Noticias e investigaciones antes de escuchar sobre esto en CNBC y otros. Solicite su prueba gratuita de 1 semana para StreetInsider Premium aquí.

Anexo 4.1

(Cara de nota)

A menos que este certificado sea presentado por un representante autorizado de The Depository Trust Company, una corporación de Nueva York ("DTC"), A la Compañía o su agente para el registro de transferencia, cambio o pago, y cualquier certificado emitido se registra a nombre de Cede & Co. o en cualquier otro nombre solicitado por un representante autorizado de DTC (y cualquier pago es hecho a Cede & Co. o cualquier otra entidad solicitada por un representante autorizado de DTC), CUALQUIER TRANSFERENCIA, COMPROMISO U OTRO USO AQUÍ POR VALOR O DE OTRA MANERA POR O CUALQUIER PERSONA ES INCORRECTO en la medida en que el propietario registrado del presente documento, Cede & Co ., tiene un interés en este documento.

|

CUSIP NO. 95001HCU3 |

CANTIDAD FACIAL: $ _________ |

NO REGISTRADO __

WELLS FARGO FINANCE LLC

NOTA A MEDIO PLAZO, SERIE A

Totalmente e incondicionalmente garantizado por Wells Fargo & Company

Valores principales en riesgo vinculados al índice S & P / TSX 60,

Convertido a dólares estadounidenses

WELLS FARGO FINANCE LLC, una compañía de responsabilidad limitada debidamente organizada y existente bajo las leyes del Estado de Delaware (en adelante denominada "Empresa", Cuyo término incluye a cualquier corporación sucesora bajo y como se define en el Indenture en adelante referido), por el valor recibido, por la presente se compromete a pagar a CEDE & Co., o cesionarios registrados, un monto igual al Monto de liquidación en efectivo (como se define a continuación) ), en la moneda o moneda de los Estados Unidos de América que en el momento del pago sea de curso legal para el pago de deudas públicas y privadas, en la Fecha de vencimiento declarada. Los "Fecha de vencimiento declarada”Será el 7 de junio de 2021. Si se pospone la Fecha de determinación (como se define a continuación), la Fecha de vencimiento declarada se pospondrá al segundo Día hábil (como se define a continuación) después de la Fecha de determinación como se pospuso. Esta seguridad no tendrá ningún interés.

Cualquier pago de esta Garantía al vencimiento se realizará contra la presentación de esta Garantía en la oficina o agencia de la Compañía mantenida para ese propósito en la Ciudad de Minneapolis, Minnesota y en cualquier otra oficina o agencia mantenida por la Compañía para tal propósito.

"Valor nominal"Significará, cuando se use con respecto a esta Seguridad, la cantidad establecida en la cara de esta Seguridad como su" Monto Facial ".

Determinación del monto de liquidación de efectivo y ciertas definiciones

Los "Monto de liquidación en efectivo"De esta Seguridad será igual a:

|

|

● |

si el Nivel de Underlier Final es mayor o igual que el Nivel de Límite, el Monto Máximo de Liquidación; |

|

|

● |

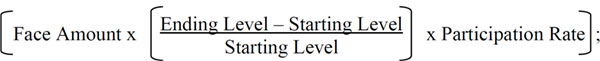

Si el Nivel de Underlier Final es mayor que el Nivel de Underlier Inicial pero menor que el Nivel de Cap, la suma de (i) el Monto Facial más (ii) el producto de (a) los tiempos de Monto Facial (b) los tiempos de Tasa de Participación Upside (c) el retorno subyacente; |

|

|

● |

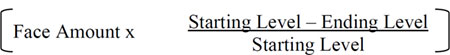

si el Nivel de Underlier Final es igual o menor que el Nivel de Underlier Inicial, la suma de (i) la Cantidad Facial más (ii) el producto de (a) los tiempos de Retorno de Underlier (b) la Cantidad Facial. |

Todos los cálculos con respecto al Monto de liquidación en efectivo se redondearán a la centésima milésima más cercana, con cinco millonésimas redondeadas al alza (por ejemplo, 0.000005 se redondearía a 0.00001); y el Monto de liquidación en efectivo se redondeará al centavo más cercano, con medio centavo redondeado hacia arriba.

Los "Underlier"Significará el índice S & P / TSX 60.

Los "Moneda subyacente"Significará, con respecto al Underlier, el dólar canadiense.

Los "Fecha de comercio"Significará el 3 de diciembre de 2019.

Los "Nivel inicial subyacente"Es 758.873303, el nivel de cierre ajustado del subyacente en la fecha de negociación, calculado de la siguiente manera: 1008.96 (el nivel de cierre del subyacente en la fecha de negociación) dividido por 1.32955 (el tipo de cambio en la fecha de negociación) (redondeado a seis decimales) lugares).

Los "Nivel de cierre"Del Underlier en cualquier Día de negociación significa el nivel de cierre oficial del Underlier informado por el Patrocinador de Underlier en dicho Día de negociación, tal como lo obtuvo el Agente de cálculo en dicho Día de negociación del proveedor de datos de mercado de terceros contratado por el Agente de cálculo. en tal momento; en particular, teniendo en cuenta la precisión decimal y / o la convención de redondeo empleada por dicho proveedor de datos de mercado de terceros con licencia en dicha fecha, sujeto a las disposiciones establecidas a continuación en "Ajustes al Underlier", "Discontinuación del Underlier" "Índice de eventos de interrupción del mercado" y "Aplazamiento de la fecha de determinación".

Los "Nivel de cierre ajustado" del Underlier en cualquier día relevante significa el Nivel de cierre del Underlier en ese día dividido por el Tipo de cambio en ese día.

Los "Tipo de cambio"En cualquier día relevante, será se expresará como una tasa de cambio de dólares canadienses por un dólar estadounidense y será igual al valor del dólar canadiense (CAD) de un dólar estadounidense (USD), según lo informado por Thomson Reuters ("Reuters") En la página de Reuters" WMRSPOT09 "

debajo del subtítulo "MID", o cualquier página sustitutiva de Reuters, aproximadamente a las 4:00 p.m., hora de Londres, según lo determine el Agente de Cálculo. El tipo de cambio en la fecha de negociación fue de 1.32955.

Los "Nivel final subyacente"Será el nivel de cierre ajustado del subyacente en la fecha de determinación.

Los "Retorno subyacente"Será el cociente de (i) el Nivel de Underlier Final menos el Nivel de Underlier Inicial dividido por (ii) el Nivel de Underlier Inicial, expresado como un porcentaje.

Los "Nivel de tapa"Es 816.547674028, que es el 107.60% del Nivel de Underlier Inicial.

Los "Monto máximo de liquidación"Es 122.80% de la cantidad nominal de esta seguridad.

Los "Tasa de participación al revés"Es 3.0.

"Patrocinador Underlier"Significará S&P Dow Jones Indices LLC.

"Día laboral"Significará un día, que no sea sábado o domingo, que no sea un feriado legal ni un día en que las instituciones bancarias estén autorizadas o obligatorias por ley o regulación para cerrar en Nueva York, Nueva York.

UNA "Día de negociación"Se refiere a un día, según lo determine el Agente de Cálculo, en el que (i) las Bolsas de Acciones Relevantes con respecto a cada valor subyacente al Subyacente estén programadas para operar en sus respectivas sesiones de negociación regulares y (ii) cada Futuro Relacionado o El intercambio de opciones está programado para abrirse a negociación para su sesión de negociación regular.

Los "Futuros relacionados o intercambio de opciones"Para el Underlier significa un sistema de intercambio o cotización en el que la negociación tiene un efecto material (según lo determine el Agente de Cálculo) en el mercado general de contratos de futuros u opciones relacionados con el Underlier.

Los "Bolsa de valores relevante"Para cualquier valor subyacente al Underlier se refiere al sistema principal de intercambio o cotización en el que se negocia dicho valor, según lo determine el Agente de Cálculo.

UNA "Moneda Día Hábil”Con respecto a la divisa subyacente es un día en el que The WM Company, a través de sus servicios de datos del mercado de divisas, publica tasas spot para el dólar canadiense en relación con el dólar estadounidense.

Los "Fecha de determinación final interrumpida"Significa el octavo día de negociación después de la fecha de determinación programada originalmente.

Un "Índice de día interrumpido, ”Con respecto al Underlier, significa un día que no es un Día de negociación o un día en el que se produce un Evento de interrupción del mercado de índices o que continúa con respecto al Underlier.

UNA "Día de la moneda interrumpida, "Con respecto a la Moneda subyacente, significa un día que no es un Día hábil monetario con respecto a la Moneda subyacente o un día en el que se produce o continúa un Evento de interrupción del mercado de divisas con respecto a la Moneda subyacente.

Los "Fecha de determinación" deberá será el 3 de junio de 2021. La Fecha de Determinación está sujeta a aplazamiento debido a Días Interrumpidos de Índice y Días Interrumpidos de Divisas. Consulte "Aplazamiento de la fecha de determinación".

"Acuerdo de agente de cálculo"Significará el Acuerdo del Agente de Cálculo fechado el 18 de mayo de 2018 entre la Compañía y el Agente de Cálculo, modificado de vez en cuando.

"Agente de cálculo"Significará la Persona que ha celebrado el Acuerdo del Agente de Cálculo con la Compañía que estipula, entre otras cosas, la determinación del Nivel de Subyacente Final y el Monto de Liquidación en Efectivo, cuyo término, a menos que el contexto lo requiera, incluirá a sus sucesores bajo dicho acuerdo de agente de cálculo. El agente de cálculo inicial será Wells Fargo Securities, LLC. De conformidad con el Acuerdo del Agente de Cálculo, la Compañía puede designar un Agente de Cálculo diferente de vez en cuando después de la emisión inicial de esta Garantía sin el consentimiento del Titular de esta Garantía y sin notificar al Titular de esta Garantía.

Ajustes al Underlier

Si en algún momento el método de cálculo del Underlier o un Underlier Sucesor, o el nivel de cierre del mismo, se modifica en un aspecto material, o si el Underlier o un Underlier Sucesor se modifica de alguna otra manera para que dicho underlier no, en la opinión del Agente de Cálculo, representa de manera justa el nivel de dicho subyacente si esos cambios o modificaciones no se hubieran realizado, entonces el Agente de Cálculo lo hará, al cierre del negocio en Nueva York, Nueva York, en cada fecha que el nivel de cierre de dicho Para calcular el subyacente, realice los cálculos y ajustes que, a juicio del Agente de Cálculo, de buena fe, puedan ser necesarios para llegar a un nivel de subyacente comparable al Underlier o al Sucesor Underlier como si esos cambios o modificaciones hubieran tenido no se ha realizado, y el Agente de cálculo calculará el nivel de cierre del Underlier o el Underlier sucesor con referencia a dicho underlier, según se ajuste. En consecuencia, si el método de cálculo del Underlier o el Underlier Sucesor se modifica de modo que el nivel de dicho underlier sea una fracción o un múltiplo de lo que hubiera sido si no se hubiera modificado (por ejemplo, debido a una división o división inversa en dicho valor subyacente), entonces el Agente de Cálculo ajustará el Underlier o el Sucesor Underlier para llegar a un nivel de dicho subyacente como si no hubiera sido modificado (por ejemplo, como si la división o división inversa no hubiera ocurrido).

Discontinuación del Underlier

Si el Patrocinador Underlier suspende la publicación del Underlier, y el Patrocinador Underlier u otra entidad publica un índice de capital sucesor o sustituto que el Agente de cálculo determina, a su exclusivo criterio, comparable al Underlier (un "Sucesor Underlier"), Luego, tras la notificación del Agente de Cálculo de esa determinación al Fiduciario y a la Compañía, el Agente de Cálculo sustituirá al Subyacente Sucesor según lo calculado por

el Patrocinador Underlier relevante o cualquier otra entidad y calcule el Nivel Underlier Final como se describió anteriormente. Ante cualquier selección por parte del Agente de Cálculo de un Subyacente Sucesor, la Compañía notificará al Titular de esta Garantía.

En el caso de que el Patrocinador Underlier suspenda la publicación del Underlier antes de, y la interrupción continúe, la Fecha de determinación y el Agente de cálculo determinan que no hay ningún Underlier sucesor disponible en ese momento, el Agente de cálculo calculará un Nivel de cierre sustituto para el Underlier de acuerdo con la fórmula y el método de cálculo del Underlier en vigencia antes de la descontinuación, pero utilizando solo aquellos valores que comprendieron el Underlier inmediatamente antes de dicha descontinuación. Si se selecciona un Underlier Sucesor o el Agente de Cálculo calcula un nivel como sustituto del Underlier, el Underlier Sucesor o nivel se utilizará como un sustituto del Underlier para todos los fines, incluido el propósito de determinar si existe un Evento de Interrupción del Mercado del Índice .

Si en la Fecha de Determinación el Patrocinador Underlier no puede calcular y anunciar el nivel del Underlier, el Agente de Cálculo calculará un Nivel de Cierre sustituto del Underlier de acuerdo con la fórmula y el método para calcular el Underlier último en vigencia antes de la falla , pero utilizando solo aquellos valores que comprendieron el Underlier inmediatamente antes de esa falla; previsto que, si ocurre un Evento de Interrupción del Mercado del Índice o continúa en ese día, entonces las disposiciones establecidas a continuación bajo "Eventos de Interrupción del Mercado del Índice" se aplicarán en lugar de lo anterior.

Eventos de sucesión de divisas

UNA "Evento de sucesión de divisas"Con respecto a la divisa subyacente o el dólar estadounidense significa la ocurrencia de cualquiera de los siguientes eventos:

|

|

(UNA) |

la moneda subyacente o el dólar estadounidense se eliminan legalmente y se reemplazan con, se convierten, se redenominan como o se cambian por otra moneda; o |

|

|

(SI) |

El país relevante para la moneda subyacente o el dólar estadounidense se divide en dos o más países o regiones económicas, según corresponda, cada uno con una moneda legal diferente inmediatamente después de ese evento. |

La moneda subyacente o el dólar estadounidense con respecto al cual se ha producido un evento de sucesión de moneda se denomina "Antigua moneda. "

En y después de la fecha de entrada en vigencia de un Evento de sucesión de moneda, se considerará que la moneda anterior se reemplaza por:

|

|

● |

en el caso de la cláusula (A) anterior, la moneda que reemplaza legalmente a la Antigua Moneda, en la cual la Antigua Moneda se convierte o redenomina, o por la cual se cambia la Antigua Moneda, según corresponda, o |

|

|

● |

en el caso de la cláusula (B) anterior, una moneda seleccionada por el Agente de cálculo entre las monedas legales resultantes de la división que el Agente de cálculo determina de buena fe y de manera comercialmente razonable es más comparable a la Moneda anterior, teniendo en cuenta contabilizar la última cotización disponible para la tasa spot del ex |

Moneda en relación con el dólar estadounidense o la moneda subyacente relevante en relación con la moneda anterior, según corresponda, y cualquier otra información que considere relevante.

La moneda de reemplazo determinada como se describe en los puntos anteriores se denomina "Moneda sucesora. "

Al ocurrir un Evento de Sucesión de Moneda, el Tipo de Cambio para la Moneda Subyacente afectada por el Evento de Sucesión de Moneda (ya sea porque el Evento de Sucesión de Moneda ha ocurrido con respecto a la Moneda Subyacente o porque el Evento de Sucesión de Moneda ha ocurrido con respecto a los EE. UU. dólar) en cualquier día anterior al evento de sucesión de divisas correspondiente se ajustará de modo que el nuevo tipo de cambio para ese día anterior sea igual al producto de:

|

|

● |

el tipo de cambio original para ese día anterior; y |

|

|

● |

una relación de la Moneda Sucesora a la Antigua Moneda, cuya relación se calculará sobre la base del tipo de cambio establecido por el país o región económica relevante de la Antigua Moneda para convertir la Antigua Moneda en la Moneda Sucesora en la fecha efectiva el Evento de sucesión de divisas, según lo determine el Agente de cálculo. |

En el caso de que el tipo de cambio no sea anunciado públicamente por el país o región económica relevante, el Agente de cálculo ajustará el tipo de cambio para ese día anterior de buena fe y de una manera comercialmente razonable.

No obstante lo anterior, si, como resultado de un Evento de Sucesión de Moneda, (a) en el caso de una Antigua Moneda que es la Moneda Subyacente, la Moneda Sucesora es el dólar estadounidense o (b) en el caso de una Antigua Moneda que es el dólar estadounidense, una moneda sucesora es la misma que la moneda subyacente relevante, en lugar de los ajustes a los tipos de cambio relevantes descritos anteriormente, el tipo de cambio de la moneda subyacente en cada día relevante que ocurre en y después de la fecha efectiva de ese El Evento de sucesión de divisas se basará en el tipo de cambio en la fecha del Evento de sucesión de divisas anunciado por el país o región económica relevante (o si ese país o región económica no ha anunciado un tipo de cambio, un tipo de cambio según lo determinado por el Cálculo Agente de buena fe y de manera comercialmente razonable).

Al ocurrir un Evento de Sucesión de Moneda, el Agente de Cálculo seleccionará de buena fe y de manera comercialmente razonable una página sustituta de Reuters o Bloomberg para determinar el tipo de cambio de la Moneda Subyacente. En la medida en que la convención de mercado para cotizar el tipo de cambio de la Moneda Sucesora en relación con el dólar estadounidense o la Moneda subyacente en relación con la Moneda sucesora, según corresponda, es diferente de la convención de mercado para la Moneda subyacente en relación con el dólar estadounidense, el El Agente de Cálculo aplicará todos los cálculos de manera consistente con la convención original del mercado al contabilizar cualquier ajuste resultante de un Evento de Sucesión de Moneda.

Índice de eventos de interrupción del mercado

Un "Interrupción del mercado índice Erespiradero"Con respecto al Underlier significa cualquiera de los siguientes eventos según lo determine el Agente de Cálculo a su exclusivo criterio:

|

|

(UNA) |

La ocurrencia o existencia de una suspensión o limitación material impuesta a la negociación por las Bolsas de Valores Relevantes o relacionada con valores que luego comprenden el 20% o más del nivel del Underlier o de cualquier Underlier Sucesor en cualquier momento durante el período de una hora que finaliza al cierre de la negociación en ese día, ya sea por movimientos en el precio que exceden los límites permitidos por esos intercambios de acciones relevantes o de otra manera. |

|

|

(SI) |

La ocurrencia o existencia de una suspensión o limitación material impuesta a la negociación por cualquier Bolsa de Futuros u Opciones Relacionadas o de otro modo en contratos de futuros u opciones relacionadas con el Subyacente o cualquier Subyacente Sucesor en cualquier Intercambio de Opciones o Futuros Relacionados en cualquier momento durante el período de hora que finaliza al cierre de la negociación de ese día, ya sea por movimientos en el precio que exceden los límites permitidos por la Bolsa de futuros u opciones relacionadas o de otra manera. |

|

|

(DO) |

La ocurrencia o existencia de cualquier evento, que no sea un cierre anticipado, que interrumpa o perjudique materialmente la capacidad de los participantes del mercado en general para efectuar transacciones u obtener valores de mercado para valores que luego comprenden el 20% o más del nivel del Underlier o cualquier sucesor Underlier en sus bolsas de valores relevantes en cualquier momento durante el período de una hora que finaliza al cierre de la negociación de ese día. |

|

|

(RE) |

La ocurrencia o existencia de cualquier evento, que no sea un cierre anticipado, que interrumpa o perjudique materialmente la capacidad de los participantes del mercado en general para efectuar transacciones u obtener valores de mercado para contratos de futuros u opciones relacionados con el Underlier o cualquier Underlier sucesor en cualquier Futuro relacionado u Intercambio de opciones en cualquier momento durante el período de una hora que finaliza al cierre de la negociación de ese día. |

|

|

(MI) |

El cierre en cualquier día hábil de intercambio de las bolsas de valores relevantes en el que los valores que luego comprenden el 20% o más del nivel del Underlier o cualquier Underlier sucesor se negocien o cualquier intercambio de futuros u opciones relacionados antes de su tiempo de cierre programado, a menos que sea anterior la hora de cierre es anunciada por la Bolsa de Valores Relevantes o la Bolsa de Futuros Relacionados u Opciones, según corresponda, al menos una hora antes de la (1) hora de cierre real de la sesión de negociación regular en dicha Bolsa de Valores Relevantes o Futuros Relacionados u Opciones Intercambie, según corresponda, y (2) la fecha límite de envío para que las órdenes se ingresen en la Bolsa de Valores Relevantes o en el Sistema de Futuros Relacionados u Opciones, según corresponda, para su ejecución en ese momento de cierre real ese día. |

|

|

(F) |

La Bolsa de Valores Relevante para cualquier valor subyacente al Underlier o Sucesor Underlier o cualquier Bolsa de Futuros u Opciones Relacionadas no se abre para operar durante su sesión de negociación regular. |

A los fines de determinar si se ha producido un evento de interrupción del mercado de índices:

|

|

(1) |

La contribución porcentual relevante de un valor al nivel del Underlier o de cualquier Underlier Sucesor se basará en una comparación de (x) la parte del nivel de dicho underlier atribuible a ese valor y (y) el nivel general del Underlier o Sucesor Underlier, en cada caso, inmediatamente antes de que ocurra el Evento de Interrupción del Mercado del Índice; |

|

|

(2) |

el "Cierre de Trading"En cualquier Día de negociación para el Underlier o cualquier Underlier sucesor significa el Tiempo de cierre programado de las bolsas de valores relevantes con respecto a los valores subyacentes al Underlier o al Underlier sucesor en dicho día de negociación; previsto que, si la hora de cierre real de la sesión de negociación regular de cualquiera de estas bolsas de valores relevantes es anterior a su hora de cierre programada en dicho día de negociación, entonces (x) a los efectos de las cláusulas (A) y (C) de la definición de " Evento de interrupción del mercado de índices "mencionado anteriormente, con respecto a cualquier valor subyacente del Underlier o el Underlier sucesor para el que dicha bolsa de valores relevante es su bolsa de valores relevante, el" cierre de negociación "significa el tiempo de cierre real y (y) a los fines de las cláusulas ( B) y (D) de la definición de "Evento de Interrupción del Mercado del Índice" anterior, con respecto a cualquier contrato de futuros u opciones relacionado con el Underlier o el Sucesor Underlier, el "cierre de la negociación" significa el último tiempo de cierre real de la negociación regular sesión de cualquiera de las bolsas de valores relevantes, pero en ningún caso después del tiempo de cierre programado de las bolsas de valores relevantes; |

|

|

(3) |

el "Hora de cierre programada"De cualquier Bolsa de Valores Relevante o Bolsa de Futuros Relacionados u Opciones en cualquier Día de Negociación para el Underlier o cualquier Underlier Sucesor significa el horario de cierre programado de lunes a viernes de dicha Bolsa de Valores Relevantes o Bolsa de Futuros Relacionados u Opciones en dicho Día de Negociación, sin tener en cuenta después del horario de atención o cualquier otra operación fuera de las horas regulares de sesión de negociación; y |

|

|

(4) |

un "Día hábil de intercambio"Significa cualquier día de negociación para el Underlier o cualquier Underlier sucesor en el que cada Bolsa de valores relevante para los valores subyacentes del Underlier o cualquier Underlier sucesor y cada Intercambio de futuros u opciones relacionadas estén abiertos para operar durante sus respectivas sesiones de negociación regulares, a pesar de cualquier Relevant Cierre de la Bolsa de Valores o Futuros relacionados u Opciones antes del tiempo de cierre programado. |

Eventos de interrupción del mercado de divisas

UNA "Evento de interrupción del mercado de divisas " con respecto a la Moneda Subyacente significa cualquiera de los siguientes eventos según lo determine el Agente de Cálculo a su exclusivo criterio:

|

|

(UNA) |

un evento de convertibilidad; |

|

|

(SI) |

un evento de entregabilidad; |

|

|

(DO) |

un evento de liquidez; |

|

|

(MI) |

un evento de discontinuidad; o |

|

|

(F) |

un evento de interrupción de la fuente del precio, |

en cada caso según lo determine el Agente de cálculo a su exclusivo criterio y en el caso de un evento descrito en las cláusulas (A), (B), (C), (D) o (E) anteriores, una determinación del Agente de cálculo a su sola discreción, dicho evento interfiere materialmente con la capacidad de la Compañía o la capacidad de cualquiera de sus afiliados para ajustar o deshacer la totalidad o una parte importante de cualquier cobertura con respecto a este Valor.

UNA "Evento de convertibilidad"Con respecto a la Moneda Subyacente significa un evento que, en efecto, previene, restringe o retrasa la capacidad de un participante del mercado para:

|

|

● |

convertir la moneda subyacente a dólares estadounidenses o convertir dólares estadounidenses a la moneda subyacente a través de los canales legales habituales; o |

|

|

● |

convertir la moneda subyacente a dólares estadounidenses a una tasa al menos tan favorable como la tasa para las instituciones nacionales ubicadas en el país de la moneda subyacente o convertir dólares estadounidenses a la moneda subyacente a una tasa al menos tan favorable como la tasa para las instituciones nacionales ubicadas en el Estados Unidos. |

UNA "Evento de entregabilidad"Con respecto a la Moneda Subyacente significa un evento que tiene el efecto de prevenir, restringir o retrasar a un participante del mercado de:

|

|

● |

entregar la moneda subyacente desde cuentas dentro del país de la moneda subyacente a cuentas fuera del país de la moneda subyacente o entregar dólares estadounidenses desde cuentas dentro de los Estados Unidos a cuentas fuera de los Estados Unidos; o |

|

|

● |

entregar la moneda subyacente entre cuentas dentro del país de la moneda subyacente o una parte que no sea residente del país de la moneda subyacente o entregar dólares estadounidenses entre cuentas dentro de los Estados Unidos o una parte que no sea residente de los Estados Unidos . |

UNA "Evento de liquidez"Con respecto a la Moneda Subyacente significa la imposición por parte de cualquier país relevante (o cualquier subdivisión política o autoridad reguladora del mismo) de cualquier control de capital o moneda (como una restricción impuesta a la tenencia de activos o transacciones a través de cualquier cuenta en la cuenta correspondiente país por un no residente de ese país relevante), o la publicación de cualquier aviso de intención de hacerlo, que el Agente de Cálculo determine de buena fe y de manera comercialmente razonable es probable que afecte materialmente una inversión en la Moneda Subyacente o dólares estadounidenses.

UNA "Evento Fiscal"Con respecto a la Moneda Subyacente significa la implementación por un país relevante (o cualquier subdivisión política o autoridad reguladora del mismo), o la publicación de cualquier aviso de una intención de implementar, cualquier cambio en las leyes o regulaciones relacionadas con la inversión extranjera en ese país relevante, según corresponda (incluidos, entre otros,

a, cambios en las leyes fiscales y / o leyes relacionadas con los mercados de capitales y la propiedad corporativa), que el Agente de Cálculo determina de buena fe de una manera comercialmente razonable es probable que afecten materialmente una inversión en la Moneda Subyacente o en dólares estadounidenses.

UNA "Evento de discontinuidad"Con respecto a la Moneda Subyacente significa la vinculación o separación de la Divisa Subyacente en relación con el dólar estadounidense (o de dólares estadounidenses en relación con la Divisa Subyacente) o la apreciación o devaluación controlada por el país relevante (o cualquier subdivisión política o autoridad reguladora del mismo) de la Moneda subyacente en relación con el dólar estadounidense (o dólares estadounidenses en relación con la Moneda subyacente), según lo determine el Agente de cálculo de buena fe y de una manera comercialmente razonable.

UNA "Evento de interrupción de la fuente del precio"Con respecto a la Moneda Subyacente significa la no publicación o falta de disponibilidad de la tasa spot aplicable para la Moneda Subyacente en relación con el dólar estadounidense en la página de Reuters aplicable (o cualquier página sustituta) y en el momento correspondiente para la determinación del Intercambio Tasa de la moneda subyacente en cualquier fecha de determinación.

Aplazamiento de la fecha de determinación

Si la Fecha de determinación programada es un Día de interrupción del índice o un Día de interrupción de la moneda, la Fecha de determinación se pospondrá al primer día que no sea un Día de interrupción del índice o un Día de interrupción de la moneda. Sin embargo, en ningún caso, la Fecha de determinación se pospondrá a una fecha posterior a la Fecha de determinación definitiva interrumpida.

Si la Fecha de Determinación se ha pospuesto a la Fecha de Determinación Final Interrumpida y ese día es un Día de Interrupción de Moneda (pero no un Día de Interrupción de Índice), el Agente de Cálculo usará el Nivel de Cierre del Subyacente en dicha Fecha de Determinación de Interrupción Final. Si la Fecha de determinación se ha pospuesto a la Fecha de determinación definitiva interrumpida y ese día es un Día de índice interrumpido, el Agente de cálculo determinará el Nivel de cierre del Subyacente en dicha Fecha de determinación final interrumpida de acuerdo con la fórmula y el método de cálculo de la El nivel de cierre del Underlier en vigencia antes del comienzo del Evento de Interrupción del Mercado del Índice, utilizando el precio de cierre (o, con respecto a cualquier valor relevante, si ha ocurrido un evento de interrupción del mercado con respecto a dicha seguridad, su estimación de buena fe de el valor de dicha seguridad en el Tiempo de cierre programado de la Bolsa de valores relevante para dicha seguridad o, si es anterior, la hora de cierre real de la sesión de negociación regular de dicha Bolsa de valores relevante) en la fecha de cada valor incluido en el Sublíder. Como se usa en este documento, "precio de cierre"Significa, con respecto a cualquier valor en cualquier fecha, la Bolsa de Valores Relevantes cotizó o cotizó el precio de dicha garantía a partir del Tiempo de Cierre Programado de la Bolsa de Valores Relevante para dicha garantía o, si es anterior, el tiempo de cierre real de la negociación regular sesión de dicha Bolsa relevante.

Si la Fecha de determinación se ha pospuesto a la Fecha de determinación definitiva interrumpida y ese día es un Día de índice interrumpido (pero no un Día de divisa interrumpida), el Agente de cálculo utilizará el Tipo de cambio en esa Fecha de determinación final interrumpida. Si se ha pospuesto una Fecha de determinación a la Fecha de determinación definitiva interrumpida y ese día es un Día de perturbación monetaria, el Agente de cálculo determinará el tipo de cambio en esa Fecha de determinación final interrumpida de buena fe y de una manera comercialmente razonable.

Agente de cálculo

El Agente de Cálculo determinará el Monto de Liquidación de Efectivo y el Nivel de Subyacente Final. Además, el Agente de cálculo (i) determinará si se requieren ajustes al Nivel de cierre del Underlier en las circunstancias descritas en esta Seguridad, (ii) si se suspende la publicación del Underlier, seleccionará un Underlier sucesor o, si no hay un sucesor El Underlier está disponible, determine el Nivel de Cierre del Underlier en las circunstancias descritas en este Valor, (iii) determine si se ha producido un Evento de Interrupción del Mercado del Índice, un Evento de Interrupción del Mercado de Divisas, un Día Laborable o un Día Hábil no monetario; y (iv) determinar el tipo de cambio en diversas circunstancias.

La Compañía se compromete a que, mientras esta Garantía sea Excepcional, siempre habrá un Agente de Cálculo (que será un corredor de bolsa, banco u otra institución financiera) con respecto a esta Garantía.

Todas las determinaciones hechas por el Agente de Cálculo con respecto a esta Seguridad serán a la sola discreción del Agente de Cálculo y, en ausencia de un error manifiesto, serán concluyentes para todos los propósitos y vinculantes para la Compañía y el Titular de esta Seguridad.

Consideraciones fiscales

La Compañía está de acuerdo, y al aceptar un interés de titularidad real en este Valor, se considerará que cada Titular de este Valor ha aceptado (en ausencia de una resolución legal, reglamentaria, administrativa o judicial en contrario), para el ingreso federal de los Estados Unidos propósitos fiscales para caracterizar y tratar esta Seguridad como un contrato de prepago derivado que es una "transacción abierta".

Redención y reembolso

Esta Garantía no está sujeta a reembolso a opción de la Compañía o reembolso a opción del Titular de la presente antes del 7 de junio de 2021. Esta Garantía no tiene derecho a ningún fondo de amortización.

Aceleración

If an Event of Default, as defined in the Indenture, with respect to this Security shall occur and be continuing, the Cash Settlement Amount (calculated as set forth in the next sentence) of this Security may be declared due and payable in the manner and with the effect provided in the Indenture. The amount payable to the Holder hereof upon any acceleration permitted under the Indenture will be equal to the Cash Settlement Amount hereof calculated as provided herein as though the date of acceleration was the Determination Date.

Reference is hereby made to the further provisions of this Security set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth at this place.

Unless the certificate of authentication hereon has been executed by the Trustee referred to on the reverse hereof by manual signature or its duly authorized agent under the Indenture referred to on the reverse hereof by manual signature, this Security shall not be entitled to any benefit under the Indenture or be valid or obligatory for any purpose.

(The remainder of this page has been left intentionally blank)

IN WITNESS WHEREOF, the Company has caused this instrument to be duly executed.

DATED:

|

|

WELLS FARGO FINANCE LLC |

||

|

|

|

|

|

|

|

By: |

|

|

|

|

|

|

|

|

|

|

|

Its: |

|

|

Attest: |

|

|

|

|

|

|

|

|

Its: |

|

TRUSTEE’S CERTIFICATE OF This is one of the Securities of the |

|

|

|

|

|

|

|

CITIBANK, N.A., |

|

|

|

as Trustee |

|

|

|

|

|

|

|

By: |

|

|

|

|

Authorized Signature |

|

|

|

|

|

|

|

OR |

|

|

|

|

|

|

WELLS FARGO BANK, N.A., |

|

|

|

as Authenticating Agent for the Trustee |

|

|

|

|

|

|

|

By: |

|

|

|

|

Authorized Signature |

|

(Reverse of Note)

WELLS FARGO FINANCE LLC

MEDIUM-TERM NOTE, SERIES A

Fully and Unconditionally Guaranteed by Wells Fargo & Company

Principal at Risk Securities Linked to the S&P/TSX 60 Index,

Converted into U.S. Dollars

This Security is one of a duly authorized issue of securities of the Company (herein called the “Securities”), issued and to be issued in one or more series under an indenture dated as of April 25, 2018, as amended or supplemented from time to time (herein called the “Indenture”), among the Company, as issuer, Wells Fargo & Company, as guarantor (the “Guarantor”) and Citibank, N.A., as trustee (herein called the “Trustee,” which term includes any successor trustee under the Indenture), to which Indenture and all indentures supplemental thereto reference is hereby made for a statement of the respective rights, limitations of rights, duties and immunities thereunder of the Company, the Guarantor, the Trustee and the Holders of the Securities, and of the terms upon which the Securities are, and are to be, authenticated and delivered. This Security is one of the series of the Securities designated as Medium-Term Notes, Series A, of the Company. The amount payable on the Securities of this series may be determined by reference to the performance of one or more equity-, commodity- or currency-based indices, exchange traded funds, securities, commodities, currencies, statistical measures of economic or financial performance, or a basket comprised of two or more of the foregoing, or any other market measure or may bear interest at a fixed rate or a floating rate. The Securities of this series may mature at different times, be redeemable at different times or not at all, be repayable at the option of the Holder at different times or not at all and be denominated in different currencies.

The Securities are issuable only in registered form without coupons and will be either (a) book-entry securities represented by one or more Global Securities recorded in the book-entry system maintained by the Depositary or (b) certificated securities issued to and registered in the names of, the beneficial owners or their nominees.

The Company agrees, to the extent permitted by law, not to voluntarily claim the benefits of any laws concerning usurious rates of interest against a Holder of this Security.

Guarantee

The Securities of this series are fully and unconditionally guaranteed by the Guarantor as and to the extent set forth in the Indenture.

Modification and Waivers

The Indenture permits, with certain exceptions as therein provided, the amendment thereof and the modification of the rights and obligations of the Company and the Guarantor and the rights

of the Holders of the Securities of each series to be affected under the Indenture at any time by the Company, the Guarantor and the Trustee with the consent of the Holders of a majority in principal amount of the Securities at the time Outstanding of all series to be affected, acting together as a class. The Indenture also contains provisions permitting the Holders of a majority in principal amount of the Securities of all series at the time Outstanding affected by certain provisions of the Indenture, acting together as a class, on behalf of the Holders of all Securities of such series, to waive compliance by the Company or the Guarantor with those provisions of the Indenture. Certain past defaults under the Indenture and their consequences may be waived under the Indenture by the Holders of a majority in principal amount of the Securities of each series at the time Outstanding, on behalf of the Holders of all Securities of such series. Solely for the purpose of determining whether any consent, waiver, notice or other action or Act to be taken or given by the Holders of Securities pursuant to the Indenture has been given or taken by the Holders of Outstanding Securities in the requisite aggregate principal amount, the principal amount of this Security will be deemed to be equal to the amount set forth on the face hereof as the “Face Amount” hereof. Any such consent or waiver by the Holder of this Security shall be conclusive and binding upon such Holder and upon all future Holders of this Security and of any Security issued upon the registration of transfer hereof or in exchange herefor or in lieu hereof, whether or not notation of such consent or waiver is made upon this Security.

Defeasance

Section 403 and Article Fifteen of the Indenture and the provisions of clause (ii) of Section 401(1)(B) of the Indenture, relating to defeasance at any time of (a) the entire indebtedness on this Security and (b) certain restrictive covenants, upon compliance by the Company or the Guarantor with certain conditions set forth therein, shall not apply to this Security. The remaining provisions of Section 401 of the Indenture shall apply to this Security.

Authorized Denominations

This Security is issuable only in registered form without coupons in denominations of $1,000 or any amount in excess thereof which is an integral multiple of $1,000.

Registration of Transfer

Upon due presentment for registration of transfer of this Security at the office or agency of the Company in the City of Minneapolis, Minnesota, a new Security or Securities of this series, with the same terms as this Security, in authorized denominations for an equal aggregate Face Amount will be issued to the transferee in exchange herefor, as provided in the Indenture and subject to the limitations provided therein and to the limitations described below, without charge except for any tax or other governmental charge imposed in connection therewith.

This Security is exchangeable for definitive Securities in registered form only if (x) the Depositary notifies the Company that it is unwilling or unable to continue as Depositary for this Security or if at any time the Depositary ceases to be a clearing agency registered under the Securities Exchange Act of 1934, as amended, and a successor depositary is not appointed within 90 days after the Company receives such notice or becomes aware of such ineligibility, (y) the Company in its sole discretion determines that this Security shall be exchangeable for definitive

Securities in registered form and notifies the Trustee thereof or (z) an Event of Default with respect to the Securities represented hereby has occurred and is continuing. If this Security is exchangeable pursuant to the preceding sentence, it shall be exchangeable for definitive Securities in registered form, having the same date of issuance, Stated Maturity Date and other terms and of authorized denominations aggregating a like amount.

This Security may not be transferred except as a whole by the Depositary to a nominee of the Depositary or by a nominee of the Depositary to the Depositary or another nominee of the Depositary or by the Depositary or any such nominee to a successor of the Depositary or a nominee of such successor. Except as provided above, owners of beneficial interests in this Global Security will not be entitled to receive physical delivery of Securities in definitive form and will not be considered the Holders hereof for any purpose under the Indenture.

Prior to due presentment of this Security for registration of transfer, the Company, the Guarantor, the Trustee and any agent of the Company, the Guarantor or the Trustee may treat the Person in whose name this Security is registered as the owner hereof for all purposes, whether or not this Security be overdue, and neither the Company, the Guarantor, the Trustee nor any such agent shall be affected by notice to the contrary.

Obligation of the Company Absolute

No reference herein to the Indenture and no provision of this Security or the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay the Cash Settlement Amount at the times, place and rate, and in the coin or currency, herein prescribed, except as otherwise provided in this Security.

No Personal Recourse

No recourse shall be had for the payment of the Cash Settlement Amount, or for any claim based hereon, or otherwise in respect hereof, or based on or in respect of the Indenture or any indenture supplemental thereto, against any incorporator, stockholder, officer or director, as such, past, present or future, of the Company or any successor corporation or of the Guarantor or any successor corporation, whether by virtue of any constitution, statute or rule of law, or by the enforcement of any assessment or penalty or otherwise, all such liability being, by the acceptance hereof and as part of the consideration for the issuance hereof, expressly waived and released.

Defined Terms

All terms used in this Security which are defined in the Indenture shall have the meanings assigned to them in the Indenture unless otherwise defined in this Security.

Governing Law

This Security shall be governed by and construed in accordance with the law of the State of New York, without regard to principles of conflicts of laws.

ABBREVIATIONS

The following abbreviations, when used in the inscription on the face of this instrument, shall be construed as though they were written out in full according to applicable laws or regulations:

|

TEN COM |

– |

as tenants in common |

|

|

|

|

|

TEN ENT |

– |

as tenants by the entireties |

|

|

|

|

|

JT TEN |

– |

as joint tenants with right |

|

|

|

of survivorship and not |

|

|

|

as tenants in common |

|

UNIF GIFT MIN ACT |

– |

|

Custodian |

|

|

|

|

(Cust) |

|

(Minor) |

Under Uniform Gifts to Minors Act

Additional abbreviations may also be used though not in the above list.

FOR VALUE RECEIVED, the undersigned hereby sell(s) and transfer(s) unto

Please Insert Social Security or

Other Identifying Number of Assignee

(Please print or type name and address including postal zip code of Assignee)

the within Security of WELLS FARGO FINANCE LLC and does hereby irrevocably constitute and appoint __________________ attorney to transfer the said Security on the books of the Company, with full power of substitution in the premises.

|

Dated: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTICE: The signature to this assignment must correspond with the name as written upon the face of the within instrument in every particular, without alteration or enlargement or any change whatever.

Exhibit

4.2

(Face of Note)

Unless this certificate is presented by an authorized representative of The Depository Trust Company, a New York corporation (“DTC”), to the Company or its agent for registration of transfer, exchange or payment, and any certificate issued is registered in the name of Cede & Co. or in such other name as requested by an authorized representative of DTC (and any payment is made to Cede & Co. or such other entity as is requested by an authorized representative of DTC), ANY TRANSFER, PLEDGE OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL inasmuch as the registered owner hereof, Cede & Co., has an interest herein.

|

CUSIP NO. 95001HCV1 |

FACE AMOUNT: $___________ |

|

REGISTERED NO. ___ |

|

WELLS FARGO FINANCE LLC

MEDIUM-TERM NOTE, SERIES A

Fully and Unconditionally Guaranteed by Wells Fargo & Company

Principal at Risk Securities Linked to the S&P 500® Index

WELLS FARGO FINANCE LLC, a limited liability company duly organized and existing under the laws of the State of Delaware (hereinafter called the “Company,” which term includes any successor corporation under and as defined in the Indenture hereinafter referred to), for value received, hereby promises to pay to CEDE & Co., or registered assigns, an amount equal to the Cash Settlement Amount (as defined below), in such coin or currency of the United States of America as at the time of payment is legal tender for payment of public and private debts, on the Stated Maturity Date. The “Stated Maturity Date” shall be December 7, 2021. If the Determination Date (as defined below) is postponed, the Stated Maturity Date will be postponed to the second Business Day (as defined below) after the Determination Date as postponed. This Security shall not bear any interest.

Any payments on this Security at Maturity will be made against presentation of this Security at the office or agency of the Company maintained for that purpose in the City of Minneapolis, Minnesota and at any other office or agency maintained by the Company for such purpose.

"Face Amount” shall mean, when used with respect to this Security, the amount set forth on the face of this Security as its “Face Amount.”

Determination of Cash Settlement Amount and Certain Definitions

The “Cash Settlement Amount” of this Security will equal:

|

|

● |

if the Final Underlier Level is greater than or equal to the Cap Level, the Maximum Settlement Amount; |

|

|

● |

if the Final Underlier Level is greater than the Initial Underlier Level but less than the Cap Level, the sum of (i) the Face Amount plus (ii) the product of (a) the Face Amount times (b) the Upside Participation Rate times (c) the Underlier Return; |

|

|

● |

if the Final Underlier Level is equal to or less than the Initial Underlier Level but greater than or equal to the Buffer Level, the Face Amount; o |

|

|

● |

if the Final Underlier Level is less than the Buffer Level, the sum of (i) the Face Amount plus (ii) the product of (a) the Buffer Rate times (b) the sum of the Underlier Return plus the Buffer Amount times (c) the Face Amount. |

All calculations with respect to the Cash Settlement Amount will be rounded to the nearest one hundred-thousandth, with five one-millionths rounded upward (e.g., 0.000005 would be rounded to 0.00001); and the Cash Settlement Amount will be rounded to the nearest cent, with one-half cent rounded upward.

The “Underlier” shall mean the S&P 500® Index.

The “Trade Date” shall mean December 3, 2019.

The “Initial Underlier Level” is 3,093.20, the Closing Level of the Underlier on the Trade Date.

The “Closing Level” of the Underlier on any Trading Day means the official closing level of the Underlier reported by the Underlier Sponsor on such Trading Day, as obtained by the Calculation Agent on such Trading Day from the licensed third-party market data vendor contracted by the Calculation Agent at such time; in particular, taking into account the decimal precision and/or rounding convention employed by such licensed third-party market data vendor on such date, subject to the provisions set forth below under “Adjustments to the Underlier,” “Discontinuance of the Underlier” and “Market Disruption Events.”

The “Final Underlier Level” will be the Closing Level of the Underlier on the Determination Date.

The “Underlier Return” will be the quotient of (i) the Final Underlier Level minus the Initial Underlier Level divided by (ii) the Initial Underlier Level, expressed as a percentage.

The “Cap Level” is 3,526.248, which is 114% of the Initial Underlier Level.

The “Buffer Level” is 2,474.56, which is equal to 80% of the Initial Underlier Level.

The “Maximum Settlement Amount” is 115.40% of the Face Amount of this Security.

The “Buffer Amount” is 20%.

The “Buffer Rate” is equal to the Initial Underlier Level divided by the Buffer Level.

The “Upside Participation Rate” is 1.1.

"Underlier Sponsor” shall mean S&P Dow Jones Indices LLC.

"Día laboral” shall mean a day, other than a Saturday or Sunday, that is neither a legal holiday nor a day on which banking institutions are authorized or required by law or regulation to close in New York, New York.

A “Trading Day” means a day, as determined by the Calculation Agent, on which (i) the Relevant Stock Exchanges with respect to each security underlying the Underlier are scheduled to be open for trading for their respective regular trading sessions and (ii) each Related Futures or Options Exchange is scheduled to be open for trading for its regular trading session.

The “Related Futures or Options Exchange” for the Underlier means an exchange or quotation system where trading has a material effect (as determined by the Calculation Agent) on the overall market for futures or options contracts relating to the Underlier.

The “Relevant Stock Exchange” for any security underlying the Underlier means the primary exchange or quotation system on which such security is traded, as determined by the Calculation Agent.

The “Determination Date” shall ser December 3, 2021. If the originally scheduled Determination Date is not a Trading Day, the Determination Date will be postponed to the next succeeding Trading Day. The Determination Date is also subject to postponement due to the occurrence of a Market Disruption Event (as defined below). See “–Market Disruption Events.”

"Calculation Agent Agreement” shall mean the Calculation Agent Agreement dated as of May 18, 2018 between the Company and the Calculation Agent, as amended from time to time.

"Calculation Agent” shall mean the Person that has entered into the Calculation Agent Agreement with the Company providing for, among other things, the determination of the Final Underlier Level and the Cash Settlement Amount, which term shall, unless the context otherwise requires, include its successors under such Calculation Agent Agreement. The initial Calculation Agent shall be Wells Fargo Securities, LLC. Pursuant to the Calculation Agent Agreement, the Company may appoint a different Calculation Agent from time to time after the initial issuance of this Security without the consent of the Holder of this Security and without notifying the Holder of this Security.

Adjustments to the Underlier

If at any time the method of calculating the Underlier or a Successor Underlier, or the closing level thereof, is changed in a material respect, or if the Underlier or a Successor Underlier is in any other way modified so that such underlier does not, in the opinion of the Calculation Agent, fairly represent the level of such underlier had those changes or modifications not been made, then the Calculation Agent will, at the close of business in New York, New

York, on each date that the closing level of such underlier is to be calculated, make such calculations and adjustments as, in the good faith judgment of the Calculation Agent, may be necessary in order to arrive at a level of an underlier comparable to the Underlier or Successor Underlier as if those changes or modifications had not been made, and the Calculation Agent will calculate the closing level of the Underlier or Successor Underlier with reference to such underlier, as so adjusted. Accordingly, if the method of calculating the Underlier or Successor Underlier is modified so that the level of such underlier is a fraction or a multiple of what it would have been if it had not been modified (e.g., due to a split or reverse split in such equity underlier), then the Calculation Agent will adjust the Underlier or Successor Underlier in order to arrive at a level of such underlier as if it had not been modified (e.g., as if the split or reverse split had not occurred).

Discontinuance of the Underlier

If the Underlier Sponsor discontinues publication of the Underlier, and the Underlier Sponsor or another entity publishes a successor or substitute equity index that the Calculation Agent determines, in its sole discretion, to be comparable to the Underlier (a “Successor Underlier”), then, upon the Calculation Agent’s notification of that determination to the Trustee and the Company, the Calculation Agent will substitute the Successor Underlier as calculated by the relevant Underlier Sponsor or any other entity and calculate the Final Underlier Level as described above. Upon any selection by the Calculation Agent of a Successor Underlier, the Company will cause notice to be given to the Holder of this Security.

In the event that the Underlier Sponsor discontinues publication of the Underlier prior to, and the discontinuance is continuing on, the Determination Date and the Calculation Agent determines that no Successor Underlier is available at such time, the Calculation Agent will calculate a substitute Closing Level for the Underlier in accordance with the formula for and method of calculating the Underlier last in effect prior to the discontinuance, but using only those securities that comprised the Underlier immediately prior to that discontinuance. If a Successor Underlier is selected or the Calculation Agent calculates a level as a substitute for the Underlier, the Successor Underlier or level will be used as a substitute for the Underlier for all purposes, including the purpose of determining whether a Market Disruption Event exists.

If on the Determination Date the Underlier Sponsor fails to calculate and announce the level of the Underlier, the Calculation Agent will calculate a substitute Closing Level of the Underlier in accordance with the formula for and method of calculating the Underlier last in effect prior to the failure, but using only those securities that comprised the Underlier immediately prior to that failure; provided that, if a Market Disruption Event occurs or is continuing on such day, then the provisions set forth below under “Market Disruption Events” shall apply in lieu of the foregoing.

Market Disruption Events

A “Market Disruption Event” means any of the following events as determined by the Calculation Agent in its sole discretion:

|

|

(A) |

The occurrence or existence of a material suspension of or limitation imposed on trading by the Relevant Stock Exchanges or otherwise relating to securities which then comprise 20% or more of the level of the Underlier or any Successor Underlier at any time during the one-hour period that ends at the Close of Trading on that day, whether by reason of movements in price exceeding limits permitted by those Relevant Stock Exchanges or otherwise. |

|

|

(B) |

The occurrence or existence of a material suspension of or limitation imposed on trading by any Related Futures or Options Exchange or otherwise in futures or options contracts relating to the Underlier or any Successor Underlier on any Related Futures or Options Exchange at any time during the one-hour period that ends at the Close of Trading on that day, whether by reason of movements in price exceeding limits permitted by the Related Futures or Options Exchange or otherwise. |

|

|

(C) |

The occurrence or existence of any event, other than an early closure, that materially disrupts or impairs the ability of market participants in general to effect transactions in, or obtain market values for, securities that then comprise 20% or more of the level of the Underlier or any Successor Underlier on their Relevant Stock Exchanges at any time during the one-hour period that ends at the Close of Trading on that day. |

|

|

(D) |

The occurrence or existence of any event, other than an early closure, that materially disrupts or impairs the ability of market participants in general to effect transactions in, or obtain market values for, futures or options contracts relating to the Underlier or any Successor Underlier on any Related Futures or Options Exchange at any time during the one-hour period that ends at the Close of Trading on that day. |

|

|

(E) |

The closure on any Exchange Business Day of the Relevant Stock Exchanges on which securities that then comprise 20% or more of the level of the Underlier or any Successor Underlier are traded or any Related Futures or Options Exchange prior to its Scheduled Closing Time unless the earlier closing time is announced by the Relevant Stock Exchange or Related Futures or Options Exchange, as applicable, at least one hour prior to the earlier of (1) the actual closing time for the regular trading session on such Relevant Stock Exchange or Related Futures or Options Exchange, as applicable, and (2) the submission deadline for orders to be entered into the Relevant Stock Exchange or Related Futures or Options Exchange, as applicable, system for execution at such actual closing time on that day. |

|

|

(F) |

The Relevant Stock Exchange for any security underlying the Underlier or Successor Underlier or any Related Futures or Options Exchange fails to open for trading during its regular trading session. |

For purposes of determining whether a Market Disruption Event has occurred:

|

|

(1) |

the relevant percentage contribution of a security to the level of the Underlier or any Successor Underlier will be based on a comparison of (x) the portion of the level of such underlier attributable to that security and (y) the overall level of the Underlier or Successor Underlier, in each case immediately before the occurrence of the Market Disruption Event; |

|

|

(2) |

the “Close of Trading” on any Trading Day for the Underlier or any Successor Underlier means the Scheduled Closing Time of the Relevant Stock Exchanges with respect to the securities underlying the Underlier or Successor Underlier on such Trading Day; provided that, if the actual closing time of the regular trading session of any such Relevant Stock Exchange is earlier than its Scheduled Closing Time on such Trading Day, then (x) for purposes of clauses (A) and (C) of the definition of “Market Disruption Event” above, with respect to any security underlying the Underlier or Successor Underlier for which such Relevant Stock Exchange is its Relevant Stock Exchange, the “Close of Trading” means such actual closing time and (y) for purposes of clauses (B) and (D) of the definition of “Market Disruption Event” above, with respect to any futures or options contract relating to the Underlier or Successor Underlier, the “close of trading” means the latest actual closing time of the regular trading session of any of the Relevant Stock Exchanges, but in no event later than the Scheduled Closing Time of the Relevant Stock Exchanges; |

|

|

(3) |

the “Scheduled Closing Time” of any Relevant Stock Exchange or Related Futures or Options Exchange on any Trading Day for the Underlier or any Successor Underlier means the scheduled weekday closing time of such Relevant Stock Exchange or Related Futures or Options Exchange on such Trading Day, without regard to after hours or any other trading outside the regular trading session hours; y |

|

|

(4) |

an “Exchange Business Day” means any Trading Day for the Underlier or any Successor Underlier on which each Relevant Stock Exchange for the securities underlying the Underlier or any Successor Underlier and each Related Futures or Options Exchange are open for trading during their respective regular trading sessions, notwithstanding any such Relevant Stock Exchange or Related Futures or Options Exchange closing prior to its Scheduled Closing Time. |

If a Market Disruption Event occurs or is continuing on the Determination Date, then the Determination Date will be postponed to the first succeeding Trading Day on which a Market Disruption Event has not occurred and is not continuing; however, if such first succeeding Trading Day has not occurred as of the eighth Trading Day after the originally scheduled Determination Date, that eighth Trading Day shall be deemed to be the Determination Date. If

the Determination Date has been postponed eight Trading Days after the originally scheduled Determination Date and a Market Disruption Event occurs or is continuing on such eighth Trading Day, the Calculation Agent will determine the Closing Level of the Underlier on such eighth Trading Day in accordance with the formula for and method of calculating the Closing Level of the Underlier last in effect prior to commencement of the Market Disruption Event, using the closing price (or, with respect to any relevant security, if a Market Disruption Event has occurred with respect to such security, its good faith estimate of the value of such security at the Scheduled Closing Time of the Relevant Stock Exchange for such security or, if earlier, the actual closing time of the regular trading session of such Relevant Stock Exchange) on such date of each security included in the Underlier. As used herein, “closing price” means, with respect to any security on any date, the Relevant Stock Exchange traded or quoted price of such security as of the Scheduled Closing Time of the Relevant Stock Exchange for such security or, if earlier, the actual closing time of the regular trading session of such Relevant Stock Exchange.

Calculation Agent

The Calculation Agent will determine the Cash Settlement Amount and the Final Underlier Level. In addition, the Calculation Agent will (i) determine if adjustments are required to the Closing Level of the Underlier under the circumstances described in this Security, (ii) if publication of the Underlier is discontinued, select a Successor Underlier or, if no Successor Underlier is available, determine the Closing Level of the Underlier under the circumstances described in this Security, and (iii) determine whether a Market Disruption Event or non-Trading Day has occurred.

The Company covenants that, so long as this Security is Outstanding, there shall at all times be a Calculation Agent (which shall be a broker-dealer, bank or other financial institution) with respect to this Security.

All determinations made by the Calculation Agent with respect to this Security will be at the sole discretion of the Calculation Agent and, in the absence of manifest error, will be conclusive for all purposes and binding on the Company and the Holder of this Security.

Tax Considerations

The Company agrees, and by acceptance of a beneficial ownership interest in this Security each Holder of this Security will be deemed to have agreed (in the absence of a statutory, regulatory, administrative or judicial ruling to the contrary), for United States federal income tax purposes to characterize and treat this Security as a prepaid derivative contract that is an “open transaction.”

Redemption and Repayment

This Security is not subject to redemption at the option of the Company or repayment at the option of the Holder hereof prior to December 7, 2021. This Security is not entitled to any sinking fund.

Acceleration

If an Event of Default, as defined in the Indenture, with respect to this Security shall occur and be continuing, the Cash Settlement Amount (calculated as set forth in the next sentence) of this Security may be declared due and payable in the manner and with the effect provided in the Indenture. The amount payable to the Holder hereof upon any acceleration permitted under the Indenture will be equal to the Cash Settlement Amount hereof calculated as provided herein as though the date of acceleration was the Determination Date.

Reference is hereby made to the further provisions of this Security set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth at this place.

Unless the certificate of authentication hereon has been executed by the Trustee referred to on the reverse hereof by manual signature or its duly authorized agent under the Indenture referred to on the reverse hereof by manual signature, this Security shall not be entitled to any benefit under the Indenture or be valid or obligatory for any purpose.

(The remainder of this page has been left intentionally blank)

IN WITNESS WHEREOF, the Company has caused this instrument to be duly executed.

DATED:

|

|

WELLS FARGO FINANCE LLC |

||

|

|

|

|

|

|

|

By: |

|

|

|

|

|

|

|

|

|

|

|

Its: |

|

|

Attest: |

|

|

|

|

|

|

|

|

Its: |

TRUSTEE’S CERTIFICATE OF

AUTHENTICATION

This is one of the Securities of the

series designated therein described

in the within-mentioned Indenture.

|

CITIBANK, N.A., |

|

|

|

|

as Trustee |

|

|

|

|

|

|

By: |

|

|

|

|

Authorized Signature |

|

|

|

|

|

|

|

OR |

|

|

|

|

|

|

WELLS FARGO BANK, N.A., |

|

|

|

as Authenticating Agent for the Trustee |

|

|

|

|

|

|

|

By: |

|

|

|

|

Authorized Signature |

|

(Reverse of Note)

WELLS FARGO FINANCE LLC

MEDIUM-TERM NOTE, SERIES A

Fully and Unconditionally Guaranteed by Wells Fargo & Company

Principal at Risk Securities Linked to the S&P 500® Index

This Security is one of a duly authorized issue of securities of the Company (herein called the “Securities”), issued and to be issued in one or more series under an indenture dated as of April 25, 2018, as amended or supplemented from time to time (herein called the “Indenture”), among the Company, as issuer, Wells Fargo & Company, as guarantor (the “Guarantor”) and Citibank, N.A., as trustee (herein called the “Trustee,” which term includes any successor trustee under the Indenture), to which Indenture and all indentures supplemental thereto reference is hereby made for a statement of the respective rights, limitations of rights, duties and immunities thereunder of the Company, the Guarantor, the Trustee and the Holders of the Securities, and of the terms upon which the Securities are, and are to be, authenticated and delivered. This Security is one of the series of the Securities designated as Medium-Term Notes, Series A, of the Company. The amount payable on the Securities of this series may be determined by reference to the performance of one or more equity-, commodity- or currency-based indices, exchange traded funds, securities, commodities, currencies, statistical measures of economic or financial performance, or a basket comprised of two or more of the foregoing, or any other market measure or may bear interest at a fixed rate or a floating rate. The Securities of this series may mature at different times, be redeemable at different times or not at all, be repayable at the option of the Holder at different times or not at all and be denominated in different currencies.

The Securities are issuable only in registered form without coupons and will be either (a) book-entry securities represented by one or more Global Securities recorded in the book-entry system maintained by the Depositary or (b) certificated securities issued to and registered in the names of, the beneficial owners or their nominees.

The Company agrees, to the extent permitted by law, not to voluntarily claim the benefits of any laws concerning usurious rates of interest against a Holder of this Security.

Guarantee

The Securities of this series are fully and unconditionally guaranteed by the Guarantor as and to the extent set forth in the Indenture.

Modification and Waivers

The Indenture permits, with certain exceptions as therein provided, the amendment thereof and the modification of the rights and obligations of the Company and the Guarantor and the rights of the Holders of the Securities of each series to be affected under the Indenture at any time by the

Company, the Guarantor and the Trustee with the consent of the Holders of a majority in principal amount of the Securities at the time Outstanding of all series to be affected, acting together as a class. The Indenture also contains provisions permitting the Holders of a majority in principal amount of the Securities of all series at the time Outstanding affected by certain provisions of the Indenture, acting together as a class, on behalf of the Holders of all Securities of such series, to waive compliance by the Company or the Guarantor with those provisions of the Indenture. Certain past defaults under the Indenture and their consequences may be waived under the Indenture by the Holders of a majority in principal amount of the Securities of each series at the time Outstanding, on behalf of the Holders of all Securities of such series. Solely for the purpose of determining whether any consent, waiver, notice or other action or Act to be taken or given by the Holders of Securities pursuant to the Indenture has been given or taken by the Holders of Outstanding Securities in the requisite aggregate principal amount, the principal amount of this Security will be deemed to be equal to the amount set forth on the face hereof as the “Face Amount” hereof. Any such consent or waiver by the Holder of this Security shall be conclusive and binding upon such Holder and upon all future Holders of this Security and of any Security issued upon the registration of transfer hereof or in exchange herefor or in lieu hereof, whether or not notation of such consent or waiver is made upon this Security.

Defeasance

Section 403 and Article Fifteen of the Indenture and the provisions of clause (ii) of Section 401(1)(B) of the Indenture, relating to defeasance at any time of (a) the entire indebtedness on this Security and (b) certain restrictive covenants, upon compliance by the Company or the Guarantor with certain conditions set forth therein, shall not apply to this Security. The remaining provisions of Section 401 of the Indenture shall apply to this Security.

Authorized Denominations

This Security is issuable only in registered form without coupons in denominations of $1,000 or any amount in excess thereof which is an integral multiple of $1,000.

Registration of Transfer

Upon due presentment for registration of transfer of this Security at the office or agency of the Company in the City of Minneapolis, Minnesota, a new Security or Securities of this series, with the same terms as this Security, in authorized denominations for an equal aggregate Face Amount will be issued to the transferee in exchange herefor, as provided in the Indenture and subject to the limitations provided therein and to the limitations described below, without charge except for any tax or other governmental charge imposed in connection therewith.

This Security is exchangeable for definitive Securities in registered form only if (x) the Depositary notifies the Company that it is unwilling or unable to continue as Depositary for this Security or if at any time the Depositary ceases to be a clearing agency registered under the Securities Exchange Act of 1934, as amended, and a successor depositary is not appointed within 90 days after the Company receives such notice or becomes aware of such ineligibility, (y) the Company in its sole discretion determines that this Security shall be exchangeable for definitive Securities in registered form and notifies the Trustee thereof or (z) an Event of Default with respect

to the Securities represented hereby has occurred and is continuing. If this Security is exchangeable pursuant to the preceding sentence, it shall be exchangeable for definitive Securities in registered form, having the same date of issuance, Stated Maturity Date and other terms and of authorized denominations aggregating a like amount.

This Security may not be transferred except as a whole by the Depositary to a nominee of the Depositary or by a nominee of the Depositary to the Depositary or another nominee of the Depositary or by the Depositary or any such nominee to a successor of the Depositary or a nominee of such successor. Except as provided above, owners of beneficial interests in this Global Security will not be entitled to receive physical delivery of Securities in definitive form and will not be considered the Holders hereof for any purpose under the Indenture.

Prior to due presentment of this Security for registration of transfer, the Company, the Guarantor, the Trustee and any agent of the Company, the Guarantor or the Trustee may treat the Person in whose name this Security is registered as the owner hereof for all purposes, whether or not this Security be overdue, and neither the Company, the Guarantor, the Trustee nor any such agent shall be affected by notice to the contrary.

Obligation of the Company Absolute

No reference herein to the Indenture and no provision of this Security or the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay the Cash Settlement Amount at the times, place and rate, and in the coin or currency, herein prescribed, except as otherwise provided in this Security.

No Personal Recourse

No recourse shall be had for the payment of the Cash Settlement Amount, or for any claim based hereon, or otherwise in respect hereof, or based on or in respect of the Indenture or any indenture supplemental thereto, against any incorporator, stockholder, officer or director, as such, past, present or future, of the Company or any successor corporation or of the Guarantor or any successor corporation, whether by virtue of any constitution, statute or rule of law, or by the enforcement of any assessment or penalty or otherwise, all such liability being, by the acceptance hereof and as part of the consideration for the issuance hereof, expressly waived and released.

Defined Terms

All terms used in this Security which are defined in the Indenture shall have the meanings assigned to them in the Indenture unless otherwise defined in this Security.

Governing Law

This Security shall be governed by and construed in accordance with the law of the State of New York, without regard to principles of conflicts of laws.

ABBREVIATIONS

The following abbreviations, when used in the inscription on the face of this instrument, shall be construed as though they were written out in full according to applicable laws or regulations:

|

TEN COM |

– |

as tenants in common |

|

|

|

|

|

TEN ENT |

– |

as tenants by the entireties |

|

|

|

|

|

JT TEN |

– |