cash or

readily marketable securities. This requirement may also cause the Fund to realize losses on offsetting or terminated derivative contracts or special transactions.

Investing in Securities of Other

Investment Companies

los

Fund may invest its assets in securities of other investment companies, including the securities of affiliated money market funds, as an efficient means of implementing its investment strategies and/or managing its

uninvested cash. The Fund may also invest in high yield and loan instruments, including trade finance loan instruments, primarily by investing in another investment company (which is not available for general

investment by the public) that owns those securities and that is advised by an affiliate of the Adviser. The Fund's investment in the trade finance instruments through these other investment vehicles may expose the

Fund to risks of loss after redemption. The Fund may also invest in such securities directly. These other investment companies are managed independently of the Fund and incur additional fees and/or expenses which

would, therefore, be borne indirectly by the Fund in connection with any such investment. However, the Adviser believes that the benefits and efficiencies of this approach should outweigh the potential additional fees

and/or expenses.

What are the Specific

Risks of Investing in the Fund?

los

following provides general information on the risks associated with the Fund's principal investments. Any additional risks associated with the Fund's non-principal investments are described in the Fund's SAI. los

Fund's SAI also may provide additional information about the risks associated with the Fund's principal investments.

Risk Associated with

Noninvestment-Grade Securities

Securities rated below investment grade, also known as junk bonds, generally entail greater economic, credit and liquidity risks than investment-grade securities. For example, their prices are more volatile,

economic downturns and financial setbacks may affect their prices more negatively, and their trading market may be more limited. These securities are considered speculative with respect to the issuer's ability to pay

interest and repay principal.

ISSUER Credit Risk

It is

possible that interest or principal on securities will not be paid when due. Noninvestment-grade securities generally have a higher default risk than investment-grade securities. Such non-payment or default may reduce

the value of the Fund's portfolio holdings, its share price and its performance.

Many

fixed-income securities receive credit ratings from nationally recognized statistical rating organizations (NRSROs) such as Fitch Rating Service, Moody's Investor Services, Inc. and Standard & Poor's that assign

ratings to securities by assessing the likelihood of an issuer and/or guarantor default. Higher credit ratings correspond to lower perceived credit risk and lower credit ratings correspond to higher perceived credit

risk. Credit ratings may be upgraded or downgraded from time to time as an NRSRO's assessment of the financial condition of a party obligated to make payments with respect to such securities and credit risk changes.

The impact of any credit rating downgrade can be uncertain. Credit rating downgrades may lead to increased interest rates and volatility in financial markets, which in turn could negatively affect the value of the

Fund's portfolio holdings, its share price and its investment performance. Credit ratings are not a guarantee of quality. Credit ratings may lag behind the current financial conditions of the issuer and/or guarantor

and do not provide assurance against default or other loss of money. Credit ratings do not protect against a decline in the value of a security. If a security has not received a rating, the Fund must rely entirely

upon the Adviser's credit assessment.

Fixed-income securities generally compensate for greater credit risk by paying interest at a higher rate. The difference between the yield of a security and the yield of a U.S. Treasury security or other appropriate

benchmark with a comparable maturity (the “spread”) measures the additional interest paid for risk. Spreads may increase generally in response to adverse economic or market conditions. A security's spread

may also increase if the security's rating is lowered, or the security is perceived to have an increased credit risk. An increase in the spread will cause the price of the security to decline if interest rates remain

unchanged.

Counterparty Credit Risk

Crédito

risk includes the possibility that a party to a transaction involving the Fund will fail to meet its obligations. This could cause the Fund to lose money or to lose the benefit of the transaction or prevent the Fund

from selling or buying other securities to implement its investment strategy.

RISK RELATED TO THE ECONOMY

los

value of the Fund's portfolio may decline in tandem with a drop in the overall value of the markets in which the Fund invests and/or other markets based on negative developments in the U.S. and global economies.

Economic, political and financial conditions, or industry or economic trends and developments, may, from time to time, and for varying periods of time, cause volatility, illiquidity or other potentially adverse

effects in the financial markets, including the fixed-income market. The commencement, continuation or ending of government policies and economic stimulus programs, changes in monetary policy, increases or decreases

in interest rates, or other factors or events that affect the financial markets, including the fixed-income markets, may contribute to the development of or increase in volatility, illiquidity, shareholder redemptions

and other adverse effects, which could negatively impact the Fund's performance. For example, the value of certain portfolio securities may rise or fall in response to changes in interest rates, which could result

from a change in government policies, and has the potential to cause investors to move out of certain portfolio securities, including fixed-income securities, on a large scale. This may increase redemptions from funds

that hold large amounts of certain securities and may result in decreased liquidity and increased volatility in the financial markets. Market factors, such as the demand for particular portfolio securities, may cause

the price of certain portfolio securities to fall while the prices of other securities rise or remain unchanged. Among other investments, lower-grade bonds and loans may be particularly sensitive to changes in the

economy.

LIQUIDITY RISK

Trading

opportunities are more limited for fixed-income securities that have not received any credit ratings, have received any credit ratings below investment grade or are not widely held. These features may make it more

difficult to sell or buy a security at a favorable price or time. Consequently, the Fund may have to accept a lower price to sell a security, sell other securities to raise cash or give up an investment opportunity,

any of which could have a negative effect on the Fund's performance. Infrequent trading of securities may also lead to an increase in their price volatility.

Liquidity risk also refers to the possibility that the Fund may not be able to sell a security or close out a derivative contract when it wants to. If this happens, the Fund will be required to continue to hold the

security or keep the position open, and the Fund could incur losses.

OTC

derivative contracts generally carry greater liquidity risk than exchange-traded contracts. This risk may be increased in times of financial stress, if the trading market for OTC derivative contracts becomes

restricted.

Interest Rate Risk

Prices

of fixed-income securities rise and fall in response to changes in interest rates. Generally, when interest rates rise, prices of fixed-income securities fall. However, market factors, such as the demand for

particular fixed-income securities, may cause the price of certain fixed-income securities to fall while the prices of other securities rise or remain unchanged.

los

longer the duration of a fixed-income security, the more susceptible it is to interest rate risk. The duration of a fixed-income security may be equal to or shorter than the stated maturity of a fixed-income security.

Recent and potential futures changes in monetary policy made by central banks and/or their governments are likely to affect the level of interest rates. Duration measures the price sensitivity of a fixed-income

security given a change in interest rates. For example, if a fixed-income security has an effective duration of three years, a 1% increase in general interest rates would be expected to cause the security's value to

decline about 3% while a 1% decrease in general interest rates would be expected to cause the security's value to increase about 3%.

Risk of Foreign Investing

Foreign

securities pose additional risks because foreign economic or political conditions may be less favorable than those of the United States. Securities in foreign markets may also be subject to taxation policies that

reduce returns for U.S. investors.

Foreign

companies may not provide information (including financial statements) as frequently or to as great an extent as companies in the United States. Foreign companies may also receive less coverage than U.S. companies by

market analysts and the financial press. In addition, foreign countries may lack uniform accounting, auditing and financial reporting standards or regulatory requirements comparable to those applicable to U.S.

companies. These factors may prevent the Fund and its Adviser from obtaining information concerning foreign companies that is as frequent, extensive and reliable as the information available concerning companies in

the United States.

Foreign

countries may have restrictions on foreign ownership of securities or may impose exchange controls, capital flow restrictions or repatriation restrictions which could adversely affect the liquidity of the Fund's

investments.

Since

many loan instruments involve parties (for example, lenders, borrowers and agent banks) located in multiple jurisdictions outside of the United States, there is a risk that a security interest in any related

collateral may be unenforceable and obligations under the related loan agreements may not be binding.

Currency Risk

Exchange rates for currencies fluctuate daily. The combination of currency risk and market risks tends to make securities traded in foreign markets more volatile than securities traded exclusively in the United

States. The Adviser attempts to manage currency risk by limiting the amount the Fund invests in securities denominated in a particular currency. However, diversification will not protect the Fund against a general

increase in the value of the U.S. dollar relative to other currencies.

Investing in currencies or securities denominated in a foreign currency, entails risk of being exposed to a currency that may not fully reflect the strengths and weaknesses of the economy of the country or region

utilizing the currency. Currency risk includes both the risk that currencies in which the Fund's investments are traded, or currencies in which the Fund has taken an active investment position, will decline in value

relative to the U.S. dollar and, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency being hedged. In addition, it is possible that a currency (such as, for example,

the euro) could be abandoned in the future by countries that have already adopted its use, and the effects of such an abandonment on the applicable country and the rest of the countries utilizing the currency are

uncertain but could negatively affect the Fund's investments denominated in the currency. If a currency used by a country or countries is replaced by another currency, the Fund's Adviser would evaluate whether to

continue to hold any investments denominated in such currency, or whether to purchase investments denominated in the currency that replaces such currency, at the time. Such investments may continue to be held, or

purchased, to the extent consistent with the Fund's investment objective(s) and permitted under applicable law.

Many countries rely heavily upon export-dependent businesses and any strength in the exchange rate between a currency and the U.S. dollar or other currencies can have either a positive or a

negative effect upon corporate profits and the performance of investments in the country or region utilizing the currency. Adverse economic events within such country or region may increase the volatility of exchange

rates against other currencies, subjecting the Fund's investments denominated in such country's or region's currency to additional risks. In addition, certain countries, particularly emerging market countries, may

impose foreign currency exchange controls or other restrictions on the transferability, repatriation or convertibility of currency.

eurozone Related risk

UN

number of countries in the European Union (EU) have experienced, and may continue to experience, severe economic and financial difficulties. Additional EU member countries may also fall subject to such difficulties.

These events could negatively affect the value and liquidity of the Fund's investments in euro-denominated securities and derivatives contracts, securities of issuers located in the EU or with significant exposure to

EU issuers or countries. If the euro is dissolved entirely, the legal and contractual consequences for holders of euro-denominated obligations and derivative contracts would be determined by laws in effect at such

time. Such investments may continue to be held, or purchased, to the extent consistent with the Fund's investment objective(s) and permitted under applicable law. These potential developments, or market perceptions

concerning these and related issues, could adversely affect the value of the Shares.

Certain

countries in the EU have had to accept assistance from supra-governmental agencies such as the International Monetary Fund, the European Stability Mechanism (the ESM) or other supra-governmental agencies. The European

Central Bank has also been intervening to purchase Eurozone debt in an attempt to stabilize markets and reduce borrowing costs. There can be no assurance that these agencies will continue to intervene or provide

further assistance and markets may react adversely to any expected reduction in the financial support provided by these agencies. Responses to the financial problems by European governments, central banks and others

including austerity measures and reforms, may not work, may result in social unrest and may limit future growth and economic recovery or have other unintended consequences.

En

addition, one or more countries may abandon the euro and/or withdraw from the EU. The impact of these actions, especially if they occur in a disorderly fashion, could be significant and far-reaching. In June 2016, the

United Kingdom (U.K.) approved a referendum to leave the EU, commonly referred to as “Brexit,” which sparked depreciation in the value of the British pound, short-term declines in global stock markets and

heightened risk of continued worldwide economic volatility. As a result of Brexit, there is considerable uncertainty as to the arrangements that will apply to the U.K.'s relationship with the EU and other countries

leading up to, and following, its withdrawal. This long-term uncertainty may affect other countries in the EU and elsewhere. Further, the U.K.'s departure from the EU may cause volatility within the EU, triggering

prolonged economic downturns in certain European countries or sparking additional member states to contemplate departing the EU. In addition, Brexit can create actual or perceived additional economic stresses for the

U.K., including potential for decreased trade, capital outflows, devaluation of the British pound, wider corporate bond spreads due to uncertainty and possible declines in business and consumer spending as well as

foreign direct investment.

Leverage Risk

Leverage risk is created when an investment, which includes, for example, an investment in a derivative contract, exposes the Fund to a level of risk that exceeds the amount invested. Changes in the value of such an

investment magnify the Fund's risk of loss and potential for gain. Investments can have these same results if their returns are based on a multiple of a specified index, security or other benchmark.

Risk of Investing in Emerging

Market Countries

Securities issued or traded in emerging markets generally entail greater risks than securities issued or traded in developed countries. For example, their prices may be significantly more volatile than prices in

developed countries. Emerging market economies may also experience more severe down-turns (with corresponding currency devaluations) than developed economies.

Emerging market countries may have relatively unstable governments and may present the risk of nationalization of businesses, expropriation, confiscatory taxation or, in certain instances, reversion to closed

market, centrally planned economies.

Risk of Investing in Derivative

Contracts and Hybrid Instruments

los

Fund's exposure to derivative contracts and hybrid instruments (either directly or through its investment in another investment company) involves risks different from, or possibly greater than, the risks associated

with investing directly in securities and other traditional investments. First, changes in the value of the derivative contracts and hybrid instruments in which the Fund invests may not be correlated with changes in

the value of the underlying Reference Instruments or, if they are correlated, may move in the opposite direction than originally anticipated. Second, while some strategies involving

derivatives may reduce the risk of loss,

they may also reduce potential gains or, in some cases, result in losses by offsetting favorable price movements in portfolio holdings. Third, there is a risk that derivative contracts and hybrid instruments may be

erroneously priced or improperly valued and, as a result, the Fund may need to make increased cash payments to the counterparty. Fourth, exposure to derivative contracts and hybrid instruments may have tax

consequences to the Fund and its shareholders. For example, derivative contracts and hybrid instruments may cause the Fund to realize increased ordinary income or short-term capital gains (which are treated as

ordinary income for Federal income tax purposes) and, as a result, may increase taxable distributions to shareholders. In addition, under certain circumstances certain derivative contracts and hybrid instruments may

cause the Fund to: (a) incur an excise tax on a portion of the income related to those contracts and instruments; and/or (b) reclassify, as a return of capital, some or all of the distributions previously made to

shareholders during the fiscal year as dividend income. Fifth, a common provision in OTC derivative contracts permits the counterparty to terminate any such contract between it and the Fund, if the value of the Fund's

total net assets declines below a specified level over a given time period. Factors that may contribute to such a decline (which usually must be substantial) include significant shareholder redemptions and/or a marked

decrease in the market value of the Fund's investments. Any such termination of the Fund's OTC derivative contracts may adversely affect the Fund (for example, by increasing losses and/or costs, and/or preventing the

Fund from fully implementing its investment strategies). Sixth, the Fund may use a derivative contract to benefit from a decline in the value of a Reference Instrument. If the value of the Reference Instrument

declines during the term of the contract, the Fund makes a profit on the difference (less any payments the Fund is required to pay under the terms of the contract). Any such strategy involves risk. There is no

assurance that the Reference Instrument will decline in value during the term of the contract and make a profit for the Fund. The Reference Instrument may instead appreciate in value creating a loss for the Fund.

Seventh, a default or failure by a CCP or an FCM (also sometimes called a “futures broker”), or the failure of a contract to be transferred from an Executing Dealer to the FCM for clearing, may expose the

Fund to losses, increase its costs, or prevent the Fund from entering or exiting derivative positions, accessing margin, or fully implementing its investment strategies. The central clearing of a derivative and

trading of a contract over a SEF could reduce the liquidity in, or increase costs of entering into or holding, any contracts. Finally, derivative contracts and hybrid instruments may also involve other risks described

in this Prospectus, such as interest rate, credit, currency, liquidity and leverage risks.

RISK OF LOSS AFTER REDEMPTION

los

Fund may also invest in trade finance loan instruments primarily by investing in other investment companies (which are not available for general investment by the public) that owns those instruments, and that are

advised by an affiliate of the Adviser and is structured as an extended payment fund (EPF). In the EPF, the Fund, as shareholder, will bear the risk of investment loss during the period between when shares of such EPF

are presented to the transfer agent of the EPF for redemption and when the net asset value of the EPF is determined for payment of the redeemed EPF shares (the “Redemption Pricing Date”). The time between

when EPF shares are presented for redemption and the Redemption Pricing Date will be at least twenty-four (24) calendar days. EPF shares tendered for redemption will participate proportionately in the EPF's gains and

losses during between when EPF shares are presented for redemption and the Redemption Pricing Date. During this time the value of the EPF shares will likely fluctuate and EPF shares presented for redemption could be

worth less on the Redemption Pricing Date than on the day the EPF shares were presented to the transfer agent of the EPF for redemption. The EPF has adopted a fundamental policy that may only be changed by shareholder

vote, that the Redemption Pricing Date will fall no more than twenty-four (24) days after the date the Fund, as shareholder, presents EPF shares for redemption in good order. If such date is a weekend or holiday, the

Redemption Pricing Date will be on the preceding business day.

technology Risk

los

Adviser uses various technologies in managing the Fund, consistent with its investment objective(s) and strategy described in this Prospectus. For example, proprietary and third-party data and systems are utilized to

support decision-making for the Fund. Data imprecision, software or other technology malfunctions, programming inaccuracies and similar circumstances may impair the performance of these systems, which may negatively

affect Fund performance.

What Do Shares Cost?

CALCULATION OF NET ASSET

VALUE

Cuando

the Fund receives your transaction request in proper form (as described in this Prospectus under the sections entitled “How to Purchase Shares” and “How to Redeem and Exchange Shares”), it is

processed at the next calculated net asset value of a Share (NAV). A Share's NAV is determined as of the end of regular trading on the New York Stock Exchange (NYSE) (normally 4:00 p.m. Eastern time) each day the NYSE

is open. The Fund calculates the NAV of each class by valuing the assets allocated to each class and dividing the balance by the number of Shares of the class outstanding.

The NAV for each class of Shares may

differ due to the level of expenses allocated to each class as well as a result of the variance between the amount of accrued investment income and capital gains or losses allocated to each class and the amount

actually distributed to shareholders of each class. The Fund's current NAV and/or public offering price may be found at FederatedInvestors.com, via online news sources and in certain newspapers.

Tú

can purchase, redeem or exchange Shares any day the NYSE is open.

Cuando

the Fund holds securities that trade principally in foreign markets on days the NYSE is closed, the value of the Fund's assets may change on days you cannot purchase or redeem Shares. This may also occur when the U.S.

markets for fixed-income securities are open on a day the NYSE is closed.

En

calculating its NAV, the Fund generally values investments as follows:

| ■ | Fixed-income securities are fair valued using price evaluations provided by a pricing service approved by the Board of Trustees (“Board”). |

| ■ | Derivative contracts listed on exchanges are valued at their reported settlement or closing price, except that options are valued at the mean of closing bid and asked quotations. |

| ■ | Over-the-counter (OTC) derivative contracts are fair valued using price evaluations provided by a pricing service approved by the Board. |

If any

price, quotation, price evaluation or other pricing source is not readily available when the NAV is calculated, if the Fund cannot obtain price evaluations from a pricing service or from more than one dealer for an

investment within a reasonable period of time as set forth in the Fund's valuation policies and procedures, or if information furnished by a pricing service, in the opinion of the Valuation Committee, is deemed not

representative of the fair value of such security, the Fund uses the fair value of the investment determined in accordance with the procedures generally described below. There can be no assurance that the Fund could

obtain the fair value assigned to an investment if it sold the investment at approximately the time at which the Fund determines its NAV per share.

Shares

of other mutual funds are valued based upon their reported NAVs. The prospectuses for these mutual funds explain the circumstances under which they will use fair value pricing and the effects of using fair value

pricing.

Fair Valuation and Significant

Events Procedures

los

Board has ultimate responsibility for determining the fair value of investments for which market quotations are not readily available. The Board has appointed a Valuation Committee comprised of officers of the Fund,

the Adviser and certain of the Adviser's affiliated companies to assist in determining fair value and in overseeing the calculation of the NAV. The Board has also authorized the use of pricing services recommended by

the Valuation Committee to provide fair value evaluations of the current value of certain investments for purposes of calculating the NAV. In the event that market quotations and price evaluations are not available