Royal Bank of Canada ofrece notas de barrera de cupón contingente autocalificables (las “Notas”) vinculadas al menor rendimiento de las acciones de dos fondos negociados en bolsa (cada uno, una “Referencia

Activo "y, juntos, los" Activos de referencia "). Los Bonos ofrecidos son obligaciones senior no garantizadas de Royal Bank of Canada, pagarán un Cupón contingente trimestral a la tasa y bajo las circunstancias especificadas a continuación, y tendrán los términos

descrito en los documentos descritos anteriormente, como complementado o modificado por este suplemento de términos.

|

Barreras de cupones y precios de activación |

|||||

|

iShares® ETF de gran capitalización de China ("FXI") |

65% de su precio inicial |

||||

|

Vectores de mercado® Gold Miners ETF ("GDX") |

65% de su precio inicial |

* Para cada activo de referencia, el precio inicial será su precio de cierre en la fecha de negociación.

Los Bonos no garantizan ninguna devolución del capital al vencimiento. Cualquier pago en el Notas son

sujeto a nuestro riesgo de crédito.

Invertir en el Notas implica una serie de riesgos. Consulte "Consideraciones de riesgo seleccionadas" que comienzan en la página P-8 de este suplemento de términos, y

"Factores de riesgo" que comienzan en la página PS-5 del suplemento del prospecto del producto con fecha 10 de septiembre de 2018 y en la página S-1 del suplemento del prospecto con fecha 7 de septiembre de 2018.

los Notas no constituirá depósitos asegurados por la Corporación de Seguros de Depósitos de Canadá, la Corporación Federal de Seguros de Depósitos de EE. UU.

o cualquier otra agencia o instrumental del gobierno canadiense o estadounidense. Los Bonos no están sujetos a conversión en nuestras acciones ordinarias según la subsección 39.2 (2.3) de la Ley de Corporación de Seguros de Depósitos de Canadá.

Ni la Comisión de Bolsa y Valores (la "SEC") ni ninguna comisión estatal de valores ha aprobado o desaprobado los Bonos o ha determinado que este término complementario es

Verdadero o completo. Cualquier representación en contrario es un delito penal.

|

Editor: |

Royal Bank of Canada |

Listado de Bolsa de Valores: |

Ninguna |

|

Fecha comercial: |

28 de enero de 2020 |

Cantidad principal: |

$ 1,000 por nota |

|

Fecha de asunto: |

31 de enero de 2020 |

Fecha de vencimiento: |

2 de febrero de 2023 |

|

Fechas de observación: |

Trimestralmente, como se establece a continuación. |

Fechas de pago de cupones: |

Trimestralmente, como se establece a continuación |

|

Fecha de la valoración: |

30 de enero de 2023 |

Tasa de cupón contingente: |

8.00% anual |

|

Cupón contingente: |

Si el precio de cierre de cada El activo de referencia es mayor o igual a su barrera de cupón en la fecha de observación aplicable, nosotros |

||

|

Pago al vencimiento (si conservado hasta su vencimiento): |

Si las Notas no se llamaron previamente, le pagaremos al vencimiento un monto basado en el Precio Final del Activo de Referencia de Menor Desempeño: Por cada monto de capital de $ 1,000, $ 1,000 más el Cupón contingente al vencimiento, a menos que el Precio final del activo de referencia de menor rendimiento sea menor que su Precio de activación. Si el precio final del activo de referencia de menor rendimiento es menor que su precio de activación, entonces el inversionista recibirá al vencimiento, por cada $ 1,000 en el monto principal, un pago en efectivo igual $ 1,000 + ($ 1,000 x Retorno del activo de referencia del activo de referencia de menor rendimiento) Los inversores en los Bonos podrían perder parte o la totalidad de su monto principal si el Precio final del activo de referencia de menor rendimiento es menor que su Activador |

||

|

Menor rendimiento Activo de referencia: |

El activo de referencia con el retorno de activo de referencia más bajo. |

||

|

Característica de llamada: |

Si el precio de cierre de cada El activo de referencia es mayor o igual a su precio inicial a partir del 28 de julio de 2020 y en cualquier |

||

|

Fechas de liquidación de llamadas: |

La fecha de pago del cupón correspondiente a esa fecha de observación. |

||

|

Precio final: |

Para cada activo de referencia, su precio de cierre en la fecha de valoración. |

||

|

CUSIP: |

78015KJK1 |

||

|

Precio al publico(1) |

100.00% |

PS |

|

|

Suscripción de descuentos y comisiones(1) |

|||

|

Ingresos al Royal Bank of Canada |

98,00% |

PS |

| (1) |

Ciertos distribuidores que compran los Bonos para la venta a ciertas cuentas de asesoramiento basadas en honorarios pueden renunciar a parte o la totalidad de sus descuentos de suscripción o concesiones de venta. El precio de oferta pública para los inversores. |

Se espera que el valor inicial estimado de los Bonos a la Fecha de Negociación esté entre $ 941.03 y $ 961.03 por cada $ 1,000 en monto de capital, y será menor que el precio al público.

El suplemento de precio final relacionado con los Bonos establecerá nuestra estimación del valor inicial de los Bonos a partir de la Fecha de Negociación. El valor real de las Notas en cualquier momento reflejará muchos factores, no se puede predecir con precisión y puede ser

menos de esta cantidad Describimos nuestra determinación del valor estimado inicial con más detalle a continuación.

Si los Bonos a la fecha de este término complementan, RBC Capital Markets, LLC, a la que nos referimos como RBCCM, que actúa como agente del Royal Bank of Canada, recibiría una comisión de aproximadamente

$ 20.00 por $ 1,000 en el monto principal de los Bonos y usaría una parte de esa comisión para permitir la venta de concesiones a otros distribuidores de hasta aproximadamente $ 20.00 por $ 1,000 en el monto principal de los Bonos. Los otros distribuidores pueden renunciar, en

a su exclusivo criterio, algunas o todas sus concesiones de venta. Consulte "Plan de distribución suplementario (conflictos de intereses)" a continuación.

RESUMEN

La información en esta sección "Resumen" está calificada por la información más detallada establecida en este suplemento de términos, el suplemento del prospecto del producto, el prospecto

suplemento y el prospecto.

|

General: |

Este suplemento de términos se refiere a una oferta de Notas de barrera de cupón contingente autocalificables (las "Notas") vinculadas al menor rendimiento de las acciones de dos bolsas |

|

Editor: |

Royal Bank of Canada ("Royal Bank") |

|

Fecha comercial: |

28 de enero de 2020 |

|

Fecha de asunto: |

31 de enero de 2020 |

|

Fecha de la valoración: |

30 de enero de 2023 |

|

Fecha de vencimiento: |

2 de febrero de 2023 |

|

Denominaciones: |

Denominación mínima de $ 1,000 y múltiplos integrales de $ 1,000 a partir de entonces. |

|

Moneda designada: |

Dólares estadounidenses |

|

Cupón contingente: |

Le pagaremos un Cupón contingente durante el plazo de los Bonos, periódicamente atrasado en cada Fecha de pago del cupón, en las condiciones que se describen a continuación: • Si el cierre • Si el cierre No puede recibir un Cupón contingente por uno o más períodos trimestrales durante el plazo de las Notas. |

|

Tasa de cupón contingente: |

8.00% anual (2.00% por trimestre) |

|

Fechas de observación: |

Trimestralmente, el 28 de abril de 2020, 28 de julio de 2020, 28 de octubre de 2020, 28 de enero de 2021, 28 de abril de 2021, 28 de julio de 2021, 28 de octubre de 2021, 28 de enero de 2022, 28 de abril de 2022, 28 de julio , |

|

Fechas de pago de cupones: |

El cupón contingente, si es pagadero, se pagará trimestralmente el 1 de mayo de 2020, el 31 de julio de 2020, el 2 de noviembre de 2020, el 2 de febrero de 2021, el 3 de mayo de 2021, el 2 de agosto de 2021, el 2 de noviembre de 2021, el 2 de febrero, 2022, mayo |

|

Fecha de registro: |

La fecha de registro para cada Fecha de Pago de Cupón será un día hábil anterior a la Fecha de Pago de Cupón programada; siempre, sin embargo, que cualquier Cupón contingente pagadero a |

|

Característica de llamada: |

Si, a partir del 28 de julio de 2020 y en cualquier Fecha de Observación posterior, el precio de cierre de cada Activo de Referencia es mayor o igual |

|

Pago si se llama: |

Si las Notas se invocan automáticamente, entonces, en la Fecha de Liquidación de Llamada correspondiente, por cada monto de capital de $ 1,000, recibirá $ 1,000 más el Cupón Contingente que de otro modo se vence en ese |

|

Fechas de liquidación de llamadas: |

Si los Bonos son llamados en cualquier Fecha de Observación que comience el 28 de julio de 2020 o posteriormente, la Fecha de Liquidación de la Llamada será la Fecha de Pago del Cupón correspondiente a ese |

|

Precio inicial: |

Para cada activo de referencia, su precio de cierre en la fecha de negociación. |

|

Precio final: |

Para cada activo de referencia, su precio de cierre en la fecha de valoración. |

|

Precio de activación y cupón Barrera: |

Para cada activo de referencia, el 65% de su precio inicial. Los precios de activación y las barreras de cupón reales se determinarán en la fecha de negociación. |

|

Pago al vencimiento (si no llamado previamente y conservado hasta su vencimiento): |

Si las Notas no se llamaron previamente, le pagaremos al vencimiento un monto basado en el Precio Final del Activo de Referencia de Menor Desempeño: • Si el precio final del activo de referencia de menor rendimiento es mayor o igual que su precio de activación, nosotros • Si el precio final del activo de referencia de menor rendimiento es menor que su precio de activación, recibirá en $ 1,000 + ($ 1,000 x Retorno del activo de referencia del activo de referencia de menor rendimiento) La cantidad de efectivo que reciba será menor que el monto de su capital, en todo caso, lo que resultará en una pérdida que es proporcional a la disminución del rendimiento menor |

|

Liquidación de existencias: |

No aplica. Los pagos de los Bonos se realizarán únicamente en efectivo. |

|

Retorno de activos de referencia: |

Con respecto a cada activo de referencia: Precio final – Precio inicial Precio inicial |

|

Menor rendimiento Activo de referencia: |

El activo de referencia con el retorno de activo de referencia más bajo. |

|

Eventos de interrupción del mercado: |

La ocurrencia de un evento de interrupción del mercado (o un día sin negociación) en cuanto a cualquiera de los Activos de Referencia dará como resultado el aplazamiento de una Fecha de Observación o el |

|

Agente de cálculo: |

RBC Capital Markets, LLC ("RBCCM") |

|

Tratamiento fiscal de EE. UU .: |

Al comprar una Nota, cada titular acuerda (en ausencia de un cambio en la ley, una determinación administrativa o una resolución judicial en contrario) tratar las Notas como una orden incobrable |

|

Mercado secundario: |

RBCCM (o una de sus filiales), aunque no está obligado a hacerlo, puede mantener un mercado secundario en las Notas después de la Fecha de Emisión. La cantidad que puede recibir en |

|

Listado: |

Los Bonos no se incluirán en ninguna bolsa de valores. |

|

Asentamiento: |

DTC global (incluso a través de sus participantes indirectos Euroclear y Clearstream, Luxemburgo, como se describe en “Descripción de los valores de deuda: propiedad y anotación en cuenta» |

|

Términos incorporados en el Nota maestra: |

Todos los términos que aparecen sobre el artículo titulado "Mercado secundario" en las páginas P-2 y P-3 de este término complementan y los términos que aparecen bajo el título "Términos generales del |

La Fecha de negociación, la fecha de emisión y otras fechas establecidas anteriormente están sujetas a cambios y se establecerán en el suplemento de precio final relacionado con las Notas.

TÉRMINOS ADICIONALES DE SUS NOTAS

Debe leer este suplemento de términos junto con el prospecto con fecha 7 de septiembre de 2018, complementado con el suplemento con prospecto con fecha 7 de septiembre de 2018 y el suplemento con prospecto del producto con fecha 10 de septiembre,

2018, en relación con nuestras Notas Senior a mediano plazo a nivel mundial, Serie H, de las cuales forman parte estas Notas. Los términos en mayúscula utilizados pero no definidos en este suplemento tendrán el significado que se les da en el suplemento del prospecto del producto. En el caso

de cualquier conflicto, este suplemento de términos controlará. Las Notas varían de los términos descritos en el suplemento del prospecto del producto de varias maneras importantes. Deberías leer este suplemento de términos

cuidadosamente.

Este suplemento de términos, junto con los documentos enumerados a continuación, contiene los términos de las Notas y reemplaza todas las declaraciones orales anteriores o contemporáneas, así como cualquier otro material escrito, incluidos los preliminares

o términos de precios indicativos, correspondencia, ideas comerciales, estructuras para implementación, estructuras de muestra, folletos u otros materiales educativos nuestros. Debe considerar cuidadosamente, entre otras cosas, los asuntos establecidos en "Factores de riesgo"

en el suplemento de prospecto con fecha 7 de septiembre de 2018 y en el suplemento de prospecto de producto con fecha 10 de septiembre de 2018, ya que las Notas implican riesgos no asociados con valores de deuda convencionales. Le instamos a consultar su inversión, legal, fiscal,

asesores contables y de otro tipo antes de invertir en las Notas. Puede acceder a estos documentos en el sitio web de la Comisión de Bolsa y Valores en www.sec.gov de la siguiente manera (o si esa dirección ha cambiado, revisando nuestras presentaciones para la fecha correspondiente)

en el sitio web de la SEC):

Folleto de 7 de septiembre de 2018:

Folleto Suplementario de fecha 7 de septiembre de 2018:

Suplemento del Folleto del Producto del 10 de septiembre de 2018:

Nuestra clave de índice central, o CIK, en el sitio web de la SEC es 1000275. Como se usa en este suplemento de términos, "nosotros", "nos" o "nuestro" se refiere a Royal Bank of Canada.

Royal Bank of Canada ha presentado una declaración de registro (que incluye un suplemento de prospecto de producto, un suplemento de prospecto y un prospecto) ante la SEC para la oferta a la que se refiere este suplemento de términos. Antes de invertir, debe

lea esos documentos y otros documentos relacionados con esta oferta que hemos presentado ante la SEC para obtener información más completa sobre nosotros y esta oferta. Puede obtener estos documentos sin costo visitando EDGAR en el sitio web de la SEC en

www.sec.gov. Alternativamente, Royal Bank of Canada, cualquier agente o distribuidor que participe en esta oferta se encargará de enviarle el suplemento del prospecto del producto, el suplemento del prospecto y el prospecto si así lo solicita llamando al número gratuito

al 1-877-688-2301.

EJEMPLOS HIPOTETETICOS

La tabla que figura a continuación se incluye solo con fines ilustrativos. La tabla ilustra el pago al vencimiento de las notas (incluido el cupón contingente final, si es pagadero) para un hipotético

rango de rendimiento para el activo de referencia de menor rendimiento, suponiendo los siguientes términos y que las notas no se invocan automáticamente antes de su vencimiento:

|

Precio inicial hipotético (para cada activo de referencia): |

$ 100.00 * |

|

|

Precio del disparador hipotético y barrera del cupón (para cada activo de referencia): |

$ 65.00, que es el 65% de su precio inicial hipotético (los precios de activación y las barreras de cupón reales se determinarán en la fecha de negociación). |

|

|

Tasa de cupón contingente: |

8.00% por año (o 2.00% por trimestre) |

|

|

Cantidad de cupón contingente: |

$ 20.00 por trimestre |

|

|

Fechas de observación: |

Trimestral |

|

|

Cantidad principal: |

$ 1,000 por nota |

* El precio inicial hipotético de $ 100 utilizado en los ejemplos a continuación se ha elegido solo con fines ilustrativos y no representa el precio inicial real esperado de ninguno de los activos de referencia. los

El precio inicial real para cada activo de referencia se establecerá en la portada del suplemento de precio final relacionado con las Notas. No hacemos ninguna representación o garantía en cuanto a cuál de los

Los activos de referencia serán los activos de referencia de menor rendimiento. Es posible que el precio final de cada activo de referencia sea inferior a su precio inicial.

Los precios finales hipotéticos se muestran en la primera columna a la izquierda. La segunda columna muestra el pago al vencimiento para un rango de precios finales en la fecha de valoración. La tercera columna muestra la cantidad.

de efectivo a pagar en los Bonos por $ 1,000 en monto de capital. Si los Bonos son llamados antes del vencimiento, los ejemplos hipotéticos a continuación no serán relevantes, y usted recibirá en la Fecha de Pago del Cupón correspondiente, por cada capital de $ 1,000

monto, $ 1,000 más el Cupón contingente que de otro modo se pagaría en las Notas.

|

Precio final hipotético de el menor desempeño Activo de referencia |

Pago al vencimiento como Porcentaje del director Cantidad |

Pago al vencimiento (suponiendo que las Notas no fueron llamados previamente) |

|

$ 150.00 |

102,00% |

$ 1,020.00 * |

|

$ 140.00 |

102,00% |

$ 1,020.00 * |

|

$ 125.00 |

102,00% |

$ 1,020.00 * |

|

$ 120.00 |

102,00% |

$ 1,020.00 * |

|

$ 110.00 |

102,00% |

$ 1,020.00 * |

|

$ 100.00 |

102,00% |

$ 1,020.00 * |

|

$ 90.00 |

102,00% |

$ 1,020.00 * |

|

$ 80.00 |

102,00% |

$ 1,020.00 * |

|

$ 70.00 |

102,00% |

$ 1,020.00 * |

|

$ 65.00 |

102,00% |

$ 1,020.00 * |

|

$ 64.99 |

64,99% |

$ 649.90 |

|

$ 60.00 |

60,00% |

$ 600.00 |

|

$ 50.00 |

50,00% |

$ 500.00 |

|

$ 40.00 |

40,00% |

$ 400.00 |

|

$ 30.00 |

30,00% |

$ 300.00 |

|

$ 20.00 |

20,00% |

$ 200.00 |

|

$ 10.00 |

10,00% |

$ 100.00 |

|

$ 0.00 |

0.00% |

$ 0.00 |

* *Incluyendo el cupón contingente final, si es pagadero.

Ejemplos hipotéticos de importes por pagar al vencimiento

Los siguientes ejemplos hipotéticos ilustran cómo se calculan los pagos al vencimiento establecidos en la tabla anterior, suponiendo que no se hayan llamado las Notas.

Ejemplo 1: El precio del activo de referencia de menor rendimiento aumenta en un 40% desde el precio inicial de $ 100.00 a su precio final de $ 140.00. Porque la final

El precio del activo de referencia de menor rendimiento es mayor que su precio de activación y la barrera del cupón, el inversor recibe al vencimiento, además del cupón contingente final que de otro modo se vencía en los Bonos, un pago en efectivo de $ 1,000 por Bono, a pesar de

la apreciación del 40% en el precio del activo de referencia de menor rendimiento.

Ejemplo 2: El precio del activo de referencia de menor rendimiento disminuye en un 10% desde el precio inicial de $ 100.00 a su precio final de $ 90.00. Porque la final

El precio del activo de referencia de menor rendimiento es mayor que su precio de activación y la barrera del cupón, el inversor recibe al vencimiento, además del cupón contingente final que de otro modo se vencía en los Bonos, un pago en efectivo de $ 1,000 por Bono, a pesar de

la disminución del 10% en el precio del activo de referencia de menor rendimiento.

Ejemplo 3: El precio del activo de referencia de menor rendimiento es de $ 50.00 en la fecha de valoración, que es inferior a su precio de activación y barrera de cupón. Porque

el precio final del activo de referencia de menor rendimiento es menor que su precio de activación y la barrera del cupón, el cupón contingente final no se pagará en la fecha de vencimiento y pagaremos solo $ 500.00 por cada $ 1,000 en el monto principal de

las Notas, calculadas de la siguiente manera:

Importe principal + (importe principal x retorno del activo de referencia del activo de referencia de menor rendimiento)

= $ 1,000 + ($ 1,000 x -50.00%) = $ 1,000 – $ 500.00 = $ 500.00

* * *

Los pagos al vencimiento que se muestran arriba son completamente hipotéticos; se basan en los precios de los Activos de referencia que pueden no lograrse en la Fecha de valoración y en supuestos que pueden resultar erróneos. los

El valor de mercado real de sus Bonos en la Fecha de Vencimiento o en cualquier otro momento, incluido cualquier momento en que desee vender sus Bonos, puede tener poca relación con los Pagos hipotéticos al Vencimiento que se muestran arriba, y esos montos no deben considerarse como

una indicación del rendimiento financiero de una inversión en los Bonos o en una inversión en un Activo de referencia o en los valores representados por un Activo de referencia.

CONSIDERACIONES DE RIESGO SELECCIONADAS

Una inversión en las Notas implica riesgos significativos. Invertir en las Notas no es equivalente a invertir directamente en los Activos de Referencia. Estos riesgos se explican con más detalle en la sección

"Factores de riesgo" en el suplemento del prospecto del producto. Además de los riesgos descritos en el suplemento del prospecto y el suplemento del prospecto del producto, debe considerar lo siguiente:

| • |

Principal en riesgo – Los inversores en los Bonos podrían perder todo o una parte sustancial de su monto principal si hay una disminución en el precio de negociación del Menor |

| • |

Las notas están sujetas a una llamada automática: Si en cualquier Fecha de observación que comience en julio de 2020, el precio de cierre de cada Activo de referencia es mayor o igual a su |

| • |

Es posible que no reciba cupones contingentes – No necesariamente haremos ningún pago de cupón en los Bonos. Si el precio de cierre de cualquiera de los Activos de referencia en un |

| • |

Las notas están vinculadas al activo de referencia de menor rendimiento, incluso si el otro activo de referencia funciona mejor: Si alguno de los activos de referencia tiene un precio final |

| • |

Su pago en las notas se determinará por referencia a cada activo de referencia individualmente, no a una cesta, y el pago al vencimiento se basará en el rendimiento de |

| • |

La función de llamada y la función de cupón contingente limitan su potencial retorno – El potencial de devolución de las Notas se limita al Cupón contingente especificado previamente |

Bienes. Además, el rendimiento total de las Notas variará en función del número de Fechas de observación en las que el Cupón contingente sea pagadero antes de

vencimiento o una llamada automática. Además, si se llaman las Notas debido a la Función de Llamada, no recibirá ningún Cupón Contingente ni ningún otro pago con respecto a las Fechas de Observación después de la Fecha de Liquidación de Llamada correspondiente. Desde las notas

podría llamarse ya en julio de 2020, el rendimiento total de los Bonos podría ser mínimo. Si no se llaman las Notas, puede estar sujeto al rendimiento total negativo del Activo de referencia de menor rendimiento a pesar de que su rendimiento potencial sea

limitado a la tasa de cupón contingente. Como resultado, el rendimiento de una inversión en los Bonos podría ser menor que el rendimiento de una inversión directa en los Activos de referencia.

| • |

Su rendimiento puede ser inferior al rendimiento de una deuda convencional Seguridad de vencimiento comparable – El rendimiento que recibirá en las Notas, que podría ser negativo, |

| • |

Los pagos de los Bonos están sujetos a nuestro riesgo crediticio y se espera que los cambios en nuestras calificaciones crediticias afecten el valor de mercado de los Bonos. Las notas son nuestro senior |

| • |

Puede que no haya un mercado de negociación activo para las notas: las ventas en el mercado secundario pueden dar lugar a pérdidas significativas: Puede haber poco o ningún mercado secundario para |

| • |

El valor estimado inicial de las notas será menor que el precio al público – El valor estimado inicial que se establecerá |

| • |

El valor estimado inicial de las notas que proporcionaremos en el Suplemento de fijación de precios final será solo una estimación, calculada a partir del momento en que se establecen los términos de las notas |

El valor de los Bonos en cualquier momento después de la Fecha de Negociación variará en función de muchos factores, incluidos los cambios en las condiciones del mercado, y no se puede predecir con

exactitud. Como resultado, se debería esperar que el valor real que recibiría si vendiera los Bonos en cualquier mercado secundario, si lo hubiera, difiere materialmente del valor estimado inicial de sus Bonos.

| • |

An Investment in the Notes Is Subject to Risks Associated with Specific Economic Sectors— The stocks held by each exchange traded fund to which the Notes are linked are |

| • |

Our Business Activities May Create Conflicts of Interest — We and our affiliates expect to engage in trading activities related to the securities represented by the |

| • |

Owning the Notes Is Not the Same as Owning the Securities Represented by the Reference Assets — The return on your Notes is unlikely to reflect the return you would |

| • |

You Must Rely on Your Own Evaluation of the Merits of an Investment Linked to the Reference Assets — In the ordinary course of their business, our affiliates may have |

| • |

Management Risk — The Reference Assets are not managed according to traditional methods of ‘‘active’’ investment management, which involve the buying and selling of |

| • |

The Reference Assets and their Underlying Indices Are Different — The performance of each Reference Asset may not exactly replicate the performance of its respective |

During periods of market volatility, securities held by these Reference Assets may be unavailable in the secondary market, market participants may be unable to

calculate accurately their net asset value per share and their liquidity may be adversely affected. This kind of market volatility may also disrupt the ability of market participants to create and redeem shares of the applicable Reference Asset.

Further, market volatility may adversely affect, sometimes materially, the prices at which market participants are willing to buy and sell shares of the applicable Reference Asset. As a result, under these circumstances, the market value of shares of

these Reference Assets may vary substantially from the applicable net asset value per share. For all of the foregoing reasons, the performance of these Reference Assets may not correlate with the performance of their underlying indices as well as

their net asset value per share, which could materially and adversely affect the value of the Notes in the secondary market and/or reduce the payments on the Notes.

| • |

We and Our Affiliates Do Not Have Any Affiliation with the Advisors or the Sponsors of the Reference Assets or the Underlying Indices and Are Not Responsible for Their Public |

| • |

The Policies of the Reference Assets’ Investment Advisers or Underlying Indices Could Affect the Amount Payable on the Notes and Their Market Value — The policies of the |

| • |

Market Disruption Events and Adjustments — The payment at maturity, each Observation Date and the Valuation Date are subject to adjustment as described in the product |

| • |

An Investment in the Notes Is Subject to Risks Associated with the Gold and Silver Mining Industries – All or substantially all of the stocks held by the GDX are issued |

the Notes will not give holders any ownership or other direct interests in the stocks held by the GDX, the return on the Notes will be subject to certain risks associated with a direct

equity investment in gold or silver mining companies.

In addition, these companies are highly dependent on the price of gold or silver, as applicable. These prices fluctuate widely and may be affected by numerous factors. Factors affecting

gold prices include economic factors, including, among other things, the structure of and confidence in the global monetary system, expectations of the future rate of inflation, the relative strength of, and confidence in, the U.S. dollar (the

currency in which the price of gold is generally quoted), interest rates and gold borrowing and lending rates, and global or regional economic, financial, political, regulatory, judicial or other events. Gold prices may also be affected by industry

factors such as industrial and jewelry demand, lending, sales and purchases of gold by the official sector, including central banks and other governmental agencies and multilateral institutions which hold gold, levels of gold production and

production costs, and short-term changes in supply and demand because of trading activities in the gold market. Factors affecting silver prices include general economic trends, technical developments, substitution issues and regulation, as well as

specific factors including industrial and jewelry demand, expectations with respect to the rate of inflation, the relative strength of the U.S. dollar (the currency in which the price of silver is generally quoted) and other currencies, interest

rates, central bank sales, forward sales by producers, global or regional political or economic events, and production costs and disruptions in major silver producing countries such as Mexico and Peru. The supply of silver consists of a combination

of new mine production and existing stocks of bullion and fabricated silver held by governments, public and private financial institutions, industrial organizations and private individuals. In addition, the price of silver has on occasion been

subject to very rapid short-term changes due to speculative activities. From time to time, above-ground inventories of silver may also influence the market.

On the other hand, the GDX reflects the performance of shares of gold and silver mining companies and not gold bullion or silver bullion. The GDX may under- or

over-perform gold bullion and/or silver bullion over the term of the Notes.

| • |

There Are Risks Associated with Investments in Securities Linked to the Value of Foreign Equity Securities – The Reference Assets include equity securities issued by |

Securities prices in non-U.S. countries are subject to political, economic, financial and social factors that may be unique to the particular country. These factors,

which could negatively affect the non-U.S. securities markets, include the possibility of recent or future changes in the economic and fiscal policies of non-U.S. governments, the possible imposition of, or changes in, currency exchange laws or other

non-U.S. laws or restrictions applicable to non-U.S. companies or investments in non-U.S. equity securities, the possibility of fluctuations in the rate of exchange between currencies, the possibility of outbreaks of hostility and political

instability, and the possibility of natural disaster or adverse public health developments in the region. Moreover, the economies of certain foreign countries may differ favorably or unfavorably from the U.S. economy in important respects, such as

growth of gross national product, rate of inflation, trade surpluses or deficits, capital reinvestment, resources and self-sufficiency.

| • |

The Notes Are Subject to Exchange Rate Risk – Because securities held by the Reference Assets are traded in currencies other than U.S. dollars, and the Notes are |

INFORMATION REGARDING THE REFERENCE ASSETS

Information provided to or filed with the SEC by the Reference Assets under the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, can be located through the SEC’s website

at http://www.sec.gov. In addition, information may be obtained from other sources including, but not limited to, press releases, newspaper articles and other publicly disseminated documents. We have not participated in the preparation of, or

verified, such publicly available information. None of the forgoing documents or filings are incorporated by reference in, and should not be considered part of, this document.

The following information regarding the Reference Assets is derived from publicly available information.

We have not independently verified the accuracy or completeness of reports filed by the Reference Assets with the SEC, information published by them on their websites or in any other format, information about them

obtained from any other source or the information provided below.

The Notes are not sponsored, endorsed, sold or promoted by the investment adviser of any of the Reference Assets. The investment advisers make no representations or warranties to the owners of the Notes or any member of

the public regarding the advisability of investing in the Notes. The investment advisers have no obligation or liability in connection with the operation, marketing, trading or sale of the Notes.

We obtained the information regarding the historical performance of each Reference Asset set forth below from Bloomberg Financial Markets.

The iShares® China Large-Cap ETF (“FXI”)

“iShares®” and “BlackRock” are registered trademarks of BlackRock. The notes are not sponsored, endorsed, sold, or promoted by BlackRock, or by any of the iShares® Funds. Neither

BlackRock nor the iShares® Funds make any representations or warranties to the owners of the notes or any member of the public regarding the advisability of investing in the notes. Neither BlackRock nor the iShares® Funds shall

have any obligation or liability in connection with the registration, operation, marketing, trading, or sale of the notes or in connection with our use of information concerning this Reference Asset or any of the iShares® Funds.

iShares consists of numerous separate investment portfolios, including the iShares® China Large-Cap ETF.

The FXI seeks to track the investment results of the FTSE China 50 Index (the “Underlying Index”). Blackrock uses a representative sampling indexing strategy to manage the FXI. “Representative

sampling” is an indexing strategy that involves investing in a representative sample of securities that collectively has an investment profile similar to that of an applicable underlying index. The securities selected are expected to have, in the

aggregate, investment characteristics (based on factors such as market capitalization and industry weightings), fundamental characteristics (such as return variability and yield) and liquidity measures similar to those of an underlying index. The FXI

may or may not hold all of the securities in the Underlying Index.

The FXI generally invests at least 90% of its assets in securities of the Underlying Index and in depositary receipts representing securities of the Underlying Index. The FXI may invest the remainder of

its assets in certain futures, options and swap contracts, cash and cash equivalents, including shares of money market funds advised by BlackRock or its affiliates, as well as in securities not included in the Underlying Index, but which BlackRock

believes will help the FXI track the Underlying Index. The FXI may lend securities representing up to one-third of the value of the FXI’s total assets (including the value of any collateral received).

The FTSE China 50 Index

The Underlying Index is designed to measure the performance of the largest companies in the Chinese equity market that trade on the Stock Exchange of Hong Kong (the “SEHK”) and are available to

international investors, as determined by FTSE International Limited (“FTSE”). Securities in the Underlying Index are weighted based on the total market value of their shares, so that securities with higher total market values generally have a higher

representation in the Underlying Index.

Each security in the Underlying Index is a current constituent of the FTSE AllWorld Index. Individual constituents are capped such that no individual company represents more than 9% of the Underlying

Index, and so that all companies that individually have a weight greater than 4.5% in the aggregate represent no more than 38% of the Underlying Index.

The FTSE China 50 Index is calculated in real-time and published on an intra-second streaming basis.

Types of Shares in the Underlying Index

H Shares. H Shares are securities of companies incorporated in the People’s Republic of China (the “PRC”) and listed on the SEHK. They can only be traded by

Chinese investors under the Qualified Domestic Institutional Investors Scheme (the “QDII”). There are no restrictions for international investors.

Red Chips. Red Chip companies are incorporated outside the PRC and traded on the SEHK. A Red Chip company has at least 30% of its shares in aggregate held directly or

indirectly by mainland state entities, and at least 50% of its revenue or assets derived from mainland China.

P Chips. P Chip companies are incorporated outside the PRC that trade on SEHK. A P Chip is a company that is controlled by Mainland China individuals, with the

establishment and origin of the company in Mainland China and at least 50% of its revenue or assets derived from mainland China.

For additional information about the Underlying Index and its method of calculation, please see the FTSE website. However, information on that website is not included or incorporated by reference in this document.

The VanEck Vectors® Gold Miners ETF (“GDX”)

The GDX is an investment portfolio maintained, managed and advised by Van Eck. The VanEck VectorsTM ETF Trust is a registered open-end investment company that consists of numerous separate investment

portfolios, including the GDX.

The GDX is an exchange traded fund that trades on NYSE Arca under the ticker symbol “GDX.”

The GDX seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the NYSE Arca Gold Minders Index (the “Underlying Index”). The Underlying Index was

developed by the NYSE Amex and is calculated, maintained and published by NYSE Arca. The Underlying Index is a modified market capitalization-weighted index comprised of publicly traded companies involved primarily in mining for gold or silver.

The GDX utilizes a “passive” or “indexing” investment approach in attempting to track the performance of the Underlying Index. The GDX will invest in all of the securities which comprise the Underlying Index. The GDX

will normally invest at least 95% of its total assets in common stocks that comprise the Underlying Index.

The Notes are not sponsored, endorsed, sold or promoted by Van Eck. Van Eck makes no representations or warranties to the owners of the Notes or any member of the public regarding the advisability of investing in the

Notes. Van Eck has no obligation or liability in connection with the operation, marketing, trading or sale of the Notes.

The NYSE Arca Gold Miners Index

The Underlying Index is a modified market capitalization weighted index comprised of securities issued by publicly traded companies involved primarily in the mining of gold or silver. The Underlying Index was developed

by the NYSE Amex and is calculated, maintained and published by NYSE Arca.

Eligibility Criteria for Index Components

The Underlying Index includes common stocks, ADRs or GDRs of selected companies that are involved in mining for gold and silver and that are listed for trading and electronically

quoted on a major stock market that is accessible by foreign investors. Generally, this includes exchanges in most developed markets and major emerging markets, and includes companies that are cross-listed, i.e., both U.S. and Canadian listings.

NYSE Arca will use its discretion to avoid exchanges and markets that are considered “frontier” in nature or have major restrictions to foreign ownership. The Underlying Index includes companies that derive at least 50% of their revenues from gold

mining and related activities (40% for companies that are already included in the Underlying Index). Also, the Underlying Index will maintain an exposure to companies with a significant revenue exposure to silver mining in addition to gold mining,

which will not exceed 20% of the Underlying Index weight at each rebalance.

Currently, only companies with a market capitalization of greater than $750 million that have an average daily trading volume of at least 50,000 shares and an average daily value

traded of at least $1 million over the past three months are eligible for inclusion in the Underlying Index. Starting in December 2013, for companies already included in the Underlying Index, the market capitalization requirement at each rebalance

will be $450 million, the average daily volume requirement will be at least 30,000 shares over the past three months and the average daily value traded requirement will be at least $600,000 over the past three months.

NYSE Arca has the discretion to not include all companies that meet the minimum criteria for inclusion.

Calculation of the Underlying Index

The Underlying Index is calculated by NYSE Arca on a price return basis. The calculation is based on the current modified market capitalization divided by a divisor. The divisor was determined on the initial

capitalization base of the Underlying Index and the base level and may be adjusted as a result of corporate actions and composition changes, as described below. The level of the Underlying Index was set at 500.00 on December 20, 2002 which is the

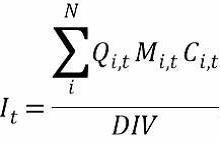

index base date. The Underlying Index is calculated using the following formula:

Dónde:

t = day of calculation;

N = number of constituent equities in the Underlying Index;

Qi,t = number of shares of equity i on day t;

Mi,t = multiplier of equity i;

Ci,t = price of equity i on day t; y

DIV = current index divisor on day t.

Underlying Index Maintenance

The Underlying Index is reviewed quarterly to ensure that at least 90% of the Underlying Index weight is accounted for by index components that continue to meet the initial eligibility requirements. NYSE Arca may at any

time and from time to time change the number of securities comprising the group by adding or deleting one or more securities, or replacing one or more securities contained in the group with one or more substitute securities of its choice, if in NYSE

Arca’s discretion such addition, deletion or substitution is necessary or appropriate to maintain the quality and/or character of the Underlying Index. Components will be removed from the Underlying Index during the

quarterly review if either (1) the market capitalization falls below $450 million or (2) the traded average daily shares for the previous three months is less than 30,000 shares and the average daily traded value for the previous three months is

less than $600,000.

At the time of the quarterly rebalance, the component security weights (also referred to as the multiplier or share quantities of each component security) will be modified to conform to the following asset

diversification requirements:

| (1) |

the weight of any single component security may not account for more than 20% of the total value of the Underlying Index; |

| (2) |

the component securities are split into two subgroups–large and small, which are ranked by market capitalization weight in the Underlying Index. Large securities are defined as having a starting index weight greater than or equal to |

| (3) |

the final aggregate weight of those component securities which individually represent more than 4.5% of the total value of the Underlying Index may not account for more than 45% of the total index value. |

The weights of the components securities (taking into account expected component changes and share adjustments) are modified in accordance with the Underlying Index’s diversification rules.

Diversification Rule 1: If any component stock exceeds 20% of the total value of the Underlying Index, then all stocks greater than 20% of the Underlying Index are reduced to

represent 20% of the value of the Underlying Index. The aggregate amount by which all component stocks are reduced is redistributed proportionately across the remaining stocks that represent less than 20% of the index value. After this

redistribution, if any other stock then exceeds 20%, the stock is set to 20% of the index value and the redistribution is repeated.

Diversification Rule 2: The components are sorted into two groups, large are components with a starting index weight of 5% or greater and small are components with a weight of

under 5% (after any adjustments for Diversification Rule 1). The large group will represent in the aggregate 45% and the small group will represent 55% in the aggregate of the final index weight. This will be

adjusted through the following process: The weight of each of the large stocks will be scaled down proportionately (with a floor of 5%) so that the aggregate weight of the large components will be reduced to represent 45% of the Underlying

Index. If any large component stock falls below a weight equal to the product of 5% and the proportion by which the stocks were scaled down following this distribution, then the weight of the stock is set equal to 5% and the components with weights

greater than 5% will be reduced proportionately. The weight of each of the small components will be scaled up proportionately from the redistribution of the large components. If any small component stock exceeds a weight equal to the product of 4.5%

and the proportion by which the stocks were scaled down following this distribution, then the weight of the stock is set equal to 4.5%. The redistribution of weight to the remaining stocks is repeated until the entire amount has been redistributed.

Changes to the Underlying Index composition and/or the component security weights in the Underlying Index are determined and announced prior to taking effect. These changes typically become effective after the close of trading on the third Friday

of each calendar quarter month in connection with the quarterly index rebalance. The share quantities of each component security in the index portfolio remains fixed between quarterly reviews except in the event of certain types of corporate actions

such as stock splits, reverse stock splits, stock dividends, or similar events. The share quantities used in the Underlying Index calculation are not typically adjusted for shares issued or repurchased between quarterly reviews. However, in the event

of a merger between two components, the share quantities of the surviving entity may be adjusted to account for any stock issued in the acquisition. NYSE Arca may substitute securities or change the number of securities included in the Underlying

Index, based on changing conditions in the industry or in the event of certain types of corporate actions, including mergers, acquisitions, spin-offs, and reorganizations. In the event of component or share quantity changes to the index portfolio,

the payment of dividends other than ordinary cash dividends, spin-offs, rights offerings, re-capitalization, or other corporate actions affecting a component security of the Underlying Index, the index divisor may be adjusted to ensure that there are

no changes to the index level as a result of nonmarket forces.

HISTORICAL INFORMATION

The graphs below set forth the information relating to the historical performance of the Reference Assets. We obtained the information regarding the historical performance of the Reference Assets in the

graphs below from Bloomberg Financial Markets.

We have not independently verified the accuracy or completeness of the information obtained from Bloomberg Financial Markets. The historical performance of either Reference Asset should not be taken as an indication of

its future performance, and no assurance can be given as to the prices of the Reference Assets at any time. We cannot give you assurance that the performance of the Reference Assets will not result in the loss of all or part of your investment.

Historical Information for the iShares® China Large-Cap ETF (“FXI”)

The graph below illustrates the performance of this Reference Asset from January 1, 2010 to January 23, 2020. The closing price of this Reference Asset on January 23, 2020 was $42.92. The red line represents a hypothetical Coupon Barrier and

Trigger Price of $27.89, which is equal to 65% of its closing price on January 23, 2020, rounded to two decimal places. The actual Coupon Barrier and Trigger Price will be based on the closing price of this Reference Asset on the Trade Date.

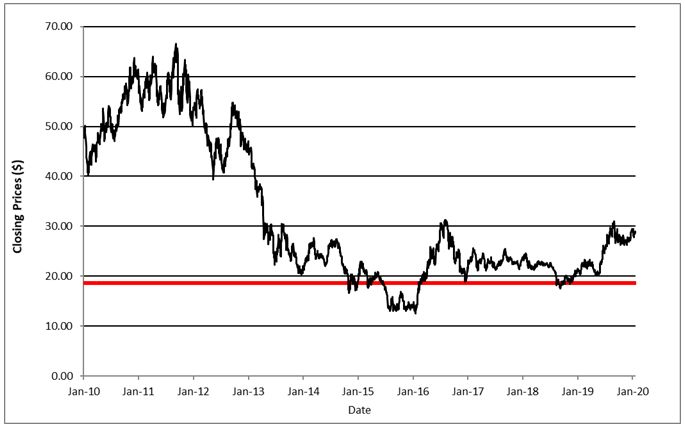

Historical Information for the VanEck Vectors® Gold Miners ETF (“GDX”)

The graph below illustrates the performance of this Reference Asset from January 1, 2010 to January 23, 2020. The closing price of this Reference Asset on January 23, 2020 was $28.66. The red line represents a hypothetical Coupon Barrier and

Trigger Price of $18.63, which is equal to 65% of its closing price on January 23, 2020, rounded to two decimal places. The actual Coupon Barrier and Trigger Price will be based on the closing price of this Reference Asset on the Trade Date.

SUPPLEMENTAL DISCUSSION OF

U.S. FEDERAL INCOME TAX CONSEQUENCES

The following disclosure supplements, and to the extent inconsistent supersedes, the discussion in the product prospectus supplement dated September 10, 2018 under “Supplemental Discussion of U.S.

Federal Income Tax Consequences.”

Under Section 871(m) of the Code, a “dividend equivalent” payment is treated as a dividend from sources within the United States. Such payments generally would be subject to a 30% U.S. withholding tax

if paid to a non-U.S. holder. Under U.S. Treasury Department regulations, payments (including deemed payments) with respect to equity-linked instruments (“ELIs”) that are “specified ELIs” may be treated as dividend equivalents if such specified ELIs

reference an interest in an “underlying security,” which is generally any interest in an entity taxable as a corporation for U.S. federal income tax purposes if a payment with respect to such interest could give rise to a U.S. source dividend.

However, the IRS has issued guidance that states that the U.S. Treasury Department and the IRS intend to amend the effective dates of the U.S. Treasury Department regulations to provide that withholding on dividend equivalent payments will not apply

to specified ELIs that are not delta-one instruments and that are issued before January 1, 2023. Based on our determination that the Notes are not delta-one instruments, non-U.S. holders should not be subject to withholding on dividend equivalent

payments, if any, under the Notes. However, it is possible that the Notes could be treated as deemed reissued for U.S. federal income tax purposes upon the occurrence of certain events affecting the Reference Assets or the Notes (for example, upon a

rebalancing of a Reference Asset), and following such occurrence the Notes could be treated as subject to withholding on dividend equivalent payments. Non-U.S. holders that enter, or have entered, into other transactions in respect of the Reference

Assets or the Notes should consult their tax advisors as to the application of the dividend equivalent withholding tax in the context of the Notes and their other transactions. If any payments are treated as dividend equivalents subject to

withholding, we (or the applicable withholding agent) would be entitled to withhold taxes without being required to pay any additional amounts with respect to amounts so withheld.

The accompanying product prospectus supplement notes that FATCA withholding on payments of gross proceeds from a sale or redemption of the Notes will only apply to payments made after December 31,

2018. That discussion is modified to reflect regulations proposed by the U.S. Treasury Department in December 2018 indicating an intent to eliminate the requirement under FATCA of withholding on gross proceeds of the disposition of financial

instruments. The U.S. Treasury Department has indicated that taxpayers may rely on these proposed regulations pending their finalization. Prospective investors are urged to consult with their own tax advisors regarding the possible implications of

FATCA on their investment in the Notes.

SUPPLEMENTAL PLAN OF DISTRIBUTION (CONFLICTS OF INTEREST)

We expect that delivery of the Notes will be made against payment for the Notes on or about January 31, 2020, which is the third (3rd) business day following the Trade Date (this settlement cycle being referred to as

“T+3”). See “Plan of Distribution” in the prospectus dated September 7, 2018. For additional information as to the relationship between us and RBCCM, please see the section “Plan of Distribution—Conflicts of Interest” in the prospectus dated

September 7, 2018.

We expect to deliver the Notes on a date that is greater than two business days following the Trade Date. Under Rule 15c6-1 of the Exchange Act, trades in the secondary market generally are required to settle in two

business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes more than two business days prior to the original Issue Date will be required to specify alternative settlement

arrangements to prevent a failed settlement.

In the initial offering of the Notes, they will be offered to investors at a purchase price equal to par, except with respect to certain accounts as indicated on the cover page of this document.

The value of the Notes shown on your account statement may be based on RBCCM’s estimate of the value of the Notes if RBCCM or another of our affiliates were to make a market in the Notes (which it is not obligated to

do). That estimate will be based upon the price that RBCCM may pay for the Notes in light of then prevailing market conditions, our creditworthiness and transaction costs. For a period of approximately 3 months after the issue date of the Notes,

the value of the Notes that may be shown on your account statement may be higher than RBCCM’s estimated value of the Notes at that time. This is because the estimated value of the Notes will not include the underwriting discount and our hedging

costs and profits; however, the value of the Notes shown on your account statement during that period may initially be a higher amount, reflecting the addition of RBCCM’s underwriting discount and our estimated costs and profits from hedging the

Notes. This excess is expected to decrease over time until the end of this period. After this period, if RBCCM repurchases your Notes, it expects to do so at prices that reflect their estimated value.

We may use this terms supplement in the initial sale of the Notes. In addition, RBCCM or another of our affiliates may use this terms supplement in a market-making transaction in the Notes after their initial sale. Unless we or our agent informs the purchaser otherwise in the confirmation of sale, this terms supplement is being used in a market-making transaction.

Each of RBCCM and any other broker-dealer offering the Notes have not offered, sold or otherwise made available and will not offer, sell or otherwise make available any of the Notes to, any retail investor in the European Economic Area (“EEA”).

For these purposes, the expression “offer” includes the communication in any form and by any means of sufficient information on the terms of the offer and the Notes to be offered so as to enable an investor to decide to purchase or subscribe the

Notes, and a “retail investor” means a person

who is one (or more) of: (a) a retail client, as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”); or (b) a customer, within the meaning of Directive 2016/97/EU, as amended, where

that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (c) not a qualified investor as defined in Regulation (EU) (2017/1129) (the “Prospectus Regulation”). Consequently, no key information

document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the EEA has been prepared, and therefore, offering or selling the

Notes or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation.

STRUCTURING THE NOTES

The Notes are our debt securities, the return on which is linked to the performance of the Reference Assets. As is the case for all of our debt securities, including our structured notes, the economic terms of the

Notes reflect our actual or perceived creditworthiness at the time of pricing. In addition, because structured notes result in increased operational, funding and liability management costs to us, we typically borrow the funds under these Notes at a

rate that is more favorable to us than the rate that we might pay for a conventional fixed or floating rate debt security of comparable maturity. Using this relatively lower implied borrowing rate rather than the secondary market rate, is a factor

that is likely to reduce the initial estimated value of the Notes at the time their terms are set. Unlike the estimated value that will be included in the final pricing supplement, any value of the Notes determined for purposes of a secondary market

transaction may be based on a different funding rate, which may result in a lower value for the Notes than if our initial internal funding rate were used.

In order to satisfy our payment obligations under the Notes, we may choose to enter into certain hedging arrangements (which may include call options, put options or other derivatives) on the issue date with RBCCM or

one of our other subsidiaries. The terms of these hedging arrangements take into account a number of factors, including our creditworthiness, interest rate movements, the volatility of the Reference Assets, and the tenor of the Notes. The economic

terms of the Notes and their initial estimated value depend in part on the terms of these hedging arrangements.

The lower implied borrowing rate is a factor that reduces the economic terms of the Notes to you. The initial offering price of the Notes also reflects the underwriting commission and our estimated hedging costs. These factors result in the

initial estimated value for the Notes on the Trade Date being less than their public offering price. See “Selected Risk Considerations—The Initial Estimated Value of the Notes Will Be Less than the Price to the Public” above.

Descargo de responsabilidad

Toda la información contenida en este sitio web se publica solo con fines de información general y no como un consejo de inversión. Cualquier acción que el lector realice sobre la información que se encuentra en nuestro sitio web es estrictamente bajo su propio riesgo. Nuestra prioridad es brindar información de alta calidad. Nos tomamos nuestro tiempo para identificar, investigar y crear contenido educativo que sea útil para nuestros lectores. Para mantener este estándar y continuar creando contenido de buena calidad. Pero nuestros lectores pueden basarse en su propia investigación.