Noticias e investigaciones antes de escuchar sobre esto en CNBC y otros. Solicite su prueba gratuita de 1 semana para StreetInsider Premium aquí.

ESTADOS UNIDOS

COMISIÓN NACIONAL DEL MERCADO DE VALORES

Washington, D.C.20549

FORMAR N-CSR

CERTIFICADO

INFORME DE ACCIONISTAS DE REGISTRADOS

GESTIÓN DE EMPRESAS DE INVERSIÓN

Número de archivo de la Ley de Sociedades de Inversión 811-23096

Legg Mason ETF Investment Trust

(Nombre exacto del registrante como se especifica en la carta)

620 octavo

Avenida, 49th Piso, Nueva York, NY 10018

(Dirección de las oficinas ejecutivas principales)

(Código postal)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 Primer lugar de Stamford

Stamford, CT 06902

(Nombre

y dirección del agente para el servicio)

Número de teléfono del registratario, incluido el código de área: 1-877-721-1926

Fecha de fin del año fiscal: 31 de octubre

Fecha del período del informe: 31 de octubre de 2019

| OBJETO 1. |

INFORME A LOS ACCIONISTAS. |

los Anual Se presenta un informe a los Accionistas.

| Reporte anual | 31 de octubre de 2019 |

LEGG MASON

MERCADOS EMERGENTES

BAJA VOLATILIDAD ALTA

DIVIDENDO ETF

LVHE

A partir de abril de 2021, según lo permitido por los reglamentos adoptados por la Comisión de Bolsa y Valores, el Fondo

tiene la intención de dejar de enviar copias impresas de los informes de accionistas del Fondo como este, a menos que solicite específicamente copias impresas de los informes de su intermediario financiero (como un corredor de bolsa o banco). En cambio, los informes serán

disponible en un sitio web, y se le notificará por correo cada vez que se publique un informe y se le proporcione un enlace al sitio web para acceder al informe.

Si ya eligió recibir informes de accionistas electrónicamente ("Entrega electrónica"), no se verá afectado por este cambio y no necesita tomar ninguna medida. Si

aún no has elegido entrega electrónica, puede optar por recibir electrónicamente informes de accionistas y otras comunicaciones del Fondo contactando a su intermediario financiero.

Puede optar por recibir todos los informes futuros en papel de forma gratuita comunicándose con su intermediario financiero para

solicite que continúe recibiendo copias en papel de sus informes de accionistas. Su elección de recibir informes en papel se aplicará a todos los fondos de Legg Mason en su cuenta con su intermediario financiero.

| PRODUCTOS DE INVERSIÓN: NO ASEGURADOS POR LA FDIC • SIN GARANTÍA BANCARIA • PUEDE PERDER VALOR |

Objetivo del fondo

El Fondo busca rastrear los resultados de inversión de un índice compuesto por valores de renta variable que cotizan en bolsa de mercados emergentes fuera de los Estados Unidos con

rendimiento relativamente alto y baja volatilidad de precios y ganancias al tiempo que mitiga la exposición a las fluctuaciones entre los valores del dólar estadounidense y las monedas en las que están denominados los valores del Fondo.

Estimado accionista,

Nos complace proporcionar el informe anual del ETF Legg Mason Emerging Markets Low Volatility High Dividend para el período de informe de doce meses

finalizó el 31 de octubre de 2019. Siga leyendo para obtener una visión detallada de las condiciones económicas y de mercado prevalecientes durante el período de presentación de informes del Fondo y para conocer cómo esas condiciones han afectado el rendimiento del Fondo.

Como siempre, seguimos comprometidos a brindarle un excelente servicio y un espectro completo de opciones de inversión. También seguimos comprometidos a complementar el

Apoyo que recibe de su asesor financiero. Una forma de lograr esto es a través de nuestro sitio web, www.leggmason.com. Aquí puede obtener acceso inmediato a información de mercado e inversión, que incluye:

| • |

Valor del activo neto del fondo y precio de mercado, |

| • |

Perspectivas de mercado y comentarios de nuestros gerentes de cartera, y |

| • |

Una gran cantidad de recursos educativos. |

Miramos

Esperamos poder ayudarle a alcanzar sus objetivos financieros.

Sinceramente,

Jane Trust, CFA

Presidente y Director Ejecutivo

29 de noviembre de 2019

|

II |

Legg Mason Mercados emergentes Baja volatilidad Alto dividendo ETF |

P. ¿Cuál es la estrategia de inversión del Fondo?

A. El ETF de Legg Mason Emerging Markets Low Volatility High Dividend (el "Fondo") busca rastrear los resultados de inversión del QS Emerging Markets Low Volatility High Dividend Hedged Index (el

"Índice subyacente"). El índice subyacente busca proporcionar ingresos estables a través de inversiones en acciones de compañías rentables en mercados emergentes fuera de los Estados Unidos con rendimientos de dividendos relativamente altos o dividendos anticipados

rendimientos y menor volatilidad de precios y ganancias, al tiempo que mitiga la exposición a las fluctuaciones del tipo de cambio entre el dólar estadounidense y las monedas en las que están denominados los valores componentes. El índice subyacente está diseñado para tener mayores rendimientos

que una inversión no cubierta equivalente cuando las monedas en las que están denominados sus valores componentes se debilitan en relación con el dólar estadounidense. Por el contrario, el índice subyacente está diseñado para tener rendimientos más bajos que un equivalente sin cobertura

inversión cuando las monedas en las que están denominados sus valores componentes están aumentando en relación con el dólar estadounidense. El índice subyacente se basa en una metodología patentada creada y patrocinada por QS Investors, LLC ("QS

Inversores "), el subconsejero del Fondo.

El Fondo invertirá al menos el 80% de sus activos netos, más préstamos para fines de inversión, si los hubiera, en

valores que componen su índice subyacente. Los valores que componen el Índice subyacente incluyen recibos de depósito que representan valores en el Índice subyacente. Si bien las acciones de los mercados emergentes son volátiles, el índice subyacente busca tener

menos volatilidad que los mercados emergentes en general.

El índice subyacente está compuesto por valores de renta variable en mercados emergentes fuera de

de los Estados Unidos a través de una gama de capitalizaciones de mercado que se incluyen en el índice IMCI de mercados emergentes de MSCIyo.

Los componentes del índice subyacente se reconstituyen anualmente y se reequilibran trimestralmente. El índice subyacente es

reconstituido en una fecha diferente del índice IMCI de mercados emergentes de MSCI. La cartera de valores del Fondo se reequilibra cuando el Índice subyacente se reequilibra o se reconstituye. La composición del Índice subyacente y el Fondo después

La reconstitución y el reequilibrio pueden fluctuar y exceder las limitaciones anteriores del índice subyacente debido a los movimientos del mercado. Los componentes del Índice subyacente, y el grado en que estos componentes representan ciertos sectores e industrias, pueden

cambian con el tiempo.

El Fondo puede invertir hasta el 20% de sus activos netos en contratos a plazo en moneda extranjera y otros instrumentos de cobertura de divisas, ciertos

índices de futuros, opciones, opciones sobre futuros de índices, contratos swap u otros derivados relacionados con su Índice subyacente y sus valores componentes; Efectivo y equivalentes de efectivo; otras compañías de inversión, incluidos los fondos cotizados en bolsa;

notas negociadas en bolsa; y en valores y otros instrumentos no incluidos en su Índice subyacente, pero que QS Investors cree que ayudarán al Fondo a rastrear su Índice subyacente.

El Fondo invierte en instrumentos de cobertura de divisas para compensar la exposición del Fondo a las monedas en las que están denominadas las tenencias del Fondo. El Fondo también puede invertir en

| Legg Mason Mercados emergentes Baja volatilidad Alto dividendo ETF 2019 Informe anual |

1 |

Resumen del fondo (cont.)

futuros sobre índices de acciones y derivados de divisas para ganar exposición a mercados locales o

segmentos de mercados locales para fines de gestión de flujo de caja y como técnica de gestión de cartera.

P. ¿Cuáles fueron el mercado general

condiciones durante el período de informe del Fondo?

A. Renta variable de mercados emergentes medida por los mercados emergentes de MSCI

Índiceii ligeramente inferior al rendimiento de sus homólogos desarrollados, medido por

el índice mundial MSCIiii para el período de informe de doce meses finalizado

31 de octubre de 2019. Durante la mayor parte del período, el bajo rendimiento fue significativo, a pesar del rendimiento superior en los primeros tres meses del período de informe (desde el 1 de noviembre de 2018 hasta el 31 de enero de 2019) y nuevamente en el último mes.

del período del informe (octubre de 2019).

Durante los primeros tres meses del período sobre el que se informa, la renta variable de los mercados emergentes superó al mercado desarrollado

acciones A partir de febrero de 2019, las acciones de los mercados emergentes tuvieron un rendimiento inferior al de las acciones de los mercados desarrollados, mientras que se mantuvieron moderadamente positivas durante el resto del primer trimestre calendario de 2019. El mercado más grande, China, y uno de los más pequeños,

Colombia, fue el mejor desempeño a nivel mundial en términos de dólares estadounidenses. Las acciones chinas vieron un fuerte interés de los inversores extranjeros. La mayoría de los otros mercados tuvieron un rendimiento inferior al Índice de Mercados Emergentes de MSCI, y varios disminuyeron a medida que las monedas se debilitaron frente al

Dólar estadounidense durante gran parte del trimestre. Los otros dos mercados más grandes, Corea del Sur y Taiwán, continuaron experimentando una demanda anémica tanto en las ventas nacionales como de exportación y se mantuvieron en contracción. A pesar de que la mayoría de los mercados experimentan disminuciones en las métricas de crecimiento,

El optimismo empresarial se mantuvo estable en la continuación de las conversaciones comerciales entre China y Estados Unidos y la acción del banco central en muchos mercados. Además, varios mercados, como Tailandia e Indonesia, experimentaron un crecimiento mejorado durante el trimestre.

La renta variable de los mercados emergentes registró un rendimiento inferior a la renta variable de los mercados desarrollados, aunque siguió siendo moderadamente positiva para el segundo trimestre calendario de 2019. China

se vio afectado negativamente por la incertidumbre del comercio mundial y el aumento mutuo de los aranceles sobre los bienes importados. Espera una reanudación de las conversaciones comerciales entre Estados Unidos y China y una reducción de los aranceles comerciales luego de la

G-20iv cumbre provocó un rebote en

Acciones chinas en junio de 2019.

Las acciones de los mercados emergentes continuaron por debajo del rendimiento de las acciones de los mercados desarrollados hasta el tercero.

trimestre calendario de 2019. Los mercados mundiales de renta variable siguieron siendo bastante volátiles, con un rendimiento mixto en todos los sectores y regiones de renta variable. Preocupaciones sobre el debilitamiento del crecimiento económico global, la inversión de la curva de rendimiento de los EE. UU.v (a principios del trimestre), tensiones relacionadas con el comercio entre Estados Unidos y China, fricciones en

Oriente Medio, y la incertidumbre en torno al Brexit siguió sacudiendo a los inversores. La Organización Mundial del Comercio redujo su pronóstico de crecimiento del comercio mundial para 2019 al nivel más débil en una década, advirtiendo que nuevas rondas de aranceles en un entorno de

una mayor incertidumbre podría provocar un "ciclo destructivo de recriminación".

La volatilidad en los mercados de renta variable mundiales retrocedió durante octubre de 2019 y

las acciones de los mercados emergentes se recuperaron bruscamente. Desarrollos positivos en las negociaciones comerciales entre Estados Unidos y China, un tercero

|

2 |

Legg Mason Mercados emergentes Baja volatilidad Alto dividendo ETF 2019 Informe anual |

veinticinco puntos básicosvi reducción de la tasa de interés en cuestión de meses de la Junta de la Reserva Federal de los Estados Unidos (la "Fed")vii y la estabilización de los precios de los productos básicos contribuyó al optimismo de los inversores.

El Fondo utiliza un enfoque de inversión pasiva para lograr su objetivo de inversión y, por lo tanto, no realizó ningún cambio en el enfoque de inversión en respuesta al mercado

condiciones

Revisión de desempeño

Durante los doce meses terminados el 31 de octubre de 2019, el ETF de Legg Mason Emerging Markets Low Volatility High Dividend generó un rendimiento del 3,64% sobre el valor del activo neto ("NAV")viii base y 2,42% en función de su mercado

precioix por acción.

La tabla de rendimiento muestra el rendimiento total del Fondo para los doce meses finalizados el 31 de octubre de 2019 en función de su NAV y precio de mercado como

del 31 de octubre de 2019. El Fondo busca hacer un seguimiento de los resultados de inversión del QS Emerging Markets Low Volatility High Dividend Hedged Index (NTR), que arrojó un 4,45% durante el mismo período. El índice de mercado de base amplia del Fondo, el MSCI

Índice local IMI de mercados emergentes (neto)X, devolvió 11.15% durante el mismo tiempo

marco. The Lipper Categoría de fondos de mercados emergentes Promedioxi devuelto 13.84%

para el periodo. Tenga en cuenta que los rendimientos del rendimiento de Lipper se basan en el NAV de cada fondo.

| Instantánea de rendimiento como del 31 de octubre de 2019 (sin auditar) |

||||||||

| 6 meses | 12 meses | |||||||

| Legg Mason Mercados emergentes ETF de baja volatilidad y alto dividendo: | ||||||||

|

$ 25.68 (NAV) |

-2,12 | % | 3,64 | % * † | ||||

|

$ 25.86 (precio de mercado) |

-2.00 | % | 2,42 | % * ‡ | ||||

| QS Mercados emergentes Índice de cobertura de alto dividendo (NTR) de baja volatilidad | -2.02 | % | 4.45 | % | ||||

| MSCI Emerging Markets IMI Local Index (Net) | -1,52 | % | 11.15 | % | ||||

| Lipper Mercados emergentes Categoría de fondos Promedio | -0,12 | % | 13,84 | % | ||||

El rendimiento mostrado representa el rendimiento pasado. El rendimiento pasado no es garantía de resultados futuros y el rendimiento actual puede

ser mayor o menor que el rendimiento que se muestra arriba. El valor del capital y los rendimientos de la inversión fluctuarán, por lo que las acciones, cuando se vendan, pueden valer más o menos que su costo original. Datos de rendimiento actualizados a los más recientes fin de mes está disponible en www.leggmason.com/etf.

Los inversores compran y venden acciones de un fondo que cotiza en bolsa

("ETF") a precio de mercado (no NAV) en el mercado secundario durante el día de negociación. Estas acciones no están disponibles individualmente para compra directa o reembolso directo al ETF. Los retornos de precios de mercado que se muestran generalmente se basan en

el punto medio entre la oferta y la demanda en el principal mercado de negociación del Fondo cuando se determina el NAV del Fondo, que generalmente es a las 4:00 p.m. Hora del este (EE. UU.). Estos rendimientos no representan

Los retornos de los inversores habrían negociado acciones en otros momentos. Las cifras de rendimiento para períodos inferiores a un año representan cifras acumulativas y no se anualizan.

| Legg Mason Mercados emergentes Baja volatilidad Alto dividendo ETF 2019 Informe anual |

3 |

Resumen del fondo (cont.)

Información que muestra el número de días que el precio de mercado de las acciones del Fondo

fue mayor que el NAV del Fondo y la cantidad de días que fue menor que el NAV del Fondo (es decir, prima o descuento) durante varios períodos de tiempo está disponible visitando el sitio web del Fondo en www.leggmason.com/etf.

A partir del prospecto actual del Fondo con fecha del 1 de marzo de 2019, el índice de gasto operativo bruto total anual del fondo para el Fondo fue del 0,50%.

* Los rendimientos totales se basan en cambios en el NAV o el precio de mercado, respectivamente. Las devoluciones reflejan la deducción de todos los gastos del Fondo. Las devoluciones no reflejan el

deducción de las comisiones o impuestos de corretaje que los inversores pagan por las distribuciones o la venta de acciones.

† El rendimiento total supone que

reinversión de todas las distribuciones, en NAV.

‡ El rendimiento total supone la reinversión de todas las distribuciones, a precio de mercado.

P. ¿Cuáles fueron los principales contribuyentes al rendimiento?

A. Mirando el Índice Subyacente por país, Rusia, Taiwán, México y Corea fueron los principales contribuyentes al rendimiento durante el período del informe en virtud de su rendimiento y peso en el Subyacente.

Índice. Los principales contribuyentes del sector al desempeño fueron los sectores de energía, tecnología de la información y consumo discrecional.

Q.

¿Cuáles fueron los principales detractores del rendimiento?

A. A nivel de país, los principales detractores del rendimiento durante el informe

período fueron Sudáfrica, Chile y China. Los principales detractores del rendimiento a nivel sectorial, si bien registraron retornos positivos, aunque más débiles, fueron los sectores de bienes raíces, materiales e industriales.

El Fondo empleó una estrategia de cobertura de divisas para reducir la volatilidad asociada con la exposición a cambios en el valor relativo entre el dólar estadounidense y la moneda.

de los mercados locales. La cobertura monetaria disminuyó el rendimiento general no cubierto durante el período de informe, ya que las monedas de los mercados emergentes se fortalecieron ampliamente frente al dólar estadounidense durante el período.

¿Buscando información adicional?

los

El NAV diario del fondo está disponible en línea en www.leggmason.com/etf. El Fondo se negocia con el símbolo "LVHE" y su precio de mercado de cierre está disponible en la mayoría de los sitios web financieros. En un continuo

esfuerzo para proporcionar información sobre el Fondo, los accionistas pueden llamar 1-877-721-1926 (sin cargo), de lunes a viernes de 8:00 a.m. a 5:30 p.m. Hora del este, para

el valor liquidativo actual del Fondo, el precio de mercado y otra información.

|

4 4 |

Legg Mason Mercados emergentes Baja volatilidad Alto dividendo ETF 2019 Informe anual |

Gracias por su inversión en Legg Mason Emerging Markets ETF de baja volatilidad y alto dividendo. Como siempre, nosotros

Apreciamos que nos haya elegido para administrar sus activos y seguimos enfocados en lograr los objetivos de inversión del Fondo.

Sinceramente,

QS Investors, LLC

18 de noviembre de 2019

RIESGOS Los valores de renta variable están sujetos a las fluctuaciones del mercado y de los precios. Internacional

Las inversiones están sujetas a riesgos especiales que incluyen fluctuaciones monetarias, incertidumbres sociales, económicas y políticas, que podrían aumentar la volatilidad. Estos riesgos se magnifican en los mercados emergentes. El Fondo puede enfocar sus inversiones en ciertos

industrias, aumentando su vulnerabilidad a la volatilidad del mercado. No hay garantía de que un Fondo logre un alto grado de correlación con el índice que busca rastrear. El Fondo no busca superar el índice que rastrea, y no busca

posiciones defensivas temporales cuando los mercados disminuyen o parecen sobrevalorados. Los derivados, como las opciones y los futuros, pueden ser ilíquidos, aumentar desproporcionadamente las pérdidas y tener un impacto potencialmente grande en el rendimiento del Fondo. En mercados al alza,

El valor de capa larga las existencias pueden no aumentar tanto como la de tapa más pequeña cepo. Pequeño-

y media tapa las acciones implican mayores riesgos y volatilidad que las acciones de gran capitalización. La inversión en divisas contiene un mayor riesgo que incluye el mercado, la política, la regulación.

y condiciones nacionales, y puede no ser adecuado para todos los inversores. Consulte el folleto del Fondo para obtener una discusión más completa sobre estos y otros riesgos y las estrategias de inversión del Fondo.

La mención de desgloses sectoriales es solo para fines informativos y no debe interpretarse como una recomendación para comprar o vender valores. los

La información proporcionada sobre tales sectores no es una base suficiente sobre la cual tomar una decisión de inversión. Inversores que buscan asesoramiento financiero sobre la conveniencia de invertir en valores o estrategias de inversión discutidas

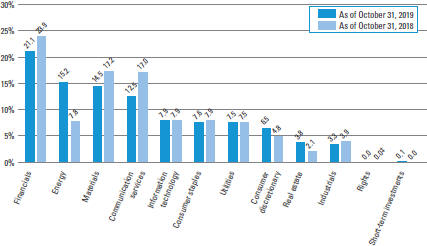

debe consultar a su profesional financiero. Las cinco principales tenencias del Fondo (como porcentaje de los activos netos) del Fondo al 31 de octubre de 2019 fueron: Finanzas (21.3%), Energía (15.3%), Materiales (14.6%), Servicios de comunicación (12.6%) y

Tecnología de la información (7,9%). La composición del Fondo puede variar con el tiempo.

Todas las inversiones están sujetas a riesgos, incluida la posible pérdida de

principal. El rendimiento pasado no es garantía de resultados futuros. Un índice es un compuesto estadístico que rastrea un mercado financiero específico, un sector o un proceso de inversión basado en reglas. A diferencia de un fondo, un índice en realidad no tiene una cartera de

valores y por lo tanto no incurre en los gastos incurridos por un fondo. Estos gastos afectan negativamente el rendimiento del fondo. Todo el rendimiento del índice no refleja ninguna deducción por honorarios, gastos o impuestos. Tenga en cuenta que un inversor no puede invertir directamente

en un índice

La información proporcionada no pretende ser un pronóstico de eventos futuros, una garantía de resultados futuros o asesoramiento de inversión. Puntos de vista

expresado puede diferir de los de la empresa en su conjunto.

| Legg Mason Mercados emergentes Baja volatilidad Alto dividendo ETF 2019 Informe anual |

5 5 |

Resumen del fondo (cont.)

| yo |

El índice IMCI de mercados emergentes de MSCI captura grandes, a mediados y pequeña tapa representación |

| ii |

El MSCI Emerging Markets Index es un índice de capitalización de mercado ajustado por flotación libre que está diseñado para medir el rendimiento del mercado de renta variable en los mercados emergentes globales. |

| iii |

El MSCI World Index es un índice no administrado considerado representativo de las existencias de crecimiento de los países desarrollados. El rendimiento del índice se calcula con dividendos netos. |

| iv |

El grupo de los veinte ("G-20") Los ministros de finanzas y los gobernadores de los bancos centrales se establecieron en 1999 para traer |

| v |

La curva de rendimiento es la representación gráfica de la relación entre el rendimiento de los bonos con la misma calidad crediticia pero diferentes vencimientos. |

| vi |

Un punto base es cien (1/100 o 0.01) del uno por ciento. |

| vii |

La Junta de la Reserva Federal (la "Fed") es responsable de la formulación de políticas estadounidenses diseñadas para promover el crecimiento económico, el pleno empleo y la estabilidad. |

| viii |

El Valor liquidativo (NAV) se calcula restando los pasivos totales del activo total y dividiendo los resultados por el número de acciones en circulación. |

| ix |

El precio de mercado está determinado por la oferta y la demanda. Es el precio al que un inversor compra o vende acciones del Fondo. El precio de mercado puede diferir del |

| X |

MSCI Emerging Markets IMI Local Index (Net) captura grandes, a mediados y pequeña tapa |

| xi |

Lipper, Inc., una subsidiaria de propiedad absoluta de Reuters, proporciona información independiente sobre las inversiones colectivas globales. Las devoluciones se basan en el período finalizado. |

|

6 6 |

Legg Mason Mercados emergentes Baja volatilidad Alto dividendo ETF 2019 Informe anual |

Fondo en un

vistazo† (sin auditar)

Desglose de inversiones (%) como porcentaje de las inversiones totales

| † |

El gráfico de barras anterior representa la composición de las inversiones del Fondo al 31 de octubre de 2019 y al 31 de octubre de 2018 y no incluye |

‡ La cantidad representa menos del 0.1%.

| Legg Mason Mercados emergentes Baja volatilidad Alto dividendo ETF 2019 Informe anual |

7 7 |

Gastos del fondo

(sin auditar)

Ejemplo

Como accionista del Fondo, usted

puede incurrir en dos tipos de costos: (1) costos de transacción, tales como comisiones de corretaje pagadas por compras y ventas de acciones del Fondo; y (2) costos continuos, incluidos los honorarios de gestión; y otros gastos del Fondo. Este ejemplo está destinado a ayudarte

comprenda sus costos actuales (en dólares) de invertir en el Fondo y compare estos costos con los costos continuos de invertir en otros fondos.

Esta

El ejemplo se basa en una inversión de $ 1,000 invertidos el 1 de mayo de 2019 y mantenidos durante los seis meses finalizados el 31 de octubre de 2019.

Gastos reales

La siguiente tabla titulada

"Basado en el rendimiento total real" proporciona información sobre los valores reales de la cuenta y los gastos reales. Puede usar la información proporcionada en esta tabla, junto con la cantidad que invirtió, para estimar los gastos que pagó durante

período. Para estimar los gastos que pagó en su cuenta, divida el valor de su cuenta final entre $ 1,000 (por ejemplo, un valor de cuenta final de $ 8,600 dividido entre $ 1,000 = 8.6), luego multiplique el resultado por el número bajo el título titulado

"Gastos pagados durante el período".

Ejemplo hipotético para fines de comparación.

La siguiente tabla titulada "Basado en el rendimiento hipotético total" proporciona información sobre los valores hipotéticos de la cuenta y los gastos hipotéticos basados en el

índice de gastos reales y una tasa de rendimiento supuesta del 5,00% anual antes de los gastos, que no es el rendimiento real del Fondo. Los valores y gastos hipotéticos de la cuenta no se pueden usar para estimar el saldo final de la cuenta o los gastos

Usted pagó por el período. Puede utilizar la información proporcionada en esta tabla para comparar los costos continuos de invertir en el Fondo y otros fondos. Para hacerlo, compare el ejemplo hipotético del 5.00% relacionado con el Fondo con el hipotético del 5.00%

ejemplos que aparecen en los informes de accionistas de los otros fondos.

Tenga en cuenta que los gastos que se muestran en la tabla a continuación están destinados a resaltar su

costos continuos únicamente y no reflejan costos transaccionales, como las comisiones de corretaje pagadas por compras y ventas de acciones del Fondo. Por lo tanto, la tabla es útil para comparar solo los costos en curso y no lo ayudará a determinar la relación

costos totales de poseer diferentes fondos. Además, si se incluyeran estos costos de transacción, sus costos habrían sido más altos.

| Basado en el rendimiento total real1 | Basado en el rendimiento hipotético total1 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Real Total Regreso2 |

Comenzando Cuenta Valor |

Finalizando Cuenta Valor |

Anualizado Gastos Proporción |

Gastos Pagado durante el período3 |

Hipotético Anualizado Regreso trotal |

Comenzando Cuenta Valor |

Finalizando Cuenta Valor |

Anualizado Gastos Proporción |

Gastos Pagado durante el período3 |

|||||||||||||||||||||||||||||||||||||||||

| -2,12% | PS | 1,000.00 | PS | 978,80 | 0,50 | % | PS | 2,49 | 5.00 | % | $ 1,000.00 | PS | 1.022,68 | 0,50 | % | PS | 2,55 | |||||||||||||||||||||||||||||||||

| 1 |

Por los seis meses terminados el 31 de octubre de 2019. |

| 2 |

Asume la reinversión de todas las distribuciones, incluidos los retornos de capital, si los hay, al valor liquidativo. El rendimiento total no es anualizado, ya que puede no ser |

| 3 |

Los gastos (netos de exenciones de tarifas y / o reembolsos de gastos) son iguales al índice de gastos anualizados del Fondo multiplicado por el valor promedio de la cuenta sobre |

|

8 |

Legg Mason Mercados emergentes Baja volatilidad Alto dividendo ETF 2019 Informe anual |

Rendimiento del fondo (sin auditar)

| Valor liquidativo | ||||

| Rentabilidad total anual promedio1 | ||||

| Doce meses terminados el 31/10/19 | 3,64 | % | ||

| Inicio * hasta el 31/10/19 | 5,67 | |||

| Retornos totales acumulados1 | ||||

| Fecha de inicio del 17/11/16 al 31/10/19 | 17,68 | % | ||

| Precio de mercado | ||||

| Rentabilidad total anual promedio2 | ||||

| Doce meses terminados el 31/10/19 | 2,42 | % | ||

| Inicio * hasta el 31/10/19 | 5.87 | |||

| Retornos totales acumulados2 | ||||

| Fecha de inicio del 17/11/16 al 31/10/19 | 18,34 | % | ||

Todas las cifras representan el rendimiento pasado y no son garantía de resultados futuros. Retornos de inversión y valor principal de

la inversión fluctuará para que las acciones de un inversor, cuando se canjeen, puedan valer más o menos que su costo original. Los rendimientos mostrados no reflejan la deducción de comisiones de corretaje o impuestos que los inversores pagarían

distribuciones o la venta de acciones. Las cifras de rendimiento pueden reflejar exenciones de tarifas y / o reembolsos de gastos. En ausencia de exenciones de tarifas y / o reembolsos de gastos, el rendimiento total habría sido menor.

Los inversores compran y venden acciones del Fondo a precio de mercado, no NAV, en el mercado secundario durante el día de negociación. Estas acciones no son individuales

disponible para compra directa o redención directa al Fondo. El VAN por acción del Fondo es el valor de una acción del Fondo y se calcula dividiendo el valor de los activos totales menos los pasivos totales por el número de acciones

excepcional. El rendimiento del valor liquidativo se basa en el valor liquidativo del fondo y el rendimiento del precio de mercado generalmente se basa en el punto medio entre la oferta y la demanda en el principal mercado de negociación del Fondo cuando el

Se determina el valor liquidativo del fondo, que suele ser a las 4:00 p.m. Hora del este (EE. UU.). Estos rendimientos no representan los rendimientos de los inversores si hubieran negociado acciones en otros momentos. El rendimiento del NAV y del precio de mercado supone que los dividendos y la ganancia de capital

las distribuciones se han reinvertido en el Fondo a precio de mercado y NAV, respectivamente. Al igual que con otros fondos que cotizan en bolsa, los rendimientos de NAV y los precios de mercado pueden diferir debido a factores como la oferta y la demanda de acciones del Fondo

evaluación de los inversores del valor subyacente de los valores de cartera del Fondo.

| 1 |

Asume la reinversión de todas las distribuciones, incluidos los retornos de capital, si los hay, al valor liquidativo. |

| 2 |

Supone la reinversión de todas las distribuciones, incluidos los retornos de capital, si los hay, a precio de mercado. |

| * * |

La fecha de inicio del Fondo es el 17 de noviembre de 2016. |

| Legg Mason Mercados emergentes Baja volatilidad Alto dividendo ETF 2019 Informe anual |

9 9 |

Rendimiento del fondo (sin auditar) (cont.)

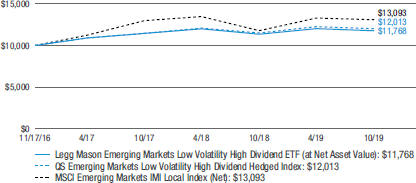

Rendimiento histórico

Valor de $ 10,000 invertidos en

Legg Mason Mercados emergentes Baja volatilidad Alto dividendo ETF vs QS Mercados emergentes Baja volatilidad Índice de alto dividendo cubierto y MSCI Emergente

Mercados IMI Local Index (Net) † – 17 de noviembre de 2016 – 31 de octubre de 2019

Todas las cifras representan el rendimiento pasado y no son garantía de resultados futuros. Retornos de inversión y valor principal de

la inversión fluctuará para que las acciones de un inversor, cuando se vendan, puedan valer más o menos que su costo original. Los rendimientos de NAV suponen que los dividendos y las distribuciones de ganancias de capital se han reinvertido en el Fondo en NAV. Los retornos mostrados

no reflejan la deducción de comisiones de corretaje o impuestos que los inversores pagarían por las distribuciones o la venta de acciones. Las cifras de rendimiento pueden reflejar exenciones de tarifas y / o reembolsos de gastos. En ausencia de exenciones de tarifas y / o gastos

reembolsos, el rendimiento total habría sido menor.

| † |

Ilustración hipotética de $ 10,000 invertidos en ETF de Legg Mason Emerging Markets Low Volatility High Dividend el 17 de noviembre de 2016 (inicio |

|

10 |

Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

October 31, 2019

Legg Mason Emerging Markets Low Volatility High Dividend ETF

| Seguridad | Shares | Valor | ||||||||||||||

| Common Stocks — 97.9% | ||||||||||||||||

| Communication Services — 10.9% | ||||||||||||||||

|

Diversified Telecommunication Services — 2.7% |

||||||||||||||||

|

China Telecom Corp. Ltd., Class H Shares |

192,000 | $ | 81,820 | |||||||||||||

|

Emirates Telecommunications Group Co. PJSC |

17,522 | 79,004 | ||||||||||||||

|

Magyar Telekom Telecommunications PLC |

4,304 | 6,423 | ||||||||||||||

|

Total Diversified Telecommunication Services |

167,247 | |||||||||||||||

|

Entertainment — 0.1% |

||||||||||||||||

|

Major Cineplex Group PCL |

7,100 | 5,784 | (a) |

|||||||||||||

|

Wireless Telecommunication Services — 8.1% |

||||||||||||||||

|

Advanced Info Service PCL, Registered Shares |

12,700 | 96,317 | (a) | |||||||||||||

|

China Mobile Ltd. |

16,500 | 134,313 | ||||||||||||||

|

DiGi.Com Bhd |

22,400 | 25,196 | ||||||||||||||

|

Globe Telecom Inc. |

300 | 10,783 | ||||||||||||||

|

Intouch Holdings PCL |

23,700 | 51,803 | ||||||||||||||

|

Maxis Bhd |

13,300 | 17,156 | ||||||||||||||

|

PLAY Communications SA |

1,972 | 15,642 | ||||||||||||||

|

SK Telecom Co. Ltd. |

382 | 77,815 | ||||||||||||||

|

Vodacom Group Ltd. |

7,857 | 68,772 | ||||||||||||||

|

Total Wireless Telecommunication Services |

|

497,797 | ||||||||||||||

|

Total Communication Services |

|

670,828 | ||||||||||||||

| Consumer Discretionary — 6.5% | ||||||||||||||||

|

Auto Components — 0.1% |

||||||||||||||||

|

Mahle-Metal Leve SA |

600 | 3,674 | ||||||||||||||

|

Automobiles — 4.5% |

||||||||||||||||

|

Hero MotoCorp Ltd. |

948 | 36,143 | ||||||||||||||

|

Hyundai Motor Co. |

1,086 | 113,879 | ||||||||||||||

|

Indus Motor Co. Ltd. |

720 | 4,314 | ||||||||||||||

|

Kia Motors Corp. |

3,308 | 120,981 | ||||||||||||||

|

Total Automobiles |

275,317 | |||||||||||||||

|

Hotels, Restaurants & Leisure — 0.8% |

||||||||||||||||

|

Berjaya Sports Toto Bhd |

8,100 | 5,137 | ||||||||||||||

|

Kangwon Land Inc. |

1,666 | 44,892 | ||||||||||||||

|

Total Hotels, Restaurants & Leisure |

50,029 | |||||||||||||||

|

Internet & Direct Marketing Retail — 0.1% |

||||||||||||||||

|

GS Home Shopping Inc. |

36 | 4,604 | ||||||||||||||

|

Multiline Retail — 0.1% |

||||||||||||||||

|

Far Eastern Department Stores Ltd. |

9,000 | 7,731 | ||||||||||||||

See Notes to Financial

Statements.

| Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

11 |

Schedule of investments (cont’d)

October 31, 2019

Legg Mason Emerging Markets Low Volatility High Dividend ETF

| Seguridad | Shares | Valor | ||||||

|

Specialty Retail — 0.1% |

||||||||

|

Bermaz Auto Bhd |

10,400 | $ | 5,675 | |||||

|

Detsky Mir PJSC |

2,630 | 3,936 | ||||||

|

Total Specialty Retail |

9,611 | |||||||

|

Textiles, Apparel & Luxury Goods — 0.8% |

||||||||

|

China Dongxiang Group Co., Ltd. |

29,000 | 3,256 | ||||||

|

Formosa Taffeta Co. Ltd. |

9,000 | 10,245 | ||||||

|

Grendene SA |

3,300 | 8,122 | ||||||

|

Luthai Textile Co. Ltd., Class B Shares |

12,000 | 11,207 | ||||||

|

Pou Chen Corp. |

5,000 | 6,693 | ||||||

|

Ruentex Industries Ltd. |

4,000 | 9,619 | * * | |||||

|

Total Textiles, Apparel & Luxury Goods |

49,142 | |||||||

|

Total Consumer Discretionary |

|

400,108 | ||||||

| Consumer Staples — 7.7% | ||||||||

|

Beverages — 2.0% |

||||||||

|

Ambev SA |

25,638 | 110,870 | ||||||

|

Carlsberg Brewery Malaysia Bhd, Class B Shares |

1,500 | 9,958 | ||||||

|

Total Beverages |

120,828 | |||||||

|

Food & Staples Retailing — 2.6% |

||||||||

|

Al Meera Consumer Goods Co. QSC |

982 | 4,234 | ||||||

|

Wal-Mart de Mexico SAB de CV |

51,610 | 155,191 | ||||||

|

Total Food & Staples Retailing |

159,425 | |||||||

|

Food Products — 0.9% |

||||||||

|

Charoen Pokphand Foods PCL |

39,700 | 33,199 | (a) | |||||

|

Kuala Lumpur Kepong Bhd |

3,900 | 20,216 | ||||||

|

Total Food Products |

53,415 | |||||||

|

Personal Products — 0.0% |

||||||||

|

Hengan International Group Co. Ltd. |

500 | 3,496 | ||||||

|

Tobacco — 2.2% |

||||||||

|

KT&G Corp. |

1,522 | 130,818 | ||||||

|

Philip Morris CR AS |

6 6 | 3,584 | ||||||

|

Total Tobacco |

134,402 | |||||||

|

Total Consumer Staples |

|

471,566 | ||||||

| Energy — 14.6% | ||||||||

|

Oil, Gas & Consumable Fuels — 14.6% |

||||||||

|

Banpu PCL Co. Ltd. |

51,500 | 19,785 | ||||||

|

China Petroleum & Chemical Corp., Class H Shares |

152,000 | 87,270 | ||||||

|

Coal India Ltd. |

12,883 | 37,698 | ||||||

|

Formosa Petrochemical Corp. |

14,000 | 44,566 | ||||||

|

Gazprom PJSC |

43,106 | 174,923 | ||||||

|

GS Holdings Corp. |

628 | 26,800 | ||||||

See Notes to Financial

Statements.

|

12 |

Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

Legg Mason Emerging Markets Low Volatility High Dividend ETF

| Seguridad | Shares | Valor | ||||||

|

Oil, Gas & Consumable Fuels — continued |

||||||||

|

Motor Oil Hellas Corinth Refineries SA |

596 | $ | 14,722 | |||||

|

Oil & Gas Development Co. Ltd. |

7,800 | 6,457 | ||||||

|

Pakistan Oilfields Ltd. |

2,900 | 7,309 | ||||||

|

Pilipinas Shell Petroleum Corp. |

6,800 | 4,556 | ||||||

|

PTT PCL |

108,400 | 162,447 | (a) | |||||

|

Qatar Gas Transport Co. Ltd. |

17,080 | 11,587 | ||||||

|

SK Innovation Co. Ltd. |

794 | 109,192 | ||||||

|

Tatneft PJSC |

14,220 | 166,056 | ||||||

|

Thai Oil PCL |

11,900 | 26,996 | (a) | |||||

|

Total Energy |

900,364 | |||||||

| Financials — 21.2% | ||||||||

|

Banks — 21.0% |

||||||||

|

Abu Dhabi Commercial Bank PJSC |

10,502 | 22,303 | ||||||

|

Agricultural Bank of China Ltd., Class H Shares |

309,000 | 127,342 | ||||||

|

Banco Santander Chile |

795,534 | 49,395 | ||||||

|

Bangkok Bank PCL, Registered Shares |

10,100 | 58,369 | ||||||

|

Bank of China Ltd., Class H Shares |

307,000 | 125,735 | ||||||

|

China CITIC Bank Corp. Ltd., Class H Shares |

96,000 | 55,731 | ||||||

|

China Construction Bank Corp., Class H Shares |

118,000 | 95,000 | ||||||

|

Doha Bank QPSC |

14,410 | 10,052 | ||||||

|

Dubai Islamic Bank PJSC |

22,803 | 32,843 | ||||||

|

First Abu Dhabi Bank PJSC |

39,192 | 162,411 | ||||||

|

First Financial Holding Co. Ltd. |

70,962 | 52,102 | ||||||

|

Hong Leong Bank Bhd |

3,500 | 14,424 | ||||||

|

Industrial Bank of Korea |

3,436 | 34,849 | ||||||

|

Kiatnakin Bank PCL |

5,300 | 11,497 | ||||||

|

Krung Thai Bank PCL |

43,800 | 24,079 | (a) | |||||

|

Malayan Banking Bhd |

51,700 | 106,407 | ||||||

|

Masraf Al Rayan QSC |

34,730 | 35,770 | ||||||

|

Mega Financial Holding Co. Ltd. |

97,000 | 95,278 | ||||||

|

Moneta Money Bank AS |

6,441 | 21,424 | ||||||

|

Public Bank Bhd |

26,300 | 127,771 | ||||||

|

Thanachart Capital PCL |

6,000 | 10,531 | (a) | |||||

|

Tisco Financial Group PCL |

5,600 | 18,082 | (a) | |||||

|

Total Banks |

1,291,395 | |||||||

|

Capital Markets — 0.1% |

||||||||

|

China Bills Finance Corp. |

8,000 | 3,916 | ||||||

|

President Securities Corp. |

9,000 | 3,903 | ||||||

|

Total Capital Markets |

7,819 | |||||||

See Notes to Financial Statements.

| Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

13 |

Schedule of investments (cont’d)

October 31, 2019

Legg Mason Emerging Markets Low Volatility High Dividend ETF

| Seguridad | Shares | Valor | ||||||||||||||

|

Mortgage Real Estate Investment Trusts (REITs) — 0.1% |

||||||||||||||||

|

Concentradora Hipotecaria SAPI de CV |

5,700 | $ | 5,619 | |||||||||||||

|

Total Financials |

1,304,833 | |||||||||||||||

| Industrials — 3.3% | ||||||||||||||||

|

Commercial Services & Supplies — 0.1% |

||||||||||||||||

|

Cleanaway Co. Ltd. |

1,000 | 5,190 | ||||||||||||||

|

Construction & Engineering — 0.2% |

||||||||||||||||

|

United Integrated Services Co. Ltd. |

2,400 | 12,497 | ||||||||||||||

|

Electrical Equipment — 0.1% |

||||||||||||||||

|

Kung Long Batteries Industrial Co. Ltd. |

1,000 | 4,747 | ||||||||||||||

|

Industrial Conglomerates — 0.9% |

||||||||||||||||

|

Dubai Investments PJSC |

23,062 | 8,100 | ||||||||||||||

|

HAP Seng Consolidated Bhd |

4,800 | 11,465 | ||||||||||||||

|

Industries Qatar QSC |

10,199 | 29,440 | ||||||||||||||

|

Reunert Ltd. |

1,775 | 8,418 | ||||||||||||||

|

Total Industrial Conglomerates |

57,423 | |||||||||||||||

|

Marine — 0.3% |

||||||||||||||||

|

MISC Bhd |

9,500 | 18,939 | ||||||||||||||

|

Trading Companies & Distributors — 0.1% |

||||||||||||||||

|

China Aircraft Leasing Group Holdings Ltd. |

5,500 | 5,684 | ||||||||||||||

|

Transportation Infrastructure — 1.6% |

||||||||||||||||

|

China Merchants Port Holdings Co. Ltd. |

16,000 | 25,068 | ||||||||||||||

|

Jiangsu Expressway Co. Ltd., Class H Shares |

14,000 | 18,613 | ||||||||||||||

|

Shenzhen International Holdings Ltd. |

11,500 | 23,417 | ||||||||||||||

|

Westports Holdings Bhd |

6,700 | 6,863 | ||||||||||||||

|

Yuexiu Transport Infrastructure Ltd. |

12,000 | 11,085 | ||||||||||||||

|

Zhejiang Expressway Co. Ltd., Class H Shares |

20,000 | 16,408 | ||||||||||||||

|

Total Transportation Infrastructure |

101,454 | |||||||||||||||

|

Total Industrials |

|

205,934 | ||||||||||||||

| Information Technology — 7.9% | ||||||||||||||||

|

Electronic Equipment, Instruments & Components — |

||||||||||||||||

|

Hana Microelectronics PCL |

6,000 | 5,067 | (a) | |||||||||||||

|

Simplo Technology Co. Ltd. |

1,400 | 12,924 | ||||||||||||||

|

Supreme Electronics Co. Ltd. |

6,000 | 5,726 | ||||||||||||||

|

Syncmold Enterprise Corp. |

2,000 | 5,144 | ||||||||||||||

|

Synnex Technology International Corp. |

16,000 | 19,106 | ||||||||||||||

|

TXC Corp. |

3,000 | 3,686 | ||||||||||||||

|

WPG Holdings Ltd. |

17,000 | 21,557 | ||||||||||||||

|

WT Microelectronics Co. Ltd. |

6,000 | 6,859 | ||||||||||||||

|

Total Electronic Equipment, Instruments & |

80,069 | |||||||||||||||

See Notes to Financial

Statements.

|

14 |

Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

Legg Mason Emerging Markets Low Volatility High Dividend ETF

| Seguridad | Shares | Valor | ||||||||||||||

|

IT Services — 2.2% |

||||||||||||||||

|

Infosys Ltd. |

13,457 | $ | 130,076 | |||||||||||||

|

Systex Corp. |

2,000 | 4,862 | ||||||||||||||

|

Total IT Services |

134,938 | |||||||||||||||

|

Semiconductors & Semiconductor Equipment — |

||||||||||||||||

|

Greatek Electronics Inc. |

3,000 | 4,223 | ||||||||||||||

|

Radiant Opto-Electronics Corp. |

10,000 | 39,750 | ||||||||||||||

|

Topco Scientific Co. Ltd. |

2,000 | 6,373 | ||||||||||||||

|

Total Semiconductors & Semiconductor Equipment |

50,346 | |||||||||||||||

|

Technology Hardware, Storage & Peripherals — |

||||||||||||||||

|

Aten International Co. Ltd. |

1,000 | 2,835 | ||||||||||||||

|

Chicony Electronics Co. Ltd. |

7,025 | 21,855 | ||||||||||||||

|

Compal Electronics Inc. |

50,000 | 29,894 | ||||||||||||||

|

Inventec Corp. |

33,000 | 23,958 | ||||||||||||||

|

Qisda Corp. |

18,000 | 13,512 | ||||||||||||||

|

Quanta Computer Inc. |

32,000 | 61,497 | ||||||||||||||

|

Samsung Electronics Co. Ltd. |

1,444 | 62,553 | ||||||||||||||

|

Transcend Information Inc. |

3,000 | 6,514 | ||||||||||||||

|

Total Technology Hardware, Storage & Peripherals |

222,618 | |||||||||||||||

|

Total Information Technology |

487,971 | |||||||||||||||

| Materials — 14.6% | ||||||||||||||||

|

Chemicals — 9.0% |

||||||||||||||||

|

Engro Fertilizers Ltd. |

15,000 | 6,875 | ||||||||||||||

|

Fauji Fertilizer Co. Ltd. |

12,000 | 7,264 | ||||||||||||||

|

Formosa Chemicals & Fibre Corp. |

38,000 | 110,603 | ||||||||||||||

|

Formosa Plastics Corp. |

41,000 | 131,726 | ||||||||||||||

|

Huabao International Holdings Ltd. |

11,000 | 4,028 | ||||||||||||||

|

Nan Ya Plastics Corp. |

52,000 | 122,994 | ||||||||||||||

|

Petronas Chemicals Group Bhd |

24,700 | 44,157 | ||||||||||||||

|

PhosAgro PJSC, Registered Shares, GDR |

3,774 | 47,477 | ||||||||||||||

|

PTT Global Chemical PCL |

35,700 | 60,298 | (a) | |||||||||||||

|

Sinopec Shanghai Petrochemical Co. Ltd., Class H Shares |

48,000 | 13,351 | ||||||||||||||

|

Taiwan Styrene Monomer |

12,000 | 8,515 | ||||||||||||||

|

Total Chemicals |

557,288 | |||||||||||||||

|

Construction Materials — 2.9% |

||||||||||||||||

|

Qatar National Cement Co. QSC |

2,607 | 4,153 | ||||||||||||||

|

Siam Cement PCL, Registered Shares |

8,375 | 101,792 | (a) | |||||||||||||

|

Taiwan Cement Corp. |

51,793 | 68,824 | ||||||||||||||

|

Waskita Beton Precast Tbk PT |

159,400 | 3,770 | ||||||||||||||

|

Total Construction Materials |

178,539 | |||||||||||||||

See Notes to Financial

Statements.

| Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

15 |

Schedule of investments (cont’d)

October 31, 2019

Legg Mason Emerging Markets Low Volatility High Dividend ETF

| Seguridad | Shares | Valor | ||||||||||||||

|

Containers & Packaging — 0.1% |

||||||||||||||||

|

Greatview Aseptic Packaging Co. Ltd. |

6,000 | $ | 3,024 | |||||||||||||

|

Metals & Mining — 2.6% |

||||||||||||||||

|

Alrosa PJSC |

47,520 | 55,262 | ||||||||||||||

|

Feng Hsin Steel Co. Ltd. |

5,000 | 8,656 | ||||||||||||||

|

Magnitogorsk Iron & Steel Works PJSC |

29,600 | 16,876 | ||||||||||||||

|

Novolipetsk Steel PJSC |

18,120 | 35,363 | ||||||||||||||

|

Severstal PJSC |

2,900 | 39,930 | ||||||||||||||

|

Tung Ho Steel Enterprise Corp. |

8,000 | 5,677 | ||||||||||||||

|

Total Metals & Mining |

161,764 | |||||||||||||||

|

Total Materials |

900,615 | |||||||||||||||

| Real Estate — 3.9% | ||||||||||||||||

|

Equity Real Estate Investment Trusts (REITs) — 2.3% |

||||||||||||||||

|

Emira Property Fund Ltd. |

7,278 | 6,131 | ||||||||||||||

|

Fibra Uno Administracion SA de CV |

35,144 | 53,600 | ||||||||||||||

|

Hyprop Investments Ltd. |

2,966 | 11,617 | ||||||||||||||

|

IGB Real Estate Investment Trust |

13,300 | 6,079 | ||||||||||||||

|

Pavilion Real Estate Investment Trust |

15,900 | 6,583 | ||||||||||||||

|

Prologis Property Mexico SA de CV |

2,100 | 4,511 | ||||||||||||||

|

Redefine Properties Ltd. |

62,476 | 31,272 | ||||||||||||||

|

Sunway Real Estate Investment Trust |

6,500 | 2,816 | ||||||||||||||

|

Yuexiu Real Estate Investment Trust |

22,000 | 14,624 | ||||||||||||||

|

Total Equity Real Estate Investment Trusts (REITs) |

137,233 | |||||||||||||||

|

Real Estate Management & Development — 1.6% |

||||||||||||||||

|

Aldar Properties PJSC |

28,137 | 18,003 | ||||||||||||||

|

Bangkok Land PCL |

61,800 | 2,804 | ||||||||||||||

|

Barwa Real Estate Co. |

12,660 | 11,891 | ||||||||||||||

|

Land & Houses PCL |

107,300 | 34,470 | ||||||||||||||

|

LSR Group PJSC, Registered Shares, GDR |

5,344 | 11,329 | ||||||||||||||

|

Pruksa Holding PCL |

4,900 | 2,564 | ||||||||||||||

|

Quality Houses PCL |

89,700 | 7,724 | (a) | |||||||||||||

|

Sansiri PCL |

122,700 | 4,632 | (a) | |||||||||||||

|

United Development Co. QSC |

16,680 | 6,414 | ||||||||||||||

|

Total Real Estate Management & Development |

99,831 | |||||||||||||||

|

Total Real Estate |

237,064 | |||||||||||||||

| Utilities — 7.3% | ||||||||||||||||

|

Electric Utilities — 3.2% |

||||||||||||||||

|

Enel Chile SA |

325,966 | 26,829 | ||||||||||||||

|

Tenaga Nasional Bhd |

44,000 | 145,947 | ||||||||||||||

|

Transmissora Alianca de Energia Eletrica SA |

3,300 | 23,601 | ||||||||||||||

|

Total Electric Utilities |

196,377 | |||||||||||||||

See Notes to Financial

Statements.

|

dieciséis |

Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

Legg Mason Emerging Markets Low Volatility High Dividend ETF

| Seguridad | Shares | Valor | ||||||||||||||

|

Gas Utilities — 0.3% |

||||||||||||||||

|

Petronas Gas Bhd |

5,300 | $ | 21,106 | |||||||||||||

|

Independent Power and Renewable Electricity Producers — |

||||||||||||||||

|

CGN Power Co. Ltd., Class H Shares |

96,000 | 24,987 | (a) | |||||||||||||

|

China Resources Power Holdings Co. Ltd. |

24,000 | 30,223 | ||||||||||||||

|

Electricity Generating PCL |

2,400 | 27,581 | (a) | |||||||||||||

|

Engie Brasil Energia SA |

3,930 | 44,054 | ||||||||||||||

|

NTPC Ltd. |

31,881 | 55,016 | ||||||||||||||

|

Ratch Group PCL |

8,500 | 20,690 | ||||||||||||||

|

Unipro PJSC |

134,000 | 5,521 | ||||||||||||||

|

Total Independent Power and Renewable Electricity Producers |

208,072 | |||||||||||||||

|

Water Utilities — 0.4% |

||||||||||||||||

|

Aguas Andinas SA, Class A Shares |

29,543 | 13,555 | ||||||||||||||

|

Inversiones Aguas Metropolitanas SA |

5,052 | 6,034 | ||||||||||||||

|

TTW PCL |

12,900 | 5,810 | (a) | |||||||||||||

|

Total Water Utilities |

25,399 | |||||||||||||||

|

Total Utilities |

450,954 | |||||||||||||||

|

Total Common Stocks (Cost — $6,126,847) |

6,030,237 | |||||||||||||||

| Rate | ||||||||||||||||

| Preferred Stocks — 2.7% | ||||||||||||||||

| Communication Services — 1.7% | ||||||||||||||||

|

Diversified Telecommunication Services — 1.7% |

||||||||||||||||

|

Telefonica Brasil SA |

— | 7,900 | 104,437 | |||||||||||||

| Energy — 0.7% | ||||||||||||||||

|

Oil, Gas & Consumable Fuels — 0.7% |

||||||||||||||||

|

Transneft PJSC |

— | dieciséis | 41,579 | |||||||||||||

| Financials — 0.1% | ||||||||||||||||

|

Capital Markets — 0.1% |

||||||||||||||||

|

Daishin Securities Co. Ltd., (Preference Shares) |

— | 615 | 4,943 | |||||||||||||

| Utilities — 0.2% | ||||||||||||||||

|

Water Utilities — 0.2% |

||||||||||||||||

|

Cia de Saneamento do Parana |

— | 3,500 | 15,868 | |||||||||||||

|

Total Preferred Stocks (Cost — $163,028) |

166,827 | |||||||||||||||

|

Total Investments before Short-Term Investments (Cost — $6,289,875) |

6,197,064 | |||||||||||||||

| Short-Term Investments — 0.1% | ||||||||||||||||

|

Invesco Treasury Portfolio, Institutional Class (Cost — $7,743) |

1.632 | % | 7,743 | 7,743 | ||||||||||||

|

Total Investments — 100.7% (Cost — $6,297,618) |

|

6,204,807 | ||||||||||||||

|

Liabilities in Excess of Other Assets — (0.7)% |

(40,767 | ) | ||||||||||||||

|

Total Net Assets — 100.0% |

$ | 6,164,040 | ||||||||||||||

See Notes to Financial

Statements.

| Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

17 |

Schedule of investments (cont’d)

October 31, 2019

Legg Mason Emerging Markets Low Volatility High Dividend ETF

| * * |

Non-income producing security. |

| (a) |

Security is valued in good faith in accordance with procedures approved by the Board of Trustees (Note 1). |

|

Abbreviations used in this schedule: |

||

| GDR | — Global Depositary Receipts | |

| PJSC | — Private Joint Stock Company | |

At October 31, 2019, the Fund had the following open forward foreign currency contracts:

| Currency Purchased |

Currency Sold |

Counterparty | Asentamiento Fecha |

Unrealized Appreciation (Depreciation) |

||||||||||||||||

| USD | 307,191 | BRL | 1,259,115 | Bank of New York | 11/12/19 | $ | (6,220) | |||||||||||||

| USD | 107,655 | CLP | 77,081,995 | Bank of New York | 11/12/19 | 3,601 | ||||||||||||||

| USD | 22,861 | CZK | 535,051 | Bank of New York | 11/12/19 | (542) | ||||||||||||||

| USD | 13,125 | EUR | 11,918 | Bank of New York | 11/12/19 | (182) | ||||||||||||||

| USD | 274,263 | INR | 19,550,859 | Bank of New York | 11/12/19 | (1,042) | ||||||||||||||

| USD | 723,265 | KRW | 871,042,331 | Bank of New York | 11/12/19 | (25,588) | ||||||||||||||

| USD | 212,992 | MXN | 4,230,446 | Bank of New York | 11/12/19 | (7,247) | ||||||||||||||

| USD | 15,307 | PHP | 793,183 | Bank of New York | 11/12/19 | (317) | ||||||||||||||

| USD | 12,978 | PLN | 51,158 | Bank of New York | 11/12/19 | (433) | ||||||||||||||

| USD | 112,081 | QAR | 408,049 | Bank of New York | 11/12/19 | 0 | 1 | |||||||||||||

| USD | 498,520 | RUB | 32,639,412 | Bank of New York | 11/12/19 | (10,056) | ||||||||||||||

| USD | 960,440 | TWD | 29,696,805 | Bank of New York | 11/12/19 | (15,617) | ||||||||||||||

| USD | 116,218 | ZAR | 1,769,686 | Bank of New York | 11/12/19 | (1,074) | ||||||||||||||

| USD | 589,045 | MYR | 2,468,276 | HSBC BANK USA, N.A. | 11/12/19 | (1,505) | ||||||||||||||

| USD | 317,820 | AED | 1,167,489 | UBS AG | 11/12/19 | (43) | ||||||||||||||

| USD | 907,579 | HKD | 7,115,602 | UBS AG | 11/12/19 | (224) | ||||||||||||||

| USD | 801,558 | THB | 24,469,113 | UBS AG | 11/12/19 | (8,892) | ||||||||||||||

| Total |

|

$ | (75,381) | |||||||||||||||||

| 1 |

Value is less than $1. |

See Notes to Financial Statements.

|

18 años |

Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

Legg Mason Emerging Markets Low Volatility High Dividend ETF

|

Abbreviations used in this table: |

||

| AED | — United Arab Emirates Dirham | |

| BRL | — Brazilian Real | |

| CLP | — Chilean Peso | |

| CZK | — Czech Koruna | |

| EUR | — Euro | |

| HKD | — Hong Kong Dollar | |

| INR | — Indian Rupee | |

| KRW | — South Korean Won | |

| MXN | — Mexican Peso | |

| MYR | — Malaysian Ringgit | |

| PHP | — Philippine Peso | |

| PLN | — Polish Zloty | |

| QAR | — Qatari Rial | |

| RUB | — Russian Ruble | |

| THB | — Thai Baht | |

| TWD | — Taiwan Dollar | |

| USD | — United States Dollar | |

| ZAR | — South African Rand | |

See Notes to Financial

Statements.

| Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

19 |

Schedule of investments (cont’d)

October 31, 2019

Legg Mason Emerging Markets Low Volatility High Dividend ETF

| Summary of Investments by Country**

(unaudited) |

||||

| Taiwán | 16.2 | % | ||

| China | 14.5 | |||

| Tailandia | 12.8 | |||

| Corea del Sur | 11.8 | |||

| Russia | 9.6 | |||

| Malasia | 9.6 | |||

| Emiratos Árabes Unidos | 5.2 | |||

| Brasil | 5.0 | |||

| India | 4.2 | |||

| Mexico | 3.5 | |||

| Sudáfrica | 2.0 | |||

| Qatar | 1.8 | |||

| Chile | 1.5 | |||

| Pakistan | 0.5 | |||

| Republica checa | 0.4 | |||

| Hong Kong | 0.3 | |||

| Poland | 0.3 | |||

| Filipinas | 0.3 | |||

| Greece | 0.2 | |||

| Hungría | 0.1 | |||

| Indonesia | 0.1 | |||

| Short-Term Investments | 0.1 | |||

| 100.0 | % | |||

| ** ** |

As a percentage of total investments. Please note that the Fund holdings are as of October 31, 2019 and are subject to change. |

See Notes to Financial

Statements.

|

20 |

Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

Statement of assets and liabilities

October 31, 2019

| Assets: | ||||

|

Investments, at value (Cost — $6,297,618) |

$ | 6,204,807 | ||

|

Foreign currency, at value (Cost — $33,588) |

33,576 | |||

|

Dividends and interest receivable |

8,814 | |||

|

Unrealized appreciation on forward foreign currency contracts |

3,601 | |||

|

Total Assets |

6,250,798 | |||

| Liabilities: | ||||

|

Unrealized depreciation on forward foreign currency contracts |

78,982 | |||

|

Accrued foreign capital gains tax |

5,172 | |||

|

Investment management fee payable |

2,604 | |||

|

Total Liabilities |

86,758 | |||

| Total Net Assets | $ | 6,164,040 | ||

| Net Assets: | ||||

|

Par value (Note 5) |

$ | 2 | ||

|

Paid-in capital in excess of par value |

6,372,806 | |||

|

Total distributable earnings (loss) |

(208,768) | † | ||

| Total Net Assets | $ | 6,164,040 | ||

| Shares Outstanding | 240,000 | |||

| Net Asset Value | $25.68 | |||

| † |

Net of accrued foreign capital gains tax of $5,172. |

See Notes to Financial Statements.

| Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

21 |

For the Year Ended October 31, 2019

| Investment Income: | ||||

|

Dividends |

$ | 321,855 | ||

|

Interest |

786 | |||

|

Less: Foreign taxes withheld |

(36,515) | |||

|

Total Investment Income |

286,126 | |||

| Expenses: | ||||

|

Investment management fee (Note 2) |

31,336 | |||

|

Interest expense |

138 | |||

|

Total Expenses |

31,474 | |||

| Net Investment Income | 254,652 | |||

| Realized and Unrealized Gain (Loss) on Investments, Futures Contracts, Forward Foreign Currency Contracts and Foreign Currency Transactions (Notes 1, 3 and 4): |

||||

|

Net Realized Gain (Loss) From: |

||||

|

Investment transactions |

(92,161) | |||

|

Futures contracts |

(6,884) | |||

|

Forward foreign currency contracts |

29,963 | |||

|

Foreign currency transactions |

(50,258) | |||

|

Net Realized Loss |

(119,340) | |||

|

Change in Net Unrealized Appreciation (Depreciation) From: |

||||

|

Inversiones |

188,024 | † | ||

|

Futures contracts |

883 | |||

|

Forward foreign currency contracts |

(103,351) | |||

|

Foreign currencies |

(269) | |||

|

Change in Net Unrealized Appreciation (Depreciation) |

85,287 | |||

| Net Loss on Investments, Futures Contracts, Forward Foreign Currency Contracts and Foreign Currency Transactions | (34,053) | |||

| Increase in Net Assets From Operations | $ | 220,599 | ||

| † |

Net of change in accrued foreign capital gains tax of $3,033. |

See Notes to Financial Statements.

|

22 |

Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

Statements of changes in net assets

| For the Years Ended October 31, | 2019 | 2018 | ||||||

| Operations: | ||||||||

|

Net investment income |

$ | 254,652 | $ | 245,140 | ||||

|

Net realized gain (loss) |

(119,340) | 219,805 | ||||||

|

Change in net unrealized appreciation (depreciation) |

85,287 | (617,007) | ||||||

|

Increase (Decrease) in Net Assets From Operations |

220,599 | (152,062) | ||||||

| Distributions to Shareholders From (Note 1): | ||||||||

|

Total distributable earnings(a) |

(332,207) | (257,494) | ||||||

|

Decrease in Net Assets From Distributions to |

(332,207) | (257,494) | ||||||

| Fund Share Transactions (Note 5): | ||||||||

|

Net proceeds from sale of shares (0 and 120,000 shares issued, respectively) |

— | 3,375,423 | ||||||

|

Increase in Net Assets From Fund Share Transactions |

— | 3,375,423 | ||||||

|

Increase (Decrease) in Net Assets |

(111,608) | 2,965,867 | ||||||

| Net Assets: | ||||||||

|

Beginning of year |

6,275,648 | 3,309,781 | ||||||

|

End of year(b) |

$ | 6,164,040 | $ | 6,275,648 | ||||

| (a) |

Distributions from net investment income and from realized gains are no longer required to be separately disclosed (Note 7). For the year ended |

| (b) |

Parenthetical disclosure of undistributed net investment income is no longer required (Note 7). For the year ended October 31, 2018, end of year net assets |

See Notes to Financial Statements.

| Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

23 |

| For a share of beneficial interest outstanding throughout each year ended October 31, unless otherwise noted: |

||||||||||||

| 20191 | 20181 | 20171,2 | ||||||||||

| Net asset value, beginning of year | $26.15 | $27.58 | $24.94 | |||||||||

| Income (loss) from operations: | ||||||||||||

|

Net investment income |

1.06 | 1.13 | 1.01 | |||||||||

|

Net realized and unrealized gain (loss) |

(0.15) | (1.34) | 2.57 | |||||||||

|

Total income (loss) from operations |

0.91 | (0.21) | 3.58 | |||||||||

| Less distributions from: | ||||||||||||

|

Net investment income |

(0.88) | (1.22) | (0.94) | |||||||||

|

Net realized gains |

(0.50) | — | — | |||||||||

|

Total distributions |

(1.38) | (1.22) | (0.94) | |||||||||

| Net asset value, end of year | $25.68 | $26.15 | $27.58 | |||||||||

|

Total return, based on NAV3 |

3.64 | % | (0.87) | % | 14.53 | % | ||||||

| Net assets, end of year (000s) | $6,164 | $6,276 | $3,310 | |||||||||

| Ratios to average net assets: | ||||||||||||

|

Gross expenses |

0.50 | % | 0.50 | % | 0.50 | %4 4 | ||||||

|

Net expenses |

0.50 | 0.50 | 0.50 | 4 4 | ||||||||

|

Net investment income |

4.06 | 4.10 | 3.93 | 4 4 | ||||||||

| Portfolio turnover rate | 27 | % | 27 | %5 5 | 25 | %5 5 | ||||||

| 1 |

Per share amounts have been calculated using the average shares method. |

| 2 |

For the period November 17, 2016 (inception date) to October 31, 2017. |

| 3 |

Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would |

| 5 5 |

Portfolio turnover excludes the value of portfolio securities received or delivered as a result of in-kind fund share |

See Notes to

Financial Statements.

|

24 |

Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

1. Organization and significant accounting policies

Legg Mason Emerging Markets Low Volatility High Dividend ETF (the “Fund”) is a separate diversified investment series of Legg Mason ETF Investment Trust

(the “Trust”). The Trust, a Maryland statutory trust, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company.

The Fund is an exchange-traded fund (“ETF”). ETFs are funds that trade like other publicly-traded securities. The Fund is designed to track an

index. Similar to shares of an index mutual fund, each share of the Fund represents an ownership interest in an underlying portfolio of securities intended to track an index. Unlike shares of a mutual fund, which can be bought from and redeemed by

the issuing fund by all shareholders at a price based on net asset value (“NAV”), shares of the Fund may be directly purchased from and redeemed by the Fund at NAV solely by certain large institutional investors who have entered into

agreements with the Fund’s distributor (“Authorized Participants”). Also unlike shares of a mutual fund, shares of the Fund are listed on a national securities exchange and trade in the secondary market at market prices that change

throughout the day.

Shares of the Fund are listed and traded at market prices on the Cboe BZX Exchange, Inc. The market price for the Fund’s shares

may be different from the Fund’s NAV. The Fund issues and redeems shares at NAV only in blocks of a specified number of shares or multiples thereof (“Creation Units”). Only Authorized Participants may purchase or redeem Creation Units

directly with the Fund at NAV. Creation Units generally are issued and redeemed partially in-kind for a basket of securities and partially in cash. Except when aggregated in Creation Units, shares of the Fund

are not redeemable securities. Shareholders who are not Authorized Participants may not redeem shares directly from the Fund at NAV.

The Fund seeks to

track the investment results of the QS Emerging Markets Low Volatility High Dividend Hedged Index (the “Underlying Index”). The Underlying Index seeks to provide more stable income through investments in stocks of profitable companies in

emerging markets outside of the United States with relatively high dividend yields or anticipated dividend yields and lower price and earnings volatility, while mitigating exposure to exchange-rate fluctuations between the U.S. dollar and currencies

in which the component securities are denominated and is based on a proprietary methodology created and sponsored by QS Investors, LLC, the Fund’s subadviser.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are

required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these

estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

| Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

25 |

Notes to financial statements (cont’d)

(a) Investment valuation. Equity securities for which market

quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. The valuations for fixed income securities (which may include, but are not limited to,

corporate, government, municipal, mortgage-backed, collateralized mortgage obligations and asset-backed securities) and certain derivative instruments are typically the prices supplied by independent third party pricing services, which may use

market prices or broker/dealer quotations or a variety of valuation techniques and methodologies. The independent third party pricing services use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds,

credit risks/spreads, default rates and quoted prices for similar securities. Investments in open-end funds are valued at the closing net asset value per share of each fund on the day of valuation. Futures

contracts are valued daily at the settlement price established by the board of trade or exchange on which they are traded. When the Fund holds securities or other assets that are denominated in a foreign currency, the Fund will use the currency

exchange rates, generally determined as of 4:00 p.m. (London Time). If independent third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the manager to be unreliable, the market

price may be determined by the manager using quotations from one or more broker/dealers or at the transaction price if the security has recently been purchased and no value has yet been obtained from a pricing service or pricing broker. Cuando

reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net

asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Trustees.

The Board of

Trustees is responsible for the valuation process and has delegated the supervision of the daily valuation process to the Legg Mason North Atlantic Fund Valuation Committee (the “Valuation Committee”). The Valuation Committee, pursuant to

the policies adopted by the Board of Trustees, is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s pricing policies, and reporting to the Board of Trustees. When determining the reliability of third

party pricing information for investments owned by the Fund, the Valuation Committee, among other things, conducts due diligence reviews of pricing vendors, monitors the daily change in prices and reviews transactions among market participants.

The Valuation Committee will consider pricing methodologies it deems relevant and appropriate when making fair value determinations. Examples of

possible methodologies include, but are not limited to, multiple of earnings; discount from market of a similar freely traded security; discounted cash-flow analysis; book value or a multiple thereof; risk premium/yield analysis; yield to maturity;

and/or fundamental investment analysis. The Valuation Committee will also consider factors it deems relevant and appropriate in light of the facts and circumstances. Examples of possible factors include, but are not limited to, the type of security;

the issuer’s financial statements; the purchase price of the security; the discount

|

26 |

Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

from market value of unrestricted

securities of the same class at the time of purchase; analysts’ research and observations from financial institutions; information regarding any transactions or offers with respect to the security; the existence of merger proposals or tender

offers affecting the security; the price and extent of public trading in similar securities of the issuer or comparable companies; and the existence of a shelf registration for restricted securities.

For each portfolio security that has been fair valued pursuant to the policies adopted by the Board of Trustees, the fair value price is compared against the last

available and next available market quotations. The Valuation Committee reviews the results of such back testing monthly and fair valuation occurrences are reported to the Board of Trustees quarterly.

The Fund uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and

the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future

cash flows to present value.

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and

liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

| • |

Level 1 — quoted prices in active markets for identical investments |

| • |

Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| • |

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those

securities.

| Legg Mason Emerging Markets Low Volatility High Dividend ETF 2019 Annual Report |

27 |

Notes to financial statements (cont’d)

The following is a summary of the inputs used in valuing the Fund’s assets and liabilities carried at fair value:

| ASSETS | ||||||||||||||||

| Descripción | Quoted Prices (Level 1) |

Other Significant Observable Inputs (Level 2) |

Significant (Level 3) |

Total | ||||||||||||

| Long-Term Investments†: | ||||||||||||||||

|

Common Stocks: |

||||||||||||||||

|

Communication Services |

$ | 568,727 | $ | 102,101 | — | $ | 670,828 | |||||||||

|

Consumer Staples |

438,367 | 33,199 | — | 471,566 | ||||||||||||

|

Energy |

710,921 | 189,443 | — | 900,364 | ||||||||||||

|

Financials |

1,252,141 | 52,692 | — | 1,304,833 | ||||||||||||

|

Information Technology |

482,904 | 5,067 | — | 487,971 | ||||||||||||

|

Materials |

738,525 | 162,090 | — | 900,615 | ||||||||||||

|

Bienes raíces |

224,708 | 12,356 | — | 237,064 | ||||||||||||

|

Utilities |

392,576 | 58,378 | — | 450,954 | ||||||||||||

|

Other Common Stocks |

606,042 | — | — | 606,042 | ||||||||||||

|