Reciba alertas instantáneas cuando salgan noticias sobre sus acciones. Solicite su prueba gratuita de 1 semana para StreetInsider Premium aquí.

unido

estados

Comisión Nacional del Mercado de Valores

Washington DC. 20549

forma n-csr

informe de accionista certificado de la gerencia registrada

empresas de inversión

Número de archivo de la Ley de Sociedades de Inversión 811-22549

Northern Lights Fund Trust II

(Nombre exacto del registrante como se especifica

en charter)

225 Pictoria Dr, Ste 450 Cincinnati, Ohio 45246

(Dirección de las oficinas ejecutivas principales) (Código postal

código)

Kevin E. Wolf, Gemini Fund Services, LLC.

80 Arkay Drive, Suite 110., Hauppauge, NY 11788

(Nombre y dirección del agente para el servicio)

Número de teléfono del registrante, incluido el código de área: 631-470-2600

Fecha de fin del año fiscal: 31/10

Fecha del período del informe: 31/10/19

Artículo 1. Informes a los accionistas.

|

| F / m Inversiones European L / S Small Cap Fund |

| Institucional Clase |

| BESMX |

| Inversor Clase |

| BESRX |

| Anual Reporte |

| octubre 31, 2019 |

| 1-844-322-8112 |

| www.fm-invest.com |

| Repartido por Northern Lights Distributors, LLC |

| Miembro FINRA |

Comenzando

el 1 de enero de 2021, según lo permitido por las regulaciones adoptadas por la Securities and Exchange Commission, copias en papel del Fondo

informes de accionistas como este ya no se enviarán por correo, a menos que solicite específicamente copias impresas de los informes.

En cambio, los informes estarán disponibles en el sitio web del Fondo www.fm-invest.com, y se le notificará por correo cada

cada vez que se publica un informe y se le proporciona un enlace al sitio web para acceder al informe.

Si

ya eligió recibir informes de accionistas electrónicamente, no se verá afectado por este cambio y no necesita tomar

cualquier acción. Puede optar por recibir electrónicamente los informes de los accionistas y otras comunicaciones del Fondo comunicándose con su

intermediario financiero (como un corredor de bolsa o banco) o, si es un inversor directo, siguiendo las instrucciones incluidas

con documentos en papel del Fondo que le han enviado por correo.

querido

Accionista,

En

El 11 de octubre de 2019, F / m Investments fue nombrado asesor del F / m Investments European L / S Small Cap Fund (el “Fondo”).

F / m se especializa en capacitar a los gerentes de activos boutique. Estamos entusiasmados de unirnos a SW Mitchell Capital, el fondo original y

Sub-asesor continuo, en el próximo capítulo del Fondo. Si bien el Fondo tiene un nuevo nombre, el Fondo conserva su larga y altamente

sub-asesor experimentado, junto con los recursos nuevos y adicionales de F / m Investments como asesor.

A pesar de que

fuimos asesores solo durante una parte de este año fiscal, hemos seguido al Fondo durante algún tiempo y consultado con el subasesor

en la entrega de esta información.

por

Durante el período de 12 meses que finalizó el 31 de octubre de 2019, el Fondo retornó -7.69%, lo que retrasó su índice, el Rendimiento Neto MSCI Europe Small Cap

Índice USD1, que devolvió 7.28%.

A

Al comienzo del año fiscal, las economías y los mercados europeos enfrentaron múltiples vientos en contra. A medida que avanzaba el año, comenzaron los vientos en contra

a cambio y los cambios positivos estaban ganando impulso en toda Europa.

los

Los vientos en contra anteriores que enfrentaron las principales economías y mercados de toda Europa incluyeron los efectos prolongados de un Brexit sin resolver,

La aversión desde hace mucho tiempo de Alemania al estímulo fiscal (más conocido como schwarze Null o el cero negro) que condujo a un

recesión técnica, protestas laborales y movimientos populistas como los chalecos jaunes (chalecos amarillos) en Francia y el

movimiento populista de cinco estrellas en Italia.

Como

de este escrito, están surgiendo eventos económicos positivos en toda Europa. De mayor impacto y sorpresa, el sustancial de Boris Johnson

La victoria electoral parlamentaria ha preparado el escenario para una conclusión del Brexit. Alemania comenzó un esfuerzo de estímulo fiscal con un "verde"

programa de infraestructura amigable con el clima y ha prometido más estímulo fiscal, con Holanda siguiendo su ejemplo. Presidente francés

Emmanuel Macron resolvió los disturbios laborales al aprobar un paquete de estímulo de miles de millones de euros. Italia eligió un nuevo gobierno más eurocéntrico.

Estos desarrollos han llevado a pronósticos positivos de varias fuentes para el crecimiento económico del Reino Unido y la UE.

En

Paralelamente a las tendencias económicas, creemos que las perspectivas para las acciones europeas, y las pequeñas capitalizaciones en particular, están mejorando.

europeo

las acciones han estado cotizando con descuentos significativos y casi históricos para sus contrapartes estadounidenses. En los últimos años, la equidad europea

los índices tuvieron un rendimiento inferior al de EE. UU., ampliando el descuento de valoración. Además, los descuentos para las acciones europeas de pequeña capitalización han sido incluso

más notable, ya que las políticas de tasas de interés negativas del banco central elevaron los mega capitalizaciones globales con base en Europa, a menudo a expensas

de empresas de base nacional, que son principalmente de pequeña capitalización.

De Europa

La confianza en la política monetaria para levantar las economías, los mercados financieros y el euro parece haber seguido su curso. Avanzando,

La política fiscal deberá reemplazar la política monetaria para acelerar las economías nacionales en todo el continente. Esta tendencia ya es

en marcha, con los países y gobiernos europeos asumiendo el papel de impulsar la recuperación económica y el crecimiento en lugar de confiar

sobre el Banco Central Europeo o el Parlamento Europeo. Las acciones europeas de pequeña capitalización pueden beneficiarse más entre los sectores de renta variable

de estímulo centrado en el país.

Más lejos,

desde el punto de vista de la moneda, el largo mercado alcista para el dólar estadounidense está a punto de relajarse, lo que agrega más ventajas a los valores europeos

y acciones de pequeña capitalización en dólares estadounidenses.

A lo largo

Con desarrollos económicos favorables y un entorno más favorable para las acciones europeas de pequeña capitalización, creemos que el Fondo está preparado

para una posible recuperación.

Terminado

A lo largo de su historia, el Fondo y su estrategia han experimentado reducciones periódicas, ya que las tenencias del Fondo a veces han caído

fuera de favor. Si bien el Fondo ha estado recientemente en dicho período, se ha recuperado de dichos períodos en el pasado. Cada vez,

el subconsejero permaneció disciplinado y comprometido con los tres pilares de su estrategia europea de pequeña capitalización: buscar empresas con

buena gestión, flujo de caja sólido y un catalizador para componer o desbloquear el valor (y lo contrario para posiciones cortas). Tiempo extraordinario,

esta

| 1 | MSCI Europa Small Net Return USD Index mide una canasta de acciones de pequeña capitalización de países europeos desarrollados convertidos al dólar estadounidense y reinvertir después de los dividendos fiscales. Los inversores no pueden invertir directamente en los índices referenciados y no gestionados las devoluciones de índice no reflejan ninguna tarifa, gasto o cargo de venta. Los índices referenciados se muestran para las comparaciones generales del mercado. |

disciplina

ha generado "doble alfa" o alfa positivo acumulativo2 tanto para posiciones largas como cortas. Además,

los retornos en una recuperación después de una disminución descendente del rendimiento han sido significativamente positivos. Seguimos creyendo nuestro enfoque defensivo.

proporciona una forma equilibrada de invertir en las oportunidades especializadas de las acciones europeas de pequeña capitalización.

En

En nombre de todos mis colegas, gracias por su continua inversión en BESMX.

Sinceramente,

Alejandro

Morris

los

el comentario representa la opinión de F / m Investments a partir de octubre de 2019 y está sujeto a cambios en función del mercado y otras condiciones.

Estas opiniones no pretenden ser un pronóstico de eventos futuros, una garantía de resultados futuros o asesoramiento de inversión. Cualquier estadística

aquí se han obtenido de fuentes que se consideran confiables, pero no se puede garantizar la precisión de esta información.

Las opiniones expresadas en este documento pueden cambiar en cualquier momento posterior a la fecha de emisión del presente. La información proporcionada no debe ser

interpretado como una recomendación o una oferta para comprar o vender o la solicitud de una oferta para comprar o vender cualquier fondo o valor.

9102-NLD-12/20/2019

| 2 | Alfa es una medida del rendimiento superior de una seguridad frente a su punto de referencia. |

| F / m Inversiones European L / S Small Cap Fund |

| PORTAFOLIO REVISIÓN (sin auditar) |

| octubre 31, 2019 |

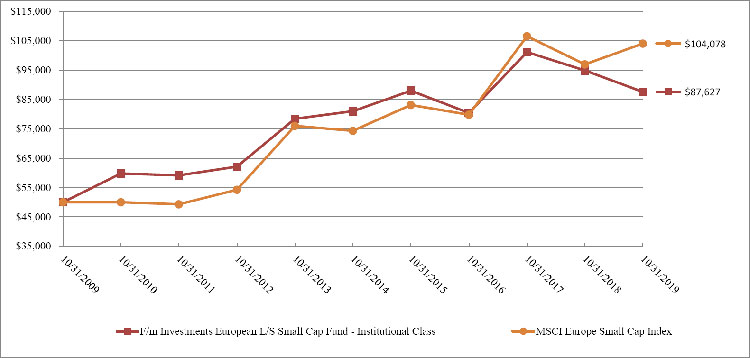

los

Cifras de rendimiento del fondo * para los períodos terminados el 31 de octubre de 2019, en comparación con su índice de referencia:

| Anualizado | Anualizado | Anualizado | ||

| Uno Año |

Cinco Año |

Ya que Inicio ** |

Ya que Inicio *** |

|

| F / m Inversiones European L / S Small Cap Fund Investor Class |

(7,92)% | N / A | 0,11% | N / A |

| F / m Inversiones European L / S Small Cap Fund Clase institucional |

(7,69)% | 1,58% | N / A | 7,16% |

| MSCI Índice de pequeña capitalización de Europa (a) |

7,28% | 6,96% | 5,78% | 3,51% |

Comparación

del cambio en el valor de una inversión de $ 50,000

| * * | los Los datos de rendimiento citados son históricos. El rendimiento pasado no es garantía de resultados futuros. El rendimiento actual puede ser mayor o inferior a los datos de rendimiento citados. El valor principal y el retorno de la inversión de una inversión fluctuarán para que su Las acciones, cuando se canjean, pueden valer más o menos que su costo original. Los rendimientos mostrados no reflejan la deducción de impuestos. que un accionista pagaría por las distribuciones del Fondo o por los reembolsos de acciones del Fondo. Los rendimientos mayores a 1 año son anualizados. El total de gastos operativos como se indica en la tabla de tarifas del folleto del Fondo con fecha del 1 de marzo de 2019 es de 4.00% y 4.30% para el Clase institucional y clase de inversores. Para obtener información actualizada sobre el último mes, llame al 1-844-322-8112. |

| ** ** | Comienzo La fecha es el 30 de diciembre de 2015. |

| *** | Comienzo la fecha es el 31 de octubre de 2007. Los datos de rendimiento de las acciones de Clase Institucional incluyen el fondo de cobertura predecesor del Fondo. |

| (un) | los El índice MSCI Europe Small Cap Captura la representación de pequeña capitalización en los 15 países de mercados desarrollados en Europa. Con 918 componentes, el índice cubre aproximadamente el 14% de la capitalización de mercado ajustada por flotación libre en el universo de renta variable europea. Índice de devoluciones asumir la reinversión de dividendos. Los inversores no pueden invertir en el Índice directamente; a diferencia de los rendimientos del Fondo, el Índice no reflejar cualquier tarifa o gasto. |

| Tenencias por industria / tipo de activo (1) | % de activos netos | |||

| Transporte | 11,0 | % | ||

| Al por menor | 9,7 | % | ||

| Mercado de dinero | 8.0 | % | ||

| Ocio | 7.6 | % | ||

| Software | 5.9 | % | ||

| Servicios comerciales | 5.1 | % | ||

| Servicios financieros diversificados | 5.0 | % | ||

| Ingeniería y construcción | 4.6 | % | ||

| Autopartes y Equipos | 4.5 4.5 | % | ||

| Seguro | 3.5 | % | ||

| Otros activos menos pasivos | 35,1 | % | ||

| 100,0 | % | |||

| (1) | Hace no incluye valores vendidos en corto en los que invierte el fondo. |

Por favor

consulte la Cartera de inversiones en este informe anual para obtener un análisis detallado de las tenencias del Fondo.

| F / m Inversiones European L / S Small Cap Fund |

| PORTAFOLIO De inversiones |

| octubre 31, 2019 |

| Comparte | Valor razonable | |||||||

| STOCK COMÚN – 89.3% | ||||||||

| LÍNEAS AÉREAS – 2.5% | ||||||||

| 5.210 | PLC de Wizz Air Holdings * ^ | PS | 257,130 | |||||

| PIEZAS DE AUTOMÓVIL Y EQUIPO – 4.5% | ||||||||

| 11,364 | CIE Automotive SA * ^ | 282,979 | ||||||

| 2,533 | MBB SE | 171,535 | ||||||

| 454,514 | ||||||||

| SERVICIOS COMERCIALES – 5.1% | ||||||||

| 56,260 | IWG PLC ^ | 279,117 | ||||||

| 42,195 | Marlowe PLC | 242,972 | ||||||

| 522,089 | ||||||||

| DISTRIBUCIÓN / AL POR MAYOR – 0.2% | ||||||||

| 2,547 | Fourlis Holdings SA * | 15,344 | ||||||

| SERVICIOS FINANCIEROS DIVERSIFICADOS – 5.0% | ||||||||

| 44,446 | Banca Farmafactoring SpA ^ | 269,253 | ||||||

| 17,675 | St. James's Place PLC | 238,092 | ||||||

| 507,345 | ||||||||

| ELECTRÓNICA – 0.1% | ||||||||

| 338 | Tecnología de detección Oy | 9,767 | ||||||

| INGENIERÍA Y CONSTRUCCIÓN – 4.6% | ||||||||

| 22,821 | Instalco Intressenter AB | 252,980 | ||||||

| 10,345 | SPIE SA ^ | 218,133 | ||||||

| 471,113 | ||||||||

| ALIMENTOS – 2.1% | ||||||||

| 62,356 | Raisio Oyj | 217,746 | ||||||

| SERVICIO DE ALIMENTOS – 3.3% | ||||||||

| 3,674 | DO & CO. AG ^ | 341,848 | ||||||

| SALUD – SERVICIOS – 2.1% | ||||||||

| 29,777 | Ambea AB | 217,278 | ||||||

| CONSTRUCTORES DE VIVIENDAS – 2.7% | ||||||||

| 316,163 | Glenveagh Properties PLC * ^ | 277,949 | ||||||

| SEGURO – 3.5% | ||||||||

| 39,250 | Lancashire Holdings Ltd. ^ | 361,367 | ||||||

| INTERNET – 2.1% | ||||||||

| 54,132 | Los datos responden ASA | 215,203 | ||||||

| EMPRESAS DE INVERSIÓN – 2.9% | ||||||||

| 315,807 | Duke Royalty Ltd. | 178,991 | ||||||

| 220,000 | PLC de Stirling Industries * # | 120,989 | ||||||

| 299,980 | ||||||||

| TIEMPO DE OCIO – 7.6% | ||||||||

| 90,645 | Gym Group PLC ^ | 306,139 | ||||||

| 14,159 | MIPS AB | 216,919 | ||||||

| 43,025 | En el grupo de playa PLC | 249,533 | ||||||

| 772,591 | ||||||||

| ALOJAMIENTO – 2.3% | ||||||||

| 39,853 | Dalata Hotel Group PLC | 235,649 | ||||||

| MAQUINARIA – DIVERSIFICADA – 2.7% | ||||||||

| 134 | Interroll Holding AG * ^ | 277,031 | ||||||

| ACEITE Y GAS – 1.0% | ||||||||

| 38,716 | Northern Drilling Ltd. * | 101,205 | ||||||

| EMBALAJE Y CONTENEDORES – 2.2% | ||||||||

| 20,027 | Zignago Vetro SpA | 227,900 | ||||||

| BIENES RAÍCES – 1.5% | ||||||||

| 4,048 | Corestate Capital Holding SA ^ | 150,840 | ||||||

| VENTA AL POR MENOR – 9.7% | ||||||||

| 28,594 | PLC de Applegreen | 177,418 | ||||||

| 237,631 | Brickability Group PLC * | 196,797 | ||||||

| 101,737 | City Pub Group PLC | 266,587 | ||||||

| 84,532 | Tumbonas PLC * | 216,034 | ||||||

| 202,158 | SiS Science in Sport PLC * | 132,104 | ||||||

| 988,940 | ||||||||

| SEMICONDUCTORES – 3.0% | ||||||||

| 314,350 | PLC IQE * ^ | 305,077 | ||||||

| SOFTWARE – 5.9% | ||||||||

| 37,642 | Codemasters Group Holdings PLC * | 110,812 | ||||||

| 9.165 | Frontier Developments PLC * | 129,506 | ||||||

| 65,016 | Team17 Group PLC * | 256,599 | ||||||

| 18,468 | Wandisco PLC * | 100,370 | ||||||

| 597,287 | ||||||||

| JUGUETES / JUEGOS / DISTRACCIONES – 1.7% | ||||||||

| 25,449 | Embracer Group AB | 173,018 | ||||||

Ver

notas adjuntas a los estados financieros.

| F / m Inversiones European L / S Small Cap Fund |

| PORTAFOLIO DE INVERSIONES (Continuación) |

| octubre 31, 2019 |

| Comparte | Valor razonable | |||||||

| STOCK COMÚN (Continuación) – 89.3% | ||||||||

| TRANSPORTE – 11.0% | ||||||||

| 34,508 | BW Offshore Ltd. * ^ | PS | 263,098 | |||||

| 7,042 | Construcciones y Auxiliar de Ferrocarriles SA ^ | 316,221 | ||||||

| 258,412 | Eddie Stobart Logística PLC # | 50,158 | ||||||

| 37,163 | Goodbulk Ltd. * # | 497,327 | ||||||

| 1,126,804 | ||||||||

| TOTAL DE ACCIONES COMUNES (Costo – $ 9,131,850) |

9.125.015 | |||||||

| INVERSIÓN A CORTO PLAZO – 8.0% | ||||||||

| FONDO DE MERCADO DE DINERO – 8.0% | ||||||||

| 815,723 | Fidelity Institutional Money Market Funds – Cartera gubernamental, clase institucional, 2.31% ** | 815,723 | ||||||

| INVERSIÓN TOTAL A CORTO PLAZO (Costo – $ 815,723) | ||||||||

| INVERSIONES TOTALES – 97.3% (Costo – $ 9,947,573) | PS | 9,940,738 | ||||||

| VALORES VENDIDOS CORTO – (27.1)% (Producto – $ 2,790,888) |

(2,765,986 | ) | ||||||

| OTROS ACTIVOS MENOS PASIVOS – 29.8% | 3,043,306 | |||||||

| ACTIVOS NETOS – 100.0% | PS | 10,218,058 | ||||||

| VALORES VENDIDOS CORTO – (27.1)% | ||||||||

| MATERIALES DE CONSTRUCCIÓN – (1.6)% | ||||||||

| 17,756 | Marshalls PLC | 163,476 | ||||||

| PRODUCTOS QUÍMICOS – (1.0)% | ||||||||

| 2,542 | Fuchs Petrolub SE | 102,521 | ||||||

| SERVICIOS COMERCIALES – (1.8)% | ||||||||

| 17,731 | Aggreko PLC | 181,441 | ||||||

| SERVICIOS FINANCIEROS DIVERSIFICADOS – (2.6)% | ||||||||

| 1,561 | Grenke AG | 147,769 | ||||||

| 5,323 | Hargreaves Lansdown PLC | 122,055 | ||||||

| 269,824 | ||||||||

| ELECTRÓNICA – (1.6)% | ||||||||

| 5,187 | Spectris PLC | 160,551 | ||||||

| ENERGÍA FUENTES ALTERNAS – (1.2)% | ||||||||

| 8.630 | Siemens Gamesa Renewable Energy SA | 118,666 | ||||||

| COMIDA – (2.6)% | ||||||||

| 914 | Kerry Group PLC | 110,536 | ||||||

| 2,845 | Viscofan SA | 154,194 | ||||||

| 264,730 | ||||||||

| PRODUCTOS DE SALUD – (1.3)% | ||||||||

| 3,051 | GN Store Nord A / S | 134,150 | ||||||

| SERVICIOS DE SALUD – (2.5)% | ||||||||

| 3.750 | Korian SA * | 158,980 | ||||||

| 3,562 | NMC Health PLC | 100,619 | ||||||

| 259,599 | ||||||||

| TIEMPO DE OCIO – (1.6)% | ||||||||

| 14,884 | Technogym SpA | 164,061 | ||||||

| MEDIOS – (1.0)% | ||||||||

| 12,095 | Pearson PLC | 106,771 | ||||||

| FABRICACIÓN DIVERSA – (3.3)% | ||||||||

| 13,057 | PLC IMI | 169,465 | ||||||

| 3,438 | Stadler Rail AG * | 166,961 | ||||||

| 336,426 | ||||||||

| SEMICONDUCTORES – (3.4)% | ||||||||

| 2,574 | Melexis NV | 180,342 | ||||||

| 2,041 | u-blox Holding AG | 165,059 | ||||||

| 345,401 | ||||||||

| TRANSPORTE – (1.6)% | ||||||||

| 57.839 | Royal Mail PLC | 158,369 | ||||||

| TOTAL DE VALORES VENDIDOS CORTO (Ingresos – $ 2,790,888) |

2,765,986 | |||||||

SOCIEDAD ANÓNIMA

– Compañía pública limitada

| * * | Sin ingresos produciendo seguridad. |

| ^ | Todos o una parte de estos valores se mantienen como garantía para valores vendidos en corto. |

| # # | Justa seguridad valorada, el valor de esta seguridad se ha determinado de buena fe bajo las políticas de la Junta de Síndicos. |

| ** ** | Dinero fondo de mercado; la tasa de interés refleja el rendimiento efectivo al 31 de octubre de 2019. |

Ver

notas adjuntas a los estados financieros.

| F / m Inversiones European L / S Small Cap Fund |

| PORTAFOLIO DE INVERSIONES (Continuación) |

| octubre 31, 2019 |

| No realizado | ||||||||||||||||

| Moneda extranjera | Fecha de liquidación | Contraparte | Moneda local | Valor en dólares estadounidenses | Apreciación / (Depreciación) | |||||||||||

| Comprar: | ||||||||||||||||

| Corona danesa | 14/11/2019 | Goldman Sachs | 835,877 | PS | 124,929 | PS | 1,376 | |||||||||

| Euro | 14/11/2019 | Goldman Sachs | 562,738 | 628,225 | 3,664 | |||||||||||

| Franco suizo | 14/11/2019 | Goldman Sachs | 247,317 | 250,823 | 2,195 | |||||||||||

| Franco suizo | 14/11/2019 | Goldman Sachs | 218,949 | 222,052 | 1,752 | |||||||||||

| PS | 1,226,029 | PS | 8,987 | |||||||||||||

| Vender: | ||||||||||||||||

| Libra británica | 14/11/2019 | Goldman Sachs | 1,631,980 | PS | 2,112,442 | PS | (48,079 | ) | ||||||||

| Libra británica | 14/11/2019 | Goldman Sachs | 168,949 | 218,688 | (22 | ) | ||||||||||

| Euro | 14/11/2019 | Goldman Sachs | 2,473,545 | 2,761,400 | (33,815 | ) | ||||||||||

| Corona noruega | 14/11/2019 | Goldman Sachs | 9,785,363 | 1,065,851 | 3,648 | |||||||||||

| Corona sueca | 14/11/2019 | Goldman Sachs | 5,149,411 | 534,775 | (10,215 | ) | ||||||||||

| PS | 6.693.156 | PS | (88,483 | ) | ||||||||||||

| Total | PS | (79,496 | ) | |||||||||||||

Ver

accompanying notes to financial statements.

| F/m Investments European L/S Small Cap Fund |

| STATEMENT OF ASSETS AND LIABILITIES |

| octubre 31, 2019 |

| ASSETS | ||||

| Investment securities: | ||||

| At cost | PS | 9,947,573 | ||

| At value | PS | 9,940,738 | ||

| Cash at broker | 4,507,776 | |||

| Cash held for collateral at custodian | 183,539 | |||

| Dividends and interest receivable | 36,509 | |||

| Receivable for securities sold | 24,220 | |||

| Receivable for Fund shares sold | 4,221 | |||

| Prepaid expenses and other assets | 24,413 | |||

| TOTAL ASSETS | 14,721,416 | |||

| LIABILITIES | ||||

| Securities sold short (Proceeds – $2,790,888) | 2,765,986 | |||

| Due to Custodian – Foreign Currency (Cost – $1,346,046) | 1,350,778 | |||

| Payable for Fund shares redeemed | 143,948 | |||

| Payable for investments purchased | 114,688 | |||

| Unrealized depreciation on foreign currency contracts | 79,496 | |||

| Investment advisory fees payable | 5,364 | |||

| Dividends payable on securities sold short | 3,546 | |||

| Payable to related parties | 698 | |||

| Distribution (12b-1) fees payable | 333 | |||

| Accrued expenses and other liabilities | 38,521 | |||

| TOTAL LIABILITIES | 4,503,358 | |||

| NET ASSETS | PS | 10,218,058 | ||

| NET ASSETS CONSIST OF: | ||||

| Paid in capital | PS | 21,502,383 | ||

| Accumulated Loss | (11,284,325 | ) | ||

| NET ASSETS | PS | 10,218,058 | ||

| NET ASSET VALUE PER SHARE: | ||||

| Institutional Class: | ||||

| Net Assets | PS | 8,729,599 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 966,461 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (a) | PS | 9.03 | ||

| Investor Class: | ||||

| Net Assets | PS | 1,488,459 | ||

| Shares of beneficial interest outstanding ($0 par value, unlimited shares authorized) | 165,394 | |||

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share (a) | PS | 9.00 | ||

| (a) | Redemptions made within 60 days of purchases may be assessed a redemption fee of 1.00%. |

Ver

accompanying notes to financial statements.

| F/m Investments European L/S Small Cap Fund |

| STATEMENT OF OPERATIONS |

| por the Year Ended October 31, 2019 |

| INVESTMENT INCOME | ||||

| Dividends (net of foreign tax withheld of $83,915) | PS | 587,571 | ||

| Interest | 139,929 | |||

| TOTAL INVESTMENT INCOME | 727,500 | |||

| EXPENSES | ||||

| Investment advisory fees | 962,028 | |||

| Distribution (12b-1) fees: | ||||

| Investor Class | 3,623 | |||

| Dividends on securities sold short | 317,129 | |||

| Interest expense | 198,844 | |||

| Custodian fees | 97,135 | |||

| Administration fees | 67,582 | |||

| Registration fees | 39,473 | |||

| Trustees fees and expenses | 30,003 | |||

| Legal fees | 29,985 | |||

| Third party administrative servicing fees | 26,954 | |||

| Compliance officer fees | 22,001 | |||

| Audit fees | 19,100 | |||

| Printing expense | 8,023 | |||

| Insurance expense | 6,216 | |||

| Shareholder service fees – Investor Class | 725 | |||

| Other expenses | 6,120 | |||

| TOTAL EXPENSES | 1,834,941 | |||

| Less: Fees waived by the Advisor | (242,083 | ) | ||

| NET EXPENSES | 1,592,858 | |||

| NET INVESTMENT LOSS | (865,358 | ) | ||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||

| Net realized gain (loss) on: | ||||

| Inversiones | (15,276,400 | ) | ||

| Foreign currency contracts | 2,500,076 | |||

| Securities sold short | 4,701,625 | |||

| (8,074,699 | ) | |||

| Net change in unrealized appreciation (depreciation) on: | ||||

| Inversiones | 8,003,659 | |||

| Foreign currency contracts | (1,218,681 | ) | ||

| Foreign currency translations | (69,073 | ) | ||

| Securities sold short | (2,395,126 | ) | ||

| 4,320,779 | ||||

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | (3,753,920 | ) | ||

| NET DECREASE IN NET ASSETS | PS | (4,619,278 | ) | |

Ver

accompanying notes to financial statements.

| F/m Investments European L/S Small Cap Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| October 31, 2019 | 31 de octubre de 2018 | |||||||

| FROM OPERATIONS | ||||||||

| Net investment loss | PS | (865,358 | ) | PS | (1,948,746 | ) | ||

| Net realized gain (loss) from investments, foreign currency contracts, and securities sold short | (8,074,699 | ) | 4,624,330 | |||||

| Net change in unrealized appreciation (depreciation) on investments, securities sold short, foreign currency contracts and foreign currency translations | 4,320,779 | (9,245,797 | ) | |||||

| Net decrease in net assets resulting from operations | (4,619,278 | ) | (6,570,213 | ) | ||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| Total Distributions Paid: | ||||||||

| Institutional Class | (4,332,627 | ) | (3,698,133 | ) | ||||

| Investor Class | (71,987 | ) | (25,767 | ) | ||||

| Net decrease in net assets resulting from distributions to shareholders | (4,404,614 | ) | (3,723,900 | ) | ||||

| FROM SHARES OF BENEFICIAL INTEREST | ||||||||

| Proceeds from shares sold: | ||||||||

| Institutional Class | 11,095,003 | 33,304,258 | ||||||

| Investor Class | 1,334,417 | 1,351,878 | ||||||

| Net asset value of shares issued in reinvestment of distributions: | ||||||||

| Institutional Class | 3,407,875 | 2,700,642 | ||||||

| Investor Class | 71,987 | 25,767 | ||||||

| Redemption fee proceeds: | ||||||||

| Institutional Class | 6,116 | 189 | ||||||

| Investor Class | 869 | 323 | ||||||

| Payments for shares redeemed: | ||||||||

| Institutional Class | (82,249,649 | ) | (9,926,213 | ) | ||||

| Investor Class | (1,150,915 | ) | (321,382 | ) | ||||

| Net increase (decrease) in net assets from shares of beneficial interest | (67,484,297 | ) | 27,135,462 | |||||

| TOTAL INCREASE (DECREASE) IN NET ASSETS | (76,508,189 | ) | 16,841,349 | |||||

| NET ASSETS | ||||||||

| Beginning of Year | 86,726,247 | 69,884,898 | ||||||

| End of Year | PS | 10,218,058 | PS | 86,726,247 | ||||

| SHARE ACTIVITY | ||||||||

| Institutional Class: | ||||||||

| Shares Sold | 1,170,894 | 2,923,852 | ||||||

| Shares Reinvested | 377,395 | 241,776 | ||||||

| Shares Redeemed | (8,784,764 | ) | (909,158 | ) | ||||

| Net increase (decrease) in shares of beneficial interest outstanding | (7,236,475 | ) | 2,256,470 | |||||

| Investor Class: | ||||||||

| Shares Sold | 143,293 | 119,230 | ||||||

| Shares Reinvested | 7,981 | 2,307 | ||||||

| Shares Redeemed | (123,270 | ) | (28,524 | ) | ||||

| Net increase in shares of beneficial interest outstanding | 28,004 | 93,013 | ||||||

Ver

accompanying notes to financial statements.

| F/m Investments European L/S Small Cap |

| FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period |

| Institutional Clase |

||||||||||||||||

| For the | For the | For the | For the | |||||||||||||

| Year Ended | Year Ended | Year Ended | Period Ended | |||||||||||||

| octubre 31, 2019 |

octubre 31, 2018 |

octubre 31, 2017 |

octubre 31, 2016 (1) |

|||||||||||||

| Red asset value, beginning of period |

PS | 10.40 | PS | 11.67 | PS | 9.27 | PS | 10.00 | ||||||||

| Activity from investment operations: |

||||||||||||||||

| Net investment loss (2) |

(0.17 | ) | (0.25 | ) | (0.21 | ) | (0.18 | ) | ||||||||

| Red realized and unrealized gain (loss) on investments |

(0.63 | ) | (0.43 | ) | 2.61 | (0.55 | ) | |||||||||

| Total from investment operations |

(0.80 | ) | (0.68 | ) | 2.40 | (0.73 | ) | |||||||||

| Less distributions from: |

||||||||||||||||

| Net investment income | (0.25 | ) | (0.31 | ) | – | – | ||||||||||

| Red realized gains |

(0.32 | ) | (0.28 | ) | – | – | ||||||||||

| Total distributions |

(0.57 | ) | (0.59 | ) | – | – | ||||||||||

| Paid-in-Capital From Redemption Fees |

0.00 | (3) | 0.00 | (3) | 0.00 | (3) | – | |||||||||

| Net asset value, end of period |

PS | 9.03 | PS | 10.40 | PS | 11.67 | PS | 9.27 | ||||||||

| Total return (4) |

(7.69 | )% | (6.18 | )% | 25.89 | % | (7.30 | )% (5) | ||||||||

| Red assets, at end of period (000’s) |

PS | 8,730 | PS | 85,302 | PS | 69,368 | PS | 24,654 | ||||||||

| Ratio of gross expenses to average net assets (6,8) |

3.83 | % | 3.97 | % | 2.71 | % | 2.87 | % (7) | ||||||||

| Ratio of net expenses to average net assets (8) |

3.33 | % | 3.73 | % | 2.46 | % | 2.45 | % (7) | ||||||||

| Ratio of net investment loss to average net assets |

(1.81 | )% | (2.24 | )% | (1.99 | )% | (2.18 | )% (7) | ||||||||

| Portfolio Turnover Rate |

141 | % | 194 | % | 154 | % | 168 | % (5) | ||||||||

| (1) | los Fund commenced operations on December 30, 2015. |

| (2) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (3) | Represents less than $0.01 per share. |

| (4) | Total returns shown exclude the effect of applicable sales charges and redemption fees and assumes the reinvestment of distributions. |

| (6) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the Advisor. |

| (8) | Excluding dividends from securities sold short and interest expense, the ratio of expenses to average net assets would have been: |

| Before fees waived | 2.74 | % | 2.48 | % | 2.49 | % | 2.66 | % (7) | ||||||||

| After fees waived | 2.24 | % | 2.24 | % | 2.24 | % | 2.24 | % (7) | ||||||||

Ver

accompanying notes to financial statements.

| F/m Investments European L/S Small Cap |

| FINANCIAL HIGHLIGHTS |

| Per Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout Each Period |

| Investor Clase |

||||||||||||||||

| For the | For the | For the | For the | |||||||||||||

| Year Ended | Year Ended | Year Ended | Period Ended | |||||||||||||

| octubre 31, 2019 |

octubre 31, 2018 |

octubre 31, 2017 |

octubre 31, 2016 (1) |

|||||||||||||

| Red asset value, beginning of period |

PS | 10.37 | PS | 11.66 | PS | 9.27 | PS | 10.00 | ||||||||

| Activity from investment operations: |

||||||||||||||||

| Net investment loss (2) |

(0.17 | ) | (0.29 | ) | (0.27 | ) | (0.18 | ) | ||||||||

| Red realized and unrealized gain (loss) on investments |

(0.66 | ) | (0.42 | ) | 2.66 | (0.55 | ) | |||||||||

| Total from investment operations |

(0.83 | ) | (0.71 | ) | 2.39 | (0.73 | ) | |||||||||

| Less distributions from: |

||||||||||||||||

| Net investment income | (0.23 | ) | (0.30 | ) | – | – | ||||||||||

| Red realized gains |

(0.32 | ) | (0.28 | ) | – | – | ||||||||||

| Total distributions |

(0.55 | ) | (0.58 | ) | – | – | ||||||||||

| Paid-in-Capital From Redemption Fees |

0.01 | 0.00 | (3) | – | – | |||||||||||

| Net asset value, end of period |

PS | 9.00 | PS | 10.37 | PS | 11.66 | PS | 9.27 | ||||||||

| Total return (4) |

(7.92 | )% | (6.44 | )% | 25.78 | % | (7.30 | )% (5) | ||||||||

| Red assets, at end of period (000’s) |

PS | 1,488 | PS | 1,425 | PS | 517 | PS | 0 0 | (8) | |||||||

| Ratio of gross expenses to average net assets (6,9) |

4.13 | % | 4.27 | % | 3.01 | % | 3.17 | % (7) | ||||||||

| Ratio of net expenses to average net assets (9) |

3.63 | % | 4.03 | % | 2.76 | % | 2.75 | % (7) | ||||||||

| Ratio of net investment loss to average net assets |

(1.85 | )% | (2.56 | )% | (2.39 | )% | (2.48 | )% (7) | ||||||||

| Portfolio Turnover Rate |

141 | % | 194 | % | 154 | % | 168 | % (5) | ||||||||

| (1) | los Fund commenced operations on December 30, 2015. |

| (2) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (3) | Represents less than $0.01 per share. |

| (4) | Total returns shown exclude the effect of applicable sales charges and redemption fees and assumes the reinvestment of distributions. |

| (6) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the Advisor. |

| (9) | Excluding dividends from securities sold short and interest expense, the ratio of expenses to average net assets would have been: |

| Before fees waived | 3.04 | % | 2.78 | % | 2.79 | % | 2.96 | % (7) | ||||||||

| After fees waived | 2.54 | % | 2.54 | % | 2.54 | % | 2.54 | % (7) | ||||||||

Ver

accompanying notes to financial statements.

| F/m Investments European L/S Small Cap Fund |

| NOTES TO FINANCIAL STATEMENTS |

| octubre 31, 2019 |

los

F/m Investments European L/S Small Cap Fund (the “Fund”), formerly known as the Balter European L/S Small Cap Fund,

changed its name as of October 11, 2019. The Fund is a diversified series of shares of beneficial interest of Northern Lights

Fund Trust II (the “Trust”), a statutory trust organized under the laws of the State of Delaware on August 26, 2010,

and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment

company. The Fund commenced operations on December 30, 2015.

los

investment objective of the Fund is to generate absolute returns by investing both long and short in European Companies. The Fund

offers two classes of shares: Institutional Class shares and Investor Class shares. Each class of shares is offered at their net

asset value. Each class of shares of the Fund has identical rights and privileges with respect to arrangements pertaining to shareholder

servicing or distribution, class-related expenses, voting rights on matters affecting a single class of shares, and the exchange

privilege of each class of shares. The Fund’s share classes differ in the fees and expenses charged to shareholders. los

Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated

proportionately each day based upon the relative net assets of each class.

| 2) | SIGNIFICANT ACCOUNTING POLICIES |

los

following is a summary of significant accounting policies followed by the Fund in preparation of their financial statements. Estas

policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual

results could differ from those estimates. The Fund is an investment companies and accordingly follow the investment company accounting

and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial

Services – Investment Companies”.

Securities

valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular

trading session of the primary exchange on the business day the value is being determined, or in the case of securities listed

on NASDAQ at the NASDAQ Official Closing Price (“NOCP”). In the absence of a sale such securities shall be valued

at the mean between the current bid and ask prices on the day of valuation. Short-term debt obligations having 60 days or less

remaining until maturity, at time of purchase may be valued at amortized cost. Forward foreign currency exchange contracts (‘forward

contracts”) are valued at the forward rate. Investments values in currencies other than the U.S. dollar are converted to

U.S. dollars using exchange rates obtained from pricing services. Investments in open-end investment companies are valued at net

asset value.

los

Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily

illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities

will be valued using the “fair value” procedures approved by the Board. The Board has delegated execution of these

procedures to a fair value committee composed of one or more representatives from each of the (i) Trust, (ii) administrator, and

(iii) advisor. The committee may also enlist third party consultants such as a valuation specialist at a public accounting firm,

valuation consultant or financial officer of a security issuer on an as-needed basis to assist in determining a security-specific

fair value. The Board has also engaged a third party valuation firm to attend valuation meetings held by the Trust, review minutes

of such meetings and report to the Board on a quarterly basis. The Board reviews and ratifies the execution of this process and

the resultant fair value prices at least quarterly to assure the process produces reliable results.

Fair

Valuation Process – As noted above, the fair value committee is composed of one or more representatives from each of

the (i) Trust, (ii) administrator, and (iii) advisor. The applicable investments are valued collectively via inputs from each

of these groups. For example, fair value determinations are required for the following securities: (i) securities for which market

quotations are insufficient or not readily available on a particular business day (including securities for which there is a short

and temporary lapse in the provision of a price by the regular pricing source), (ii) securities for which, in the judgment of

the advisor the prices or values available do not represent the fair value of the instrument. Factors which may cause the advisor

to make such a judgment include, but are not limited to, the following: only a bid price or an asked price is available; the spread

between bid and asked prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades;

and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be

| F/m Investments European L/S Small Cap Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| octubre 31, 2019 |

illiquid;

(iv) securities with respect to which an event that will affect the value thereof has occurred (a “significant event”)

since the closing prices were established on the principal exchange on which they are traded, but prior to a Fund’s calculation

of its net asset value. Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference

to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted

or illiquid securities, such as private investments or non-traded securities are valued via inputs from the advisor based upon

the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and

circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances).

If the advisor is unable to obtain a current bid from such independent dealers or other independent parties, the fair value committee

shall determine the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of

purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities

of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect

to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration

rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness;

(viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x)

current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

los

Fund utilizes various methods to measure the fair value of all of its investments on a recurring basis. GAAP establishes a hierarchy

that prioritizes inputs to valuation methods. The three levels of input are:

Level

1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to

access.

Level

2 – Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either

directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for

similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level

3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing

the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would

be based on the best information available.

los

availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including,

for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets,

and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less

observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment

exercised in determining fair value is greatest for instruments categorized in Level 3.

los

inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes,

the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the

lowest level input that is significant to the fair value measurement in its entirety.

los

inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those

securities. The following tables summarize the inputs used as of October 31, 2019 for the Fund’s investments measured at

fair value:

| Assets * | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock | PS | 8,456,541 | PS | 668,474 | PS | – | PS | 9,125,015 | ||||||||

| Money Market Funds | 815,723 | – | – | 815,723 | ||||||||||||

| Total | PS | 9,272,264 | PS | 668,474 | PS | – | PS | 9,940,738 | ||||||||

| Liabilities* | ||||||||||||||||

| Securities Sold Short | PS | 2,765,986 | PS | – | PS | – | PS | 2,765,986 | ||||||||

| Forward Currency Contracts | – | 79,496 | – | PS | 79,496 | |||||||||||

| Total | PS | 2,765,986 | PS | 79,496 | PS | – | PS | 2,845,482 | ||||||||

los

Fund did not hold any Level 3 securities during the year.

Allí

were no transfers into or out of Level 1 and Level 2 during the year. It is the Fund’s policy to recognize transfers into

or out of Level 1 and Level 2 at the end of the reporting period.

| * * | Refer to the Portfolio of Investments for industry classification. |

| F/m Investments European L/S Small Cap Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| octubre 31, 2019 |

Seguridad

transactions and related income – Security transactions are accounted for on trade date. Interest income is recognized

on an accrual basis. Discounts are accreted and premiums are amortized on securities purchased over the lives of the respective

securities. Dividend income is recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined

by comparing the identified cost of the security lot sold with the net sales proceeds.

Dividends

and distributions to shareholders – Dividends from net investment income, if any, are declared and paid annually. Distributable

net realized capital gains, if any, are declared and distributed annually. Dividends from net investment income and distributions

from net realized gains are recorded on ex dividend date and are determined in accordance with federal income tax regulations,

which may differ from GAAP. These “book/tax” differences are considered either temporary (i.e., deferred losses, capital

loss carry forwards) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified

within the composition of net assets based on their federal tax-basis treatment; temporary differences do not require reclassification.

These reclassifications have no effect on net assets, results from operations or net asset value per share of the Fund.

Forward

Currency Contracts – As foreign securities are purchased, a Fund generally enters into forward currency exchange contracts

in order to hedge against foreign currency exchange rate risks. The market value of the contract fluctuates with changes in currency

exchange rates. The contract is marked-to-market daily and the change in market value is recorded by a Fund as an unrealized gain

or loss. As foreign securities are sold, a portion of the contract is generally closed and the Fund records a realized gain or

loss equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed.

A Fund may also enter into forward currency contracts as an investment strategy consistent with that Fund’s investment objective.

Realized gains and losses from contract transactions are included as a component of net realized gains (losses) from investments

and foreign currency in the Statements of Operations.

Foreign

Currency Translations – The accounting records of the Fund is maintained in U.S. dollars. Investment securities and

other assets and liabilities denominated in a foreign currency, and income receipts and expense payments are translated into U.S.

dollars using the prevailing exchange rate at the London market close. Purchases and sales of securities are translated into U.S.

dollars at the contractual currency rates established at the approximate time of the trade.

Corto

Ventas – A “short sale” is a transaction in which the Fund sells a security it does not own but has borrowed

in anticipation that the market price of that security will decline. The Fund is obligated to replace the security borrowed by

purchasing it on the open market at a later date. If the price of the security sold short increases between the time of the short

sale and the time the Fund replaces the borrowed security, the Fund will incur a loss, unlimited in size. Conversely, if the price

declines, the Fund will realize a gain, limited to the price at which the Fund sold the security short. Certain cash and securities

are held as collateral.

Federal

income tax – It is the Fund’s policy to qualify as a regulated investment company by complying with the provisions

of the Internal Revenue Code that are applicable to regulated investment companies and to distribute substantially all of its

taxable income and net realized gains to shareholders. Therefore, no federal income tax provision is required. The Fund recognizes

the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming

examination by tax authorities. Management has analyzed the Fund’s tax positions and has concluded that no liability for

unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years ended

October 31, 2016 to October 31, 2018, or expected to be taken in the Fund’s October 31, 2019 year end tax returns. The Fund

identifies its major tax jurisdictions as U.S. Federal and Ohio, and foreign jurisdictions where the Fund makes significant investments;

however, the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized

tax benefits will change materially in the next twelve months.

Expenses

– Expenses of the Trust that are directly identifiable to a specific fund are charged to that fund. Expenses which are

not readily identifiable to a specific fund are allocated in such a manner as deemed equitable, taking into consideration the

nature and type of expense and the relative sizes of the funds in the Trust.

| F/m Investments European L/S Small Cap Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| octubre 31, 2019 |

Indemnification

– The Trust indemnifies its officers and Trustees for certain liabilities that may arise from the performance of their

duties to the Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of

representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements

is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on

experience, the risk of loss due to these warranties and indemnities appears to be remote.

| 3) | INVESTMENT TRANSACTIONS |

por

the year ended October 31, 2019, cost of purchases and proceeds from sales of portfolio securities, other than short-term investments

and securities sold short, amounted to the following:

| Purchases | Ventas | |||||

| PS | 55,532,757 | PS | 113,925,724 | |||

| 4) | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

Como

of October 11, 2019, F/m Investments LLC serves as the Fund’s investment advisor to the Fund. Prior to October 11, 2019

Balter Liquid Alternatives, LLC served as the Fund’s investment advisor to the Fund. Pursuant to an Investment Advisory

Agreement with the Fund, the Advisor, under the oversight of the Board, directs the daily operations of the Fund and supervises

the performance of administrative and professional services provided by others. As compensation for its services and the related

expenses borne by the Advisor, the Fund pays the Advisor an investment advisory fee, computed and accrued daily and paid monthly,

at an annual rate of 2.00%. The Advisor, on behalf of the Fund, has entered into a Sub-Advisory agreement with S.W. Mitchell Capital

LLP and the Advisor compensates the Sub-Advisor out of the investment Advisory fee it receives from the Fund. For the year ended

October 31, 2019, the Fund incurred advisory fees in the amount of $962,028. F/m Investments LLC earned advisory fees of $12,325

and Balter Liquid Alternatives LLC earned advisory fees of $949,703.

los

Fund’s Advisor has contractually agreed to reduce its fees and/or absorb expenses of the Fund, until at least February 28,

2022 to ensure that Total Annual Fund Operating Expenses after fee waiver and/or reimbursement (excluding interest and tax expenses,

dividends on short positions and Acquired Fund Fees and Expenses) for the Fund do not exceed 2.24% and 2.54% of the Fund’s

average net assets, for Institutional Class and Investor Class shares, respectively; subject to possible recoupment from the Fund

in future years on a rolling three year basis (within the three years after the fees have been waived or reimbursed) if such recoupment

can be achieved within the foregoing expense limits. During the year ended October 31, 2019 the total amount of advisory fees

waived was $242,083. F/m Investments LLC waived advisory fees in the amount of $8,713 which are subject to recapture and will

expire on October 31, 2022. Balter Liquid Alternatives LLC waived advisory fees in the amount of $233,370 which are not subject

to recapture. As of October 31, previously waived advisory fees by Balter Liquid Alternatives LLC totaling $397,889 are no longer

subject to recapture.

Distributor

– The distributor of the Fund is Northern Lights Distributors, LLC (the “Distributor”). The Board of Trustees

of the Northern Lights Fund Trust II has adopted, on behalf of the Fund, the Trust’s Master Distribution and Shareholder

Servicing Plan (the “Plan”), as amended, pursuant to Rule 12b-1 under the Investment Company Act of 1940, to pay for

certain distribution activities and shareholder services. Under the Plan, the Fund may pay 0.25% per year of the average daily

net assets of Investor Class shares for such distribution and shareholder service activities. For the year ended October 31, 2019,

the Fund incurred distribution fees in the amount of $3,623.

En

addition, certain affiliates of the Distributor provide services to the Fund(s) as follows:

Geminis

Fund Services, LLC (“GFS”), an affiliate of the Distributor, provides administration, fund accounting, and

transfer agent services to the Trust. Pursuant to separate servicing agreements with GFS, the Fund pays GFS customary fees for

providing administration, fund accounting and transfer agency services to the Fund. Certain officers of the Trust are also officers

of GFS, and are not paid any fees directly by the Fund for serving in such capacities.

Northern

Lights Compliance Services, LLC (“NLCS”), an affiliate of GFS and the Distributor, provides a Chief Compliance

Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under

the terms of such agreement, NLCS receives customary fees from the Fund.

| F/m Investments European L/S Small Cap Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| octubre 31, 2019 |

Blu

Giant, LLC (“Blu Giant”), an affiliate of GFS and the Distributor, provides EDGAR conversion and filing services

as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Blu Giant receives

customary fees from the Fund.

En

February 1, 2019, NorthStar Financial Services Group, LLC, the parent company of GFS and its affiliated companies including NLD,

NLCS and Blu Giant (collectively, the “Gemini Companies”), sold its interest in the Gemini Companies to a third party

private equity firm that contemporaneously acquired Ultimus Fund Solutions, LLC (an independent mutual fund administration firm)

and its affiliates (collectively, the “Ultimus Companies”). As a result of these separate transactions, the Gemini

Companies and the Ultimus Companies are now indirectly owned through a common parent entity, The Ultimus Group, LLC.

| 5) | DERIVATIVE TRANSACTIONS |

los

following is a summary of the effect of derivative instruments on the Fund’s Statement of Assets and Liabilities as of October

31, 2019.

| Contract Type/Primary Risk Exposure | Statements of Assets and Liabilities | Value | ||||

| Foreign currency contracts/Currency Risk | Unrealized depreciation on foreign currency contracts | PS | 79,496 | |||

los

following is a summary of the effect of derivative instruments on the Fund’s Statement of Operations for the year ended

October 31, 2019.

| Change in Unrealized | ||||||||

| Contract type/ | Realized Gain/(Loss) | Appreciation/(Depreciation) | ||||||

| Primary Risk Exposure | On Foreign Currency Contracts | on Foreign Currency Contracts | ||||||

| Currency contracts/Currency risk | PS | 2,500,076 | PS | (1,218,681 | ) | |||

los

notional value and contracts of the derivative instruments outstanding as of October 31, 2019 as disclosed in the Portfolio of

Investments and the amounts realized and changes in unrealized gains and losses on derivative instruments during the year as disclosed

above and within the Statement of Operations serve as indicators of the volume of derivative activity for the Fund.

Offsetting

of Financial Assets and Derivative Assets

Durante

the year ended October 31, 2019, the Fund was not subject to any master netting arrangements. The following table shows additional

information regarding the offsetting of assets and liabilities at October 31, 2019 for the Fund.

| Liabilities: | Gross Amounts | Net Amounts | ||||||||||||||||||||||

| Gross Amounts | Offset in the | Presented in | ||||||||||||||||||||||

| of Recognized | Statements of | the Statements | ||||||||||||||||||||||

| Assets & | Assets & | of Assets & | Financiero | Cash Collateral | ||||||||||||||||||||

| Descripción | Liabilities | Liabilities | Liabilities | Instruments | Pledged/Received | Net Amount | ||||||||||||||||||

| Unrealized depreciation on foreign currency contracts | PS | 79,496 | (1) | PS | – | PS | 79,496 | PS | – | PS | 79,496 | (2) | PS | – | ||||||||||

| Securities Sold Short | 2,765,986 | (1) | – | 2,765,986 | 2,765,986 | (2) | – | – | ||||||||||||||||

| PS | 2,845,482 | PS | – | PS | 2,845,482 | PS | 2,765,986 | PS | 79,496 | PS | – | |||||||||||||

| (1) | Unrealized depreciation on futures contracts, unrealized appreciation on swaps, futures options short at value, and securities sold short as presented in the Portfolio of Investments. |

| (2) | los amount is limited to the derivative liability balance and, accordingly, does not include excess collateral pledged. |

los

beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates presumption of

control of the fund, under Section 2(a)(9) of the 1940 Act. As of October 31, 2019, TD Ameritrade, Inc. held approximately 46.21%

of the voting securities of the Fund for the benefit of others. The Fund has no knowledge as to whether all or any portion of

the shares owned on record by TD Ameritrade, Inc. are also owned beneficially by any party who would be presumed to control the

Fund.

| F/m Investments European L/S Small Cap Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| octubre 31, 2019 |

los

Fund may assess a short-term redemption fee of 1.00% of the total redemption amount if a shareholder sells his shares after holding

them for less than 60 days. The redemption fee is paid directly to the Fund. For the year ended October 31, 2019 the fund assessed

redemption fees in the amount of $6,116 and $869 for the Institutional Class and Investor Class, respectively.

| 8. | AGGREGATE UNREALIZED APPRECIATION AND DEPRECIATION – TAX BASIS |

los

identified cost of investments in securities owned by the Fund for federal income tax purposes, and its respective gross unrealized

appreciation and depreciation at October 31, 2019, was as follows:

| Bruto | Bruto | Net Unrealized | ||||||||||||

| Tax | Unrealized | Unrealized | Appreciation | |||||||||||

| Cost | Appreciation | Depreciation | (Depreciation) | |||||||||||

| PS | 8,084,898 | PS | 957,427 | PS | (1,947,069 | ) | PS | (989,642 | ) | |||||

| 9. | DISTRIBUTIONS TO SHAREHOLDERS AND TAX COMPONENTS OF CAPITAL |

los

tax character of distributions paid during the period ended October 31, 2019 and October 31, 2018 was as follows:

| Fiscal Year Ended | Fiscal Year Ended | |||||||

| October 31, 2019 | 31 de octubre de 2018 | |||||||

| Ordinary Income | PS | 4,404,614 | PS | 3,711,507 | ||||

| Long-Term Capital Gain | – | 12,393 | ||||||

| PS | 4,404,614 | PS | 3,723,900 | |||||

Como

of October 31, 2019, the components of accumulated earnings/ (deficit) on a tax basis were as follows:

| Undistributed | Undistributed | Post October Loss | Capital Loss | Otro | Unrealized | Total | ||||||||||||||||||||

| Ordinary | Long-Term | y | Carry | Book/Tax | Appreciation/ | Accumulated | ||||||||||||||||||||

| Income | Gains | Late Year Loss | Forwards | Differences | (Depreciation) | Earnings/(Deficits) | ||||||||||||||||||||

| PS | 907,771 | PS | – | PS | – | PS | (11,196,146 | ) | PS | – | PS | (995,950 | ) | PS | (11,284,325 | ) | ||||||||||

A

October 31, 2019, the Funds had capital loss carry forwards for federal income tax purposes available to offset future capital

gains, as follows:

| Non-Expiring | Non-Expiring | CLCF | ||||||||||||||||

| Expiring | Short-Term | Long-Term | Total | Utilized | ||||||||||||||

| PS | – | PS | 9,969,494 | PS | 1,226,652 | PS | 11,196,146 | PS | – | |||||||||

los

difference between book basis and tax basis accumulated net investment income/(loss), accumulated net realized gain/(loss), and

unrealized appreciation/(depreciation) from investments is primarily attributable to the tax deferral of losses on wash sales,

and the mark-to-market treatment of passive foreign investment companies, and foreign exchange contracts.

| 10. | NEW ACCOUNTING PRONOUNCEMENT |

En

August 2018, the FASB issued Accounting Standards Update (“ASU”) No. 2018-13, which changes certain fair value measurement

disclosure requirements. The new ASU, in addition to other modifications and additions, removes the requirement to disclose the

amount and reasons for transfers between Level 1 and Level 2 of the fair value hierarchy, and the policy for the timing of transfers

between levels. For investment companies, the amendments are effective for financial statements issued for fiscal years beginning

after December 15, 2019, and interim periods within those fiscal years. Early adoption is allowed. At this time, management is

evaluating the implications of the ASU and any impact on the financial statement disclosures.

| F/m Investments European L/S Small Cap Fund |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| octubre 31, 2019 |

Subsequent

events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements

were issued. Management has determined that no events or transactions occurred requiring adjustment or disclosure in the financial

declaraciones.

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

| A the Board of Trustees |

| de Northern Lights Fund Trust II and |

| Shareholders de |

| F/m Investments European L/S Small Cap Fund |

Opinión

on the Financial Statements

Nosotros

have audited the accompanying statements of assets and liabilities of F/m Investments European L/S Small Cap Fund (formerly Balter

European L/S Small Cap Fund) (the “Fund”), a series of Northern Lights Fund Trust II (the “Trust”), including

the schedules of investments, as of October 31, 2019, and the related statements of operations for the year ended October 31,

2019, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for

each of the three years in the period then ended and for the period December 30, 2015 (commencement of operations) to October

31, 2016, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial

statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2019, the results of

its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and

the financial highlights for each of the three years in the period then ended and for the period December 30, 2015 (commencement

of operations) to October 31, 2016, in conformity with accounting principles generally accepted in the United States of America.

Basis

for Opinion

Estas

financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the

Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting

Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance

with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the

PCAOB. We have served as the auditor of one or more of the funds in the Trust since 2012.

We conducted our audits in accordance

with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about

whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to

have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are

required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion

on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Nuestra

audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to

error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence

regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles

used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements.

Our procedures included confirmation of securities owned as of October 31, 2019 by correspondence with the custodian and brokers;

when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable

basis for our opinion.

TAIT,

WELLER & BAKER LLP

Philadelphia,

Pensilvania

30 de diciembre de 2019

| F/m Investments European L/S Small Cap Fund |

| EXPENSE EXAMPLE (Unaudited) |

| octubre 31, 2019 |

Como

a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and

redemptions; and redemption fees; (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; y

other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds

and to compare these costs with the ongoing costs of investing in other mutual funds.

los

example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as noted below.

Actual

Expenses

los

“Actual Expenses” line in the table below provides information about actual account values and actual expenses. You

may use the information below; together with the amount you invested, to estimate the expenses that you paid over the period.

Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result

by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid

on your account during this period.

Hypothetical

Example for Comparison Purposes

los

“Hypothetical” line in the table below provides information about hypothetical account values and hypothetical expenses

based on the respective Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which

is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending

account balances or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with

the 5% hypothetical examples that appear in the shareholder reports of other funds.

Por favor

note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional

costs, such as sales charges (loads). Therefore, the table is useful in comparing ongoing costs only, and will not help you determine

the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would

have been higher.

| Beginning | Ending | Expenses Paid |

Expense Ratio During |

|||||||||||

| Cuenta Value |

Cuenta Value |

Durante Period |

el Period |

|||||||||||

| Actual | 5/1/19 | 10/31/19 | 5/1/19 – 10/31/19* | 5/1/19 – 10/31/19* | ||||||||||

| Institutional Clase |

$1,000.00 | $946.50 | $10.99 | 2.24% | ||||||||||

| Investor Clase |

$1,000.00 | $945.40 | $12.45 | 2.54% | ||||||||||

| Beginning | Ending | Expenses Paid |

Expense Ratio During |

|||||||||||

| Hypothetical ** ** |

Cuenta Value |

Cuenta Value |

Durante Period |

el Period |

||||||||||

| (5% return before expenses) |

5/1/19 | 10/31/19 | 5/1/19 – 10/31/19* | 5/1/19 – 10/31/19* | ||||||||||

| Institutional Clase |

$1,000.00 | $1,013.91 | $11.37 | 2.24% | ||||||||||

| Investor Clase |

$1,000.00 | $1,012.40 | $12.88 | 2.54% |

| * * | Expenses are equal to the average account value over the period, multiplied by the Fund’s annualized expense ratio, multiplied by the number of days in the period (184) divided by the number of days in the fiscal year (365). |

| ** ** | los hypothetical example assumes that the Fund was in operation for the full six months ended October 31, 2019. |

| F/m Investments European L/S Small Cap Fund |

| SUPPLEMENTAL INFORMATION (Unaudited) |

| octubre 31, 2019 |

SHAREHOLDER

MEETING

los

Board of Trustees of Northern Lights Fund Trust II (the “Trust”) held a Special Meeting of the Shareholders of the

F/m Investments European L/S Small Cap Fund (formerly, Balter European L/S Small Cap Fund) (the “Fund”), a series

of the Trust, on October 10, 2019, for the purpose of approving an advisory agreement between the Trust, on behalf of the Fund,

and F/m Investments, LLC (“Advisory Agreement”) and a sub-advisory agreement between F/m Investments, LLC and S.W.

Mitchell Capital, LLP (“Sub-Advisory agreement”).

At the close of business July 31, 2019, the record date for the

Special Meeting of Shareholders, there were outstanding 1,926,038 shares of beneficial interest of the Fund. Accordingly, shares

represented in person and by proxy at the Special Meeting equaled 50.40% of the outstanding shares of the Fund. Therefore, a quorum

was present for the Fund.

With respect to approval of the proposed Advisory Agreement the following votes were cast:

| por Approval: 739,379 shares voted |

| Against Approval: 20,591 shares voted |

| Abstained: 210,690 shares voted |

| Con respect to approval of the proposed Sub-Advisory Agreement the following votes were cast: |

| por Approval: 739,379 shares voted |

| Against Approval: 20,591 shares voted |

| Abstained: 210,690 shares voted |

| F/m Investments European L/S Small Cap Fund |

| SUPPLEMENTAL INFORMATION (Unaudited) |

| October 31, 2019 |

FACTORS

CONSIDERED BY THE TRUSTEES IN THE APPROVAL OF A NEW ADVISORY AGREEMENT AND NEW SUB-ADVISORY AGREEMENT

A

a regular meeting (the “Meeting”) of the Board of Trustees (the “Board”) of Northern Lights Fund Trust

II (the “Trust”) held on July 25-26, 2019, the Board, including each of the members of the Board who are not an “interested

person” of the Trust (the “Independent Trustees”), considered the approval of the proposed New Advisory Agreement

between the Trust and F/m Investments, LLC (“F/m”) on behalf of F/m Investments European L/S Small Cap Fund (formerly,

Balter European L/S Small Cap Fund) (“F/m Investments European Small Cap”) (“New Advisory Agreement”).

The Board also considered the approval of a new sub-advisory agreement between F/m and S.W. Mitchel Capital, LLP (“SWMC”)

on behalf of F/m Investments European Small Cap (the “New Sub-Advisory Agreement” and together with the New Advisory

Agreement, the “New Agreements”).

Based

on their evaluation of the information provided by F/m and SWMC, as well as information provided by other Fund service providers,

the Board, by a unanimous vote (including a separate vote of the Independent Trustees), approved the New Agreements with respect

to F/m Investments European Small Cap.

En

advance of the meeting, the Board requested and received materials to assist them in considering the New Agreements. The materials

provided contained information with respect to the factors enumerated below, including the New Agreements, a memorandum prepared

by the Independent Trustees’ outside legal counsel discussing in detail the Trustees’ fiduciary obligations and the

factors they should assess in considering the approval of the New Agreements and comparative information relating to the advisory

fees and other expenses of F/m Investments European Small Cap. The materials also included due diligence materials relating to

F/m and SWMC, and each firm’s Form ADV, select financial information of F/m and SWMC, bibliographic information regarding

F/m’s and SWMC’s key management and investment advisory personnel, and comparative fee information relating to F/m

Investments European Small Cap as well as other pertinent information. At the Meeting, the Independent Trustees were advised by

counsel that is experienced in Investment Company Act of 1940 matters and that is independent of fund management and met with

such counsel separately from fund management.

los

Board then reviewed and discussed the written materials that were provided by F/m in advance of the Meeting and deliberated

on the proposed approval of the New Advisory Agreement with respect to F/m Investments European Small Cap. The Board relied

upon the advice of independent legal counsel and their own business judgment in determining the material factors to be

considered in evaluating the New Advisory Agreement and the weight to be given to each such factor. The conclusions reached

by the Board were based on a comprehensive evaluation of all of the information provided and were not the result of any one

factor. Moreover, each Trustee may have afforded different weight to the various factors in reaching his conclusions with

respect to the New Advisory Agreement. In considering the proposed approval of the New Advisory Agreement with respect to F/m

Investments European Small Cap, the Board reviewed and analyzed various factors that they determined were relevant, including

the factors enumerated below.

Nuevo

Advisory Agreement

Nature,

Extent and Quality of Services. The Board reviewed materials provided by F/m related to the approval of the New Advisory Agreement,

including its Form ADV, a description of the manner in which investment decisions are made and executed and a review of the personnel

who will be performing services for F/m Investments European Small Cap, including the team of individuals that will primarily

monitor and execute the investment process and will provide oversight of the sub-adviser, SWMC.

los

Board then discussed the extent of F/m’s research capabilities, the quality of its compliance infrastructure and the experience