ESTADOS UNIDOS

COMISIÓN NACIONAL DEL MERCADO DE VALORES

Washington, D.C.20549

FORMULARIO N-CSR

INFORME DE ACCIONISTA CERTIFICADO DE

REGISTRADO

GESTIÓN DE EMPRESAS DE INVERSIÓN

Número de archivo de la Ley de sociedades de inversión:

811-02958

| T. Rowe Price International Funds, Inc. |

|

|

| (Exacto nombre del registrante como se especifica en la carta) |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

|

| (Dirección de las oficinas ejecutivas principales) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

|

| (Nombre y dirección del agente para el servicio) |

Número de teléfono del solicitante, incluido el código de área: (410) 345-2000

Fecha de fin del año fiscal: 31 de octubre

Fecha del período del informe: 31 de octubre de 2019

Tema 1. Informes a los accionistas

(a) Informe de conformidad con la Regla 30e-1.

|

|

Fondo de Europa emergente |

31 de octubre de 2019 |

| TREMX | Clase de inversionista |

| TTEEX | I clase |

A partir del 1 de enero de 2021, según lo permitido por las regulaciones de la SEC, ya no se enviarán por correo copias impresas de los informes de accionistas anuales y semestrales de los fondos de T. Rowe Price, a menos que usted los solicite específicamente. En cambio, los informes de los accionistas estarán disponibles en el sitio web de los fondos (troweirlines/prospectus), y se le notificará por correo con un enlace al sitio web para acceder a los informes cada vez que se publique un informe en el sitio.

Si ya eligió recibir informes electrónicamente, no se verá afectado por este cambio y no necesita tomar ninguna medida. En cualquier momento, los accionistas que invierten directamente en fondos de T. Rowe Price generalmente pueden elegir recibir informes u otras comunicaciones electrónicamente al inscribirse en trowelesale/paperless o, si usted es un patrocinador del plan de jubilación o invierte en los fondos a través de un intermediario financiero (como un asesor de inversiones, corredor de bolsa, compañía de seguros o banco), comunicándose con su representante o su intermediario financiero.

Puede optar por continuar recibiendo copias en papel de futuros informes de accionistas de forma gratuita. Para hacerlo, si invierte directamente con T. Rowe Price, llame a T. Rowe Price de la siguiente manera: IRA, titulares de cuentas sin retiro e inversores institucionales, 1-800-225-5132; cuentas de jubilación de pequeñas empresas, 1-800-492-7670. Si es patrocinador de un plan de jubilación o invierte en los fondos de T. Rowe Price a través de un intermediario financiero, comuníquese con su representante o intermediario financiero o siga las instrucciones adicionales si se incluyen con este documento. Su elección de recibir copias impresas de los informes se aplicará a todos los fondos que tenga en su cuenta con su intermediario financiero o, si invierte directamente en los fondos de T. Rowe Price, con T. Rowe Price. Su elección se puede cambiar en cualquier momento en el futuro.

| T. PRECIO ROWE FONDO EUROPEO EMERGENTE |

|

|

DESTACAR

| ■ | El Emerging Europe Fund obtuvo ganancias sustanciales en su año fiscal que terminó el 31 de octubre de 2019, pero tuvo un rendimiento inferior al MSCI Emerging Markets Europe Index Net. |

| ■ | La selección de valores en Rusia y nuestra exposición fuera del índice de referencia a Georgia y Rumania perjudicaron el rendimiento relativo. Nuestras infraponderaciones tanto en Polonia como en Turquía, así como nuestra selección de valores dentro de este último, ayudaron a los rendimientos relativos. |

| ■ | Hicimos una serie de cambios entre nuestras tenencias rusas de petróleo y gas, lo que resultó en un sobrepeso general para Rusia. Seguimos infraponderados en Turquía, con un enfoque en nombres selectivos de alta calidad, particularmente aquellos que son beneficiarios de la debilidad en la lira. |

| ■ | Mantenemos un horizonte de inversión a largo plazo y exposición a compañías bien administradas que creemos que pueden generar un crecimiento de ganancias sólido y superior con el tiempo. |

Inicie sesión en su cuenta en troweirlines para más información.

* Ciertas cuentas de fondos mutuos a las que se les aplica un cargo por servicio de cuenta anual también pueden ahorrar dinero al cambiar a e-delivery.

Comentario del mercado de CIO

Estimado accionista

Los mercados mundiales se recuperaron de un comienzo tumultuoso para ofrecer resultados sólidos para el año fiscal de su fondo, el período de 12 meses que finalizó el 31 de octubre de 2019. La Reserva Federal de EE. UU. Cambió de rumbo y se unió a otros bancos centrales moderados de todo el mundo para apoyar a los mercados después de una fuerte venta en diciembre. Esta acción, combinada con ganancias corporativas mejores de lo que se temía, ayudó a impulsar muchos índices de acciones durante el año a ganancias de dos dígitos. El índice S&P 500 alcanzó un máximo histórico, y el índice Stoxx 600 de Europa se cotizaba cerca de un cierre récord al final del período. Las acciones de crecimiento en los EE. UU. Tuvieron los mejores resultados, pero casi todos los mercados desarrollados y la mayoría de los mercados emergentes también generaron fuertes ganancias.

El dólar estadounidense terminó con resultados mixtos en comparación con otras monedas durante el período de informe de 12 meses. Un billete verde relativamente fuerte frente al euro pesó sobre los rendimientos de los inversores estadounidenses en valores europeos, por ejemplo, mientras que un yen más fuerte impulsó los rendimientos de las acciones japonesas en dólares estadounidenses.

Durante el período, los inversores se enfrentaron a preocupaciones sobre la disputa comercial entre EE. UU. Y China, Brexit y una desaceleración en la fabricación global. Sin embargo, las acciones fueron resistentes, y los peores escenarios geopolíticos no funcionaron. La retórica comercial se ha vuelto más conciliadora y los negociadores han hecho progresos modestos; el Reino Unido recibió otra extensión de Brexit hasta el 31 de enero para determinar los términos de su salida de la Unión Europea; y nuestros economistas creen que algunos indicadores de fabricación, aunque todavía débiles, parecen estar listos para una recuperación.

Las acciones de la Reserva Federal y otros bancos centrales para estimular el crecimiento económico jugaron un papel clave en el mantenimiento del sentimiento del mercado durante el período. A medida que la evidencia de la desaceleración del crecimiento global comenzó a aumentar, la Fed señaló a principios de año que tomaría medidas para mantener la expansión económica, y los responsables de las políticas del banco central siguieron con recortes de tasas de un cuarto de punto porcentual en julio, septiembre y octubre y tomó medidas para mantener la liquidez en los mercados de préstamos a corto plazo.

El Banco Central Europeo (BCE) también actuó para abordar el marcado crecimiento. El BCE bajó su tasa de depósito de referencia más profundamente en territorio negativo y anunció que planea comprar € 20 mil millones en bonos por mes a partir de noviembre de 2019 a medida que reinicia su programa de flexibilización cuantitativa.

La caída de los rendimientos impulsó un fuerte repunte en el mercado de bonos y también ayudó a los resultados de renta variable, ya que las empresas se beneficiaron de los menores costos de endeudamiento y los inversores buscaron mayores rendimientos. Las acciones que pagan dividendos en sectores como el inmobiliario superaron a los inversores en busca de oportunidades de mayores ingresos.

El rendimiento del bono del Tesoro a 30 años alcanzó un mínimo histórico en agosto, cayendo por debajo de la marca del 2% por primera vez, y el rendimiento del bono del Tesoro a 10 años bajó a su nivel más bajo desde 2016. A pesar de estar en o cerca del récord En los mínimos, los bonos del Tesoro ofrecieron mayores rendimientos que los bonos en muchos mercados extranjeros, especialmente en Europa y Japón, donde los rendimientos de los bonos del gobierno a menudo se encontraban en territorio negativo. (Los precios de los bonos y los rendimientos se mueven en direcciones opuestas).

Mirando hacia 2020, seguimos siendo optimistas de que Estados Unidos evitará una recesión en el nuevo año, pero creemos que un mayor progreso en las conversaciones comerciales entre Estados Unidos y China será un factor clave para mantener el sentimiento positivo del mercado. Una reducción en las barreras comerciales podría ayudar a las ganancias corporativas a recuperarse y proporcionar un impulso al sector manufacturero.

En los próximos meses, nuestro equipo de gerentes de cartera, analistas y economistas seguirá las conversaciones comerciales y las elecciones presidenciales de EE. UU., Junto con otros desarrollos que podrían afectar el desempeño del mercado. Nuestros equipos en Londres y Hong Kong nos han proporcionado información importante sobre el Brexit y las protestas en el territorio chino durante los últimos 12 meses. Esperamos giros y vueltas en el camino con cada uno de estos eventos, pero creemos que nuestro enfoque de la investigación fundamental en todo el mundo continuará agregando valor en el próximo año.

Gracias por su continua confianza en T. Rowe Price.

Sinceramente,

Robert Sharps

Director de inversiones del grupo

Discusión de la gerencia sobre el rendimiento del fondo

OBJETIVO DE INVERSIÓN

El fondo busca un crecimiento de capital a largo plazo a través de inversiones principalmente en acciones comunes de empresas ubicadas (o con operaciones primarias) en los países de mercados emergentes de Europa.

COMENTARIO DEL FONDO

¿Cómo se desempeñó el fondo en los últimos 12 meses?

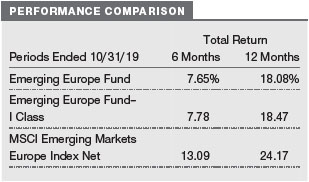

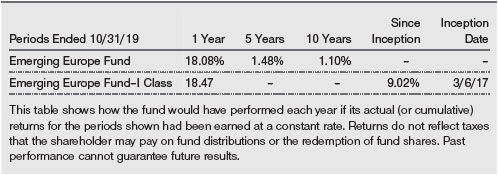

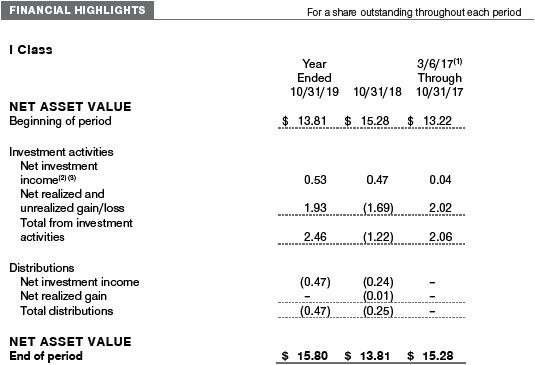

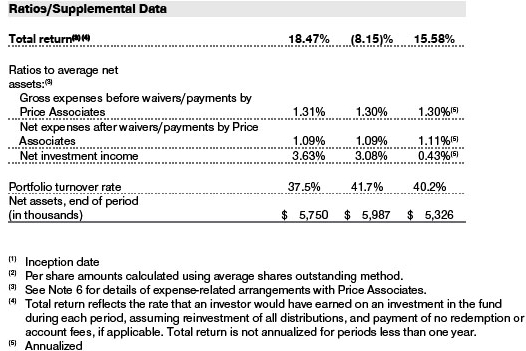

El Emerging Europe Fund obtuvo un rendimiento del 18.08% en el período de 12 meses que finalizó el 31 de octubre de 2019. Como se muestra en la tabla de Comparación de rendimiento, el fondo obtuvo un rendimiento inferior al MSCI Emerging Markets Europe Index Net. (El rendimiento de las acciones de Clase I variará debido a una estructura de tarifas diferente. El rendimiento pasado no puede garantizar resultados futuros.)

¿Qué factores influyeron en el rendimiento del fondo?

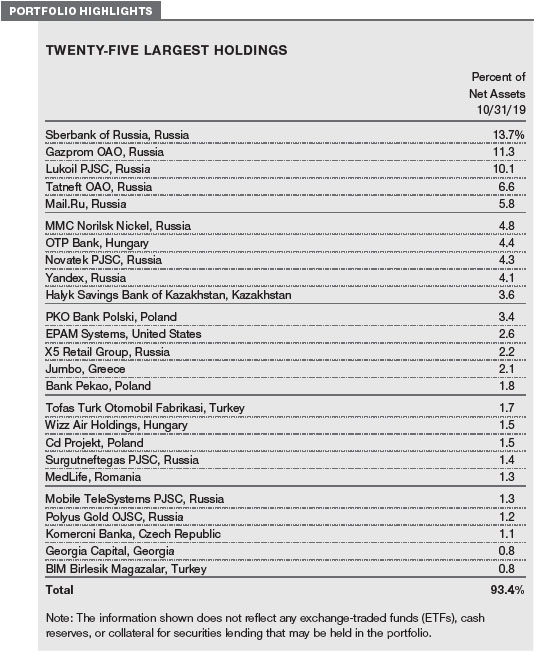

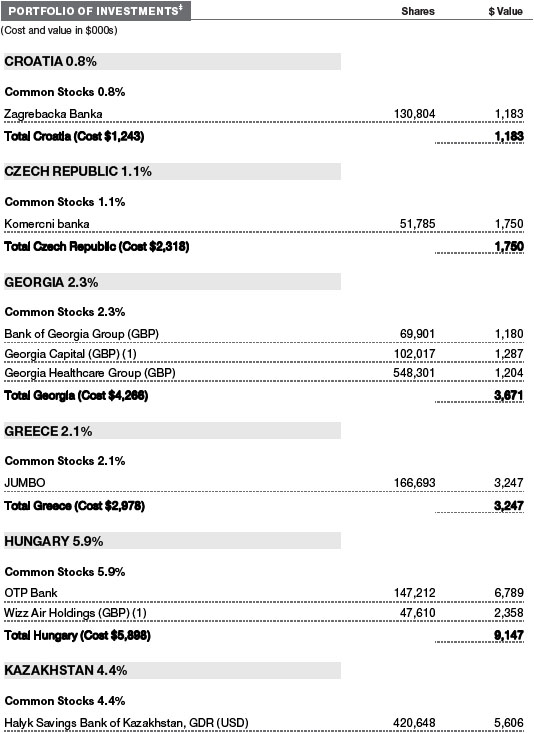

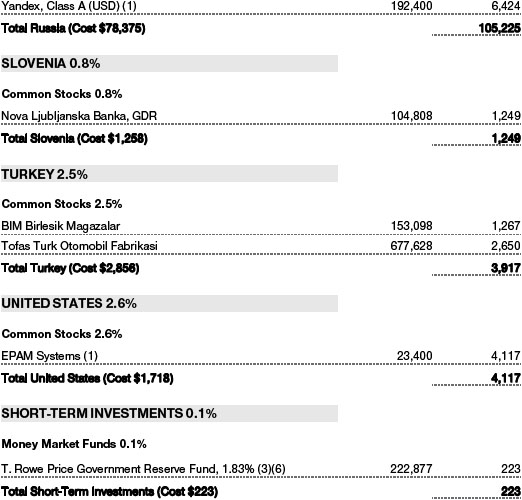

A nivel de país, la selección de valores en Rusia fue el mayor obstáculo para el rendimiento relativo. Esto era principalmente debido a nuestra posición en Gazprom versus el punto de referencia. Aunque terminamos el período con una ponderación cercana al índice de referencia, no pudimos cerrar la infraponderación lo suficientemente rápido debido a las reglas de límite de concentración de fondos. (Consulte la cartera de inversiones del fondo para obtener una lista completa de las tenencias y la cantidad que cada una representa en la cartera).

Acciones en Mail.Ru debilitado a principios del período de revisión por las preocupaciones sobre sus importantes inversiones en nuevas iniciativas, como la entrega de alimentos y el comercio electrónico. Las acciones se vieron presionadas luego de la noticia en julio de que Rusia había presentado un proyecto de ley que proponía un límite del 20% a la propiedad extranjera de compañías de tecnología de la información rusas "importantes". Sin embargo, esta ley ha sido retirada recientemente. Mantenemos nuestra opinión de que Mail. Ru está bien posicionado para continuar beneficiándose del rápido crecimiento de la actividad en línea, especialmente la publicidad móvil dirigida en Rusia a través de sus plataformas de redes sociales. También creemos que la compañía tiene un gran potencial adicional para monetizar sus nuevos servicios, que incluyen un mercado clasificado basado en la ubicación y la empresa conjunta formada con Sberbank de Rusia para entrega de alimentos y movilidad.

La exposición fuera de referencia de la cartera a Georgia frenó el rendimiento. El mercado en su conjunto se vendió a causa de las continuas tensiones geopolíticas y las preocupaciones de que estas están conduciendo a una perspectiva macroeconómica empeorada. A principios de julio, las aerolíneas rusas suspendieron los vuelos a Georgia. Sin embargo, creemos que el impacto económico real de esto ha sido bastante limitado, y las relaciones con Rusia están mejorando una vez más. El mercado georgiano también se vendió debido a una cierta depreciación en el lari georgiano, que creemos que fue impulsado principalmente por factores técnicos de la política de desdolarización del Banco Nacional de Georgia. Esto ahora se revierte, y desde nuestro punto de vista, la moneda debería estabilizarse desde aquí. Nuestras tres participaciones son Banco de georgia, sociedad de cartera diversificada Georgia capitaly Georgia Healthcare Group, todo lo cual disminuyó durante el período.

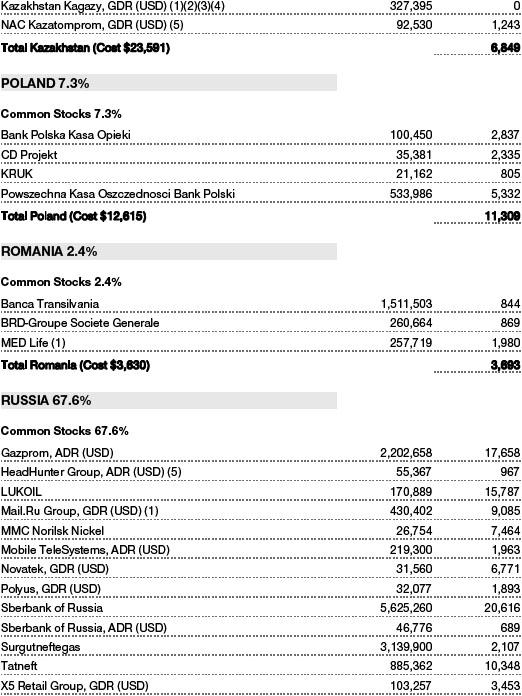

Nuestra infraponderación en Polonia fue el mayor contribuyente individual a los rendimientos relativos, ya que este mercado tuvo un rendimiento significativamente inferior al índice de referencia en el transcurso del año fiscal de la cartera. En particular, las acciones bancarias polacas se vieron sometidas a una presión considerable mientras los inversores esperaban para ver si el sector sería castigado por el Tribunal de Justicia de las Comunidades Europeas por vender hipotecas denominadas en francos suizos entre 2006 y 2008. En octubre de 2019, el fallo fue a favor de la Prestatarios polacos.

La selección de valores en Hungría fue uno de los principales aspectos positivos. Aquí, nuestra posición fuera de referencia en Wizz Air Holdings fue beneficioso; La aerolínea de bajo costo continúa teniendo un buen desempeño y señaló en mayo de 2019 que los altos precios del combustible han expulsado a sus competidores más débiles del mercado, lo que le permite a Wizz ganar participación en el mercado. Nuestra evitación de MOL Hungarian Oil and Gas y Richter Gedeon también fue beneficiosa ya que ambas acciones perdieron terreno durante el período.

Nuestra selección de valores en Turquía, así como nuestra infraponderación en ese mercado, también contribuyeron a medida que la economía cayó en recesión durante el período y el mercado de renta variable quedó muy por debajo del índice de referencia del fondo.

¿Cómo se posiciona el fondo?

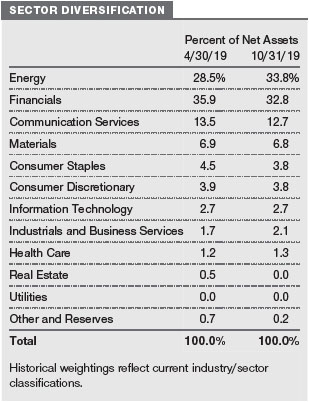

Rusia es el mercado de renta variable dominante en la región emergente de Europa y la asignación de país más grande de la cartera en términos absolutos. Hicimos una serie de cambios en nuestras tenencias rusas de petróleo y gas durante el período de 12 meses, lo que resultó en que la ponderación del país pasara de una pequeña infraponderación a una sobreponderación. El mayor cambio de cartera fue construir una posición cercana al peso de referencia en Gazprom, ya que anteriormente no había tenido exposición a este peso pesado de referencia. (Las restricciones en la concentración de posición nos impidieron comprar una ponderación de índice completa en Gazprom.) La acción tuvo una baja valoración durante un período prolongado. El catalizador de esta decisión fue el anuncio de la gerencia de una propuesta de aumento significativo de dividendos durante todo el año, que condujo a una rentabilidad por dividendo del 10%. Creemos que esta es una dirección positiva para la empresa y que representa un cambio genuino por parte de la gerencia. En el futuro, creemos que la necesidad de pagar dividendos podría ayudar a impulsar una mayor eficiencia de capital en Gazprom. También establecimos una nueva posición en Tatneft OAO. La compañía ha reducido su orientación sobre gastos de capital, y creemos que aumentará su dividendo en más de lo que generalmente se espera.

Financiamos estas compras en parte mediante la reducción del tamaño de nuestras participaciones en una compañía energética integrada Rosneft y el principal productor ruso de gas natural Novatek PJSC. Creíamos que este último parecía costoso y que la compañía enfrenta un viento en contra de los bajos precios de la gasolina.

La cartera mantiene una infraponderación en Turquía, sin embargo, aumentamos el tamaño de nuestra exposición durante el año pasado. Creemos que la lira sigue siendo vulnerable, y la situación geopolítica del país es un desafío. Estamos monitoreando de cerca si el gobierno se apega a la ruta de ajuste macroeconómico y si el banco central mantiene las condiciones de política monetaria lo suficientemente estrictas. A pesar de este difícil telón de fondo, vemos algunas oportunidades en el país. Nuestras tenencias se componen de algunos nombres selectivos de alta calidad, particularmente aquellos que son beneficiarios de debilidad en la lira. Iniciamos un puesto en fabricante de automóviles Tofas Turk Otomobil Fabrikasi por razones de valoración, luego de una reducción sustancial en el nombre. Creemos que los márgenes de la compañía se beneficiarán de la debilidad en la moneda turca. Continuamos evitando la exposición a las finanzas turcas ya que la calidad de los activos del sector bancario sigue bajo presión.

Aunque mantenemos una gran posición absoluta en Polonia, seguimos significativamente infraponderados. El contexto macroeconómico allí sigue siendo de apoyo, pero las valoraciones no son atractivas en relación con el resto de la clase de activos de Europa emergente. Tenemos posiciones fuera del índice de referencia en varios países, incluidos Kazajstán, Rumania y Georgia.

¿Cuál es la perspectiva de la administración de cartera?

Mantenemos un horizonte de inversión a largo plazo y exposición a compañías bien administradas que creemos que pueden generar un crecimiento de ganancias sólido y superior con el tiempo.

Rusia, que tiene un alto consumo de energía, el mercado más grande en el índice, ha mostrado un desempeño sólido hasta ahora en 2019 a pesar de las nuevas sanciones de EE. UU. Que se implementaron este año y el año pasado. El precio del petróleo ha sido un factor útil, pero el crecimiento económico en Rusia se ha moderado y es probable que se mantenga así, ya que el precio del petróleo no se ha traducido en una mayor inversión fija y el gobierno mantiene una política fiscal conservadora. Por otro lado, sin embargo, Rusia ha estado ejecutando una de las políticas fiscales y monetarias más estrictas entre los mercados emergentes y, por lo tanto, se ha vuelto increíblemente estable. También creemos que su moneda, el rublo, está bien respaldada aquí. La mejora del compromiso de las empresas estatales con la tasa de pago del 50% deseada por el gobierno (la razón de dividendos a ganancias) ha llevado a aumentos significativos en los dividendos, y el mercado ruso está ofreciendo el mayor rendimiento de dividendos con diferencia entre los mercados emergentes. Creemos que el mercado ruso tiene más margen para revalorarse, ya que su costo de capital está bajando aún más con los recortes de tasas del banco central ruso.

Turquía tuvo problemas a principios de 2019, ya que su debilidad monetaria compensó el movimiento al alza en el mercado de valores y el aumento de los riesgos geopolíticos sigue siendo un obstáculo. Más recientemente, la economía ha comenzado a reequilibrarse, lo que ha llevado a que la tasa de inflación baje rápidamente y se acelere el crecimiento económico. Sin embargo, el Fondo Monetario Internacional ha cuestionado la sostenibilidad de la estrategia económica del país sin más reformas.

En Europa central, la demanda interna sigue siendo fuerte, en nuestra opinión, y los salarios reales están creciendo. Polonia continúa experimentando un sólido telón de fondo macro, liderado por el consumidor, pero creemos que las valoraciones son muy importantes en comparación con la región. Esto ha significado que, a nuestro juicio, la elección de nombres de mayor calidad con valoraciones razonables ha sido limitada.

Las opiniones expresadas reflejan las opiniones de T. Rowe Price a la fecha de este informe y están sujetas a cambios basados en cambios en el mercado, condiciones económicas u otras condiciones. Estas opiniones no pretenden ser un pronóstico de eventos futuros y no son garantía de resultados futuros.

RIESGOS DE INVERTIR EN EL FONDO EMERGENTE DE EUROPA

Las acciones generalmente fluctúan en valor más que los bonos y pueden disminuir significativamente en cortos períodos de tiempo. Existe la posibilidad de que los precios de las acciones en general disminuyan porque los mercados de acciones tienden a moverse en ciclos, con períodos de precios al alza y a la baja. El valor de una acción en la que invierte el fondo puede disminuir debido a la debilidad general en el mercado de valores o debido a factores que afectan a una empresa o industria en particular.

Invertir en valores de emisores no estadounidenses implica riesgos especiales que generalmente no están asociados con la inversión en emisores estadounidenses. Los valores internacionales tienden a ser más volátiles y menos líquidos que las inversiones en valores estadounidenses y pueden perder valor debido a acontecimientos locales, políticos, sociales o económicos adversos en el extranjero o debido a cambios en los tipos de cambio entre las monedas extranjeras y el dólar estadounidense. Además, las inversiones internacionales están sujetas a prácticas de liquidación y normas regulatorias y de información financiera que difieren de las de los EE. UU.

Los riesgos de la inversión internacional aumentan para los valores de emisores en países de mercados emergentes. Los países de mercados emergentes tienden a tener estructuras económicas que son menos diversas y maduras, y sistemas políticos que son menos estables que los de los países desarrollados. Además de todos los riesgos de invertir en mercados desarrollados internacionales, los mercados emergentes son más susceptibles a la interferencia gubernamental, se imponen impuestos locales a las inversiones internacionales, restricciones para obtener acceso a los ingresos de las ventas y mercados comerciales menos líquidos y menos eficientes. Los mercados fronterizos generalmente tienen economías más pequeñas y mercados de capital menos maduros que los mercados emergentes. Como resultado, los riesgos de invertir en países de mercados emergentes se magnifican en países de mercados fronterizos.

Debido a que el fondo concentra sus inversiones en una región geográfica particular, el rendimiento del fondo está estrechamente vinculado a las condiciones sociales, políticas y económicas dentro de esa región. La evolución política y los cambios en la política regulatoria, fiscal o económica en determinados países de la región podrían afectar significativamente a los mercados de esos países, así como a toda la región. Como resultado, es probable que el fondo sea más volátil que los fondos internacionales geográficamente más diversos.

Estos son algunos de los principales riesgos de invertir en este fondo. Para una discusión más exhaustiva de los riesgos, consulte el folleto del fondo.

INFORMACIÓN DE REFERENCIA

Nota: MSCI no ofrece garantías o representaciones explícitas o implícitas y no tendrá responsabilidad alguna con respecto a los datos de MSCI contenidos en este documento. Los datos de MSCI no se pueden redistribuir ni utilizar como base para otros índices o valores o productos financieros. Este informe no está aprobado, revisado ni producido por MSCI.

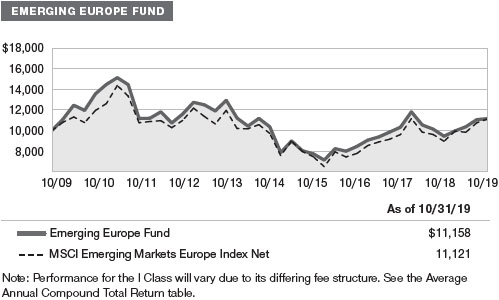

CRECIMIENTO DE $ 10,000

Este gráfico muestra el valor de una hipotética inversión de $ 10,000 en el fondo durante los últimos 10 períodos del año fiscal o desde el inicio (para fondos que carecen de registros de 10 años). El resultado se compara con los puntos de referencia, que incluyen un índice de mercado de base amplia y también pueden incluir un promedio o índice de grupo de pares. Los índices de mercado no incluyen los gastos, que se deducen de los rendimientos de los fondos, así como los promedios e índices de fondos mutuos.

PROMEDIO ANUAL COMPUESTA DEVOLUCIÓN TOTAL

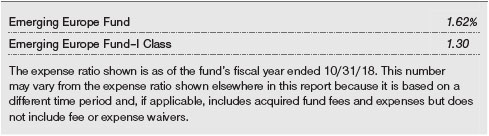

ÍNDICE DE GASTOS

EJEMPLO DE GASTOS DE FONDO

Como accionista de fondos mutuos, puede incurrir en dos tipos de costos: (1) costos de transacción, tales como tarifas de reembolso o cargas de ventas, y (2) costos continuos, incluidas tarifas de administración, tarifas de distribución y servicio (12b-1), y Otros gastos del fondo. El siguiente ejemplo tiene la intención de ayudarlo a comprender sus costos actuales (en dólares) de invertir en el fondo y comparar estos costos con los costos continuos de invertir en otros fondos mutuos. El ejemplo se basa en una inversión de $ 1,000 invertidos al comienzo del período de seis meses más reciente y que se mantiene durante todo el período.

Tenga en cuenta que el fondo tiene dos clases de acciones: la clase de acciones original (clase de inversores) no cobra comisión de distribución y servicio (12b-1), y las acciones de la clase I también están disponibles para clientes orientados institucionalmente y no imponen 12b-1 o administrativos pago de honorarios. Cada clase de acciones se presenta por separado en la tabla.

Gastos reales

La primera línea de la siguiente tabla (Actual) proporciona información sobre los valores y gastos reales de la cuenta en función de los rendimientos reales del fondo. Puede usar la información en esta línea, junto con el saldo de su cuenta, para estimar los gastos que pagó durante el período. Simplemente divida el valor de su cuenta entre $ 1,000 (por ejemplo, un valor de cuenta de $ 8,600 dividido entre $ 1,000 = 8.6), luego multiplique el resultado por el número en la primera línea bajo el título "Gastos pagados durante el período" para estimar los gastos que pagó en su cuenta durante este período.

Ejemplo hipotético para fines de comparación

La información en la segunda línea de la tabla (Hipotética) se basa en valores de cuenta hipotéticos y gastos derivados de la relación de gastos reales del fondo y una tasa de rendimiento supuesta del 5% por año antes de los gastos (no el rendimiento real del fondo). Puede comparar los costos continuos de invertir en el fondo con otros fondos comparando este ejemplo hipotético del 5% y los ejemplos hipotéticos del 5% que aparecen en los informes de los accionistas de los otros fondos. Los valores y gastos hipotéticos de la cuenta no se pueden usar para estimar el saldo final de la cuenta o los gastos que pagó durante el período.

Nota: T. Rowe Price cobra una tarifa de servicio de cuenta anual de $ 20, generalmente para cuentas con menos de $ 10,000. La tarifa no se aplica a ningún inversor cuyas cuentas de fondos mutuos de T. Rowe Price sumen $ 50,000 o más; cuentas que eligen recibir entregas electrónicas de estados de cuenta, confirmaciones de transacciones, prospectos e informes de accionistas; o cuentas de un inversor que sea cliente de T. Rowe Price Personal Services o de Enhanced Personal Services (la inscripción en estos programas generalmente requiere activos de T. Rowe Price de al menos $ 250,000). Esta tarifa no está incluida en la tabla adjunta. Si está sujeto a la tarifa, tenga en cuenta cuando calcule los gastos continuos de invertir en el fondo y cuando compare los gastos de este fondo con otros fondos.

También debe tener en cuenta que los gastos que se muestran en la tabla resaltan solo sus costos continuos y no reflejan ningún costo de transacción, como las tarifas de reembolso o las cargas de ventas. Por lo tanto, la segunda línea de la tabla es útil para comparar solo los costos continuos y no lo ayudará a determinar los costos totales relativos de poseer diferentes fondos. Sin embargo, en la medida en que un fondo cobra costos de transacción, el costo total de poseer ese fondo es mayor.

DEVOLUCIONES DE FIN DE TRIMESTRE

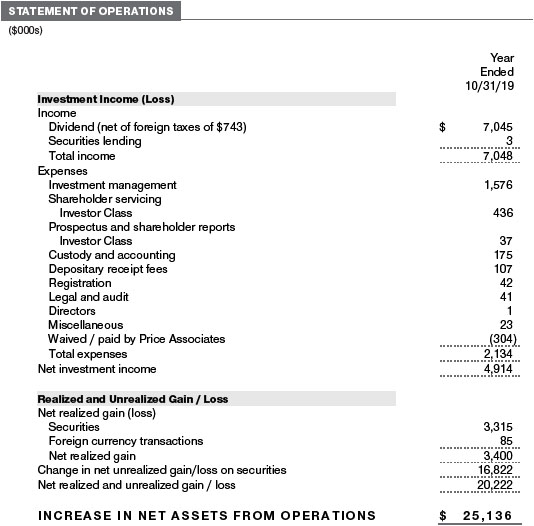

Las notas adjuntas son parte integral de estos estados financieros.

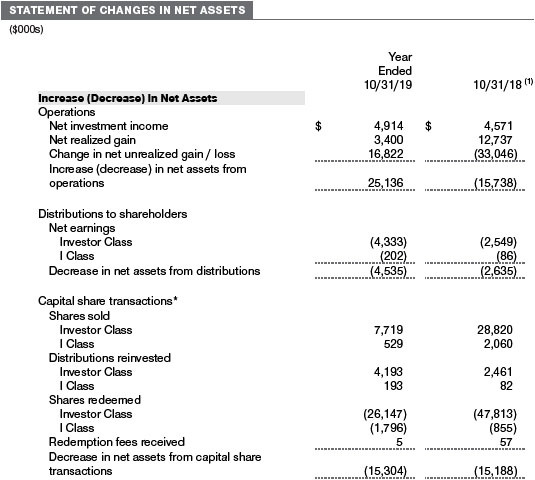

Las notas adjuntas son parte integral de estos estados financieros.

Las notas adjuntas son parte integral de estos estados financieros.

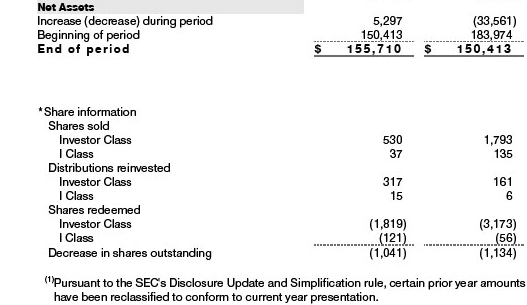

Las notas adjuntas son parte integral de estos estados financieros.

Las notas adjuntas son parte integral de estos estados financieros.

Las notas adjuntas son parte integral de estos estados financieros.

| NOTAS A LOS ESTADOS FINANCIEROS |

T. Rowe Price International Funds, Inc. (la corporación) está registrada bajo la Ley de Sociedades de Inversión de 1940 (la Ley de 1940). El Emerging Europe Fund (el fondo) es una compañía de inversión de gestión abierta no diversificada establecida por la corporación. El fondo busca un crecimiento de capital a largo plazo a través de inversiones principalmente en acciones comunes de empresas ubicadas (o con operaciones primarias) en los países de mercados emergentes de Europa. El fondo tiene dos clases de acciones: el Emerging Europe Fund (Clase de inversores) y el Emerging Europe Fund – I Class (I Class). Las acciones de Clase I requieren un mínimo de inversión inicial de $ 1 millón, aunque el mínimo generalmente no se aplica a los planes de jubilación, intermediarios financieros y ciertas otras cuentas. Cada clase tiene derechos de voto exclusivos en asuntos relacionados únicamente con esa clase; derechos de voto separados sobre asuntos relacionados con ambas clases; y, en todos los demás aspectos, los mismos derechos y obligaciones que la otra clase.

NOTA 1 – POLÍTICAS CONTABLES SIGNIFICATIVAS

Bases de preparación El fondo es una compañía de inversión y sigue la guía de contabilidad y presentación de informes en el Consejo de Normas de Contabilidad Financiera (FASB) Codificación de normas contables Tema 946 (ASC 946). Los estados financieros adjuntos se prepararon de acuerdo con los principios de contabilidad generalmente aceptados en los Estados Unidos de América (GAAP), que incluyen, entre otros, ASC 946. GAAP requiere el uso de estimaciones hechas por la administración. La gerencia cree que las estimaciones y valoraciones son apropiadas; sin embargo, los resultados reales pueden diferir de esos estimados, y las valoraciones reflejadas en los estados financieros adjuntos pueden diferir del valor finalmente realizado al momento de la venta o vencimiento. Ciertos montos del año anterior en los estados financieros adjuntos y los aspectos financieros destacados se han reexpresado para cumplir con la presentación del año actual.

Transacciones de inversión, ingresos de inversión y distribuciones Las transacciones de inversión se contabilizan según la fecha de negociación. Los ingresos y gastos se registran sobre la base devengada. Las ganancias y pérdidas realizadas se informan sobre la base del costo identificado. Los intereses y multas relacionadas con el impuesto a las ganancias, si se incurre, se registran como gastos por impuestos a las ganancias. Los dividendos recibidos de las inversiones de fondos mutuos se reflejan como ingresos por dividendos; Las distribuciones de ganancias de capital se reflejan como ganancias / pérdidas realizadas. Los ingresos por dividendos y las distribuciones de ganancias de capital se registran en la fecha ex dividendo. Los dividendos no monetarios, si los hay, se registran al valor justo de mercado del activo recibido. Las distribuciones a los accionistas se registran en la fecha ex dividendo. Las distribuciones de ingresos, si las hay, son declaradas y pagadas por cada clase anualmente. El fondo también puede declarar y pagar una distribución de ganancias de capital anualmente.

Conversión de moneda Los activos, incluidas las inversiones y los pasivos denominados en monedas extranjeras, se convierten cada día en valores en dólares estadounidenses al tipo de cambio vigente, utilizando la media de la oferta y los precios solicitados de dichas monedas en dólares estadounidenses según lo citado por un banco importante. Las compras y ventas de valores, ingresos y gastos se convierten a dólares estadounidenses al tipo de cambio vigente en la fecha respectiva de dicha transacción. El efecto de los cambios en los tipos de cambio de divisas sobre las ganancias y pérdidas de seguridad realizadas y no realizadas no se bifurca de la porción atribuible a los cambios en los precios del mercado.

Contabilidad de clase El servicio al accionista, el prospecto y los gastos de informes de accionistas en los que incurre cada clase se cargan directamente a la clase a la que se refieren. Los gastos comunes a ambas clases, los ingresos por inversiones y las ganancias y pérdidas realizadas y no realizadas se asignan a las clases en función de los activos netos diarios relativos de cada clase.

Tarifas de redención Antes del 1 de abril de 2019, se evaluó una comisión del 2% sobre los reembolsos de acciones de fondos mantenidos durante 90 días o menos para disuadir la negociación a corto plazo y proteger los intereses de los accionistas a largo plazo. Las comisiones de reembolso fueron retenidas de los ingresos que los accionistas recibieron de la venta o intercambio de acciones del fondo. Los honorarios se pagaron al fondo y se registraron como un aumento del capital pagado. Las tarifas pueden haber causado que el precio de rescate por acción difiera del valor del activo neto por acción.

Nueva guía contable En marzo de 2017, el FASB emitió una guía modificada para acortar el período de amortización de ciertos títulos de deuda exigibles mantenidos con una prima. La guía es efectiva para los años fiscales y los períodos intermedios que comiencen después del 15 de diciembre de 2018. La adopción no tendrá ningún efecto sobre los activos netos del fondo o los resultados de las operaciones.

Indemnización En el curso normal de los negocios, el fondo puede proporcionar una indemnización en relación con sus funcionarios y directores, proveedores de servicios y / o inversiones de empresas privadas. Se desconoce la exposición máxima del fondo en virtud de estos acuerdos; sin embargo, el riesgo de pérdida de material se considera actualmente remoto.

NOTA 2 – VALORACIÓN

Los instrumentos financieros del fondo se valoran y el valor liquidativo (NAV) de cada clase se calcula al cierre de la Bolsa de Nueva York (NYSE), normalmente a las 4 p.m. ET, cada día, el NYSE está abierto para los negocios. Sin embargo, el valor liquidativo por acción puede calcularse en un momento distinto al cierre normal de la Bolsa de Nueva York si la negociación en la Bolsa de Nueva York está restringida, si la Bolsa de Nueva York cierra antes o según lo permita la SEC.

Valor razonable Los instrumentos financieros del fondo se informan a su valor razonable, que GAAP define como el precio que se recibiría por vender un activo o se pagaría por transferir un pasivo en una transacción ordenada entre participantes del mercado en la fecha de medición. El Comité de Valoración de Precios de T. Rowe (el Comité de Valoración) es un comité interno al que la Junta de Directores del Fondo (la Junta) le ha delegado ciertas responsabilidades para garantizar que los instrumentos financieros tengan un precio apropiado al valor razonable de acuerdo con los PCGA y 1940 Actuar. Sujeto a la supervisión de la Junta, el Comité de Valoración desarrolla y supervisa las políticas y procedimientos relacionados con los precios y aprueba todas las determinaciones del valor razonable. Específicamente, el Comité de Valoración establece procedimientos para valorar valores; determina técnicas de precios, fuentes y personas elegibles para efectuar acciones de precios de valor razonable; supervisa la selección, los servicios y el desempeño de los proveedores de precios; supervisa las prácticas de continuidad del negocio relacionadas con la valoración; y proporciona orientación sobre controles internos y asuntos relacionados con la valoración. El Comité de Valoración reporta a la Junta y tiene representación legal, gestión de cartera y comercio, operaciones, gestión de riesgos y el tesorero del fondo.

Se utilizan diversas técnicas de valoración e insumos para determinar el valor razonable de los instrumentos financieros. Los PCGA establecen la siguiente jerarquía de valor razonable que clasifica las entradas utilizadas para medir el valor razonable:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made. OTC Bulletin Board securities are valued at the mean of the closing bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the closing bid and asked prices for domestic securities and the last quoted sale or closing price for international securities.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted to reflect the fair value of such securities at the close of the NYSE. If the fund determines that developments between the close of a foreign market and the close of the NYSE will affect the value of some or all of its portfolio securities, the fund will adjust the previous quoted prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust quoted prices to reflect fair value, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. The fund uses outside pricing services to provide it with quoted prices and information to evaluate or adjust those prices. The fund cannot predict how often it will use quoted prices and how often it will determine it necessary to adjust those prices to reflect fair value. As a means of evaluating its security valuation process, the fund routinely compares quoted prices, the next day’s opening prices in the same markets, and adjusted prices.

Actively traded equity securities listed on a domestic exchange generally are categorized in Level 1 of the fair value hierarchy. Non-U.S. equity securities generally are categorized in Level 2 of the fair value hierarchy despite the availability of quoted prices because, as described above, the fund evaluates and determines whether those quoted prices reflect fair value at the close of the NYSE or require adjustment. OTC Bulletin Board securities, certain preferred securities, and equity securities traded in inactive markets generally are categorized in Level 2 of the fair value hierarchy.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation and are categorized in Level 1 of the fair value hierarchy. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

Thinly traded financial instruments and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded.

Subject to oversight by the Board, the Valuation Committee regularly makes good faith judgments to establish and adjust the fair valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of an equity investment with limited market activity, such as a private placement or a thinly traded public company stock, the Valuation Committee considers a variety of factors, which may include, but are not limited to, the issuer’s business prospects, its financial standing and performance, recent investment transactions in the issuer, new rounds of financing, negotiated transactions of significant size between other investors in the company, relevant market valuations of peer companies, strategic events affecting the company, market liquidity for the issuer, and general economic conditions and events. In consultation with the investment and pricing teams, the Valuation Committee will determine an appropriate valuation technique based on available information, which may include both observable and unobservable inputs. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants, transaction information can be reliably obtained, and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as market-based valuation multiples; a discount or premium from market value of a similar, freely traded security of the same issuer; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the issue. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants. Depending on the relative significance of unobservable inputs, including the valuation technique(s) used, fair valued securities may be categorized in Level 2 or 3 of the fair value hierarchy.

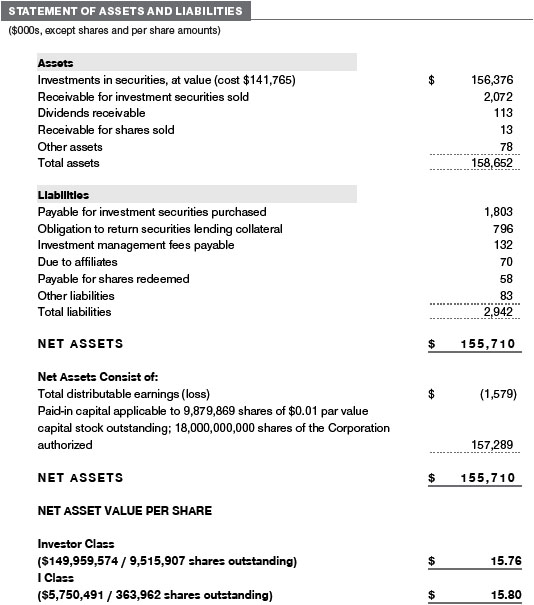

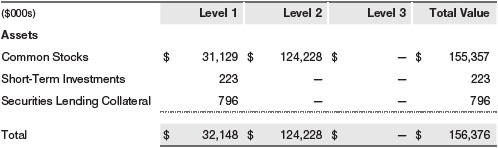

Valuation Inputs The following table summarizes the fund’s financial instruments, based on the inputs used to determine their fair values on October 31, 2019 (for further detail by category, please refer to the accompanying Portfolio of Investments):

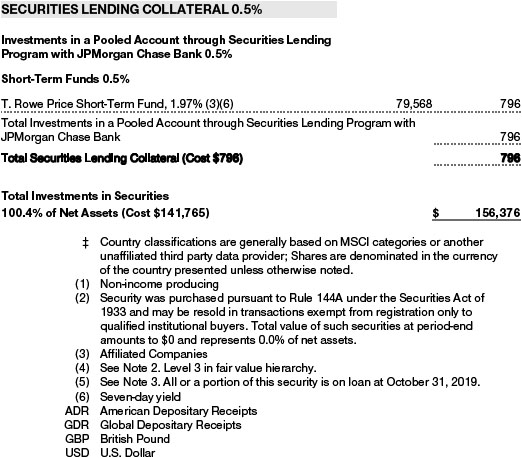

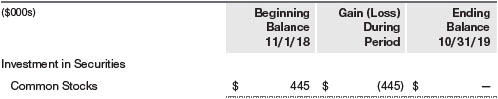

Following is a reconciliation of the fund’s Level 3 holdings for the year ended October 31, 2019. Gain (loss) reflects both realized and change in unrealized gain/loss on Level 3 holdings during the period, if any, and is included on the accompanying Statement of Operations. The change in unrealized gain/loss on Level 3 instruments held at October 31, 2019, totaled $(445,000) for the year ended October 31, 2019.

NOTE 3 – OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Emerging and Frontier Markets The fund may invest, either directly or through investments in other T. Rowe Price funds, in securities of companies located in, issued by governments of, or denominated in or linked to the currencies of emerging and frontier market countries. Emerging markets, and to a greater extent frontier markets, generally have economic structures that are less diverse and mature, and political systems that are less stable, than developed countries. These markets may be subject to greater political, economic, and social uncertainty and differing regulatory environments that may potentially impact the fund’s ability to buy or sell certain securities or repatriate proceeds to U.S. dollars. Such securities are often subject to greater price volatility, less liquidity, and higher rates of inflation than U.S. securities. Investing in frontier markets is significantly riskier than investing in other countries, including emerging markets.

In response to political and military actions undertaken by Russia, the U.S., European Union, and other jurisdictions have instituted various sanctions against Russia. These sanctions and additional sanctions, if issued, could have adverse consequences for the Russian economy, including a weakening or devaluation of the ruble, a downgrade in the country’s credit rating, and a significant decline in the value and liquidity of securities issued by Russian companies or the Russian government. Sanctions could impair a fund’s ability to invest in accordance with its investment program, to determine the overall value of its net assets, and to sell holdings as needed to meet shareholder redemptions. At October 31, 2019, approximately 68% of the fund’s net assets were invested in Russian securities; on that date, none of the fund’s investments were in securities issued by entities subject to sanctions.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

Securities Lending The fund may lend its securities to approved borrowers to earn additional income. Its securities lending activities are administered by a lending agent in accordance with a securities lending agreement. Security loans generally do not have stated maturity dates, and the fund may recall a security at any time. The fund receives collateral in the form of cash or U.S. government securities. Collateral is maintained over the life of the loan in an amount not less than the value of loaned securities; any additional collateral required due to changes in security values is delivered to the fund the next business day. Cash collateral is invested in accordance with investment guidelines approved by fund management. Additionally, the lending agent indemnifies the fund against losses resulting from borrower default. Although risk is mitigated by the collateral and indemnification, the fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities, collateral investments decline in value, and the lending agent fails to perform. Securities lending revenue consists of earnings on invested collateral and borrowing fees, net of any rebates to the borrower, compensation to the lending agent, and other administrative costs. In accordance with GAAP, investments made with cash collateral are reflected in the accompanying financial statements, but collateral received in the form of securities is not. At October 31, 2019, the value of loaned securities was $758,000; the value of cash collateral and related investments was $796,000.

Depositary Receipts The fund may invest in American Depositary Receipts (ADRs), Global Depositary Receipts (GDRs), and other depositary receipts, which are certificates issued by U.S. and international institutions, such as a bank or trust company, that represent ownership of foreign securities held by the issuing institution. Depositary receipts are transferable, trade on established markets, and entitle the holder to all dividends paid by the underlying foreign security. Issuing institutions generally charge a security administration fee.

Otro Purchases and sales of portfolio securities other than short-term securities aggregated $56,528,000 and $71,843,000, respectively, for the year ended October 31, 2019.

NOTE 4 – FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

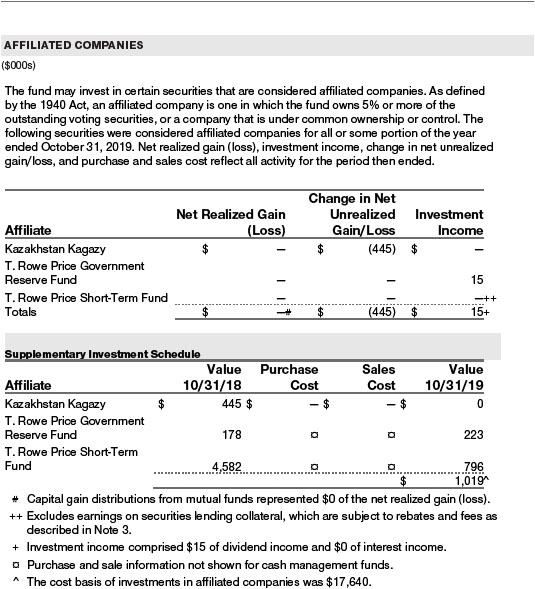

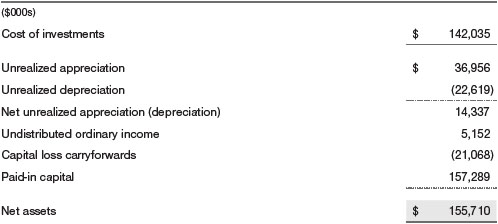

Distributions during the years ended October 31, 2019 and October 31, 2018, totaled $4,535,000 and $2,635,000, respectively, and were characterized as ordinary income for tax purposes. At October 31, 2019, the tax-basis cost of investments and components of net assets were as follows:

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to the realization of gains/losses on passive foreign investment companies for tax purposes. The fund intends to retain realized gains to the extent of available capital loss carryforwards. Net realized capital losses may be carried forward indefinitely to offset future realized capital gains. During the year ended October 31, 2019, the fund utilized $3,316,000 of capital loss carryforwards.

NOTE 5 – FOREIGN TAXES

The fund is subject to foreign income taxes imposed by certain countries in which it invests. Additionally, capital gains realized upon disposition of securities issued in or by certain foreign countries are subject to capital gains tax imposed by those countries. All taxes are computed in accordance with the applicable foreign tax law, and, to the extent permitted, capital losses are used to offset capital gains. Taxes attributable to income are accrued by the fund as a reduction of income. Current and deferred tax expense attributable to capital gains is reflected as a component of realized or change in unrealized gain/loss on securities in the accompanying financial statements. To the extent that the fund has country specific capital loss carryforwards, such carryforwards are applied against net unrealized gains when determining the deferred tax liability. Any deferred tax liability incurred by the fund is included in either Other liabilities or Deferred tax liability on the accompanying Statement of Assets and Liabilities.

NOTE 6 – RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). Price Associates has entered into a sub-advisory agreement(s) with one or more of its wholly owned subsidiaries, to provide investment advisory services to the fund. The investment management agreement between the fund and Price Associates provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.75% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.265% for assets in excess of $650 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At October 31, 2019, the effective annual group fee rate was 0.29%.

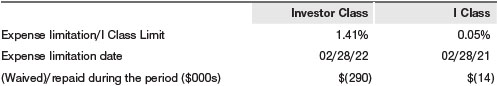

Effective October 1, 2019, Investor Class is subject to a contractual expense limitation through the expense limitation date indicated in the table below. During the limitation period, Price Associates is required to waive its management fee or pay any expenses (excluding interest; expenses related to borrowings, taxes, and brokerage; and other non-recurring expenses permitted by the investment management agreement) that would otherwise cause the class’s ratio of annualized total expenses to average net assets (net expense ratio) to exceed its expense limitation. The class is required to repay Price Associates for expenses previously waived/paid to the extent the class’s net assets grow or expenses decline sufficiently to allow repayment without causing the class’s net expense ratio (after the repayment is taken into account) to exceed the lesser of: (1) the expense limitation in place at the time such amounts were waived; or (2) the class’s current expense limitation. However, no repayment will be made more than three years after the date of a payment or waiver.

The I Class is also subject to an operating expense limitation (I Class Limit) pursuant to which Price Associates is contractually required to pay all operating expenses of the I Class, excluding management fees; interest; expenses related to borrowings, taxes, and brokerage; and other non-recurring expenses permitted by the investment management agreement, to the extent such operating expenses, on an annualized basis, exceed the I Class Limit. This agreement will continue through the expense limitation date indicated in the table below, and may be renewed, revised, or revoked only with approval of the fund’s Board. The I Class is required to repay Price Associates for expenses previously paid to the extent the class’s net assets grow or expenses decline sufficiently to allow repayment without causing the class’s operating expenses (after the repayment is taken into account) to exceed the lesser of: (1) the I Class Limit in place at the time such amounts were paid; or (2) the current I Class Limit. However, no repayment will be made more than three years after the date of a payment or waiver.

Pursuant to these agreements, expenses were waived/paid by and/or repaid to Price Associates during the year ended October 31, 2019 as indicated in the table below. Including these amounts, expenses previously waived/paid by Price Associates in the amount of $13,000 remain subject to repayment by the fund at October 31, 2019. Any repayment of expenses previously waived/paid by Price Associates during the period would be included in the net investment income and expense ratios presented on the accompanying Financial Highlights.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates, each an affiliate of the fund (collectively, Price). Price Associates provides certain accounting and administrative services to the fund. T. Rowe Price Services, Inc. provides shareholder and administrative services in its capacity as the fund’s transfer and dividend-disbursing agent. T. Rowe Price Retirement Plan Services, Inc. provides subaccounting and recordkeeping services for certain retirement accounts invested in the Investor Class. For the year ended October 31, 2019, expenses incurred pursuant to these service agreements were $70,000 for Price Associates; $310,000 for T. Rowe Price Services, Inc.; and $8,000 for T. Rowe Price Retirement Plan Services, Inc. All amounts due to and due from Price, exclusive of investment management fees payable, are presented net on the accompanying Statement of Assets and Liabilities.

The fund is also one of several mutual funds sponsored by Price Associates (underlying Price Funds) in which the T. Rowe Price Spectrum Funds (Spectrum Funds) may invest. The Spectrum Funds do not invest in the underlying Price Funds for the purpose of exercising management or control. Pursuant to special servicing agreements, expenses associated with the operation of the Spectrum Funds are borne by each underlying Price Fund to the extent of estimated savings to it and in proportion to the average daily value of its shares owned by the Spectrum Funds. Expenses allocated under these special servicing agreements are reflected as shareholder servicing expense in the accompanying financial statements. For the year ended October 31, 2019, the fund was allocated $5,000 of Spectrum Funds’ expenses. Of these amounts, $3,000 related to services provided by Price. All amounts due to and due from Price, exclusive of investment management fees payable, are presented net on the accompanying Statement of Assets and Liabilities. Additionally, redemption fees received by the Spectrum Funds are allocated to each underlying Price Fund in proportion to the average daily value of its shares owned by the Spectrum Funds. Less than $1,000 of redemption fees reflected in the accompanying financial statements were received from the Spectrum Funds. At October 31, 2019, approximately 7% of the outstanding shares of the Investor Class were held by the Spectrum Funds.

The fund may invest its cash reserves in certain open-end management investment companies managed by Price Associates and considered affiliates of the fund: the T. Rowe Price Government Reserve Fund or the T. Rowe Price Treasury Reserve Fund, organized as money market funds, or the T. Rowe Price Short-Term Fund, a short-term bond fund (collectively, the Price Reserve Funds). The Price Reserve Funds are offered as short-term investment options to mutual funds, trusts, and other accounts managed by Price Associates or its affiliates and are not available for direct purchase by members of the public. Cash collateral from securities lending is invested in the T. Rowe Price Short-Term Fund. The Price Reserve Funds pay no investment management fees.

As of October 31, 2019, T. Rowe Price Group, Inc., or its wholly owned subsidiaries owned 18,911 shares of the I Class, representing 5% of the I Class’s net assets

The fund may participate in securities purchase and sale transactions with other funds or accounts advised by Price Associates (cross trades), in accordance with procedures adopted by the fund’s Board and Securities and Exchange Commission rules, which require, among other things, that such purchase and sale cross trades be effected at the independent current market price of the security. During the year ended October 31, 2019, the fund had no purchases or sales cross trades with other funds or accounts advised by Price Associates.

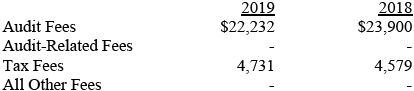

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors of T. Rowe Price International Funds, Inc. and

Shareholders of T. Rowe Price Emerging Europe Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of T. Rowe Price Emerging Europe Fund (one of the funds constituting T. Rowe Price International Funds, Inc., hereafter referred to as the “Fund”) as of October 31, 2019, the related statement of operations for the year ended October 31, 2019, the statement of changes in net assets for each of the two years in the period ended October 31, 2019, including the related notes, and the financial highlights for each of the periods indicated therein (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended October 31, 2019 and the financial highlights for each of the periods indicated therein, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of October 31, 2019 by correspondence with the custodian, transfer agent and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

December 17, 2019

We have served as the auditor of one or more investment companies in the T. Rowe Price group of investment companies since 1973.

TAX INFORMATION (UNAUDITED) FOR THE TAX YEAR ENDED 10/31/19

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

For taxable non-corporate shareholders, $6,011,000 of the fund’s income represents qualified dividend income subject to a long-term capital gains tax rate of not greater than 20%.

The fund will pass through foreign source income of $5,784,000 and foreign taxes paid of $743,000.

INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www.troweprice.com/corporate/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Policies.” Click on the Proxy Voting Policies link in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS

Effective for reporting periods on or after March 1, 2019, a fund, except a money market fund, files a complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. Prior to March 1, 2019, a fund, including a money market fund, filed a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. A money market fund files detailed month-end portfolio holdings information on Form N-MFP with the SEC each month and posts a complete schedule of portfolio holdings on its website (troweprice.com) as of each month-end for the previous six months. A fund’s Forms N-PORT, N-MFP, and N-Q are available electronically on the SEC’s website (sec.gov).

ABOUT THE FUND’S DIRECTORS AND OFFICERS

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting or potentially affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and business and regulatory affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of the Board’s members are independent of the Boards of T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates; “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

| INDEPENDENT DIRECTORS(a) | ||

| Nombre (Year of Birth) Year Elected (Number of T. Rowe Price Portfolios Overseen) |

Principal Occupation(s) and Directorships of Public Companies and Other Investment Companies During the Past Five Years | |

| Teresa Bryce Bazemore (1959) 2018 (188) |

President, Radian Guaranty (2008 to 2017); Chief Executive Officer, Bazemore Consulting LLC (2018 to present); Director, Chimera Investment Corporation (2017 to present); Director, Federal Home Loan Bank of Pittsburgh (2017 to present) | |

| Ronald J. Daniels (1959) 2018 (188) |

President, The Johns Hopkins University(b) and Professor, Political Science Department, The Johns Hopkins University (2009 to present); Director, Lyndhurst Holdings (2015 to present) | |

| Bruce W. Duncan (1951) 2013 (188) |

Chief Executive Officer and Director (January 2009 to December 2016), Chairman of the Board (January 2016 to present), and President (January 2009 to September 2016), First Industrial Realty Trust, an owner and operator of industrial properties; Chairman of the Board (2005 to September 2016) and Director (1999 to September 2016), Starwood Hotels & Resorts, a hotel and leisure company; Member, Investment Company Institute Board of Governors (2017 to present); Member, Independent Directors Council Governing Board (2017 to present); Senior Advisor, KKR (November 2018 to present); Director, Boston Properties (May 2016 to present); Director, Marriott International, Inc. (September 2016 to present) | |

| Robert J. Gerrard, Jr. (1952) 2012 (188) |

Advisory Board Member, Pipeline Crisis/Winning Strategies, a collaborative working to improve opportunities for young African Americans (1997 to 2016); Chairman of the Board, all funds (July 2018 to present) | |

| Paul F. McBride (1956) 2013 (188) |

Advisory Board Member, Vizzia Technologies (2015 to present); Board Member, Dunbar Armored (2012 to 2018) | |

| Cecilia E. Rouse, Ph.D. (1963) 2012 (188) |

Dean, Woodrow Wilson School (2012 to present); Professor and Researcher, Princeton University (1992 to present); Director, MDRC, a nonprofit education and social policy research organization (2011 to present); Member, National Academy of Education (2010 to present); Research Associate of Labor Studies Program at the National Bureau of Economic Research (2011 to 2015); Board Member, National Bureau of Economic Research (2011 to present); Chair of Committee on the Status of Minority Groups in the Economic Profession of the American Economic Association (2012 to 2018); Vice President (2015 to 2016), Board Member, American Economic Association (2018 to present) | |

| John G. Schreiber (1946) 2001 (188) |

Owner/President, Centaur Capital Partners, Inc., a real estate investment company (1991 to present); Cofounder, Partner, and Cochairman of the Investment Committee, Blackstone Real Estate Advisors, L.P. (1992 to 2015); Director, Blackstone Mortgage Trust, a real estate finance company (2012 to 2016); Director and Chairman of the Board, Brixmor Property Group, Inc. (2013 to present); Director, Hilton Worldwide (2007 to present); Director, Hudson Pacific Properties (2014 to 2016); Director, Invitation Homes (2014 to 2017); Director, JMB Realty Corporation (1980 to present) | |

| Mark R. Tercek(c) (1957) 2009 (0) |

President and Chief Executive Officer, The Nature Conservancy (2008 to present) | |

| (a) All information about the independent directors was current as of February 19, 2019, unless otherwise indicated, except for the number of portfolios overseen, which is current as of the date of this report. |

| (b) William J. Stromberg, president and chief executive officer of T. Rowe Price Group, Inc., the parent company of the Price Funds’ investment advisor, has served on the Board of Trustees of Johns Hopkins University since 2014 and is a member of the Johns Hopkins University Board’s Compensation Committee. |

| (c) Effective February 15, 2019, Mr. Tercek resigned from his role as independent director of the Price Funds. |

| INSIDE DIRECTORS | ||

| Nombre (Year of Birth) Year Elected* (Number of T. Rowe Price Portfolios Overseen) |

Principal Occupation(s) and Directorships of Public Companies and Other Investment Companies During the Past Five Years | |

| David Oestreicher (1967) 2018 (188) |

Chief Legal Officer, Vice President, and Secretary, T. Rowe Price Group, Inc.; Director, Vice President, and Secretary, T. Rowe Price Investment Services, Inc., T. Rowe Price Retirement Plan Services, Inc., T. Rowe Price Services, Inc., and T. Rowe Price Trust Company; Vice President and Secretary, T. Rowe Price, T. Rowe Price Hong Kong (Price Hong Kong), and T. Rowe Price International; Vice President, T. Rowe Price Japan (Price Japan) and T. Rowe Price Singapore (Price Singapore); Principal Executive Officer and Executive Vice President, all funds | |

| Robert W. Sharps, CFA, CPA** (1971) 2017 (188) |

Director and Vice President, T. Rowe Price; Vice President, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company; Vice President, International Funds | |

| *Each inside director serves until retirement, resignation, or election of a successor. |

| **Mr. Sharps replaced Edward A. Wiese as director of the domestic fixed income Price Funds effective January 1, 2019. |

| OFFICERS | ||

| Name (Year of Birth) | ||

| Position Held With International Funds | Principal Occupation(s) | |

| Mariel Abreu (1981) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Jason R. Adams (1979) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc.; formerly, Research Analyst, Caxton Associates (to 2015) | |

| Ulle Adamson, CFA (1979) Executive Vice President |

Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International | |

| Roy H. Adkins (1970) Vice President |

Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International | |

| Christopher D. Alderson (1962) President |

Director and Vice President, T. Rowe Price International; Vice President, Price Hong Kong, Price Singapore, and T. Rowe Price Group, Inc. | |

| Syed H. Ali (1970) Vice President |

Vice President, Price Singapore and T. Rowe Price Group, Inc. | |

| Kennard W. Allen (1977) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Paulina Amieva (1981) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Malik S. Asif (1981) Vice President |

Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International | |

| Ziad Bakri, M.D., CFA (1980) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Harishankar Balkrishna (1983) Vice President |

Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International | |

| Sheena L. Barbosa (1983) Vice President |

Vice President, Price Hong Kong and T. Rowe Price Group, Inc. | |

| Peter J. Bates, CFA (1974) Executive Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Jason Bauer (1979) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Luis M. Baylac (1982) Vice President |

Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International | |

| Timothy Bei (1973) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Oliver D.M. Bell (1969) Executive Vice President |

Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International | |

| R. Scott Berg, CFA (1972) Executive Vice President |

Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company | |

| Steven E. Boothe, CFA (1977) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Peter I. Botoucharov (1965) Vice President |

Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International | |

| Tala Boulos (1984) Vice President |

Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International | |

| Darrell N. Braman (1963) Vice President and Secretary |

Vice President, Price Hong Kong, Price Singapore, T. Rowe Price, T. Rowe Price Group, Inc., T. Rowe Price International, T. Rowe Price Retirement Plan Services, Inc., and T. Rowe Price Services, Inc. | |

| Christopher P. Brown, Jr., CFA (1977) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Sheldon Chan (1981) Vice President |

Vice President, Price Hong Kong and T. Rowe Price Group, Inc. | |

| Andrew Chang (1983) Vice President |

Vice President, T. Rowe Price Group, Inc. | |

| William Chen (1979) Vice President |

Vice President, Price Hong Kong; formerly, Greater China TMT and Automation Analyst, J.P. Morgan Asset Management (to 2018) | |

| Carolyn Hoi Che Chu (1974) Vice President |

Vice President, Price Hong Kong and T. Rowe Price Group, Inc. | |

| Archibald Ciganer Albeniz, CFA (1976) Executive Vice President |

Director and Vice President, Price Japan; Vice President, T. Rowe Price Group, Inc. | |

| Richard N. Clattenburg, CFA (1979) Executive Vice President |

Vice President, Price Singapore, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price International | |

| Michael J. Conelius, CFA (1964) Executive Vice President |

Vice President, T. Rowe Price, T. Rowe Price Group, Inc., T. Rowe Price International, and T. Rowe Price Trust Company | |

| Michael F. Connelly, CFA (1977) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Andrew S. Davis (1978) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Richard de los Reyes (1975) Vice President |

Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company | |

| Michael Della Vedova (1969) Executive Vice President |

Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International | |

| Maria Elena Drew (1973) Vice President |

Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International; formerly, Executive Director, Goldman Sachs Asset Management (to 2017) | |

| Shawn T. Driscoll (1975) Vice President |

Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company | |

| Alan S. Dupski, CPA (1982) Assistant Treasurer |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Bridget A. Ebner (1970) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| David J. Eiswert, CFA (1972) Executive Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Dawei Feng (1979) Vice President |

Vice President, Price Hong Kong and T. Rowe Price Group, Inc.; formerly, Head of China Consumer in Equity Research, Credit Lyonnais Asia-Pacific (to 2018) | |

| Ryan W. Ferro (1985) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Mark S. Finn, CFA, CPA (1963) Vice President |

Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company | |

| Quentin S. Fitzsimmons (1968) Vice President |

Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International; formerly, Portfolio Manager, Royal Bank of Scotland Group (to 2015) | |

| Melissa C. Gallagher (1974) Vice President |

Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International | |

| Justin T. Gerbereux, CFA (1975) Vice President |

Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company | |

| Aaron Gifford, CFA (1987) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc.; formerly, Strategist, Morgan Stanley & Co. LLC (to 2017) | |

| John R. Gilner (1961) Chief Compliance Officer |

Chief Compliance Officer and Vice President, T. Rowe Price; Vice President, T. Rowe Price Group, Inc., and T. Rowe Price Investment Services, Inc. | |

| Vishnu V. Gopal (1979) Vice President |

Vice President, Price Hong Kong and T. Rowe Price Group, Inc. | |

| Joel Grant (1978) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Gary J. Greb (1961) Vice President |

Vice President, T. Rowe Price, T. Rowe Price International, and T. Rowe Price Trust Company | |

| Paul D. Greene II (1978) Vice President |

Vice President, T. Rowe Price and T. Rowe Price Group, Inc. | |

| Benjamin Griffiths, CFA (1977) Vice President |

Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International | |

| Gianluca Guicciardi (1983) Vice President |