Reciba alertas instantáneas cuando salgan noticias sobre sus acciones. Solicite su prueba gratuita de 1 semana para StreetInsider Premium aquí.

ESTADOS UNIDOS

COMISIÓN NACIONAL DEL MERCADO DE VALORES

Washington, D.C.20549

FORMAR N-CSR

CERTIFICADO

INFORME DE ACCIONISTAS DE REGISTRADOS

GESTIÓN DE EMPRESAS DE INVERSIÓN

Número de archivo de la Ley de Sociedades de Inversión 811-22582

Western Asset Middle Market Income Fund Inc.

(Nombre exacto del registrante como se especifica en la carta)

620 octavo

Avenida, 49th Piso, Nueva York, NY 10018

(Dirección de las oficinas ejecutivas principales)

(Código postal)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 Primer lugar de Stamford

Stamford, CT 06902

(Nombre

y dirección del agente para el servicio)

Número de teléfono del registratario, incluido el código de área: (888) 777-0102

Fecha de fin del año fiscal: 30 de abril

Fecha del período del informe: 31 de octubre de 2019

| OBJETO 1. |

INFORME A LOS ACCIONISTAS. |

los Semi anual Se presenta un informe a los Accionistas.

| Informe semestral | 31 de octubre de 2019 |

ACTIVO OCCIDENTAL

MERCADO MEDIO

FONDO DE INGRESOS INC.

A partir de abril de 2021, según lo permitido por las regulaciones adoptadas por la Comisión de Bolsa y Valores, el Fondo tiene la intención

ya no envíe por correo copias impresas de los informes de accionistas del Fondo como este, a menos que solicite específicamente copias impresas de los informes del Fondo o de su intermediario financiero (como un corredor de bolsa o banco). En cambio, el

los informes estarán disponibles en un sitio web, y se le notificará por correo cada vez que se publique un informe y se le proporcione un enlace al sitio web para acceder al informe.

Si invierte a través de un intermediario financiero y ya eligió recibir informes de accionistas electrónicamente ("Entrega electrónica"), no se verá afectado por este cambio y no necesita tomar ninguna medida. Si aún no has elegido entrega electrónica, puedes elegir recibir

informes de accionistas y otras comunicaciones del Fondo electrónicamente contactando a su intermediario financiero.

Puede elegir recibir todos los informes futuros en papel sin cargo. Si invierte a través de un intermediario financiero,

puede comunicarse con su intermediario financiero para solicitar que continúe recibiendo copias en papel de sus informes de accionistas. Esa elección se aplicará a todos los fondos de Legg Mason en su cuenta en ese intermediario financiero. Si eres directo

accionista del Fondo, puede llamar al Fondo al 1-888-888-0151, o escriba al Fondo por correo postal a P.O. Box 505000,

Louisville, KY 40233 o mediante entrega nocturna a Computershare, 462 South 4th Street, Suite 1600, Louisville, KY 40202 para informar al Fondo que desea continuar recibiendo copias en papel de sus informes de accionistas. Esa elección se aplicará a todos los Legg

Mason Funds en su cuenta mantenida directamente con el complejo de fondos.

| PRODUCTOS DE INVERSIÓN: NO ASEGURADOS POR LA FDIC • SIN GARANTÍA BANCARIA • PUEDE PERDER VALOR |

Objetivos del fondo

El objetivo principal de inversión del Fondo es proporcionar altos ingresos. Como objetivo secundario de inversión, el Fondo busca la revalorización del capital.

El Fondo busca alcanzar sus objetivos de inversión invirtiendo, en condiciones normales de mercado, al menos el 80% de sus activos gestionados (los activos netos del Fondo más el

monto principal de cualquier préstamo y acciones preferentes que puedan estar en circulación) en valores, incluidos préstamos, emitidos por empresas del mercado intermedio. Para fines de inversión, "mercado intermedio" se refiere a empresas con ingresos anuales de

entre $ 100 millones y $ 1 mil millones al momento de la inversión del Fondo. Los valores de los emisores del mercado medio generalmente se consideran por debajo del grado de inversión (también comúnmente conocidos como "bonos basura").

Se anticipa que el Fondo terminará el 30 de diciembre de 2022 o antes.

| II | Western Asset Middle Market Income Fund Inc. |

Estimado accionista,

Nos complace proporcionar el informe semestral de Western Asset Middle Market Income Fund Inc. para el seis meses informes

período finalizado el 31 de octubre de 2019. Lea la información de rendimiento del Fondo durante el período de informe del Fondo.

Como siempre, seguimos comprometidos con

brindándole un excelente servicio y un espectro completo de opciones de inversión. También seguimos comprometidos a complementar el soporte que recibe de su asesor financiero. Una forma de lograr esto es a través de nuestro sitio web, www.lmcef.com. Tu aquí

puede obtener acceso inmediato a información de mercado e inversión, que incluye:

| • |

Fondos activos netos y rendimiento |

| • |

Perspectivas de mercado y comentarios de nuestros gerentes de cartera, y |

| • |

Una gran cantidad de recursos educativos. |

Esperamos poder ayudarlo a alcanzar sus objetivos financieros.

Sinceramente,

Jane Trust, CFA

Presidente, presidente y director ejecutivo

29 de noviembre de 2019

| Western Asset Middle Market Income Fund Inc. | III |

Para los seis meses terminados el 31 de octubre de 2019, Western Asset Middle Market Income Fund Inc.

regresado -0,91% basado en su valor liquidativo ("NAV")yo. El índice de referencia no gestionado del Fondo, el Bloomberg Barclays U.S. Corporate High Yield

– Índice del 2% del componente Caa del emisoriidevuelto -3,61% por el mismo periodo The Lipper Alto rendimiento (apalancado) Promedio de la categoría de fondos cerradosiii devolvió 1.86% durante el mismo período de tiempo. Tenga en cuenta que los rendimientos del rendimiento de Lipper se basan en el NAV de cada fondo.

Durante esto seis meses período de informe, el Fondo realizó distribuciones a los accionistas por un total de $ 30.39 por acción. A partir de

El 31 de octubre de 2019, el Fondo estima que el 87% de las distribuciones se obtuvieron de los ingresos netos de inversión y el 13% constituyeron un retorno de capital. * La tabla de rendimiento muestra el rendimiento del Fondo. seis meses

rendimiento total basado en su VAN al 31 de octubre de 2019. El rendimiento pasado no es garantía de resultados futuros.

|

Instantánea de rendimiento |

||||

| Precio por acción |

6 meses Regreso trotal** |

|||

| $ 713.07 (NAV) | -0,91 | % † | ||

Todas las cifras representan el rendimiento pasado y no son garantía de resultados futuros. Cifras de rendimiento para períodos inferiores a un año.

representan cifras acumulativas y no están anualizadas.

** El rendimiento total se basa en cambios en el NAV. El rendimiento refleja la deducción de todos los gastos del Fondo, incluidos

honorarios de administración, gastos operativos y otros gastos del Fondo. El rendimiento no refleja la deducción de comisiones de corretaje o impuestos que los inversores pagan por las distribuciones o la disposición de las acciones.

† El rendimiento total supone la reinversión de todas las distribuciones, incluidos los retornos de capital, si los hay, en NAV.

¿Buscando información adicional?

los

El NAV diario del fondo está disponible en línea bajo el símbolo "XWMFX" en la mayoría de los sitios web financieros. En un esfuerzo continuo por proporcionar información sobre el Fondo, los accionistas pueden llamar 1-888-777-0102 (sin cargo), de lunes a viernes de 8:00 a.m. a 5:30 p.m. Hora del Este, para el NAV actual del Fondo y otros

información.

| * * |

Estas estimaciones no son para fines fiscales. El Fondo emitirá un Formulario 1099 con la composición final de las distribuciones para |

| IV | Western Asset Middle Market Income Fund Inc. |

Gracias por su inversión en Western Asset Middle Market Income Fund Inc. Como siempre, le agradecemos que haya elegido

nosotros para administrar sus activos y seguimos enfocados en lograr los objetivos de inversión del Fondo.

Sinceramente,

Jane Trust, CFA

Presidente, presidente y director ejecutivo

18 de noviembre de 2019

RIESGOS El fondo es un no diversificado final cerrado inversión de gestión

empresa. Una inversión en el Fondo implica un alto grado de riesgo. El Fondo debe considerarse una inversión ilíquida. Este Fondo no cotiza en bolsa y está cerrado a nuevos inversores. El Fondo no tiene la intención de solicitar una cotización en bolsa, y

Es muy poco probable que exista un mercado secundario para la compra y venta de las acciones del Fondo. Los inversores podrían perder parte o la totalidad de su inversión. Una inversión en el Fondo no es apropiada para todos los inversores y no está destinada a

Ser un programa de inversión completo. El Fondo está diseñado como una inversión a largo plazo para inversores que están preparados para mantener las Acciones Comunes del Fondo hasta el vencimiento de su plazo, y no es un vehículo comercial. Porque el fondo es no diversificado, puede ser más susceptible a eventos económicos, políticos o regulatorios que un fondo diversificado. Los valores de renta fija están sujetos a numerosos riesgos, que incluyen, entre otros, crédito,

riesgos de inflación, ingresos, prepago y tasas de interés. A medida que aumentan las tasas de interés, disminuye el valor de los valores de renta fija. Las empresas del mercado medio tienen riesgos adicionales debido a sus historiales operativos limitados, recursos financieros limitados, menos

resultados operativos predecibles, líneas de productos más estrechas y otros factores. Los valores de los emisores del mercado medio generalmente se consideran de alto rendimiento. Se considera que los valores de renta fija de alto rendimiento de calidad inferior al grado de inversión tienen

características predominantemente especulativas con respecto a la capacidad del emisor para pagar intereses y pagar el principal. Los bonos de alto rendimiento ("bonos basura") están sujetos a un mayor riesgo crediticio y a un mayor riesgo de incumplimiento. El fondo puede invertir

todo o una parte de sus activos administrados en valores ilíquidos. El Fondo puede realizar inversiones significativas en valores para los que no hay precios de mercado observables; los precios deben ser estimados por Western Asset, el subconsejero del Fondo, y

aprobado por el Comité de Valoración del Fondo del Atlántico Norte Legg Mason. Las inversiones en valores extranjeros implican riesgos, incluida la posibilidad de pérdidas debido a cambios en los tipos de cambio de divisas y desarrollos negativos en el ámbito político, económico.

o estructura reguladora de países o regiones específicos. Estos riesgos son mayores en los mercados emergentes. El apalancamiento puede resultar en una mayor volatilidad del valor liquidativo de las acciones comunes y aumenta el riesgo de pérdida de un accionista. Derivado

los instrumentos pueden ser ilíquidos, aumentar desproporcionadamente las pérdidas y tener un impacto potencialmente grande en el rendimiento del Fondo. Las distribuciones no están garantizadas y están sujetas a cambios.

| Western Asset Middle Market Income Fund Inc. | V |

Revisión de desempeño (cont.)

Todas las inversiones están sujetas a riesgos, incluida la posible pérdida de capital. El rendimiento pasado es

Sin garantía de resultados futuros. Todo el rendimiento del índice no refleja ninguna deducción por honorarios, gastos o impuestos. Tenga en cuenta que un inversor no puede invertir directamente en un índice.

| yo |

El valor del activo neto ("NAV") se calcula restando el total de pasivos, incluidos los pasivos asociados con |

| ii |

Bloomberg Barclays Corporate Corporate High Yield – 2% Issuer Cap Caa Component es un índice del 2% de emisor Cap |

| iii |

Lipper, Inc., una subsidiaria de propiedad absoluta de Reuters, proporciona información independiente sobre las inversiones colectivas globales. Devoluciones |

| VI | Western Asset Middle Market Income Fund Inc. |

Fondo de un vistazo† (sin auditar)

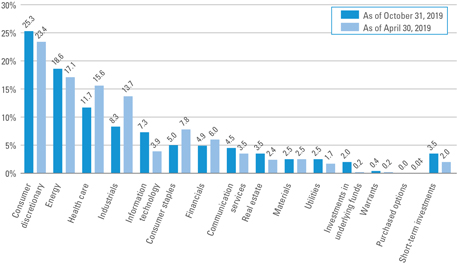

Desglose de inversiones (%) como porcentaje de las inversiones totales

| † |

El gráfico de barras anterior representa la composición de las inversiones del Fondo al 31 de octubre de 2019 y |

| ‡ |

Representa menos del 0.1%. |

| Western Seset Middle Market Income Fund Inc. Informe semestral de 2019 | 1 |

Calendario de inversiones (sin auditar)

31 de octubre de 2019

Medio activo occidental

Market Income Fund Inc.

| Seguridad | Velocidad |

Madurez Fecha |

Cara Cantidad† |

Valor | ||||||||||||

| Bonos corporativos y pagarés: 76.1% | ||||||||||||||||

| Servicios de comunicación – 4.5% | ||||||||||||||||

|

Telecomunicaciones diversificadas |

|

|||||||||||||||

|

Cogent Communications Group Inc., Notas garantizadas senior |

5.375 | % | 1/3/22 | 1,200,000 | PS | 1,254,000 | (un) | |||||||||

|

Telecomunicaciones Inalámbricas |

|

|||||||||||||||

|

CSC Holdings LLC, Notas Senior |

6.625 | % | 15/10/25 | 1,000,000 | 1,067,500 | (a) (b) | ||||||||||

|

CSC Holdings LLC, Notas Senior |

10.875 | % | 15/10/25 | 747,000 | 844,360 | (a) (b) | ||||||||||

|

Sprint Communications Inc., Notas Senior |

11.500 | % | 15/11/21 | 815,000 | 946,419 | (si) | ||||||||||

|

Sprint Corp., Notas Senior |

7.875 | % | 15/09/23 | 2,520,000 | 2,787,750 | |||||||||||

|

Telecomunicación inalámbrica total |

|

5,646,029 | ||||||||||||||

|

Servicios de comunicación total |

6,900,029 | |||||||||||||||

| Consumo discrecional – 20.0% |

|

|||||||||||||||

|

Servicios al consumidor diversificados |

|

|||||||||||||||

|

Carriage Services Inc., Notas Senior |

6.625 | % | 1/6/26 | 2,080,000 | 2,173,600 | (a) (b) | ||||||||||

|

Hoteles, restaurantes y |

|

|||||||||||||||

|

24 Hour Fitness Worldwide Inc., Notas Senior |

8.000 | % | 1/6/22 | 2,500,000 | 1,818,750 | (a) (b) | ||||||||||

|

Autoridad de desarrollo aguas abajo de la tribu Quapaw de Oklahoma, asegurada por personas mayores |

10.500 | % | 15/2/23 | 3.830.000 | 4,050,225 | (a) (b) | ||||||||||

|

Golden Entertainment Inc., Notas Senior |

7.625 | % | 15/4/26 | 3,290,000 | 3,466,837 | (a) (b) | ||||||||||

|

Golden Nugget Inc., Notas Senior |

8.750 | % | 1/10/25 | 910,000 | 960,050 | (un) | ||||||||||

|

Jack Ohio Finance LLC / Jack Ohio Finance 1 Corp., Notas garantizadas |

10,250 | % | 15/11/22 | 3,000,000 | 3,187,500 | (a) (b) | ||||||||||

|

Jacobs Entertainment Inc., Notas garantizadas |

7.875 | % | 2/1/24 | 3.818.000 | 4,066,170 | (a) (b) | ||||||||||

|

Nathan’s Famous Inc., Notas garantizadas senior |

6.625 | % | 1/11/25 | 3,770,000 | 3.826.550 | (a) (b) | ||||||||||

|

Sugarhouse HSP Gaming Prop Mezz LP / Sugarhouse HSP Gaming Finance Corp., Senior Secured |

5.875 | % | 15/5/25 | 3,000,000 | 2.977.500 | (a) (b) | ||||||||||

|

Twin River Worldwide Holdings Inc., Notas Senior |

6.750 | % | 1/6/27 | 1,900,000 | 2,005,070 | (un) | ||||||||||

|

Total de hoteles, restaurantes y |

26,358,652 | |||||||||||||||

|

Artículos duraderos del hogar – |

|

|||||||||||||||

|

APX Group Inc., Notas Senior |

8.750 | % | 1/12/20 | 2,006,000 | 1,978,418 | (si) | ||||||||||

|

Total del consumidor discrecional |

30,510,670 | |||||||||||||||

Ver notas a Financial

Declaraciones

| 2 | Western Seset Middle Market Income Fund Inc. Informe semestral de 2019 |

Mercado medio de activos occidentales

Income Fund Inc.

| Seguridad | Velocidad |

Madurez Fecha |

Cara Cantidad† |

Valor | ||||||||||||

| Productos de consumo básico: 2.0% |

|

|||||||||||||||

|

Tabaco – |

|

|||||||||||||||

|

Pyxus International Inc., Notas garantizadas |

9.875 | % | 15/7/21 | 4,960,000 | PS | 3,100,000 | (si) | |||||||||

| Energía – 21,9% |

|

|||||||||||||||

|

Equipos de energía y |

|

|||||||||||||||

|

Pride International LLC, Notas Senior |

7.875 | % | 15/8/40 | 2,750,000 | 1,430,000 | (si) | ||||||||||

|

USA Compression Partners LP / USA Compression Finance Corp., Senior Notes |

6.875 | % | 4/1/26 | 2,000,000 | 2,030,000 | |||||||||||

|

Equipo de energía total y |

3,460,000 | |||||||||||||||

|

Petróleo, Gas y Consumibles |

|

|||||||||||||||

|

Antero Midstream Partners LP / Antero Midstream Finance Corp., Senior Notes |

5.750 | % | 15/1/28 | 1,990,000 | 1,512,400 | (un) | ||||||||||

|

Berry Petroleum Co. LLC, Notas Senior |

7,000 | % | 15/2/26 | 3,650,000 | 3,412,750 | (un) | ||||||||||

|

Blue Racer Midstream LLC / Blue Racer Finance Corp., Notas Senior |

6.125 | % | 15/11/22 | 2,379,000 | 2,349,262 | (a) (b) | ||||||||||

|

Endeavour Energy Resources LP / EER Finance Inc., Notas Senior |

5.500 | % | 30/1/26 | 1,200,000 | 1,242,024 | (un) | ||||||||||

|

MEG Energy Corp., Notas Senior |

6.375 | % | 30/1/23 | 1,500,000 | 1,423,125 | (a) (b) | ||||||||||

|

Montage Resources Corp., Notas Senior |

8.875 | % | 15/7/23 | 2,530,000 | 1,954,425 | |||||||||||

|

Oasis Petroleum Inc., Notas Senior |

6.500 | % | 1/11/21 | 4,088,000 | 3.944.920 | (si) | ||||||||||

|

Oasis Petroleum Inc., Notas Senior |

6.875 | % | 15/3/22 | 2,017,000 | 1,780,003 | (si) | ||||||||||

|

Oasis Petroleum Inc., Notas Senior |

6.875 | % | 15/1/23 | 800,000 | 696,000 | (si) | ||||||||||

|

Petrobras Global Finance BV, Notas Senior |

6.750 | % | 27/01/41 | 1,900,000 | 2,205,188 | |||||||||||

|

Shelf Drilling Holdings Ltd., Notas Senior |

8.250 | % | 15/2/25 | 3,470,000 | 2.932.150 | (a) (b) | ||||||||||

|

Teine Energy Ltd., Notas Senior |

6.875 | % | 30/09/22 | 1,620,000 | 1,628,100 | (un) | ||||||||||

|

Transportadora de Gas del Sur SA, Notas Senior |

6.750 | % | 25/05/25 | 3,000,000 | 2,530,500 | (un) | ||||||||||

|

Vesta Energy Corp., Notas Senior |

8.125 | % | 24/7/23 | 3,800,000 | CANALLA | 2,345,723 | (un) | |||||||||

|

Total de petróleo, gas y consumibles |

29,956,570 | |||||||||||||||

|

Energía total |

33,416,570 | |||||||||||||||

| Finanzas – 0.6% |

|

|||||||||||||||

|

Servicios financieros diversificados |

|

|||||||||||||||

|

Werner FinCo LP / Werner FinCo Inc., Notas principales |

8.750 | % | 15/7/25 | 1,000,000 | 873,750 | (un) | ||||||||||

| Cuidado de la salud – 8.4% |

|

|||||||||||||||

|

Cuidado de la salud |

|

|||||||||||||||

|

Immucor Inc., Notas Senior |

11.125 | % | 15/2/22 | 3,700,000 | 3.720.350 | (a) (b) | ||||||||||

Ver notas a Financial

Declaraciones

| Western Seset Middle Market Income Fund Inc. Informe semestral de 2019 | 3 |

Calendario de inversiones

(sin auditar) (cont.)

31 de octubre de 2019

Western Asset Middle Market Income Fund Inc.

| Seguridad | Velocidad |

Madurez Fecha |

Cara Cantidad† |

Valor | ||||||||||||

|

Cuidado de la salud |

|

|||||||||||||||

|

Air Medical Group Holdings Inc., Notas Senior |

6.375 | % | 15/5/23 | 4.860.000 | PS | 4,155,300 | (a) (b) | |||||||||

|

MPH Acquisition Holdings LLC, Notas Senior |

7.125 | % | 1/6/24 | 2,000,000 | 1,860,100 | (a) (b) | ||||||||||

|

Tenet Healthcare Corp., Notas Senior |

8.125 | % | 4/1/22 | 690,000 | 748,685 | |||||||||||

|

Total de proveedores de atención médica y |

6.764.085 | |||||||||||||||

|

Productos farmacéuticos |

|

|||||||||||||||

|

Bausch Health Cos. Inc., Notas Senior |

5.875 | % | 15/5/23 | 934,000 | 951,513 | (a) (b) | ||||||||||

|

Bausch Health Cos. Inc., Notas Senior |

6.125 | % | 15/4/25 | 280,000 | 291,375 | (un) | ||||||||||

|

Bausch Health Cos. Inc., Notas Senior |

9,000 | % | 15/12/25 | 1,010,000 | 1,137,714 | (un) | ||||||||||

|

Total de productos farmacéuticos |

2,380,602 | |||||||||||||||

|

Total Health Care |

12,865,037 | |||||||||||||||

| Industriales – 10.2% |

|

|||||||||||||||

|

Servicios comerciales & |

|

|||||||||||||||

|

Garda World Security Corp., Notas Senior |

7.250 | % | 15/11/21 | 2,610,000 | 2,614,567 | (a) (b) | ||||||||||

|

Waste Pro USA Inc., Notas principales |

5.500 | % | 15/2/26 | 3,090,000 | 3.205.875 | (a) (b) | ||||||||||

|

Servicios comerciales totales y |

5,820,442 | |||||||||||||||

|

Maquinaria |

|

|||||||||||||||

|

Cleaver-Brooks Inc., Notas garantizadas senior |

7.875 | % | 1/3/23 | 460,000 | 435,850 | (un) | ||||||||||

|

MAI Holdings Inc., pagarés senior garantizados |

9.500 | % | 1/6/23 | 1,320,000 | 561,000 | |||||||||||

|

Maquinaria total |

996,850 | |||||||||||||||

|

Marina – |

|

|||||||||||||||

|

Navios Maritime Acquisition Corp./ Navios Acquisition Finance U.S. Inc., Senior Secured |

8.125 | % | 15/11/21 | 3,390,000 | 2,779,800 | (a) (b) | ||||||||||

|

Carretera y ferrocarril – |

|

|||||||||||||||

|

Flexi-Van Leasing Inc., Notas garantizadas |

10.000 | % | 15/2/23 | 3,120,000 | 2.979.600 | (a) (b) | ||||||||||

|

Companías comerciales & |

|

|||||||||||||||

|

Ahern Rentals Inc., Notas garantizadas |

7.375 | % | 15/5/23 | 980,000 | 798,700 | (a) (b) | ||||||||||

|

Emeco Pty Ltd., Bonos Senior Garantizados |

9.250 | % | 31/3/22 | 1,978,824 | 2,095,575 | (si) | ||||||||||

|

Total de empresas comerciales y |

2,894,275 | |||||||||||||||

|

Industriales totales |

15,470,967 | |||||||||||||||

Ver notas a Financial

Declaraciones

| 4 4 | Western Seset Middle Market Income Fund Inc. Informe semestral de 2019 |

Western Asset Middle Market Income Fund Inc.

| Seguridad | Velocidad |

Madurez Fecha |

Cara Cantidad† |

Valor | ||||||||||||

| Tecnología de la información – 2.8% | ||||||||||||||||

|

Software – 2.8% |

||||||||||||||||

|

Fair Isaac Corp., Notas Senior |

5.250 | % | 15/5/26 | 3,645,000 | PS | 3.973.050 | (a) (b) | |||||||||

|

Interface Special Holdings Inc., Senior Notes (19.000% PIK) |

19.000 | % | 1/11/23 | 3,310,046 | 248,253 | (a) (c) (d) (e) | ||||||||||

|

Tecnología de información total |

4,221,303 | |||||||||||||||

| Materiales – 3.1% |

|

|||||||||||||||

|

Productos químicos |

|

|||||||||||||||

|

Techniplas LLC, Notas garantizadas senior |

10.000 | % | 1/5/20 | 2,080,000 | 1,768,000 | (a) (b) | ||||||||||

|

Metales y Minería – |

|

|||||||||||||||

|

Northwest Adquisitions ULC / Dominion Finco Inc., Notas garantizadas |

7.125 | % | 1/11/22 | 410,000 | 206,025 | (un) | ||||||||||

|

Papel y bosque |

|

|||||||||||||||

|

Mercer International Inc., Notas Senior |

6.500 | % | 2/1/24 | 1,000,000 | 1,033,750 | (si) | ||||||||||

|

Mercer International Inc., Notas Senior |

7.375 | % | 15/1/25 | 720,000 | 748,800 | (a) | ||||||||||

|

Mercer International Inc., Senior Notes |

5.500 | % | 1/15/26 | 1,000,000 | 973,080 | |||||||||||

|

Total Paper & Forest |

2,755,630 | |||||||||||||||

|

Total Materials |

4,729,655 | |||||||||||||||

| Real Estate — 2.6% |

|

|||||||||||||||

|

Bienes raíces |

|

|||||||||||||||

|

Five Point Operating Co. LP/Five Point Capital Corp., Senior Notes |

7.875 | % | 11/15/25 | 2,030,000 | 1,923,770 | (a) | ||||||||||

|

Kennedy-Wilson Inc., Senior Notes |

5.875 | % | 4/1/24 | 2,000,000 | 2,080,000 | (b) | ||||||||||

|

Total Real Estate |

4,003,770 | |||||||||||||||

|

Total Corporate Bonds & Notes (Cost — |

|

116,091,751 | ||||||||||||||

| Senior Loans — 35.5% |

|

|||||||||||||||

| Communication Services — 1.0% |

|

|||||||||||||||

|

Diversified Telecommunication |

|

|||||||||||||||

|

Securus Technologies Holdings Inc., First Lien Initial Term Loan |

6.286 | % | 11/1/24 | 1,960,025 | 1,543,520 | (f)(g)(h) | ||||||||||

| Consumer Discretionary — 10.9% |

|

|||||||||||||||

|

Commercial Services & |

|

|||||||||||||||

|

Garda World Security Corp., First Lien Term Loan B |

— | 10/23/26 | 2,000,000 | 1,991,250 | (i) | |||||||||||

|

KC Culinarte Intermediate LLC, First Lien Initial Term Loan |

5.560 | % | 8/25/25 | 1,989,900 | 1,972,488 | (f)(g)(h) | ||||||||||

|

Total Commercial Services & |

3,963,738 | |||||||||||||||

See Notes to Financial

Statements.

| Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report | 5 5 |

Schedule of investments

(unaudited) (cont’d)

October 31, 2019

Western Asset Middle Market Income Fund Inc.

| Seguridad | Rate |

Maturity Fecha |

Face Amount† |

Valor | ||||||||||||

|

Hotels, Restaurants & Leisure |

||||||||||||||||

|

Affinity Gaming LLC, Second Lien Initial Term Loan (1 mo. USD LIBOR +8.250%) |

10.036 | % | 1/31/25 | 3,990,000 | $ | 3,832,894 | (f)(g)(h) | |||||||||

|

CEC Entertainment Inc., Term Loan B (1 mo. USD LIBOR +6.500%) |

8.286 | % | 8/17/26 | 2,030,000 | 1,951,338 | (f)(g)(h) | ||||||||||

|

Station Casinos LLC, Term Loan Facility B (1 mo. USD LIBOR +2.500%) |

4.290 | % | 6/8/23 | 1,989,627 | 1,994,827 | (f)(g)(h) | ||||||||||

|

Total Hotels, Restaurants & |

7,779,059 | |||||||||||||||

|

Specialty Retail — |

||||||||||||||||

|

Isagenix International LLC, Term Loan (3 mo. USD LIBOR +5.750%) |

7.850 | % | 6/16/25 | 1,874,466 | 1,440,214 | (f)(g)(h) | ||||||||||

|

Spencer Spirit IH LLC, Initial Term Loan |

5.000-7.846 | % | 6/12/26 | 1,980,000 | 1,940,400 | (f)(g)(h) | ||||||||||

|

Total Specialty Retail |

3,380,614 | |||||||||||||||

|

Textiles, Apparel & Luxury Goods |

||||||||||||||||

|

TOMS Shoes LLC, Initial Term Loan (3 mo. USD LIBOR +5.500%) |

7.430 | % | 10/30/20 | 2,442,355 | 1,581,425 | (f)(g)(h) | ||||||||||

|

Total Consumer Discretionary |

16,704,836 | |||||||||||||||

| Consumer Staples — 4.1% | ||||||||||||||||

|

Food Products — |

||||||||||||||||

|

8th Avenue Food & Provisions Inc., Second Lien Term Loan (3 mo. USD LIBOR + |

9.690 | % | 10/1/26 | 2,720,000 | 2,713,200 | (d)(f)(g)(h) | ||||||||||

|

CSM Bakery Solutions LLC, Second Lien Term Loan (3 mo. USD LIBOR +7.750%) |

9.780 | % | 7/5/21 | 4,000,000 | 3,580,000 | (d)(f)(g)(h) | ||||||||||

|

Total Consumer Staples |

6,293,200 | |||||||||||||||

| Financials — 4.1% | ||||||||||||||||

|

Diversified Financial Services — |

||||||||||||||||

|

GI Revelation Acquisition LLC, First Lien Term Loan (1 mo. USD |

6.786 | % | 4/16/25 | 1,984,875 | 1,858,339 | (f)(g)(h) | ||||||||||

|

Insurance — 2.9% |

||||||||||||||||

|

AIS Holdco LLC, First Lien Term Loan (3 mo. USD LIBOR +5.000%) |

6.927 | % | 8/15/25 | 3,256,500 | 3,061,110 | (d)(f)(g)(h) | ||||||||||

|

AmeriLife Group LLC, First Lien Delayed Draw Term Loan |

— | 6/12/26 | 160,877 | 160,676 | (i) | |||||||||||

|

AmeriLife Group LLC, First Lien Initial Term Loan (1 mo. USD LIBOR +4.500%) |

6.286 | % | 6/12/26 | 1,146,250 | 1,144,817 | (f)(g)(h) | ||||||||||

|

Total Insurance |

4,366,603 | |||||||||||||||

|

Total Financials |

6,224,942 | |||||||||||||||

See Notes to Financial Statements.

| 6 6 | Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report |

Western Asset Middle Market Income Fund Inc.

| Seguridad | Rate |

Maturity Fecha |

Face Amount† |

Valor | ||||||||||||

| Health Care — 5.7% | ||||||||||||||||

|

Health Care Equipment & Supplies |

||||||||||||||||

|

Air Methods Corp., Initial Term Loan (3 mo. USD LIBOR +3.500%) |

5.604 | % | 4/22/24 | 993,960 | $ | 795,583 | (f)(g)(h) | |||||||||

|

Health Care Providers & Services |

||||||||||||||||

|

Medical Solutions Holdings Inc., First Lien Closing Date Term Loan (1 mo. USD |

6.286 | % | 6/14/24 | 2,030,000 | 2,022,388 | (f)(g)(h) | ||||||||||

|

MPH Acquisition Holdings LLC, Initial Term Loan (3 mo. USD LIBOR +2.750%) |

4.854 | % | 6/7/23 | 1,480,000 | 1,392,356 | (f)(g)(h) | ||||||||||

|

Option Care Health Inc., First Lien Term Loan B (1 mo. USD LIBOR +4.500%) |

6.286 | % | 8/6/26 | 2,000,000 | 1,970,000 | (d)(f)(g)(h) | ||||||||||

|

Radnet Management Inc., First Lien Term Loan B1 |

5.510-7.500 | % | 6/30/23 | 1,185,143 | 1,184,031 | (f)(g)(h) | ||||||||||

|

Total Health Care Providers & |

6,568,775 | |||||||||||||||

|

Pharmaceuticals — |

|

|||||||||||||||

|

Pearl Intermediate Parent LLC, Second Lien Initial Term Loan (1 mo. USD |

8.036 | % | 2/13/26 | 1,350,000 | 1,317,937 | (f)(g)(h) | ||||||||||

|

Total Health Care |

8,682,295 | |||||||||||||||

| Information Technology — 6.2% |

|

|||||||||||||||

|

IT Services — |

|

|||||||||||||||

|

Access CIG LLC, Second Lien Initial Term Loan (1 mo. USD LIBOR +7.750%) |

9.536 | % | 2/13/26 | 3,470,984 | 3,453,629 | (f)(g)(h) | ||||||||||

|

Datto Inc., Term Loan (1 mo. USD LIBOR +4.250%) |

6.036 | % | 4/2/26 | 1,965,075 | 1,980,632 | (f)(g)(h) | ||||||||||

|

Project Alpha Intermediate Holding Inc., 2019 Incremental Term Loan (3 mo. USD |

6.240 | % | 4/26/24 | 1,965,075 | 1,962,619 | (f)(g)(h) | ||||||||||

|

Total IT Services |

7,396,880 | |||||||||||||||

|

Software — |

|

|||||||||||||||

|

DigiCert Holdings Inc., First Lien Initial Term Loan |

— | 10/16/26 | 2,030,000 | 1,995,322 | (i) | |||||||||||

|

Total Information Technology |

9,392,202 | |||||||||||||||

| Real Estate — 1.7% |

|

|||||||||||||||

|

Real Estate Management & |

||||||||||||||||

|

Coastal Construction Corp., Delayed Draw Term Loan |

— | 9/4/24 | 670,000 | 651,106 | (c)(d)(i) | |||||||||||

|

Coastal Construction Products LLC, Term Loan B (3 mo. USD LIBOR +5.375%) |

7.325 | % | 9/4/24 | 1,980,850 | 1,924,990 | (c)(d)(f)(g)(h) | ||||||||||

|

Total Real Estate |

2,576,096 | |||||||||||||||

See Notes to Financial

Statements.

| Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report | 7 7 |

Schedule of investments

(unaudited) (cont’d)

October 31, 2019

Western Asset Middle Market Income Fund Inc.

|

Seguridad |

Rate | Maturity Fecha |

Face Amount† |

Valor | ||||||||||||

| Utilities — 1.8% | ||||||||||||||||

|

Electric Utilities — |

||||||||||||||||

|

Panda Temple Power LLC, Second Lien Term Loan (2 mo. USD LIBOR +8.000% |

10.054 | % | 2/7/23 | 2,673,796 | $ | 2,688,836 | (e)(f)(g)(h) | |||||||||

|

Total Senior Loans (Cost — |

54,105,927 | |||||||||||||||

| Shares | ||||||||||||||||

| Investments in Underlying Funds — 2.4% | ||||||||||||||||

|

SPDR Bloomberg Barclays Short Term High Yield Bond ETF |

135,000 | 3,616,650 | ||||||||||||||

| Common Stocks — 2.3% | ||||||||||||||||

| Energy — 0.9% | ||||||||||||||||

|

Oil, Gas & Consumable Fuels |

||||||||||||||||

|

Berry Petroleum Corp. |

94,787 | 890,050 | ||||||||||||||

|

Downstream Development Authority of the Quapaw Tribe of Oklahoma Escrow |

3,830,000 | 0 0 | * *(b)(c)(d)(j) | |||||||||||||

|

Montage Resources Corp. |

92,531 | 418,240 | * * | |||||||||||||

|

Total Energy |

1,308,290 | |||||||||||||||

| Health Care — 0.1% | ||||||||||||||||

|

Health Care Providers & Services |

||||||||||||||||

|

Option Care Health Inc. |

59,045 | 209,019 | * * | |||||||||||||

| Utilities — 1.3% | ||||||||||||||||

|

Electric Utilities — |

||||||||||||||||

|

Panda Temple Power LLC |

91,433 | 2,011,526 | * *(d) |

|||||||||||||

|

Total Common Stocks (Cost — |

3,528,835 | |||||||||||||||

| Rate | ||||||||||||||||

| Preferred Stocks — 1.3% | ||||||||||||||||

| Financials — 1.3% | ||||||||||||||||

|

Capital Markets — |

||||||||||||||||

|

B. Riley Financial Inc. (Cost — $1,997,500) |

6.875 | % | 79,900 | 2,055,028 | (b) | |||||||||||

|

Expiration Fecha |

Warrants | |||||||||||||||

| Warrants — 0.4% | ||||||||||||||||

|

Option Care Health Inc. (Cost — $94,113) |

6/29/27 | 263,683 | 683,730 | * *(c)(d) |

||||||||||||

|

Total Investments before Short-Term Investments |

|

180,081,921 | ||||||||||||||

See Notes to Financial

Statements.

| 8 | Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report |

Western Asset Middle Market Income Fund Inc.

| Seguridad |

Rate |

Maturity Fecha |

Face Amount† |

Valor | ||||||||||||

| Short-Term Investments — 4.3% | ||||||||||||||||

| Repurchase Agreements — 1.6% | ||||||||||||||||

|

Bank of America Corp. repurchase agreement dated 10/31/19; Proceeds at maturity — |

1.730 | % | 11/1/19 | 2,500,000 | 2,500,000 | |||||||||||

| Shares | ||||||||||||||||

| Money Market Funds — 2.7% | ||||||||||||||||

|

Dreyfus Government Cash Management, Institutional Shares (Cost — $4,027,603) |

1.691 | % | 4,027,603 | $ | 4,027,603 | |||||||||||

|

Total Short-Term Investments (Cost — |

6,527,603 | |||||||||||||||

|

Total Investments — 122.3% (Cost — |

186,609,524 | |||||||||||||||

|

Liabilities in Excess of Other Assets — (22.3)% |

(33,993,668 | ) | ||||||||||||||

|

Total Net Assets — 100.0% |

$ | 152,615,856 | ||||||||||||||

| † |

Face amount denominated in U.S. dollars, unless otherwise noted. |

| * * |

Non-income producing security. |

| (a) |

Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in |

| (b) |

All or a portion of this security is pledged as collateral pursuant to the loan agreement (Note 6). |

| (c) |

Security is valued in good faith in accordance with procedures approved by the Board of Directors (Note 1). |

| (d) |

Security is valued using significant unobservable inputs (Note 1). |

| (e) |

Payment-in-kind security for which the |

| (f) |

Interest rates disclosed represent the effective rates on senior loans. Ranges in interest rates are attributable to |

| (g) |

Senior loans may be considered restricted in that the Fund ordinarily is contractually obligated to receive approval from |

| (h) |

Variable rate security. Interest rate disclosed is as of the most recent information available. Certain variable rate |

| (i) |

All or a portion of this loan is unfunded as of October 31, 2019. The interest rate for fully unfunded term loans is to be |

| (j) |

Value is less than $1. |

See Notes to Financial Statements.

| Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report | 9 9 |

Schedule of investments

(unaudited) (cont’d)

October 31, 2019

Western Asset Middle Market Income Fund Inc.

|

Abbreviations used in this |

||

| CAD | — Canadian Dollar | |

| ETF | — Exchange-Traded Fund | |

| LIBOR | — London Interbank Offered Rate | |

| PIK | — Payment-In-Kind | |

| SPDR | — Standard & Poor’s Depositary Receipts | |

| USD | — United States Dollar | |

At October 31, 2019, the Fund had the following open forward foreign currency contracts:

|

Currency Purchased |

Currency Sold |

Counterparty |

Asentamiento Fecha |

Unrealized Depreciation |

||||||||||

| USD 2,671,736 | CAD 3,555,941 | Barclays Bank PLC | 1/17/20 | $ | (29,269 | ) | ||||||||

|

Abbreviations used in this |

||

| CAD | — Canadian Dollar | |

| USD | — United States Dollar | |

See Notes to Financial

Statements.

| 10 | Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report |

Statement of assets and liabilities (unaudited)

31 de octubre de 2019

| Assets: | ||||

|

Investments, at value (Cost — $200,971,162) |

$ | 186,609,524 | ||

|

Foreign currency, at value (Cost — $116,937) |

117,208 | |||

|

Cash |

45,601 | |||

|

Interest receivable |

3,310,682 | |||

|

Prepaid expenses |

2,569 | |||

|

Total Assets |

190,085,584 | |||

| Liabilities: | ||||

|

Loan payable (Note 6) |

32,300,000 | |||

|

Payable for securities purchased |

4,813,266 | |||

|

Investment management fee payable |

182,662 | |||

|

Unrealized depreciation on forward foreign currency contracts |

29,269 | |||

|

Interest payable |

27,976 | |||

|

Directors’ fees payable |

15,602 | |||

|

Accrued expenses |

100,953 | |||

|

Total Liabilities |

37,469,728 | |||

| Total Net Assets | $ | 152,615,856 | ||

| Net Assets: | ||||

|

Par value ($0.001 par value; 214,026 shares issued and outstanding; 100,000,000 shares |

$ | 214 | ||

|

Paid-in capital in excess of par value |

239,471,211 | |||

|

Total distributable earnings (loss) |

(86,855,569) | |||

| Total Net Assets | $ | 152,615,856 | ||

| Shares Outstanding | 214,026 | |||

| Net Asset Value | $713.07 | |||

See Notes to Financial

Statements.

| Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report | 11 |

Statement of operations (unaudited)

For the Six Months Ended October 31, 2019

| Investment Income: | ||||

|

Interest |

$ | 7,791,165 | ||

|

Dividends |

173,296 | |||

|

Income from non-cash interest |

503,612 | |||

|

Total Investment |

8,468,073 | |||

| Expenses: | ||||

|

Investment management fee (Note 2) |

1,193,911 | |||

|

Interest expense (Note 6) |

371,548 | |||

|

Transfer agent fees |

62,252 | |||

|

Audit and tax fees |

38,591 | |||

|

Fund accounting fees |

37,099 | |||

|

Directors’ fees |

24,802 | |||

|

Legal fees |

19,470 | |||

|

Shareholder reports |

12,654 | |||

|

Custody fees |

3,161 | |||

|

Seguro |

1,876 | |||

|

Miscellaneous expenses |

7,448 | |||

|

Total Expenses |

1,772,812 | |||

|

Less: Fee waivers and/or expense reimbursements (Note 2) |

(95,513) | |||

|

Net Expenses |

1,677,299 | |||

| Net Investment Income | 6,790,774 | |||

|

Realized and Unrealized Gain (Loss) on Investments, Forward Foreign Contracts and Foreign Currency Transactions (Notes 1, 3 and 4): |

||||

|

Net Realized Gain (Loss) From: |

||||

|

Investment transactions |

(892,920) | |||

|

Forward foreign currency contracts |

12,232 | |||

|

Foreign currency transactions |

880 | |||

|

Net Realized Loss |

(879,808) | |||

|

Change in Net Unrealized Appreciation (Depreciation) From: |

||||

|

Investments |

(7,311,847) | |||

|

Forward foreign currency contracts |

(47,194) | |||

|

Foreign currencies |

942 | |||

|

Change in Net Unrealized Appreciation |

(7,358,099) | |||

| Net Loss on Investments, Forward Foreign Currency Contracts and Foreign Currency Transactions | (8,237,907) | |||

| Decrease in Net Assets From Operations | $ | (1,447,133) | ||

See Notes to Financial

Statements.

| 12 | Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report |

Statements of changes in net assets

| For the Six Months Ended October 31, 2019 (unaudited) and the Year Ended April 30, 2019 |

October 31 | April 30 | ||||||

| Operations: | ||||||||

|

Net investment income |

$ | 6,790,774 | $ | 17,096,536 | ||||

|

Net realized loss |

(879,808) | (4,222,411) | ||||||

|

Change in net unrealized appreciation (depreciation) |

(7,358,099) | 1,953,843 | ||||||

|

Increase (Decrease) in Net Assets From |

(1,447,133) | 14,827,968 | ||||||

| Distributions to Shareholders From (Note 1): | ||||||||

|

Total distributable earnings |

(6,880,343) | (17,432,726) | ||||||

|

Decrease in Net Assets From Distributions |

(6,880,343) | (17,432,726) | ||||||

| Fund Share Transactions: | ||||||||

|

Reinvestment of distributions (1,043 and 2,417 shares issued, respectively) |

757,522 | 1,808,289 | ||||||

|

Cost of shares repurchased through tender offer (18,143 and 32,435 shares repurchased, |

(13,144,983) | (24,195,474) | ||||||

|

Decrease in Net Assets From Fund Share |

(12,387,461) | (22,387,185) | ||||||

|

Decrease in Net |

(20,714,937) | (24,991,943) | ||||||

| Net Assets: | ||||||||

|

Beginning of period |

173,330,793 | 198,322,736 | ||||||

|

End of period |

$ | 152,615,856 | $ | 173,330,793 | ||||

See Notes to Financial

Statements.

| Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report | 13 |

Statement of cash flows (unaudited)

For the Six Months Ended October 31, 2019

| Increase (Decrease) in Cash: | ||||

| Cash Provided (Used) by Operating Activities: |

|

|||

|

Net decrease in net assets resulting from operations |

$ | (1,447,133) | ||

|

Adjustments to reconcile net decrease in net assets resulting from operations to net provided (used) by operating activities: |

||||

|

Purchases of portfolio securities |

(49,077,236) | |||

|

Sales of portfolio securities |

51,131,444 | |||

|

Net purchases, sales and maturities of short-term investments |

(2,358,461) | |||

|

Payment-in-kind |

(503,612) | |||

|

Net amortization of premium (accretion of discount) |

(719,131) | |||

|

Decrease in receivable for securities sold |

2,932,878 | |||

|

Decrease in interest receivable |

107,553 | |||

|

Increase in prepaid expenses |

(1,271) | |||

|

Increase in payable for securities purchased |

2,148,266 | |||

|

Decrease in investment management fee payable |

(3,401) | |||

|

Increase in Directors’ fees payable |

2,628 | |||

|

Increase in interest payable |

5,293 | |||

|

Decrease in accrued expenses |

(39,165) | |||

|

Net realized loss on investments |

892,920 | |||

|

Change in net unrealized appreciation (depreciation) of investments and forward foreign currency contracts |

7,359,041 | |||

|

Net Cash Provided by Operating |

10,430,613 | |||

| Cash Flows From Financing Activities: | ||||

|

Distributions paid on common stock |

(6,122,821) | |||

|

Proceeds from loan facility borrowings |

39,000,000 | |||

|

Repayment of loan facility borrowings |

(30,000,000) | |||

|

Payment for shares repurchased through tender offer |

(13,144,983) | |||

|

Net Cash Used in Financing |

(10,267,804) | |||

| Net Increase in Cash and Restricted Cash | 162,809 | |||

| Cash and restricted cash at beginning of period | — | |||

| Cash and restricted cash at end of period | $ | 162,809 | ||

| * * |

Included in operating expenses is cash of $366,255 paid for interest on borrowings. |

|

The following table provides a reconciliation of cash and restricted cash reported within the Statement of Assets and |

| October 31, 2019 | ||||

| Cash | $ | 162,809 | ||

| Restricted cash | — | |||

| Total cash and restricted cash shown in the Statement of Cash Flows | $ | 162,809 | ||

| Non-Cash Financing Activities: | ||||

|

Proceeds from reinvestment of distributions |

$ | 757,522 | ||

See Notes to Financial

Statements.

| 14 | Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report |

| For a share of capital stock outstanding throughout each year ended April 30, unless otherwise noted: | ||||||||||||||||||||||||

| 20191,2 | 20191 | 20181 | 20171 | 20161 | 20151,3 | |||||||||||||||||||

| Net asset value, beginning of period | $749.94 | $759.44 | $799.71 | $708.75 | $915.01 | $998.00 | 4 4 | |||||||||||||||||

| Income (loss) from operations: |

|

|||||||||||||||||||||||

|

Net investment income |

30.36 | 68.47 | 76.58 | 87.83 | 86.64 | 50.82 | ||||||||||||||||||

|

Net realized and unrealized gain (loss) |

(36.84) | (8.83) | (38.51) | 93.13 | (202.90) | (92.81) | ||||||||||||||||||

|

Total income (loss) from |

(6.48) | 59.64 | 38.07 | 180.96 | (116.26) | (41.99) | ||||||||||||||||||

| Less distributions from: | ||||||||||||||||||||||||

|

Net investment income |

(30.39) | 5 5 | (69.14) | (78.34) | (90.00) | (90.00) | (41.00) | |||||||||||||||||

|

Total |

(30.39) | (69.14) | (78.34) | (90.00) | (90.00) | (41.00) | ||||||||||||||||||

| Net asset value, end of period | $713.07 | $749.94 | $759.44 | $799.71 | $708.75 | $915.01 | ||||||||||||||||||

|

Total return, based on NAV6 6 |

(0.91) | % | 8.20 | % | 5.04 | % | 26.72 | % | (12.74) | % | (4.11) | % | ||||||||||||

| Net assets, end of period (millions) | $153 | $173 | $198 | $229 | $222 | $291 | ||||||||||||||||||

| Ratios to average net assets: | ||||||||||||||||||||||||

|

Gross expenses |

2.14 | %7 7 | 2.29 | % | 2.36 | % | 2.45 | % | 1.83 | % | 1.55 | %7 7 | ||||||||||||

|

Net expenses |

2.03 | 7,8 | 2.17 | 8 | 2.23 | 8 | 2.40 | 8 | 1.83 | 1.55 | 7 7 | |||||||||||||

|

Net investment income |

8.20 | 7 7 | 8.98 | 9.81 | 11.37 | 11.20 | 7.99 | 7 7 | ||||||||||||||||

| Portfolio turnover rate | 26 | % | 28 | % | 32 | % | 51 | % | 39 | % | 29 | % | ||||||||||||

| Supplemental data: |

|

|||||||||||||||||||||||

|

Loan Outstanding, End of Period (000s) |

$32,300 | $23,300 | $47,400 | $94,000 | $53,000 | $53,000 | ||||||||||||||||||

|

Asset Coverage Ratio for Loan |

572 | % | 844 | % | 518 | % | 343 | % | 518 | % | 649 | % | ||||||||||||

|

Asset Coverage, per $1,000 Principal Amount of Loan Outstanding9 9 |

$5,725 | $8,439 | $5,184 | $3,431 | $5,181 | $6,486 | ||||||||||||||||||

|

Weighted Average Loan (000s) |

$25,335 | $36,567 | $58,175 | $88,175 | $53,000 | $40,118 | 10 | |||||||||||||||||

|

Weighted Average Interest Rate on Loan |

2.92 | % | 3.00 | % | 2.08 | % | 1.37 | % | 1.00 | % | 0.89 | %10 | ||||||||||||

See Notes to Financial

Statements.

| Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report | 15 |

Financial highlights (cont’d)

| 1 |

Per share amounts have been calculated using the average shares method. |

| 2 |

For the six months ended October 31, 2019 (unaudited). |

| 3 |

For the period August 26, 2014 (commencement of operations) to April 30, 2015. |

| 4 4 |

Initial public offering price of $1,000.00 per share, exclusive of sales load, less offering costs of $2.00 per share. |

| 5 5 |

The actual source of the Fund’s current fiscal year distributions may be from net investment income, return of |

| 6 6 |

Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. En el |

| 8 |

Reflects fee waivers and/or expense reimbursements. |

| 9 9 |

Represents value of net assets plus the loan outstanding at the end of the period divided by the loan outstanding at the |

| 10 |

Weighted average based on the number of days that the Fund had a loan outstanding. |

See Notes to Financial Statements.

| dieciséis | Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report |

Notes to financial statements (unaudited)

1. Organization and significant accounting policies

Western Asset Middle Market Income Fund Inc. (the “Fund”) was incorporated in Maryland on June 29, 2011 and is registered as a non-diversified,

limited-term closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund commenced operations on August 26, 2014. The Fund’s

primary investment objective is to provide high income. As a secondary objective, the Fund seeks capital appreciation. The Fund seeks to achieve its investment objectives by investing, under normal market conditions, at least 80% of its managed

assets (the net assets of the Fund plus the principal amount of any borrowings and any preferred stock that may be outstanding) in securities, including loans, issued by middle market companies. For investment purposes, “middle market”

refers to companies with annual revenues of between $100 million and $1 billion at the time of investment by the Fund. Securities of middle market issuers are typically considered below investment grade (also commonly referred to as

“junk bonds”). It is anticipated that the Fund will terminate on or before December 30, 2022. Upon its termination, it is anticipated that the Fund will have distributed substantially all of its net assets to stockholders, although

securities for which no market exists or securities trading at depressed prices, if any, may be placed in a liquidating trust.

On October 31, 2019, the Board

of Directors of the Fund approved amendments to the Fund’s bylaws. The amended and restated bylaws were subsequently filed on Form 8-K and are available on the SEC’s website at www.sec.gov.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles

(“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets

and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. The valuations for fixed income securities (which

may include, but are not limited to, corporate, government, municipal, mortgage-backed, collateralized mortgage obligations and asset-backed securities) and certain derivative instruments are typically the prices supplied by independent third party

pricing services, which may use market prices or broker/dealer quotations or a variety of valuation techniques and methodologies. The independent third party pricing services use inputs that are observable such as issuer details, interest rates,

yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar securities. Investments in open-end funds are valued at the closing net asset value per share of each fund on

the day of valuation. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. When the Fund holds securities or other

assets that are denominated in a foreign currency, the Fund will normally use the currency exchange rates as of 4:00 p.m. (Eastern Time). If independent

| Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report | 17 |

Notes to financial statements

(unaudited) (cont’d)

third party pricing services are unable to supply prices for a portfolio investment, or if the

prices supplied are deemed by the manager to be unreliable, the market price may be determined by the manager using quotations from one or more broker/dealers or at the transaction price if the security has recently been purchased and no value has

yet been obtained from a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the

security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Directors.

The Board of Directors is responsible for the valuation process and has delegated the supervision of the daily valuation process to the Legg Mason North Atlantic Fund

Valuation Committee (the “Valuation Committee”). The Valuation Committee, pursuant to the policies adopted by the Board of Directors, is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s

pricing policies, and reporting to the Board of Directors. When determining the reliability of third party pricing information for investments owned by the Fund, the Valuation Committee, among other things, conducts due diligence reviews of pricing

vendors, monitors the daily change in prices and reviews transactions among market participants.

The Valuation Committee will consider pricing methodologies it

deems relevant and appropriate when making fair value determinations. Examples of possible methodologies include, but are not limited to, multiple of earnings; discount from market of a similar freely traded security; discounted cash-flow analysis;

book value or a multiple thereof; risk premium/yield analysis; yield to maturity; and/or fundamental investment analysis. The Valuation Committee will also consider factors it deems relevant and appropriate in light of the facts and circumstances.

Examples of possible factors include, but are not limited to, the type of security; the issuer’s financial statements; the purchase price of the security; the discount from market value of unrestricted securities of the same class at the time

of purchase; analysts’ research and observations from financial institutions; information regarding any transactions or offers with respect to the security; the existence of merger proposals or tender offers affecting the security; the price

and extent of public trading in similar securities of the issuer or comparable companies; and the existence of a shelf registration for restricted securities.

For

each portfolio security that has been fair valued pursuant to the policies adopted by the Board of Directors, the fair value price is compared against the last available and next available market quotations. The Valuation Committee reviews the

results of such back testing monthly and fair valuation occurrences are reported to the Board of Directors quarterly.

The Fund uses valuation techniques to measure

fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by

| 18 años | Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report |

market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are

summarized in the three broad levels listed below:

| • |

Level 1 — quoted prices in active markets for identical investments |

| • |

Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, |

| • |

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of |

The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those

securities.

The following is a summary of the inputs used in valuing the Fund’s assets and liabilities carried at fair value:

| ASSETS | ||||||||||||||||

| Descripción | Quoted Prices (Level 1) |

Other Significant Observable Inputs (Level 2) |

Significant Unobservable |

Total | ||||||||||||

| Long-Term Investments†: | ||||||||||||||||

|

Corporate Bonds & Notes: |

||||||||||||||||

|

Information Technology |

— | $ | 3,973,050 | $ | 248,253 | $ | 4,221,303 | |||||||||

|

Other Corporate Bonds & Notes |

— | 111,870,448 | — | 111,870,448 | ||||||||||||

|

Senior Loans: |

||||||||||||||||

|

Consumer Staples |

— | — | 6,293,200 | 6,293,200 | ||||||||||||

|

Financials |

— | 3,163,832 | 3,061,110 | 6,224,942 | ||||||||||||

|

Health Care |

— | 6,712,295 | 1,970,000 | 8,682,295 | ||||||||||||

|

Bienes raíces |

— | — | 2,576,096 | 2,576,096 | ||||||||||||

|

Other Senior Loans |

— | 30,329,394 | — | 30,329,394 | ||||||||||||

|

Investments in Underlying Funds |

$ | 3,616,650 | — | — | 3,616,650 | |||||||||||

|

Common Stocks: |

||||||||||||||||

|

Energy |

1,308,290 | — | 0 0 | * * | 1,308,290 | |||||||||||

|

Health Care |

209,019 | — | — | 209,019 | ||||||||||||

|

Utilities |

— | — | 2,011,526 | 2,011,526 | ||||||||||||

|

Preferred Stocks |

2,055,028 | — | — | 2,055,028 | ||||||||||||

|

Warrants |

— | — | 683,730 | 683,730 | ||||||||||||

| Total Long-Term Investments | 7,188,987 | 156,049,019 | 16,843,915 | 180,081,921 | ||||||||||||

| Short-Term Investments!: | ||||||||||||||||

|

Repurchase Agreements |

— | 2,500,000 | — | 2,500,000 | ||||||||||||

|

Money Market Funds |

4,027,603 | — | — | 4,027,603 | ||||||||||||

| Total Short-Term Investments | 4,027,603 | 2,500,000 | — | 6,527,603 | ||||||||||||

| Total Investments | $ | 11,216,590 | $ | 158,549,019 | $ | 16,843,915 | $ | 186,609,524 | ||||||||

| Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report | 19 |

Notes to financial statements

(unaudited) (cont’d)

| LIABILITIES | ||||||||||||||||

| Descripción |

Quoted Prices (Level 1) |

Other Significant Observable Inputs (Level 2) |

Significant Unobservable (Level 3) |

Total | ||||||||||||

| Other Financial Instruments: | ||||||||||||||||

|

Forward Foreign Currency Contracts |

— | $ | 29,269 | — | $ | 29,269 | ||||||||||

| † |

See Schedule of Investments for additional detailed categorizations. |

| * * |

Amount represents less than $1. |

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| Investments in Securities |

Balance as of April 30, 2019 |

Accrued premiums/ discounts |

Realized gain (loss)1 |

Change in unrealized appreciation (depreciation)2 |

Purchases | |||||||||||||||

| Corporate Bonds & Notes: | ||||||||||||||||||||

|

Energy |

$ | 0 0 | * * | — | $ | 0 0 | * * | — | — | |||||||||||

|

Health Care |

4,246,529 | $ | 5,894 | 650,219 | $ | (456,830) | $ | 183,577 | ||||||||||||

|

Information |

||||||||||||||||||||

|

Tecnología |

— | — | — | — | — | |||||||||||||||

| Senior Loans: | ||||||||||||||||||||

|

Consumer Discretionary |

1,902,735 | 97,049 | 315 | (405,887) | — | |||||||||||||||

|

Consumer Staples |

4,342,650 | 4,456 | (1,154) | 40,898 | — | |||||||||||||||

|

Financials |

5,211,484 | 1,464 | 229 | (241,928) | — | |||||||||||||||

|

Health Care |

— | — | — | (30,000) | 2,000,000 | |||||||||||||||

|

Bienes raíces |

2,619,936 | 2,233 | 214 | (21,275) | — | |||||||||||||||

| Common Stocks: | ||||||||||||||||||||

|

Energy |

— | — | — | — | 0 0 | * * | ||||||||||||||

|

Utilities |

1,965,810 | — | — | 45,716 | — | |||||||||||||||

| Warrants | 282,624 | — | 0 0 | * * | 432,478 | 94,113 | ||||||||||||||

| Total | $ | 20,571,768 | $ | 111,096 | $ | 649,823 | $ | (636,828) | $ | 2,277,690 | ||||||||||

| 20 | Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report |

| Investments in Securities (cont’d) |

Ventas |

Traslados dentro Level 33 |

Traslados Level 34 4 |

Balance as October 31, 2019 |

Net change (depreciation) para investments |

|||||||||||||||

| Corporate Bonds & Notes: | ||||||||||||||||||||

|

Energy |

$ | (0) | * * | — | — | — | — | |||||||||||||

|

Health Care |

(4,629,389) | — | — | — | — | |||||||||||||||

|

Information Tecnología |

— | $ | 248,253 | — | $ | 248,253 | — | |||||||||||||

| Senior Loans: | ||||||||||||||||||||

|

Consumidor |

||||||||||||||||||||

|

Discretionary |

(12,787) | — | $ | (1,581,425) | — | — | ||||||||||||||

|

Consumer Staples |

(4,386,850) | 6,293,200 | — | 6,293,200 | — | |||||||||||||||

|

Financials |

(51,800) | — | (1,858,339) | 3,061,110 | $ | (122,224) | ||||||||||||||

|

Health Care |

— | — | — | 1,970,000 | (30,000) | |||||||||||||||

|

Bienes raíces |

(25,012) | — | — | 2,576,096 | (21,275) | |||||||||||||||

| Common Stocks: | ||||||||||||||||||||

|

Energy |

— | — | — | 0 0 | * * | — | ||||||||||||||

|

Utilities |

— | — | — | 2,011,526 | 45,716 | |||||||||||||||

| Warrants | (125,485) | — | — | 683,730 | 589,617 | |||||||||||||||

| Total | $ | (9,231,323) | $ | 6,541,453 | $ | (3,439,764) | $ | 16,843,915 | $ | 461,834 | ||||||||||

| * * |

Amount represents less than $1. |

| 1 |

This amount is included in net realized gain (loss) from investment transactions in the accompanying Statement of |

| 2 |

This amount is included in the change in net unrealized appreciation (depreciation) in the accompanying Statement of |

| 3 |

Transferred into Level 3 as a result of the unavailability of a quoted price in an active market for an identical |

| 4 4 |

Transferred out of Level 3 as a result of the availability of a quoted price in an active market for an identical |

The following table summarizes the valuation techniques used and

unobservable inputs approved by the Valuation Committee to determine the fair value of certain, material Level 3 investments. The table does not include Level 3 investments with values derived utilizing

| Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report | 21 |

Notes to financial statements

(unaudited) (cont’d)

prices from prior transactions or third party pricing information without adjustment (e.g., broker

quotes, pricing services, net asset values).

| Fair Value at 10/31/19 (000’s) |

Valuation Technique(s) |

Unobservable Input(s) |

Range/Average |

impact to Valuation Input* |

||||||||||||

| Senior Loans | $ | 2,576 | Market Approach | Yield to

Maturity |

2.596%-8.148%

range 4.414% average |

Decrease | ||||||||||

| Transaction Spread |

3.239% | Decrease | ||||||||||||||

| * * |

This column represents the directional change in the fair value of the Level 3 investments that would result in an |

(b) Purchased options. Cuando el

Fund purchases an option, an amount equal to the premium paid by the Fund is recorded as an investment on the Statement of Assets and Liabilities, the value of which is

marked-to-market to reflect the current market value of the option purchased. If the purchased option expires, the Fund realizes a loss equal to the amount of premium

paid. When an instrument is purchased or sold through the exercise of an option, the related premium paid is added to the basis of the instrument acquired or deducted from the proceeds of the instrument sold. The risk associated with purchasing put

and call options is limited to the premium paid.

(c) Forward foreign currency contracts. The Fund enters into a forward foreign currency contract to hedge against foreign currency exchange rate risk on its non-U.S. dollar denominated securities or to facilitate

settlement of a foreign currency denominated portfolio transaction. A forward foreign currency contract is an agreement between two parties to buy and sell a currency at a set price with delivery and settlement at a future date. The contract is marked-to-market daily and the change in value is recorded by the Fund as an unrealized gain or loss. When a forward foreign currency contract is closed, through either

delivery or offset by entering into another forward foreign currency contract, the Fund recognizes a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value of the contract at the time

it is closed.

Forward foreign currency contracts involve elements of market risk in excess of the amounts reflected on the Statement of Assets and

Liabilities. The Fund bears the risk of an unfavorable change in the foreign exchange rate underlying the forward foreign currency contract. Risks may also arise upon entering into these contracts from the potential inability of the counterparties

to meet the terms of their contracts.

(d) Loan participations. los

Fund may invest in loans arranged through private negotiation between one or more financial institutions. The Fund’s investment in any such loan may

| 22 | Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report |

be in the form of a participation in or an assignment of the loan. In connection with purchasing participations, the Fund generally will have no right to enforce compliance by the borrower with

the terms of the loan agreement related to the loan, or any rights of off-set against the borrower and the Fund may not benefit directly from any collateral supporting the loan in which it has purchased the

participation.

The Fund assumes the credit risk of the borrower, the lender that is selling the participation and any other persons interpositioned between the Fund

and the borrower. In the event of the insolvency of the lender selling the participation, the Fund may be treated as a general creditor of the lender and may not benefit from any off-set between the lender and

the borrower.

(e) Unfunded loan commitments. The Fund may enter into

certain credit agreements where all or a portion of which may be unfunded. The Fund is obligated to fund these commitments at the borrower’s discretion. The commitments are disclosed in the accompanying Schedule of Investments. At

October 31, 2019, the Fund had sufficient cash and/or securities to cover these commitments.

(f)

Repurchase agreements. The Fund may enter into repurchase agreements with institutions that its investment manager has determined are creditworthy. Each repurchase agreement is recorded at cost. Bajo la

terms of a typical repurchase agreement, the Fund acquires a debt security subject to an obligation of the seller to repurchase, and of the Fund to resell, the security at an agreed-upon price and time, thereby determining the yield during the

Fund’s holding period. When entering into repurchase agreements, it is the Fund’s policy that its custodian or a third party custodian, acting on the Fund’s behalf, take possession of the underlying collateral securities, the market

value of which, at all times, at least equals the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction maturity exceeds one business day, the value of the collateral is marked-to-market and measured against the value of the agreement in an effort to ensure the adequacy of the collateral. If the counterparty defaults, the Fund generally has

the right to use the collateral to satisfy the terms of the repurchase transaction. However, if the market value of the collateral declines during the period in which the Fund seeks to assert its rights or if bankruptcy proceedings are commenced

with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

(g) Cash flow information. The Fund invests in securities and distributes dividends from net investment income and net realized gains, which are paid in cash and

may be rein vested at the discretion of shareholders. These activities are reported in the Statement of Changes in Net Assets and additional information on cash receipts and cash payments are presented in the Statement of Cash Flows.

| Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report | 23 |

Notes to financial statements

(unaudited) (cont’d)

(h) Foreign currency translation. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the date of valuation. Purchases and sales of

investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the respective dates of such transactions.

The Fund does not isolate that portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from the fluctuations arising

from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized

foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the

difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise

from changes in the values of assets and liabilities, other than investments in securities, on the date of valuation, resulting from changes in exchange rates.

|

Foreign security and currency transactions may involve certain considerations and risks not typically associated with |

(i) Credit and market risk. The Fund invests in

high-yield and emerging market instruments that are subject to certain credit and market risks. The yields of high-yield and emerging market debt obligations reflect, among other things, perceived credit and market risks. The Fund’s investments

in securities rated below investment grade typically involve risks not associated with higher rated securities including, among others, greater risk related to timely and ultimate payment of interest and principal, greater market price volatility

and less liquid secondary market trading. The consequences of political, social, economic or diplomatic changes may have disruptive effects on the market prices of investments held by the Fund. The Fund’s investments in non-U.S. dollar denominated securities may also result in foreign currency losses caused by devaluations and exchange rate fluctuations.

(j) Foreign investment risks. The Fund’s investments in foreign

securities may involve risks not present in domestic investments. Since securities may be denominated in foreign currencies, may require settlement in foreign currencies or pay interest or dividends in foreign currencies, changes in the relationship

of these foreign currencies to the U.S. dollar can significantly affect the value of the investments and earnings of the Fund. Foreign

| 24 | Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report |

investments may also subject the Fund to foreign government exchange restrictions, expropriation, taxation or other political, social or economic developments, all of which affect the market

and/or credit risk of the investments.

(k) Counterparty risk and credit-risk-related contingent features of

derivative instruments. The Fund may invest in certain securities or engage in other transactions, where the Fund is exposed to counterparty credit risk in addition to broader market risks. The Fund may

invest in securities of issuers, which may also be considered counterparties as trading partners in other transactions. This may increase the risk of loss in the event of default or bankruptcy by the counterparty or if the counterparty otherwise

fails to meet its contractual obligations. The Fund’s subadviser attempts to mitigate counterparty risk by (i) periodically assessing the creditworthiness of its trading partners, (ii) monitoring and/or limiting the amount of its net

exposure to each individual counterparty based on its assessment and (iii) requiring collateral from the counterparty for certain transactions. Market events and changes in overall economic conditions may impact the assessment of such

counterparty risk by the subadviser. In addition, declines in the values of underlying collateral received may expose the Fund to increased risk of loss.

With exchange traded and centrally cleared derivatives, there is less counterparty risk to the Fund since the exchange or clearinghouse, as counterparty to such

instruments, guarantees against a possible default. The clearinghouse stands between the buyer and the seller of the contract; therefore, the credit risk is limited to failure of the clearinghouse. While offset rights may exist under applicable law,

the Fund does not have a contractual right of offset against a clearing broker or clearinghouse in the event of a default of the clearing broker or clearinghouse.

The Fund has entered into master agreements, such as an International Swaps and Derivatives Association, Inc. Master Agreement (“ISDA Master Agreement”) or

similar agreement, with certain of its derivative counterparties that govern over-the-counter derivatives and provide for general obligations, representations,

agreements, collateral posting terms, netting provisions in the event of default or termination and credit related contingent features. The credit related contingent features include, but are not limited to, a percentage decrease in the Fund’s

net assets or NAV over a specified period of time. If these credit related contingent features were triggered, the derivatives counterparty could terminate the positions and demand payment or require additional collateral.

Under an ISDA Master Agreement, the Fund may, under certain circumstances, offset with the counterparty certain derivative financial instruments’ payables and/or

receivables with collateral held and/or posted and create one single net payment. However, absent an event of default by the counterparty or a termination of the agreement, the terms of the ISDA Master Agreements do not result in an offset of

reported amounts of financial assets and

| Western Asset Middle Market Income Fund Inc. 2019 Semi-Annual Report | 25 |